Bill.com Bundle

Who Exactly Does Bill.com Serve?

In the fast-evolving world of financial technology, understanding the Bill.com SWOT Analysis is crucial, especially when considering its customer base. As a leader in financial management software, Bill.com (now BILL) has revolutionized how businesses handle accounts payable and accounts receivable. This exploration dives into the customer demographics and Bill.com target market, revealing the core of BILL's business strategy.

From its inception, BILL has focused on streamlining business payments, initially targeting small and midsize businesses (SMBs) struggling with manual processes. Now, with over 470,000 businesses using BILL as their central hub for financial operations, understanding the Bill.com company's evolving customer profile is key to grasping its market share and future growth potential. This analysis will examine the Bill.com target audience analysis, including Bill.com user demographics and Bill.com customer segmentation to understand who uses Bill.com software and why.

Who Are Bill.com’s Main Customers?

Understanding the Owners & Shareholders of Bill.com requires examining its primary customer segments. The company, operating under a B2B model, primarily focuses on small and midsize businesses (SMBs) and accounting firms. This strategic focus allows for a targeted approach in providing financial management software solutions.

As of the end of fiscal year 2024, over 470,000 businesses utilize BILL's solutions. The company estimates its core customer base to be around 6 million businesses with employees in the U.S. These businesses seek to automate their financial processes, including invoice processing and digital payment management, to improve efficiency and cash flow.

The target market for BILL encompasses a broad range of industries. This includes construction, nonprofits, education, professional services, healthcare, retail and e-commerce, hospitality, software and technology, and manufacturing. This diversity highlights the broad applicability of its business payments and accounts payable solutions.

While specific demographics like age or income aren't directly applicable in a B2B context, the customer base is diverse. The company targets SMBs and accounting firms across various industries. This broad approach allows for capturing a significant market share.

BILL has expanded its target market through acquisitions like Divvy and Invoice2go. These acquisitions broadened the platform's capabilities to include spend and expense management. This strategic move has allowed the company to serve a wider range of businesses.

A significant portion of BILL's customer base includes accounting firms. The company actively partners with thousands of firms to serve their SMB clients. This dual approach strengthens its market position.

- SMBs: Small and midsize businesses looking for financial automation.

- Accounting Firms: Partners who assist SMBs with financial management.

- Suppliers: Businesses that receive payments through the platform, representing approximately 30% of BILL's core revenue.

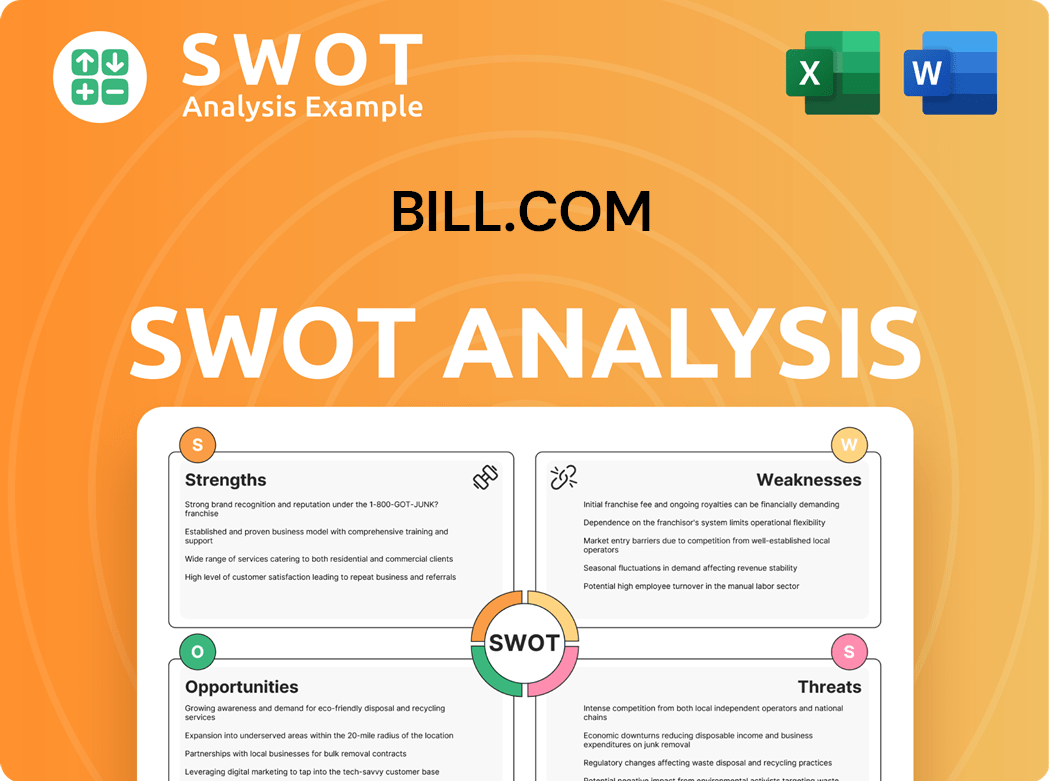

Bill.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bill.com’s Customers Want?

Understanding the customer needs and preferences is crucial for Bill.com's success. The company, which provides financial management software, caters to businesses seeking efficiency, control, and clarity in their financial operations. This focus allows the company to effectively target its services and enhance customer satisfaction.

Small and midsize businesses (SMBs) often struggle with time-consuming and error-prone manual processes. They are looking for solutions that automate accounts payable (AP) and accounts receivable (AR), streamline digital payment management, and offer robust expense management tools. This is where the company steps in, offering a platform designed to address these specific pain points, improving cash flow visibility, and providing predictive cash flow tools.

The core needs of the company's customers revolve around simplifying complex financial tasks. By reducing the stress associated with financial management, the company enables business owners and financial professionals to concentrate on their core missions. This focus on ease of use and mobility is highly valued, allowing businesses to manage finances from anywhere.

Customers seek to automate accounts payable and receivable processes. The goal is to reduce manual efforts and errors.

Seamless integration with existing accounting software like QuickBooks, Xero, and NetSuite is a key requirement. This integration minimizes disruption and ensures data consistency.

Businesses need better visibility into their cash flow. This allows for more informed financial decisions and improved planning.

The ability to manage finances from anywhere is highly valued. This feature provides flexibility and convenience for business owners.

Robust expense management tools are essential. They help businesses track and control spending effectively.

Customers want to reduce the time and effort spent on administrative tasks. This allows them to focus on core business activities.

The purchasing behaviors of the company's target market are heavily influenced by the need for seamless integration with existing accounting systems. Decision-making criteria often include the ability to centralize payment management, improve cash flow visibility, and access predictive cash flow tools. The psychological drivers behind these choices often revolve around reducing the stress and complexity associated with financial tasks. According to recent data, only 38% of SMBs use dedicated financial planning tools, highlighting the need for solutions like those offered by the company.

The company addresses several common pain points. These include issues like unresponsive customer service, challenges with complex accounting system integrations, and limitations in international payment capabilities, as noted in some user reviews from March 2024.

- Unresponsive Customer Service: Addressing customer service issues is crucial.

- Complex Accounting System Integrations: Ensuring smooth integration with various accounting systems is essential.

- Limitations in International Payment Capabilities: Expanding and improving international payment options is important.

- Enhancements and New Features: The company continuously enhances its platform, as evidenced by its 2024 product roundup, which included new invoice workflows, enhanced mobile accounting experiences, and improved 1099 management.

- Data-Driven Tools: The company offers 'BILL Insights' and 'BILL Cash Flow Forecasting' tools to provide SMBs with timely and actionable data.

- Marketing and Product Features: The company tailors its marketing and product features to specific segments by emphasizing efficiency gains, time savings, and comprehensive financial control.

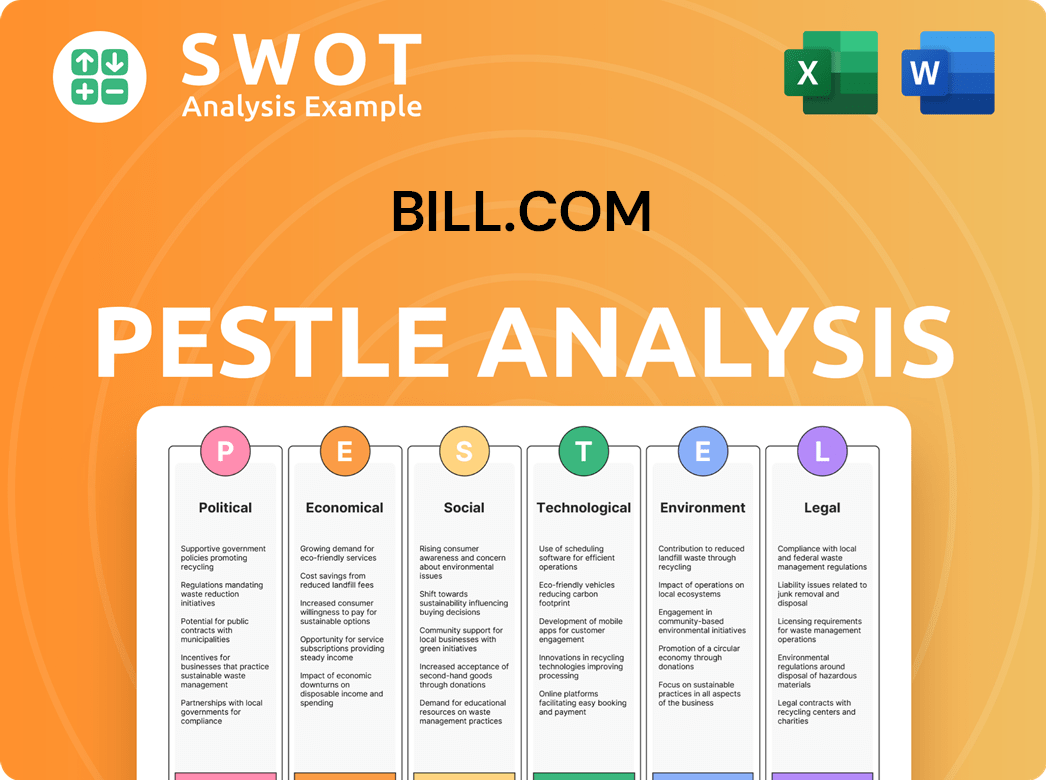

Bill.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bill.com operate?

The primary geographical market for the company is the United States. The company focuses on small and midsize businesses (SMBs) and accounting firms within the U.S. The company's headquarters is located in San Jose, California, solidifying its base within the U.S. market.

The company's strategy is centered on becoming the essential financial operations platform for U.S. SMBs. This focus is supported by its extensive payment network and strong partnerships with U.S. financial institutions and accounting firms. As of mid-2024, the company served approximately 471,500 businesses in the U.S.

While the core market is the U.S., the company has a long-term vision for international expansion. The company aims to tap into a global total addressable market of around 35 million businesses. This indicates a strategic intent to broaden its geographical footprint beyond the U.S. market.

The company's primary focus is on the U.S. market, targeting SMBs and accounting firms. This is where the company has established a strong presence and a robust customer base. The company leverages its financial management software and business payments capabilities to serve its U.S. customers.

Strategic partnerships with U.S. financial institutions and accounting firms are crucial for market penetration. The company collaborates with leading accounting software providers like QuickBooks and Xero. Recent moves, such as extending its partnership with Bank of America, further solidify its presence in the U.S. financial landscape.

The company addresses regional differences within the U.S. through its integrated platform and partnerships. The launch of Regions CashFlowIQ, powered by the company, demonstrates localization through financial institution collaborations. This approach helps tailor services to meet specific regional needs.

The company has plans for international expansion, targeting a global market of approximately 35 million businesses. This indicates a strategic vision to grow beyond its current U.S. focus. The company aims to become a key player in the global financial management software market.

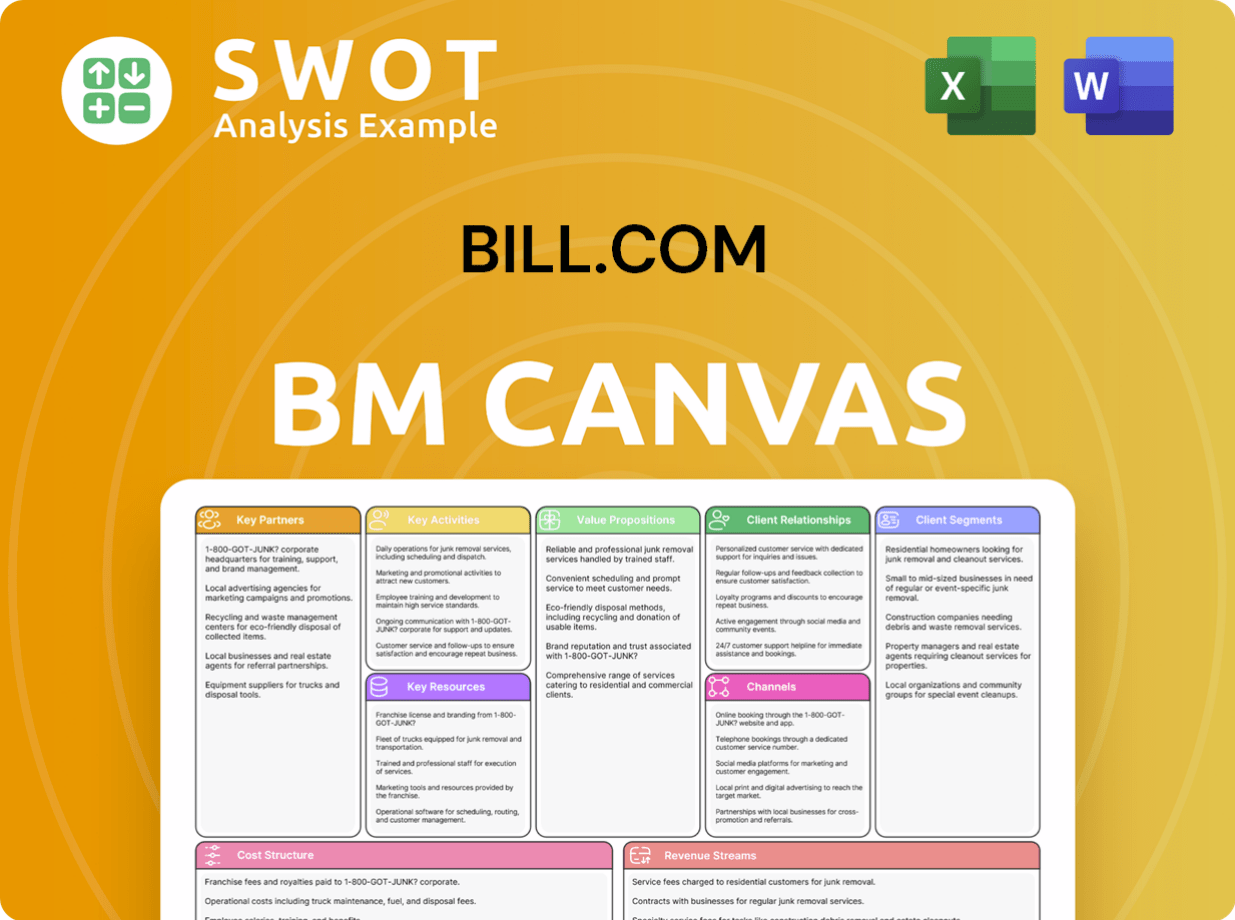

Bill.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bill.com Win & Keep Customers?

The company employs a multi-faceted approach to customer acquisition and retention, utilizing digital channels and strategic partnerships to reach its target audience. This strategy focuses on attracting new customers while fostering loyalty among existing users. The goal is to build a strong customer base and maintain a high retention rate, which is essential for sustainable growth.

For acquiring new customers, the company leverages digital marketing, strategic partnerships, and content marketing to reach its target market. These efforts are designed to increase brand awareness, generate leads, and convert prospects into paying customers. The company also focuses on continuous product improvement, personalized experiences, and fostering a strong network to retain customers.

The company's customer acquisition strategy is a blend of digital marketing and strategic partnerships, tailored to reach its target market effectively. Digital marketing campaigns on platforms like LinkedIn and Google Ads target key decision-makers such as CFOs, controllers, accounting professionals, and small and medium business owners. Strategic partnerships with accounting software providers and financial institutions extend its reach and provide embedded finance solutions.

Digital marketing is a primary method for customer acquisition, with targeted B2B online advertising campaigns. This includes platforms like LinkedIn and Google Ads, aimed at CFOs, controllers, accounting professionals, and small and medium business owners. In Q1 2024, the company spent $81.3 million on sales and marketing expenses.

Content marketing, including blog posts, webinars, and white papers, attracts new customers and establishes thought leadership. The estimated annual content marketing budget for 2024 is $5.6 million. This approach helps educate potential customers and positions the company as a valuable resource.

Strategic partnerships are crucial for customer acquisition. The company integrates with leading accounting software providers like QuickBooks, Xero, NetSuite, and Sage. Collaborations with U.S. financial institutions, such as Regions Bank, provide embedded finance solutions and extend its reach.

The company actively engages with accounting firms through its Accountant Partner Program. This program recognizes accounting firms as key influencers and channels for reaching SMBs. This approach leverages the trusted relationships that accounting firms have with their clients.

For customer retention, the company emphasizes continuous product improvement, personalized experiences, and fostering a strong network. The focus is on ease of use, scalability, and centralized payment management, which are highly valued by customers. The company also strives to address customer feedback to improve overall satisfaction and reduce churn.

The company focuses on ease of use, scalability, and centralized payment management to retain customers. These features are highly valued by customers and contribute to their satisfaction. Continuous updates and new features are also key to keeping customers engaged.

Loyalty programs, such as the BILL Rewards Program updated in October 2024, offer points or cashback on purchases. These programs incentivize continued usage and reward customer loyalty. This approach helps to retain customers and encourage repeat business.

The company is committed to delivering new features and updates, as highlighted in its 2024 Product Roundup. This includes enhanced mobile experiences and cash flow forecasting tools, aiming to keep customers engaged and derive ongoing value. These updates demonstrate a commitment to meeting customer needs.

The company strives to address customer feedback, such as concerns about customer service and international payment capabilities. Addressing customer feedback helps improve overall satisfaction and reduce churn. This demonstrates a commitment to customer satisfaction.

As of June 30, 2024, the company reported an 86% logo retention rate, indicating strong customer loyalty. This high retention rate reflects the effectiveness of the company's customer retention strategies. The company's focus on customer satisfaction and product improvement contributes to this high retention rate.

By focusing on customer needs and providing valuable solutions, the company aims to maintain a loyal customer base. This approach is crucial for sustainable growth and long-term success. Understanding the Revenue Streams & Business Model of Bill.com can provide further insights into how the company generates value for its customers.

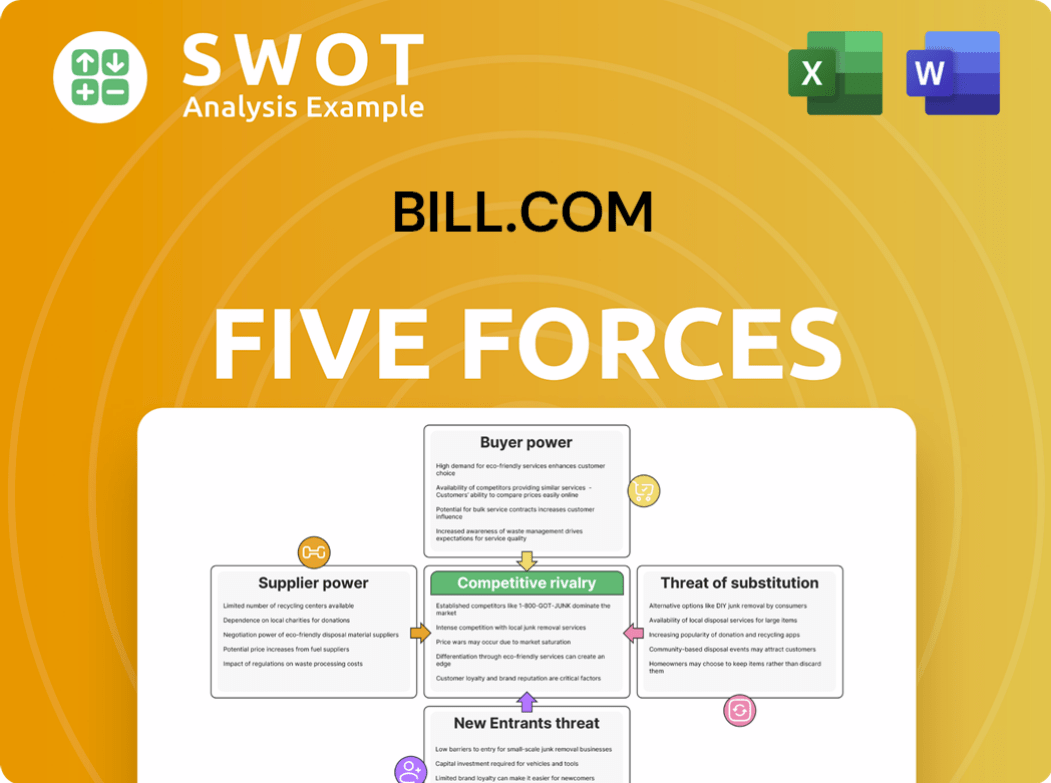

Bill.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bill.com Company?

- What is Competitive Landscape of Bill.com Company?

- What is Growth Strategy and Future Prospects of Bill.com Company?

- How Does Bill.com Company Work?

- What is Sales and Marketing Strategy of Bill.com Company?

- What is Brief History of Bill.com Company?

- Who Owns Bill.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.