Agria Bundle

Decoding Agria Company: How Does It Thrive?

Agria Corporation, a major player in the agricultural arena, is a force in producing and distributing a wide array of agricultural goods. With a focus on boosting agricultural productivity and efficiency, Agria's influence spans agribusiness, processing, and trade. In 2024, Agria Group Holding reported a consolidated revenue of BGN 654 million, and the company's Q1 2024 revenue reached $1.2 billion, demonstrating market confidence.

To fully grasp Agria's potential, it's vital to understand its operational structure, revenue sources, and strategic direction. This analysis will explore Agria's core operations, value proposition, and key milestones. Considering the dynamic agricultural market and the Agria SWOT Analysis, investors and stakeholders can gain valuable insights into its competitive advantages and future prospects. Whether you're interested in Agria insurance, Agria pet insurance, or simply want to know how the company operates, this is a must-read.

What Are the Key Operations Driving Agria’s Success?

The core operations of the [Company Name] are centered around agribusiness, processing, and the trade of agricultural products. This encompasses a wide range of activities, from cultivating agricultural land to processing and trading grains and other agricultural goods, primarily in North-Eastern Bulgaria. The company has expanded its reach internationally, indicating a strategic focus on both local and global markets.

The company's value proposition is built on an integrated approach to agricultural production and supply chain management. It emphasizes quality and technological advancements to improve efficiency and productivity. This includes investments in precision agriculture technologies and modernizing storage facilities to enhance crop yields and reduce operational costs.

The company's diverse business segments help spread risk and navigate market volatility. This diversification led to a 15% increase in revenue for diversified companies in 2024 compared to those focused on a single sector.

The agribusiness segment focuses on cultivating agricultural land and producing grain crops, including wheat, barley, maize, sunflower, and rapeseed. It also involves the production of fruit trees and provides various farming and technical services. This segment is crucial for the company's integrated approach.

The processing industry handles the storage and processing of grains, producing flours, bran, semolina, and hulled wheat, as well as oils from oilseed grains. This segment adds value to the raw agricultural products.

The company is involved in the trade and export of agricultural products, including farming fertilizers, plant protection chemicals, fuels, lubricants, and sowing seeds. This segment facilitates the distribution of products.

The company's value proposition is rooted in its integrated approach to agricultural production and supply chain management. Investments in precision agriculture technologies, which increased by 15% in 2024, are expected to boost yields and reduce expenses. Its operational processes are supported by strategic investments in capacity building and efficiency.

The company focuses on technological advancements and strategic investments to enhance efficiency. However, its supply chain and distribution networks are vulnerable to disruptions, which increased by 15% in 2024-2025.

- Precision agriculture technologies are key to improving yields and reducing costs.

- Modernizing storage facilities is crucial for operational efficiency.

- Supply chain disruptions pose a significant risk.

- Diversification across business segments helps mitigate market volatility.

Agria SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Agria Make Money?

The revenue streams and monetization strategies of the company are multifaceted, primarily focusing on sales of goods and materials, and sales of production. In 2024, the company's financial performance reflected shifts in market dynamics and strategic initiatives aimed at sustaining profitability.

The company's revenue model is largely driven by its sales of goods and materials, particularly grains, and sales of production, which includes oils derived from oilseed grains. These core activities are supplemented by other revenue sources such as government funding and financial revenues. The company also strategically utilizes acquisitions to enhance its financial position.

In 2024, the company's total consolidated revenues were BGN 654 million, a 15.9% decrease from the previous year. Sales revenue, which includes sales of goods and materials (grains) and sales of production (oils from oilseed grains), constituted the vast majority, decreasing by 14.4% to BGN 622 million.

The company's revenue streams are diverse, with a significant portion coming from sales of goods and materials, and sales of production. The company also leverages acquisitions and anticipates positive impacts from strategic pricing adjustments. For more information about the Owners & Shareholders of Agria, please visit the website.

- Sales of goods and materials (grains) decreased by 21.3% to BGN 482 million in 2024, impacted by lower commodity prices for sunflower and wheat.

- Sales of production (oils) increased by 24.8% to BGN 135 million, showing positive growth.

- Other revenue sources include government funding, which dropped 12.6% to BGN 11 million, and other revenues, which saw a 4.3x rise to BGN 19 million, including BGN 16 million from the sale of non-current assets.

- Financial revenues decreased by 19% to BGN 2.6 million.

- The acquisition of Almagest EOOD in 2023 positively contributed BGN 32.2 million from the difference between the acquisition price and fair value of assets.

- The company is considering future price increases for its products, expecting positive results in 2025 due to a reversal of negative price trends.

Agria PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Agria’s Business Model?

The Agria Company has significantly shaped its operations and financial performance through strategic moves and key milestones. A notable strategic move was the acquisition of Almagest EOOD in 2023, which contributed BGN 32.2 million to revenues that year. The company also acquired a remaining 0.74% stake in Kristera JSC and completed the acquisition of Komerce EOOD in early 2024. These acquisitions demonstrate a pattern of expanding their operational footprint and market reach. Furthermore, Agria Group Holding adopted a decision to increase the capital of its subsidiary Kristera EAD by BGN 10 million in October 2024.

The company has faced operational challenges, particularly sensitivity to commodity price fluctuations, which impacted its profitability in 2024 due to global grain price volatility. Additionally, increased leverage and debt, with long-term bank debt reaching BGN 88 million in 2024 and short-term bank loans rising 30% by the end of 2024 to BGN 265 million, have increased financial expenses. Exposure to agricultural risks, such as extreme weather events, led to a 15% reduction in yields for key crops in 2024, directly affecting operational stability. Supply chain disruptions also increased by 15% in 2024-2025, potentially increasing costs and reducing profitability.

Agria's competitive advantages include its established brand and market trust, supported by a Q1 2024 revenue of $1.2 billion. Its diversified business segments across agribusiness, processing, and trade help spread risk and navigate market volatility. Strategic investments in capacity building, efficiency, and technology, with a 15% increase in precision agriculture investments in 2024, enhance its operational capabilities and product quality. Strong partnerships and collaborations, including a €20 million financing from the European Investment Bank in 2024 and animal insurance partnerships expanding market share by 15% in 2024, have further driven growth, with collaborations increasing revenue by 10% in 2024. The company continues to adapt by exploring renewable energy, integrating precision agriculture and AI, and focusing on sustainable agriculture, with the global market for sustainable agriculture projected to reach $22.3 billion by 2025.

Acquisition of Almagest EOOD in 2023 contributed BGN 32.2 million to revenues. Completed the acquisition of Komerce EOOD in early 2024. Increased capital of Kristera EAD by BGN 10 million in October 2024.

Expansion through acquisitions to increase market reach. Investment in precision agriculture increased by 15% in 2024. Strong partnerships and collaborations, including a €20 million financing from the European Investment Bank in 2024.

Established brand and market trust, supported by a Q1 2024 revenue of $1.2 billion. Diversified business segments spread risk and navigate market volatility. Focus on sustainable agriculture, with the global market projected to reach $22.3 billion by 2025.

Sensitivity to commodity price fluctuations impacted profitability in 2024. Increased leverage and debt, with long-term bank debt reaching BGN 88 million in 2024. Exposure to agricultural risks, such as extreme weather events, led to a 15% reduction in yields for key crops in 2024.

The company's financial performance in 2024 was influenced by several factors, including acquisitions, market volatility, and strategic investments. The acquisitions of Almagest EOOD and Komerce EOOD expanded the company's operational footprint. The company's marketing strategy is further explained in Marketing Strategy of Agria.

- Revenue from Almagest EOOD in 2023 was BGN 32.2 million.

- Long-term bank debt reached BGN 88 million in 2024.

- Investments in precision agriculture increased by 15% in 2024.

- Collaborations increased revenue by 10% in 2024.

Agria Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Agria Positioning Itself for Continued Success?

The Agria Company holds a well-established position within the agricultural sector. Its long-standing presence and strong brand recognition contribute to its market strength. Agria's diversified business model, encompassing agribusiness, processing, and trade, helps in managing risks and adapting to market changes.

However, Agria faces several challenges. Profitability is subject to commodity price fluctuations, and the company deals with increased leverage, leading to higher financial expenses. Reliance on agriculture also exposes it to unpredictable weather events and disease outbreaks. Supply chain disruptions and intense market competition add further pressure, alongside potential regulatory changes.

Agria benefits from a strong market position in the agricultural sector, supported by its long history and recognized brand. The company's diverse operations, including agribusiness, processing, and trade, help to mitigate risks. Total assets reached BGN 749.24 million in 2024.

Agria faces risks from commodity price volatility, with global grain prices fluctuating in 2024. The company's leverage has increased, with long-term debt at BGN 88 million and short-term bank loans at BGN 265 million by the end of 2024. Weather events and disease outbreaks caused a 15% reduction in key crop yields in 2024.

Agria is focused on strategic initiatives to sustain and expand its profitability. The company anticipates positive results in 2025 as prices reverse negative trends seen in 2024. Investments in technology, such as precision agriculture, are expected to boost yields and cut expenses, with investments in this area increasing by 15% in 2024.

Agria is capitalizing on the rising demand for sustainable agriculture, with the global market projected to reach $22.3 billion by 2025. The company is also pursuing market expansion opportunities, particularly in the rapidly growing Asian agricultural market, projected to reach $3.5 trillion by 2025. Strategic acquisitions and alliances continue to be a part of its growth strategy, as evidenced by recent acquisitions in early 2024.

Agria is focused on strategic initiatives to sustain and expand its profitability, including investments in technology and market expansion. The company is positioning itself for future price increases in its main products, anticipating a very positive result in 2025. Strategic acquisitions and alliances continue to be a part of its growth strategy, as evidenced by recent acquisitions in early 2024.

- Investment in precision agriculture to boost yields and cut expenses.

- Capitalizing on the rising demand for sustainable agriculture.

- Expanding into the rapidly growing Asian agricultural market.

- Strategic acquisitions and alliances to support growth.

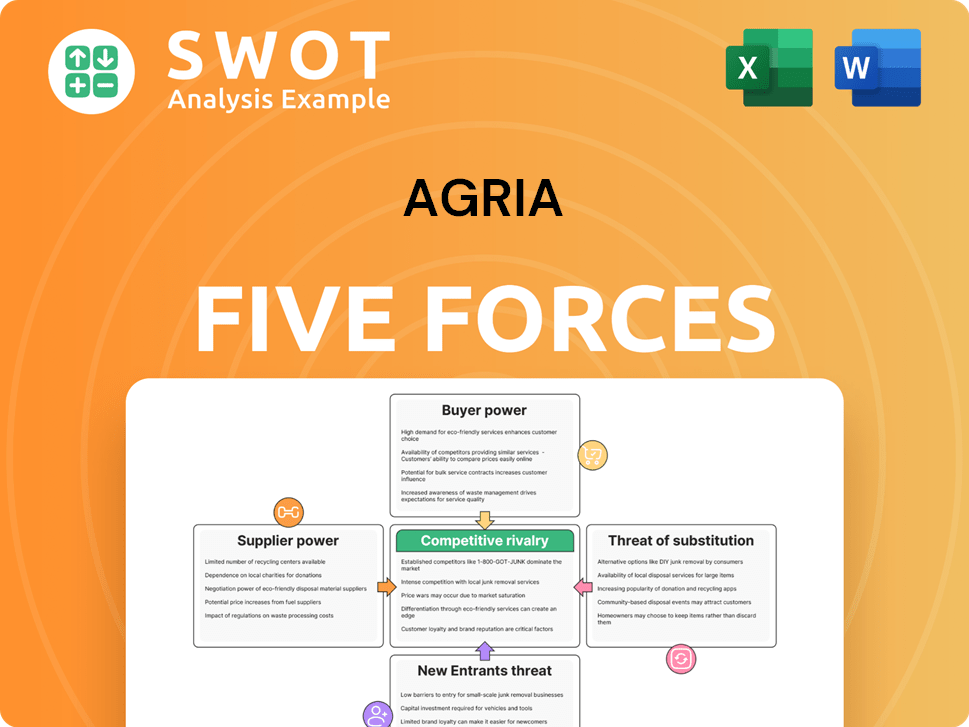

Agria Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agria Company?

- What is Competitive Landscape of Agria Company?

- What is Growth Strategy and Future Prospects of Agria Company?

- What is Sales and Marketing Strategy of Agria Company?

- What is Brief History of Agria Company?

- Who Owns Agria Company?

- What is Customer Demographics and Target Market of Agria Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.