Benteler International AG Bundle

How does Benteler International AG stack up against its rivals?

Benteler International AG, a titan in metal processing, shapes the automotive, energy, and engineering sectors with its innovative solutions. From its inception in 1876, the company has evolved from manufacturing seamless tubes to producing advanced automotive components. Understanding its competitive position is crucial in today's dynamic market.

To truly grasp Benteler's standing, we must dissect its Benteler International AG SWOT Analysis and delve into its competitive landscape. This analysis will explore the company's market share, key strategies, and the challenges it faces within the automotive industry and beyond. A thorough competitor analysis will reveal how Benteler International AG navigates its competitive environment and maintains its market position, offering valuable insights into its financial performance and future outlook.

Where Does Benteler International AG’ Stand in the Current Market?

Benteler International AG holds a significant market position within the global metal processing industry, particularly in the automotive sector. The company specializes in manufacturing components for the automotive, energy, and engineering industries. Its core operations involve producing automotive structures, chassis components, engine and exhaust systems, and specialized tubes for various industrial applications. As of early 2024, Benteler operated in approximately 26 countries, with 86 plants and a workforce of around 23,000 employees, highlighting its extensive global presence.

The value proposition of Benteler centers on providing high-value-added products and solutions, especially in the realm of e-mobility and sustainable manufacturing. This focus includes investing in advanced materials and manufacturing processes to meet the growing demand for lighter, more efficient, and environmentally friendly vehicles. Benteler's strategic shift towards these areas underscores its commitment to innovation and its ability to adapt to evolving market demands. The company's financial health is reflected in its consistent investments in research and development and its ability to secure significant contracts with major global OEMs.

Benteler's market position is further strengthened by its technological expertise and long-standing customer relationships, particularly within the European automotive supply chain. The company's diverse geographic presence, serving major automotive hubs in Europe, North America, and Asia, enables it to capitalize on new growth opportunities. With sales reaching €8.6 billion in 2023, Benteler demonstrates its substantial revenue generation and resilience in navigating global economic fluctuations and supply chain challenges. For a deeper understanding of their strategic moves, consider reading about the Growth Strategy of Benteler International AG.

Benteler is a leading supplier of automotive components, especially in lightweight solutions and chassis systems. Specific market share figures are often proprietary, but the company is widely recognized for its significant presence. Benteler's competitive landscape includes various global and regional players in the automotive industry.

Benteler's primary product lines include automotive structures, chassis components, engine and exhaust systems, and specialized tubes. These products cater to diverse industrial applications. The company's focus on high-value-added products is a key element of its market strategy.

Benteler has a diverse geographic presence, serving major automotive hubs in Europe, North America, and Asia. The company's global presence extends to approximately 26 countries. This broad reach supports its competitive advantages.

Benteler strategically focuses on high-value-added products and solutions. This includes a strong emphasis on e-mobility and sustainable manufacturing. Investments in advanced materials and processes are central to this strategy.

Benteler's financial performance is generally assessed through consistent investments in R&D and securing significant contracts with major global OEMs. In 2023, the company reported sales of €8.6 billion, demonstrating its substantial revenue generation. The company's outlook involves adapting to global economic fluctuations and supply chain challenges.

- Benteler's focus on e-mobility and sustainable manufacturing positions it well for future growth.

- The company's resilience in navigating economic challenges is a key strength.

- Benteler's strong position in the European automotive supply chain provides a competitive advantage.

- Continuous expansion in emerging markets is a key strategy for capitalizing on new opportunities.

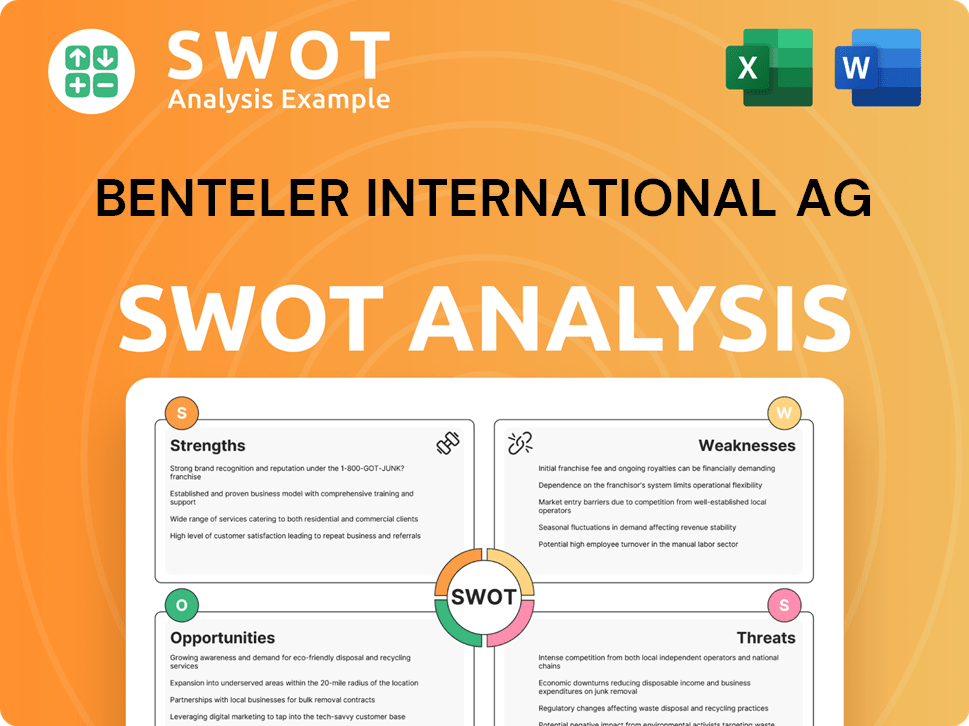

Benteler International AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Benteler International AG?

The Brief History of Benteler International AG reveals that the company operates within a dynamic competitive landscape, facing both direct and indirect rivals across its diverse business segments. A thorough Benteler analysis indicates that understanding these competitors is crucial for assessing its market position and future prospects. The competitive environment is shaped by factors such as technological advancements, cost-effectiveness, and global supply chain dynamics.

In the automotive industry, the competitive landscape is particularly intense. Benteler must continuously innovate and optimize its operations to maintain its market share. The company's financial performance is directly impacted by its ability to compete effectively against these key players and adapt to the evolving demands of the automotive sector. A detailed competitor analysis provides insights into the strategies and strengths of these rivals.

The energy and engineering sectors also present significant competitive challenges. The competitive landscape in these areas varies depending on the specific applications and regions. Benteler's ability to adapt to these changes and remain competitive is critical for its overall success. The company's key strategies must focus on technological advancements and sustainable practices to stay ahead.

Key direct competitors include Magna International, ZF Friedrichshafen AG, and Gestamp Automoción. These companies compete with Benteler across various product lines, such as body and chassis systems. They possess similar global footprints and extensive R&D capabilities, making the competition fierce.

Magna International is a diversified automotive supplier. It competes with Benteler in body and chassis systems. Magna's global presence and R&D capabilities make it a significant rival.

ZF Friedrichshafen AG specializes in driveline and chassis technology. It poses a significant challenge, especially in advanced chassis systems and e-mobility solutions. ZF's technological advancements are a key competitive factor.

Gestamp Automoción focuses on metal components for automobiles. It competes with Benteler in stamping and body-in-white segments. Gestamp leverages its scale and global production network.

Indirect competition comes from specialized material providers and alternative manufacturing process developers. Companies developing advanced composites or additive manufacturing techniques can disrupt traditional metal processing. OEMs' in-house production capabilities also add to the indirect competition.

Competitors in the energy and engineering sectors vary widely. They range from large steel manufacturers to specialized tube and pipe suppliers. Emerging players focusing on sustainable materials and circular economy principles also impact the competitive landscape.

Several factors are critical in the competitive landscape. Cost-effectiveness, technological innovation, and supply chain reliability are key differentiators. Mergers and alliances constantly reshape the competitive dynamics, requiring agility and strategic alignment. The future outlook for Benteler depends on its ability to navigate these challenges.

- Cost-Effectiveness: Offering competitive pricing while maintaining profitability.

- Technological Innovation: Investing in R&D to develop advanced products and processes.

- Supply Chain Reliability: Ensuring a robust and efficient supply chain to meet customer demands.

- Sustainability Initiatives: Embracing sustainable materials and circular economy principles.

- Strategic Alliances: Forming partnerships to enhance capabilities and market reach.

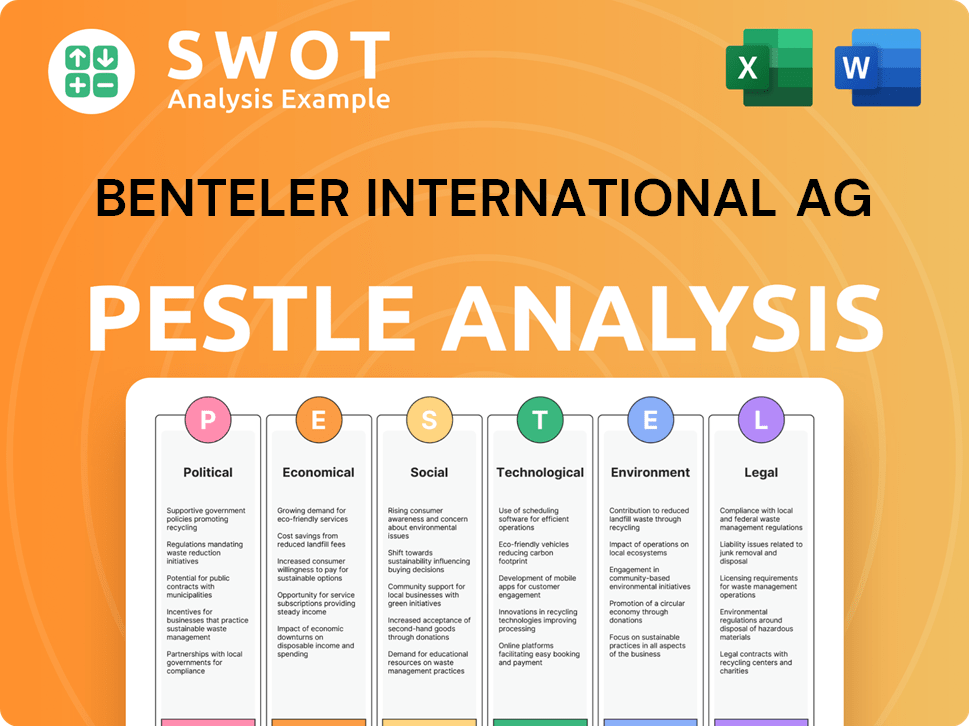

Benteler International AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Benteler International AG a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Benteler International AG requires a close look at its strengths. The company's success stems from its ability to innovate and adapt within the automotive and industrial sectors. Benteler analysis reveals a focus on advanced materials and manufacturing, positioning it well in a market demanding lighter, stronger, and more efficient components.

Benteler International AG has strategically built a global presence, which allows it to serve major clients worldwide. This global footprint is crucial for supporting the automotive industry and other sectors. The company's long-standing relationships with key players in the automotive industry and its commitment to quality further solidify its market position.

Benteler's competitive advantages are evident in its product portfolio and its approach to innovation. By continuously investing in research and development, the company stays ahead of industry trends. This proactive stance helps Benteler maintain its competitive edge in a dynamic market.

Benteler excels in developing and producing high-strength steel and aluminum components. This expertise is crucial for meeting the automotive industry's demands for lightweight solutions. The company's focus on tailored blanks and hot-formed parts gives it a significant edge in the automotive industry.

Benteler's global network, with plants across key regions, ensures efficient service to international customers. This extensive footprint supports localized production and supply chain optimization. The company's ability to adapt to regional market demands is a key strength.

Benteler has built strong relationships with major global OEMs and industrial clients. These relationships are based on trust, reliable delivery, and quality. Collaborative product development and responsiveness to customer needs are central to its strategy.

Continuous investment in research and development is a core strategy for Benteler. This leads to patents in areas like crash management systems and chassis components. The company's focus on innovation helps it to stay competitive in a rapidly evolving market.

Benteler International AG maintains a strong position through its technological expertise, global reach, and customer relationships. These advantages are crucial for navigating the competitive environment. The company's ability to integrate material development with component assembly ensures its advantages are not easily replicated.

- Advanced Material Expertise: Development and production of high-strength steel and aluminum components.

- Global Production Network: Extensive manufacturing plants across key automotive and industrial regions.

- Long-Standing Customer Relationships: Strong ties with major global OEMs and industrial clients.

- Innovation and R&D: Continuous investment in research and development, leading to numerous patents.

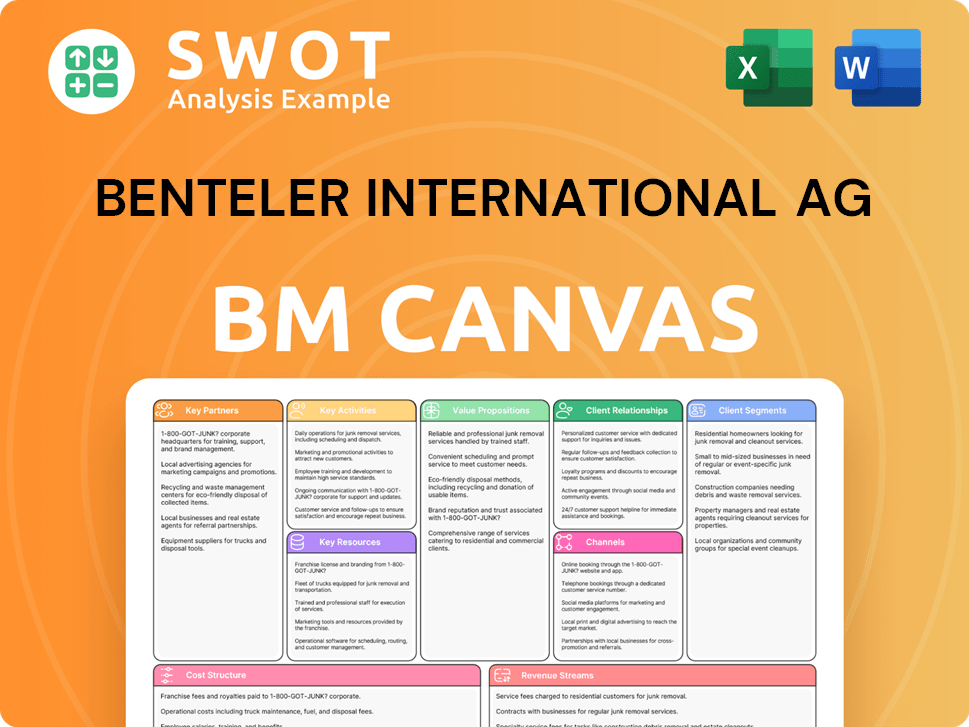

Benteler International AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Benteler International AG’s Competitive Landscape?

The competitive landscape for Benteler International AG is significantly shaped by the dynamic shifts within the automotive industry. The company faces both immediate risks and promising opportunities as it navigates technological advancements, regulatory changes, and global economic uncertainties. Understanding these factors is crucial for assessing Benteler's future outlook and its ability to maintain a strong market position.

Benteler's operations are closely tied to the automotive sector, where trends like e-mobility and sustainability are redefining industry standards. The company must adapt to these changes to remain competitive. This includes managing supply chain disruptions, fluctuating raw material costs, and the need for continuous innovation in product development and manufacturing processes.

The automotive industry is undergoing rapid transformation, with a strong focus on electric vehicles (EVs) and sustainable practices. This shift requires suppliers like Benteler to innovate in lightweight materials, battery enclosures, and thermal management systems. Regulatory pressures, such as stricter emission standards, also play a critical role.

Benteler faces challenges including supply chain disruptions, fluctuating raw material prices, and the need for a highly skilled workforce. Geopolitical instability and economic uncertainties add further pressure. The company must also manage the transition to new technologies and adapt to evolving customer demands.

Growth opportunities exist in emerging markets and the increasing demand for sustainable solutions. Benteler can capitalize on these by localizing production, developing eco-friendly materials, and focusing on high-value components. Strategic partnerships and investments in R&D are also key.

The competitive landscape is influenced by technological advancements, such as digitalization and automation, which demand increased efficiency and flexibility. Benteler's ability to adapt to these changes and leverage its strengths will determine its success. For more details, see Target Market of Benteler International AG.

Benteler's key strategies involve adapting to e-mobility, investing in sustainable manufacturing, and expanding its global presence. The company must focus on innovation and operational excellence to remain competitive. This includes managing costs and optimizing supply chains.

- Prioritize investments in R&D for EV components and sustainable materials.

- Enhance operational efficiency through digitalization and automation.

- Develop strategic partnerships to expand market reach and access new technologies.

- Focus on cost management and supply chain optimization to improve profitability.

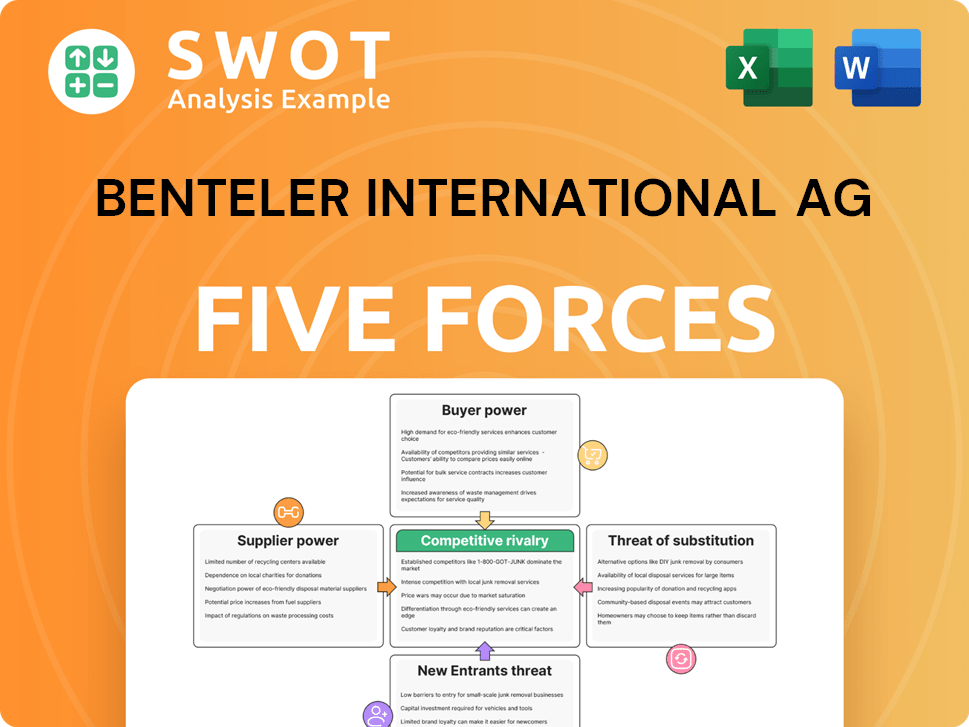

Benteler International AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Benteler International AG Company?

- What is Growth Strategy and Future Prospects of Benteler International AG Company?

- How Does Benteler International AG Company Work?

- What is Sales and Marketing Strategy of Benteler International AG Company?

- What is Brief History of Benteler International AG Company?

- Who Owns Benteler International AG Company?

- What is Customer Demographics and Target Market of Benteler International AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.