Bridgestone Bundle

Can Bridgestone Conquer the Tire Industry's Toughest Roads?

Bridgestone, a name synonymous with quality tires, faces a constantly shifting global market. From its humble beginnings in Japan, the company has become a global force, but how does it stack up against its rivals? This analysis dives deep into the Bridgestone SWOT Analysis to uncover the strategies and challenges shaping its future.

The tire industry is a battlefield, and understanding the Bridgestone competitive landscape is crucial for investors and industry watchers. This exploration will dissect Bridgestone competitors, examining their strengths and weaknesses in a market defined by innovation and sustainability. We'll also investigate Bridgestone market share and its strategic positioning in a sector undergoing rapid transformation, including the impact of electric vehicles and evolving consumer demands.

Where Does Bridgestone’ Stand in the Current Market?

Bridgestone maintains a leading global market position, consistently ranking among the top tire manufacturers by revenue and market share. The company's dominance is especially pronounced in the premium tire segment and key geographic regions, including North America, Europe, and Asia. Its primary offerings include tires for original equipment manufacturers (OEMs) and the replacement market, serving a wide array of customers from individual consumers to large commercial fleets.

Over time, Bridgestone has strategically diversified its offerings beyond conventional tires, expanding into advanced mobility solutions and sustainable materials. This shift reflects a broader industry trend toward providing value-added services and circular economy initiatives. The company's robust financial health provides a solid foundation for continued investment in research and development and strategic acquisitions. For instance, in its 2024 outlook, Bridgestone projected a solid financial performance, demonstrating its resilience in a challenging economic climate.

While specific market share figures for 2024-2025 are still emerging, Bridgestone consistently holds one of the top two positions globally, often competing with Michelin for the top spot. The company has a particularly strong presence in the truck and bus tire segment and off-the-road tires, reinforcing its diverse market reach. For more insight into the company's financial structure, consider reading about the Revenue Streams & Business Model of Bridgestone.

Bridgestone is a global leader in the tire industry. It consistently ranks among the top tire manufacturers by revenue and market share. This strong market position is a key factor in its competitive landscape.

Bridgestone has expanded beyond traditional tires. The company has ventured into advanced mobility solutions and sustainable materials. This diversification strategy helps it to stay competitive in the evolving market.

Bridgestone has a strong presence in key regions. These regions include North America, Europe, and Asia. These markets are crucial for its overall market position.

The company's strong financial performance supports its market position. This financial health enables continued investment in research and development. It also facilitates strategic acquisitions.

Bridgestone's competitive advantages include its global presence, strong brand reputation, and diverse product portfolio. The company's focus on innovation and sustainability further enhances its market position. These factors contribute to its ability to compete effectively in the tire industry.

- Strong brand recognition and customer loyalty.

- Extensive distribution network.

- Commitment to research and development.

- Focus on sustainable practices.

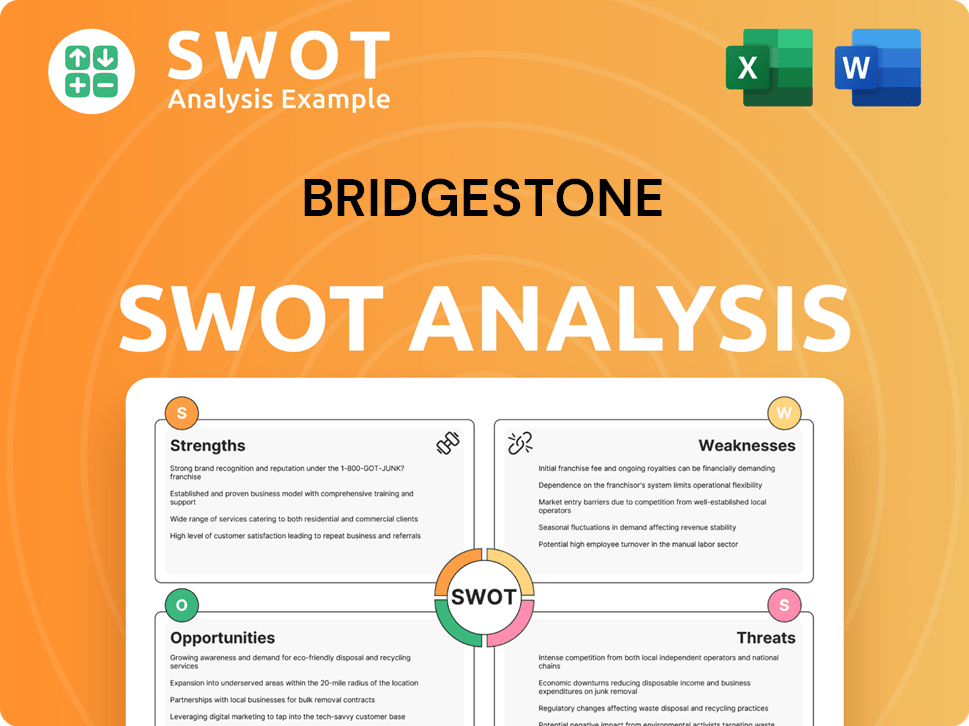

Bridgestone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bridgestone?

The Bridgestone competitive landscape is primarily defined by a few major global players in the tire industry. These companies compete fiercely across various segments, including passenger car tires, truck and bus tires, and specialty tires. The industry is characterized by high barriers to entry due to the capital-intensive nature of manufacturing and the need for extensive research and development.

Bridgestone competitors face challenges from fluctuating raw material prices, evolving consumer preferences, and the increasing demand for sustainable and eco-friendly products. Market dynamics are also influenced by technological advancements, such as the rise of electric vehicles and the development of smart tire technologies. The Bridgestone market share and its rivals are constantly shifting due to these factors.

The global tire industry is a dynamic market, with companies constantly vying for market share and adapting to changing consumer demands and technological advancements. Competition is particularly intense in the premium tire segment, where innovation and brand reputation are crucial.

Michelin, based in France, is a key competitor, known for its focus on innovation and high-performance tires. They have a strong presence in the premium tire segment and are expanding into mobility services. The company's revenue in 2023 was approximately €28.3 billion.

Goodyear, headquartered in the USA, competes across various segments, emphasizing its brand heritage and advanced tire technologies. They have a significant presence in North America. Goodyear's net sales for 2023 were around $19.9 billion.

Continental AG, a German company, is a major automotive supplier with a strong presence in the tire market. They offer comprehensive mobility solutions. In 2023, Continental reported sales of approximately €41.4 billion.

Sumitomo Rubber Industries, based in Japan, is a significant competitor, particularly in specific regional markets. They have a strong focus on research and development. Sumitomo's revenue for the fiscal year 2023 was around ¥899.5 billion.

Pirelli, an Italian company, competes in the high-performance and motorcycle tire segments. They are known for their premium products and strong brand image. Pirelli's revenue in 2023 was approximately €6.6 billion.

Other competitors include companies from Asia, who often compete on price, and new entrants in the market. The tire industry is also seeing an increase in mergers and alliances aimed at consolidating market power.

Bridgestone's global market position and its ability to compete effectively are influenced by several factors. These include product innovation, brand reputation, distribution networks, and pricing strategies. Understanding these factors is crucial for tire industry analysis.

- Product Innovation: Continuous investment in research and development to create advanced and high-performance tires.

- Brand Reputation: Building and maintaining a strong brand image through marketing and quality products.

- Distribution Networks: Establishing efficient distribution channels to reach customers globally.

- Pricing Strategies: Balancing competitive pricing with profitability.

- Sustainability Initiatives: Addressing environmental concerns and consumer preferences for eco-friendly products.

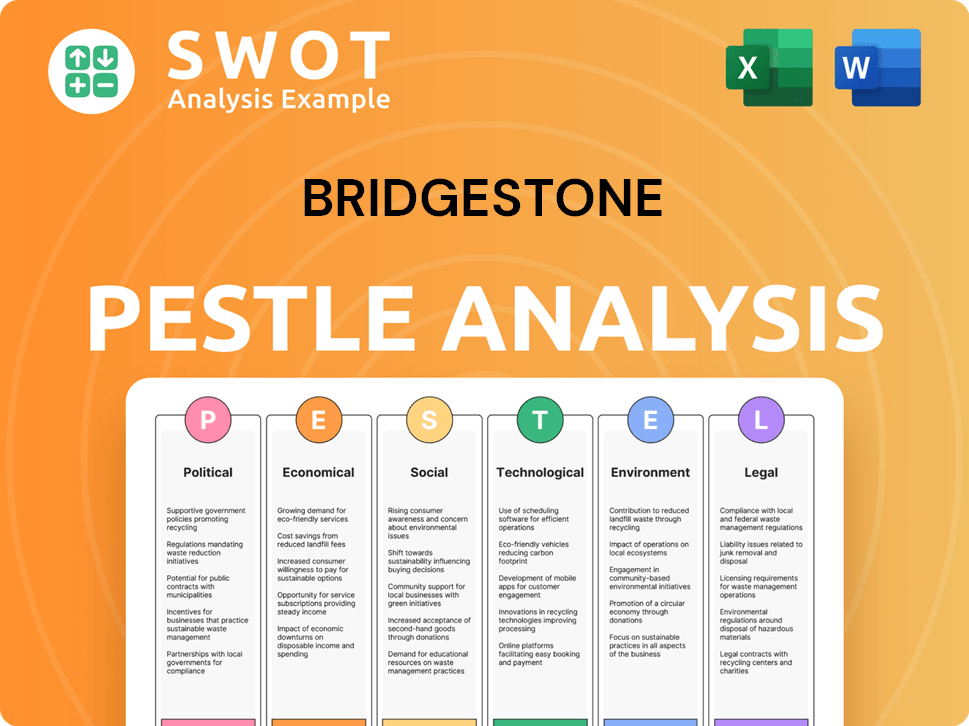

Bridgestone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bridgestone a Competitive Edge Over Its Rivals?

Examining the Bridgestone competitive landscape reveals a company that has cultivated several key advantages over its rivals. These advantages are rooted in its technological prowess, global presence, and dedication to sustainability. Understanding these strengths provides insight into how Bridgestone maintains its position in the dynamic tire industry analysis.

Bridgestone's strategic focus on innovation, particularly in sustainable technologies, positions it well for future growth. The company's continuous investments in research and development, exceeding 100 billion yen in 2023, are a testament to its commitment to staying ahead of the curve. This commitment is crucial in a market where consumer preferences and technological advancements are rapidly evolving.

The company's competitive edge is further enhanced by its strong brand reputation and extensive manufacturing and distribution networks. These factors enable Bridgestone to effectively serve a global customer base. The shift towards 'Solutions Business' also helps differentiate it from competitors, offering value-added services that enhance customer relationships and operational efficiency.

Bridgestone consistently invests in research and development, with expenditures exceeding 100 billion yen in 2023. This investment supports the development of advanced technologies like ENLITEN, which enhances tire performance and sustainability. These innovations are crucial for meeting the evolving demands of the market and staying ahead of Bridgestone competitors.

With over 150 manufacturing plants and R&D centers worldwide, Bridgestone benefits from significant economies of scale. This extensive global footprint allows for efficient distribution and effective service to diverse markets. The company's ability to manage a complex global supply chain is a key factor in its competitive advantage and Bridgestone market share.

Bridgestone has built a strong brand reputation over decades, known for reliable and high-quality products. This strong brand equity fosters customer loyalty, providing a stable foundation in a competitive market. Customer trust and satisfaction are vital in maintaining market position and influencing purchasing decisions.

The company's strategic focus on 'Solutions Business,' including tire-related services and digital fleet management, sets it apart. This approach leverages data and connectivity to improve operational efficiencies for customers. This shift towards offering value beyond just the product enhances customer relationships and drives long-term growth.

Bridgestone's competitive advantages include technological innovation, global reach, and strong brand equity. These strengths are supported by significant investments in R&D and a focus on sustainable practices. These factors contribute to its ability to compete effectively in the rubber industry rivals landscape.

- Continuous investment in R&D, exceeding 100 billion yen in 2023, drives innovation.

- A global manufacturing footprint with over 150 plants supports efficient distribution.

- Strong brand reputation and customer loyalty built over decades.

- Strategic shift towards 'Solutions Business' enhances customer value.

For a deeper dive into Bridgestone's strategic initiatives, consider exploring the Growth Strategy of Bridgestone. This article provides further insights into how the company is positioning itself for future success in the tire industry.

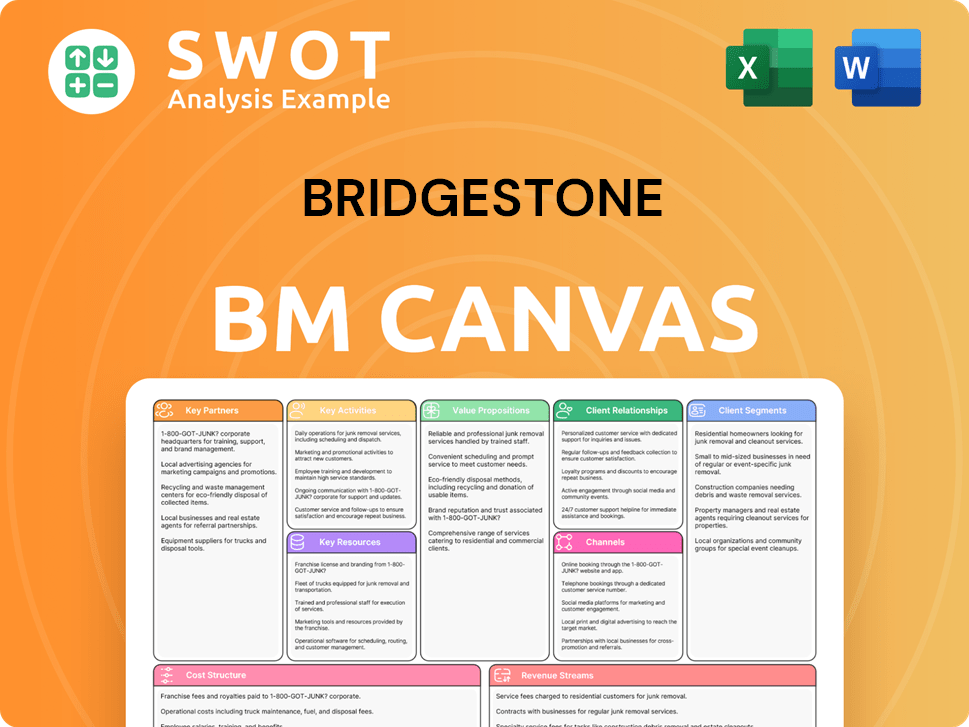

Bridgestone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bridgestone’s Competitive Landscape?

The global tire industry is experiencing significant shifts, driven by the rise of electric vehicles (EVs), the push for sustainable materials, and the integration of smart technologies. These trends are reshaping the competitive landscape, creating both challenges and opportunities for major players like Bridgestone. Understanding the current industry dynamics is crucial for assessing Bridgestone's position, risks, and future outlook.

Bridgestone faces the challenge of adapting its traditional business model to embrace 'Tire as a Service' and other mobility solutions, which require significant digital transformation and new competencies. Conversely, these trends also present significant opportunities. Bridgestone is actively pursuing growth in emerging markets, investing in advanced materials and recycling technologies to achieve its long-term sustainability goals, and forming strategic partnerships to accelerate its smart mobility initiatives.

The tire industry is evolving with the growth of EVs, which require tires with specific characteristics like lower rolling resistance. There's also a rising demand for sustainable materials and circular economy solutions. Furthermore, smart and connected technologies are increasingly integrated into tires, enhancing performance and safety. The Marketing Strategy of Bridgestone reflects these trends.

Bridgestone faces challenges such as managing fluctuating raw material costs and navigating geopolitical uncertainties that can disrupt supply chains. Intense price competition, particularly from emerging market manufacturers, also poses a threat. Adapting to new business models like 'Tire as a Service' requires significant digital transformation and new competencies.

The shift towards EVs creates opportunities for specialized tire development. Bridgestone can expand in emerging markets and invest in advanced materials and recycling technologies. Forming strategic partnerships can accelerate smart mobility initiatives. Focusing on becoming a 'sustainable solutions company' is central to remaining competitive.

In recent financial reports, Bridgestone has shown resilience, with a focus on premium tires and solutions. While specific market share figures vary by region, Bridgestone maintains a strong global presence. The company is investing in R&D, with recent expenditures exceeding $1 billion annually to drive innovation and address industry challenges.

Bridgestone is focusing on several key strategies to navigate the evolving tire industry. These include expanding its EV tire offerings, investing in sustainable materials, and forming strategic partnerships to enhance its digital capabilities. The company is also working to optimize its supply chain and improve operational efficiency.

- Expanding EV Tire Portfolio: Developing tires specifically designed for EVs to meet their unique performance requirements.

- Sustainability Initiatives: Investing in research and development of sustainable materials and recycling technologies to reduce environmental impact.

- Strategic Partnerships: Collaborating with technology companies and automotive manufacturers to enhance its smart mobility solutions and digital capabilities.

- Operational Efficiency: Optimizing supply chains and manufacturing processes to improve cost competitiveness and responsiveness to market demands.

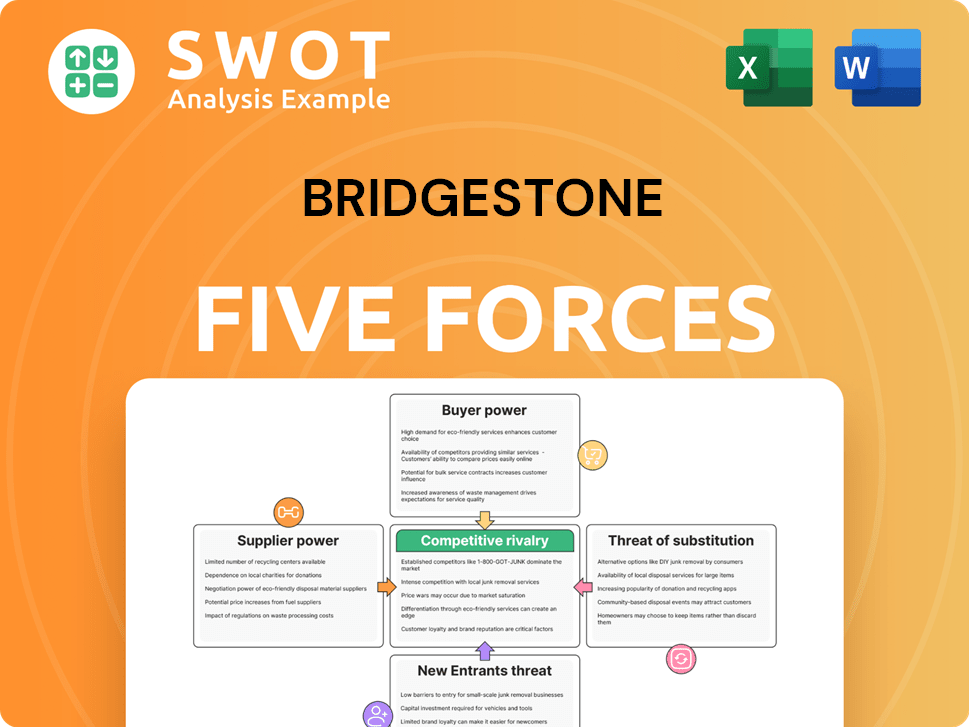

Bridgestone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bridgestone Company?

- What is Growth Strategy and Future Prospects of Bridgestone Company?

- How Does Bridgestone Company Work?

- What is Sales and Marketing Strategy of Bridgestone Company?

- What is Brief History of Bridgestone Company?

- Who Owns Bridgestone Company?

- What is Customer Demographics and Target Market of Bridgestone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.