Agria Bundle

How Does Agria Company Stack Up in Today's Agricultural Arena?

The agricultural sector is undergoing a massive transformation, fueled by technological innovation and shifting consumer demands. Agria Company, a prominent player in this evolving landscape, is focused on boosting agricultural productivity and efficiency. But how does Agria navigate this dynamic environment, and what challenges and opportunities does it face?

This analysis dives deep into the Agria SWOT Analysis, examining its market position and the competitive environment it operates within. We'll explore Agria's key rivals, analyze its unique advantages, and assess the overall industry trends shaping its future. Understanding the Agria Company competitive landscape is crucial for anyone seeking insights into the Agria industry and its potential for growth, including an understanding of Agria competitors and market share Agria.

Where Does Agria’ Stand in the Current Market?

Agria Group Holding holds a significant position in the agricultural sector, particularly in North-Eastern Bulgaria. The company's core operations revolve around cultivating essential crops such as wheat, barley, maize, sunflower, and rapeseed. Beyond crop cultivation, Agria is deeply involved in grain storage and processing, as well as the production of sunflower crude and refined oils.

The value proposition of Agria lies in its integrated approach to agriculture, encompassing cultivation, storage, processing, and trade. This comprehensive model allows for greater control over the supply chain and the ability to adapt to market fluctuations. This integrated structure enhances operational efficiency and supports its export operations, solidifying its market position.

In 2024, Agria's consolidated revenues reached BGN 654 million, although this represented a 15.9% decrease compared to the previous year. Sales revenue declined by 14.4% to BGN 622 million, primarily due to reduced prices for key materials like sunflower and wheat. Despite this, the company's EBITDA grew by 72% to BGN 62.7 million, and EBIT jumped by 182% to BGN 39.7 million, indicating improved operational performance when excluding one-off events. As of September 30, 2024, Agria Group Holding reported trailing 12-month revenue of $356 million. For a deeper understanding of the company's strategic growth, you can review the Growth Strategy of Agria.

Agria's market position is strong in North-Eastern Bulgaria, where it cultivates a significant amount of land. The company's focus on optimizing its cultivated lands and strengthening export operations indicates a strategic effort to maintain and enhance its market share. The company is also exploring investments in biotechnology, specifically wet corn milling, to refine grains produced by its subsidiaries.

- Agria cultivates approximately 15,000 hectares of agricultural land, with 8,000 hectares owned.

- The company has a substantial grain storage capacity of around 290,000 tonnes.

- Key crops include wheat, barley, maize, sunflower, and rapeseed.

- Agria's strategic focus includes optimizing agricultural lands and strengthening export operations.

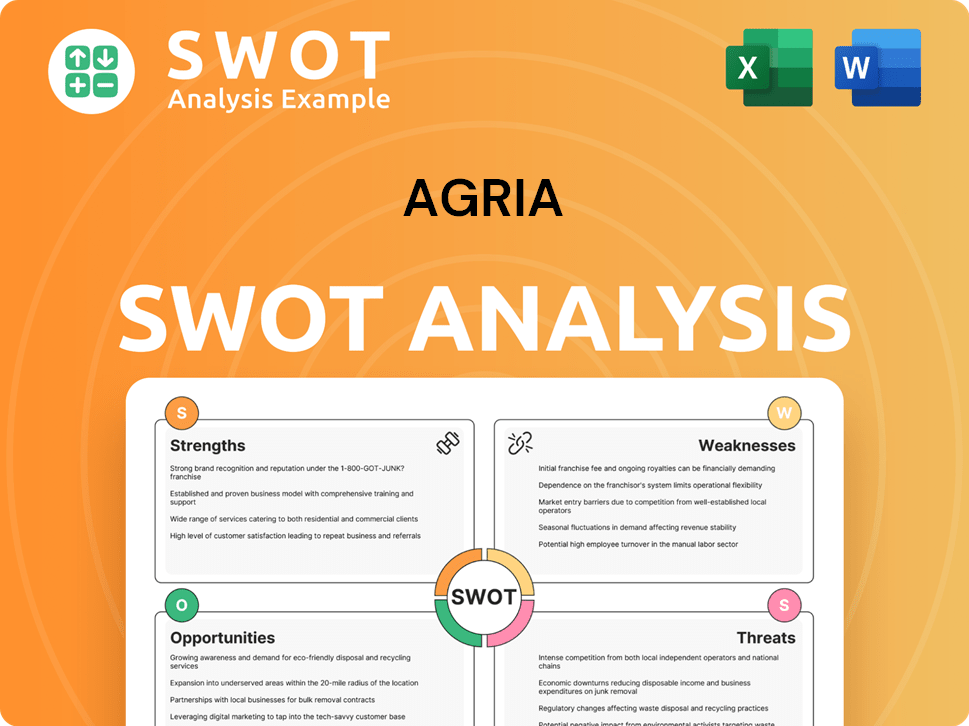

Agria SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Agria?

The competitive landscape for the Agria Company is multifaceted, encompassing various segments within the agricultural and pet insurance industries. Understanding the Agria analysis of its competitors is crucial for assessing its market position and identifying opportunities for growth. The Agria industry faces constant shifts, making it essential to monitor the strategies and performance of key players.

The competitive landscape varies significantly across Agria's business areas. In the corn seed business, Agria faces competition from both domestic and multinational companies. The sheep/goat breeding operations also have a unique set of competitors, mainly local farms. Additionally, Agria Pet Insurance operates in a distinct market with its own set of rivals.

To understand the competitive dynamics, it's important to examine the specific players and their strategies. This includes analyzing their market share, product offerings, and financial performance. For a deeper dive into the ownership structure, you can explore the details in the article Owners & Shareholders of Agria.

Agria's corn seed business competes with domestic entities such as Denghai Seed Joint Stock Limited Company, Beijing Denong Seed Company Limited, and Shangxi Tunyu Seed Science and Technology Joint Stock Limited Company. These companies often have an advantage in local markets.

Multinational seed companies like Pioneer, Monsanto, and Syngenta pose significant competition. These companies leverage greater financial and technical resources.

In sheep/goat breeding, Agria faces competition from local farms. Key competitors include Tianjin Jisheng Sheep Breeding Center, Hualiang Group, and Fumin Muslim Food Co., Ltd.

Agria's seedling business competes with local seedling companies in Shanxi. The competition is based primarily on technological capabilities and the scale of greenhouses.

Agria Pet Insurance competes with companies like Petplan, ManyPets, and Trupanion. These companies are prominent in the European pet insurance market.

Agria differentiates itself through integrated pet care packages and market expertise. Petplan introduced a new mobile app with telemedicine services in August 2024.

The Agria Company's competitive environment is shaped by several factors. These include product attributes, pricing strategies, brand recognition, and economies of scale. The ability to innovate and adapt to changing market demands is also critical.

- Market share Agria: Understanding Agria's market share in each segment is vital for assessing its competitive position.

- Agria competitors: Identifying and analyzing the strategies of Agria's competitors provides insights into the competitive dynamics.

- Agria industry: Industry trends, such as technological advancements and changing consumer preferences, influence Agria's competitive landscape.

- Agria Company competitive advantages: Analyzing Agria's strengths, such as its product offerings and market presence, highlights its competitive advantages.

- Agria Company market position analysis: Assessing Agria's market position involves evaluating its strengths, weaknesses, opportunities, and threats (SWOT analysis).

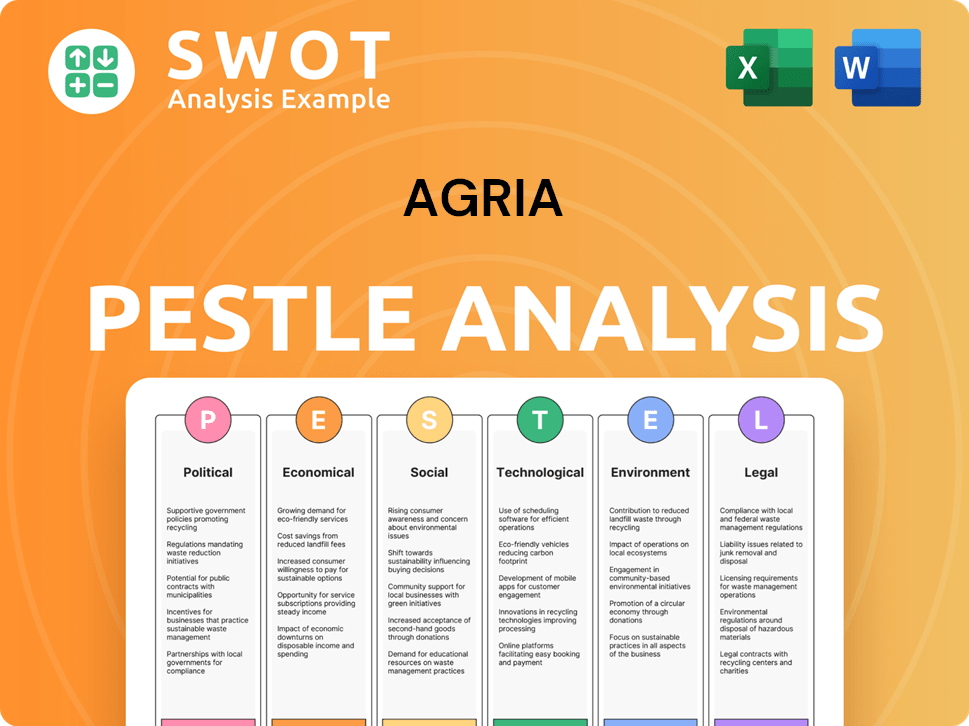

Agria PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Agria a Competitive Edge Over Its Rivals?

The competitive landscape of the Agria Company is shaped by its strategic focus on integrated agricultural operations. Agria's approach encompasses a wide range of activities, from land ownership and cultivation to grain storage and processing, which sets it apart in the industry. This integrated model allows for greater control over the supply chain and enhances its ability to manage costs effectively.

Agria's competitive advantages are further strengthened by its investments in infrastructure and technology. The company's grain storage facilities, with a capacity of approximately 290,000 tonnes, and its use of advanced equipment for agricultural activities demonstrate a commitment to efficiency. These strategic moves support its export capabilities and improve the quality of its products.

In 2024, despite a decrease in total revenues, Agria achieved significant financial growth, with a 72% increase in EBITDA to BGN 62.7 million and a 182% jump in EBIT to BGN 39.7 million. This financial performance highlights Agria's strong operational efficiency and cost management, positioning the company for sustainable growth within the agricultural sector. The company's focus on optimizing cultivated lands and strengthening export operations further supports its long-term strategy.

Agria's ownership and cultivation of approximately 8,000 hectares of agricultural land is a key competitive advantage. This direct control over raw materials, including wheat, barley, maize, sunflower, and rapeseed, ensures supply chain stability and quality control. This integrated model supports its overall market position and operational efficiency.

The company's investment in grain storage and processing facilities, with a total capacity of around 290,000 tonnes across three main bases, offers a crucial logistical advantage. This infrastructure supports the efficient handling, storage, and processing of agricultural products, including the production of sunflower crude and refined oils. Strategic locations near major ports like Varna and Burgas enhance export capabilities.

Agria utilizes its own highly productive equipment for agricultural activities and processing. The use of compounds for vegetation protection and fertilizers to improve production quality further enhances its operational efficiency. The construction of irrigation systems, such as those in Smyadovo and Veliki Preslav, demonstrates a commitment to optimizing yields and mitigating climate-related risks.

Agria's strong financial performance in 2024, with significant growth in EBITDA and EBIT, highlights its operational efficiency and cost management. This financial resilience, combined with its long-term strategy of optimizing cultivated lands and strengthening export operations, positions Agria for sustainable growth. The company's commitment to animal health and research programs also underscores a strong brand reputation.

Agria's competitive advantages are multifaceted, encompassing integrated operations, strategic infrastructure, and financial strength. These elements combine to create a robust business model designed for long-term sustainability and growth. For more insights into the company's target market, consider reading about the Target Market of Agria.

- Integrated Operations: Owning and cultivating agricultural land provides control over raw materials.

- Strategic Infrastructure: Grain storage and processing facilities enhance logistical capabilities.

- Financial Performance: Strong financial results demonstrate operational efficiency and cost management.

- Technological Advancement: Use of advanced equipment and irrigation systems improves yields.

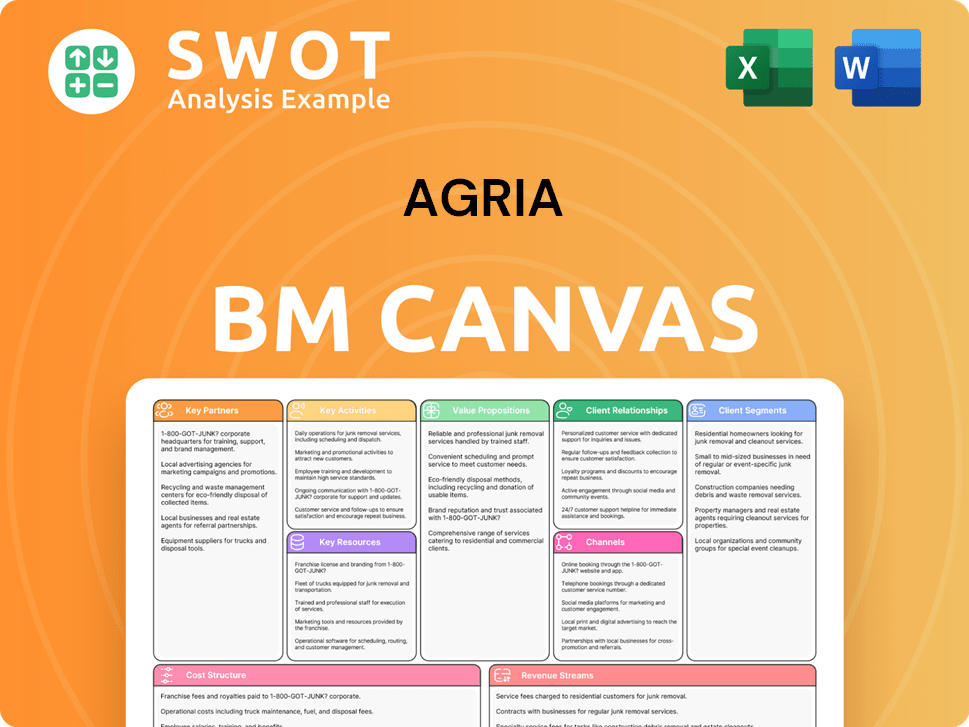

Agria Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Agria’s Competitive Landscape?

The agricultural sector is currently undergoing significant transformations, creating a dynamic competitive landscape for companies like Agria. Understanding the industry trends, future challenges, and opportunities is crucial for Agria's strategic planning and sustained success. This Agria Company analysis provides insights into the competitive environment and the factors shaping its future.

The agricultural sector is experiencing shifts driven by sustainability, technological advancements, and evolving consumer preferences. These changes present both risks and prospects for Agria, influencing its market position and strategic direction. Adapting to these trends is essential for maintaining and enhancing its competitive edge.

The primary trend is the increasing demand for sustainable agricultural practices, driven by a global population expected to reach 8.5 billion by 2030. Technological advancements are also transforming the sector, with precision agriculture, AI, IoT, and robotics gaining traction. Regenerative agriculture is also being integrated, with 15% of farmers globally applying its practices.

Agria faces challenges such as volatility and price reductions in main agricultural products, as seen in 2024 with sunflower and wheat prices decreasing. Adverse weather conditions and climate variations pose ongoing threats to yields. The high cost of advanced agritech technologies can also hinder adoption by smaller businesses.

Agria can capitalize on the high growth potential for agricultural exports, projected to grow by USD 23.5 billion from 2024-2028. Investment in biotechnology, such as wet corn milling, offers an avenue for Agria to diversify its offerings. The growing adoption of digital platforms for booking and online marketing in agritourism also presents opportunities.

The company's focus on improving agricultural productivity and efficiency aligns with the industry's need for enhanced crop yields, which are expected to provide 87% of the necessary productivity improvement by 2030. Agria's existing infrastructure for grain storage and processing, along with its strategic locations near export ports, positions it to capitalize on the high growth potential.

Agria's competitive advantages include its focus on improving agricultural productivity and efficiency, aligning with the industry's need for enhanced crop yields. Its existing infrastructure for grain storage and processing, along with strategic locations near export ports, offers a strong market position. Continuous investment in modernizing facilities and exploring new technologies is also crucial.

- Agria's infrastructure for grain storage and processing.

- Strategic locations near export ports.

- Continuous investment in modernizing facilities.

- Exploration of new technologies.

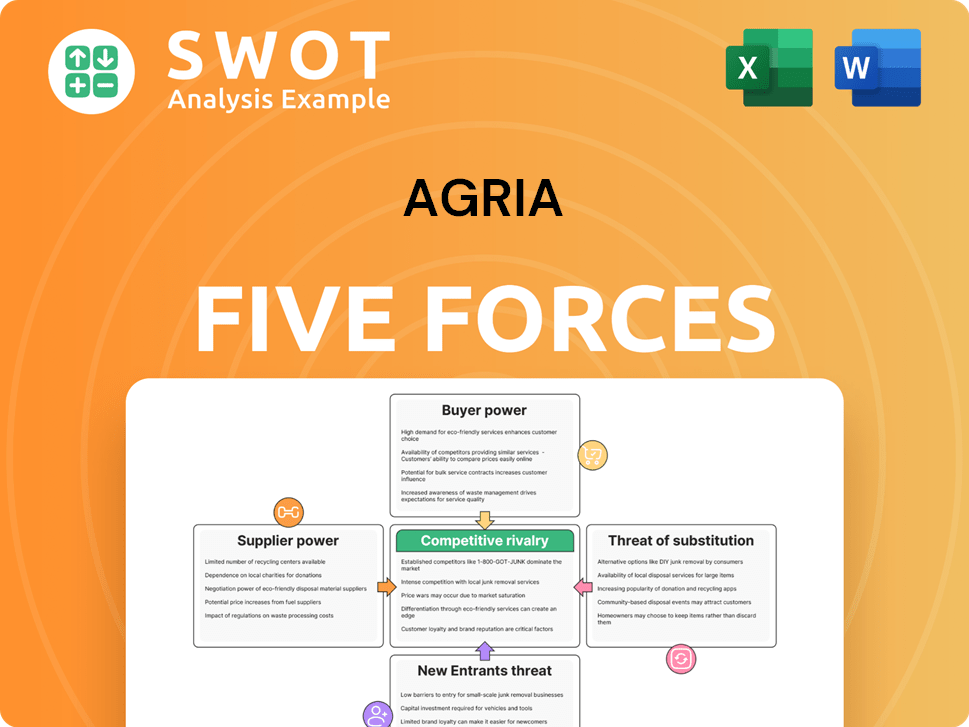

Agria Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agria Company?

- What is Growth Strategy and Future Prospects of Agria Company?

- How Does Agria Company Work?

- What is Sales and Marketing Strategy of Agria Company?

- What is Brief History of Agria Company?

- Who Owns Agria Company?

- What is Customer Demographics and Target Market of Agria Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.