BMC Software Bundle

Who Really Owns BMC Software?

The landscape of enterprise IT is constantly shifting, and understanding who controls the key players is paramount. BMC Software, a titan in IT solutions, has seen significant changes in its ownership structure over the years. Unraveling the BMC Software SWOT Analysis and its ownership history offers crucial insights for anyone invested in the tech sector.

From its humble beginnings in Houston, Texas, to its current status, the BMC Software BMC company has navigated a complex web of acquisitions and investments. Knowing the BMC ownership situation provides a clearer picture of the company's strategic direction and future prospects. This deep dive explores the BMC acquisition history and identifies the BMC parent company, providing valuable context for investors and industry watchers alike. We will also explore questions like: Who is the current owner of BMC Software; Has BMC Software been sold; Who owns BMC Helix; Is BMC Software a public company; Where is BMC Software headquarters located; BMC Software company history; Who acquired BMC Software; When was BMC Software founded; BMC Software revenue; BMC Software market share; BMC Software competitors; BMC Software leadership; BMC Software stock price; BMC Software financial performance; Latest news on BMC Software ownership.

Who Founded BMC Software?

BMC Software, a significant player in the enterprise software sector, was established in 1980. The founders of the company were Scott Boulette, John Moores, and Richard Hosley. Their initial focus was on developing software to improve the management of mainframe systems, a strategic niche that quickly positioned the company for growth.

The early ownership of BMC Software was primarily held by its founders. While precise equity distributions at the company's inception are not publicly available, it's reasonable to assume the ownership structure reflected their respective contributions and roles. The company's early success in the mainframe software market allowed it to become publicly traded, which significantly altered its ownership structure.

The company's early funding likely came from personal investments, friends, and family, or small angel investments. The company's rapid expansion indicates successful early product development and market penetration without relying heavily on external venture capital in its initial stages. The company's growth trajectory led to its public listing, broadening its ownership beyond the founding members.

Scott Boulette, John Moores, and Richard Hosley founded BMC Software in 1980.

The company initially focused on software solutions for IBM mainframe environments.

Early funding sources likely included personal investments and angel investors.

BMC Software became a publicly traded company, diversifying its ownership.

The public listing shifted ownership from the founders to public shareholders.

Details of early agreements, such as vesting schedules, are not publicly available.

The evolution of BMC ownership has seen significant changes since its founding. The company's journey from a startup to a publicly traded entity, and subsequent BMC acquisition, has altered the landscape of BMC company ownership. For more insights into the competitive environment, you can explore the Competitors Landscape of BMC Software. The company's headquarters are located in Houston, Texas. The company's BMC Software revenue in 2023 was approximately $2.4 billion. The current BMC parent company is KKR & Co. Inc. and Main Street Capital Corporation after a 2018 acquisition. Details regarding specific buy-sell clauses among the founders are not publicly available.

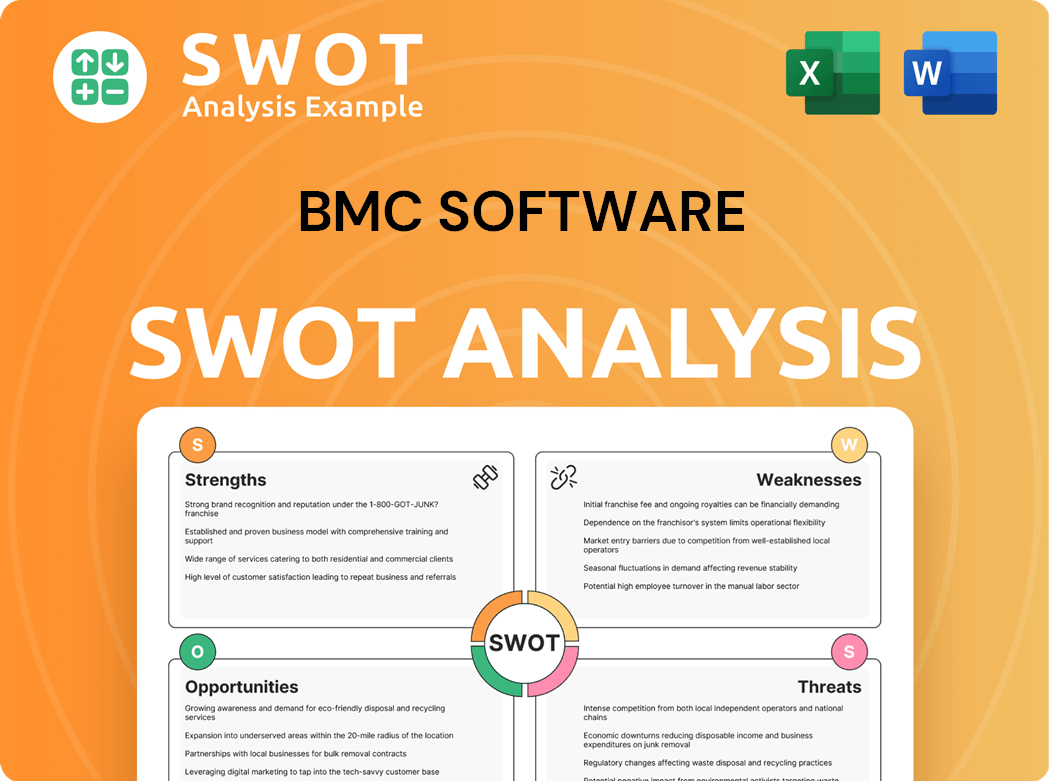

BMC Software SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BMC Software’s Ownership Changed Over Time?

The ownership of the BMC Software company has seen significant shifts over the years. Initially, BMC operated as a publicly traded entity, a status it held from 1988. This period saw a diverse shareholder base, including institutional and individual investors. The company's financial performance and market dynamics influenced the stakes held by major institutional investors during this time.

A major turning point occurred in 2013 when a consortium of private equity firms, including Bain Capital and Golden Gate Capital, acquired BMC Software. This move, valued at approximately $6.9 billion, took the company private. Other firms, such as GIC Special Investments and Insight Venture Partners, also participated in the acquisition. This change allowed BMC to focus on long-term strategies without the immediate pressures of public market scrutiny. In 2018, KKR acquired a majority stake in BMC Software from the consortium, further consolidating the private equity ownership.

| Event | Date | Impact |

|---|---|---|

| Initial Public Offering | 1988 | Diversified ownership among public shareholders. |

| Acquisition by Private Equity Consortium | 2013 | Took the company private; led by Bain Capital and Golden Gate Capital. |

| KKR Acquires Majority Stake | 2018 | Consolidated private equity ownership; valued at approximately $8.3 billion. |

Today, BMC's primary stakeholders are private equity firms, with KKR holding a dominant position. These firms aim to enhance the company's value, often focusing on operational efficiency and strategic acquisitions. The business model of BMC Software has been significantly impacted by these ownership changes, influencing its strategic direction and market approach. The company's headquarters is located in Houston, Texas.

The ownership structure of BMC Software has evolved significantly, transitioning from a publicly traded company to a privately held entity under private equity ownership.

- BMC went public in 1988, with diverse shareholders.

- In 2013, a private equity consortium acquired BMC for approximately $6.9 billion.

- KKR acquired a majority stake in 2018, valuing BMC at around $8.3 billion.

- The current ownership structure is dominated by private equity firms.

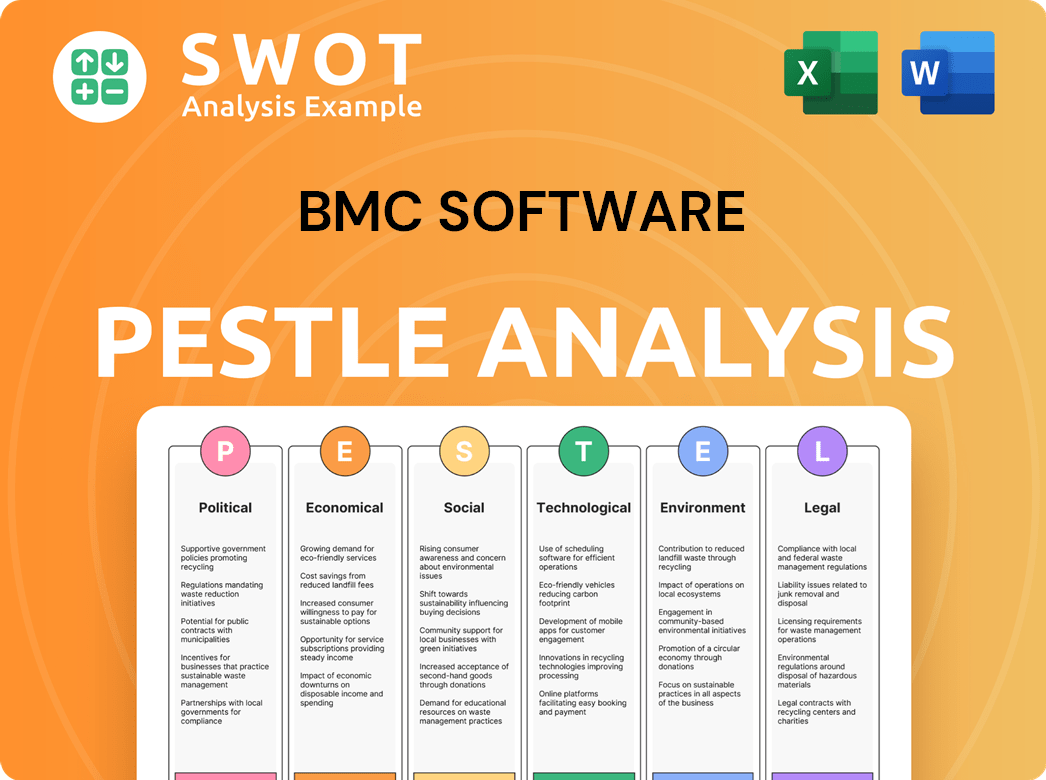

BMC Software PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BMC Software’s Board?

Under the current private equity ownership structure, the Board of Directors of the BMC Software company is primarily shaped by its major shareholders, especially KKR. While a detailed public list of all current board members and their specific affiliations isn't readily available for private companies, it's common for representatives from leading private equity firms to hold significant board seats. These representatives ensure that the company's strategic direction aligns with the investment goals of their respective firms. The BMC ownership structure is heavily influenced by these key stakeholders.

In addition to representatives from KKR and potentially other remaining private equity investors, the board would likely include independent directors with relevant industry expertise and BMC's senior management, such as the CEO. The voting structure in a privately held company like BMC Software is generally straightforward: shares held by the private equity firms carry the corresponding voting power. There are typically no complex dual-class share structures or special voting rights that would dilute the control of the majority owner. Understanding the BMC parent company and its influence is crucial for grasping the company's governance.

| Board Member | Affiliation | Role |

|---|---|---|

| Representative | KKR | Board Member |

| Independent Director | Industry Expert | Board Member |

| CEO | BMC Software | Board Member |

Given its private status, BMC Software is not subject to the same proxy battles or activist investor campaigns that publicly traded companies might face. Governance controversies, if any, would be handled internally among the ownership group and the board. The board's main responsibility is to oversee the company's performance, approve major strategic initiatives, and ensure accountability to its private equity owners, focusing on maximizing value for a future exit. You can learn more about the company's origins in the Brief History of BMC Software.

The board of directors is primarily influenced by major shareholders, particularly KKR, reflecting the BMC acquisition. The voting power is directly tied to share ownership within the private equity structure. The board focuses on strategic initiatives and maximizing value for potential future exit strategies.

- Private equity firms heavily influence the board composition.

- Voting power is proportional to share ownership.

- The board's focus is on performance and strategic initiatives.

- Governance is handled internally due to the private status.

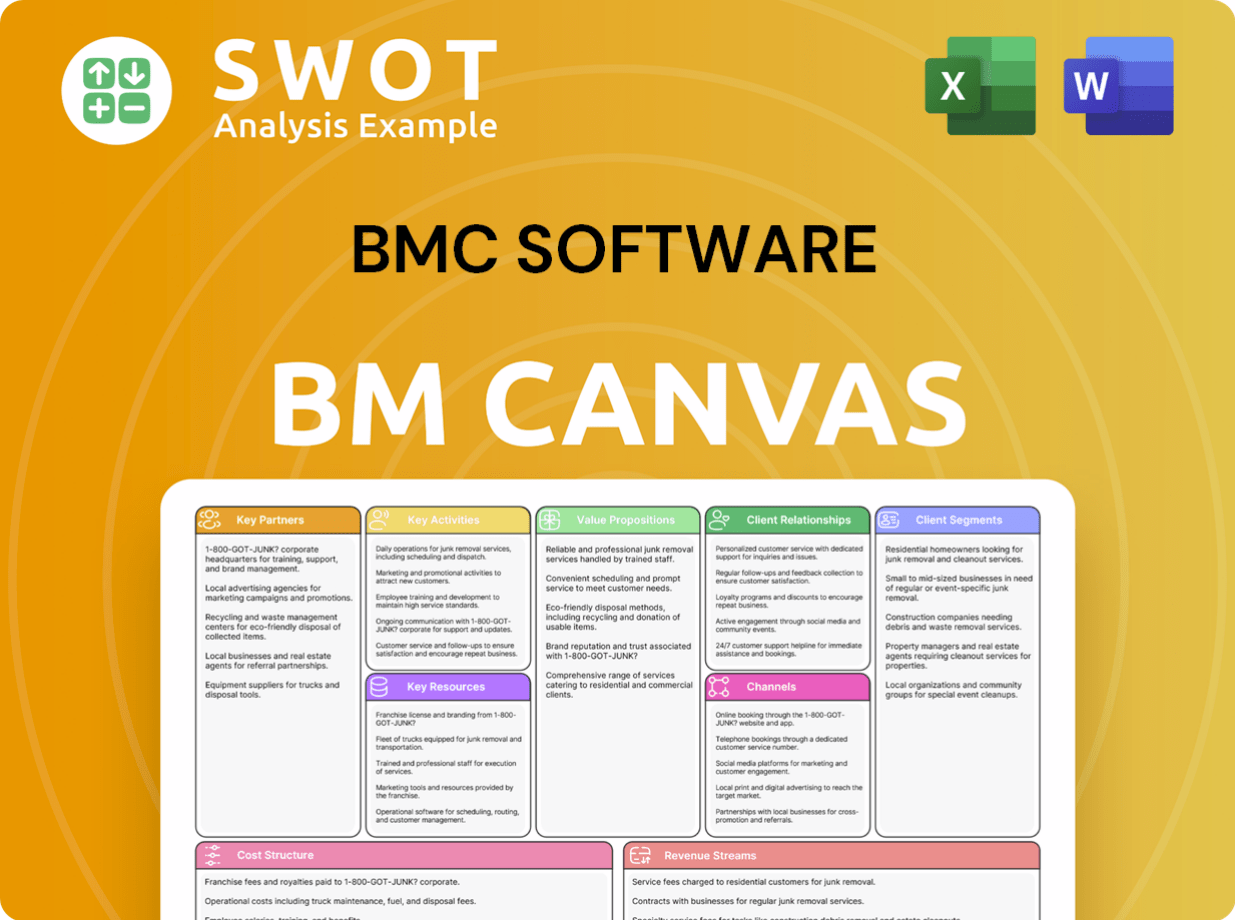

BMC Software Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BMC Software’s Ownership Landscape?

Over the past few years, the ownership structure of BMC Software has remained largely consistent, with KKR as the primary owner. This stability indicates continued confidence in BMC's position within the enterprise software sector and its growth potential. Although specific financial details remain private, the ongoing investment from KKR suggests a strategic focus on long-term value creation. The company has been concentrating on its core offerings, including automation, service management, and security, and has likely pursued strategic acquisitions to expand its product portfolio and market reach. This approach is typical for private equity-backed technology companies, allowing for focused investment and strategic planning away from the pressures of public markets.

Industry trends show a preference for private equity ownership among established technology companies. This allows for significant transformations, heavy R&D investments, and market consolidation without the immediate pressure of quarterly earnings reports. For BMC, this has meant a continued focus on innovation in areas like AIOps, intelligent automation, and hybrid cloud management, as evidenced by product updates and strategic partnerships announced in late 2024 and early 2025. These developments reflect a commitment to evolving with the needs of its enterprise clients. For further insight into the company's strategic direction, consider exploring the Target Market of BMC Software.

While there have been no public announcements regarding a re-listing or significant ownership changes, KKR, as a private equity firm, typically operates with a defined investment horizon. This suggests that KKR will eventually seek an exit strategy for its investment in BMC. This could involve a sale to another private equity firm, a strategic sale to a larger technology company, or a return to the public markets through an IPO. The timing of any such move will depend on market conditions and BMC's continued financial performance and strategic execution. The company's ability to maintain its market share and adapt to technological advancements will be key factors in determining the outcome of any future ownership changes.

BMC Software has maintained its focus on core offerings like automation and service management. Strategic acquisitions are a key part of its growth strategy. The company continues to innovate in areas like AIOps and hybrid cloud management.

KKR is the primary owner of BMC Software. Private equity ownership allows for long-term strategic planning. An exit strategy for KKR's investment is expected in the future. Potential exit strategies include another sale or an IPO.

BMC Software Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BMC Software Company?

- What is Competitive Landscape of BMC Software Company?

- What is Growth Strategy and Future Prospects of BMC Software Company?

- How Does BMC Software Company Work?

- What is Sales and Marketing Strategy of BMC Software Company?

- What is Brief History of BMC Software Company?

- What is Customer Demographics and Target Market of BMC Software Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.