Bridgestone Bundle

Can Bridgestone Drive its Future Growth in a Changing World?

In the dynamic landscape of the automotive industry, understanding Bridgestone's growth strategy is crucial. The company, a global leader with a rich history, is evolving beyond its core tire business. This article dives into Bridgestone's strategic initiatives, exploring its plans for expansion and innovation to navigate the Bridgestone SWOT Analysis and future prospects.

Bridgestone's commitment to innovation, from its origins in Japan, is evident in its proactive approach to the automotive market outlook. The company's ability to adapt to tire industry trends, including the rise of electric vehicles, will be key to its long-term growth potential. This Bridgestone company analysis will provide insights into how the company plans to maintain its competitive advantages and navigate the challenges facing Bridgestone in the tire market.

How Is Bridgestone Expanding Its Reach?

The Bridgestone growth strategy focuses on expanding its solutions business. This shift moves beyond simple volume expansion, emphasizing premium tires and advanced mobility solutions. The company's strategic initiatives are heavily influenced by long-term goals, particularly within the sustainable mobility sector.

A core element of Bridgestone's future prospects includes mergers and acquisitions. These are carefully chosen to align with its long-term business plan. The company is particularly interested in high-growth areas, such as sustainable mobility. This strategic approach reflects the evolving needs of the automotive market.

Bridgestone aims to enhance its retread business globally. Success in North America and Europe provides a foundation for this expansion. This initiative supports the company's circular economy objectives. The company is also prioritizing digital solutions, such as ENLITEN technology.

The company actively seeks mergers and acquisitions to bolster its position. These strategic moves are particularly focused on high-growth areas. This approach supports the company's long-term strategic business plan.

Bridgestone is expanding its retread business worldwide. This initiative builds on successes in North America and Europe. It is a key part of their circular economy goals and sustainability efforts.

The company prioritizes the expansion of digital solutions. ENLITEN technology is a prime example, designed to reduce environmental impact. This technology also enhances tire performance.

Bridgestone aims for a 90% sustainable material usage in tires by 2050. This ambitious goal requires extensive product pipeline development. It also involves strategic partnership strategies.

In 2024, Bridgestone announced a new organizational structure. This was designed to accelerate its mid-long term business strategy. The restructuring reinforces its solutions portfolio. This is a key step in adapting to tire industry trends and the automotive market outlook.

- The company is investing in research and development.

- Strategic partnerships are crucial for innovation.

- Focus on sustainable materials and circular economy.

- Digital transformation is a key priority.

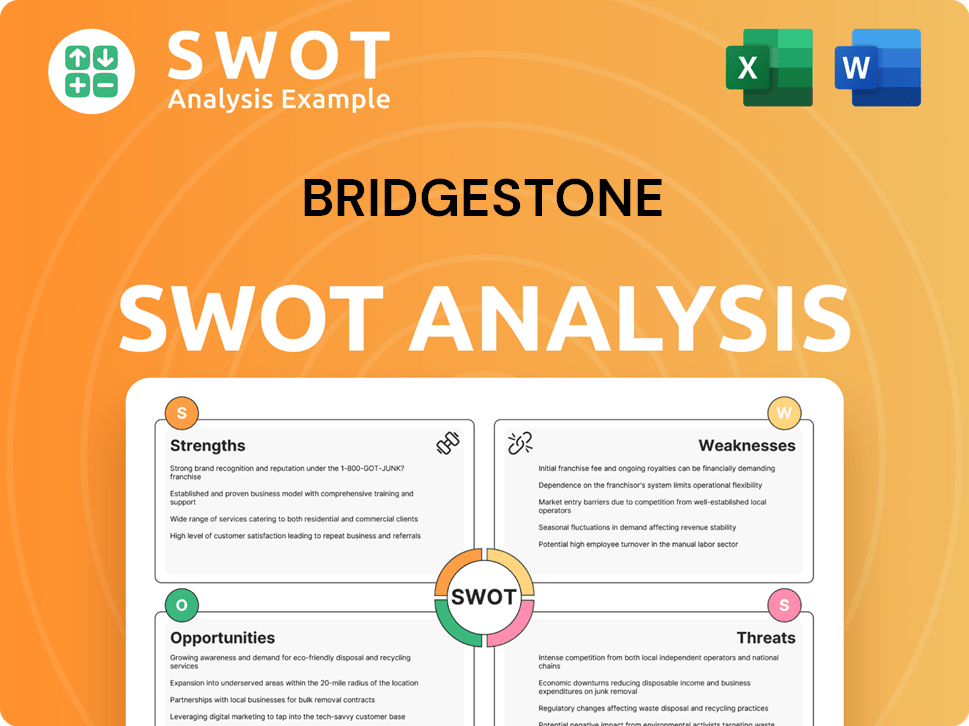

Bridgestone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bridgestone Invest in Innovation?

The innovation and technology strategy of the company is a core element of its Bridgestone growth strategy, driving both its current performance and its Bridgestone future prospects. The company is heavily invested in research and development to maintain its leadership in the tire industry and to address evolving tire industry trends. This commitment is crucial for navigating the automotive market outlook and maintaining a competitive edge.

The company's approach is guided by its 'Bridgestone E8 Commitment,' which shapes its sustainability initiatives and technological advancements. This commitment underscores the company's dedication to long-term value creation and responsible business practices. The company's focus on innovation aims to deliver superior products and services while contributing to a more sustainable future.

A key technological focus is on ENLITEN technology, designed to improve tire environmental performance. This includes reducing rolling resistance and extending tire life. The company is also advancing its digital transformation, leveraging data and AI to optimize tire performance and enhance fleet management solutions. These initiatives are central to the company's Bridgestone business model and its ability to adapt to changing market demands.

ENLITEN technology is a significant focus, aiming to enhance tire environmental performance. This includes reducing rolling resistance, which improves fuel efficiency, and extending tire life, which reduces waste.

The company is leveraging data and AI to optimize tire performance. This includes predictive maintenance and advanced fleet management solutions. These digital tools provide real-time insights for commercial fleets.

The company aims to use 100% sustainable materials in its products by 2050. This requires significant investment in material science and new manufacturing processes. This goal demonstrates a strong commitment to environmental responsibility.

Advanced sensor technologies are being developed to provide real-time insights for commercial fleets. These sensors collect data on tire pressure, temperature, and wear. This data helps to optimize tire performance and reduce downtime.

Cloud-based platforms are being used to analyze data from sensors and provide actionable insights. These platforms enable proactive maintenance and improve overall fleet efficiency. This enhances the value proposition for commercial customers.

The company has received industry recognition for its innovations, particularly in sustainable tire technologies. This recognition validates the company's efforts and reinforces its position as a leader in the tire industry.

The company's commitment to sustainability is further demonstrated by its goal of using 100% sustainable materials in its products by 2050, requiring significant investment in material science and new manufacturing processes. The company has received industry recognition for its innovations, including awards for its sustainable tire technologies. For more insights into the company's performance, consider reading Owners & Shareholders of Bridgestone.

The company's technological advancements are focused on enhancing tire performance, sustainability, and digital capabilities. These advancements are critical for addressing the challenges facing Bridgestone in the tire market and capitalizing on Bridgestone's competitive advantages.

- ENLITEN Technology: Improves environmental performance by reducing rolling resistance and extending tire life.

- Digital Transformation: Leveraging data and AI for predictive maintenance and fleet management.

- Sustainable Materials: Aiming for 100% sustainable materials by 2050, impacting Bridgestone's sustainability efforts.

- Sensor Technologies: Developing advanced sensors for real-time tire performance data.

- Cloud-Based Platforms: Utilizing cloud platforms to analyze sensor data and provide actionable insights.

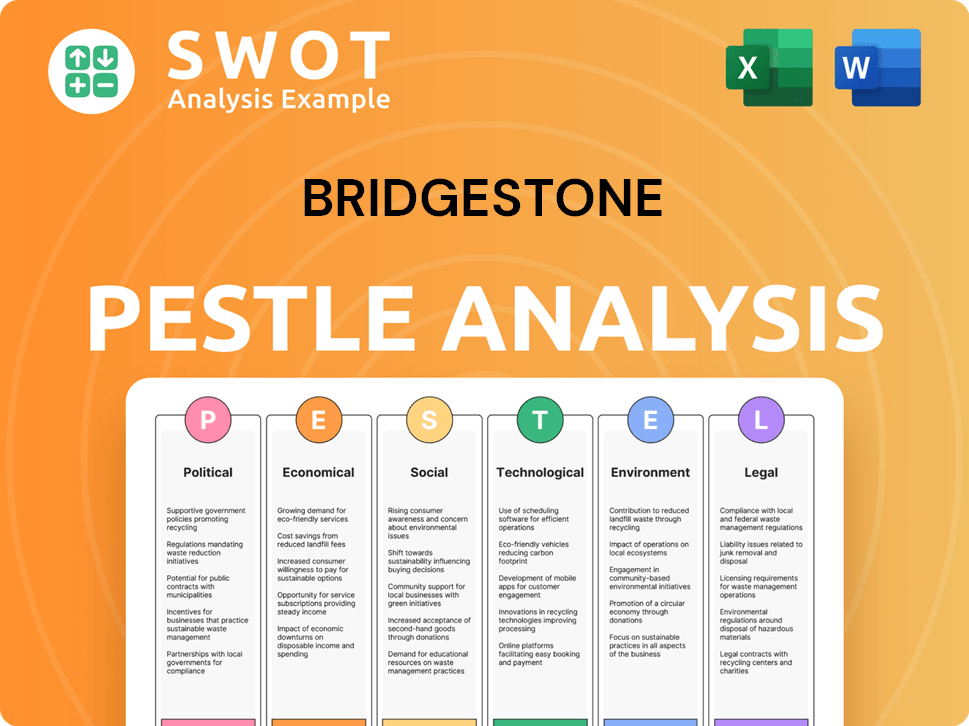

Bridgestone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bridgestone’s Growth Forecast?

The financial outlook for Bridgestone reflects a strategic shift towards solutions and sustainable growth. The company is focused on enhancing profitability and achieving long-term objectives within the dynamic automotive market outlook. This approach is designed to strengthen its market position.

For the fiscal year ending December 31, 2024, Bridgestone projects significant financial results. These projections highlight the company's commitment to steady financial performance and strategic investments. The company's financial strategy includes investments in its solutions business and advanced technologies.

Bridgestone's commitment to financial health is evident in its strategic initiatives. The company aims for a return on equity (ROE) of 10% or more. This financial discipline supports its long-term growth potential and shareholder value. A key aspect of the Bridgestone growth strategy involves a disciplined capital allocation strategy.

Bridgestone anticipates sales revenue of 4,300.0 billion JPY for the fiscal year ending December 31, 2024. This figure indicates the company's expected financial performance and market position. This projection is a key element of the Bridgestone financial performance analysis.

The company projects an operating profit of 400.0 billion JPY for the same period. This forecast reflects the company's focus on profitability and operational efficiency. This is a key indicator of Bridgestone's business model effectiveness.

Bridgestone expects a profit attributable to owners of parent of 290.0 billion JPY. This figure is a crucial indicator of the company's financial health and its ability to generate value for shareholders. This is a key aspect of the Bridgestone company analysis.

The company anticipates a free cash flow of 230.0 billion JPY. This indicates the company's financial flexibility and ability to invest in future growth. This is important for understanding Bridgestone's future prospects.

These financial projections are supported by a disciplined capital allocation strategy. This strategy balances growth investments with shareholder returns. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Bridgestone.

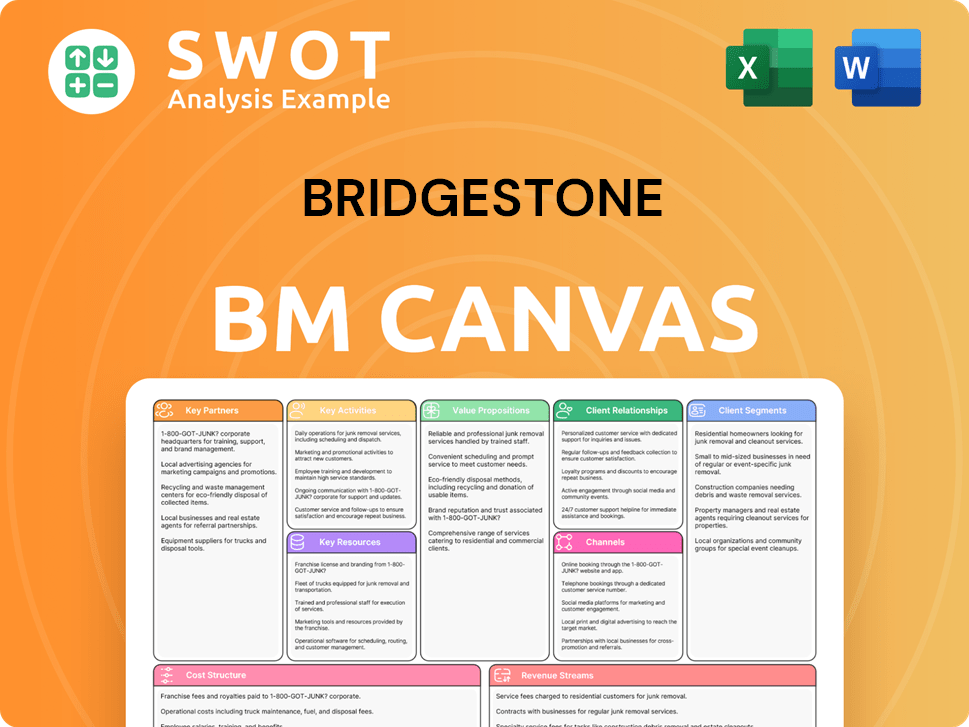

Bridgestone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bridgestone’s Growth?

The future of Bridgestone, like any major player in the automotive sector, is subject to a variety of risks and obstacles. These challenges can significantly impact the company's growth trajectory and overall financial performance. Understanding these potential pitfalls is essential for investors and stakeholders assessing the long-term viability of the business.

Several external factors could hinder Bridgestone's progress. These include intense competition from both established and emerging tire manufacturers, shifts in consumer preferences, and the increasing complexity of the global automotive market. Internal operational challenges, such as managing a vast global supply chain and maintaining consistent quality, also present significant hurdles.

To navigate these complexities, Bridgestone must proactively address potential risks through strategic planning and operational adjustments. This involves adapting to evolving market dynamics, investing in innovation, and fortifying its business model against external shocks. A strong risk management framework is crucial for sustaining long-term growth and profitability.

The tire industry is highly competitive, with numerous players vying for market share. Low-cost manufacturers and emerging competitors, particularly in the electric vehicle (EV) tire segment, put pressure on pricing and margins. This competitive landscape necessitates continuous innovation and efficiency improvements to maintain a competitive edge.

Changes in environmental regulations, vehicle safety standards, and trade policies can significantly impact Bridgestone's operations. Compliance with stricter emission standards and evolving safety requirements necessitates ongoing investment in research and development (R&D) and manufacturing processes. The company must adapt to stay ahead of these regulatory shifts.

Supply chain disruptions, including raw material price volatility and geopolitical instability, pose a substantial risk. The price of natural rubber and other key materials directly affects production costs. Diversifying the supply base and implementing robust risk management strategies are essential to mitigate these vulnerabilities. Recent global events have highlighted the importance of supply chain resilience.

The rapid advancement of autonomous vehicles and new mobility services presents both opportunities and challenges. Bridgestone must invest in technologies such as smart tires and data analytics to remain relevant. Adapting to the changing needs of the automotive market, including the rise of EVs, is critical for long-term success. The company must anticipate and invest in future technologies.

Managing a vast global operation with diverse product lines requires significant resources. Ensuring consistent quality across all manufacturing facilities and maintaining efficient distribution networks are complex tasks. Streamlining operations, investing in employee training, and leveraging technology are key to managing this complexity effectively. The company’s global footprint requires careful oversight.

Economic recessions can significantly reduce demand for new vehicles and replacement tires, impacting Bridgestone's sales. The automotive market is cyclical, and economic downturns can lead to decreased profitability. The company needs to prepare for economic fluctuations through cost-saving measures and strategic inventory management. Economic conditions directly affect demand.

To address these risks, Bridgestone employs several strategies. The company focuses on product diversification, expanding its offerings beyond traditional tires. It also invests in sustainable sourcing of raw materials and enhances its manufacturing footprint to improve supply chain resilience. Further insights into the company's strategic approach can be found in our analysis of the Marketing Strategy of Bridgestone.

The tire industry is characterized by intense competition. Major players like Michelin, Goodyear, and Continental constantly innovate. New entrants, particularly from China, are increasing competition, especially in the value tire segment. Bridgestone needs to differentiate itself through premium products and brand value.

Raw materials, particularly natural rubber, account for a significant portion of production costs. Price volatility in these commodities can impact profitability. In 2024, natural rubber prices have fluctuated, affecting the cost of goods sold. Bridgestone mitigates this by hedging and diversifying its supplier base.

The automotive industry is undergoing rapid technological changes. The shift to electric vehicles and autonomous driving requires significant investment in R&D. Bridgestone is developing smart tires and tire-related services to capitalize on these trends. These investments are crucial for future growth.

Geopolitical events and trade wars can disrupt supply chains and impact sales. The company has global manufacturing facilities and a worldwide distribution network. Diversifying its production locations and maintaining strong relationships with suppliers are essential to manage these risks. Global events can affect operations.

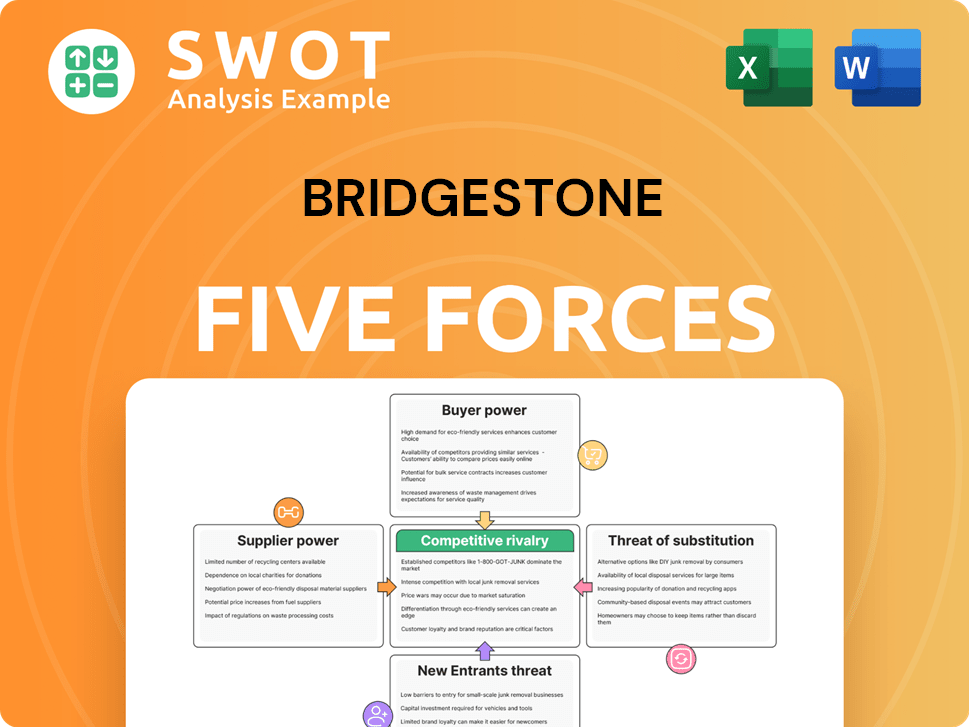

Bridgestone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bridgestone Company?

- What is Competitive Landscape of Bridgestone Company?

- How Does Bridgestone Company Work?

- What is Sales and Marketing Strategy of Bridgestone Company?

- What is Brief History of Bridgestone Company?

- Who Owns Bridgestone Company?

- What is Customer Demographics and Target Market of Bridgestone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.