Capital Bank Bundle

How Does Capital Bank Navigate the Banking Battlefield?

The financial sector is a dynamic arena, constantly reshaped by innovation and shifting consumer demands. Understanding the competitive landscape is crucial for any bank aiming for success. This analysis dives deep into Capital Bank's position, examining its rivals, strategies, and the forces shaping its future.

Capital Bank's journey, from its inception in 1995 to its current standing, showcases its resilience and adaptability in the face of Capital Bank SWOT Analysis. This exploration of the Capital Bank competitive landscape will provide a detailed Capital Bank market analysis, assessing its strengths and weaknesses, and comparing its financial performance to competitors within the banking industry competition. We'll investigate who Capital Bank's main rivals are and evaluate Capital Bank's growth strategies compared to competitors, providing insights into its strategic positioning and future outlook in the competitive landscape.

Where Does Capital Bank’ Stand in the Current Market?

Capital Bank Company maintains a strong market position as a community bank, primarily serving individuals and businesses within its core geographic regions, with a notable presence in North Carolina and surrounding states. The bank's consistent growth in deposits and loan portfolios underscores its robust standing relative to its peers within the Capital Bank competitive landscape.

Capital Bank's primary offerings include a full suite of checking and savings accounts, diverse loan options such as commercial real estate loans, small business loans, and consumer mortgages, alongside modern online and mobile banking solutions. Capital Bank strategically focuses on serving local businesses, including small and medium-sized enterprises (SMEs), and individual customers seeking personalized financial services. Over time, Capital Bank has adapted its positioning by significantly investing in digital transformation, enhancing its online banking platforms and mobile applications to meet the evolving preferences of its tech-savvy customer base, while still maintaining its strong emphasis on in-person customer service.

As of Q1 2024, Capital Bank's total assets reached approximately $2.5 billion, reflecting a steady increase from previous years and indicating a healthy financial scale compared to the average community bank. This financial stability allows the bank to continue investing in technology and expanding its service offerings. The bank holds a particularly strong position in its established local markets, where its long-standing community relationships provide a significant competitive edge. However, like many community banks, its market position may be weaker in highly saturated metropolitan areas dominated by larger national and regional banks.

Capital Bank's market share, while specific figures can be granular for community banks, is marked by consistent growth in both deposits and loan portfolios. This growth indicates a solid position within its target markets. The bank's focus on local businesses and individual customers has contributed to its steady expansion.

Capital Bank offers a comprehensive range of financial products, including checking and savings accounts, and various loan options. The bank has invested in digital banking to meet evolving customer preferences. This includes online banking platforms and mobile applications.

Capital Bank's financial health is evidenced by consistent profitability and strong capital ratios, often above industry averages for community banks. This financial stability supports ongoing investments in technology and service expansion. Recent analyst assessments from late 2024 highlight the bank's robust financial standing.

Capital Bank's primary geographic focus is on North Carolina and surrounding states, where it has established strong community relationships. Its local market presence provides a competitive advantage. However, its market position may be weaker in highly saturated metropolitan areas dominated by larger national and regional banks.

Capital Bank's competitive advantages include strong local market presence, personalized customer service, and a focus on serving local businesses and individuals. The bank's investment in digital transformation enhances its ability to meet evolving customer needs, while maintaining its commitment to in-person service.

- Strong community relationships

- Focus on local businesses and individuals

- Investment in digital transformation

- Consistent financial performance

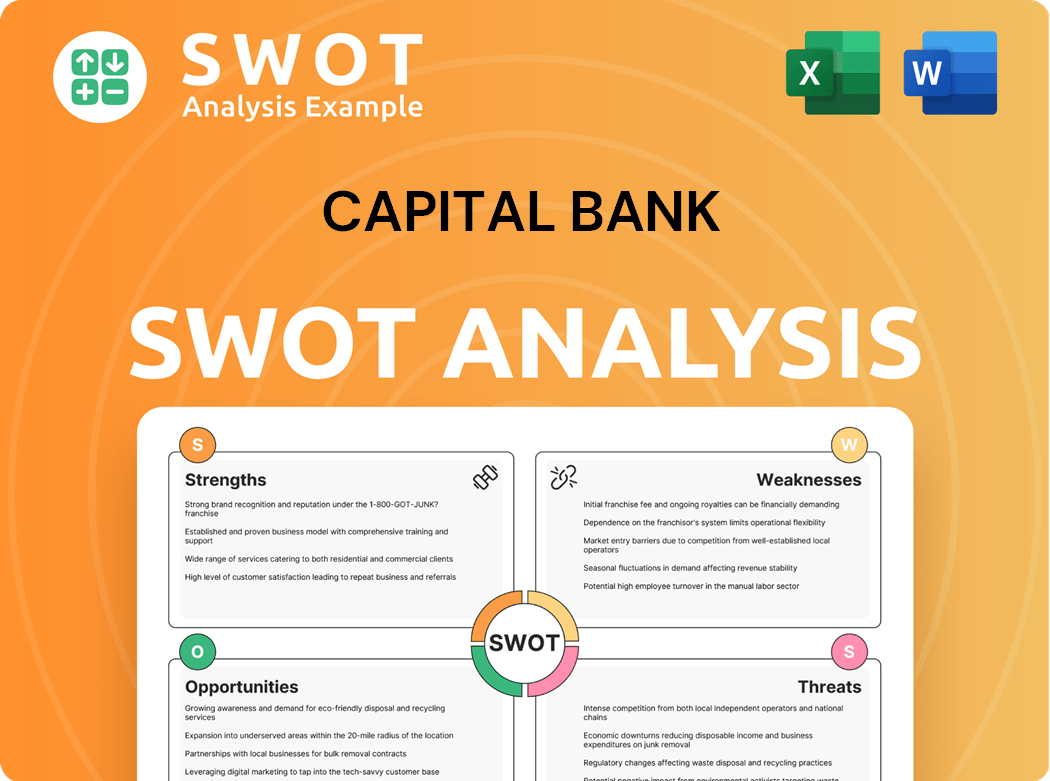

Capital Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Capital Bank?

The Growth Strategy of Capital Bank is significantly influenced by the competitive dynamics within the banking sector. The Capital Bank competitive landscape is shaped by a diverse array of financial institutions, each vying for market share and customer loyalty. Understanding these competitors is crucial for Capital Bank to formulate effective strategies and maintain a strong position in the market.

Capital Bank competitors include both direct and indirect rivals, ranging from large regional banks to smaller community banks and emerging FinTech companies. The intensity of competition varies across different product lines and geographic markets, necessitating a nuanced approach to competitive analysis. A thorough Capital Bank market analysis reveals the strengths and weaknesses of each competitor, providing insights into potential opportunities and threats.

Capital Bank operates within a highly competitive environment, facing challenges from various financial institutions. Its primary direct competitors include larger regional banks such as Truist Financial Corporation and PNC Financial Services Group, both of which offer a broader array of products, extensive branch networks, and substantial digital capabilities. Truist, for example, reported assets exceeding $500 billion as of late 2024, dwarfing Capital Bank's scale and enabling them to compete aggressively on pricing for loans and deposits. Similarly, PNC, with assets around $560 billion in early 2025, leverages its vast resources for technological innovation and national marketing campaigns.

Direct competitors are financial institutions that offer similar products and services to Capital Bank, competing for the same customer base. These rivals often have a more extensive reach and greater resources, which can impact Capital Bank's market share.

Indirect competitors include entities that provide alternative financial solutions, such as credit unions and FinTech companies. These institutions may not offer the full suite of traditional banking services but can attract customers with competitive rates or innovative digital platforms.

Analyzing the competitive advantages of each rival helps Capital Bank identify areas for differentiation. This includes assessing their pricing strategies, customer service models, and technological capabilities to gain a competitive edge.

Understanding the market share of each competitor provides insights into their market positions. This analysis helps Capital Bank assess its own performance relative to its rivals and identify opportunities for growth.

Examining how competitors acquire customers reveals effective strategies that Capital Bank can adapt. This includes analyzing their marketing campaigns, promotional offers, and digital banking initiatives.

Evaluating competitors' digital banking platforms is crucial in today's market. This includes assessing their mobile apps, online banking features, and overall user experience to stay competitive.

The banking industry competition is intense, with several key players vying for market share. Understanding the strategies of financial services rivals is essential for Capital Bank to maintain its competitive position. The following are some of Capital Bank's main rivals:

- Truist Financial Corporation: Truist, with assets exceeding $500 billion as of late 2024, focuses on a broad range of financial services, including retail banking, wealth management, and corporate banking. Their strategy involves extensive branch networks and digital capabilities.

- PNC Financial Services Group: PNC, with assets around $560 billion in early 2025, emphasizes technological innovation and national marketing campaigns to attract customers. They offer a wide array of products and services.

- First Citizens BancShares: With assets of approximately $220 billion as of Q4 2024, First Citizens BancShares competes on personalized service and local market knowledge, particularly in the Southeast. They often have slightly larger branch networks.

- SouthState Corporation: SouthState also focuses on personalized service and local market knowledge, competing with Capital Bank in core geographic markets.

- Credit Unions: Credit unions offer competitive rates and benefit from strong community loyalty, posing a challenge to traditional banks.

- FinTech Companies (e.g., Chime, Ally Bank): These companies offer digital banking solutions with lower overheads, providing highly attractive interest rates and innovative user experiences.

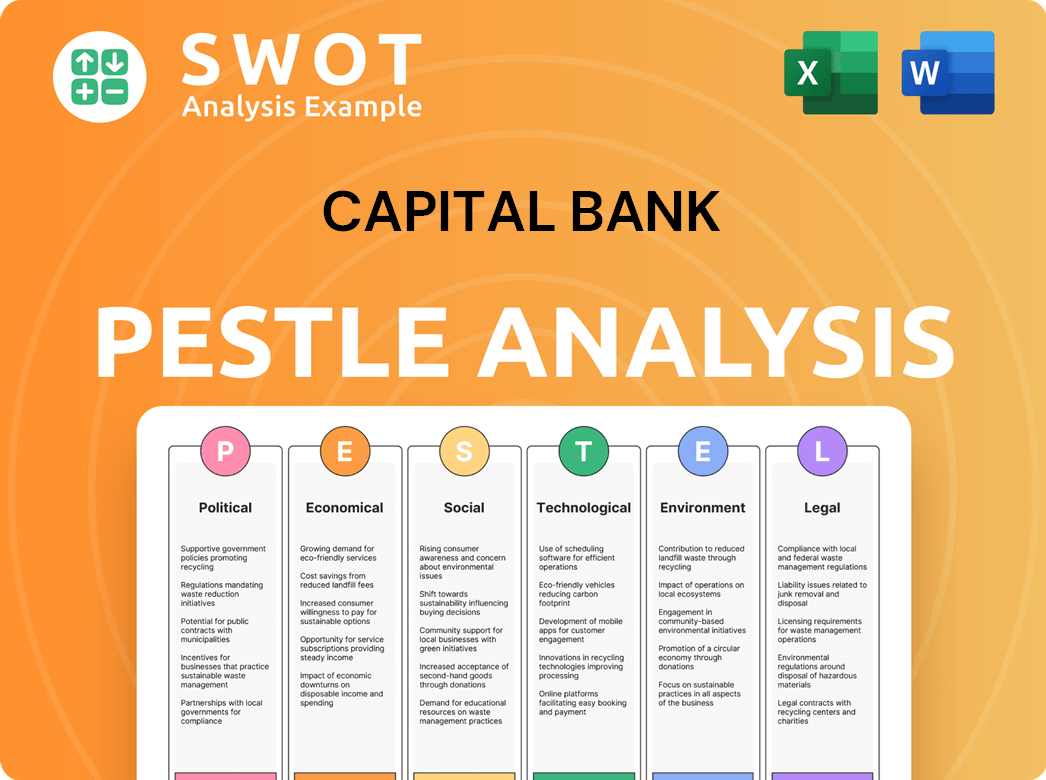

Capital Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Capital Bank a Competitive Edge Over Its Rivals?

Understanding the competitive landscape for Capital Bank requires a deep dive into its core strengths and how it differentiates itself within the banking industry competition. Unlike larger national banks, Capital Bank focuses on building strong, lasting relationships with its customers. This community-centric approach, coupled with personalized service, forms the foundation of its competitive advantage, leading to higher customer loyalty and retention rates, critical factors in a commoditized market. For a comprehensive overview, consider reading Brief History of Capital Bank.

Capital Bank's strategy revolves around local decision-making, enabling quicker loan approvals and more flexible terms, especially beneficial for small businesses. This agility is a significant advantage over larger institutions with rigid processes. Furthermore, the bank's consistent involvement in local events and sponsorships builds a strong brand equity within its communities, fostering trust and generating new customer referrals. Its experienced local bankers, possessing deep knowledge of the regional economy, further enhance its ability to serve its target market effectively.

While not primarily technology-driven, Capital Bank strategically invests in digital platforms to complement its personal service. Its user-friendly online banking and mobile app offer essential digital convenience without sacrificing the personal touch. These advantages are relatively sustainable, built on relationships and local market expertise, though they face threats from aggressive digital innovation and the expanding reach of larger financial institutions. For example, in 2024, community banks saw a 5% increase in digital banking adoption, highlighting the need for Capital Bank to continue investing in its digital offerings to remain competitive.

Capital Bank distinguishes itself through its focus on community relationships. This approach fosters higher customer loyalty and retention rates compared to larger banks. The bank's commitment to local involvement builds a strong brand reputation, attracting new customers through referrals.

Capital Bank's personalized service is a key differentiator. It understands and caters to the unique financial needs of its customers. This focus on individual needs results in tailored solutions and a more satisfying banking experience.

The bank's local decision-making capabilities provide a competitive edge. This allows for faster loan approvals and more flexible terms, particularly beneficial for small businesses. This agility sets Capital Bank apart from larger institutions.

Capital Bank complements its personal service with strategic investments in digital platforms. Its user-friendly online banking and mobile app provide essential digital convenience. These investments enhance customer experience without compromising personal touch.

Capital Bank's competitive advantages are rooted in its community focus and personalized service. These strengths are relatively sustainable due to their reliance on relationships and local expertise, but they face challenges from digital innovation and larger financial institutions. The bank's strategy involves balancing personal service with technological advancements to maintain its competitive edge.

- Relationship Banking: Building strong, long-term relationships with customers.

- Local Expertise: Experienced local bankers with deep regional knowledge.

- Brand Equity: Strong reputation through local community involvement.

- Digital Integration: User-friendly digital platforms complementing personal service.

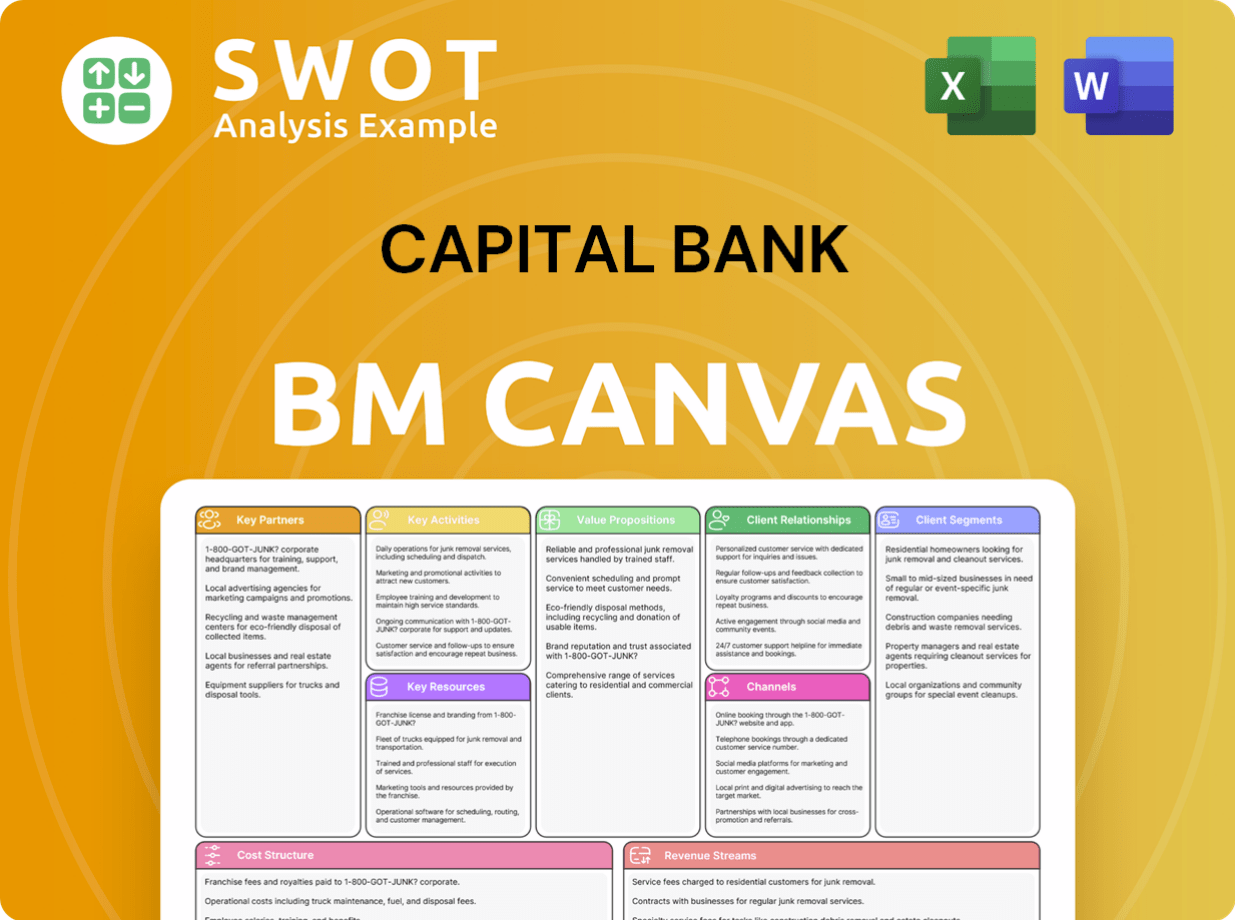

Capital Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Capital Bank’s Competitive Landscape?

The Capital Bank competitive landscape is currently shaped by significant industry trends, presenting both challenges and opportunities. Technological advancements and evolving consumer preferences are driving the need for digital transformation. Simultaneously, regulatory changes and economic uncertainties add complexity to the banking environment. Understanding these dynamics is crucial for Capital Bank market analysis and strategic planning.

Capital Bank's position in the market requires a balanced approach, leveraging its strengths while adapting to change. The bank must navigate the evolving banking industry competition to remain relevant and competitive. This includes addressing risks associated with digital disruption and economic fluctuations while pursuing opportunities for growth and innovation.

The banking sector is experiencing rapid digitization, with FinTech companies and established banks investing heavily in digital platforms. Data analytics and AI are transforming customer service and risk management. Furthermore, there's a growing emphasis on sustainable and community-focused banking practices.

Maintaining a balance between traditional community banking and digital services poses a significant challenge. Increased competition from FinTech and larger banks, coupled with economic uncertainties, could impact profitability. Compliance with evolving regulations and data privacy laws also adds to operational costs.

Capital Bank can leverage its strong customer relationships to cross-sell digital products and expand its reach. Strategic partnerships with FinTech firms can accelerate technology adoption. The demand for socially responsible banking practices provides a further differentiation opportunity.

To thrive, Capital Bank needs a hybrid model, combining its local presence with a robust digital platform. Investing in digital infrastructure and exploring partnerships are crucial. Furthermore, focusing on customer experience and community engagement will be key for long-term success. For more information, see Owners & Shareholders of Capital Bank.

Capital Bank's future outlook hinges on several key strategies. These include enhancing digital capabilities, forming strategic partnerships, and emphasizing community engagement. Focusing on these areas will help Capital Bank navigate banking industry competition effectively.

- Invest in digital platforms and customer experience.

- Explore partnerships with FinTech companies to expand service offerings.

- Strengthen community ties and promote sustainable practices.

- Adapt to changing regulatory requirements.

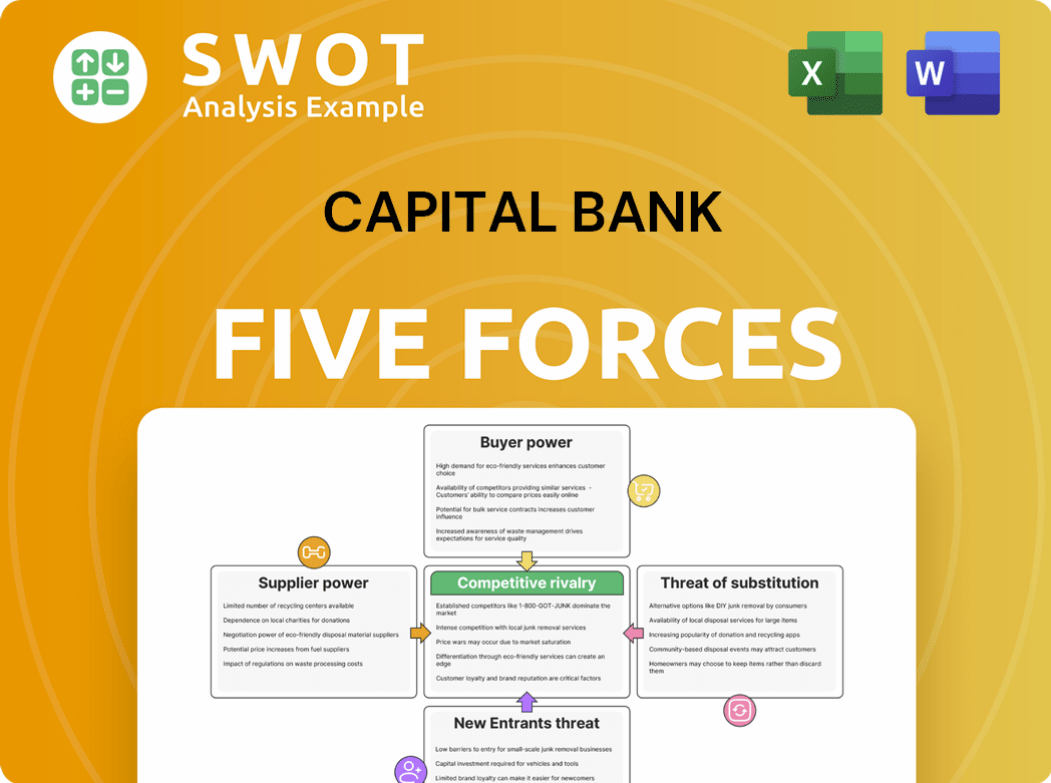

Capital Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Capital Bank Company?

- What is Growth Strategy and Future Prospects of Capital Bank Company?

- How Does Capital Bank Company Work?

- What is Sales and Marketing Strategy of Capital Bank Company?

- What is Brief History of Capital Bank Company?

- Who Owns Capital Bank Company?

- What is Customer Demographics and Target Market of Capital Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.