Alaska Air Group Bundle

How Does Alaska Air Group Soar in the Airlines Industry?

Alaska Air Group, fresh off a record-breaking $11.7 billion revenue year in 2024, is a powerhouse in the air travel sector. With its strategic acquisition of Hawaiian Airlines and a robust presence across North America and beyond, the company is rapidly expanding. Understanding the inner workings of Alaska Air Group is key for anyone looking to navigate the complexities of the airlines industry.

This exploration dives deep into Alaska Air Group's Alaska Air Group SWOT Analysis, examining its airline operations, revenue streams, and strategic initiatives. From Alaska Airlines' extensive route map and fleet size to its commitment to customer service and sustainable practices, we'll uncover how this airline holding company generates profit. Whether you're interested in the Alaska Airlines stock price, its frequent flyer program, or its overall financial performance, this analysis provides a comprehensive overview of Alaska Air Group's operations and future outlook within the competitive airlines industry.

What Are the Key Operations Driving Alaska Air Group’s Success?

Alaska Air Group delivers value through passenger and cargo air transportation services, targeting a diverse customer base. The company's core operations involve scheduled flights, primarily serving destinations in Alaska, the Lower 48, Hawaii, Canada, and Mexico. The 2024 acquisition of Hawaiian Airlines significantly expanded its reach, now serving over 140 destinations, including Central America, Asia, and the Pacific.

The company's 'Alaska Accelerate' strategy is a key component of its growth, with Seattle positioned as a global gateway. New nonstop flights to key Asian markets like Tokyo Narita and Seoul Incheon are planned to start in 2025. This expansion, coupled with an emphasis on customer service and operational efficiency, is central to its value proposition.

Operational processes are centered on safety, customer care, and performance. The company invested $150 million in technology upgrades in 2024 to enhance the digital customer experience, resulting in an 8% increase in customer satisfaction scores. On-time performance reached 82% in 2024, reflecting its commitment to reliable service. The integration of Hawaiian Airlines is also a significant operational undertaking, with co-located stations in major hubs like LAX and JFK and unified cargo operations critical for maximizing synergies.

Alaska Air Group differentiates itself through a blend of regional connectivity and expanding international reach. This is coupled with a strong focus on premium services and a robust loyalty program. The company aims to boost its premium seat mix from 26% to 29% by 2027, projecting an additional $100 million in profit.

Focus on premium offerings, a revamped Mileage Plan, and a new premium credit card launching in summer 2025 enhance customer benefits and market differentiation. These initiatives are supported by a resilient business model, a strong balance sheet, and cost advantages. For more details on their strategic approach, consider reading about the Growth Strategy of Alaska Air Group.

Alaska Air Group's operational success is supported by several key factors. These include a strong focus on customer service and operational efficiency, as evidenced by technology investments and improved customer satisfaction. The integration of Hawaiian Airlines is a major undertaking, aimed at maximizing synergies and expanding the network.

- 82% On-time performance in 2024.

- $150 million invested in technology upgrades in 2024.

- Expansion to over 140 destinations with Hawaiian Airlines integration.

- Aim to increase premium seat mix to 29% by 2027.

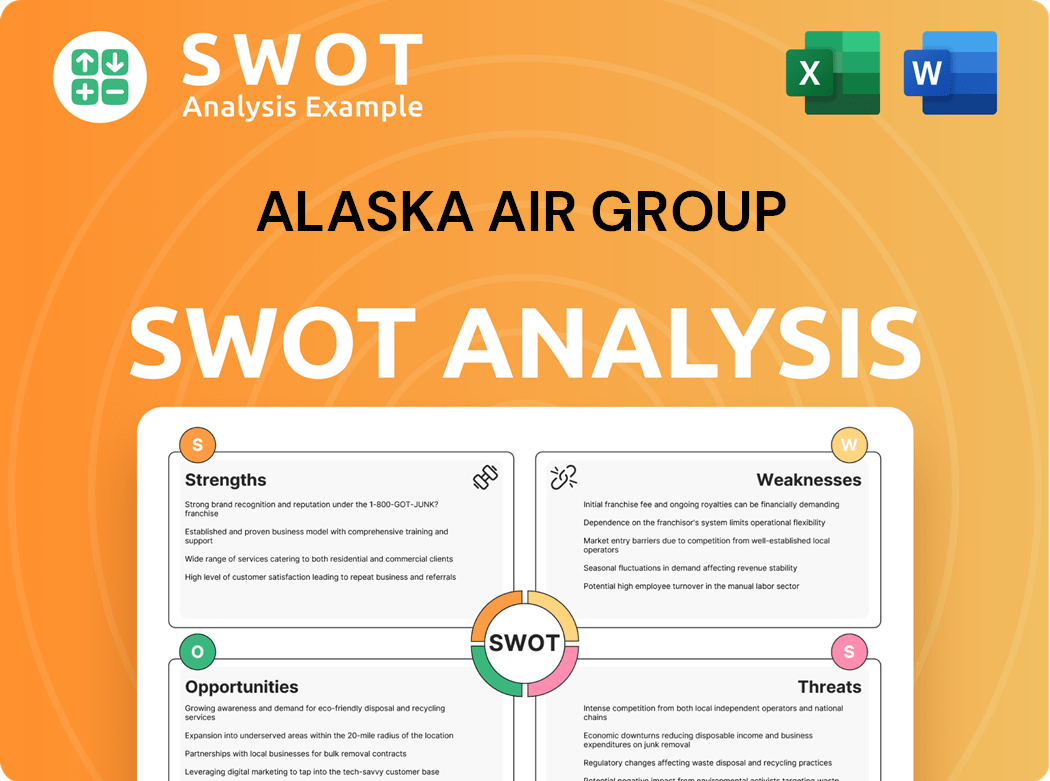

Alaska Air Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alaska Air Group Make Money?

The primary revenue streams for Alaska Air Group stem from air transportation services, encompassing both passenger and cargo operations. The company strategically employs various monetization strategies to enhance profitability and diversify income sources. These strategies include premium service offerings and loyalty programs.

In 2024, Alaska Air Group achieved a record full-year revenue of $11.7 billion, marking a 12.56% increase from the $10.426 billion reported in 2023. The positive trend continued into 2025, with total operating revenue reaching $12.640 billion for the twelve months ending March 31, reflecting a 20.82% year-over-year increase.

Passenger sales are a significant revenue driver, with a substantial 40% increase in Q1 2025, reaching $2.808 billion compared to Q1 2024, partially due to the Hawaiian Airlines acquisition. The company's loyalty program also contributes significantly to revenue. For a deeper dive into the financial structure, consider exploring Owners & Shareholders of Alaska Air Group.

Alaska Air Group is investing in premium services and expanding its cargo operations to boost revenue. The company plans to introduce a new premium credit card to further diversify its income streams.

- Premium cabin revenue saw double-digit growth in Q4 2024 and is projected to outperform main cabin products in 2025.

- The company is retrofitting 84 Boeing 737-900ER aircraft by summer 2025 to increase premium seating to 29% of total capacity by 2026.

- The expanded cargo organization aims to double its revenue in the coming years, with estimated margins two to three times the system average.

- A new premium credit card is planned for late summer 2025, offering enhanced travel benefits.

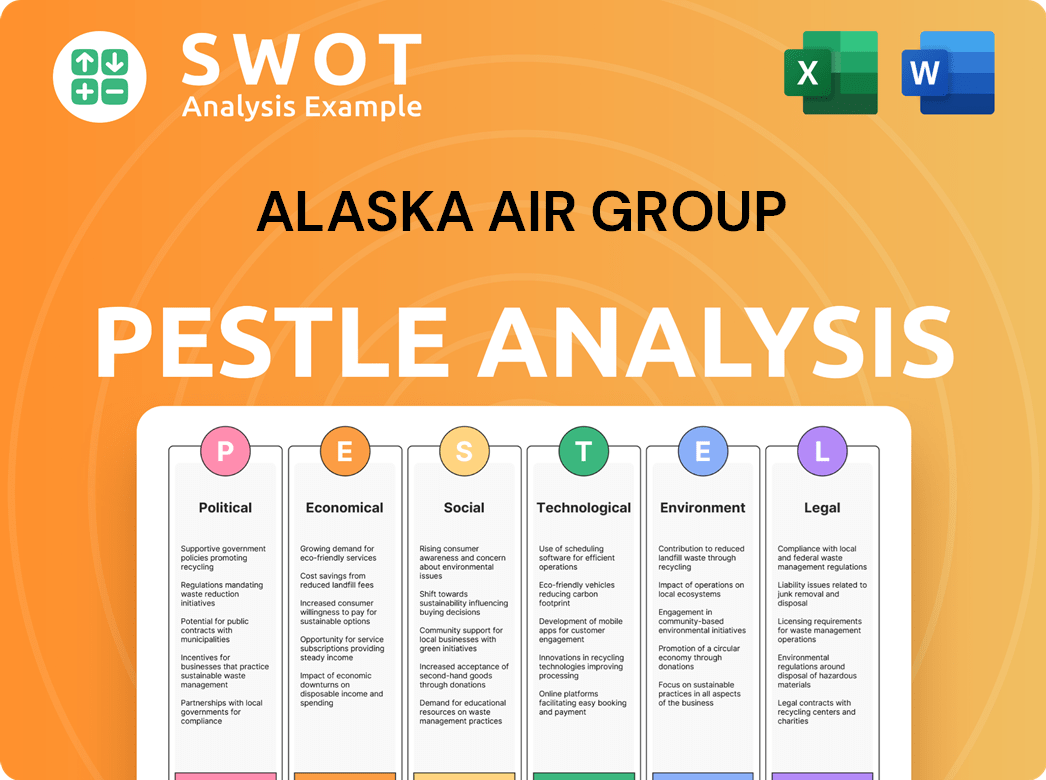

Alaska Air Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Alaska Air Group’s Business Model?

Alaska Air Group has significantly evolved through strategic initiatives and key milestones. The acquisition of Hawaiian Airlines in 2024 was a game-changer, extending its reach to over 140 destinations. This expansion is central to the 'Alaska Accelerate' plan, designed to boost pretax profit and earnings per share (EPS) by 2027.

The company's strategic moves have been crucial in navigating market dynamics. Despite facing headwinds like a softening domestic demand in early 2025, which impacted Q1 2025 results, Alaska Air Group demonstrated resilience. The focus on cost management and the integration of Hawaiian Airlines are key strategies to maintain profitability.

Alaska Air Group's competitive edge lies in its strong brand, customer service, and loyalty program. The company's commitment to sustainability and innovation, including investments in sustainable aviation fuel (SAF) and fleet upgrades, positions it well for future growth and environmental responsibility. If you want to learn more about the company, you can read a Brief History of Alaska Air Group.

The acquisition of Hawaiian Airlines in 2024 expanded the company's network significantly. This strategic move immediately increased the number of destinations served. It is a cornerstone of the 'Alaska Accelerate' plan.

The 'Alaska Accelerate' plan aims for $1 billion in incremental pretax profit by 2027. Establishing Seattle as a global gateway is a key initiative, with new international routes planned. The company is also focusing on cost management.

Alaska Air Group benefits from strong brand recognition and customer service. The Mileage Plan loyalty program enhances customer retention. The company is investing in sustainability initiatives and fleet upgrades.

Despite a Q1 2025 GAAP net loss of $166 million, total revenue increased by 9% year-over-year. Unit costs (CASMex) rose by 2.1% year-over-year in Q1 2025. The integration of Hawaiian Airlines showed promising synergies.

Alaska Air Group's strategic plan targets an EPS of at least $10 and pretax margins of 11-13% by 2027. The company is launching new international routes, including Tokyo Narita in May 2025 and Seoul Incheon in October 2025.

- The company aims for net-zero emissions by 2040 through investments in SAF.

- 84 Boeing 737-900ER aircraft are planned to be retrofitted by summer 2025 to expand premium seating.

- Hawaiian Airlines showed an 8.8% increase in unit revenue and a 14-point improvement in adjusted pretax margins.

- Alaska Air Group was named 'best airline of 2025' by NerdWallet, highlighting its customer service focus.

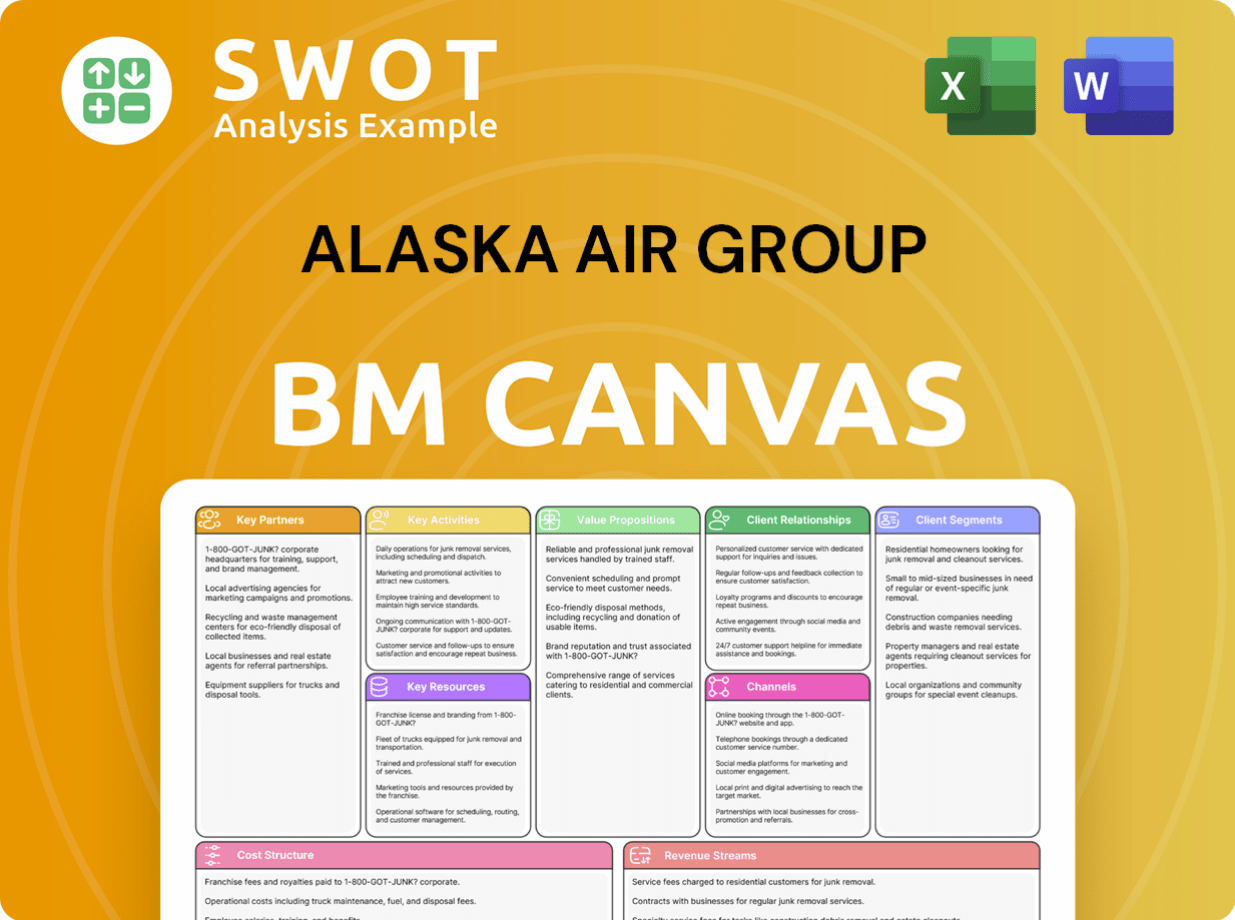

Alaska Air Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Alaska Air Group Positioning Itself for Continued Success?

As of early 2025, Alaska Air Group, including Alaska Airlines, holds a strong position in the U.S. airline industry. This is enhanced by its 2024 acquisition of Hawaiian Airlines. This has expanded its reach to over 140 destinations, with a focus on connecting the West Coast to Hawaii, Canada, Mexico, and new Asian markets like Tokyo and Seoul. The company aims to be Hawaii's trusted airline, enhancing service for residents with improved network connectivity and a tailored loyalty program.

Despite its strategic positioning, Alaska Air Group faces several risks. These include softening domestic market demand and macroeconomic uncertainty. Rising operating expenses, particularly labor and maintenance costs, are also putting pressure on profitability. Additionally, delays in Boeing 737 MAX deliveries have constrained capacity growth. Regulatory hurdles related to the Hawaiian Airlines acquisition could impact synergy realization.

Alaska Air Group, which includes Alaska Airlines, is a key player in the U.S. airline industry. The acquisition of Hawaiian Airlines in 2024 significantly boosted its market presence. The expanded network now serves over 140 destinations, focusing on routes between the West Coast and Hawaii, Canada, Mexico, and new Asian markets.

The company faces challenges such as softening domestic demand and macroeconomic uncertainty. Rising operating costs, especially for labor and maintenance, are also a concern. Delays in Boeing 737 MAX deliveries and regulatory hurdles from the Hawaiian Airlines acquisition pose additional risks to Alaska Air Group's competitors landscape.

Alaska Air Group is focused on its 'Alaska Accelerate' strategic plan, targeting $1 billion in incremental pretax profit by 2027. Key initiatives include expanding the international network and enhancing premium travel offerings. The company plans to invest in premium services, including upgraded airport facilities and a revamped loyalty platform.

Alaska Air Group reported a GAAP net loss of $166 million in Q1 2025. The company has a strong balance sheet with $2.5 billion in unrestricted cash as of March 31, 2025. It aims to reduce net leverage to 1.5x by 2026. While the 2025 financial outlook was withdrawn, it will be reassessed in July 2025.

Alaska Air Group aims for at least $10 EPS by 2027, driven by the 'Alaska Accelerate' plan. This plan focuses on expanding the international network and enhancing premium travel. The company is optimistic about the recovery of corporate travel and is committed to sustainability, with a goal of net-zero emissions by 2040.

- Expanding international routes, including new Asian markets.

- Enhancing premium travel offerings with upgraded facilities.

- Maximizing revenue through cargo growth and innovation.

- Investing in fuel-efficient aircraft.

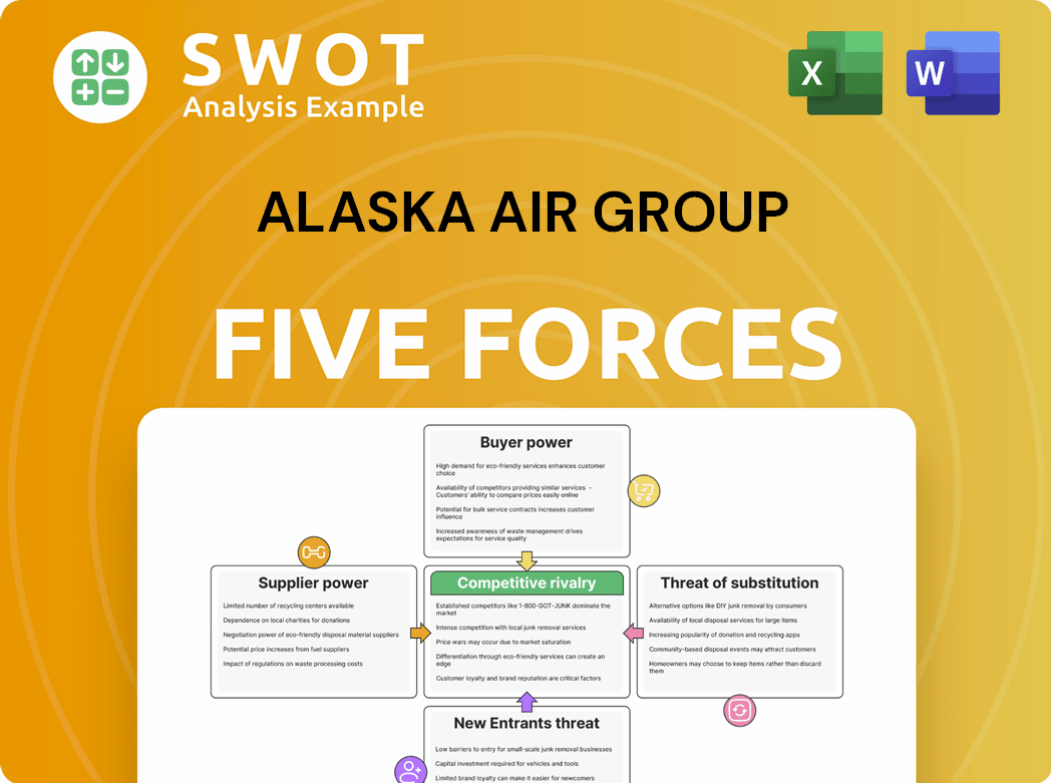

Alaska Air Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alaska Air Group Company?

- What is Competitive Landscape of Alaska Air Group Company?

- What is Growth Strategy and Future Prospects of Alaska Air Group Company?

- What is Sales and Marketing Strategy of Alaska Air Group Company?

- What is Brief History of Alaska Air Group Company?

- Who Owns Alaska Air Group Company?

- What is Customer Demographics and Target Market of Alaska Air Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.