Capital Bank Bundle

How Did Capital Bank Achieve Record Profits in 2024?

Capital Bank of Jordan's remarkable ascent in the Jordanian banking sector, culminating in a 50% surge in net profits in 2024, is a story of strategic brilliance. From its 'Starts with Gold, Ends with Cash' campaign to its ambitious acquisitions, the bank has consistently outmaneuvered competitors. But what are the specific Capital Bank sales strategy and Capital Bank marketing strategy that fueled this impressive growth?

This analysis delves into the core elements of Capital Bank's success, examining its customer-centric approach and innovative marketing initiatives. We'll dissect its digital transformation, including the impact of its digital bank Blink, and explore the key factors behind its ability to capture market share. Understanding Capital Bank's approach offers valuable insights for anyone interested in the banking industry marketing landscape and effective financial services sales strategies, including a deep dive into their Capital Bank SWOT Analysis.

How Does Capital Bank Reach Its Customers?

The sales channels of Capital Bank are designed to reach a broad customer base, integrating both traditional and digital methods. This approach, which forms part of the broader Capital Bank sales strategy, aims to provide accessible and convenient banking services to both individuals and businesses. The bank's strategy focuses on leveraging technology to enhance customer experience and streamline operations.

Capital Bank's sales and marketing approach includes physical branches and a strong digital presence. The bank has invested heavily in digital platforms to cater to the evolving needs of its customers. This omnichannel strategy is crucial for acquiring and retaining customers in the competitive banking industry.

Capital Bank's marketing strategy is multifaceted, focusing on digital adoption and omnichannel integration to enhance customer engagement and acquisition. This includes the use of digital platforms and strategic partnerships to broaden its market reach.

Capital Bank operates through a network of physical branches, with 17 branches across Jordan as of December 31, 2024, serving personal and corporate banking segments. Complementing this, the bank has a robust digital footprint, including its mobile banking app and the Blink digital bank. These channels are integral to the bank's customer acquisition strategy.

In early 2022, Capital Bank launched Blink, a digital bank, to redefine banking for retail customers. The bank revamped its mobile banking app in October 2022, powered by Codebase Technologies' Digibanc platform. By October 2023, the mobile app saw a 120% increase in registrations, with a penetration rate of around 79%, and 26 new features launched.

Capital Bank launched its Open Banking and Finance Platform to facilitate seamless integration for fintech companies. This aligns with Jordan's vision of integrating financial institutions with the fintech ecosystem and promoting financial inclusion. This initiative is part of the bank's bank marketing plan.

Key partnerships have significantly contributed to Capital Bank's growth. The bank partners with fintechs and MSME lenders, such as Liwwa and Sanadcom, to broaden its target market. In April 2025, Capital Bank partnered with Falcons Soft to expand electronic point-of-sale (POS) services across Jordan, offering advanced e-payment services to a wider network of merchants.

Capital Bank leverages strategic partnerships and technology to enhance its sales channels. The bank's partnership with Temenos for core banking technology has been instrumental in its rapid expansion. These partnerships and technological advancements are crucial for the bank's competitive analysis marketing.

- Partnerships with fintechs and MSME lenders to broaden its target market.

- Use of Temenos core banking technology for rapid expansion and integration.

- Launch of Blink, a digital bank, to redefine banking for retail customers.

- Integration of an Open Banking and Finance Platform for fintech collaboration.

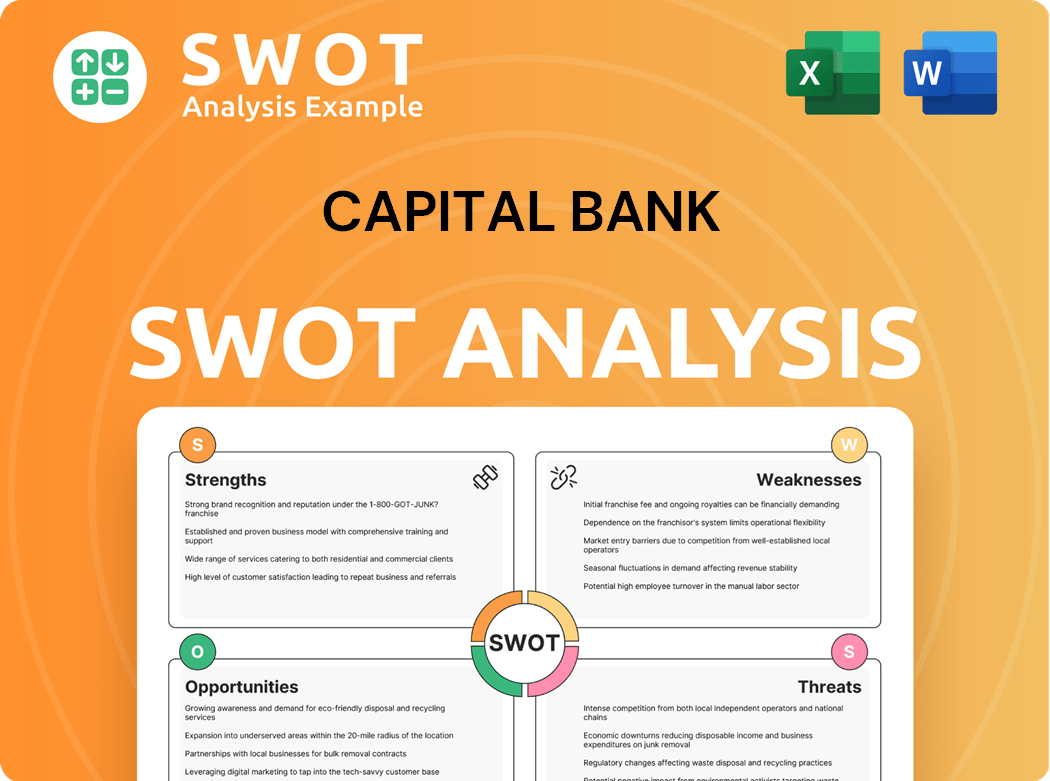

Capital Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Capital Bank Use?

The marketing tactics of Capital Bank are designed to boost brand awareness, generate leads, and drive sales through a mix of digital and traditional methods. A strong emphasis is placed on digital transformation to improve customer experience and operational efficiency. Capital Bank uses data-driven marketing, customer segmentation, and personalization to better understand customer needs and build stronger relationships. This approach is key to their Growth Strategy of Capital Bank.

Capital Bank's strategy involves leveraging digital channels and traditional marketing efforts, as well as community-focused initiatives. The bank's initiatives, often involving employee volunteerism, contribute to brand awareness and positive community perception. The bank also uses public relations and press releases to announce financial results, strategic partnerships, and awards.

Capital Bank's approach to marketing involves a blend of digital and traditional tactics, aiming to enhance customer experience and drive operational efficiency. The bank focuses on data-driven marketing, customer segmentation, and personalization to deepen its understanding of customer needs and build stronger relationships. This approach is supported by the use of advanced technologies like machine learning and AI to predict demand for banking products and target specific cross-selling offers.

Capital Bank uses machine learning and AI to analyze customer data, predicting demand for banking products. This enables targeted cross-selling, increasing conversion rates. The bank uses an IBM Cloud Pak for Data platform for centralized data analysis and quicker decision-making.

The launch of digital bank, Blink, in early 2022, redefined banking for retail customers. The revamped mobile banking app, powered by Codebase Technologies, focuses on personalized experiences. By October 2023, the bank reported a 120% increase in mobile app registrations.

The mobile app saw a 79% penetration rate by October 2023, with 26 new features launched. The bank integrates advanced solutions like contactless payments and biometric authentication. The Open Banking and Finance Platform facilitates integration with fintech companies.

Capital Bank engages in traditional marketing and community-focused initiatives. The bank focuses on financial literacy, entrepreneurship, women's empowerment, and environmental sustainability. The 'Capital Cares' club contributes to brand awareness and positive community perception.

The 2024 annual savings campaign, 'Starts with Gold, Ends with Cash,' generated significant client enthusiasm. The bank leverages public relations to announce financial results and strategic partnerships. Capital Bank announced a record 50% profit growth in 2024.

Capital Bank's marketing efforts support its financial performance. The focus on digital channels and data-driven strategies drives growth. The bank's strategic initiatives contribute to its overall success in the banking industry marketing landscape.

Capital Bank's marketing strategy focuses on a mix of digital and traditional tactics to build awareness and drive sales. The bank uses data-driven marketing, customer segmentation, and personalization to enhance customer relationships. Here are some key elements of their Capital Bank marketing strategy:

- Digital Marketing: Emphasis on digital channels, including the mobile app and Open Banking platform, to enhance customer experience and drive operational efficiency.

- Data-Driven Analysis: Utilizing machine learning and AI to analyze customer data for targeted marketing campaigns and cross-selling opportunities.

- Community Engagement: Implementing corporate social responsibility (CSR) initiatives to address local issues and build brand awareness.

- Traditional Marketing: Employing traditional marketing methods and public relations to announce financial results and strategic partnerships.

- Customer-Centric Approach: Focusing on personalized and user-friendly experiences to grow the customer base and improve retention.

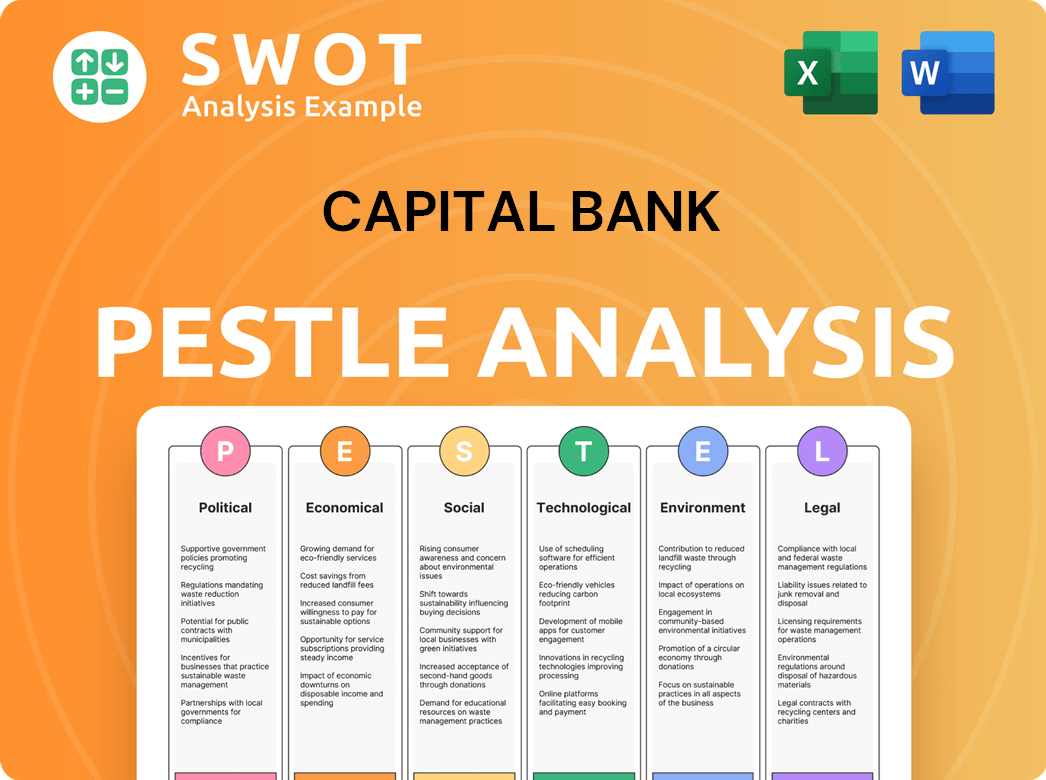

Capital Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Capital Bank Positioned in the Market?

Capital Bank positions itself as a leading financial institution in Jordan, focusing on commercial and investment banking. The bank aims to empower individuals, corporations, and the nation by offering innovative, simplified, and holistic financial solutions. This is achieved through enhanced products and a high level of customer service in the Jordanian and Iraqi markets.

The bank's brand identity is built on trust and personalized service, principles that have guided it for over 180 years. Capital Bank distinguishes itself through an ambitious growth strategy, including rapid expansion in local and regional markets. This is supported by strategic acquisitions and technological advancements, contributing to its ranking among the top banks in the region.

The bank's strategy includes a strong commitment to digital transformation, aiming to be the leading digitally enabled bank in Jordan. The launch of Blink, its digital bank in 2022, is a key differentiator, targeting a younger demographic and expanding its customer base through a true digital banking experience. This approach is part of its overall Capital Bank sales and marketing approach.

Capital Bank's sales strategy emphasizes customer-centric practices and excellence in digital banking services. The bank focuses on delivering a high-quality, personalized experience for all customers. This is supported by unified data management and advanced analytics to improve sales performance.

The bank's marketing strategy includes continuous enhancement of existing services and the introduction of new products. This is achieved by leveraging technology platforms such as Temenos core banking and IBM Cloud Pak for Data. The bank also uses content marketing for banking to attract new customers.

Capital Bank is committed to being the number one digitally enabled bank in Jordan. The bank has invested heavily in digital transformation, including the launch of Blink, its digital bank. This focus is part of the overall bank marketing plan.

The bank prioritizes customer experience through personalized service and innovative financial solutions. This includes the use of advanced analytics to understand customer needs and preferences. The bank aims to improve customer acquisition strategy.

Capital Bank differentiates itself through several key strategies, including strategic acquisitions and technological advancements. The bank's commitment to digital transformation and customer-centric practices sets it apart from competitors. The bank's sales goals and objectives are aligned with these differentiators.

- Rapid Expansion: Strategic acquisitions, such as Bank Audi's and Société Générale Bank's businesses, have fueled rapid growth.

- Digital Innovation: The launch of Blink and other digital initiatives enhance the customer experience.

- Customer-Centric Approach: Personalized service and innovative financial solutions are key priorities.

- Awards and Recognition: Receiving awards like 'Best Digital Bank' in Jordan validates its strategy.

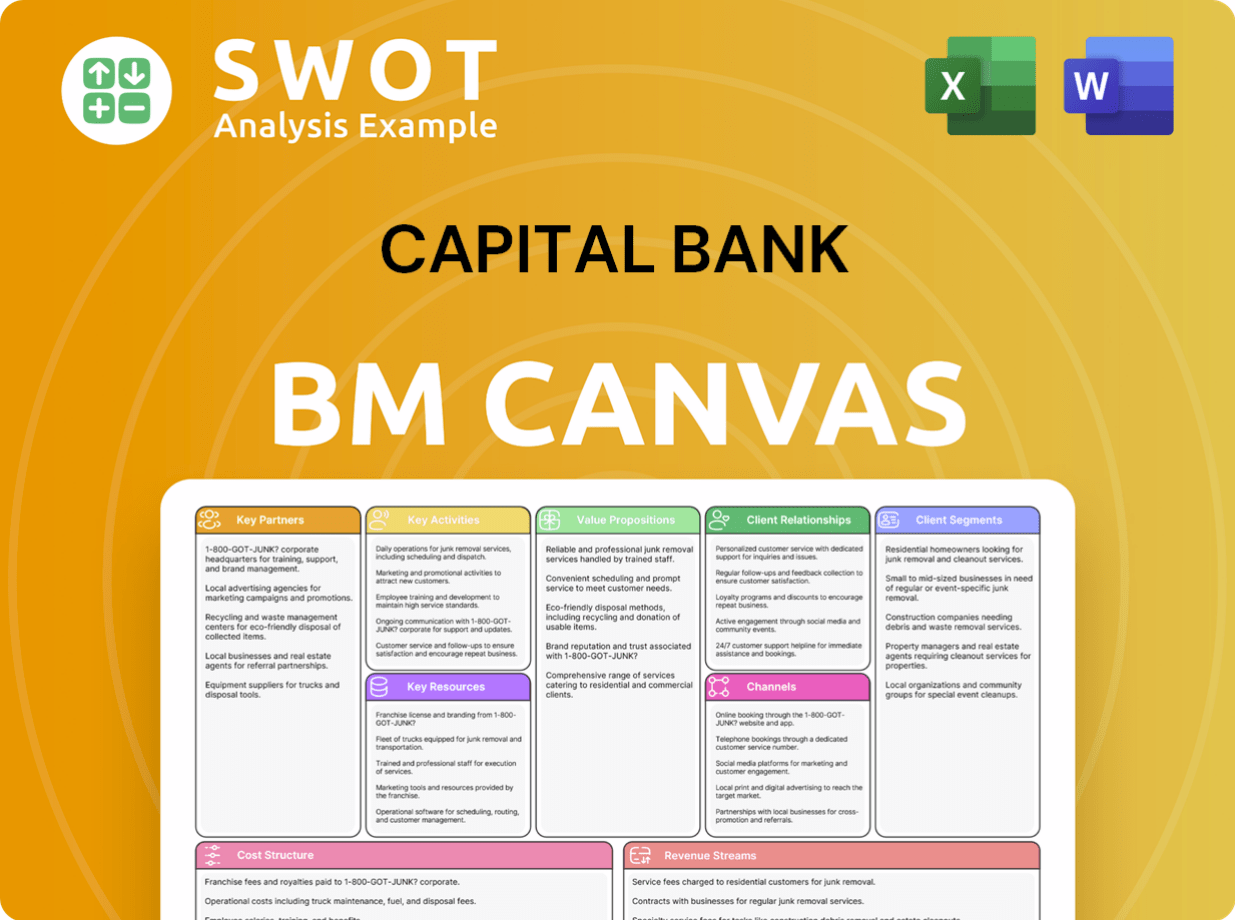

Capital Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Capital Bank’s Most Notable Campaigns?

The sales and marketing strategy of Capital Bank has been characterized by impactful campaigns designed to build brand awareness, drive customer acquisition, and foster customer loyalty. These initiatives, spanning various channels and targeting diverse segments, reflect a commitment to innovation and community engagement within the banking industry. Capital Bank's approach, as demonstrated through its key campaigns, showcases a forward-thinking strategy aimed at achieving sustainable growth and maintaining a competitive edge.

Through a mix of traditional and digital marketing techniques, Capital Bank has successfully launched campaigns that resonate with its target audience. These campaigns have not only enhanced the bank's market presence but also contributed significantly to its financial performance. The bank's marketing plan emphasizes a customer-centric approach, ensuring that each campaign delivers value and meets the evolving needs of its clients. The strategic use of digital platforms, community engagement, and innovative products has played a crucial role in its success.

Capital Bank's sales strategy and marketing efforts are designed to meet specific sales goals and objectives. These efforts include detailed customer acquisition strategies, content marketing for banking, and a robust social media marketing strategy. The bank's performance is continuously analyzed to optimize sales processes and refine its marketing budget allocation. Through these methods, Capital Bank aims to improve its brand awareness and competitive analysis within the financial services sector.

This campaign aimed to promote a culture of saving and provide exceptional value to clients. The campaign theme featured gold prizes at the start and substantial cash prizes at the end. The multi-channel campaign included promotions at bank branches in Zarqa, Irbid, and Amman, along with broader advertising. The campaign was a success, exceeding expectations and generating 'incredible enthusiasm' from clients.

Blink aimed to redefine banking for retail customers, particularly those aged 18 to 40, and expand the bank's footprint in new segments. Positioned as Jordan's first neobank, Blink emphasized convenience and digital onboarding. The primary channel was a new mobile banking app powered by Codebase Technologies' Digibanc platform. The launch of Blink led to a 120% increase in mobile app registrations.

In March 2025, Capital Bank hosted a charitable iftar for underprivileged children as part of its 30th-anniversary celebrations. The event aimed to promote solidarity and community spirit. Bank employees volunteered their time to engage with children through educational and recreational activities. This initiative reinforced the bank's dedication to its social programs, contributing to a positive brand perception.

Capital Bank's digital transformation efforts, including partnerships with IBM and JBS to build a data platform for machine learning and artificial intelligence, are a continuous 'campaign'. This strategic move aims to provide more personalized services and develop products compatible with unique customer needs. The digital initiatives aim to enhance customer experience and operational efficiency.

Capital Bank's sales and marketing approach is multifaceted, incorporating digital platforms, community engagement, and innovative product development. The bank's focus on customer acquisition strategy and a robust digital marketing strategy has been key to its success.

- The 'Starts with Gold, Ends with Cash' campaign included substantial cash prizes, reinforcing client trust.

- The launch of Blink resulted in a significant increase in mobile app registrations.

- Community-focused campaigns have enhanced Capital Bank's brand perception.

- Ongoing digital transformation efforts are aimed at improving customer experience.

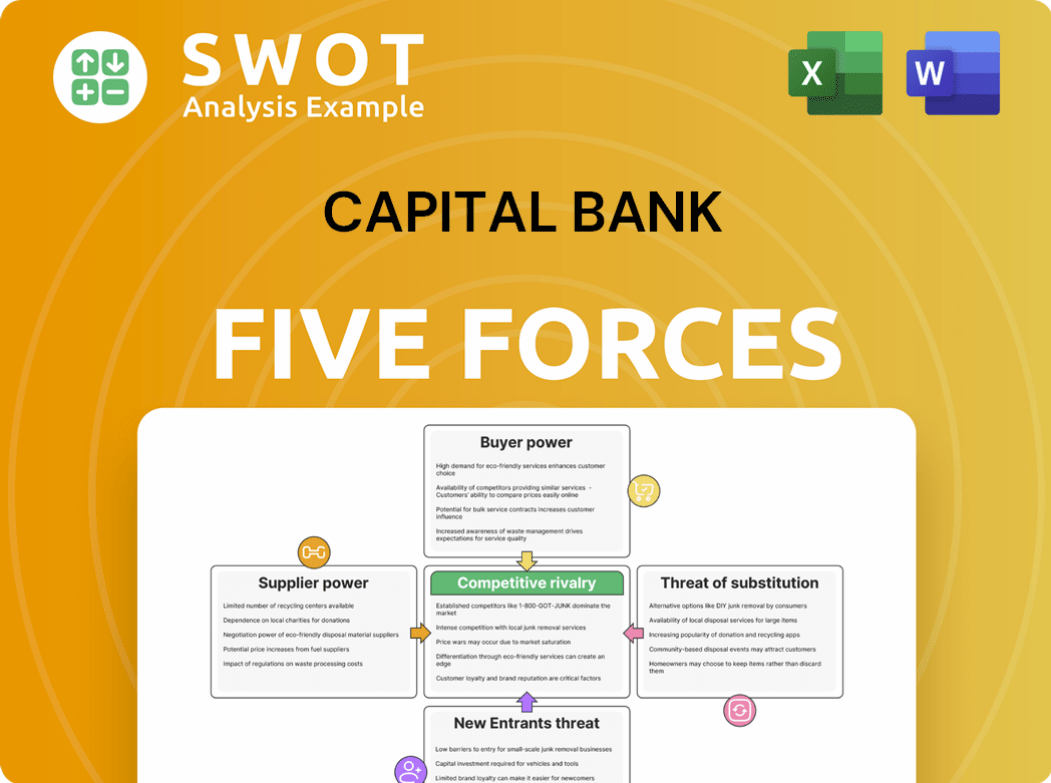

Capital Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Capital Bank Company?

- What is Competitive Landscape of Capital Bank Company?

- What is Growth Strategy and Future Prospects of Capital Bank Company?

- How Does Capital Bank Company Work?

- What is Brief History of Capital Bank Company?

- Who Owns Capital Bank Company?

- What is Customer Demographics and Target Market of Capital Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.