Agria Bundle

How Will Agria Company Thrive in the Agricultural Future?

Agria Company, a key player in the agricultural sector, is focused on boosting productivity through its diverse product offerings. With a rich history rooted in animal welfare and agricultural support, understanding its Agria SWOT Analysis is crucial. This report dives into Agria's plans for future growth within the dynamic agricultural landscape.

This exploration will analyze Agria Company's growth strategy, including its expansion plans, innovation, and financial performance. We'll examine its market share and trends, providing insights into how Agria plans to grow and navigate challenges. This comprehensive market analysis will help stakeholders assess the future prospects and investment opportunities within the agricultural sector, considering both its strategic initiatives and long-term growth strategy.

How Is Agria Expanding Its Reach?

The Growth strategy of the Agria Company centers on ambitious expansion initiatives, particularly within its insurance operations. These efforts are designed to strengthen its market position and enhance its offerings across Europe and beyond. The company's strategic moves, including mergers and partnerships, are key to its future prospects and sustained financial performance.

Agria is focused on becoming a leading player in the pet insurance market in Europe. Its expansion strategy includes both organic growth and strategic acquisitions. The company's commitment to strategic partnerships and market penetration demonstrates its proactive approach to business development and market analysis.

The company's international operations are already profitable in all countries where it has a presence, including Norway, Denmark, Finland, the UK, France, Ireland, and Germany. This existing foundation supports its aggressive expansion plans.

A significant move in Agria's Growth strategy was the merger between the insurance broker Capstone Financial Services Ltd and Agria, decided in 2024 and completed on February 28, 2025. This merger is expected to boost Agria's market share and offerings. The company aims to become the largest pet insurance provider in Europe.

Agria is also leveraging strategic partnerships to expand its reach and improve customer access. In April 2025, Agria Pet Insurance partnered with the Irish Kennel Club (IKC) to improve canine health and welfare. This collaboration, along with a longstanding partnership with the Royal Kennel Club of England, highlights Agria's dedication to specific market segments.

Agria's expansion strategy is multi-faceted, incorporating mergers, strategic partnerships, and market-specific initiatives. These efforts are aimed at enhancing brand awareness and fostering strong connections within the animal world. The company's ability to capture market share in competitive markets, such as the UK, is a testament to its effective strategies.

- Merger with Capstone Financial Services Ltd to strengthen market position.

- Partnerships with organizations like the Irish Kennel Club (IKC) and British Equestrian.

- Focus on becoming the largest pet insurance provider in Europe.

- Ongoing efforts to build brand awareness and strengthen connections with animal-related communities.

For more insights into the company's core values and mission, you can refer to Mission, Vision & Core Values of Agria. These initiatives are critical to the company's long-term growth strategy and its ability to navigate challenges and opportunities in the market.

Agria SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Agria Invest in Innovation?

The Agria Company strategically uses innovation and technology to drive its growth strategy, particularly in pet and crop insurance. This approach involves continuous investment in research and development, as demonstrated by the Agria Research Fund. This commitment supports advancements in veterinary medicine and animal health, which is critical for its future prospects.

By focusing on digital transformation and sustainable practices, the company aims to enhance its services and meet evolving customer needs. The company's digital initiatives, such as digital vet consultations, and sustainability efforts, like the carbon calculator, reflect its commitment to both customer service and environmental responsibility. This dual focus positions the company well for future growth and market leadership.

Through these initiatives, Agria Company aims to strengthen its market position and foster long-term sustainability. The company's dedication to research, digital innovation, and environmental responsibility is key to its business development and achieving its strategic goals.

The Agria Company invests heavily in research and development, primarily through the Agria Research Fund. The fund, established in 1938, allocates a portion of insurance premiums to support research benefiting pets, horses, and farm animals. This continuous investment is a core part of their growth strategy.

In 2024, the fund awarded over SEK 10.4 million to various research projects. These projects were in collaboration with other research foundations. The funding supported a range of projects, including ten new projects focused on pets, eight on equine research, and four on agriculture.

The R&D efforts have financed hundreds of projects, improving veterinary medicine expertise. This includes advancements in animal health, diagnostics, treatment methods, and rehabilitation. The company's commitment to research is a key factor in its financial performance.

In 2025, Agria Company, in collaboration with the Swedish University of Agricultural Sciences, will award the first 'Big Research Prize in Veterinary Medicine'. This prize will highlight research that benefits animals. This initiative further underscores the company's dedication to innovation.

The company has embraced digital transformation to enhance its service offerings. The company provides digital vet consultations through its subsidiary, Agria Vet Guide AB. This service is available in Sweden and Denmark, offering convenience to customers.

Agria is committed to sustainable veterinary care and reasonable costs. It has also launched a carbon calculator for pets. The company aims to become carbon positive in 2024 by investing in international projects. These initiatives align with UN Sustainable Development Goals.

The Agria Company focuses on several key initiatives to drive its growth strategy. These include continuous investment in research and development, digital transformation, and sustainable practices. These initiatives are designed to enhance customer service, improve operational efficiency, and contribute to environmental sustainability, which are crucial for the company's market analysis.

- Research and Development: The Agria Research Fund supports projects that improve animal health and veterinary practices.

- Digital Transformation: Digital vet consultations and online services enhance customer convenience and reduce paper consumption.

- Sustainability Initiatives: The carbon calculator and investments in sustainable projects demonstrate the company's commitment to environmental responsibility.

- Customer Focus: By offering innovative services and sustainable options, Agria aims to meet the evolving needs of its customers.

Agria PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Agria’s Growth Forecast?

In 2024, the financial performance of the Agria Company reflected a blend of expansion and hurdles, setting the stage for potential positive outcomes in 2025. The company's strategic positioning is crucial for navigating the market and achieving its growth strategy. A detailed market analysis reveals key trends and opportunities for Agria to capitalize on.

For the year ending December 31, 2024, Agria Group Holding AD reported sales of BGN 621.63 million, a decrease from BGN 726.25 million the previous year. Net income was BGN 19.1 million, down from BGN 28.71 million. Despite the revenue decrease, the company's operating expenses dropped, leading to a significant growth in EBITDA and EBIT.

The company's total consolidated revenues decreased by 15.9% in 2024 to BGN 654 million, including a 14.4% decrease in sales revenue to BGN 622 million. This decline was primarily due to a 21.3% drop in sales of goods and materials (grains). However, sales of production (oils from oilseed grains) increased by 24.8% to BGN 135 million. The company's Brief History of Agria provides context to the company's evolution and financial strategy.

Agria's 2024 financial performance showed a decrease in sales revenue, primarily due to a drop in grain sales. However, the company saw a significant increase in sales of oils from oilseed grains. These shifts indicate the company's ability to adapt to market changes.

Agria is optimistic about 2025, expecting positive results due to anticipated increases in product prices and volumes. The company's strategic initiatives focus on capitalizing on the positive operational trends seen in the second half of 2024 and early 2025.

Agria anticipates a very positive result in 2025 due to an expected increase in product prices and volumes. The prices of main products reversed their negative trend in the second half of 2024 and early 2025, signaling a positive operational trend.

Agria's solvency ratio on December 31, 2024, was 167%, an increase from 152%. Own funds grew by SEK 61 million to SEK 1,709 million. This strong capital position is supported by net profit, despite planned dividends.

The company's investment portfolio primarily consists of interest-bearing assets. The investment return increased to 5.9% in 2024, demonstrating effective management of financial resources. This reflects the company's focus on maximizing returns and ensuring financial stability.

- EBITDA Growth: 72% increase to BGN 62.7 million.

- EBIT Growth: 182% increase to BGN 39.7 million.

- Solvency Ratio: Increased to 167% by the end of 2024.

- Own Funds: Grew by SEK 61 million to SEK 1,709 million.

Agria Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Agria’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the Target Market of Agria and its future prospects. Several factors could impede its growth strategy, including market competition, regulatory changes, and supply chain vulnerabilities.

The company's operations in both the agricultural and insurance sectors expose it to a variety of challenges. These risks necessitate a proactive approach to ensure sustained financial performance and successful business development. Understanding and mitigating these risks is vital for investors and stakeholders.

The company must navigate a complex landscape to achieve its strategic goals. This includes adapting to evolving market dynamics, technological advancements, and emerging risks to maintain its competitive edge and achieve long-term sustainability.

Intense competition in the pet insurance market poses a significant challenge. The company addresses this by strengthening brand awareness and building strong connections within the animal world. Effective marketing and customer relationship management are crucial for maintaining and increasing market share.

Adapting to new regulations, particularly those related to sustainability reporting, is essential. The implementation of standards like the European Sustainability Reporting Standards (ESRS) requires adjustments to operational and reporting practices. Compliance ensures long-term viability and investor confidence.

Supply chain disruptions, especially within the agricultural sector, can impact operations. Climate risks and extreme weather events can affect crop yields and livestock health, potentially leading to financial losses. Diversification and robust risk management are essential.

Advancements in AI and automation present both opportunities and risks. The company must continually adapt to technological changes to remain competitive. Investments in digital transformation, such as digital vet consultations, are vital for future success.

Identifying and managing emerging risks through continuous risk-management activities is a priority. The annual Own Risk and Solvency Assessment (ORSA) helps in proactively addressing new challenges. This includes non-life insurance risks and operational risks arising from insurance operations.

The concentration of risk could arise if the insurance business is not sufficiently diversified. The livestock and crop insurance business helps mitigate this by increasing diversification. A diversified portfolio minimizes the impact of any single event.

The company's risk management framework focuses on controlling risk-taking as an integrated part of business governance. Forward-looking analyses are crucial for anticipating and mitigating potential threats. This approach includes addressing known risks and identifying new ones, ensuring a proactive and adaptive strategy.

The financial outlook is closely tied to effective risk management and strategic initiatives. The company’s ability to navigate these challenges will significantly impact its financial performance. Analyzing market trends and financial data provides a comprehensive view of potential investment opportunities and long-term growth.

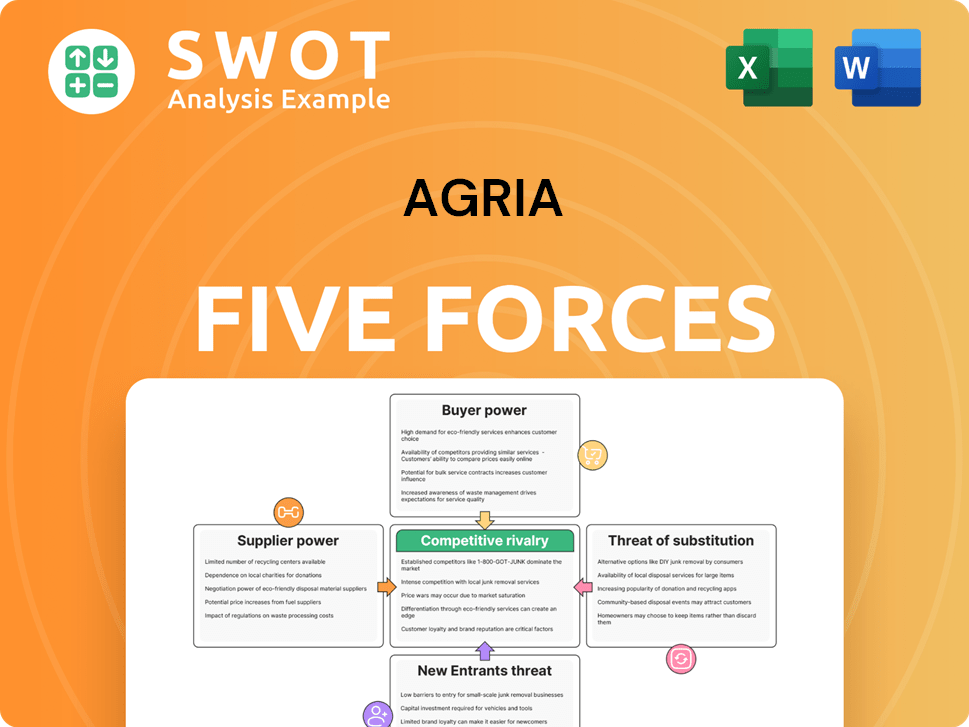

Agria Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agria Company?

- What is Competitive Landscape of Agria Company?

- How Does Agria Company Work?

- What is Sales and Marketing Strategy of Agria Company?

- What is Brief History of Agria Company?

- Who Owns Agria Company?

- What is Customer Demographics and Target Market of Agria Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.