Cemex Bundle

Who Really Owns Cemex?

Unraveling the Cemex SWOT Analysis is just the beginning; the true power lies in understanding its ownership. Cemex, a global leader in building materials, has a complex ownership structure that dictates its strategic direction and future. Knowing who controls Cemex is crucial for anyone looking to invest or understand the market.

From its humble beginnings in Mexico to its current status as a multinational corporation, the Cemex company has seen significant shifts in its Cemex ownership. This exploration will delve into the Cemex ownership structure, detailing the influence of major shareholders and the evolution of the Cemex corporation. Understanding the Cemex owner is key to grasping the company's long-term vision and operational strategies, especially given its Cemex headquarters location and global footprint.

Who Founded Cemex?

The story of Cemex's growth strategy begins in 1906 with its founding as Cementos Hidalgo in Hidalgo, Nuevo León, Mexico. The establishment of the company was a pivotal moment in Mexican industrial history, driven by the vision of key figures like Lorenzo Zambrano, Sr., and other Mexican business leaders. Their primary goal was to create a robust cement production facility to support the nation's infrastructure development.

The initial ownership structure of the

While specific details regarding the exact equity distribution at the time of the company's inception are not readily available in public records, it is understood that the founding team's vision was reflected in the initial capital allocation. The focus was on building a vertically integrated and regionally dominant cement producer. There is no widely publicized information available about early ownership disputes or buyouts from the company's initial phase.

Understanding the early ownership of

- The founders, including Lorenzo Zambrano, Sr., played a critical role in the early stages.

- Early investors recognized the potential in the building materials sector.

- The focus was on establishing manufacturing and distribution networks.

- There are no widely publicized details on early ownership disputes or buyouts.

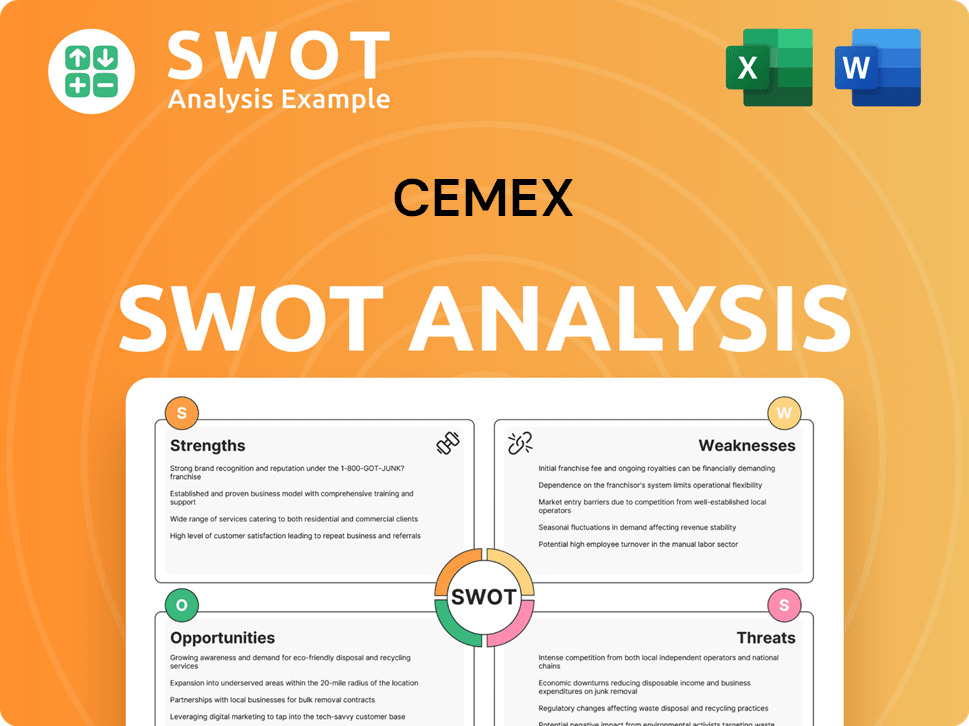

Cemex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Cemex’s Ownership Changed Over Time?

The evolution of Cemex's ownership reflects its growth from a regional player to a global leader in the building materials industry. Initially, the company was closely held, with the founding Zambrano family maintaining significant control. The transition to a publicly traded entity, marked by its listing on the Mexican Stock Exchange and later the New York Stock Exchange, broadened its investor base and introduced institutional investors.

Key events impacting Cemex's ownership structure include its initial public offering (IPO) and subsequent equity offerings, which diluted the family's stake. Acquisitions, such as the purchase of RMC Group in 2005, also played a role, as these often involved issuing new shares. Furthermore, the company's expansion into new markets and strategic partnerships influenced the distribution of ownership, leading to a more diversified shareholder base.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Broadened investor base, diluted family control | Not readily available, but many decades ago |

| Acquisition of RMC Group | Issued new shares, increased institutional ownership | 2005 |

| Subsequent Equity Offerings | Further diluted family stake, attracted institutional investors | Ongoing |

As of early 2025, the ownership of Cemex is characterized by a mix of institutional investors, mutual funds, and the remaining stake held by the Zambrano family. While specific percentages fluctuate, major institutional holders like BlackRock and Vanguard consistently hold significant positions. The shift towards institutional ownership has influenced corporate strategy, emphasizing shareholder value and global market penetration. The company's SEC filings provide detailed information on the latest ownership percentages.

Cemex's ownership structure has evolved significantly since its IPO, moving from family control to a more diversified model. Institutional investors now hold a substantial portion of the shares, influencing corporate strategy. The Zambrano family, descendants of the founders, still hold a notable stake in the company.

- The company is listed on the Mexican Stock Exchange (BMV) and the New York Stock Exchange (NYSE).

- Major shareholders include institutional investors, mutual funds, and index funds.

- The shift has led to a greater focus on shareholder value and global market penetration.

- Specific ownership percentages are detailed in the latest SEC filings.

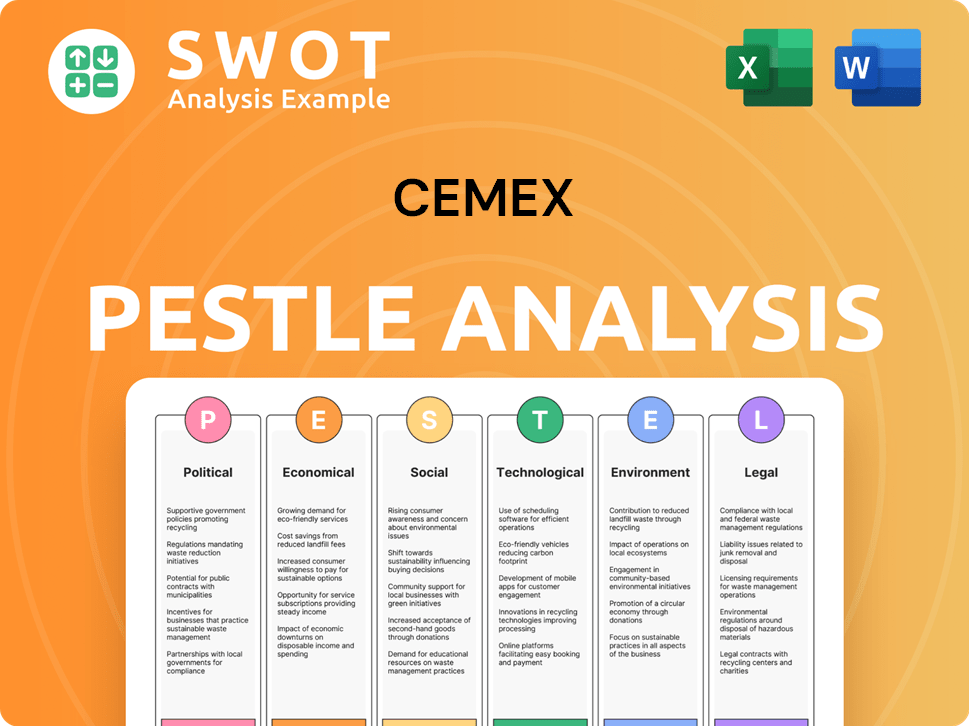

Cemex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Cemex’s Board?

The Board of Directors of the Cemex company plays a vital role in its governance and strategic direction. As of early 2025, the board includes a mix of independent directors, representatives of major shareholders, and executive management. These individuals bring extensive experience in finance, international business, and the construction industry. The presence of independent directors is a key aspect of modern corporate governance, ensuring a balance of power and oversight within the organization. The specific composition of the board may change over time, but the commitment to a diverse and experienced leadership team remains a constant.

While specific board members representing major institutional shareholders are not always explicitly identified as such, the influence of these large investors is significant. The board's structure aims to reflect the diverse interests of its ownership base, promoting transparency and accountability. The board's decisions are crucial in shaping the company's future, including strategic initiatives, financial performance, and overall corporate strategy. The board's composition and actions are closely watched by investors and stakeholders alike.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Rogelio Zambrano Lozano | Chairman of the Board | Extensive experience in the construction materials industry and corporate governance. |

| Fernando A. González Olivieri | Chief Executive Officer | Deep knowledge of the company's operations and strategic direction. |

| Independent Directors | Various | Diverse backgrounds in finance, international business, and other relevant fields. |

Cemex operates primarily under a one-share-one-vote structure for its common shares. This structure promotes a more equitable distribution of voting power among shareholders. The influence of large institutional investors is exerted through their voting on board elections, executive compensation, and other corporate matters, shaping decision-making within the company. This approach ensures that the company's decisions are aligned with the interests of its shareholders and promotes transparency in its governance practices. There are no publicly available details about dual-class shares or special voting rights.

The ownership of Cemex is primarily distributed among institutional investors and the founding families. The board of directors oversees the company's strategic direction and governance. Key decisions, such as board elections and executive compensation, are influenced by shareholder voting.

- Cemex is a publicly traded company, making its ownership accessible to various investors.

- The company's governance structure is designed to balance the interests of all shareholders.

- The board's composition reflects a commitment to experience and diversity.

- The one-share-one-vote structure ensures equitable voting power.

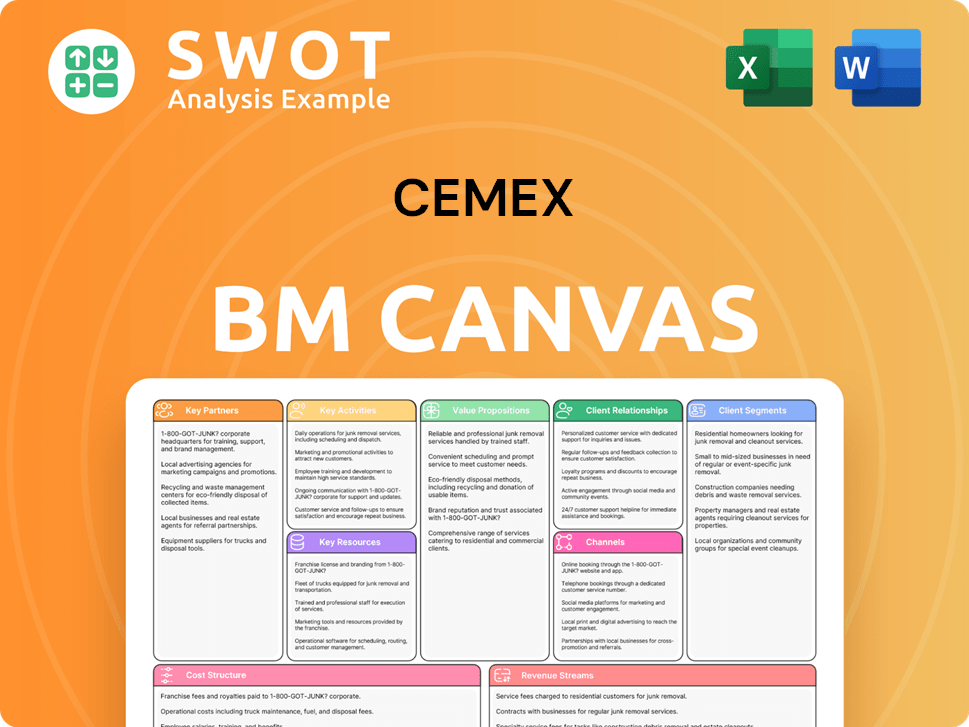

Cemex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Cemex’s Ownership Landscape?

Over the past few years (2022-2024), the ownership structure of the Cemex company has remained relatively stable, with no major shifts like complete privatization or significant public offerings. The company has focused on strategic initiatives that indirectly affect its ownership, such as share buyback programs designed to boost shareholder value and potentially increase earnings per share. Additionally, strategic divestitures of non-core assets have been employed to reshape the company's financial health and investor appeal.

Industry trends, including increased institutional ownership, have played a role in shaping the company's ownership profile. Large institutional investors and passive funds continue to be significant holders, reflecting a broader market trend towards consolidation among major asset managers. While the Zambrano family retains a notable presence, founder dilution is a natural outcome of a company's growth and public listing. The company's commitment to sustainability, digital transformation, and operational efficiency, as highlighted in recent financial reports and investor calls, continues to shape its appeal to various investor segments. Cemex's focus on ESG (Environmental, Social, and Governance) investing, such as reducing its carbon footprint, may attract new institutional investors.

| Metric | Details | Year (Approximate) |

|---|---|---|

| Market Capitalization | Approximately $8 billion | 2024 |

| Institutional Ownership | Around 50-60% of outstanding shares | 2024 |

| Share Buyback Programs | Ongoing, with varying amounts depending on financial performance | 2022-2024 |

The current ownership structure of the

The ownership structure is a mix of institutional investors, the Zambrano family, and public shareholders. Institutional investors hold a significant percentage of outstanding shares. The company's filings provide details on major shareholders.

Major shareholders include large institutional investors and members of the Zambrano family. The exact percentages fluctuate based on market activity. Information is available in Cemex's annual reports and SEC filings.

Share buyback programs and strategic divestitures are key initiatives. ESG investing is becoming increasingly important for attracting investors. The company is focused on sustainability and operational efficiency.

Cemex's focus on ESG factors, such as reducing its carbon footprint, is attracting new investors. This aligns with the growing trend of sustainable investing. ESG initiatives can influence the company's valuation.

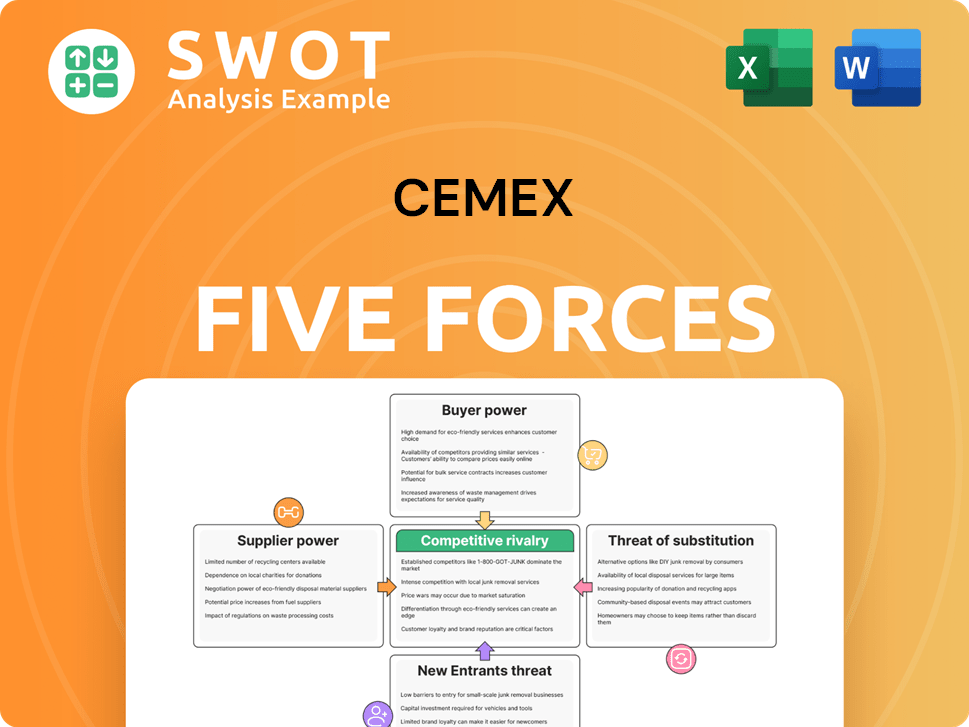

Cemex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cemex Company?

- What is Competitive Landscape of Cemex Company?

- What is Growth Strategy and Future Prospects of Cemex Company?

- How Does Cemex Company Work?

- What is Sales and Marketing Strategy of Cemex Company?

- What is Brief History of Cemex Company?

- What is Customer Demographics and Target Market of Cemex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.