Alaska Air Group Bundle

How Does Alaska Air Group Soar Above the Competition?

The airline industry is a turbulent arena, and understanding the Alaska Air Group SWOT Analysis is crucial for navigating its complexities. Alaska Air Group, a major player since 1985, faces intense competition in a market prone to volatility. This analysis delves into the company's competitive landscape, examining its position within the U.S. airline market and beyond.

This exploration of the Alaska Air Group delves into its competitive landscape, revealing its strategies for maintaining and growing its market share. We'll dissect the company's performance, including its impressive 2024 revenue figures, and analyze its strategic initiatives. By identifying Alaska Airlines competitors and evaluating its strengths and weaknesses, we can ascertain how Alaska Airlines intends to shape the future of Alaska Airlines competitive landscape.

Where Does Alaska Air Group’ Stand in the Current Market?

Alaska Air Group's core operations revolve around providing passenger and cargo air transportation. They primarily operate through Alaska Airlines and Horizon Air, serving a diverse network of destinations. Their value proposition centers on offering a comprehensive service within the United States, with significant presence on the West Coast, and expanding into new international markets.

The company's market position is strengthened by its strategic focus on customer service, operational efficiency, and route network optimization. The acquisition of Hawaiian Airlines in September 2024 significantly broadened its reach, particularly in Hawaii and the Pacific, enhancing its competitive footprint. This strategic move allows Alaska Air Group to compete more effectively in key markets and offer a wider array of travel options.

In 2024, Alaska Air Group reported record revenues of $11.7 billion, demonstrating strong financial performance. The company's market share based on total revenue was approximately 5.98% in Q1 2025. Although they reported a GAAP net loss in Q1 2025, the adjusted net loss narrowed, and total revenue increased by 9% year-over-year, fueled by the inclusion of Hawaiian Airlines' results. Premium revenue and loyalty program cash remuneration also saw growth, indicating robust customer engagement and revenue diversification.

Alaska Air Group ranks as the fifth-largest airline in the U.S. by revenue passenger miles. Their market share is a critical indicator of their competitive standing within the airline industry. The company's focus on strategic route planning and customer service contributes to maintaining and growing its market share.

The airline's primary operational focus is within the United States, with significant service to Alaska, the contiguous U.S., Hawaii, Canada, and Mexico. The integration of Hawaiian Airlines has expanded its network, particularly in Hawaii. This expansion allows for greater route diversity and enhanced service offerings.

In 2024, Alaska Air Group achieved record revenues of $11.7 billion and $1.5 billion in operating cash flow. Despite a reported GAAP net loss in Q1 2025, the adjusted net loss narrowed. The increase in revenue, partially due to Hawaiian Airlines, demonstrates the company's resilience and strategic growth.

Alaska Air Group serves a diverse customer base, with a strong presence on the West Coast. The acquisition of Hawaiian Airlines has broadened its network and customer reach. This strategic move allows the company to enhance its competitive position and offer more travel options.

The integration of Hawaiian Airlines presents significant opportunities for Alaska Air Group, expanding its route network and market presence. The company's ability to navigate industry challenges and capitalize on strategic partnerships will be crucial for future growth. Understanding the target market of Alaska Air Group is essential for strategic planning.

- Expansion into new markets.

- Enhanced competitive positioning.

- Improved financial performance.

- Increased customer base.

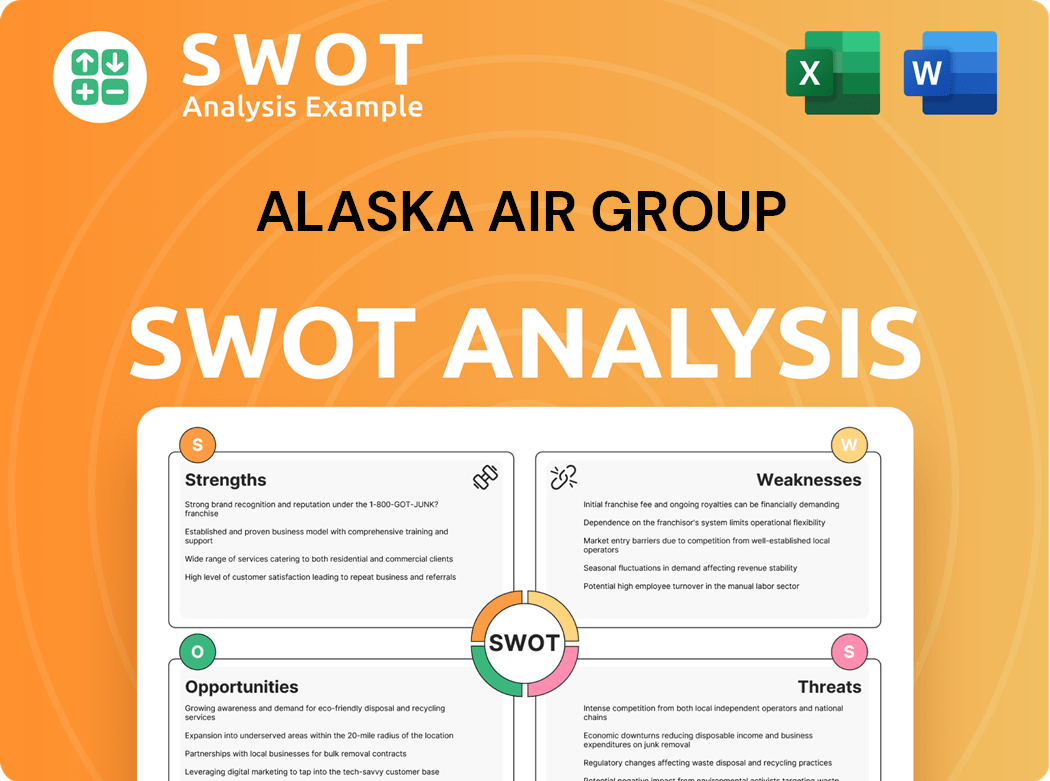

Alaska Air Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Alaska Air Group?

The Growth Strategy of Alaska Air Group operates within a highly competitive airline industry. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This analysis considers both direct and indirect competitors, evaluating their strategies and impact on Alaska Air Group.

The competitive dynamics are shaped by factors such as pricing, innovation, branding, distribution, and technology. The airline industry analysis reveals a complex interplay of these elements, with mergers, alliances, and capacity adjustments constantly reshaping the competitive environment. This chapter provides an overview of Alaska Air Group's key rivals and the challenges and opportunities they present.

Alaska Air Group faces a diverse set of competitors, each with unique strengths and strategies. These competitors challenge the company across various aspects of the business, including pricing, route networks, and customer service. The competitive landscape is dynamic, with capacity changes and strategic moves by rivals constantly influencing market share and profitability.

The primary direct competitors of Alaska Air Group include major airlines like Delta Air Lines, United Airlines, and American Airlines. These airlines operate extensive domestic and international networks, often with larger fleets and broader global reach through alliances. They compete directly with Alaska Air Group on many of the same routes and in key markets.

Southwest Airlines is a significant low-cost carrier competitor, known for its point-to-point network and focus on efficiency and customer satisfaction. This airline's pricing strategies and operational model pose a challenge to Alaska Air Group. Other low-cost carriers like Frontier Group and Sun Country Airlines also compete in specific markets.

Hawaiian Airlines, prior to its acquisition, was a direct competitor, particularly on routes to and from Hawaii. Other regional carriers like SkyWest and airlines such as JetBlue Airways and Allegiant Travel Co also compete in specific markets. Copa is another competitor, particularly in the Latin American market.

Competitors employ various strategies, including aggressive pricing, route expansion, and enhanced customer service. Innovation in technology and branding also plays a crucial role. Alaska Air Group must continuously adapt to these strategies to maintain its market share and profitability.

Mergers and alliances significantly reshape the competitive dynamics. Alaska Air Group's oneworld alliance membership and its acquisition of Hawaiian Airlines are key examples. These moves impact route networks, market share, and overall competitive positioning. The acquisition of Hawaiian Airlines, completed in 2024, is a major strategic move.

Analyzing market share data and financial performance metrics is essential for understanding the competitive landscape. Comparing Alaska Air Group's financial performance to its competitors provides insights into its strengths and weaknesses. Specific data from 2024 and 2025 will be crucial for evaluating the impact of recent strategic moves and market changes.

Several factors influence the competitive landscape for Alaska Air Group. These include pricing strategies, route network efficiency, customer service quality, and technological innovation.

- Pricing: Competitors often use dynamic pricing models to attract customers. Alaska Air Group must balance competitive pricing with profitability.

- Route Network: The breadth and efficiency of the route network are critical. Expanded route networks, especially in key hubs, can provide a competitive advantage.

- Customer Service: High customer satisfaction ratings can differentiate Alaska Air Group. Investing in customer service is essential for loyalty.

- Technology: Utilizing technology for booking, in-flight entertainment, and operational efficiency is vital.

- Brand and Loyalty Programs: Strong branding and loyalty programs, such as the Alaska Airlines Mileage Plan, are crucial for customer retention.

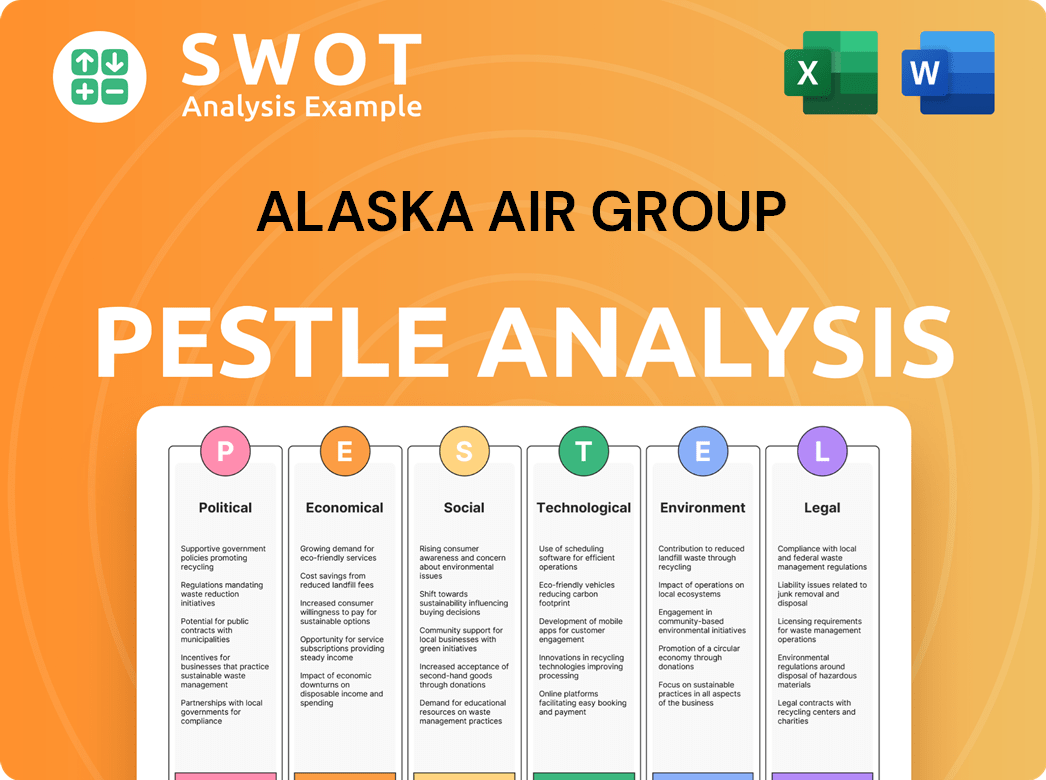

Alaska Air Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Alaska Air Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Alaska Air Group requires a deep dive into its strengths and how it positions itself within the airline industry. The company has cultivated a strong presence, particularly along the West Coast and in Alaska, setting the stage for a competitive edge. Moreover, its commitment to customer service and operational efficiency further solidifies its position, influencing its market share and financial performance.

Strategic moves, such as the integration of Hawaiian Airlines, are designed to enhance its network and expand its reach. This expansion is a key element in its competitive strategy. Additionally, the 'Alaska Accelerate' plan reflects a proactive approach to leverage existing strengths. These moves are critical for understanding the future of Alaska Air Group's competitive landscape.

The company's competitive advantages are multifaceted, including a focus on customer satisfaction and operational efficiency. The loyalty program and cost advantages also contribute to its success. This analysis is essential for investors and industry analysts seeking to understand the dynamics of the airline industry.

Alaska Air Group's robust network along the West Coast and in Alaska provides a significant advantage. This geographical focus allows for optimized route planning and better customer service. The company's ability to dominate these regions is a key factor in its market position.

Consistently high rankings in customer satisfaction, punctuality, and baggage handling set it apart. These factors contribute to customer loyalty and positive brand perception. This customer-centric approach is a critical differentiator in the competitive airline industry.

The Mileage Plan loyalty program is a valuable asset, fostering customer loyalty and repeat business. This program incentivizes customers to choose Alaska Air Group, enhancing its competitive edge. The program's benefits and ease of use contribute to its success.

Historically, Alaska Air Group has demonstrated a durable cost advantage compared to legacy airlines. This operational efficiency allows the company to offer competitive pricing. This cost advantage is crucial in maintaining profitability and competitiveness.

Alaska Air Group's competitive advantages include its strong West Coast and Alaska presence, focus on customer service, and operational efficiency. These factors contribute to its market share and financial performance, making it a strong player in the airline industry. The integration of Hawaiian Airlines further strengthens its network and market reach.

- Strong Network: A robust network, especially along the West Coast and in Alaska, provides strategic advantages.

- Customer Loyalty: High customer satisfaction ratings and the Mileage Plan loyalty program enhance customer retention.

- Operational Efficiency: Durable cost advantages and operational efficiency contribute to profitability.

- Strategic Integration: The merger with Hawaiian Airlines expands its network and international reach.

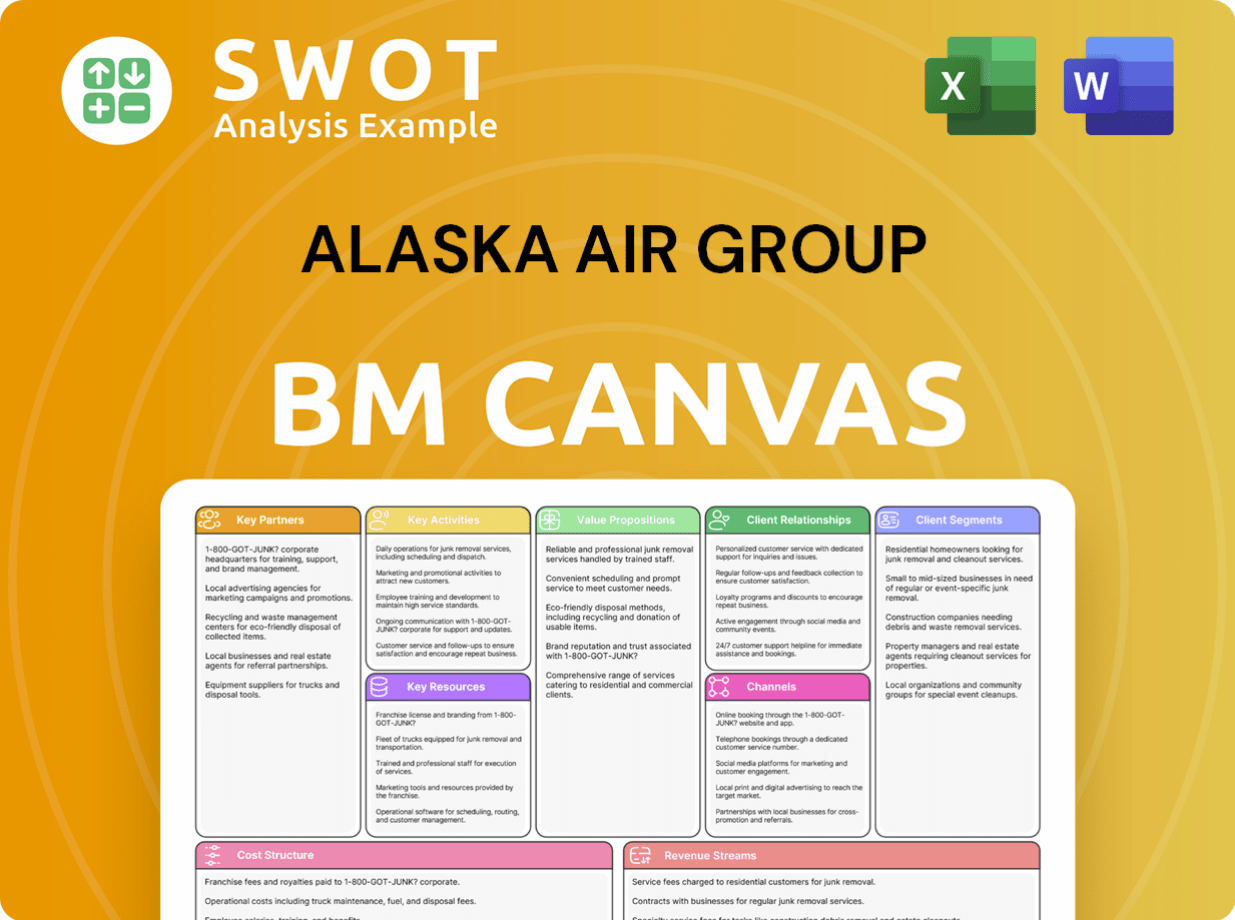

Alaska Air Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Alaska Air Group’s Competitive Landscape?

Understanding the competitive landscape for Alaska Air Group involves analyzing industry trends, future challenges, and potential opportunities. The airline industry is dynamic, shaped by technological advancements, regulatory changes, evolving consumer preferences, and global economic conditions. This analysis provides a comprehensive view of Alaska Air Group's position within this environment.

The company faces a mix of challenges and opportunities. Macroeconomic factors, fuel price volatility, and supply chain dependencies, particularly regarding aircraft deliveries, present hurdles. However, the integration of Hawaiian Airlines and strategic expansions offer significant growth prospects. This dual perspective is crucial for assessing the long-term viability and potential of Alaska Air Group in a competitive market.

Technological advancements are driving operational efficiency and enhancing customer experience. Regulatory changes, including those related to environmental policies and trade, impact airline operations. Consumer preferences continue to favor leisure travel, with a gradual recovery in corporate travel. These trends shape the strategies of all players in the airline industry.

Macroeconomic uncertainty and fluctuating fuel prices pose significant risks. Supply chain dependencies, especially aircraft delivery delays, limit capacity growth. Labor costs and potential disruptions also present challenges. Addressing these issues is crucial for maintaining profitability and competitiveness in the Marketing Strategy of Alaska Air Group.

The integration of Hawaiian Airlines offers network expansion, particularly in the Pacific region. Expanding international routes from Seattle is a key growth area. Investing in premium services, enhancing the loyalty program, and exploring cargo growth provide revenue diversification opportunities. These strategic initiatives are essential for long-term success.

The company aims to achieve double-digit pretax margins and increased earnings per share by 2027. This signifies a focus on long-term resilience and growth. Meeting these financial targets requires effective cost management, revenue optimization, and strategic investments. These goals are central to Alaska Air Group's strategic plan.

The airline industry is highly competitive, with factors such as fuel costs, labor expenses, and route profitability significantly impacting financial performance. Alaska Air Group must navigate these complexities to maintain its market position. Strategic decisions regarding fleet management, route optimization, and customer service are critical.

- Market Share Analysis: Evaluating Alaska Air Group's market share against competitors like Delta and United is crucial.

- Route Network Analysis: Assessing the profitability and efficiency of its route network, including the impact of the Hawaiian Airlines integration.

- Competitive Advantages: Identifying and leveraging its strengths, such as customer loyalty programs and operational efficiency.

- Financial Performance: Monitoring key financial metrics, including revenue per available seat mile (RASM) and cost per available seat mile (CASM).

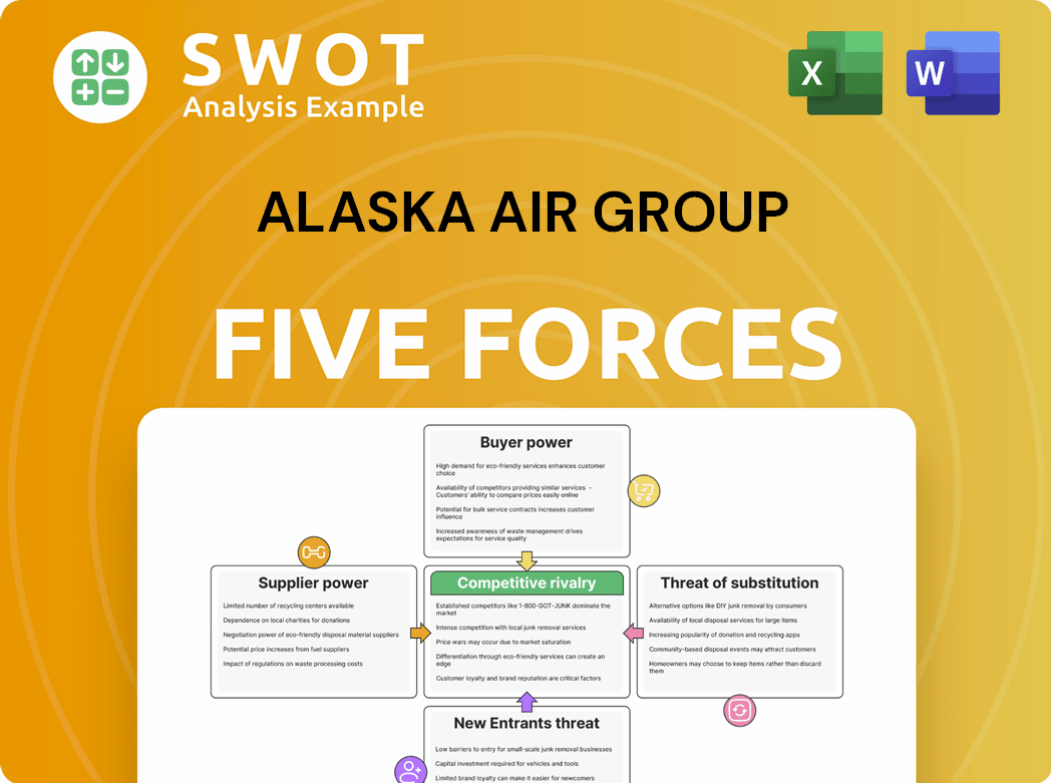

Alaska Air Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alaska Air Group Company?

- What is Growth Strategy and Future Prospects of Alaska Air Group Company?

- How Does Alaska Air Group Company Work?

- What is Sales and Marketing Strategy of Alaska Air Group Company?

- What is Brief History of Alaska Air Group Company?

- Who Owns Alaska Air Group Company?

- What is Customer Demographics and Target Market of Alaska Air Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.