Agfa-Gevaert Bundle

Can Agfa-Gevaert Re-Image Its Future?

Agfa-Gevaert, a titan with roots in 1867 Berlin, has navigated a complex industry landscape, evolving from dyes to become a global imaging leader. Its journey underscores the critical importance of a dynamic growth strategy. Today, the company's strategic adaptation and foresight are key to maintaining relevance and competitiveness in a rapidly changing market.

This Agfa-Gevaert SWOT Analysis will delve into the company's ambitious plans for expansion, innovation, and financial planning, providing a comprehensive Agfa-Gevaert company analysis. We'll explore the Agfa-Gevaert growth strategy, examining how it aims to capitalize on its current market position and future prospects within the printing industry, healthcare sector, and industrial applications. Investors and strategists alike will gain valuable insights into Agfa-Gevaert's business model, financials, and long-term growth potential, including its digital transformation strategy and sustainability efforts.

How Is Agfa-Gevaert Expanding Its Reach?

Agfa-Gevaert's growth strategy is centered on strategic expansion initiatives designed to strengthen its market position and diversify its revenue streams. These initiatives are particularly focused on healthcare and digital printing, reflecting the company's commitment to adapting to evolving industry trends. The company's future prospects are closely tied to the successful execution of these strategies, which aim to capitalize on emerging opportunities and mitigate risks associated with mature markets.

The company's approach involves both organic growth through product development and market penetration, as well as inorganic growth through partnerships and collaborations. This dual strategy allows Agfa-Gevaert to accelerate its entry into new segments and leverage complementary technologies. A thorough Agfa-Gevaert company analysis reveals a proactive stance towards innovation and strategic positioning in key growth areas.

Agfa-Gevaert is actively pursuing several expansion initiatives to drive future growth, focusing on both market penetration and diversification. In the healthcare sector, the company is intensifying its efforts in digital radiography and healthcare IT solutions, particularly through its DR (digital radiography) and HealthCare IT divisions. The company aims to strengthen its position in these areas by enhancing its product portfolio and expanding its geographical reach, especially in emerging markets where the demand for advanced healthcare imaging is growing.

Agfa-Gevaert is focusing on digital radiography and healthcare IT solutions. This involves enhancing product offerings and expanding into emerging markets. The company leverages its DR and HealthCare IT divisions to drive growth in this segment. For instance, Agfa's Q1 2024 results highlighted a strong order intake for its HealthCare IT solutions, indicating continued momentum in this segment.

The company is exploring new applications for its inkjet technology. This includes venturing into industrial printing markets beyond traditional graphic arts. The focus is on developing solutions for packaging, decor, and specialized industrial applications. The aim is to diversify revenue streams and capitalize on the broader industrial digital printing trend.

Agfa-Gevaert is pursuing partnerships to accelerate market entry into new segments. These collaborations aim to leverage complementary technologies. The goal is to access new customer bases and mitigate reliance on mature markets. These initiatives help the company stay ahead of evolving industry demands.

The company's strategy includes both market penetration and diversification. This approach helps Agfa-Gevaert to adapt to changing market conditions. The initiatives are designed to access new customer bases and mitigate reliance on mature markets. This strategy supports the company's long-term growth potential.

Agfa-Gevaert's expansion initiatives are designed to drive Agfa-Gevaert revenue growth and strengthen its market position. These initiatives focus on healthcare IT, digital printing, and strategic partnerships. The company's approach includes both organic and inorganic growth strategies to capitalize on emerging opportunities.

- Focus on digital radiography and healthcare IT solutions.

- Exploring new applications for inkjet technology in industrial printing.

- Strategic partnerships to accelerate market entry and leverage technologies.

- Expanding geographical reach, particularly in emerging markets.

Agfa-Gevaert SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Agfa-Gevaert Invest in Innovation?

The core of the Agfa-Gevaert growth strategy revolves around innovation and technological advancement. The company's commitment to research and development (R&D) is a cornerstone of its approach to maintain a competitive edge. This focus is particularly evident in its efforts towards digital transformation across key segments.

Agfa-Gevaert's future prospects are significantly tied to its ability to develop and implement cutting-edge solutions. This includes the development of AI-powered diagnostic tools and cloud-based imaging platforms for healthcare. The company is also focused on creating sustainable and environmentally friendly solutions within its Digital Print & Chemicals division.

Agfa-Gevaert's dedication to sustainability is reflected in its product development, with a focus on reducing the environmental impact of its operations and products. Recent advancements in 'ECO' product lines highlight this commitment, offering more sustainable options for customers. The company's collaborative approach, involving partnerships with external innovators, further accelerates product development cycles and strengthens its position in the imaging market.

Agfa-Gevaert invests a significant portion of its revenue in research and development (R&D) to drive innovation. This investment is crucial for developing new technologies and maintaining its competitive edge. The company's R&D efforts span across its divisions, focusing on both healthcare and industrial printing solutions.

A key area of focus for Agfa-Gevaert is digital transformation within its healthcare segment. This involves developing AI-powered diagnostic tools and cloud-based imaging platforms. The company's HealthCare IT portfolio, including ORBIS and Enterprise Imaging solutions, is critical for driving digital transformation in hospitals.

In the Digital Print & Chemicals division, Agfa-Gevaert is at the forefront of developing new inkjet inks and printing technologies. These innovations are geared towards various industrial applications. The company emphasizes sustainable and environmentally friendly solutions in its product development.

Agfa-Gevaert is committed to sustainability, focusing on reducing the environmental footprint of its operations and products. This includes advancements in 'ECO' product lines, which offer more sustainable alternatives for customers. The company's sustainability efforts are integral to its long-term growth objectives.

Agfa-Gevaert actively engages in collaborations with external innovators and research institutions to accelerate product development. These partnerships help co-develop new technologies and secure key patents. This collaborative approach is essential for maintaining its position as a leader in imaging innovation.

Recent breakthroughs include advancements in its 'ECO' product lines, designed to offer more sustainable alternatives for customers. Agfa also engages in collaborations with external innovators and research institutions to co-develop new technologies and accelerate product development cycles. These efforts aim to secure key patents and maintain Agfa-Gevaert's position as a leader in imaging innovation, directly contributing to its long-term growth objectives.

Agfa-Gevaert's technological advancements are crucial for its future success. These innovations are designed to improve efficiency, accuracy, and sustainability across its various business segments. The company's focus on digital transformation and sustainable solutions positions it well in the evolving market.

- Healthcare IT: The ORBIS platform and Enterprise Imaging solutions are key drivers of digital transformation in hospitals, improving workflow and patient care.

- Digital Print & Chemicals: New inkjet inks and printing technologies are being developed for industrial applications, with an emphasis on sustainability and environmental friendliness.

- Sustainability: The 'ECO' product lines offer more sustainable alternatives, reducing the environmental impact of Agfa-Gevaert's products.

- Collaborations: Partnerships with external innovators accelerate product development and ensure access to cutting-edge technologies.

- Intellectual Property: Securing key patents is a priority to maintain a competitive advantage and protect its innovations.

Agfa-Gevaert PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Agfa-Gevaert’s Growth Forecast?

The financial outlook for Agfa-Gevaert is centered on strategic moves aimed at enhancing profitability and focusing on core business areas. The company's Agfa-Gevaert growth strategy involves reshaping its portfolio to concentrate on higher-margin segments. This approach is designed to improve the company's financial performance in the coming years.

In Q1 2024, the company reported a revenue of 406 million Euro. The adjusted EBITDA for the same period was 21 million Euro. The gross profit margin for Q1 2024 was 28.5% of revenue, demonstrating the company's ability to manage its costs and maintain profitability.

A key element of Agfa-Gevaert's financial strategy is the divestment of its Offset Solutions division, completed in April 2024. This strategic decision is expected to reduce debt and allow the company to channel resources into its growth engines: Digital Print & Chemicals, Radiology Solutions, and HealthCare IT. This refocusing is crucial for realizing the Agfa-Gevaert future prospects.

The company's Q1 2024 results showed a reported revenue of 406 million Euro. Adjusted EBITDA was 21 million Euro, indicating solid operational performance. The gross profit margin for the same period was 28.5% of revenue.

The divestment of the Offset Solutions division, finalized in April 2024, is a key strategic move. This action aims to reduce debt and reallocate resources to core growth areas. This strategic shift is vital for the Agfa-Gevaert company analysis.

The company is concentrating on Digital Print & Chemicals, Radiology Solutions, and HealthCare IT. These segments are expected to drive future revenue and profit growth. This focus is a key part of its Agfa-Gevaert business model.

The financial strategy involves optimizing capital allocation and driving sustainable growth. The aim is to improve financial performance by leveraging technological advancements and market expansion. For more information, check out the Competitors Landscape of Agfa-Gevaert.

Agfa-Gevaert Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Agfa-Gevaert’s Growth?

The company, like any major player in the market, faces several potential risks and obstacles that could affect its growth, especially concerning its Agfa-Gevaert growth strategy. Market competition remains a significant challenge, particularly from established players and new entrants in both the healthcare IT and industrial printing sectors. Additionally, the rapid pace of technological disruption requires continuous investment in research and development to stay ahead of evolving industry standards and customer demands.

Supply chain vulnerabilities, compounded by global events, can lead to increased costs and production delays, impacting profitability and market responsiveness. Regulatory changes, particularly in the healthcare sector, could also affect product development and market access. For instance, the Q1 2024 report highlighted the impact of raw material and freight cost inflation on its gross profit margin, underscoring the challenges in maintaining profitability amidst external pressures.

Emerging risks, such as increasing cybersecurity threats to its digital platforms and the need for continuous talent acquisition in specialized technology fields, will also shape the company's future trajectory. These challenges highlight the importance of proactive risk management and strategic adaptation to ensure sustained success. Understanding these obstacles is crucial for anyone looking into Agfa-Gevaert future prospects and conducting a thorough Agfa-Gevaert company analysis.

The competitive landscape includes established players and new entrants in both healthcare IT and industrial printing. The intensity of competition can affect Agfa-Gevaert market position and its ability to capture market share. The company must continuously innovate and differentiate its products and services to maintain a competitive edge, as highlighted in Marketing Strategy of Agfa-Gevaert.

Rapid technological advancements require significant investment in research and development to stay ahead. This includes adapting to new industry standards and meeting evolving customer demands. Failure to innovate can lead to obsolescence and loss of market share, affecting long-term growth potential.

Global events can exacerbate supply chain issues, leading to increased costs and production delays. These disruptions can negatively impact profitability and the company's ability to meet market demands. Effective supply chain management and diversification are crucial for mitigating these risks.

Changes in regulations, particularly in the healthcare sector, can affect product development and market access. Compliance with new regulations may require significant investments and adjustments to the company's operations. Staying informed and adapting to regulatory changes is essential.

Increasing cybersecurity threats to digital platforms pose a growing risk. Protecting sensitive data and ensuring the security of digital infrastructure require continuous investment in cybersecurity measures. Breaches can lead to financial losses and reputational damage.

The need for continuous talent acquisition in specialized technology fields is crucial. Attracting and retaining skilled employees is essential for driving innovation and maintaining a competitive advantage. Competition for talent may increase costs and impact the company's ability to execute its strategic initiatives.

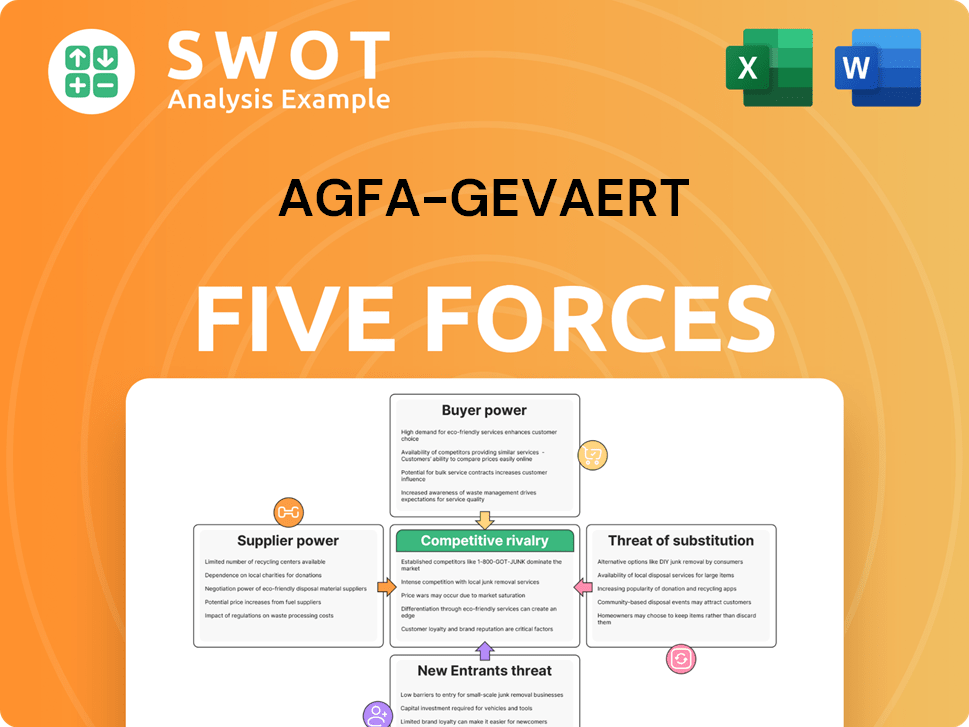

Agfa-Gevaert Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agfa-Gevaert Company?

- What is Competitive Landscape of Agfa-Gevaert Company?

- How Does Agfa-Gevaert Company Work?

- What is Sales and Marketing Strategy of Agfa-Gevaert Company?

- What is Brief History of Agfa-Gevaert Company?

- Who Owns Agfa-Gevaert Company?

- What is Customer Demographics and Target Market of Agfa-Gevaert Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.