Societe BIC Bundle

Can BIC Still Compete in Today's Market?

In a world of constant change, how does a company like Société BIC, known for its everyday essentials, maintain its edge? From its iconic pens to its lighters and shavers, BIC has built a global presence. Understanding the Societe BIC SWOT Analysis is crucial to understanding its position in the market.

This deep dive into the Societe BIC competitive landscape will explore its current BIC market position, identifying key BIC competitors and analyzing its BIC business strategy. We'll uncover BIC's competitive advantages and disadvantages, as well as examine the BIC industry trends shaping its future, providing a comprehensive BIC company analysis for investors and strategists alike.

Where Does Societe BIC’ Stand in the Current Market?

Société BIC S.A. maintains a strong market position, primarily in stationery, lighters, and shavers. The company's success is rooted in its strong brand recognition, extensive distribution network, and commitment to providing value to consumers. This strategic approach has allowed BIC to establish a global presence and maintain its competitive edge across various product categories.

BIC's core operations revolve around manufacturing and distributing essential consumer goods. The company's value proposition centers on offering affordable, high-quality products that meet everyday needs. This focus on value has resonated with a broad customer base, contributing to BIC's sustained market leadership in several segments. The company's ability to balance cost-effectiveness with product reliability is a key factor in its competitive advantage.

In 2023, BIC reported net sales of €2,263.2 million, showcasing its significant scale within the consumer goods industry. This financial performance underscores the company's ability to generate substantial revenue and maintain a stable financial position. BIC's diverse product portfolio and global operational footprint support its financial health, allowing it to navigate market fluctuations effectively.

BIC is a global leader in ballpoint pens, with the BIC Cristal pen being one of the best-selling pens worldwide. In the lighter segment, BIC holds a dominant position in many geographies. The company also maintains a significant presence in the disposable shaver market, competing with major personal care brands.

BIC products are distributed globally, reaching a vast array of customer segments. The company's extensive distribution network ensures its products are readily available to consumers worldwide. BIC's focus on mass-market segments has allowed it to capture a broad customer base and maintain a strong market presence.

BIC's primary product lines include stationery (pens, markers, correction products), lighters, and shavers. The company has been introducing more sustainable or premium versions of its core offerings. This reflects evolving consumer preferences and a broader industry move towards environmental consciousness.

BIC holds particularly strong positions in emerging markets, where the demand for affordable, high-quality essential products remains robust. It also maintains a strong presence in mature markets. This diversified geographic presence helps mitigate risks and ensures consistent revenue streams.

BIC's competitive advantages include strong brand recognition, a vast distribution network, and a focus on value. The company's disadvantages may include vulnerability to raw material price fluctuations and intense competition in the stationery and consumer goods markets. Understanding these factors is crucial for a comprehensive BIC company analysis.

- Competitive Advantage: Strong Brand Recognition

- Competitive Advantage: Extensive Distribution Network

- Competitive Advantage: Focus on Value and Affordability

- Competitive Disadvantage: Dependence on Raw Materials

Societe BIC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Societe BIC?

The competitive landscape for Société BIC S.A. is complex, shaped by its diverse product offerings in stationery, lighters, and shavers. Understanding the key rivals and their strategies is crucial for a thorough BIC company analysis. This analysis helps to assess BIC's market position and identify opportunities and threats within the competitive landscape.

BIC's success hinges on its ability to navigate this competitive environment, which is constantly evolving due to changes in consumer preferences, technological advancements, and the strategies of its competitors. The following sections detail the main competitors in each of BIC's primary business segments, providing insights into their strengths, strategies, and impact on BIC's market share and overall performance. This detailed view is essential for anyone looking to understand the dynamics of the BIC industry.

The competitive dynamics vary significantly across BIC’s main product categories. In stationery, BIC faces established players and emerging brands. The lighter segment sees competition from both traditional and innovative product types. Finally, in shavers, BIC competes with global consumer goods giants and disruptive direct-to-consumer models. Each segment presents unique challenges and opportunities for BIC's business strategy.

In the stationery market, BIC's main rivals include Newell Brands and Pilot Corporation. These competitors employ different strategies to capture market share. The competition is intense, with continuous product development and marketing efforts.

Newell Brands, with brands like Paper Mate and Sharpie, directly competes with BIC. Newell's broad portfolio and marketing strength challenge BIC. Continuous innovation and strong retail partnerships are key to Newell's strategy.

Pilot Corporation, a Japanese multinational, competes in the premium stationery segment. Pilot focuses on high-quality pens and specialized writing tools. This positions Pilot as a rival in the more specialized segments.

BIC's primary competitor in the lighter segment is Clipper. Other competitors include smaller regional manufacturers and electric lighters. The competitive focus here is on design, safety, and price.

Clipper is known for its refillable lighters and distinctive designs. Clipper appeals to a different consumer aesthetic. This creates a competitive dynamic focused on design and functionality.

In the shaver market, BIC competes with Gillette (Procter & Gamble) and Schick/Wilkinson Sword (Edgewell Personal Care). These competitors have significant marketing budgets and product lines. Emerging direct-to-consumer models also pose a threat.

The competitive landscape for BIC is characterized by several key factors. These include the strength of established brands, the impact of product innovation, and the rise of new distribution models. Understanding these dynamics is critical for analyzing BIC's market position and future prospects.

- Marketing and Branding: Competitors like Gillette and Newell Brands invest heavily in marketing.

- Product Innovation: Continuous innovation in blade technology and stationery products is a key competitive factor.

- Distribution Channels: The rise of direct-to-consumer models challenges traditional distribution.

- Market Share: BIC's ability to maintain and grow its market share is a key performance indicator.

Societe BIC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Societe BIC a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of Societe BIC is crucial for assessing its competitive standing. The company, often recognized simply as BIC, has carved a significant niche in the stationery, lighter, and shaver markets. Its enduring success is a testament to its strategic advantages and ability to adapt to market dynamics. This analysis delves into the core strengths that define BIC's competitive landscape.

BIC's competitive edge stems from a combination of factors, including brand strength, operational efficiency, and global reach. These elements have enabled BIC to maintain a strong position against its rivals. The company's ability to innovate and respond to consumer needs further solidifies its market presence. Analyzing these aspects provides a comprehensive view of BIC's competitive advantages.

The company's focus on value, quality, and accessibility has resonated with consumers worldwide. This approach has helped BIC to withstand competition and maintain its market position. The following sections detail the key advantages that contribute to BIC's success in the competitive landscape.

BIC's brand is globally recognized for affordability, reliability, and simplicity. This strong brand recognition reduces marketing costs and creates a barrier to entry for new competitors. The brand's widespread appeal has fostered strong customer loyalty over decades, contributing significantly to its market position.

BIC's ability to produce billions of pens, lighters, and shavers annually results in significant cost efficiencies. This scale allows BIC to procure raw materials and manufacture products at a lower cost. This advantage enables BIC to offer competitive prices while maintaining profitability, a feat difficult for smaller competitors to match.

BIC's products are sold in over 160 countries, reaching diverse retail channels. This pervasive presence ensures product accessibility and acts as a powerful competitive advantage. The vast distribution network allows BIC to quickly adapt to changing market demands and consumer preferences.

BIC's focus on functional design and consistent quality, often protected by proprietary processes, contributes to its competitive edge. The consistent performance and durability of products like the BIC Cristal pen are key selling points. These advantages have evolved by adapting to global supply chains and digital distribution.

BIC's competitive advantages are multifaceted, encompassing brand recognition, economies of scale, and a robust distribution network. These strengths enable BIC to maintain a strong market position and compete effectively against rivals. The company's strategic focus on value and quality further enhances its competitive edge.

- Brand Recognition: BIC's global brand recognition reduces marketing costs and fosters customer loyalty.

- Economies of Scale: Large-scale production allows for cost efficiencies in procurement and manufacturing.

- Global Distribution: A vast distribution network ensures product accessibility in over 160 countries.

- Product Quality: Consistent quality and functional design contribute to customer satisfaction and brand loyalty.

Societe BIC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Societe BIC’s Competitive Landscape?

The Societe BIC competitive landscape is significantly influenced by evolving industry trends, presenting both challenges and opportunities. The company’s market position hinges on its ability to adapt to changing consumer preferences, technological advancements, and regulatory environments. Understanding these dynamics is crucial for assessing the company's future outlook and strategic direction, including its ability to maintain and grow its market share.

Assessing the BIC company analysis requires a close look at its responses to risks such as economic downturns, which could impact consumer spending on its affordable products, and increasing competition from both established and emerging brands. The future outlook for BIC depends on its capacity to innovate, expand its product offerings, and strengthen its presence in key markets, while also addressing sustainability concerns and leveraging digital technologies.

Key industry trends include the rising demand for sustainable products, which challenges BIC to innovate. Technological advancements, particularly in digital writing, impact traditional product lines. Regulatory changes concerning safety and environmental impact also present challenges.

Challenges include adapting to the digital shift, managing raw material costs due to economic shifts, and competing with new market entrants. Economic downturns can affect consumer spending. Regulatory compliance and the shift towards sustainability pose ongoing challenges.

Opportunities include developing sustainable product lines, exploring hybrid products, and expanding into emerging markets. There's also potential in product innovation, such as personalized stationery. Strengthening online presence and direct sales channels is crucial.

BIC must focus on sustainability, digital integration, and global expansion. Maintaining its value proposition while adapting to the market is key. Strengthening online presence and direct sales channels is crucial for continued success.

The strategies for BIC's business strategy must include a focus on sustainability, digital integration, and global expansion. According to recent reports, the global stationery market is valued at approximately $30 billion, with a projected growth rate of around 3-4% annually. For example, in 2024, the company's revenue was approximately €2.3 billion, with a significant portion coming from its stationery segment. The company's ability to adapt to these trends and leverage its strengths will determine its future success in a competitive market. For a deeper dive into the company's revenue streams, consider reading about the Revenue Streams & Business Model of Societe BIC.

BIC's BIC competitors include both global and regional players. The company needs to focus on innovation and sustainability to maintain its competitive edge. Its Societe BIC market share analysis indicates a strong position in its core markets, but it faces increasing competition.

- Innovation in sustainable products is vital.

- Expansion into digital accessories could be beneficial.

- Strengthening online presence and direct sales.

- Adapting to regulatory changes and economic shifts.

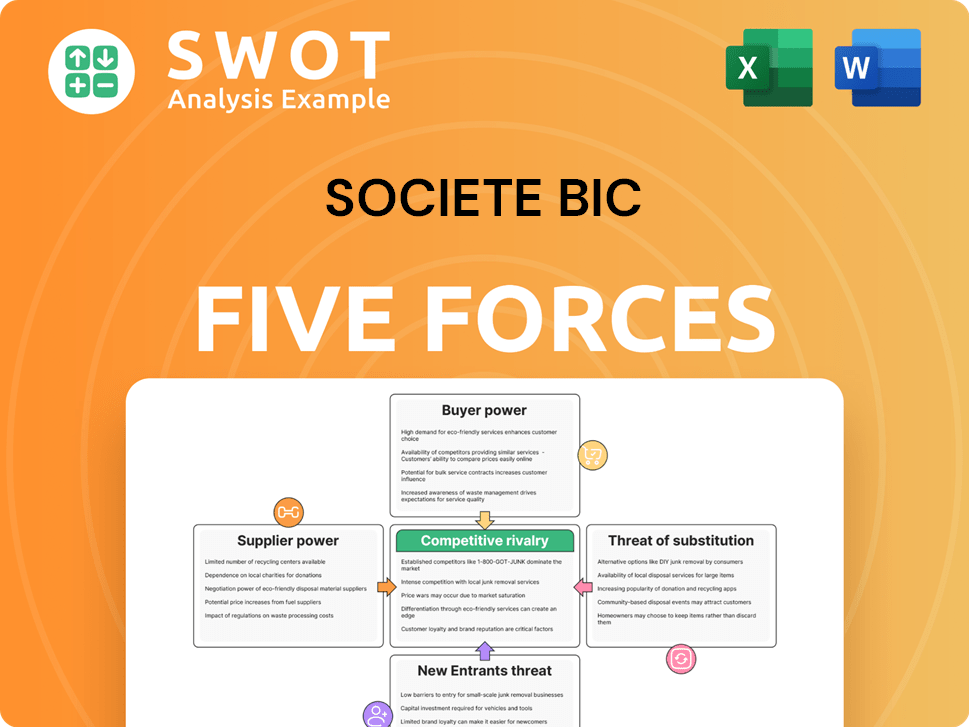

Societe BIC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Societe BIC Company?

- What is Growth Strategy and Future Prospects of Societe BIC Company?

- How Does Societe BIC Company Work?

- What is Sales and Marketing Strategy of Societe BIC Company?

- What is Brief History of Societe BIC Company?

- Who Owns Societe BIC Company?

- What is Customer Demographics and Target Market of Societe BIC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.