Betterware de Mexico Bundle

Who Buys Betterware? Unveiling the Customer Profile of Betterware de Mexico

Understanding the "who" behind the purchase is critical for any business, and for Betterware de Mexico, this understanding is the cornerstone of its success. From its humble beginnings in Mexico to its recent expansion into the U.S. market, the company's ability to identify and cater to its target market has been key. This analysis delves into the Betterware de Mexico SWOT Analysis to explore its customer demographics and refine its strategies.

This exploration into Betterware de Mexico's customer demographics and target market provides a comprehensive market analysis, examining the consumer profile and the evolution of its direct selling model. By investigating factors like Betterware de Mexico customer age range, income levels, and geographic location, we uncover the nuances of its consumer base. We will also analyze Betterware de Mexico buying behavior and product preferences to understand how the company has adapted its customer segmentation strategies to reach its target audience profile.

Who Are Betterware de Mexico’s Main Customers?

Understanding the customer demographics and target market of Betterware de Mexico is crucial for analyzing its business strategy. The company primarily focuses on a direct-to-consumer model, reaching a vast network of consumers through distributors and associates. This approach allows Betterware to cater to specific market segments with its diverse product offerings.

As of late 2024 and early 2025, Betterware Mexico had an estimated reach of 8 million Mexican households and a base of 675,000 associates. This extensive network highlights the company's significant presence in the Mexican market. The company's focus is on providing affordable home solutions to a broad consumer base.

In 2023, 68% of Betterware's customer base consisted of price-sensitive consumers. The average transaction value was approximately $35 USD, with a repeat purchase rate of 47.3%. This data underscores the importance of value and affordability in attracting and retaining customers within the target market.

Betterware de Mexico segments its customers into two main groups: end-consumers and independent sales representatives. End-consumers are primarily price-sensitive individuals seeking affordable and practical home solutions. Independent sales representatives, on the other hand, are individuals looking to earn supplemental income through direct selling.

The company's product offerings span various household categories, including kitchen, home, bedroom, bathroom, cleaning, and technology. Products range in price from approximately 20 MXN to 1,700 MXN, catering to a wide range of budgets. This diversity helps attract a broad customer base.

Betterware also caters to individuals seeking supplemental income through its direct selling model, effectively serving a 'B2B' segment of independent sales representatives. As of 2024, Betterware had 87,500 active independent sales representatives, with 62,300 being part-time and 25,200 full-time.

The acquisition of JAFRA in April 2022 expanded Betterware's reach into the beauty market in Mexico and the United States. Furthermore, the company launched operations in the United States in April 2024, targeting the Hispanic population. This expansion aims to capitalize on new customer segments and drive sales growth.

Betterware de Mexico's customer demographics are primarily focused on price-sensitive consumers seeking affordable home solutions. The company's target market includes both end-consumers and independent sales representatives. To learn more about the company's revenue streams and business model, check out this article: Revenue Streams & Business Model of Betterware de Mexico.

- Betterware's core customer base in Mexico values practicality and cost-effectiveness.

- The company's direct selling model provides opportunities for supplemental income.

- Expansion into the beauty market and the U.S. Hispanic population broadens the customer base.

- Betterware's strategic focus is on value, accessibility, and market diversification.

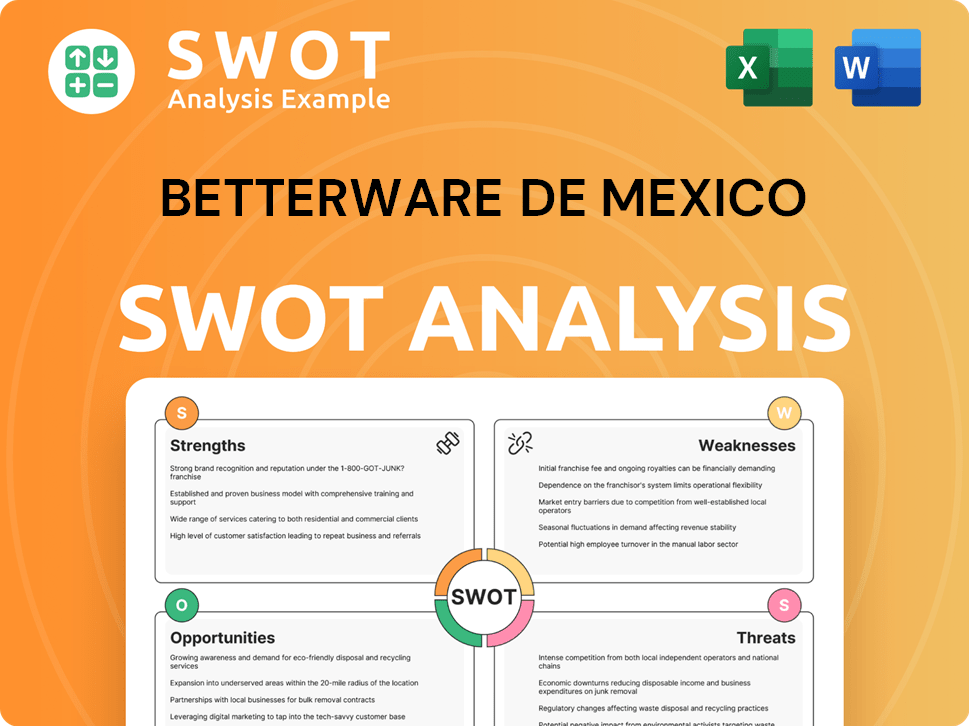

Betterware de Mexico SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Betterware de Mexico’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For Betterware de Mexico, this involves a deep dive into what drives their customers' purchasing decisions and how the company can best meet those needs. The focus is on delivering innovative and affordable home solutions that address practical and aspirational needs.

The company's approach is centered around providing practical, space-saving, and hygiene-focused products. This strategy is supported by a strong innovation pipeline, with a significant number of new products planned for 2024. This responsiveness to market trends and customer feedback is key to maintaining and growing their customer base.

Betterware de Mexico's customer base is primarily driven by the need for home organization and improvement. The company's product portfolio, which includes categories like kitchen, home, bedroom, bathroom, laundry, cleaning, wellness, and technology, directly addresses these needs. The company focuses on providing 'life-hack' products that offer compelling value propositions to 'surprise and delight consumers.'

Customers prioritize affordability and the usefulness of products. In 2023, 68% of customers were price-sensitive, seeking budget-friendly home solutions. This highlights the importance of offering competitive pricing.

Customers seek innovative solutions for daily household problems. Betterware addresses common pain points with products designed for convenience and efficiency. The company's strong innovation pipeline, with over 250 new products planned for 2024, reflects its commitment to meeting these needs.

Loyalty is built through the direct selling model, offering a convenient home shopping experience. This model provides a network of distributors and associates. This approach also empowers individuals to generate supplemental income.

Betterware tailors its marketing and product features by introducing new products and niche categories. They also refine their business model to enhance operational efficiency and scalability. The company emphasizes improving communication, including strengthening its social network management.

The company explores new digital tools like live shopping to better engage with consumers. This helps Betterware de Mexico stay connected with its customer base. This strategy is crucial for adapting to evolving consumer behaviors.

The direct selling model provides a flexible business opportunity. This resonates with a segment of its customer base. This empowers individuals to generate supplemental income, which is a key factor in customer loyalty and engagement.

Betterware de Mexico's strategy is centered on meeting the needs of its target market. This involves understanding their preferences and adapting to market trends. Betterware de Mexico's focus on innovation and affordability drives customer loyalty.

- Affordability: Customers prioritize budget-friendly solutions.

- Innovation: Demand for creative solutions to everyday problems.

- Convenience: The direct selling model offers a convenient shopping experience.

- Practicality: Products are designed to address home organization and improvement needs.

- Value: Products provide compelling value propositions.

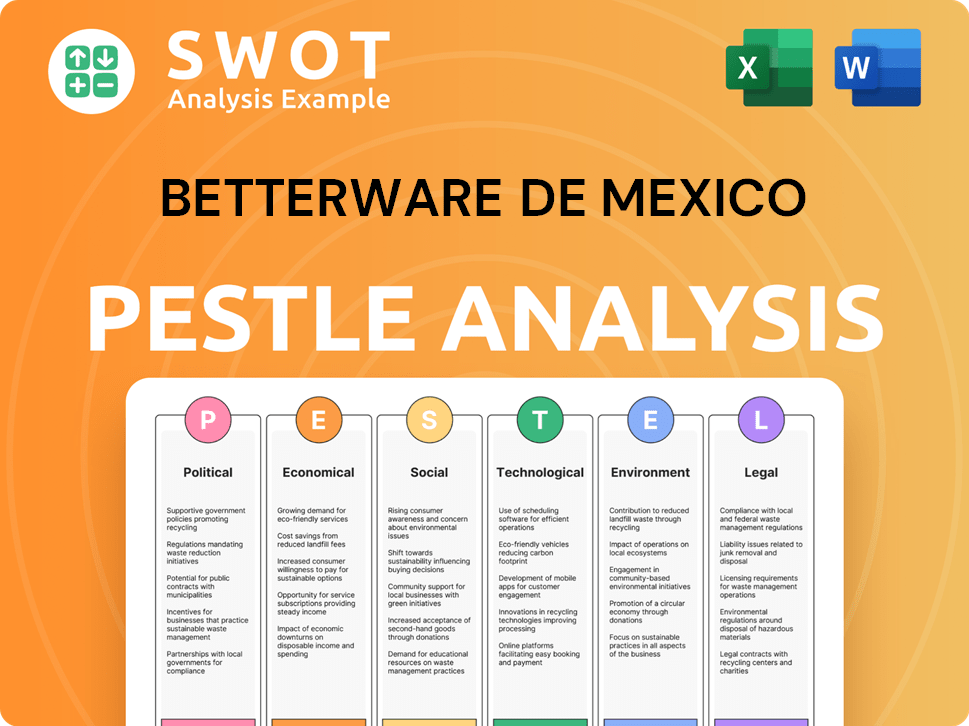

Betterware de Mexico PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Betterware de Mexico operate?

The primary geographical market for Betterware de Mexico is Mexico, where it has established a strong direct-to-consumer presence. The company's extensive distribution network covers a significant portion of the country, reaching millions of households. This strategic focus allows for efficient product delivery and market penetration within Mexico.

As of early 2025, the company's distribution network reached an estimated 8 million Mexican households, with approximately 25% home penetration. Betterware de Mexico holds an estimated 4.0% market share in the overall household product market in Mexico. Its strong presence in Mexico enables cost-effective shipping across the country, even to remote areas.

In April 2024, Betterware de Mexico expanded into the United States, specifically targeting the Hispanic population through its new brand, Betterware U.S. The U.S. headquarters are in Dallas, Texas, chosen for its robust distribution network and access to a skilled workforce. This expansion is a move to diversify its customer base and tap into a larger market.

Betterware de Mexico's core market remains Mexico, where it has built a strong brand presence. The company's distribution network is a key asset, ensuring wide reach. This focus allows for efficient operations and strong market penetration.

The U.S. expansion targets the large and growing Hispanic population. Dallas, Texas, was selected for its strategic advantages. This expansion is a key step in diversifying the customer base.

Betterware de Mexico is also targeting international markets like Colombia and Brazil. The company plans to invest in these markets to increase its global footprint. These expansions are part of a broader growth strategy.

In June 2025, Betterware plans to enter Ecuador, marking its first venture into the Andean region. This expansion will allow the company to adapt its offerings to succeed in diverse markets. This move underscores the company's commitment to international growth.

The company has international expansion strategies that include targeting Colombia and Brazil, with a projected investment of $3.2 million in market entry costs and an estimated potential market penetration of 6-8% within 18 months. In June 2025, Betterware plans to begin operations in Ecuador, marking its first move into the Andean region, which also includes Peru and Colombia. For more details on the company's strategic growth, see the Growth Strategy of Betterware de Mexico.

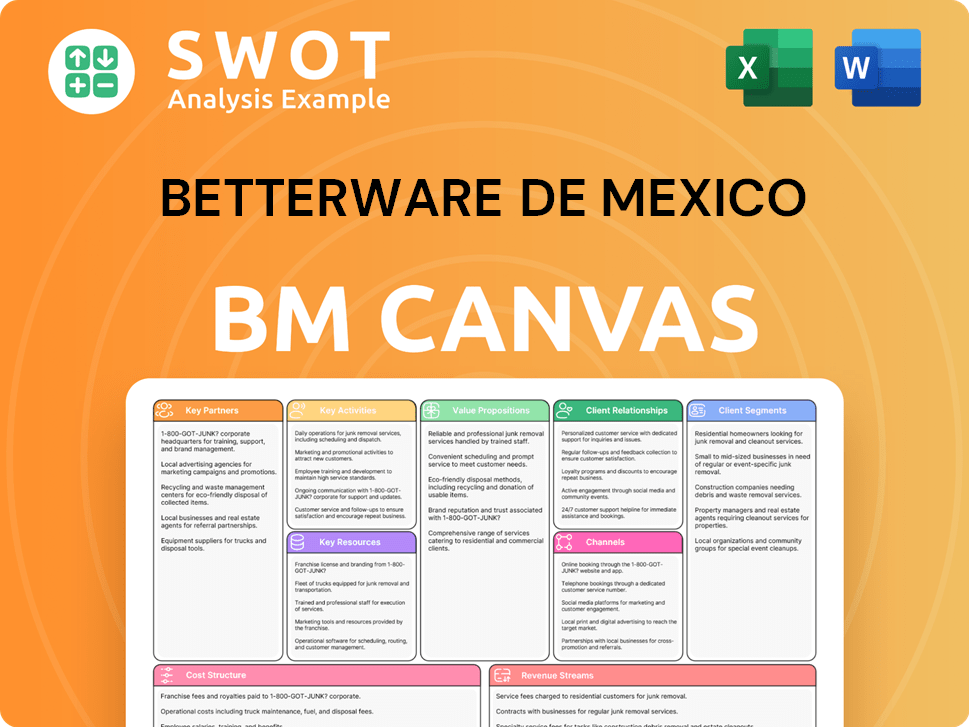

Betterware de Mexico Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Betterware de Mexico Win & Keep Customers?

The customer acquisition and retention strategies of Betterware de Mexico are deeply rooted in its direct-to-consumer business model, leveraging an extensive network of distributors and associates. These brand partners, incentivized with discounts and a reward program, are key to acquiring end-customers. The company continuously refines its approach, integrating digital tools and product innovation to maintain a competitive edge in the market. This strategy is essential for understanding the Competitors Landscape of Betterware de Mexico.

Betterware de Mexico focuses on a multi-faceted approach to customer acquisition and retention, primarily utilizing its direct selling model. This model empowers a network of distributors and associates, who are supported by incentives like discounts and reward programs. These strategies are designed to attract and retain both the sales force and the end-customers, driving sustainable growth. The company's commitment to innovation and digital transformation further strengthens its market position.

The company's approach to customer acquisition and retention is designed to create a continuous cycle of growth and engagement. By supporting its distributors and associates, the company ensures a robust sales force capable of reaching a wide customer base. Simultaneously, a focus on product innovation and digital tools enhances customer loyalty and drives repeat purchases. These strategies are crucial for the company's long-term success and market relevance.

The primary method of customer acquisition involves a network of distributors and associates. These individuals sell products through catalogs and online platforms, creating entrepreneurial opportunities. This direct selling model is a cornerstone of the company's strategy, driving customer acquisition and market penetration.

The company supports its sales force with incentives, including product discounts and a reward plan. In 2025, enhancements to these programs are planned to promote growth in the associate base. These incentives are designed to motivate distributors and associates, thereby boosting sales and customer reach.

Marketing channels are evolving to include both traditional print catalogs and digital social selling. Betterware is strengthening its social network management and exploring new digital tools like live shopping. This strategy aims to augment the catalog's reach and engage consumers more effectively.

Customer retention is fostered through a strong product innovation pipeline. Betterware launched 42 new products in 2023. The company’s household product lines exhibit strong customer loyalty, with a repeat purchase rate of 73.5% and a customer retention rate of 68.9% in 2023.

Betterware de Mexico's customer acquisition and retention strategies are multifaceted, focusing on direct selling, incentive programs, digital marketing, and product innovation. The company aims to impact customer loyalty and lifetime value positively by adapting to market conditions and continuously enhancing the customer and associate experience. Strategic pricing and cost optimization also contribute to maintaining competitiveness and supporting customer loyalty. In 2023, digital sales represented 35.7% of total revenue, with an online growth rate of 22.4%.

The company focuses on data-driven segmentation and coaching for its salesforce. This approach is designed to reignite sales momentum and improve the effectiveness of the sales team. Enhanced training and support are key to maintaining a strong sales network.

In 2024, a comprehensive pricing strategy was implemented to protect margins while remaining competitive. In Q1 2025, price increases prompted an aggressive promotional push. These efforts are designed to balance profitability and market competitiveness.

Betterware is investing in technology enhancements, including new features in its proprietary B+ app. A new Learning Management System (LMS) is also being implemented for online training. These tools improve the experience for associates and distributors.

The company leverages its 'Betterware Points' system, exchangeable for company products or benefits, to foster customer loyalty. This program provides added value and encourages repeat purchases. The focus on customer retention is critical to the company's business model.

Betterware de Mexico conducts thorough market analysis to understand its customer demographics and target market. This includes analyzing customer behavior and product preferences. These insights inform strategic decisions and improve customer acquisition strategies.

Understanding product preferences is essential for Betterware. The company's focus on household products and niche categories with compelling value propositions drives customer loyalty. The constant introduction of new products keeps the customer base engaged.

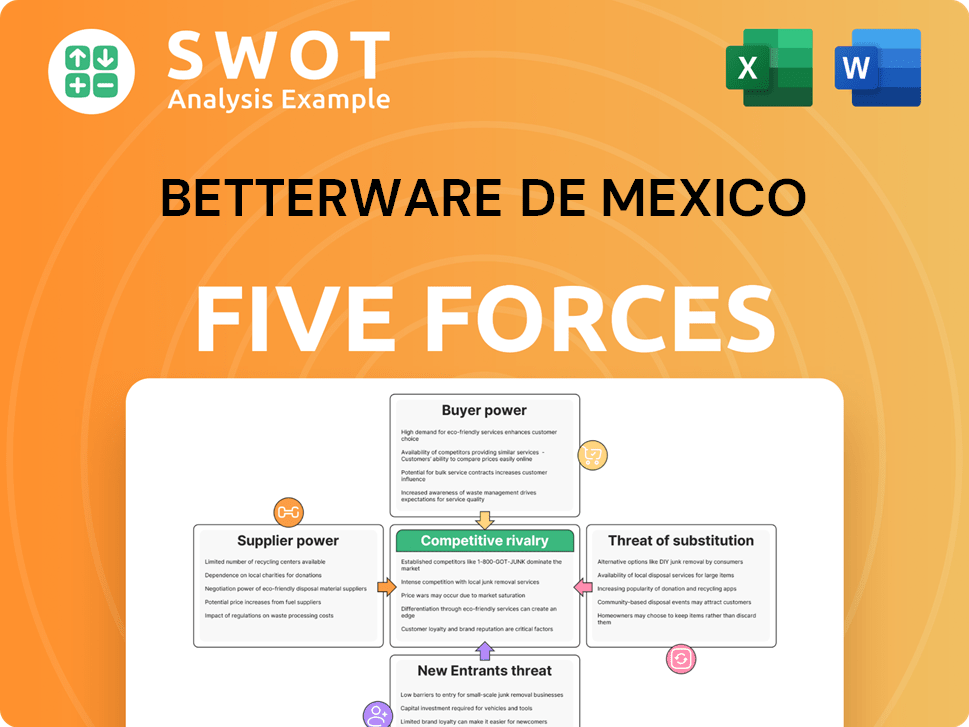

Betterware de Mexico Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Betterware de Mexico Company?

- What is Competitive Landscape of Betterware de Mexico Company?

- What is Growth Strategy and Future Prospects of Betterware de Mexico Company?

- How Does Betterware de Mexico Company Work?

- What is Sales and Marketing Strategy of Betterware de Mexico Company?

- What is Brief History of Betterware de Mexico Company?

- Who Owns Betterware de Mexico Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.