Betterware de Mexico Bundle

How Does Betterware de Mexico Thrive in a Competitive Market?

In the ever-evolving world of retail, understanding the Betterware de Mexico SWOT Analysis is crucial for investors and strategists alike. Betterware de Mexico, a prominent player in the direct selling arena, has successfully navigated a complex market landscape. This company analysis delves into the core of Betterware's operations, examining its business model and market position.

This in-depth exploration of the Betterware de Mexico competitive landscape will reveal its market share, key competitors, and the strategies that fuel its growth. We'll dissect its direct selling approach, assess its financial performance, and investigate its distribution network. By analyzing Betterware de Mexico's competitive advantages, we aim to provide actionable insights for anyone interested in the company's growth potential and the broader industry trends.

Where Does Betterware de Mexico’ Stand in the Current Market?

Betterware de México maintains a strong market position within the home organization and improvement product sector, particularly in Mexico. It is a dominant player in the direct-to-consumer market. The company's primary focus is on providing practical and affordable solutions for everyday living through its diverse product lines.

The company's core operations revolve around its extensive direct selling network, which is complemented by a growing digital presence. This approach allows Betterware to reach a broad customer base, from middle to lower-income households. The company's value proposition centers on offering value-for-money products that enhance the quality of life in homes across Mexico and expanding Latin American markets.

Betterware de México's market position is significantly bolstered by its strong financial performance. For instance, its net revenue for the fourth quarter of 2023 was reported at Ps. 2,662.9 million. This financial health supports continued investment in product development and market expansion, reinforcing its competitive advantages.

Betterware de México holds a leading position in the direct-to-consumer home organization and improvement product market in Mexico. While specific market share data for 2024-2025 is still emerging, the company's historical performance indicates significant dominance.

The company's product lines, encompassing home organization, kitchenware, bathroom accessories, and general household solutions, cater to a wide range of consumer needs. This diverse product catalog supports its strong market position by offering comprehensive solutions.

Betterware's extensive direct selling network remains a key strength, complemented by growing digital sales channels. This dual approach enables broad market reach and effective customer engagement.

Betterware de México has demonstrated robust financial performance, consistently exceeding industry averages in revenue growth and profitability. This financial strength provides a solid foundation for continued expansion and investment.

Betterware de México's market position is enhanced by several key advantages. These include its strong brand recognition, extensive distribution network, and a product portfolio tailored to consumer needs.

- Dominant presence in the direct-to-consumer market in Mexico.

- A broad and appealing product catalog.

- A well-established distribution network.

- Strong financial health supporting growth initiatives.

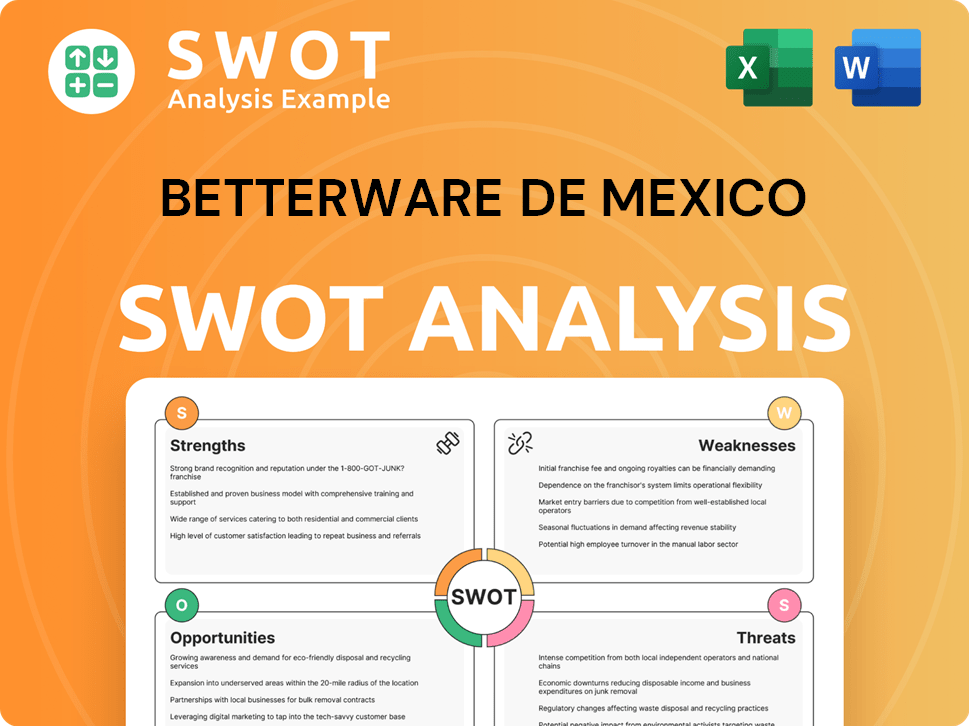

Betterware de Mexico SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Betterware de Mexico?

The Competitive landscape for Betterware de Mexico is multifaceted, encompassing both direct and indirect competitors. A comprehensive company analysis reveals that the firm faces challenges from established direct selling enterprises and the rapid expansion of e-commerce platforms. Understanding these competitive dynamics is crucial for assessing Betterware de Mexico's market position and future growth potential.

Betterware de Mexico operates primarily within the direct selling model, placing it in direct competition with other multi-level marketing (MLM) companies. These competitors often focus on similar product categories, including home goods and personal care items, vying for market share through their distributor networks. The business model of Betterware de Mexico is heavily reliant on its direct sales force, which is a key factor in its competitive strategy.

Indirect competition comes from a broader spectrum of retailers, including big-box stores, department stores, and online marketplaces. These entities offer diverse product selections and competitive pricing, posing a significant challenge to Betterware de Mexico's sales strategy. The rise of e-commerce giants further intensifies this competition, as they provide alternative purchasing channels and broader product assortments.

Direct competitors include other multi-level marketing (MLM) companies. These companies often focus on home goods and personal care products. They challenge Betterware de Mexico through their established distributor networks.

Indirect competition comes from big-box stores, department stores, and online marketplaces. Retailers like Walmart and Amazon offer a wide range of products. These competitors challenge Betterware de Mexico through competitive pricing and extensive delivery networks.

E-commerce giants such as Amazon and Mercado Libre represent a growing threat. They offer vast product selections, competitive pricing, and efficient logistics. These platforms directly appeal to consumers seeking convenience and variety.

The rise of new, agile online-only brands specializing in niche home goods is emerging. These brands often leverage social media and influencer marketing. They target specific audiences with specialized product offerings.

Mergers and alliances within the retail sector can shift competitive dynamics. These changes can create larger, more formidable retail entities. This can impact the market share and competitive landscape.

Betterware de Mexico's competitive advantages include its strong distributor network and innovative product offerings. The company's focus on direct selling allows for personalized customer interactions. This can lead to higher customer loyalty and repeat purchases.

Betterware de Mexico faces competition from both established direct selling companies and e-commerce platforms. A Betterware de Mexico market analysis 2024 reveals that the company must continuously adapt to maintain its competitive edge. Understanding the strengths and weaknesses of competitors is crucial for strategic planning.

- Tupperware Brands: Operates globally and competes in similar product categories.

- Walmart and Liverpool: Offer a wide range of home organization products at competitive prices.

- Amazon and Mercado Libre: Provide vast product selections and efficient logistics.

- Regional Direct Sales Players: Challenge Betterware de Mexico with competitive pricing and localized offerings.

- Niche Online Brands: Leverage social media and influencer marketing to reach targeted audiences.

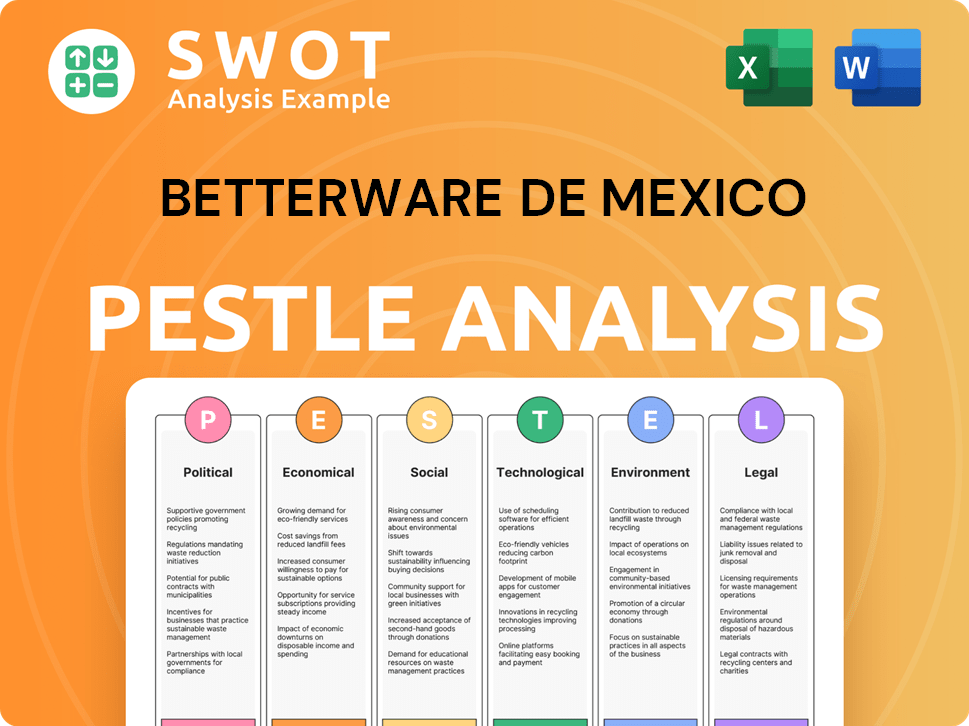

Betterware de Mexico PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Betterware de Mexico a Competitive Edge Over Its Rivals?

The competitive advantages of Betterware de México are primarily rooted in its direct-to-consumer sales model, strong brand equity, and continuous innovation. This approach allows the company to build a robust distribution network, reaching a broad customer base, particularly in areas where traditional retail is less developed. The direct selling model fosters strong relationships between sellers and customers, leading to high customer loyalty and repeat purchases. This positions Betterware favorably within the competitive landscape.

Betterware's brand, established over several decades, is associated with practical, innovative, and affordable home solutions. This gives it a significant advantage in consumer trust and recognition. The company consistently introduces new and relevant products, which is a key differentiator. It emphasizes product development that addresses specific household needs, often offering unique designs or functionalities not readily available through conventional retail.

The company's efficient supply chain and operational efficiencies also contribute to its competitive edge, allowing it to offer products at attractive price points while maintaining healthy profit margins. These advantages have evolved from its initial catalog-based approach to a more integrated multi-channel strategy, leveraging digital tools to empower its sales force and enhance customer engagement. While the direct selling model faces threats from changing consumer shopping habits and the rise of e-commerce, Betterware's continuous investment in its digital platforms and its strong community of sellers aims to sustain these advantages against imitation and industry shifts. For a deeper dive into the company's structure, consider exploring Owners & Shareholders of Betterware de Mexico.

Betterware de México leverages a direct-to-consumer sales model, which allows it to bypass traditional retail channels. This approach enables the company to build strong relationships with its distributors and customers. This model also allows for targeted marketing and personalized customer service, enhancing customer loyalty and repeat purchases.

The company has built a strong brand reputation over the years, associated with practical, innovative, and affordable home solutions. This brand equity fosters consumer trust and recognition, giving Betterware a competitive edge. The brand's reputation helps attract and retain customers, supporting its market share and growth.

Betterware consistently introduces new and relevant products, keeping its catalog fresh and appealing. The company focuses on product development that addresses specific household needs, often offering unique designs or functionalities. This focus on innovation ensures customer interest remains high and drives sales.

Efficient supply chain management and operational excellence allow Betterware to offer products at competitive prices. This efficiency helps maintain healthy profit margins while providing value to customers. These operational efficiencies are crucial for sustaining a competitive edge in the market.

Betterware de México's competitive advantages are multifaceted, encompassing its direct-to-consumer model, strong brand recognition, and continuous product innovation. These factors contribute to its robust market position and growth potential. The company's ability to adapt and innovate is crucial for maintaining its competitive edge.

- Direct Sales Network: Extensive network of distributors and associates.

- Brand Reputation: Strong brand equity and consumer trust.

- Product Innovation: Consistent introduction of new and relevant products.

- Operational Efficiency: Efficient supply chain and operational excellence.

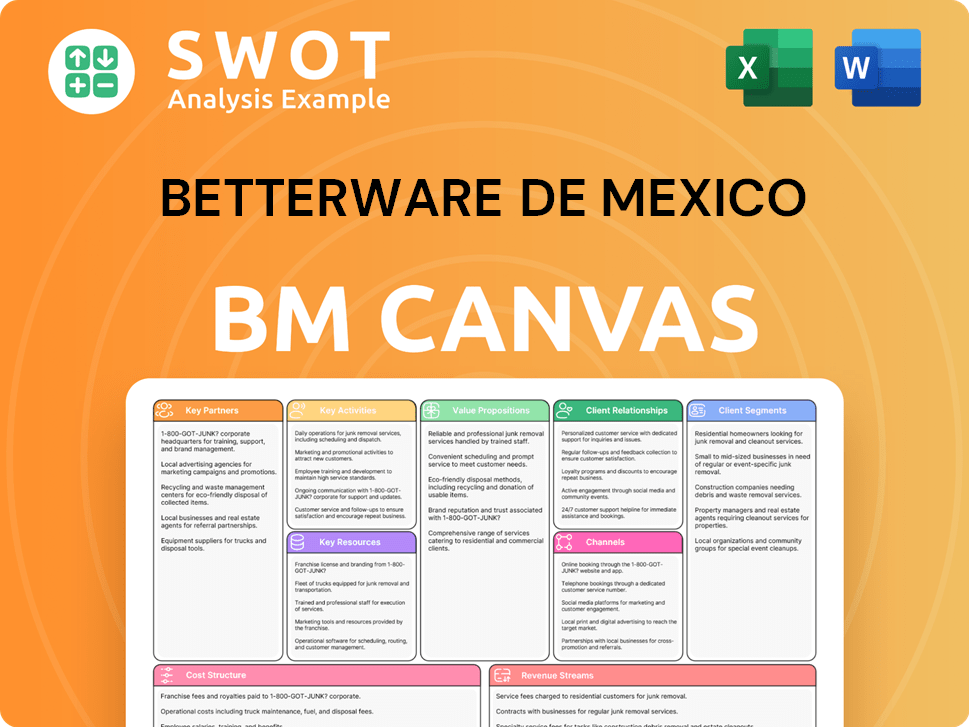

Betterware de Mexico Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Betterware de Mexico’s Competitive Landscape?

An examination of the Marketing Strategy of Betterware de Mexico reveals a company navigating a dynamic home organization and improvement market. The competitive landscape for companies like this is shaped by evolving consumer preferences, technological advancements, and the rise of e-commerce. Understanding these trends is crucial for assessing the future outlook of Betterware de México.

The risks and opportunities facing Betterware de México are multifaceted. The company's direct selling business model is both a strength and a potential vulnerability in a market increasingly influenced by digital platforms. The ability to adapt to changing consumer behaviors and competitive pressures will be key to maintaining and growing its market share.

The home organization and improvement industry is experiencing significant shifts. There's a growing demand for practical and aesthetically pleasing home solutions. Sustainability and eco-friendly products are also gaining traction. E-commerce continues to accelerate, influencing how consumers discover and purchase products.

Betterware de México faces challenges from new direct-to-consumer brands leveraging social media. Increased competition from large online retailers poses a threat. Changing consumer preferences, such as subscription models, could impact sales. Declining demand in specific product categories is another potential risk.

Significant growth opportunities exist in emerging markets within Latin America. Product innovation, particularly in smart home organization and sustainable materials, is a key area for expansion. Strategic partnerships could unlock new market segments and enhance product offerings.

The competitive landscape includes direct selling companies, online retailers, and specialized niche brands. Betterware de México's ability to adapt its business model and product offerings will determine its market position. The integration of digital and direct selling channels is crucial for long-term success.

To thrive, Betterware de México must focus on several key areas. The company should invest in its digital presence and e-commerce capabilities to reach a wider audience. Understanding consumer behavior through data analytics is vital for product development and sales strategies.

- Expand digital marketing efforts to increase brand visibility and attract new customers.

- Develop innovative products that meet evolving consumer needs and preferences.

- Explore strategic partnerships to broaden product offerings and enter new markets.

- Continuously analyze market trends and adapt the business model to remain competitive.

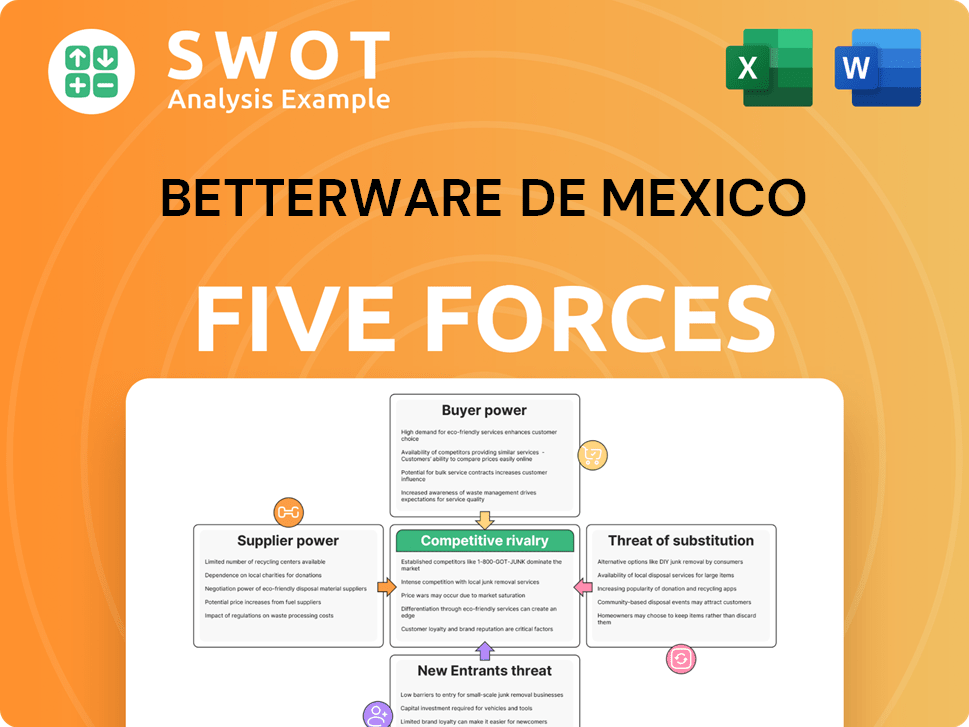

Betterware de Mexico Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Betterware de Mexico Company?

- What is Growth Strategy and Future Prospects of Betterware de Mexico Company?

- How Does Betterware de Mexico Company Work?

- What is Sales and Marketing Strategy of Betterware de Mexico Company?

- What is Brief History of Betterware de Mexico Company?

- Who Owns Betterware de Mexico Company?

- What is Customer Demographics and Target Market of Betterware de Mexico Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.