Bill.com Bundle

Can Bill.com Maintain Its Edge in the FinTech Arena?

In the ever-evolving world of financial technology, Bill.com SWOT Analysis offers a compelling look at a company that has revolutionized how small and midsize businesses (SMBs) manage their finances. Founded in 2006, Bill.com has grown from a simple accounts payable and receivable solution into a comprehensive financial automation platform. But how does it stack up against the competition?

This exploration of the Bill.com competitive landscape will dive deep into its rivals and market dynamics. We'll analyze Bill.com competitors, examining their strengths and weaknesses to understand the company's strategic positioning. A thorough Bill.com market analysis will reveal the key factors driving its success and the challenges it faces within the bill payment software and accounts payable automation sectors.

Where Does Bill.com’ Stand in the Current Market?

Bill.com holds a prominent market position within the financial automation sector, particularly for small and medium-sized businesses (SMBs). Its core operations revolve around providing cloud-based accounts payable (AP) and accounts receivable (AR) solutions. This focus allows businesses to automate and streamline their financial workflows, enhancing efficiency and reducing manual errors.

The company's value proposition centers on simplifying financial operations. By automating invoicing, payments, and cash flow management, Bill.com helps businesses save time and money. This is especially beneficial for SMBs that often lack the resources for extensive in-house finance departments. The company serves a broad network of businesses across various industries, primarily in the North American market.

Bill.com's core platform automates key financial processes. These include invoice creation and management, payment processing (both AP and AR), and cash flow tracking. The platform also offers integrations with popular accounting software like QuickBooks, enhancing its appeal to SMBs. These features streamline financial workflows.

While Bill.com has a global presence, its primary market is North America. This strategic focus allows for tailored solutions and localized customer support. The company's strong presence in the North American market is a key factor in its competitive standing. This geographical concentration allows the company to optimize its resources.

The acquisition of Divvy in 2021 for approximately $2.5 billion significantly expanded Bill.com's offerings. This move into spend management and corporate cards broadened its customer base. This acquisition allowed the company to provide a more integrated financial operations platform. The acquisition broadened its customer segments.

In fiscal year 2024, Bill.com reported a total revenue of $1.2 billion. This reflects the company's substantial scale and financial health. This growth demonstrates a successful strategy of expanding its ecosystem to capture a larger share of the SMB financial operations market. The company's financial performance is a key indicator of its market position.

The strategic expansion and strong financial performance highlight Bill.com's robust position in the market. The company's ability to innovate and adapt, as seen with the Divvy acquisition, is crucial for maintaining its competitive edge. For a deeper understanding of the company's market approach, consider exploring the Marketing Strategy of Bill.com.

Bill.com's success stems from several key advantages. These include a strong focus on SMBs, a comprehensive suite of financial automation tools, and strategic acquisitions. The company's commitment to innovation and customer satisfaction further strengthens its market position.

- Strong market position in the AP/AR automation space.

- Successful integration of spend management solutions through acquisitions.

- Consistent revenue growth and financial stability.

- Extensive integration capabilities with popular accounting software.

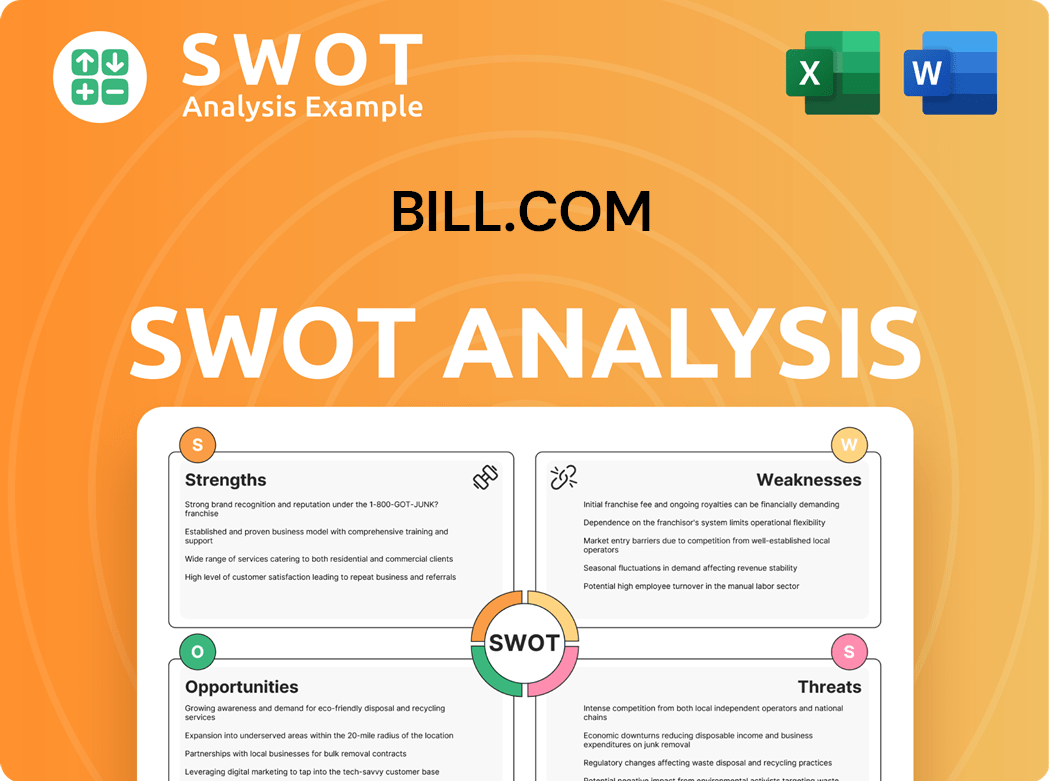

Bill.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bill.com?

The Growth Strategy of Bill.com involves navigating a competitive landscape filled with both direct and indirect rivals in the financial automation and spend management sectors. Understanding the strengths and weaknesses of these competitors is crucial for Bill.com to maintain its market position and drive growth. This analysis provides insights into the key players challenging Bill.com's dominance and the strategies they employ.

Bill.com's competitive environment is dynamic, shaped by technological advancements, evolving customer needs, and the strategic moves of its rivals. The company faces pressure from established players and emerging FinTech startups, each vying for market share in the rapidly expanding financial automation space. This competitive analysis helps decision-makers understand the competitive dynamics and make informed choices.

In the direct accounts payable (AP) and accounts receivable (AR) automation market, Bill.com competes with several key players. These competitors offer similar services, focusing on automating financial processes for businesses. Understanding their strategies and offerings is crucial for Bill.com to differentiate itself and maintain a competitive edge.

AvidXchange is a significant competitor, particularly in the mid-market and enterprise segments. It provides automated AP solutions and payment networks. Its focus on larger businesses often puts it in direct competition with Bill.com for larger SMB clients.

Stampli offers AI-powered AP automation, emphasizing ease of use and quick implementation. This focus challenges Bill.com on user experience and efficiency. Stampli's approach aims to attract businesses looking for streamlined and user-friendly solutions.

Brex and Ramp are key competitors in the spend management and corporate card arena, especially after Bill.com's acquisition of Divvy. Both offer integrated solutions combining banking, credit, and spend control, often with a strong emphasis on modern user interfaces and real-time insights. These competitors challenge Bill.com by providing comprehensive financial management tools.

Traditional accounting software providers like Intuit QuickBooks and Xero, while often partners with Bill.com through integrations, also offer some built-in AP/AR functionalities. This creates an indirect competitive dynamic by potentially reducing the need for standalone solutions for some smaller businesses. These platforms provide integrated accounting and financial management tools.

Emerging FinTech startups continuously introduce innovative solutions, potentially disrupting traditional models with niche offerings or advanced technologies. These startups often leverage cutting-edge technologies to offer specialized financial automation services. They challenge established players with innovative features and competitive pricing.

The Bill.com competitive landscape is characterized by a mix of established players and emerging FinTech companies. The market is dynamic, with companies constantly innovating and adapting to customer needs. Understanding the Bill.com competitors and their strategies is essential for making informed decisions. A thorough Bill.com market analysis reveals the key trends and challenges in the industry.

- Bill.com alternatives offer various features and benefits, making it crucial to compare options.

- Bill payment software solutions compete on features, pricing, and ease of use.

- Accounts payable automation is a core focus for many competitors, driving efficiency and cost savings.

- The Bill.com vs Xero comparison highlights the differences in functionality and target markets.

- Bill.com pricing plans and Bill.com competitor pricing comparison are essential factors for businesses.

- Bill.com features and benefits should be evaluated against those of competitors.

- Best Bill.com competitors for small businesses vary based on specific needs and requirements.

- Bill.com customer reviews provide valuable insights into user experiences.

- Bill.com integration with QuickBooks is a key feature for many users.

- Bill.com vs AvidXchange comparisons highlight the differences in their offerings.

- Bill.com market share analysis provides insights into its position in the market.

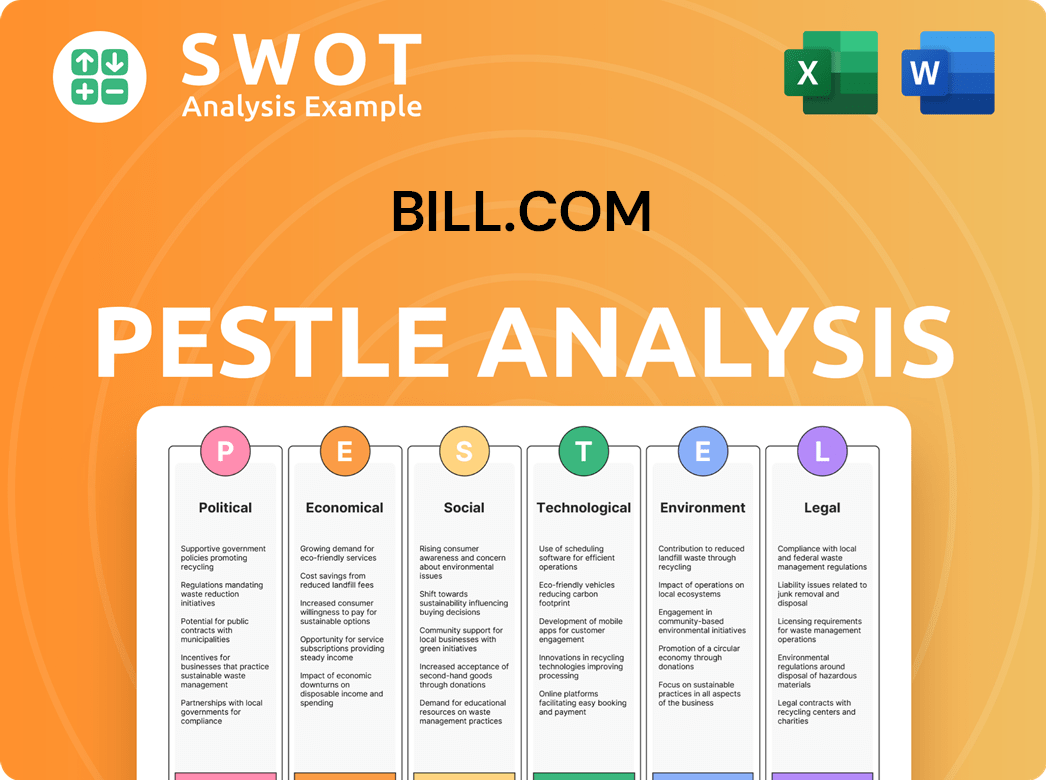

Bill.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bill.com a Competitive Edge Over Its Rivals?

Analyzing the Bill.com competitive landscape reveals several key strengths. The company has established itself as a significant player in the financial automation space, particularly for small and medium-sized businesses (SMBs). Its strategic moves, including acquisitions and partnerships, have broadened its offerings and enhanced its market position. To understand its competitive edge, it's important to examine its core competencies and how they stack up against Bill.com competitors.

A deep dive into Bill.com market analysis shows a focus on streamlining financial operations. The company's platform offers robust features for accounts payable (AP) and accounts receivable (AR), aiming to reduce manual processes and improve efficiency. This focus has allowed it to capture a substantial customer base. Furthermore, the company's cloud-based platform and integrations with popular accounting software are key differentiators.

The evolution of the company from a basic AP/AR solution to a comprehensive financial operations platform is a testament to its adaptability. It has consistently leveraged technology and strategic alliances to maintain its leadership. The company's ability to offer a more integrated financial operations platform has been a key driver of its success. For more background, you can read a Brief History of Bill.com.

The cloud-based platform provides seamless integration with accounting software like QuickBooks, Xero, and NetSuite. This integration streamlines workflows and reduces manual data entry. According to recent reports, the company processes billions of dollars in transactions annually, highlighting the scale of its operations.

The company's network connects businesses with vendors and customers for electronic payments. This network effect increases the platform's value as more participants join. The more businesses and vendors using the platform, the more valuable it becomes for all users.

The acquisition of Divvy expanded the company's offerings into spend management. This expansion enables the company to provide a more comprehensive suite of financial automation tools. This strategic move allows the company to cater to a wider range of SMB needs.

The company's focus on simplifying financial operations for SMBs has contributed to strong brand recognition. SMBs often find it challenging to find solutions that meet their specific needs. This focus has allowed the company to build a loyal customer base.

The company's competitive advantages include its robust platform, extensive network, and strategic acquisitions. These advantages have positioned it well in the market. While the company has a strong position, it must continuously innovate to stay ahead.

- Seamless Integration: Deep integration with popular accounting software streamlines workflows.

- Network Effect: The growing network of users enhances the platform's value.

- Comprehensive Suite: Offers a wide range of financial automation tools.

- SMB Focus: Addresses the specific needs of small and medium-sized businesses.

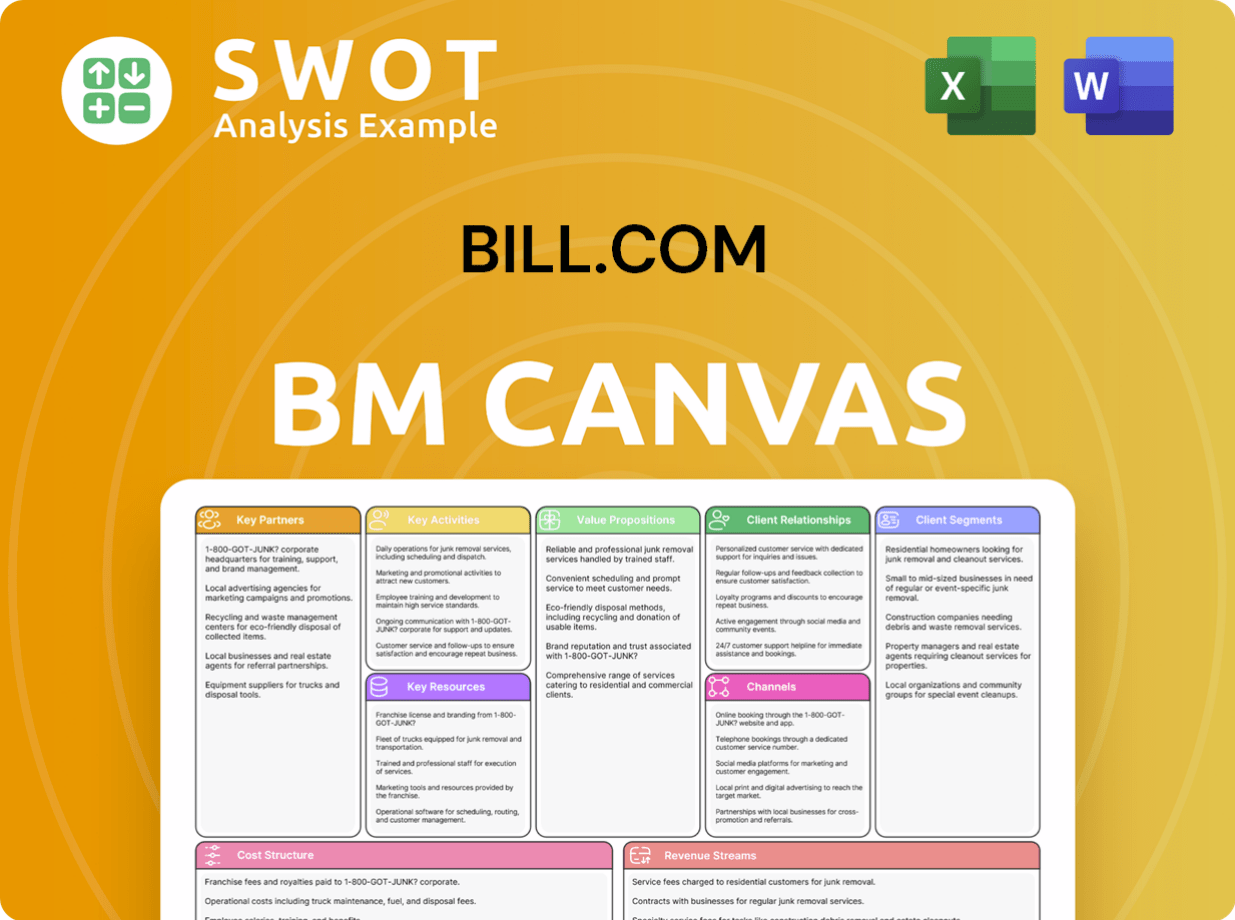

Bill.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bill.com’s Competitive Landscape?

The competitive landscape for financial automation software is dynamic, with companies like Bill.com navigating a market shaped by rapid technological advancements and evolving customer needs. Understanding the industry trends, future challenges, and opportunities is crucial for assessing its long-term viability and strategic positioning. This analysis will explore the key factors influencing the company's trajectory, providing insights for investors and stakeholders.

The company faces both internal and external risks, including intense competition and potential economic downturns. However, the company also has significant opportunities, such as expanding its international presence and leveraging AI. This analysis will help to understand how the company can navigate these challenges and capitalize on its opportunities.

The financial automation sector is experiencing significant growth, driven by cloud adoption and digital transformation. The increasing demand for real-time data and analytics is reshaping how businesses manage cash flow. Regulatory changes in data privacy and payment security are also critical factors.

The company faces intense competition from established players and FinTech startups. Continuous innovation is necessary to meet evolving customer demands, especially in AI-powered automation. Economic downturns could impact spending on software solutions, presenting a challenge to growth.

Expanding its international presence beyond North America could unlock new markets. Further integrating AI and machine learning could enhance automation and offer greater value. Strategic partnerships with banks and other software providers could broaden its reach.

The company is focused on continuous innovation, strategic expansion, and strengthening its competitive position. The company aims to leverage opportunities and proactively address challenges. These initiatives are designed to ensure long-term success in the financial automation sector.

The company's success depends on its ability to adapt to industry trends and capitalize on opportunities. The company should focus on innovation, strategic partnerships, and global expansion to maintain its competitive edge. This approach will allow the company to remain a leader in financial automation.

- Competitive Landscape: The company competes with established players and emerging FinTech companies. Key competitors include Xero, AvidXchange, and Tipalti.

- Market Growth: The market for accounts payable automation is growing, with increased demand for cloud-based solutions. The company's market analysis indicates significant growth potential.

- Technology Integration: The integration of AI and machine learning is crucial for enhancing automation and fraud detection. The company is investing in these technologies to improve its platform.

- Strategic Partnerships: Collaborations with banks and financial institutions can expand the company's reach. These partnerships are essential for creating new revenue streams.

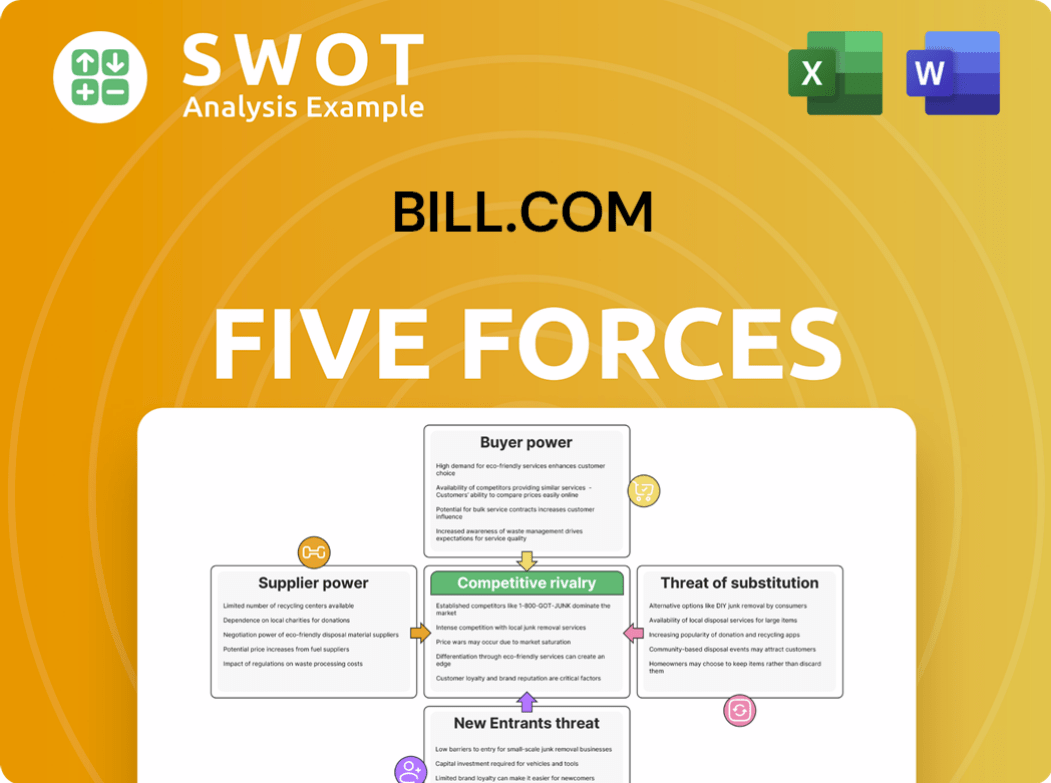

Bill.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bill.com Company?

- What is Growth Strategy and Future Prospects of Bill.com Company?

- How Does Bill.com Company Work?

- What is Sales and Marketing Strategy of Bill.com Company?

- What is Brief History of Bill.com Company?

- Who Owns Bill.com Company?

- What is Customer Demographics and Target Market of Bill.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.