Benteler International AG Bundle

Can Benteler International AG Drive Future Growth in a Changing World?

Benteler International AG, a titan in metal processing, is strategically positioned to capitalize on the evolving demands of the automotive industry and beyond. With a rich history dating back to 1876, Benteler has consistently adapted, evolving from innovative tube manufacturing to a global leader. Their focus on lightweight solutions and sustainable mobility highlights their commitment to future-proofing their business.

This Benteler International AG SWOT Analysis will delve into the company's strategic planning, examining its growth strategy and future prospects within the competitive landscape. We'll explore Benteler's expansion plans, innovative technologies, and financial outlook, providing a comprehensive company analysis. Understanding Benteler's journey and its strategic initiatives is crucial for investors and industry professionals seeking insights into the future of mobility and the automotive industry.

How Is Benteler International AG Expanding Its Reach?

As part of its growth strategy, Benteler International AG is actively pursuing expansion initiatives to strengthen its market position and diversify its revenue streams. This involves a strategic focus on broadening its global footprint, particularly in emerging markets, to access new customer bases and capitalize on growing industrial demands. This approach is crucial for the company's long-term growth strategy and adaptation to changing market dynamics.

The company is heavily invested in developing solutions for electric vehicles (EVs) and sustainable energy applications. This includes advanced lightweight solutions for EV battery trays and chassis components, addressing the industry's push for increased energy efficiency and reduced emissions. These strategic moves are designed to enhance Benteler's global market presence and ensure its relevance in the evolving automotive and energy sectors.

Benteler's expansion efforts are supported by strategic partnerships and investments in innovative technologies. These initiatives are designed to enhance the company's competitiveness and drive sustainable growth in the face of evolving market challenges. The company's focus on innovation and strategic alliances positions it well for future growth.

Benteler is expanding its operations in regions like North America and Asia, where the automotive and energy sectors are experiencing significant growth. This geographical expansion is often accompanied by the localization of production and supply chains to enhance efficiency and responsiveness to regional market needs. For example, in 2024, the company announced plans to increase its manufacturing capacity in China to meet growing demand.

The company is focusing on developing solutions for electric vehicles (EVs) and sustainable energy applications. This includes advanced lightweight solutions for EV battery trays and chassis components. Benteler is also exploring new business models, such as offering integrated system solutions rather than just individual components, to provide greater value to its customers.

Benteler is forming strategic partnerships with leading automotive OEMs and energy companies to facilitate joint development and market penetration for new technologies. These collaborations are crucial for capturing a larger share of the rapidly expanding EV market. In 2024, the company announced a partnership with a major EV manufacturer to develop advanced chassis solutions.

Benteler is investing heavily in research and development to create innovative technologies and solutions. This includes investments in lightweight materials, advanced manufacturing processes, and digital technologies. The company's R&D spending increased by 6% in 2024, reflecting its commitment to innovation.

Benteler's expansion initiatives are focused on key areas to ensure sustained growth and market leadership. These efforts are designed to enhance the company's competitiveness and drive sustainable growth.

- Expanding its global footprint, particularly in emerging markets like Asia and North America.

- Developing advanced solutions for electric vehicles (EVs) and sustainable energy applications.

- Forming strategic partnerships with leading automotive OEMs and energy companies.

- Investing in research and development to create innovative technologies.

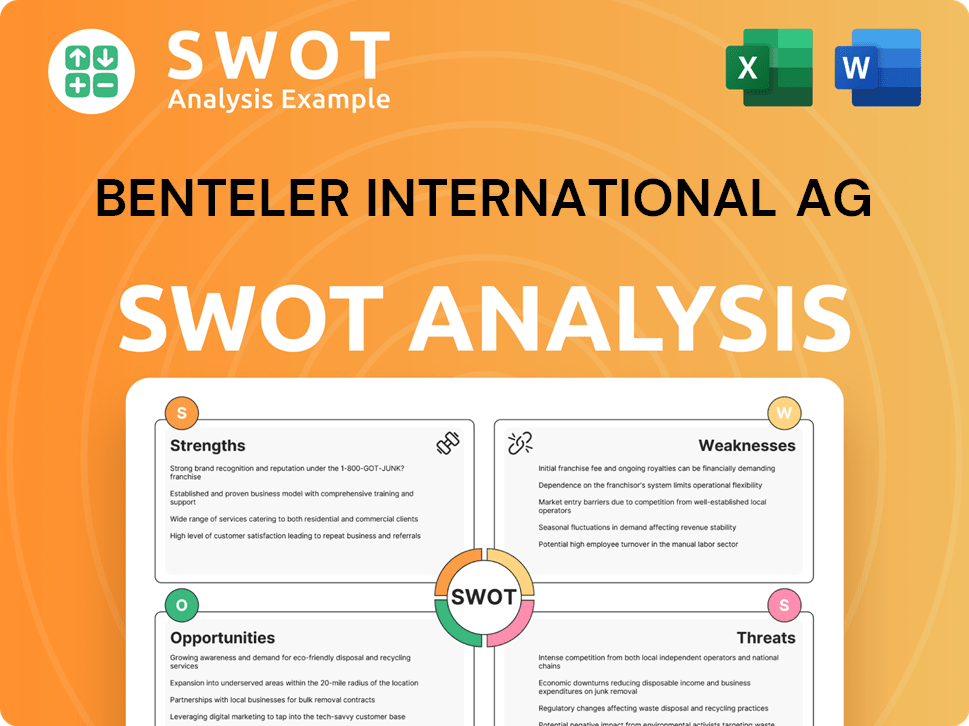

Benteler International AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Benteler International AG Invest in Innovation?

The growth strategy of Benteler International AG is deeply intertwined with its commitment to innovation and technological advancement, particularly within the automotive industry. Benteler's strategic focus on research and development (R&D) is a cornerstone of its future prospects, driving the development of cutting-edge materials and manufacturing processes. This approach allows the company to stay competitive and meet the evolving demands of the automotive market, including the shift towards electric vehicles.

Benteler's dedication to innovation extends beyond materials science. It also encompasses the digital transformation of its operations, incorporating automation, artificial intelligence (AI), and the Internet of Things (IoT) to enhance efficiency and product quality. This comprehensive strategy positions Benteler to capitalize on emerging opportunities and navigate the challenges within the dynamic automotive landscape. A detailed analysis of the Target Market of Benteler International AG reveals the importance of these technological advancements.

The company’s investments in R&D are substantial, reflecting its commitment to staying at the forefront of technological advancements. These investments support the development of advanced materials like high-strength steel and aluminum alloys, crucial for lighter and safer vehicle structures. These lighter materials are essential for improving fuel efficiency and extending the range of electric vehicles, addressing key customer needs and preferences.

Benteler's R&D efforts are concentrated on advanced materials, manufacturing processes, and digital transformation to support its growth strategy. This includes developing high-strength steel and aluminum alloys for lighter and safer vehicles.

Digital transformation is a core pillar, integrating automation, AI, and IoT across production and supply chains. AI-powered quality control systems have reduced defect rates by approximately 15% in 2024.

The company emphasizes environmentally friendly production processes and recyclable products. This commitment aligns with the growing demand for sustainable practices in the automotive industry.

Benteler collaborates with universities, research institutions, and technology startups to foster open innovation. These partnerships enhance its in-house development capabilities.

Benteler holds a portfolio of patents in areas like lightweight design and advanced joining technologies. This strengthens its position as a technological leader.

Benteler forms strategic partnerships to enhance its technological capabilities and market reach. These collaborations are crucial for its long-term growth strategy.

Benteler's innovation strategy focuses on several key areas to drive its future prospects and maintain its competitive edge within the automotive industry. The company's commitment to technological leadership is evident through its strategic investments and partnerships.

- Advanced Materials: Development of high-strength steel and aluminum alloys, crucial for lightweight vehicle designs. These materials enhance fuel efficiency and vehicle safety.

- Digitalization: Implementation of AI-powered quality control systems and smart factory concepts. These initiatives have led to a reported reduction in defect rates by approximately 15% in 2024.

- Sustainability: Focus on environmentally friendly production processes and the development of recyclable products. This aligns with the growing demand for sustainable practices.

- Collaborations: Partnerships with universities and research institutions to foster open innovation. These collaborations enhance R&D capabilities.

- Patents: A strong portfolio of patents in lightweight design and advanced joining technologies, solidifying its position as a technological leader.

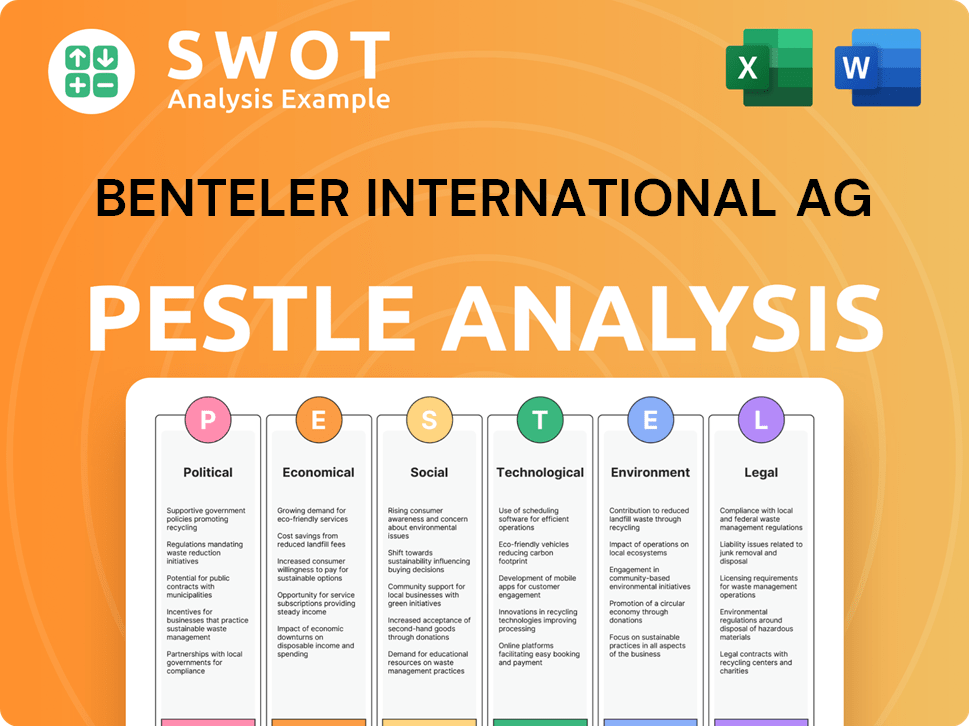

Benteler International AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Benteler International AG’s Growth Forecast?

The financial outlook for Benteler International AG is focused on sustainable growth, emphasizing investments in key areas. The company aims to increase revenue from its diverse portfolio, especially from the automotive and energy sectors. This strategic approach is designed to enhance profitability through operational efficiencies and a higher value-added product mix. For a deeper understanding, explore the Revenue Streams & Business Model of Benteler International AG.

Benteler's financial strategy includes robust investment levels, particularly in research and development (R&D) and the expansion of production capacities for lightweight components and electric vehicle (EV) components. The company's long-term financial goals involve strengthening its balance sheet and maintaining a healthy liquidity position to support future strategic initiatives. Recent reports show that the company is aiming to improve its profitability margins through effective cost management.

The company is exploring various funding avenues, including potential capital raises or strategic partnerships, to finance large-scale projects. Benteler's financial narrative is characterized by prudent investment and disciplined growth. This approach aims to leverage its technological leadership and market position to deliver sustained financial performance in the coming years. As of 2023, the company's annual report highlighted a significant improvement in its financial results, driven by strong demand in its core markets and effective cost management.

Benteler International AG's financial performance is closely tied to the automotive industry and its strategic planning. The company's ability to adapt to market changes and technological advancements, like the shift towards electric vehicles, is crucial for its financial health. Analyzing Benteler AG market share analysis provides insights into its competitive standing and growth potential.

Future investment opportunities for Benteler International AG are focused on expansion and innovation. The company's growth strategies for automotive suppliers include investments in new technologies and production capabilities. These investments are designed to support the company's long-term growth strategy and enhance its position in the global market.

Benteler International AG's sustainability initiatives and innovative technologies are integral to its future prospects. The company's commitment to sustainable practices and the development of cutting-edge solutions are key drivers of its long-term success. The impact of autonomous driving on Benteler is also a significant factor in its strategic planning.

Strategic partnerships play a vital role in Benteler International AG's growth strategy. Collaborations can provide access to new markets, technologies, and resources, supporting the company's expansion plans in electric vehicles and other areas. These partnerships help navigate the challenges and opportunities in the automotive industry.

Benteler aims for increased revenue, particularly from the automotive and energy sectors. The company is focusing on improving its profitability margins through operational efficiencies and a higher value-added product mix. Recent reports show a positive trajectory, with the company aiming to strengthen its financial performance.

Investment levels are expected to remain robust, especially in R&D and the expansion of production capacities. The company is investing in new technologies and production capabilities to support its long-term growth strategy. This includes expanding its capacities for lightweight components and EV components.

Benteler's financial strategy includes strengthening its balance sheet and maintaining a healthy liquidity position. The company is exploring various funding avenues to support its growth ambitions. This financial narrative emphasizes prudent investment and disciplined growth.

Benteler aims to leverage its technological leadership and market position. The company's focus is on delivering sustained financial performance in the coming years. Benteler's global market presence and strategic partnerships are key to its future growth.

Understanding the competitive landscape is crucial for Benteler. The company faces challenges and opportunities within the automotive industry. Benteler's recent acquisitions and strategic partnerships are key to maintaining a competitive edge.

The shift towards electric vehicles significantly impacts Benteler's future. The company is expanding its production capabilities for EV components to capitalize on this trend. Benteler's expansion plans in electric vehicles are a key part of its growth strategy.

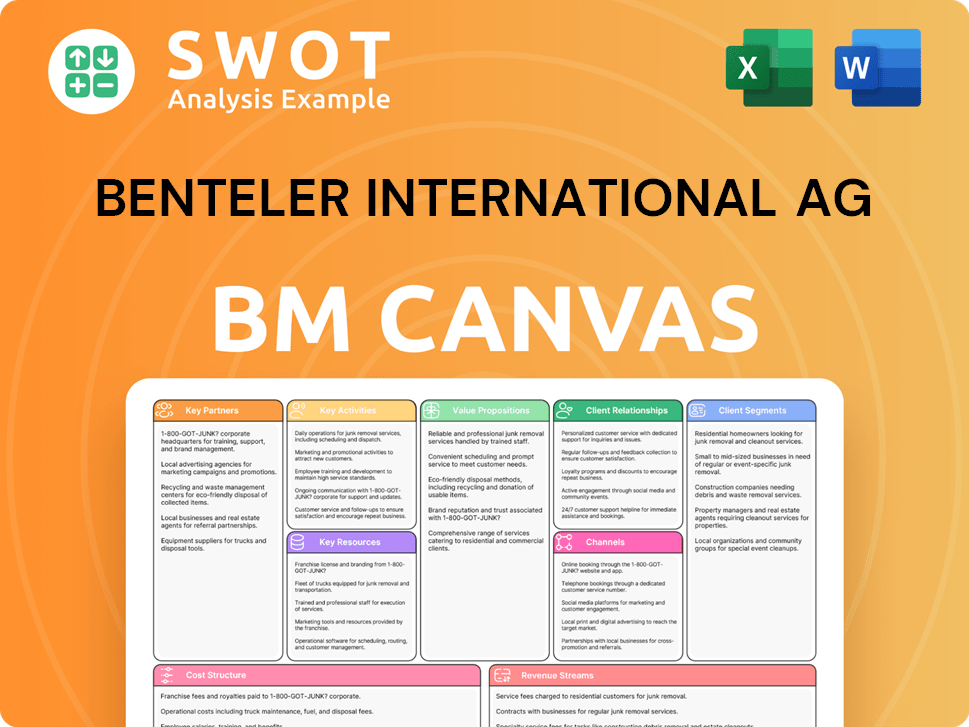

Benteler International AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Benteler International AG’s Growth?

The Growth Strategy and Future Prospects of Benteler International AG are subject to several risks and obstacles. These challenges could potentially affect the company's ability to achieve its ambitious growth targets. Understanding these risks is crucial for assessing the long-term viability of Benteler International AG.

Benteler International AG operates within a dynamic global market, where several factors can impact its performance. These include intense competition, regulatory changes, and geopolitical instability. Successfully navigating these complexities requires proactive risk management and strategic adaptability.

Market competition presents a significant challenge for Benteler International AG. The automotive industry is highly competitive, with established players and new entrants constantly vying for market share. The increasing demand for EV components, for instance, intensifies the competitive pressure, potentially impacting pricing and profit margins. A thorough Company Analysis is vital.

Regulatory changes, particularly those related to environmental standards and trade policies, pose a risk. These changes can lead to increased compliance costs and disruptions in global supply chains. Adapting to these changes quickly is crucial.

Ongoing geopolitical instability and its impact on raw material prices and energy costs present another challenge. Benteler International AG, as a major consumer of steel and aluminum, is particularly vulnerable to these fluctuations. Managing these costs is essential.

Supply chain vulnerabilities, exacerbated by recent global events, are a continuing concern. These vulnerabilities necessitate robust risk management frameworks and diversification of suppliers to ensure operational continuity. Strengthening supply chain resilience is a priority.

Technological disruption represents both an opportunity and a risk. Failure to adapt quickly to new innovations or the emergence of superior technologies from competitors could be detrimental. Investing in innovation is key.

Internal resource constraints, such as the availability of skilled labor or capital for large-scale investments, could impede growth. Efficient resource allocation and strategic investments are vital for sustained expansion. The company's financial performance is crucial.

Benteler International AG addresses these risks through a comprehensive risk management framework. This includes scenario planning and diversification of its customer base and product offerings. Proactive risk mitigation is essential.

Benteler International AG has actively worked on strengthening its supply chain resilience by establishing multiple sourcing options and regionalizing production where feasible. This strategy helps mitigate disruptions. Diversifying suppliers reduces dependency on any single source.

Strategic partnerships can also play a vital role in mitigating risks and fostering growth. These partnerships can provide access to new technologies, markets, and resources. Collaborations can drive innovation and improve competitiveness.

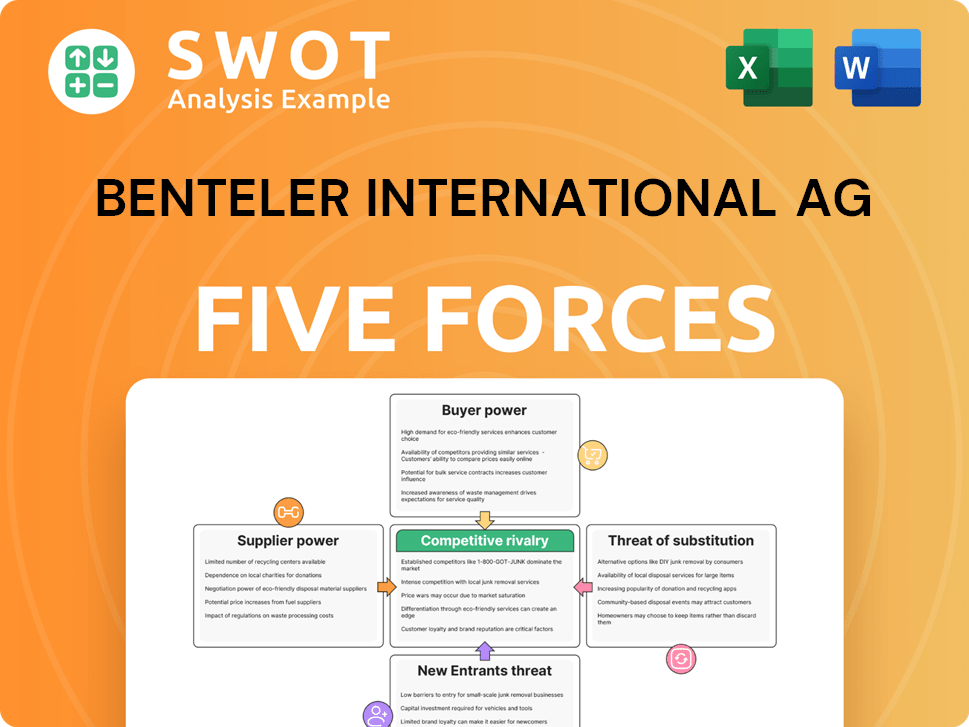

Benteler International AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Benteler International AG Company?

- What is Competitive Landscape of Benteler International AG Company?

- How Does Benteler International AG Company Work?

- What is Sales and Marketing Strategy of Benteler International AG Company?

- What is Brief History of Benteler International AG Company?

- Who Owns Benteler International AG Company?

- What is Customer Demographics and Target Market of Benteler International AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.