Cemex Bundle

How Does Cemex Dominate the Global Building Materials Market?

The building materials market is a battlefield of innovation and competition, and Cemex is a key player in this dynamic environment. Founded in 1906, Cemex has transformed from a regional cement producer into a global powerhouse. But how does Cemex navigate this complex landscape and maintain its leading position?

To understand Cemex's success, we must delve into its competitive landscape, examining its rivals, market strategies, and financial performance. This Cemex SWOT Analysis will provide a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats. Analyzing Cemex's market share analysis 2024 and its global presence offers crucial insights into its competitive advantages and disadvantages within the cement industry. Understanding how Cemex competes in the construction industry is essential for investors and strategists alike.

Where Does Cemex’ Stand in the Current Market?

Cemex holds a significant position in the global building materials market, particularly in cement, ready-mix concrete, and aggregates. The company's core operations involve producing and distributing these materials to various construction projects worldwide. Cemex's value proposition centers on providing high-quality building materials and innovative solutions to its customers, supporting infrastructure, housing, and industrial projects.

In 2023, Cemex reported net sales of approximately $17.4 billion, showcasing its substantial financial scale within the industry. This financial performance underscores Cemex's ability to maintain a strong market presence and adapt to the cyclical nature of the construction sector. The company's strategic focus on digitalization and sustainability further enhances its value proposition, aligning with evolving market demands.

Cemex's primary product lines—cement, ready-mix concrete, and aggregates—cater to a broad spectrum of customer segments, including housing, infrastructure, and industrial projects. The company's geographical presence spans across the Americas, Europe, Africa, the Middle East, and Asia, demonstrating its global reach and market diversification. This widespread presence allows Cemex to capitalize on diverse market opportunities and mitigate regional economic fluctuations.

Cemex consistently ranks among the top global producers of building materials. While specific global market share figures for 2024-2025 are subject to ongoing market dynamics, Cemex maintains a strong competitive position. Its extensive operations and diverse product offerings contribute to its significant market presence.

Cemex has a robust presence across the Americas, Europe, Africa, the Middle East, and Asia. This global reach allows the company to serve diverse markets and mitigate risks associated with regional economic downturns. Cemex's strategic presence in emerging economies also supports its growth strategy.

Cemex emphasizes digitalization and sustainability through initiatives like 'Operation Resilience' and 'Future in Action.' These programs aim to improve operational efficiency and reduce CO2 emissions. These strategies reflect a move towards higher-value offerings and a commitment to sustainable practices.

Cemex's financial health, as evidenced by its net sales and strategic investments, positions it as a resilient player. The company's ability to navigate the cyclical nature of the construction sector highlights its financial strength. This resilience is crucial for maintaining a competitive edge.

The Cemex competitive landscape is shaped by factors such as global construction trends, regional economic conditions, and the rise of sustainable building practices. Cemex market analysis indicates a focus on adapting to these dynamics through innovation and strategic investments. The company's response to industry challenges includes a commitment to reducing its environmental impact.

- Emphasis on sustainable building materials and practices.

- Strategic investments in digital technologies to improve efficiency.

- Expansion into emerging markets to diversify revenue streams.

- Focus on customer-centric solutions and value-added services.

For more insights into Cemex's growth strategy, consider reading this article: Growth Strategy of Cemex.

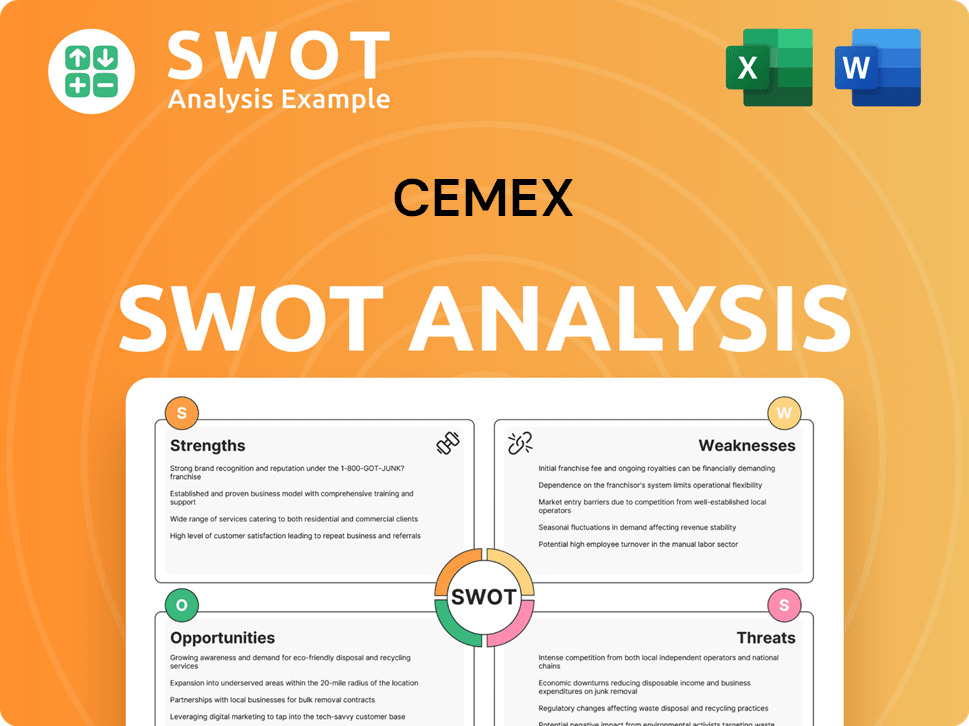

Cemex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Cemex?

The Cemex competitive landscape is shaped by a global building materials market characterized by intense competition. Key players continually vie for market share, leveraging diverse strategies such as innovation, sustainability, and strategic acquisitions. Understanding these dynamics is crucial for analyzing Cemex's market position and future prospects.

Cemex faces both direct and indirect competition from a variety of companies. The primary competitors include major global players in the cement, concrete, and aggregates sectors. These companies compete across various dimensions, including product offerings, geographic reach, and financial performance.

The building materials market is dynamic, with evolving competitive pressures. Emerging trends, such as the demand for sustainable construction materials and advanced technologies, further influence the competitive environment. This necessitates continuous adaptation and strategic initiatives to maintain a strong market position.

Holcim, formerly LafargeHolcim, is a major competitor with a significant global presence. The company is known for its broad product portfolio, including cement, aggregates, and ready-mix concrete. Holcim's focus on sustainable construction solutions directly challenges Cemex.

Heidelberg Materials, formerly HeidelbergCement, is another major global player. It competes directly with Cemex in the cement and aggregates markets. Heidelberg Materials has a substantial global footprint, particularly in Europe and North America.

CRH plc is an Irish multinational company with a strong presence in aggregates and asphalt. It has a growing footprint in cement, especially in the Americas. CRH's extensive distribution networks and focus on infrastructure projects pose a competitive challenge.

These competitors challenge Cemex through various strategies. Holcim and Heidelberg Materials often focus on product innovation and sustainability initiatives. CRH leverages its strong distribution networks and infrastructure project focus. High-profile competition often involves major infrastructure contracts and market share in key urban areas.

Emerging players, particularly those focused on green building materials or advanced construction technologies, represent a growing threat. These companies can disrupt traditional market dynamics. The industry has seen mergers and alliances that intensify the competitive landscape.

The cement industry is highly consolidated, with the top players controlling a significant portion of the global market. According to recent reports, Holcim and Heidelberg Materials hold substantial market shares globally. The demand for sustainable building materials is increasing, influencing competition.

Cemex's competitors employ diverse strategies to gain market share. These include investments in sustainable technologies, expansion through acquisitions, and strategic partnerships. The competitive landscape is also influenced by regional variations and specific project opportunities.

- Product Innovation: Developing and launching innovative cement and concrete products with enhanced performance and sustainability features.

- Sustainability Initiatives: Investing in technologies and processes to reduce carbon emissions and offer eco-friendly building materials.

- Strategic Acquisitions: Expanding market presence and consolidating market power through acquisitions of smaller companies or assets.

- Geographic Expansion: Targeting high-growth markets and expanding operations in regions with increasing construction activity.

- Pricing Strategies: Implementing competitive pricing models to attract customers and maintain market share.

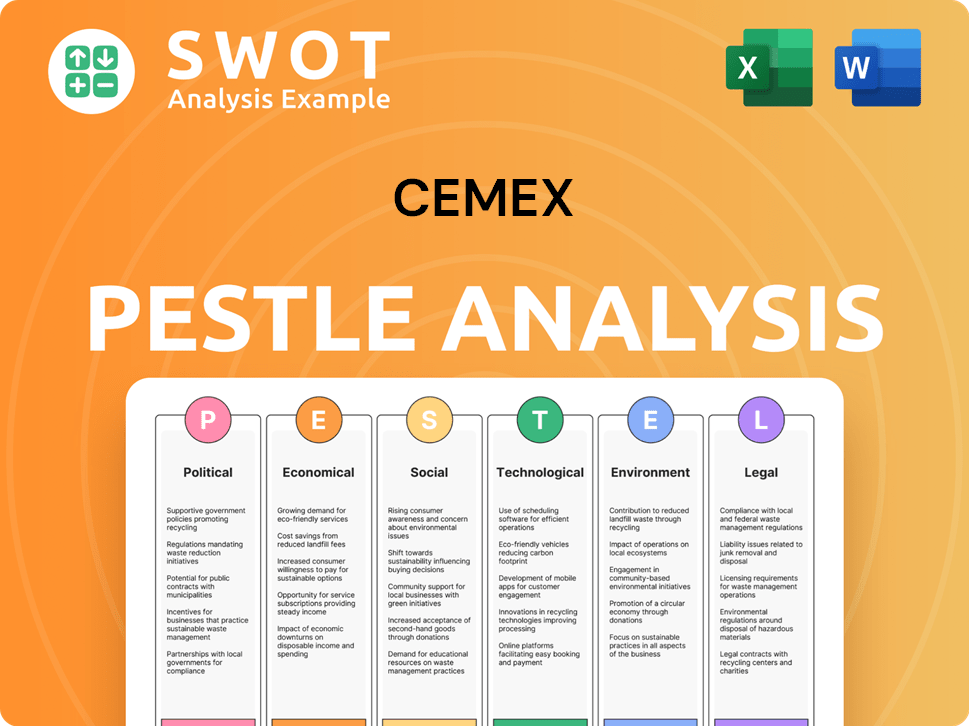

Cemex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Cemex a Competitive Edge Over Its Rivals?

The competitive advantages of the company, a major player in the cement industry, are rooted in a robust global presence and operational efficiencies. Its extensive distribution network and supply chain allow for efficient delivery of cement, ready-mix concrete, and aggregates across multiple continents. This logistical prowess ensures timely supply and responsiveness to customer demands, which is critical in the building materials market.

The company's strategic advantages are also bolstered by economies of scale, enabling it to optimize production costs and maintain competitive pricing, especially in high-volume product categories. Furthermore, continuous investment in proprietary technologies and research and development has positioned the company at the forefront of sustainable building solutions. This includes its Vertua lower-carbon cement products, which address the growing demand for environmentally friendly construction materials.

Over a century of brand equity has fostered strong customer loyalty and trust, providing a significant intangible asset. The company's strategic partnerships and collaborations within the construction ecosystem further solidify its market position. These advantages have evolved over time, with a recent emphasis on digitalization and sustainable practices. The company leverages these strengths in its marketing, product development, and strategic partnerships, aiming to maintain its leadership in the cement industry.

The company's global distribution network is a key competitive advantage, enabling efficient delivery of products worldwide. This extensive reach allows it to serve diverse markets and respond quickly to customer needs. The company's robust supply chain ensures timely delivery of construction materials, which is crucial in the building materials market.

The company benefits significantly from economies of scale, optimizing production costs and maintaining competitive pricing. This advantage is particularly evident in high-volume product categories, allowing the company to offer cost-effective solutions. The company's ability to manage costs effectively enhances its competitive standing.

The company's commitment to research and development, including sustainable building solutions, enhances its competitive edge. Its Vertua lower-carbon cement products meet the growing demand for environmentally friendly construction materials. This focus on innovation aligns with global sustainability trends, attracting environmentally conscious clients.

The company's brand equity, built over a century, fosters strong customer loyalty and trust. This intangible asset provides a significant competitive advantage in the market. Strategic partnerships and collaborations within the construction ecosystem further solidify its market position.

The company's competitive advantages include a global distribution network, economies of scale, technological innovation, and strong brand equity. These strengths are crucial in the cement industry, helping the company maintain its market position. The company's strategic moves, such as focusing on sustainable products, are key to its long-term success. To understand more about the company's growth strategy, you can read about the Growth Strategy of Cemex.

- Extensive Global Reach: Serving customers worldwide with efficient logistics.

- Cost Efficiency: Leveraging economies of scale to optimize production.

- Sustainable Solutions: Offering innovative, eco-friendly products.

- Strong Brand: Building customer loyalty and trust over time.

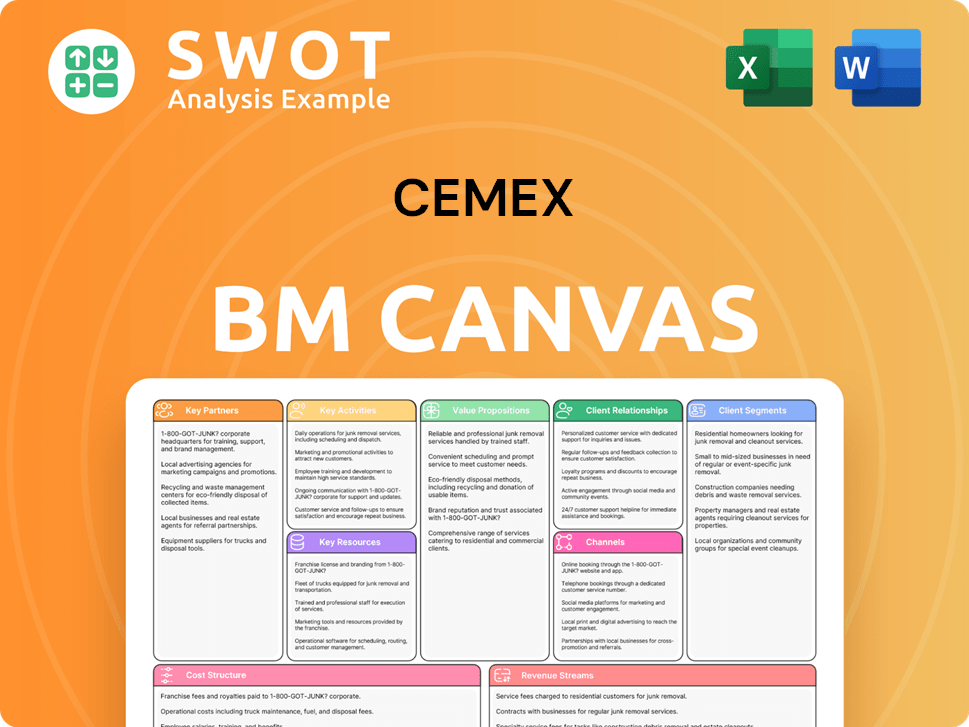

Cemex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Cemex’s Competitive Landscape?

The Owners & Shareholders of Cemex face a dynamic landscape shaped by industry trends, challenges, and opportunities. Understanding the Cemex competitive landscape is crucial for investors and stakeholders. The building materials market is undergoing significant shifts, demanding strategic adaptation to ensure long-term success and maintain a strong Cemex market position.

Cemex's financial performance and its ability to navigate these changes will be key determinants of its future. The company's response to these factors will significantly influence its competitive standing and its ability to capitalize on emerging opportunities in the cement industry.

The cement industry is seeing a growing demand for sustainable construction materials and practices. Digitalization and automation are also reshaping the industry, from supply chains to smart factories. Regulatory changes and stricter emissions standards are pushing companies toward green technologies.

Transitioning to a low-carbon economy requires substantial capital investment. The industry faces potential disruptions from new market entrants with innovative materials. Geopolitical instability and fluctuating energy prices pose ongoing threats to raw material costs.

The growing demand for sustainable products offers a substantial market for Cemex's eco-friendly solutions. Digitalization can enhance operational efficiency and reduce costs. Emerging markets, especially those with high urbanization rates, offer significant growth potential.

Cemex's 'Future in Action' program, targeting a 47% reduction in CO2 emissions by 2030, demonstrates its proactive approach. Strategic partnerships and innovation are key to maintaining a competitive edge. The company aims to evolve its competitive position and remain resilient.

Cemex's commitment to sustainability, with a target of reducing CO2 emissions by 47% by 2030, is a critical aspect of its strategy. The company is investing in eco-friendly solutions, such as its Vertua line, to meet the growing demand for green building materials. Digitalization and automation are also key areas of investment for Cemex, aiming to improve operational efficiency and customer service.

- Cemex's focus on sustainable products positions it well to capitalize on the increasing demand for green building materials.

- Digitalization efforts are expected to enhance operational efficiency and reduce costs, improving the company's competitive standing.

- Strategic partnerships and innovation are vital for Cemex to stay ahead of market trends and maintain its competitive advantage.

- The company's financial performance and market share analysis in 2024 will be key indicators of its success in navigating these challenges and opportunities.

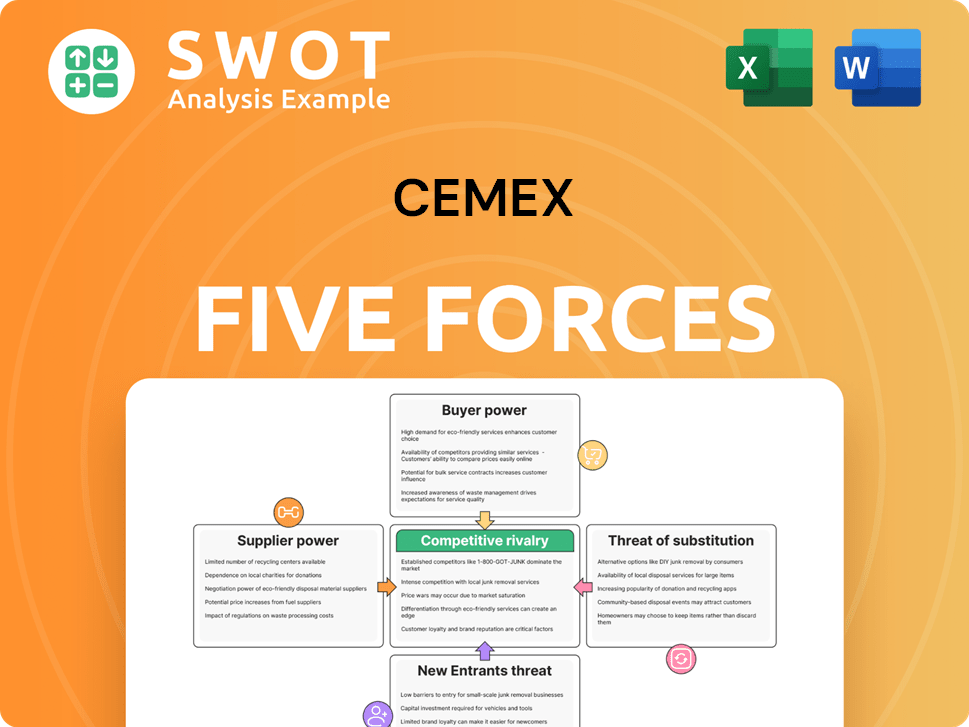

Cemex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cemex Company?

- What is Growth Strategy and Future Prospects of Cemex Company?

- How Does Cemex Company Work?

- What is Sales and Marketing Strategy of Cemex Company?

- What is Brief History of Cemex Company?

- Who Owns Cemex Company?

- What is Customer Demographics and Target Market of Cemex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.