Capital Bank Bundle

Who Really Owns Capital Bank?

Unraveling the intricate web of Capital Bank SWOT Analysis ownership is key to understanding its strategic moves and financial health. From acquisitions to IPOs, the ownership structure of a bank can dramatically shift, impacting its direction and accountability. This exploration delves into the diverse entities bearing the 'Capital Bank' name, focusing on their unique histories and ownership dynamics.

This analysis of Capital Bank ownership investigates the Capital Bank owner and the Capital Bank parent company, including the roles of Capital Bank shareholders and Capital Bank executives. We'll examine the Capital Bank company structure, from Capital Bank major stakeholders to the Capital Bank board of directors, offering insights into the Capital Bank leadership team and the influence of its Capital Bank financial backers. Understanding the Capital Bank controlling interest and the identity of the Capital Bank largest shareholders offers a comprehensive view of the bank's operations.

Who Founded Capital Bank?

Understanding the ownership structure of Capital Bank involves looking at its parent company and key figures. Capital Bank, N.A. operates as a wholly-owned subsidiary of Capital Bancorp, Inc. This structure is crucial for understanding the bank's operations and who ultimately controls it. The ownership has evolved over time, with significant changes occurring through recapitalizations and acquisitions.

The current iteration of Capital Bank traces its roots back to a recapitalization in 2002, spearheaded by Chairman Stephen Ashman. While the exact initial equity distribution isn't detailed publicly, it's important to note the influence of early investors and key personnel. This early ownership laid the foundation for the bank's future growth and strategic direction. The ownership structure is a key aspect of the Brief History of Capital Bank.

For the entity known as Capital Bank Financial, the story begins with North American Financial Holdings (NAFH), founded on November 30, 2009. NAFH was created to acquire struggling banks following the 2008 financial crisis. This strategic move highlights the proactive approach taken to expand and consolidate within the banking sector.

Chairman Stephen Ashman led a recapitalization. This event marked a significant turning point in the bank's history.

As of June 30, 2018, directors, executive officers, their families, and related entities beneficially owned approximately 56% of Capital Bancorp's outstanding shares. Many were shareholders since the 2002 recapitalization.

North American Financial Holdings (NAFH) was established on November 30, 2009. The primary goal was to acquire banks facing challenges after the 2008 financial crisis.

NAFH raised $900 million in December 2009. This funding came from private equity firms like Crestview Partners, Oak Hill Advisors, and Falfurrias Capital Partners.

In December 2010, shareholders approved the sale of a majority stake to NAFH. NAFH purchased newly issued stock to facilitate this acquisition.

On January 28, 2011, NAFH acquired an 85% stake in Capital Bank for $181 million. Gene Taylor, NAFH's CEO, then became CEO of Capital Bank.

The ownership structure of Capital Bank reflects a combination of long-term shareholders and strategic acquisitions. The involvement of private equity firms and the leadership of key executives have shaped the bank's trajectory. Understanding these elements is crucial for assessing the bank's stability and future prospects.

- Capital Bancorp, Inc. is the parent company of Capital Bank, N.A.

- Directors, executive officers, and their families held approximately 56% of Capital Bancorp's shares as of June 30, 2018.

- North American Financial Holdings (NAFH) was formed to acquire struggling banks.

- NAFH raised $900 million from private equity firms in December 2009.

- NAFH acquired an 85% stake in Capital Bank in January 2011.

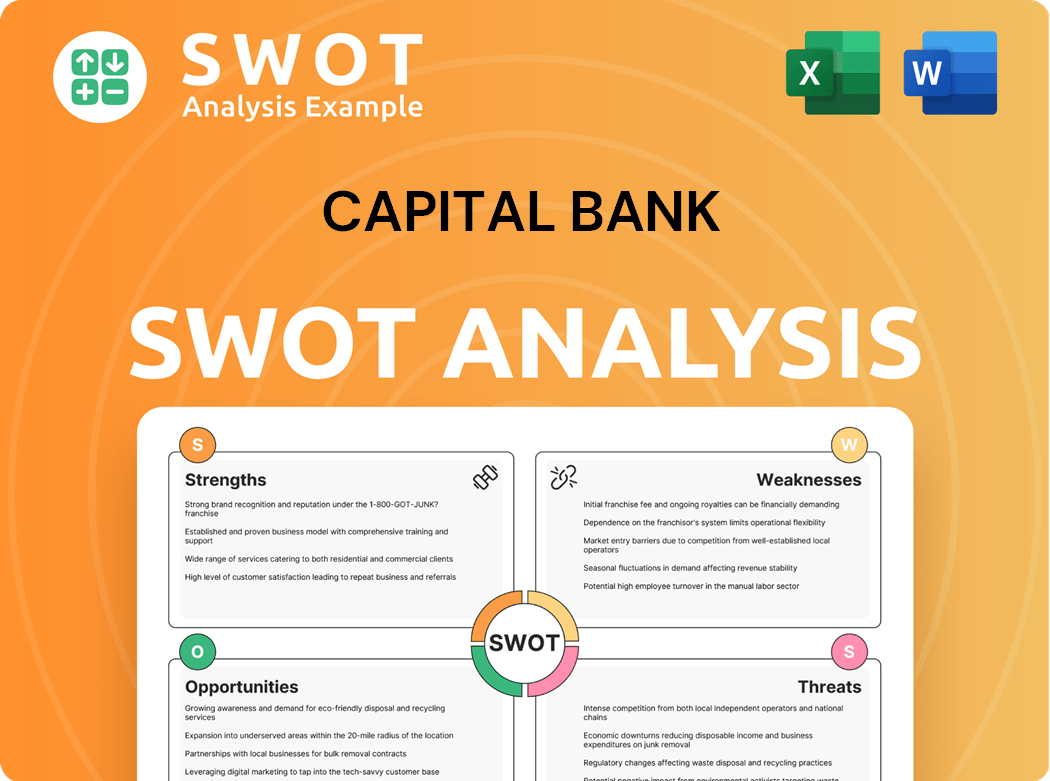

Capital Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Capital Bank’s Ownership Changed Over Time?

The ownership structure of Capital Bank has seen significant changes over time. Capital Bancorp, Inc. (NASDAQ: CBNK), the parent company of Capital Bank, N.A., is publicly traded, with a focus on shareholder value. As of December 31, 2024, Capital Bancorp, Inc. reported over $3.2 billion in assets, indicating a substantial financial presence in the market. The management team and board of directors are known for their commitment to prioritizing shareholder value.

Looking back at Capital Bank Financial, its ownership journey began with North American Financial Holdings (NAFH) acquiring several distressed banks. NAFH then went public in September 2012, becoming Capital Bank Financial Corp. (CBF). The company expanded through acquisitions, such as the $350 million purchase of CommunityOne Bank in October 2016, which boosted its assets to $8.1 billion and its branch network to 165. First Horizon National Corporation later acquired Capital Bank Financial for $2.2 billion on December 1, 2017. Understanding the Growth Strategy of Capital Bank provides further insight into the company's evolution.

| Entity | Ownership Event | Date |

|---|---|---|

| North American Financial Holdings (NAFH) | Acquisition of distressed banks, IPO | September 2012 |

| Capital Bank Financial Corp. | Acquisition of CommunityOne Bank | October 2016 |

| First Horizon National Corporation | Acquisition of Capital Bank Financial | December 1, 2017 |

Capital Bank of Jordan, established in 1995, holds a significant stake in the National Bank of Iraq (NBI). In 2021 and 2022, Capital Bank Group expanded its operations by acquiring Bank Audi's operations in Jordan and Iraq, followed by Société Générale Bank in Jordan. In 2022, Capital Bank of Jordan issued a USD 100 million Tier 1 perpetual bond and issued new shares to the Public Investment Fund (PIF), which holds a 23.97% stake. As of March 31, 2025, Capital Bank Group reported total assets of JOD 8.2 billion and total equity of approximately JOD 756.5 million.

The ownership of Capital Bank involves various entities, including publicly traded and strategic investors.

- Capital Bancorp, Inc. is the parent company of Capital Bank, N.A.

- Capital Bank of Jordan has a significant presence in the region.

- The Public Investment Fund (PIF) is a major shareholder.

- The evolution reflects strategic acquisitions and public offerings.

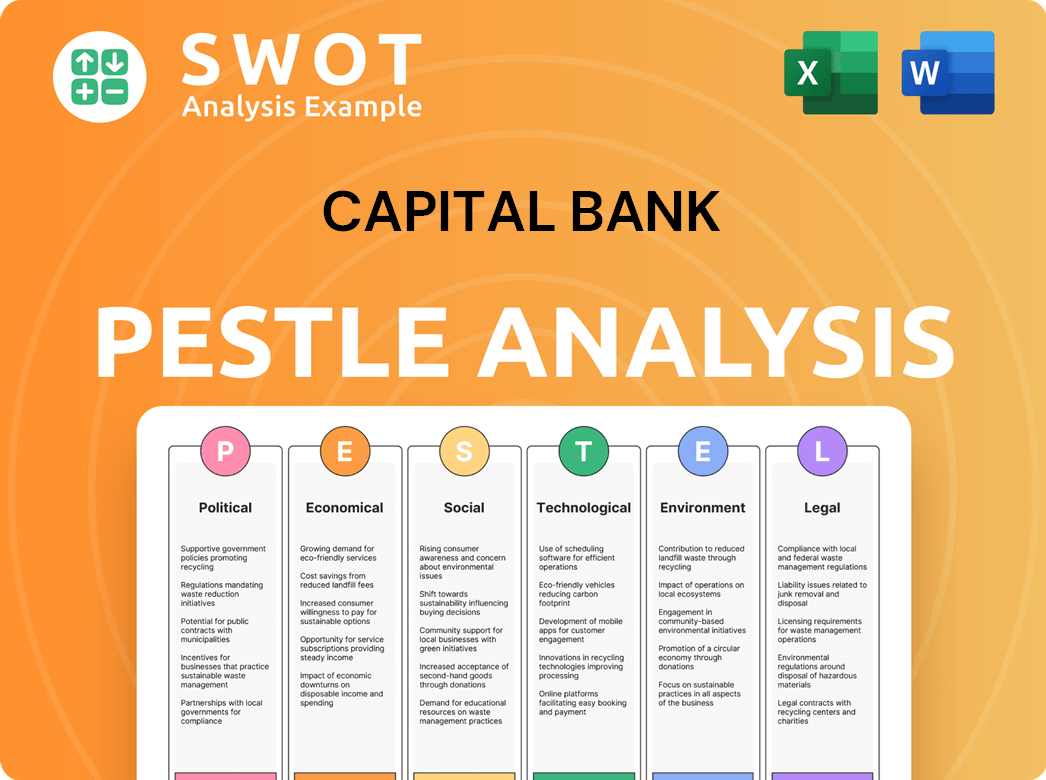

Capital Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Capital Bank’s Board?

As of June 30, 2018, the board of directors and senior executive management, along with their families and affiliated entities, beneficially owned approximately 56% of the outstanding common stock of Capital Bancorp, Inc., the parent company of Capital Bank, N.A. This substantial ownership indicates a strong alignment between the leadership and shareholder interests. Although the specific details of the current board members and their individual affiliations are not readily available in the provided information, the emphasis on 'client first' advice and customized financial solutions suggests a board dedicated to guiding the company's strategic direction. Understanding the structure of the board and the interests of the Capital Bank owner is crucial for assessing the company's governance and strategic focus.

The composition and influence of the board of directors play a critical role in shaping the strategic direction of Capital Bank. The board's decisions, from risk management to the approval of major transactions, directly impact the bank's performance and its shareholders. The focus on tailored financial solutions and client-centric advice suggests that the board is committed to fostering a culture of strong corporate governance and shareholder value. Analyzing the board's structure and the voting power within the company is essential for understanding the dynamics of Capital Bank ownership and the interests of its major stakeholders.

| Board Member | Title | Ownership |

|---|---|---|

| Information Not Available | Information Not Available | Information Not Available |

| Information Not Available | Information Not Available | Information Not Available |

| Information Not Available | Information Not Available | Information Not Available |

Publicly traded companies generally use a one-share-one-vote system for common stock, although dual-class shares can exist, providing different voting rights. The provided information does not specify if Capital Bancorp, Inc. uses a dual-class share structure. In the context of electing board members, cumulative voting systems can be used, permitting shareholders to distribute their votes. This system can empower minority shareholders by allowing them to cast all their votes for a single candidate or distribute them among multiple candidates. For more insights, you can check out the Marketing Strategy of Capital Bank.

Understanding the ownership structure of Capital Bank is crucial for investors and stakeholders.

- The board of directors and senior management hold a significant portion of the company's stock.

- Voting structures, such as one-share-one-vote, are common, but dual-class shares may exist.

- Cumulative voting can empower minority shareholders in board elections.

- The insights into Capital Bank shareholders and Capital Bank executives are vital for assessing corporate governance.

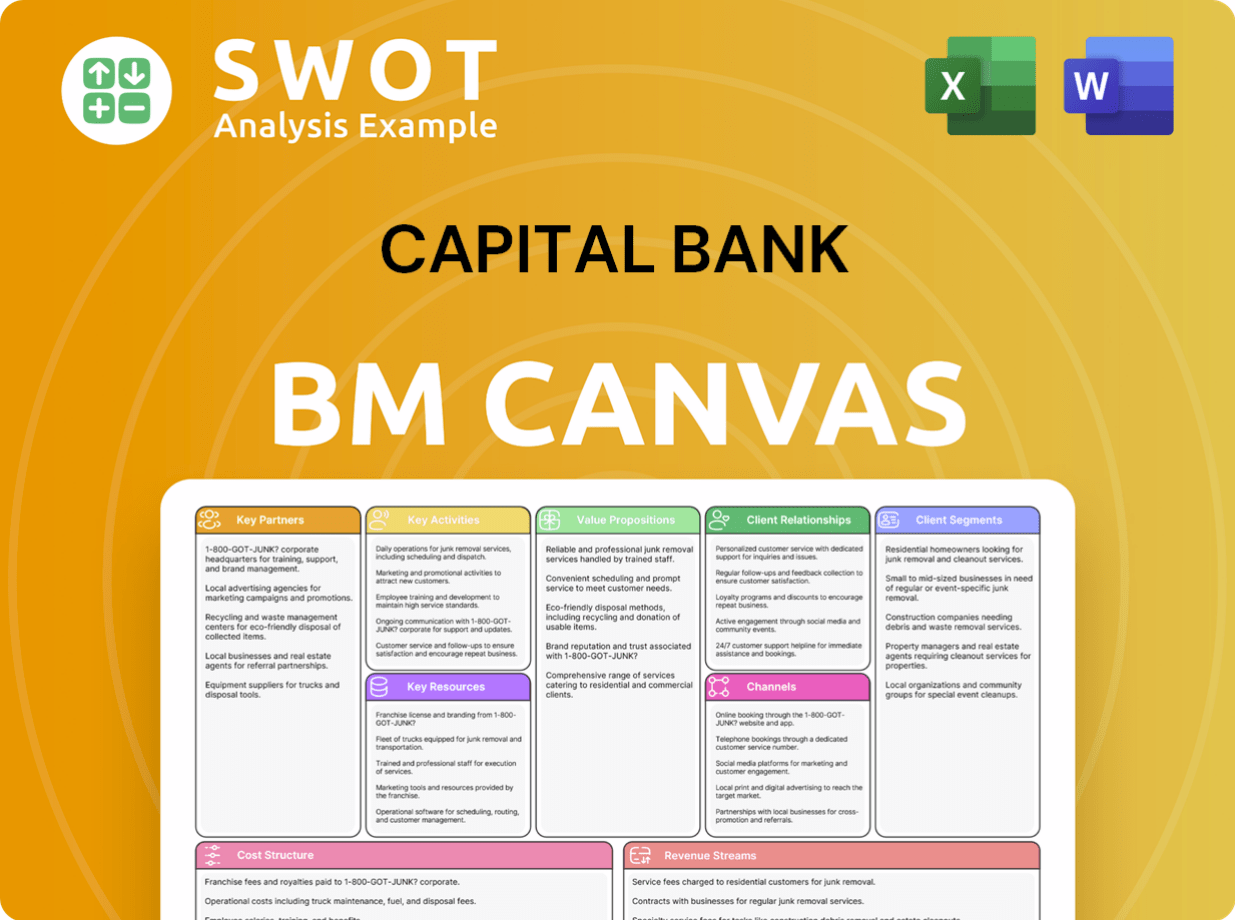

Capital Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Capital Bank’s Ownership Landscape?

Recent developments at Capital Bancorp, Inc. (NASDAQ: CBNK) indicate a focus on strategic growth and financial performance. The company announced its fourth quarter and full-year 2024 results on January 27, 2025, revealing a net income of $7.5 million for the fourth quarter of 2024. A significant event was the completion of the merger with IFH on October 1, 2024, which impacted the tangible book value per share, decreasing it by 6.8% to $18.77 as of December 31, 2024. This merger and related accounting adjustments were the primary drivers of this change. Additionally, nonperforming assets increased to 0.94% of total assets by the end of 2024.

Understanding who owns Capital Bank is crucial for investors and stakeholders. The company's performance and strategic decisions are closely tied to its ownership structure. The increase in nonperforming assets and the impact of the IFH merger on tangible book value are key factors influencing shareholder value. The company's leadership is likely focused on maintaining and enhancing shareholder value, which reflects an awareness of investor expectations. For a broader view, you can explore the Competitors Landscape of Capital Bank.

Capital Bank's ownership structure is influenced by various factors, including institutional investors, management, and potentially, activist shareholders. The board of directors and key personnel play a crucial role in corporate governance. Understanding the company's major stakeholders provides insights into its strategic direction.

The banking industry is increasingly focused on succession planning to ensure continuity. This includes preparing for future ownership transfers. Succession plans typically involve business valuations and buy-sell agreements. These plans are critical for long-term stability.

Capital Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Capital Bank Company?

- What is Competitive Landscape of Capital Bank Company?

- What is Growth Strategy and Future Prospects of Capital Bank Company?

- How Does Capital Bank Company Work?

- What is Sales and Marketing Strategy of Capital Bank Company?

- What is Brief History of Capital Bank Company?

- What is Customer Demographics and Target Market of Capital Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.