Agfa-Gevaert Bundle

Who Really Owns Agfa-Gevaert?

Understanding a company's ownership structure is crucial for investors and strategists alike. Knowing who controls a business like Agfa-Gevaert can unlock valuable insights into its future direction and potential risks. This exploration unveils the intricate web of stakeholders behind the Belgian multinational, revealing the forces that shape its strategic decisions and market performance. Get ready to uncover the ownership secrets of this imaging and IT solutions giant.

Agfa-Gevaert's Agfa-Gevaert SWOT Analysis provides a deeper understanding of its strategic positioning. Founded in 1964, the company's history is marked by significant shifts in its ownership, impacting its operations across digital imaging, healthcare, and IT solutions. This analysis will examine the evolution of Agfa-Gevaert's ownership, from its founding to the present day, including key shareholders and the impact of its headquarters location in Mortsel, Belgium. We'll explore who owns Agfa, the Agfa company's structure, and how ownership changes have shaped its trajectory.

Who Founded Agfa-Gevaert?

The story of Agfa-Gevaert, a company whose ownership structure has evolved significantly over time, begins with two separate entities. Understanding the founders and early ownership provides a crucial foundation for grasping the company's later developments and current standing. The journey of Agfa-Gevaert ownership is a fascinating tale of mergers, acquisitions, and strategic shifts.

The origins of the company can be traced back to the late 19th century. The initial roots of the company are in Germany and Belgium. These two companies, though initially independent, would later merge to form the global entity known today.

Agfa was founded in 1867 in Rummelsburg, near Berlin, by Paul Mendelssohn Bartholdy and Carl Alexander von Martius. Initially focused on dye manufacturing, Agfa expanded into photographic film production by 1908. Simultaneously, Lieven Gevaert established his workshop in Antwerp, Belgium, in 1890, focusing on calcium paper for photography. By 1894, with Armand Seghers' assistance, 'L. Gevaert & Cie' was established as a limited stock company.

Agfa was founded in 1867 in Germany by Paul Mendelssohn Bartholdy and Carl Alexander von Martius.

Lieven Gevaert started his workshop in Antwerp, Belgium, in 1890.

Gevaert Photo-Producten N.V. had a capital of 15 million Belgian francs (€375,000) by 1920.

The merger between Agfa AG and Gevaert Photo-Producten N.V. occurred in early 1964.

After the merger, Bayer and Gevaert each held a 50% stake in the new operating companies.

The merger resulted in Gevaert-Agfa N.V. in Belgium and Agfa-Gevaert AG in Germany.

The pivotal merger between Agfa AG (a Bayer subsidiary) and Gevaert Photo-Producten N.V. in early 1964 marked a turning point in the company's history. This union led to two new operating companies, Gevaert-Agfa N.V. in Belgium and Agfa-Gevaert AG in Germany, both with Bayer and Gevaert each owning a 50% stake. This shared ownership reflected a collaborative vision for the newly formed entity. For a deeper dive into the strategic moves that have shaped the company, consider reading about the Growth Strategy of Agfa-Gevaert.

The early ownership of Agfa-Gevaert involved distinct founders and a significant merger.

- Agfa was founded in 1867 and expanded into photographic film.

- Gevaert started in 1890, manufacturing photographic paper.

- The 1964 merger created a 50/50 ownership split between Bayer and Gevaert.

- The merger established Gevaert-Agfa N.V. and Agfa-Gevaert AG.

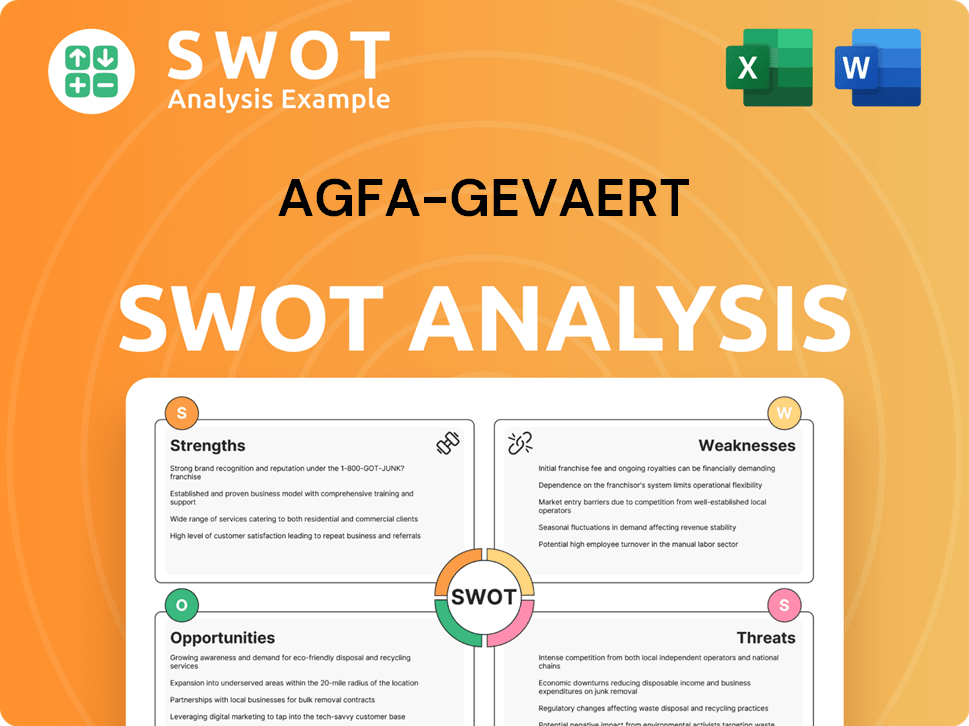

Agfa-Gevaert SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Agfa-Gevaert’s Ownership Changed Over Time?

The evolution of Agfa-Gevaert's ownership has been marked by significant shifts. Initially, the company was fully owned by Bayer after a merger. This changed in 1999 when Agfa-Gevaert went public, listing shares on the Brussels and Frankfurt stock exchanges. This initial public offering (IPO) was a pivotal moment, transforming the company from a subsidiary to a publicly traded entity. Bayer completely divested its ownership in 2002.

These ownership transitions reflect the company's strategic evolution and its adaptation to the market. The move to a public structure opened the door to a diverse shareholder base, influencing the company's direction and investment strategies. The shifts in major shareholding highlight the changing investor landscape and the company's strategic direction.

| Key Dates | Ownership Events | Impact |

|---|---|---|

| 1964 | Merger | Formation of Agfa-Gevaert |

| 1981 | Bayer Acquires Full Ownership | Agfa-Gevaert becomes a wholly-owned subsidiary of Bayer |

| 1999 | Initial Public Offering (IPO) | Agfa-Gevaert listed on stock exchanges, transitioning to a public company |

| 2002 | Bayer Divests Remaining Stake | Bayer exits ownership, Agfa-Gevaert becomes fully independent |

| October 1, 2024 | Active Ownership Capital S.à.r.l. Stake | Significant institutional shareholder emerges |

As of December 31, 2024, the total number of existing shares in Agfa-Gevaert was 154,820,528. Active Ownership Capital S.à.r.l. held a substantial stake as of October 1, 2024, with 29,538,699 shares, representing 19.08% of the voting rights. Other significant shareholders include Axxion S.A. with 4.99% as of October 29, 2024, and Boldhaven Management LLP with 3.15% as of October 31, 2023. Norges Bank held a 3.00% stake as of March 11, 2021.

Understanding Agfa-Gevaert's ownership structure is crucial for investors and stakeholders. The company's history shows a shift from corporate ownership to a publicly traded model.

- Active Ownership Capital S.à.r.l. is a major shareholder.

- Other institutional investors hold significant stakes.

- The company is listed on the stock exchanges in Brussels and Frankfurt.

- The total number of shares as of December 31, 2024, was 154,820,528.

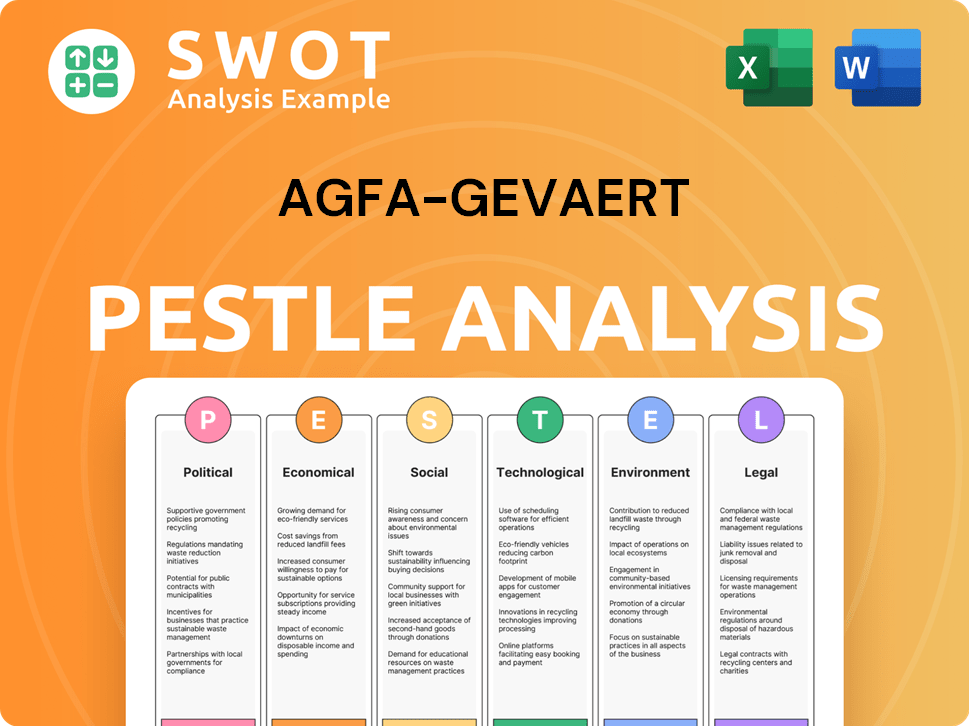

Agfa-Gevaert PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Agfa-Gevaert’s Board?

The current board of directors of Agfa-Gevaert plays a vital role in the company's governance. The board is composed of both executive and non-executive members, ensuring a balance of operational expertise and independent oversight. Pascal Juéry serves as the Chief Executive Officer and Executive Director, also being a Member of the Executive Committee. Other members of the executive committee include Fiona Lam (Chief Financial Officer), Gunther Koch (Chief Human Resources Officer and Head of Sustainability), Nathalie McCaughley (President of the HealthCare IT Division), Jeroen Spruyt (President - Radiology Solutions), and Vincent Wille (President - Digital Print & Chemicals).

Non-executive members provide independent oversight and represent shareholder interests. Frank Aranzana is the Non-Executive Independent Chairman of the Board. Other non-executive directors include Christian Reinaudo, Klaus Röhrig, Michel Govaert (Independent Director), and Line De Decker (Non-Executive Independent Director). Mark Pensaert was proposed for appointment as an independent director until the end of the ordinary general meeting in 2027, and he also serves as a non-executive board member and chair of the audit committee of Agfa-Gevaert NV. Klaus Röhrig, a non-executive director, is associated with Active Ownership Capital S.à.r.l., which holds a significant stake in the company, highlighting the influence of this major shareholder.

| Board Member | Position | Role |

|---|---|---|

| Pascal Juéry | CEO and Executive Director | Member of the Executive Committee |

| Fiona Lam | Chief Financial Officer | Member of the Executive Committee |

| Frank Aranzana | Non-Executive Independent Chairman | Oversees Board Activities |

Agfa-Gevaert's voting structure generally operates on a one-share-one-vote basis for ordinary shares. According to Belgian law and the company's bylaws, a shareholder's direct or indirect stake reaching, exceeding, or falling below a threshold of 5% or a multiple of 5% of the denominator (154,820,528 shares) must be disclosed. Additionally, the bylaws specify that a 3% threshold also requires disclosure. For general meetings, such as the one held on February 28, 2025, and May 13, 2025, specific attendance and majority requirements apply for resolutions, particularly for amendments to the articles of association. The board has adopted a majority voting standard for uncontested director elections.

Understanding the board of directors and voting power is crucial for anyone interested in Agfa-Gevaert ownership. The board structure ensures both operational expertise and independent oversight. For more insights, consider exploring the Marketing Strategy of Agfa-Gevaert.

- The board includes both executive and non-executive directors.

- Shareholders must disclose stakes reaching or exceeding specific thresholds.

- Voting operates on a one-share-one-vote basis.

- The board has adopted a majority voting standard for uncontested director elections.

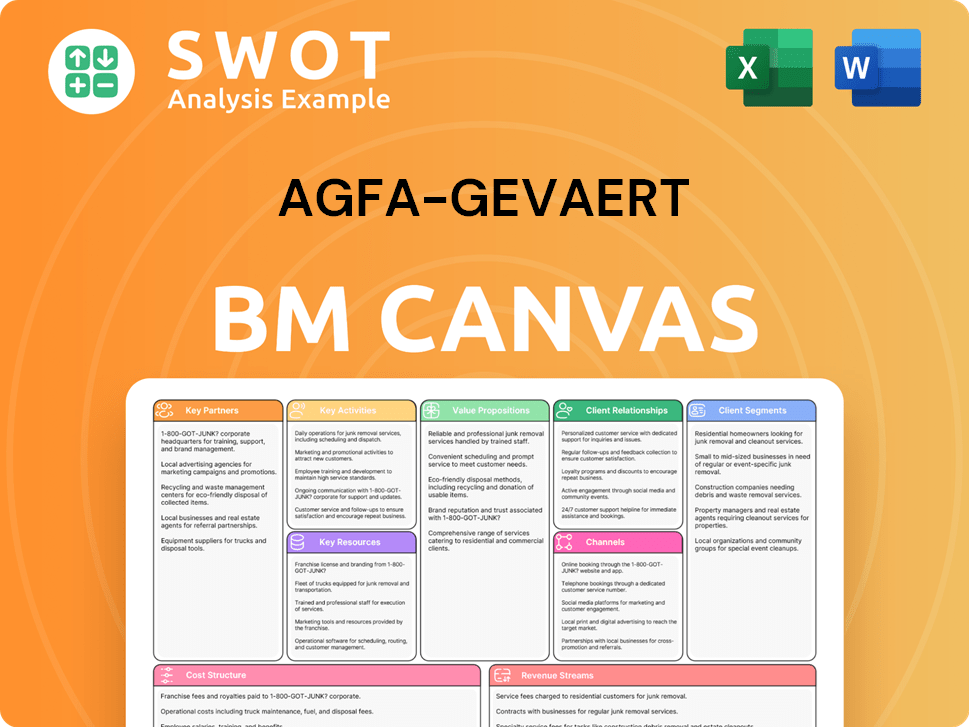

Agfa-Gevaert Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Agfa-Gevaert’s Ownership Landscape?

Over the past few years, the company has undergone a strategic transformation, which has significantly influenced its ownership profile. A crucial step in this transformation was the sale of its Offset Solutions division to AURELIUS Group in April 2023. This move was part of a broader strategy to concentrate on growth areas. Understanding who owns Agfa and the evolution of its ownership structure provides insights into its strategic direction.

The company's financial performance in 2024 and the first quarter of 2025 reflects its strategic pivot. In 2024, the company reported revenues of $1.22 billion USD, a slight decrease from $1.24 billion USD in 2023. Despite a net loss of €92 million in 2024, primarily due to restructuring expenses and an impairment in Radiology Solutions, its growth engines, particularly HealthCare IT, Digital Printing Solutions, and Green Hydrogen Solutions, showed strong performance. The company is also implementing a savings program to align its cost base, aiming to reduce costs by €50 million by the end of 2027.

| Metric | 2023 | 2024 | Q1 2024 | Q1 2025 |

|---|---|---|---|---|

| Revenue (USD Billion) | $1.24 | $1.22 | N/A | N/A |

| Net Loss (€ Million) | N/A | -€92 | -€12.7 | -€10.6 |

| HealthCare IT Order Intake Increase | N/A | 32% | N/A | N/A |

| HealthCare IT Revenue Growth (Q1 YoY) | N/A | N/A | N/A | 12.0% |

Institutional ownership remains a key aspect of the company's ownership. As of May 27, 2025, the company has 25 institutional owners holding a total of 2,628,970 shares. Major institutional shareholders include Dfa Investment Trust Co - The Continental Small Company Series, DFIEX - International Core Equity Portfolio - Institutional Class, and DISVX - Dfa International Small Cap Value Portfolio - Institutional Class. The involvement of activist investors, such as Active Ownership Capital S.à.r.l., which held 19.08% as of October 1, 2024, has also played a role in influencing strategic decisions. To learn more about the company, you can explore the history of the company and its structure.

The company's ownership structure is influenced by institutional investors and activist shareholders. The sale of the Offset Solutions division was a key strategic move. Financial results indicate a shift towards growth in specific sectors.

Major institutional shareholders include Dfa Investment Trust Co and DFIEX. Active Ownership Capital S.à.r.l. has a significant stake. Understanding Agfa shareholders is important for investors.

2024 revenue was $1.22 billion USD, with a net loss of €92 million. HealthCare IT showed strong growth in order intake. The company is implementing a cost-saving program.

The company is concentrating on growth businesses. Digital Printing Solutions and Green Hydrogen Solutions are key. The company's headquarters is located in Belgium.

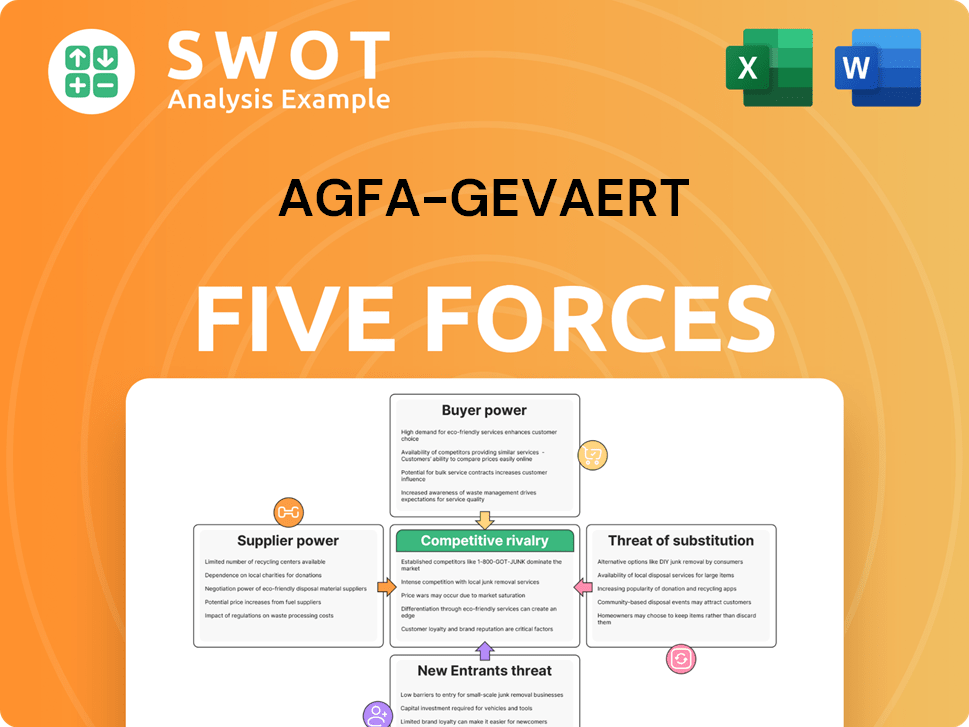

Agfa-Gevaert Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agfa-Gevaert Company?

- What is Competitive Landscape of Agfa-Gevaert Company?

- What is Growth Strategy and Future Prospects of Agfa-Gevaert Company?

- How Does Agfa-Gevaert Company Work?

- What is Sales and Marketing Strategy of Agfa-Gevaert Company?

- What is Brief History of Agfa-Gevaert Company?

- What is Customer Demographics and Target Market of Agfa-Gevaert Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.