Societe BIC Bundle

How Does the BIC Company Still Thrive?

Societe BIC, a global powerhouse, has cemented its place in homes and offices worldwide with its iconic BIC products. From pens to lighters, the BIC brand has become synonymous with affordability and reliability. But how does this consumer goods giant maintain its dominance in a constantly evolving market?

With a rich Societe BIC SWOT Analysis, understanding the inner workings of BIC Corporation is crucial for anyone interested in the consumer goods sector. This article explores the BIC Company's operational strategies, revenue sources, and market positioning. We'll examine the BIC history and dissect the business model that has allowed it to flourish for over seven decades, providing insights into its enduring appeal and future prospects, including details on BIC writing instruments and BIC lighter manufacturing process.

What Are the Key Operations Driving Societe BIC’s Success?

The core operations of the company revolve around the mass production and global distribution of its primary product categories: stationery, lighters, and shavers. The company's value proposition centers on providing high-quality, essential products that are simple, reliable, and affordable, ensuring accessibility to a broad consumer base worldwide. The company's success is built on this model, making it a household name globally.

The company serves a diverse customer base, including individual consumers, businesses, and educational institutions, across various demographics and income levels. The operational processes are highly integrated and efficient, encompassing advanced manufacturing, strategic raw material sourcing, and a robust global logistics network. This approach allows the company to maintain its competitive edge in the market.

The company's extensive global reach is facilitated by partnerships with distributors and retailers, ensuring its products are available in over 160 countries. The company's focus on simplification and standardization translates into consistent product quality and cost-effectiveness. This operational efficiency, combined with strong brand recognition and expansive distribution, enables the company to offer superior value to its customers. For more details on the company's structure, you can refer to Owners & Shareholders of Societe BIC.

The company operates numerous manufacturing facilities worldwide, leveraging economies of scale to maintain cost leadership. Its supply chain is designed for efficiency and resilience, ensuring timely delivery to various sales channels. This streamlined approach allows for consistent product availability and competitive pricing.

The company's products are available in over 160 countries through partnerships with distributors and retailers. This extensive global reach is critical for maintaining market share and ensuring product accessibility. The distribution network is a key component of the company's success.

The company's core capabilities directly translate into customer benefits such as widespread availability, consistent performance, and exceptional affordability. The company's focus on simplification and standardization results in consistent product quality. This focus differentiates the company from competitors.

Customers benefit from widespread product availability, consistent performance, and exceptional affordability. The company's strong brand recognition and expansive distribution network ensure its products are easily accessible. This combination of factors solidifies the company's market differentiation.

The company's operations are characterized by mass production, global distribution, and a focus on affordability. The company's efficient supply chain and manufacturing processes are key to its success. The company's strategy ensures consistent product quality and cost-effectiveness.

- The company's global market share in lighters was approximately 38% in 2024.

- Stationery sales accounted for about 40% of total revenue in 2024.

- The company invested approximately €60 million in capital expenditures in 2024 to enhance manufacturing capacity.

- The company's products are sold in over 160 countries worldwide.

Societe BIC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Societe BIC Make Money?

The Growth Strategy of Societe BIC focuses on revenue generation through the sale of its core products. The company's business model is straightforward, relying on high-volume sales of affordable, essential items to generate income. This approach has allowed the company to establish a strong market presence and achieve consistent financial results.

The company's revenue streams are primarily driven by the sale of stationery, lighters, and shavers. In 2023, these three categories collectively generated a substantial amount of revenue, demonstrating the importance of each segment to the overall financial performance of the company. The company's monetization strategy is centered on competitive pricing and widespread availability, leveraging its extensive distribution network and brand recognition.

The company's revenue model is based on direct product sales, focusing on high volumes and global demand. The company's strategy emphasizes broad distribution and brand recognition to maximize sales. The company has expanded into emerging markets and optimized its product mix to diversify its revenue base geographically and by consumer segment.

The BIC Company generates revenue from three main product categories. In 2023, Stationery accounted for 37% of net sales, Lighters for 42%, and Shavers for 21%. Total net sales for 2023 reached €2,236.1 million.

- The primary revenue source is product sales, driven by high volume and global demand.

- Monetization relies on competitive pricing and widespread availability.

- The company uses its extensive distribution network to ensure consumer access.

- The company benefits from cross-selling opportunities within its product categories.

Societe BIC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Societe BIC’s Business Model?

The journey of the BIC Company, now known as Societe BIC, has been marked by significant milestones and strategic maneuvers that have solidified its position in the consumer goods market. The introduction of the BIC Cristal pen in 1950 was a pivotal moment, revolutionizing the writing instrument industry with an affordable, reliable, and disposable option. This launch set the stage for the company's commitment to providing accessible products to a broad consumer base.

Subsequent product introductions, such as the BIC lighter in 1973 and the BIC shaver in 1975, further diversified the company's portfolio. These strategic moves allowed BIC to expand its global footprint and cater to evolving consumer needs. The company's ability to adapt and innovate within its core categories has been crucial to its sustained success.

Societe BIC has faced operational challenges, including fluctuations in raw material prices and supply chain disruptions. For instance, in 2023, the company adjusted its pricing to offset inflationary pressures, showcasing its responsiveness to market dynamics. Despite these hurdles, the company's competitive advantages, including its strong brand recognition, global distribution network, and manufacturing economies of scale, have underpinned its business model.

The launch of the BIC Cristal pen in 1950 was a transformative event, establishing the company's presence in the writing instrument market. The introduction of the BIC lighter in 1973 and the BIC shaver in 1975 expanded its product range. These launches were strategic moves to capture new markets and consumer needs.

BIC has consistently focused on expanding its product offerings and global reach. The company has adapted to market changes by introducing initiatives like refillable pens and products with recycled content. This demonstrates a commitment to sustainability and innovation.

The BIC brand is recognized globally for reliability and value, fostering strong customer loyalty. Its extensive global distribution network, spanning over 160 countries, provides a significant advantage. High-volume production capabilities enable cost efficiencies that are difficult for competitors to match.

In 2023, BIC implemented pricing adjustments to mitigate inflationary pressures, demonstrating its agility in response to market dynamics. The company continues to focus on innovation and sustainability. For a deeper dive into the company's origins, consider reading a Brief History of Societe BIC.

BIC's success is built on a foundation of strong brand recognition, a vast global distribution network, and efficient manufacturing processes. The company's ability to adapt to market changes and consumer preferences is crucial. The company's commitment to sustainability is evident through initiatives like refillable pens and products with recycled content.

- Brand Strength: The 'BIC' brand is synonymous with reliability and value, fostering strong customer loyalty.

- Global Reach: An extensive global distribution network, spanning over 160 countries, provides a formidable barrier to entry.

- Cost Efficiency: High-volume production capabilities allow for cost efficiencies that are difficult for smaller players to replicate.

- Sustainability: BIC is increasingly focused on sustainability, introducing refillable pens and recycled content in its products.

Societe BIC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Societe BIC Positioning Itself for Continued Success?

The BIC Company, known for its stationery, lighters, and shavers, holds a strong industry position. It's a global leader, often with significant market share, due to its widespread presence and affordable pricing. The company's products are sold in over 160 countries, demonstrating its formidable market penetration and distribution capabilities. BIC's success is built on decades of delivering reliable and accessible products, fostering deep trust among consumers.

However, the BIC Corporation faces risks, including fluctuating raw material costs and intense competition. Changing consumer preferences and regulatory changes also pose challenges. The company's ability to adapt to these factors will be crucial for its future success. The company is constantly working on innovation and cost management to stay competitive.

BIC consistently ranks among the top players globally in its core categories. Its widespread availability and affordable pricing strategy have solidified its market presence. The BIC brand is recognized worldwide, contributing to strong customer loyalty.

Fluctuating raw material costs, especially for plastics and metals, can impact profit margins. Competition from both established and low-cost regional players is a constant threat. Adapting to changing consumer preferences for sustainable products is also essential.

BIC is focused on growth in emerging markets and product innovation, including sustainable alternatives. Enhancing e-commerce capabilities is also a key strategy. The company's future depends on adapting to consumer demands and managing its supply chain.

BIC is investing in product innovation, particularly in sustainable alternatives and premium offerings. It is enhancing its e-commerce capabilities to capitalize on the growing online retail trend. Leadership emphasizes responsible growth and a diversified product portfolio.

Looking ahead, BIC's success hinges on its ability to adapt to evolving consumer demands and leverage its brand equity. The Growth Strategy of Societe BIC highlights the company's focus on sustainable growth. The company's future outlook depends on its ability to maintain its competitive edge and profitability. BIC's ability to manage supply chain complexities and adapt to market dynamics will be critical for its long-term success. In recent reports, the company has emphasized its commitment to operational efficiency and a diversified product portfolio to navigate future challenges. BIC's strategies involve expanding in emerging markets and continuous product innovation.

BIC's future success depends on several key factors, including innovation, cost management, and market adaptability. The company must continue to introduce new products and improve existing ones to meet evolving consumer needs. Effective supply chain management and operational efficiency are also crucial.

- Product innovation, especially in sustainable alternatives.

- Expansion into emerging markets with untapped potential.

- Enhancing e-commerce capabilities for online retail growth.

- Maintaining strong brand equity and global distribution.

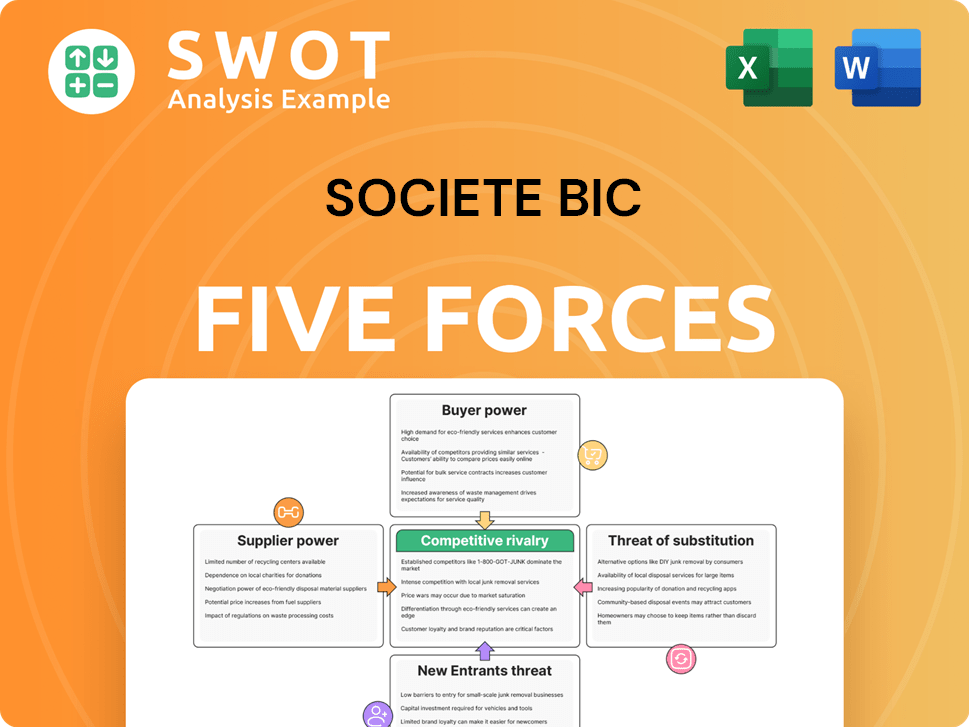

Societe BIC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Societe BIC Company?

- What is Competitive Landscape of Societe BIC Company?

- What is Growth Strategy and Future Prospects of Societe BIC Company?

- What is Sales and Marketing Strategy of Societe BIC Company?

- What is Brief History of Societe BIC Company?

- Who Owns Societe BIC Company?

- What is Customer Demographics and Target Market of Societe BIC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.