BMC Software Bundle

How Will BMC Software Navigate Its Evolving Competitive Arena?

As BMC Software prepares to split into two independent entities, a critical examination of its competitive landscape becomes paramount. This strategic shift, slated for early 2025, follows impressive growth and signals a renewed focus on innovation within the IT sector. Understanding the BMC Software SWOT Analysis is crucial for investors and strategists alike.

This deep dive into the BMC Software competitive landscape will analyze its BMC Software competitors, market share, and strategic positioning. We'll explore the BMC Software industry dynamics, assessing BMC Software market analysis to identify key challenges and opportunities. Furthermore, this analysis will provide insights into BMC Software business strategy and its potential for future growth, including a look at its BMC Software strengths and weaknesses in comparison to its rivals.

Where Does BMC Software’ Stand in the Current Market?

BMC Software has established a strong market position as a leading provider of business service management solutions. The company's focus is on cloud and IT management, offering a comprehensive suite of products and services. This includes cloud management and IT automation, catering to a wide range of industries and sectors. This makes BMC Software a versatile choice for organizations of all sizes.

Operating globally, BMC Software has key regional offices across the United States, Europe, Asia, and Australia. This ensures effective support for its diverse customer base. The company's financial performance reflects consistent growth. BMC Software's revenue increased by 3.5% in fiscal year 2024, excluding transaction price adjustments. Product bookings and annual recurring revenue (ARR) saw improvements of 13.4% and 7.4%, respectively.

Subscription sales accounted for nearly 60% of sales for the year. This indicates substantial progress in its shift to a subscription revenue model. S&P Global Ratings forecasts BMC's revenues to increase by approximately 4.1% in fiscal year 2025. EBITDA margins are expected to return to over 40%. BMC's digital product exports were estimated at $4.36 billion in 2023, with the Netherlands as a key partner.

BMC Software maintains a significant presence in the IT service management (ITSM) and cloud management markets. It serves a diverse customer base across various industries. The company's global operations and product offerings contribute to its strong market position.

BMC Software has demonstrated consistent financial growth. Revenue increased in fiscal year 2024, with improvements in product bookings and ARR. The shift to a subscription model has also been a key driver of financial success. For more information about the company, you can read about Owners & Shareholders of BMC Software.

The upcoming split into BMC and BMC Helix, effective early 2025, will refine BMC's market positioning. The core BMC entity will focus on Intelligent Z Optimization and Transformation (IZOT) and Digital Business Automation (DBA). BMC Helix will specialize in Digital Service and Operations Management (DSOM) with an emphasis on AI-driven capabilities.

BMC Software's strategic division is designed to accelerate growth in specific, rapidly evolving markets. This includes AI and automation. The company's focus on innovation and customer support is expected to drive future growth.

BMC Software's competitive advantages include its comprehensive product suite, strong customer base, and global presence. The company's focus on innovation and customer support further enhances its market position. BMC Software's ability to adapt to market changes and emerging technologies is also a key strength.

- Comprehensive Product Suite: Offers a wide range of solutions.

- Strong Customer Base: Serves diverse industries.

- Global Presence: Operates worldwide.

- Innovation: Focuses on new technologies.

BMC Software SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BMC Software?

The BMC Software competitive landscape is a dynamic environment, shaped by both established players and emerging innovators. The company faces competition across its product lines and geographic presence, with rivals ranging from industry giants to specialized startups. A thorough BMC Software market analysis reveals the intensity of the competition and the strategies needed to maintain and grow market share.

Understanding the BMC Software competitors is essential for assessing the company's position and future prospects. This analysis includes direct competitors offering similar solutions and indirect competitors providing alternative approaches to IT service management and enterprise automation. Analyzing the strengths and weaknesses of each competitor provides insights into the competitive dynamics and strategic opportunities.

The competitive landscape for BMC Software encompasses a variety of companies, each with distinct strengths and market approaches. The BMC Software industry is highly competitive, requiring continuous innovation and strategic adaptation. This landscape is constantly evolving, with mergers, acquisitions, and new product launches influencing the competitive balance.

BMC Software competes directly with several major players in the IT service management and enterprise automation market. These competitors offer similar solutions, often targeting the same customer base and addressing similar business needs.

ServiceNow is a primary rival, providing a comprehensive platform for IT service management and business process automation. In Q1 2025, ServiceNow reported $3 billion in total revenue, a 19% year-over-year increase. They have also formed strategic partnerships, such as with Nvidia for AI services.

IBM is a key competitor, offering a wide range of IT management solutions, including cloud-based and on-premise offerings. IBM's presence in the business service management platform industry is significant, with a broad portfolio of products and services.

Broadcom, through its acquisition of CA Technologies, remains a significant competitor in the business service management platform industry. This acquisition has expanded Broadcom's portfolio and market reach.

Micro Focus offers various IT management solutions, including cloud management, application delivery, and security. This company directly competes with BMC Software's services, providing a range of offerings for IT operations.

Ivanti is another key player in the cloud ITSM market, offering solutions that enhance the digital employee experience and improve vulnerability prioritization. Ivanti launched Neurons for ITSM, a hyper-automation platform leveraging AI.

Atlassian's Jira Service Management is an ITSM automation tool that helps organizations design, deliver, manage, and improve IT services. Jira Service Management offers a robust platform for managing IT service workflows.

Other notable competitors include ManageEngine, Zendesk, and Freshworks, all of which offer IT service management tools. These companies are recognized as top cloud ITSM companies.

Emerging players like Rezolve.ai, which offers an AI-driven ITSM solution integrated into Microsoft Teams, are also impacting the market. These companies often focus on innovative approaches to improve employee support and automate inquiries.

The BMC Software competitive landscape is further shaped by mergers and acquisitions. These events can significantly alter the competitive balance and provide customers with more value from their technology investments. Analyzing these trends is crucial for understanding the company's market position.

- Flexera Software's acquisition of Snow Software in February 2024 is an example of how mergers and acquisitions impact the market.

- The increasing adoption of AI and automation in ITSM is a significant trend, with companies like ServiceNow and Ivanti investing heavily in these areas.

- The shift towards cloud-based solutions continues, with many competitors offering cloud-native ITSM platforms.

- Understanding the BMC Software market share requires considering these trends and their impact on the competitive landscape.

For a deeper understanding of BMC Software's strategic positioning, it's beneficial to analyze its target market. Learn more about the Target Market of BMC Software to gain insights into the company's customer base and market focus.

BMC Software PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BMC Software a Competitive Edge Over Its Rivals?

Analyzing the BMC Software competitive landscape reveals a company that has consistently adapted to the evolving IT management solutions market. Key milestones and strategic moves have shaped its competitive edge, allowing it to maintain a strong position. The company's focus on innovation and customer satisfaction has been a constant throughout its history, allowing it to build a loyal customer base and expand its offerings.

BMC Software's business strategy has been centered on providing comprehensive solutions that meet the diverse needs of its customers. This approach, combined with a commitment to technological advancement, has allowed it to differentiate itself from rivals. The company's ability to anticipate market trends and invest in research and development has been crucial to its continued success. A thorough BMC Software market analysis is essential to understanding its position.

The company's competitive advantages are multifaceted, contributing to its sustained growth and market presence. These advantages include a broad portfolio of solutions, a proven track record, and a strong commitment to innovation. The company's ability to scale and adapt to the evolving needs of businesses is also a key differentiator.

BMC Software offers a wide array of cloud and IT management solutions. This includes service management, automation, monitoring, and mainframe solutions. This comprehensive approach allows the company to cater to various business needs across different industries, from BMC Helix ITSM to Control-M and BMC AMI.

With over four decades of experience since its founding in 1980, BMC Software has established itself as a trusted partner. The company's consistent customer retention and loyal following speak to its reliability and expertise. BMC empowers 86% of the Forbes Global 50, indicating strong relationships with large, influential clients.

BMC is known for its commitment to innovation, constantly developing cutting-edge solutions. The company's significant investment in research and development ensures its products remain at the forefront of technological advancements, particularly in areas like artificial intelligence (AI) and machine learning (ML). In February 2024, BMC announced the expansion of its Enterprise Service Management (ESM) and AIOps competencies.

A key advantage of BMC's solutions is their ability to scale and adapt to the evolving needs of businesses. This flexibility allows BMC to cater to a wide range of customer requirements and market shifts. This adaptability is crucial in the dynamic IT management solutions space.

BMC Software has cultivated a robust customer base comprising leading organizations across various industries. Its reputation for reliability, innovation, and customer service has been instrumental in attracting and retaining top-tier clients. The company's strong customer relationships contribute significantly to its market position.

- BMC Software has a proven track record of delivering value to its clients.

- The company's focus on innovation keeps its solutions competitive.

- BMC maintains a strong reputation for customer service and support.

- The ability to scale solutions to meet diverse customer needs.

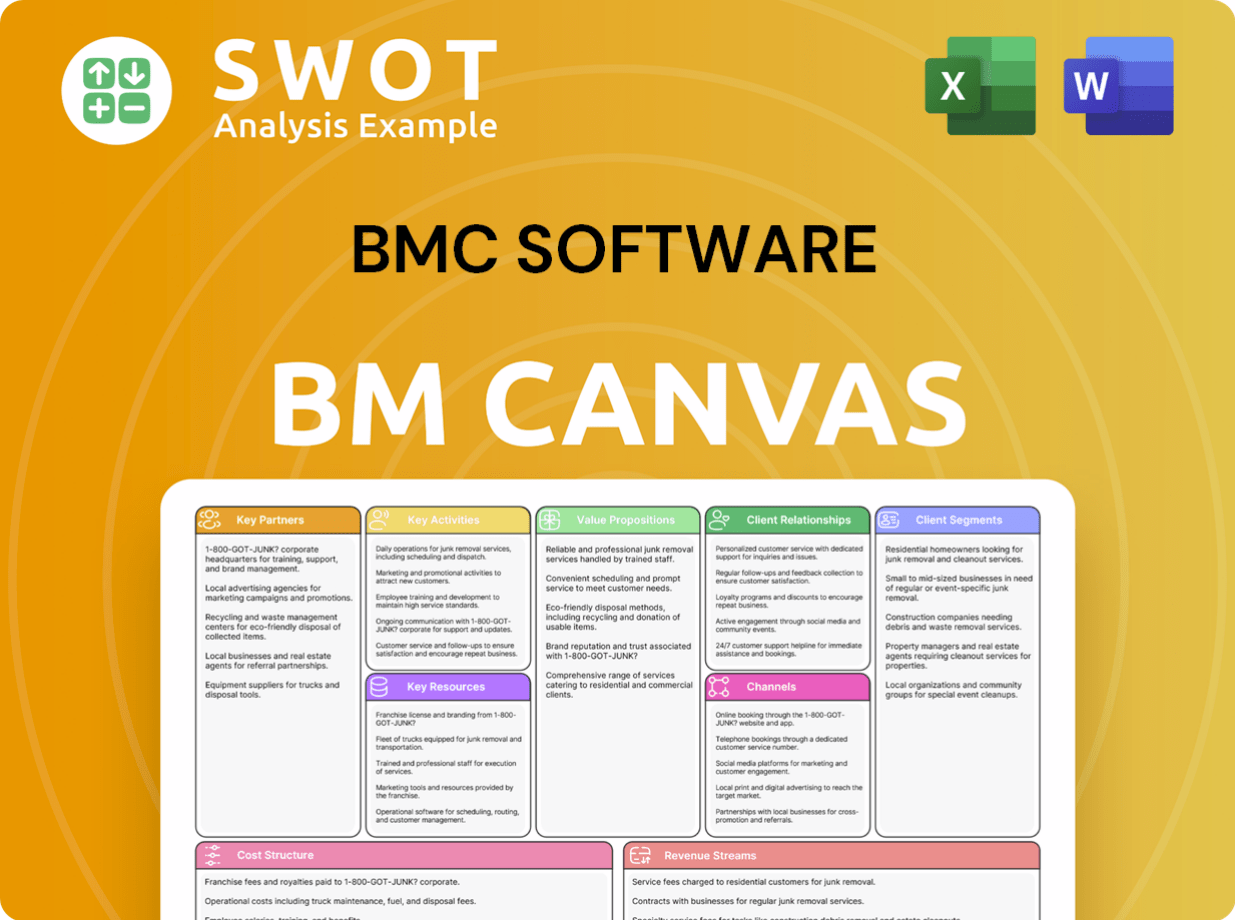

BMC Software Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BMC Software’s Competitive Landscape?

The BMC Software competitive landscape is currently shaped by industry trends such as cloud computing, AI, and cybersecurity. These factors present both opportunities and challenges for the company. Understanding the BMC Software market analysis is crucial for businesses looking to leverage IT management solutions, especially in a rapidly evolving digital environment. For more insights, consider exploring the Revenue Streams & Business Model of BMC Software.

The primary risks involve intense competition and rapid technological changes. However, the future outlook for the company remains positive, with significant growth potential in emerging markets and through innovative product offerings. The company's strategic split into BMC and BMC Helix is a key move to capitalize on these opportunities, potentially leading to an IPO for BMC Helix in the future.

The industry is seeing a rapid shift towards cloud computing, with an estimated 60% of enterprise IT infrastructure spending going to public cloud services by 2025. The integration of AI and ML in IT management is also on the rise. Cybersecurity and data privacy are also becoming increasingly important.

BMC Software competitors present a significant challenge, requiring continuous innovation and differentiation. Rapid technological advancements and changing customer demands necessitate staying ahead of the curve. Managing changing cultures and attitudes towards automation is also a challenge.

Expanding into emerging markets provides a key growth avenue for BMC. Enhancing product offerings, particularly in AI-driven service management, is crucial. Strategic partnerships can further solidify BMC's position. The expected economic recovery and growth in 2025 will likely lead to an expansion in IT initiatives.

The strategic split into BMC and BMC Helix is designed to accelerate innovation and focus on specific market segments. This restructuring aims to enhance agility and responsiveness to market demands, potentially leading to an IPO for BMC Helix. This move is critical for BMC Software's business strategy.

Analyzing the BMC Software market share involves assessing its position relative to its competitors. BMC Software's competitive advantages include a focus on cloud management and AI-driven solutions. Understanding the evolving landscape is essential for strategic decision-making.

- Focus on Cloud Management Solutions

- Leveraging AI and Machine Learning

- Strategic Partnerships for Growth

- Innovation in Product Offerings

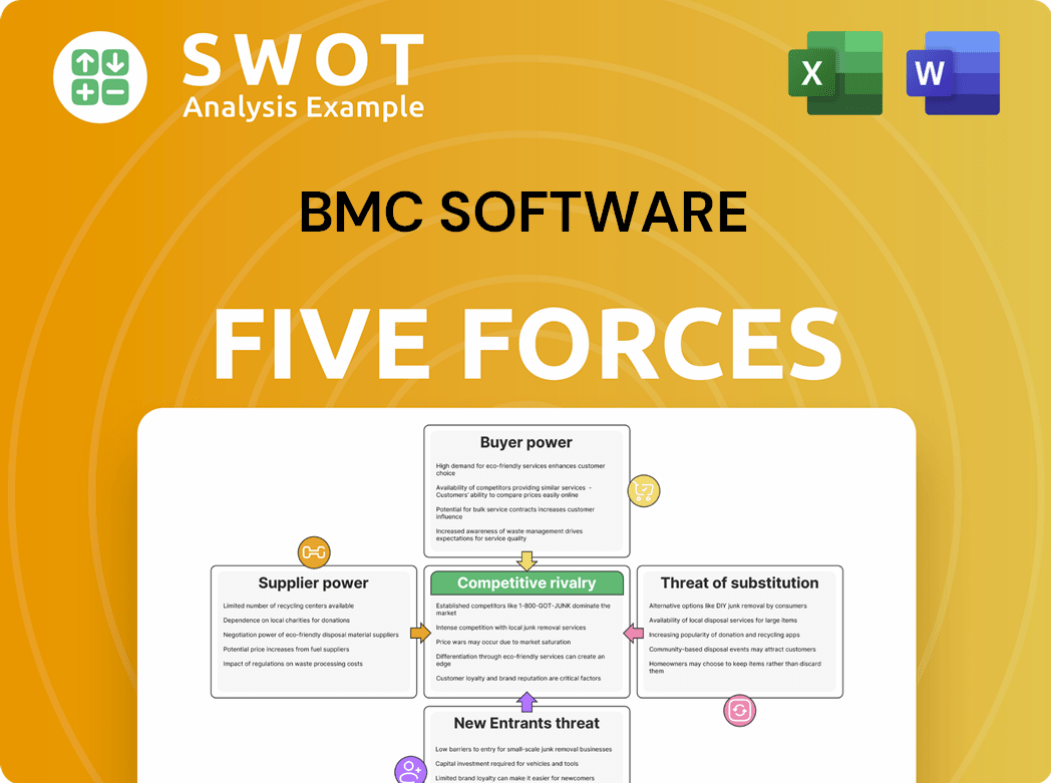

BMC Software Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BMC Software Company?

- What is Growth Strategy and Future Prospects of BMC Software Company?

- How Does BMC Software Company Work?

- What is Sales and Marketing Strategy of BMC Software Company?

- What is Brief History of BMC Software Company?

- Who Owns BMC Software Company?

- What is Customer Demographics and Target Market of BMC Software Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.