Betterware de Mexico Bundle

How Does Betterware de Mexico Thrive in the Direct-to-Consumer Market?

Betterware de México has revolutionized the home goods sector, particularly in Mexico and the U.S., with its innovative and affordable products. Originating in 1928 and establishing its Mexican presence in 1995, the company has become a prominent player in the direct selling market. Leveraging a robust network of distributors and associates, Betterware de México has achieved impressive growth, making it a compelling subject for investors and industry observers.

This exploration into the Betterware de Mexico SWOT Analysis will uncover the core of its operational strategies, focusing on its direct selling model and product innovation. Understanding the Betterware business model and how it generates revenue is crucial for anyone interested in the home goods market or the dynamics of network marketing Mexico. Learn about Betterware products, the company's history, and its potential as a business opportunity, while also considering aspects like the Betterware de Mexico compensation plan and product reviews.

What Are the Key Operations Driving Betterware de Mexico’s Success?

The core operations of Betterware de Mexico revolve around a direct-to-consumer sales model, focusing on home organization and improvement products. This approach allows the company to efficiently reach customers across Mexico. The Betterware business model leverages a network of distributors and associates to facilitate sales and distribution, optimizing its reach and minimizing logistical costs.

Betterware products span a wide range of categories, including kitchen, home, bedroom, bathroom, cleaning, and technology. The price points for these products typically range from 20 MXN to 1,700 MXN, catering to a broad customer base. In 2024, the company aimed to introduce over 250 new products, demonstrating its commitment to innovation and expanding its product offerings.

The company's value proposition lies in providing accessible, innovative home solutions through a convenient direct-selling model. This approach not only offers customers a diverse product selection but also presents a business opportunity for distributors and associates. The company's ability to adapt and innovate, as demonstrated by its digital platform and data-driven decision-making, further enhances its value proposition in the competitive direct selling Mexico market.

Betterware de Mexico offers products across six main categories: kitchen, home, bedroom, bathroom, cleaning, and technology. These categories provide a comprehensive range of home solutions. The diverse product portfolio caters to various customer needs and preferences.

Products are priced between 20 MXN and 1,700 MXN, offering affordability and value. This pricing strategy makes Betterware products accessible to a wide range of consumers. The varied price points allow customers to choose products that meet their budget and needs.

The distribution model involves distributors and associates, streamlining the sales process. Associates place orders with distributors, who then forward them to Betterware de Mexico. This structure helps manage 'last mile' delivery costs.

Betterware de Mexico utilizes a digital platform, including an app and e-commerce website. The app facilitates communication with sellers, while the e-commerce site expands market reach. These digital tools enhance the Betterware business model and customer experience.

The operational efficiency of Betterware de Mexico is supported by a state-of-the-art distribution center in Zapopan. This center can handle over 180,000 orders and pack more than 1.5 million products daily. The company's logistics are streamlined through partnerships with five exclusive delivery companies.

- Direct selling model with distributors and associates.

- Delivery within 24-48 hours.

- Data-driven decision-making for pricing and product mix.

- Focus on innovation with over 250 new product launches planned in 2024.

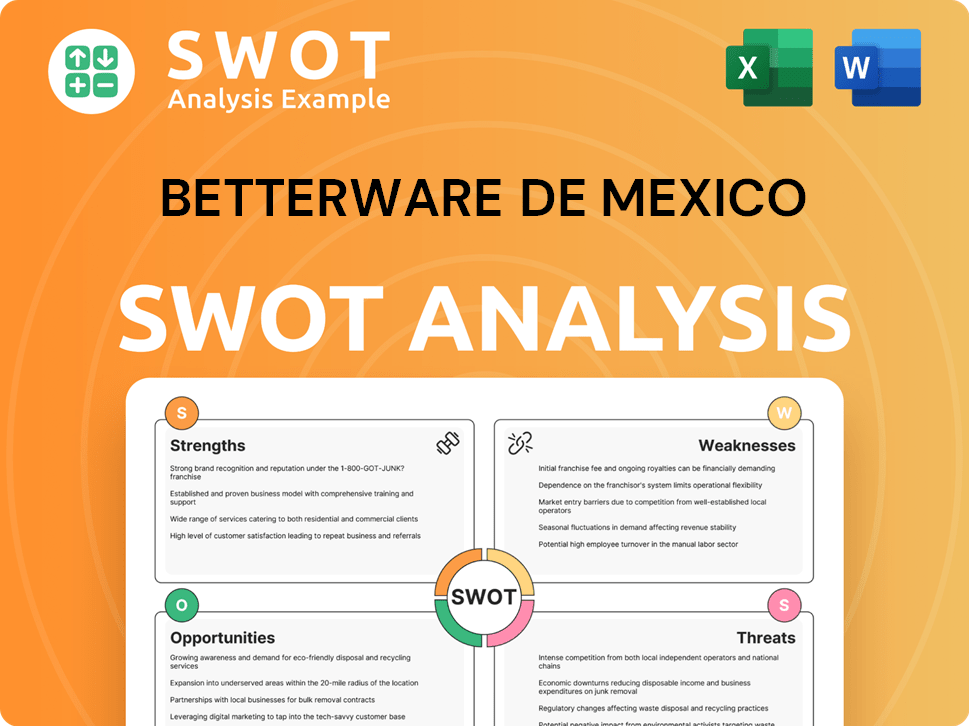

Betterware de Mexico SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Betterware de Mexico Make Money?

The revenue streams and monetization strategies of Betterware de Mexico are primarily centered around direct sales. The company leverages a network of distributors to sell its home organization and improvement products directly to consumers. This approach allows for a streamlined distribution process and direct customer interaction.

Betterware de Mexico's financial performance demonstrates its effective monetization strategies. In 2024, the company's revenue reached $0.75 billion USD, up from $0.74 billion USD in 2023. The company's trailing twelve-month revenue, as of May 2025, was $0.71 billion USD.

The company's revenue streams are divided into two main segments: the Betterware segment, focused on home organization products, and the Jafra segment, which includes beauty and personal care products acquired in April 2022. In Q1 2024, the company's consolidated net revenue increased by 10.4% year-over-year, reaching $209 million USD, with a gross margin of 73.6%.

Betterware de Mexico employs several monetization strategies to drive sales and revenue growth. These strategies include a focus on product innovation, distributor incentives, and an asset-light business model. Distributors and associates acquire products at a discount and profit by selling them to the end consumer at a higher price.

- Catalog Sales: The company releases nine catalogs annually, featuring approximately 400 products, with over 300 new products introduced each year. This constant refresh keeps the product line appealing and drives repeat purchases.

- Distributor Network: The direct selling model relies on a network of distributors who purchase products at a discount and sell them at a markup. This incentivizes distributors to actively promote and sell products.

- Reward Programs: Betterware uses a reward plan with 'Betterware Points,' which distributors can exchange for products or other benefits. This system further motivates distributors and encourages sales.

- Segment Performance: In Q4 2024, Betterware de México reported sales of MXN 3,778.47 million, compared to MXN 3,401.69 million in Q4 2023, representing an 11.1% growth. For the full year 2024, total revenue grew by 8.4% compared to 2023, with Jafra Mexico contributing a 13.0% increase and Betterware Mexico a 4.6% increase.

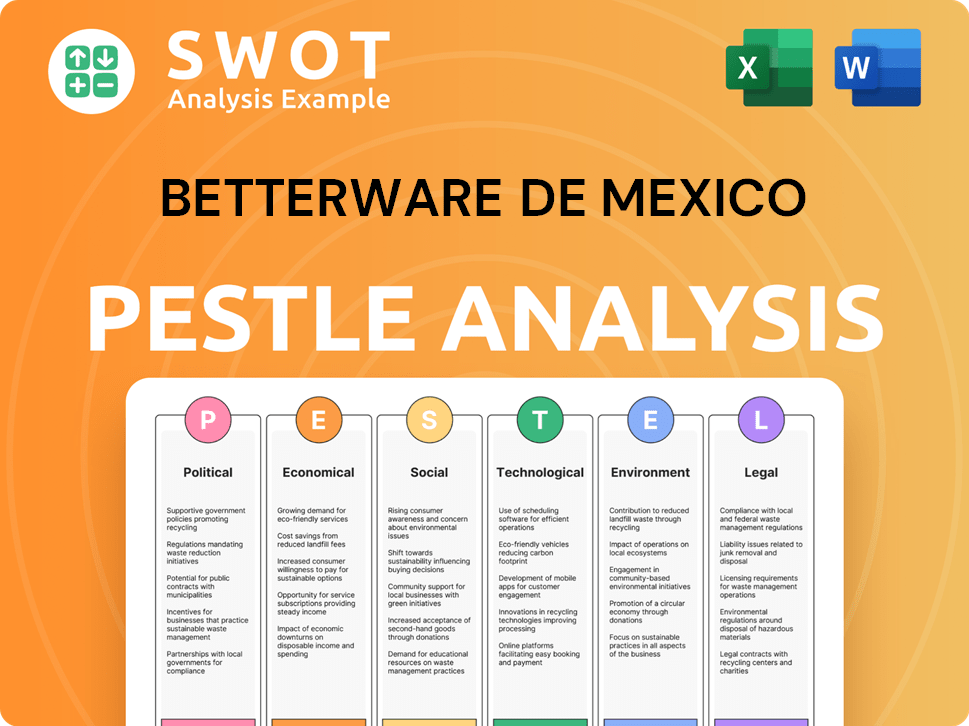

Betterware de Mexico PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Betterware de Mexico’s Business Model?

Betterware de México has demonstrated a robust ability to adapt and thrive, marked by significant milestones and strategic decisions. The company's journey includes pivotal moments like the acquisition of the Latin American division in 2001 and its initial public offering (IPO) on Nasdaq in 2019, a first for a Mexican company. These moves, along with strategic acquisitions, have shaped its operational landscape and financial performance, positioning it as a key player in the direct selling market.

Strategic expansions, such as the acquisition of Jafra on April 7, 2022, have broadened the company's product offerings, particularly in the beauty sector. This strategic move, coupled with a strong direct selling network, has allowed the company to navigate challenges, including the COVID-19 pandemic. The company's resilience is evident in its financial results, including record sales figures and continued growth in recent quarters.

The company's success is further underpinned by a focus on innovation, launching over 300 new products annually, and a data-driven approach to business. Betterware de Mexico's competitive advantages also include a strong brand loyalty and an asset-light business model. These elements contribute to its ability to maintain high operating margins and adapt to market trends.

The acquisition of the Latin American division in 2001 by current Chairman Luis Campos was a pivotal moment. The establishment of the distribution center in Guadalajara in 2003 enhanced operational efficiency. The IPO on Nasdaq in 2019 marked a significant achievement, being the first Mexican company to list directly on the exchange.

A major strategic move was the acquisition of Jafra on April 7, 2022, expanding into the beauty market. The company has continually launched new products, with over 300 annually. Betterware has also adopted a hybrid digital and personal contact approach, proving beneficial during the pandemic.

Betterware de Mexico benefits from strong brand loyalty and an extensive direct selling network. The company's asset-light business model supports high operating margins. Continuous innovation and a data-driven approach strengthen its competitive position. The company has a strong presence in the home goods Mexico market.

The company achieved record sales of MXN 7,238 million in 2020 and MXN 10,068 million in 2021. In Q4 2024, Betterware Mexico demonstrated resilience, growing by 1.5%. As of April 2024, the combined network across Mexico and the U.S. included 63,300 distributors and 1.18 million associates.

Betterware de Mexico's success is supported by its strong brand recognition and an extensive network of distributors. The company's business model allows for high operating margins. Continuous innovation and data-driven strategies further enhance its competitive position in the direct selling Mexico market.

- Strong Brand Loyalty: A key factor in customer retention.

- Extensive Direct Selling Network: Over 63,300 distributors and 1.18 million associates as of April 2024, driving sales.

- Asset-Light Business Model: Facilitates high operating margins, enhancing profitability.

- Continuous Innovation: Launching over 300 new products annually to meet market demands.

- Data-Driven Approach: Utilizing business intelligence and technology for informed decision-making.

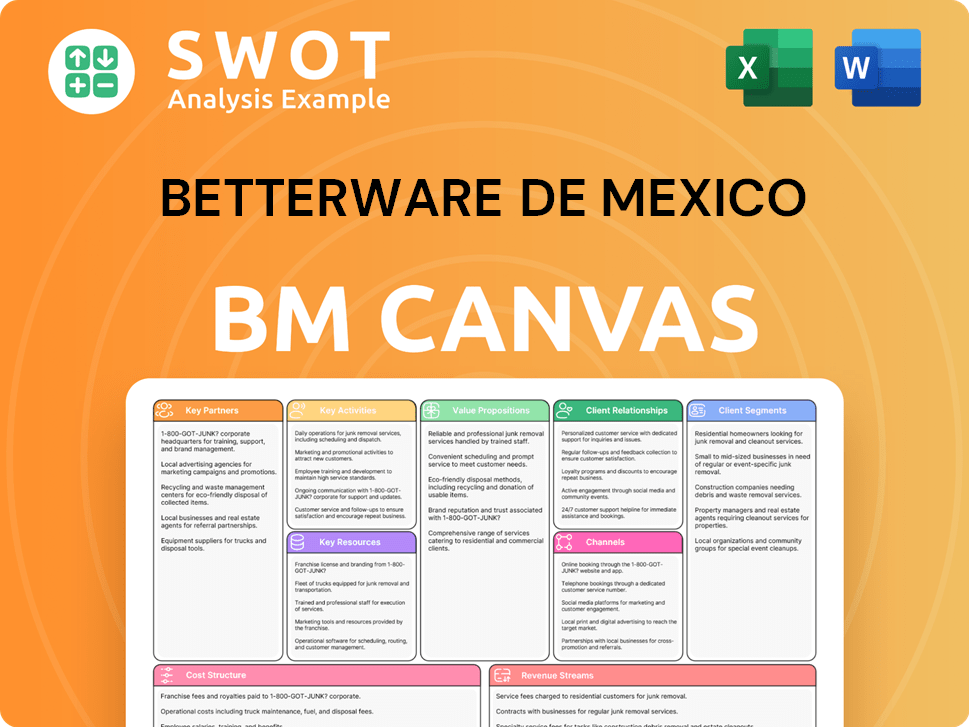

Betterware de Mexico Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Betterware de Mexico Positioning Itself for Continued Success?

Betterware de Mexico holds a significant position in Mexico's direct selling industry, particularly in the home organization sector. The company's robust network and strategic initiatives highlight its market presence. In 2023, it secured a 12.6% market share within Mexico's direct selling industry. Betterware's expansion into the U.S. market, targeting the Hispanic population, further underscores its growth strategy.

Despite its strong market position, Betterware de Mexico faces several risks. The company contends with intense competition from traditional retailers, e-commerce platforms, and external economic factors. Declining margins and efficiency, coupled with rising import duties and freight costs, pose challenges to profitability. Addressing these risks is crucial for maintaining its competitive edge and ensuring sustainable growth. You can learn more about the Competitors Landscape of Betterware de Mexico.

Betterware de Mexico has a strong foothold in the direct selling market, especially in the home organization segment in Mexico. Its combined network with Jafra includes 63,300 distributors and 1.18 million associates across Mexico and the U.S. The company's expansion into the U.S. market demonstrates its growth ambitions.

Betterware faces risks from competition with traditional retail and e-commerce. Declining margins and efficiency, along with external pressures such as peso depreciation and rising costs, impact profitability. These challenges require strategic adjustments to maintain market competitiveness and financial health.

The company aims for mid-to-high single-digit growth in both net revenue and EBITDA in 2025, expecting 6-9% growth. Strategic initiatives include product innovation, category expansion, and enhancing its social network management. International expansion, particularly in Guatemala and Ecuador, is also a focus.

Key initiatives for 2025 include a strong innovation pipeline and expanding into new categories. Strengthening social network management, including potential digital tools like live shopping. Enhancing incentive programs for the sales force and focusing on technology enhancements. The company aims to reduce excess inventory by 52% by year-end 2025, targeting a drop from MXN 529 million to MXN 252 million.

Betterware de Mexico is focused on sustainable growth through strategic initiatives and market expansion. The company is celebrating its 30th anniversary in 2025, showcasing its long-term presence and resilience in the market. The company is also enhancing incentive programs for its sales force and focusing on technology enhancements.

- Mid-to-high single-digit growth forecast for 2025.

- Emphasis on innovation and category expansion.

- Continued international expansion into new markets.

- Inventory reduction targets for improved efficiency.

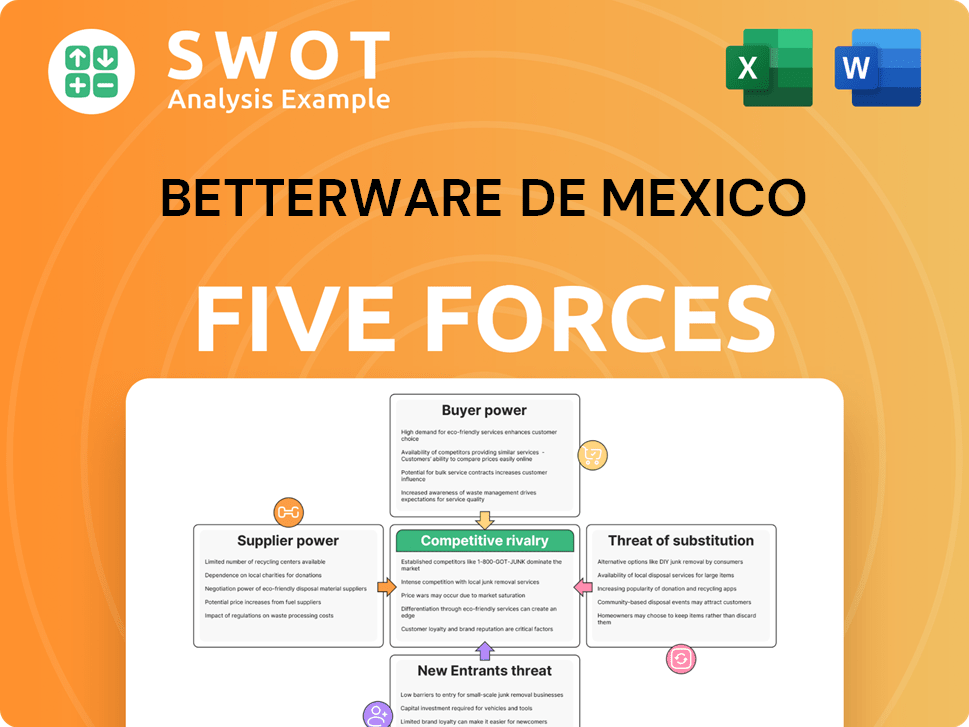

Betterware de Mexico Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Betterware de Mexico Company?

- What is Competitive Landscape of Betterware de Mexico Company?

- What is Growth Strategy and Future Prospects of Betterware de Mexico Company?

- What is Sales and Marketing Strategy of Betterware de Mexico Company?

- What is Brief History of Betterware de Mexico Company?

- Who Owns Betterware de Mexico Company?

- What is Customer Demographics and Target Market of Betterware de Mexico Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.