Agfa-Gevaert Bundle

Can Agfa-Gevaert Maintain Its Edge in a Changing Market?

Agfa-Gevaert, a historic name in imaging and printing, faces a dynamic competitive landscape. From its origins in dye production to its current status as a provider of imaging systems and IT solutions, the company's evolution is a testament to its resilience. Understanding the Agfa-Gevaert SWOT Analysis is crucial for investors and strategists alike.

This analysis will dissect Agfa-Gevaert's competitive environment, identifying its key competitors and evaluating its strategic positioning within the Agfa-Gevaert industry. We will explore the company's market share comparison and assess its competitive advantages and disadvantages. Furthermore, this deep dive into Agfa-Gevaert's business strategy and financial performance will provide actionable insights for informed decision-making, covering aspects from recent market trends to the impact of digital transformation on its operations.

Where Does Agfa-Gevaert’ Stand in the Current Market?

Agfa-Gevaert's market position is primarily defined by its operations in the printing industry and the healthcare sector. The company's core business involves providing solutions for prepress in printing, digital print technologies, and radiology solutions. This focus allows it to serve specialized segments with dedicated products and services.

The value proposition of Agfa-Gevaert lies in its ability to offer integrated solutions that cater to the specific needs of its customers. In printing, it provides essential components like printing plates, while in healthcare, it offers a range of imaging solutions, including digital radiography systems and IT solutions. This approach enables the company to maintain a competitive edge in its target markets.

In the printing industry, Agfa-Gevaert is a key provider of prepress solutions, including printing plates and software. The company's Digital Print & Chemicals division focuses on growth areas such as industrial inkjet. It aims for leadership in niche applications, capitalizing on the increasing demand for digital printing technologies.

Agfa-Gevaert's Radiology Solutions and HealthCare IT divisions are critical to its market standing. The Radiology Solutions division offers analog and digital radiography solutions. Its HealthCare IT division provides enterprise imaging and IT solutions for hospitals. The company holds a strong position in certain geographic regions.

Agfa-Gevaert reported revenues of 1,846 million euros in 2023, with an adjusted EBITDA of 127 million euros. The company faces pressures from global economic conditions and supply chain disruptions. Strategic shifts focus on higher-growth digital segments and IT solutions.

Agfa-Gevaert has a strong presence in Europe, North America, and parts of Asia. It leverages established distribution networks and customer relationships. The company's strategic divestment of its Offset Solutions division in 2024 is expected to reshape its market focus.

The Agfa-Gevaert competitive landscape is significantly influenced by digital transformation and evolving customer needs. The company's strategic focus on digital print, healthcare IT, and radiology solutions demonstrates an effort to adapt to changing market dynamics. This shift is expected to strengthen its position in higher-growth markets.

- The company faces intense competition from larger, diversified technology companies in the healthcare IT space.

- Agfa-Gevaert's focus on specialized solutions allows it to maintain a competitive edge in certain market niches.

- The divestment of the Offset Solutions division is a key strategic move.

- The company is working to diversify its offerings and adapt to changing market dynamics.

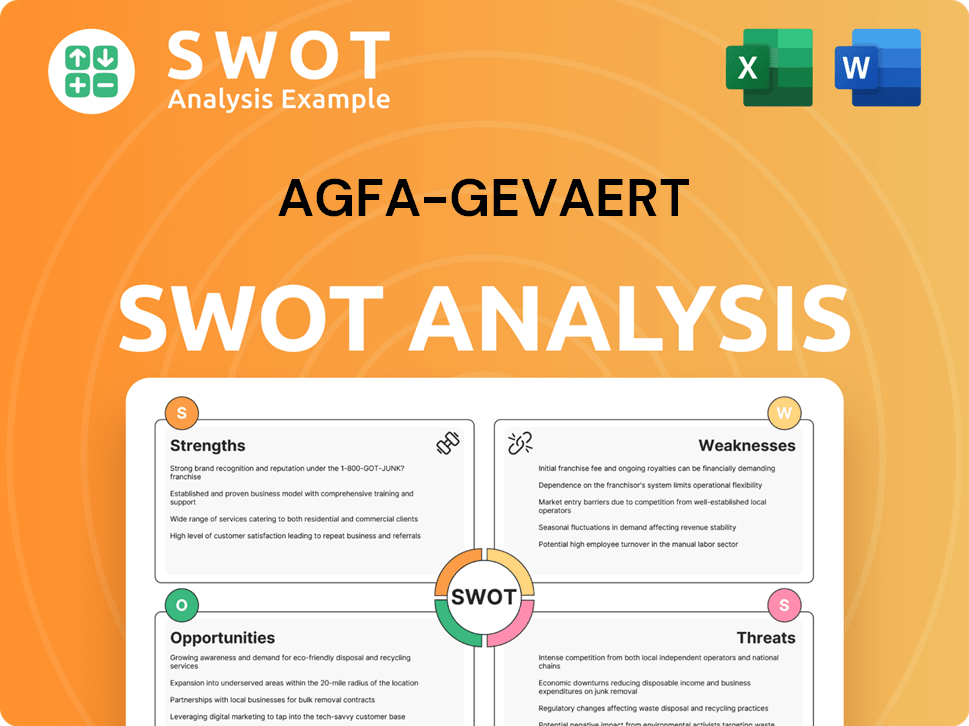

Agfa-Gevaert SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Agfa-Gevaert?

Understanding the Agfa-Gevaert competitive landscape is crucial for investors and industry analysts. The company operates in diverse sectors, including printing, digital print & chemicals, and healthcare, each with its unique set of Agfa-Gevaert competitors. Analyzing the competitive dynamics provides insights into the company's business strategy and potential for growth.

This analysis examines the key players and competitive strategies within each of these segments. The Agfa-Gevaert market analysis reveals how the company positions itself against established giants and specialized niche players. This overview helps to assess Agfa-Gevaert's financial performance and its ability to navigate market challenges.

For a deeper dive into the company's origins, consider reading Brief History of Agfa-Gevaert.

In the Offset Solutions division (prior to its planned divestment), key competitors included Fujifilm, Kodak, and Toray. These companies offered a comprehensive range of printing plates, chemicals, and prepress solutions. The competition centered on price, quality, and technological innovation.

The competitive landscape in Digital Print & Chemicals is more fragmented. Major players in industrial inkjet include Fujifilm, Konica Minolta, Ricoh, and Epson. Agfa-Gevaert competes by developing specialized inks and integrated inkjet solutions.

In the healthcare sector, the Radiology Solutions division competes with global medical imaging giants such as Siemens Healthineers, GE Healthcare, Philips, and Canon Medical Systems. In HealthCare IT, the competition is fierce, with major players like Epic Systems, Cerner (now Oracle Health), Meditech, and numerous smaller, specialized software vendors.

Agfa-Gevaert differentiates itself through its focus on specific imaging modalities and integrated workflow solutions in healthcare. In digital print, it focuses on specialized inks and integrated inkjet solutions. The company competes on technological innovation and customer-specific solutions.

The market for healthcare IT is seeing new entrants focused on AI-driven analytics, telehealth, and cybersecurity. Mergers and acquisitions continue to reshape the competitive dynamics. The printing industry is influenced by digital transformation and environmental concerns.

Assessing Agfa-Gevaert's financial health requires looking at revenue streams, profitability, and market share. The company's performance is influenced by its ability to innovate, manage costs, and adapt to market changes. Recent financial data provides insights into its competitive positioning.

The Agfa-Gevaert competitive landscape includes a variety of players, each with distinct strategies. Understanding these strategies is essential for evaluating Agfa-Gevaert's competitive advantages and disadvantages.

- Fujifilm: Fujifilm competes across multiple segments. In printing, it focuses on high-quality plates and digital solutions. In healthcare, it offers a range of imaging systems.

- Kodak: Kodak concentrates on the printing industry, providing plates and prepress solutions. It also has a presence in advanced materials.

- Konica Minolta: Konica Minolta is a major player in industrial inkjet, offering printhead technologies and ink formulations.

- Siemens Healthineers, GE Healthcare, Philips, Canon Medical Systems: These companies are global leaders in medical imaging, offering comprehensive portfolios of medical equipment and leveraging extensive R&D capabilities.

- Epic Systems, Cerner (Oracle Health), Meditech: These companies compete in healthcare IT, providing EHR and enterprise imaging solutions. They focus on interoperability, cloud capabilities, and AI-driven analytics.

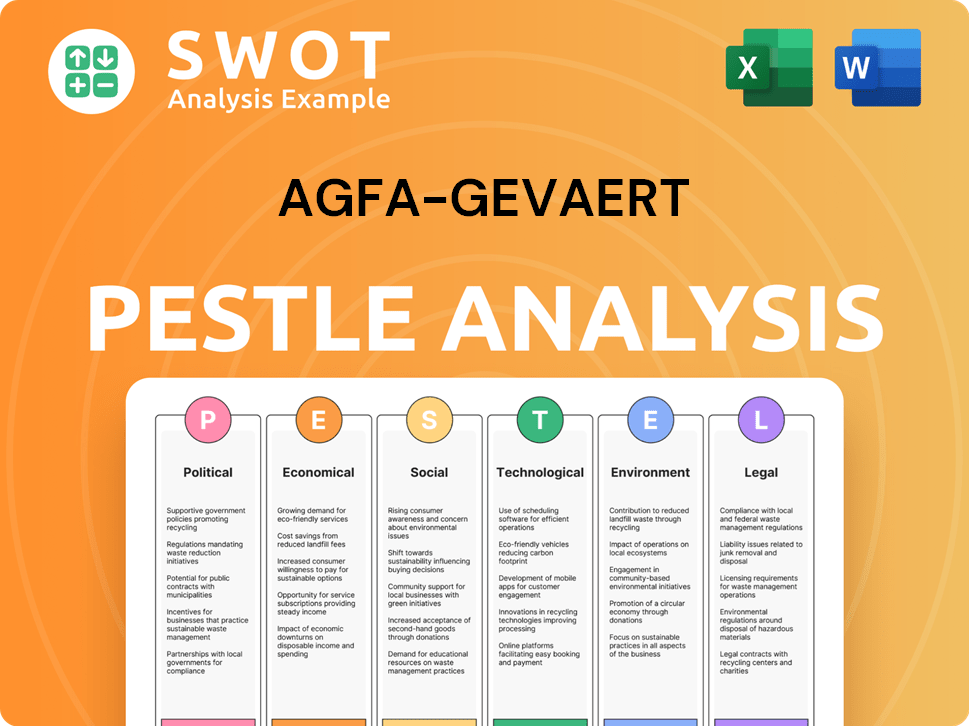

Agfa-Gevaert PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Agfa-Gevaert a Competitive Edge Over Its Rivals?

The competitive advantages of Agfa-Gevaert are rooted in its established expertise in imaging technology, a diverse product portfolio, and a strong commitment to research and development. The company's strategic focus on innovation and customer relationships has been key to navigating the ever-changing Agfa-Gevaert competitive landscape. A detailed Marketing Strategy of Agfa-Gevaert can provide additional insights into its market positioning.

Agfa-Gevaert's ability to adapt to market shifts and technological advancements has been critical. This includes leveraging its proprietary technologies and intellectual property. The company's brand equity and global distribution network further solidify its position, allowing it to serve diverse markets effectively. This has been essential in maintaining a competitive edge in the Agfa-Gevaert industry.

In the healthcare sector, Agfa-Gevaert's integrated solutions combining imaging equipment with IT platforms provide a significant advantage. Its HealthCare IT solutions, such as the Enterprise Imaging platform, offer a unified view of patient data, improving clinical workflows and efficiency. Furthermore, the company's focus on sustainability and environmental responsibility in its product development resonates with a growing segment of environmentally conscious customers.

Agfa-Gevaert's competitive edge is significantly bolstered by its proprietary technologies and intellectual property, particularly in areas such as printing plates, industrial inkjet inks, and medical imaging software. The company holds numerous patents related to its imaging systems and chemical formulations, creating barriers to entry for competitors. This focus on innovation allows for customized solutions that meet specific customer needs.

With a history spanning over a century, the Agfa-Gevaert brand is recognized globally, especially in the graphic arts and healthcare sectors. This long-standing reputation for quality and reliability fosters strong customer relationships and repeat business. The company's extensive global distribution network further enhances its reach and ability to serve diverse markets efficiently.

In the healthcare sector, Agfa-Gevaert's integrated solutions, combining imaging equipment with IT platforms, offer a significant advantage. Its HealthCare IT solutions, such as the Enterprise Imaging platform, provide a unified view of patient data, improving clinical workflows and efficiency. This integrated approach differentiates it from competitors offering more siloed solutions.

Agfa-Gevaert's focus on sustainability and environmental responsibility in its product development, such as eco-friendly printing plates and energy-efficient imaging systems, resonates with a growing segment of environmentally conscious customers. This provides another layer of differentiation in the market. These efforts align with current market trends and consumer preferences.

Agfa-Gevaert's competitive advantages include proprietary technologies, strong brand recognition, and integrated healthcare solutions. The company's focus on sustainability and environmental responsibility further enhances its market position. These factors contribute to its resilience in a dynamic market.

- Proprietary Technologies: Strong IP in printing plates, industrial inkjet inks, and medical imaging software.

- Brand Equity: Recognized globally for quality and reliability, especially in graphic arts and healthcare.

- Integrated Healthcare Solutions: Unified patient data view improves clinical workflows and efficiency.

- Sustainability: Eco-friendly products and energy-efficient systems appeal to environmentally conscious customers.

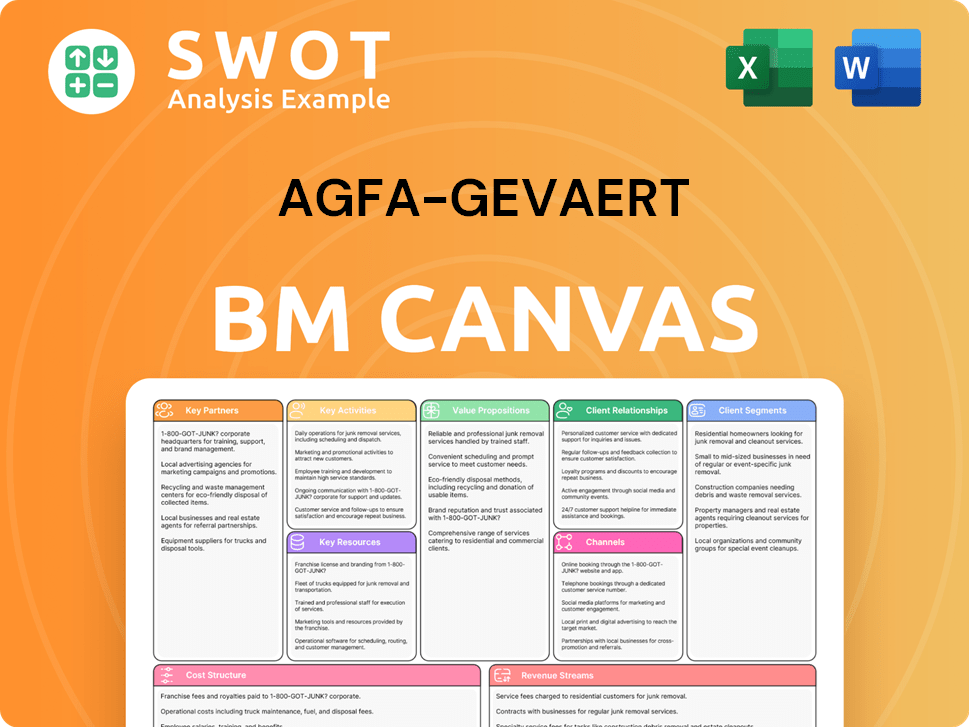

Agfa-Gevaert Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Agfa-Gevaert’s Competitive Landscape?

The competitive landscape for Agfa-Gevaert is influenced by industry trends, future challenges, and opportunities. The company operates in dynamic markets, including printing and healthcare, facing digital transformation and evolving economic conditions. Understanding these factors is crucial for assessing the company's strategic positioning and future prospects. For a deeper dive into the company's target audience, consider exploring the Target Market of Agfa-Gevaert.

Agfa-Gevaert's business strategy must navigate the shift from analog to digital technologies in printing and the integration of digital health solutions in healthcare. This requires continuous innovation, strategic partnerships, and a focus on emerging markets. The company's financial performance is tied to its ability to adapt and invest in growth areas while managing economic and geopolitical risks.

The printing industry is experiencing a significant shift towards digital technologies, particularly industrial inkjet printing. In healthcare, there's a growing emphasis on integrated digital health ecosystems and AI. These trends drive the need for advanced inkjet solutions and efficient healthcare IT systems.

Maintaining a competitive edge in innovative markets and managing manufacturing and distribution costs are key challenges. Economic pressures and supply chain disruptions, along with environmental regulations, also impact the company. Adapting to rapid technological changes requires substantial investment in R&D.

Growth opportunities exist in emerging markets with expanding healthcare infrastructure and increasing digital adoption. Product innovations, such as advanced materials and AI-powered diagnostic tools, offer significant potential. Strategic focus on digital print and healthcare IT is crucial for future growth.

Agfa-Gevaert's competitive positioning is influenced by its ability to adapt to digital transformation and manage costs. Its strategic focus on digital print and healthcare IT is essential. The company must continue to innovate and form partnerships to maintain its market share.

Agfa-Gevaert's strategic focus includes digital print, healthcare IT, and radiology solutions to drive growth. The company's ability to innovate and expand into new markets will be critical for long-term success. Key priorities involve adapting to digital transformation and managing operational efficiencies.

- Digital Print: Focus on industrial inkjet solutions and specialty inks. The global industrial inkjet market is projected to reach $7.8 billion by 2025.

- Healthcare IT: Develop integrated digital health ecosystems and AI-driven solutions. The healthcare IT market is expected to grow significantly, with a projected value of $430 billion by 2025.

- Radiology Solutions: Enhance diagnostic tools with AI and data analytics. The radiology market is influenced by technological advancements and increasing demand for efficient imaging solutions.

- Geographic Expansion: Target growth in emerging markets with expanding healthcare infrastructure and digital adoption.

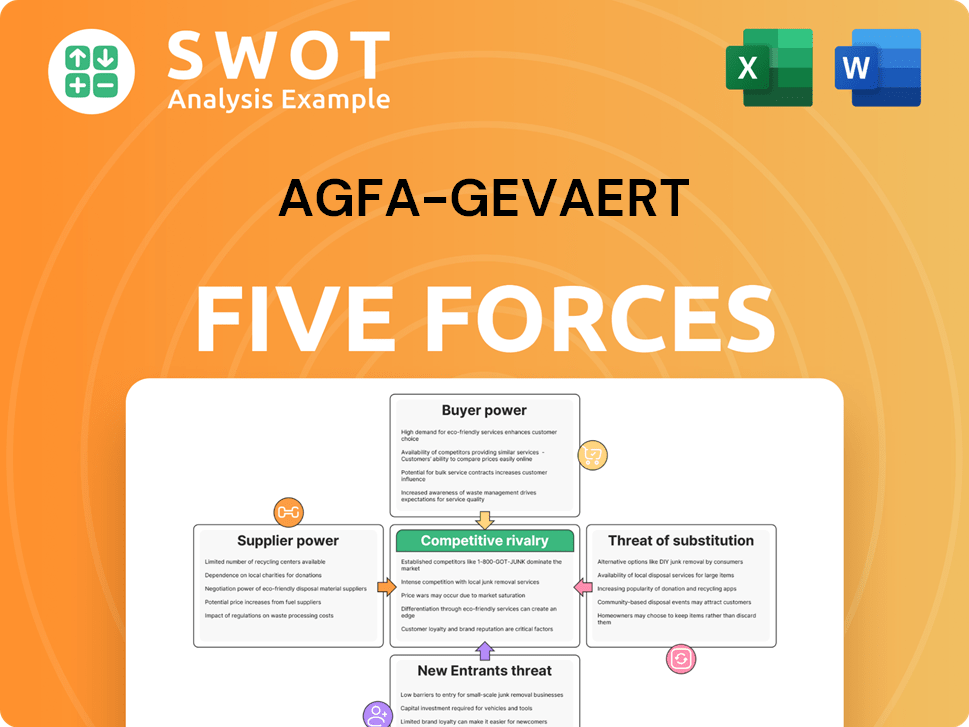

Agfa-Gevaert Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agfa-Gevaert Company?

- What is Growth Strategy and Future Prospects of Agfa-Gevaert Company?

- How Does Agfa-Gevaert Company Work?

- What is Sales and Marketing Strategy of Agfa-Gevaert Company?

- What is Brief History of Agfa-Gevaert Company?

- Who Owns Agfa-Gevaert Company?

- What is Customer Demographics and Target Market of Agfa-Gevaert Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.