Cemex Bundle

Can Cemex Cement a Strong Future?

Founded in 1906, Cemex has evolved from a Mexican cement producer to a global building materials giant. With operations spanning continents, Cemex has solidified its position as a key player in the construction industry. This article dives deep into the Cemex SWOT Analysis, exploring its growth strategy and future prospects.

Cemex's journey, marked by strategic acquisitions like Southdown Inc., showcases its commitment to expansion and market leadership. Understanding the Cemex Business Model and its ability to adapt to market changes is crucial. Analyzing Cemex's Financial Performance and its approach to Cemex revenue growth strategies will provide a comprehensive view of its potential and investment opportunities, including its long-term growth potential.

How Is Cemex Expanding Its Reach?

The Owners & Shareholders of Cemex can look forward to a growth strategy focused on expanding both geographically and in product offerings. The company is actively working to penetrate strategic urban markets and enhance its sustainable product lines. This approach aims to capture new customer segments and diversify revenue streams, moving beyond traditional cement sales.

A key element of the

The company’s

Cemex is increasing its presence in strategic urban markets. This expansion includes leveraging its vertically integrated operations to maximize efficiency and customer reach. The company aims to capitalize on the growing demand in these areas by providing a range of construction solutions.

The company is enhancing its product and service offerings, particularly within its Green Business initiatives. This includes expanding its Urbanization Solutions business, which offers sustainable products and services for urban development projects. The focus is on meeting the growing demand for sustainable construction.

This strategy aims to optimize the supply chain and operational footprint. Investments in new grinding mills and terminals, such as the new grinding facility in the Philippines, are part of this initiative. The goal is to better serve growing demand in key regions and improve operational efficiency.

This program targets carbon neutrality by 2050. It drives expansion into lower-carbon products like Vertua cement. Sales of these products are expected to continue growing significantly in 2024 and beyond, contributing to the company's sustainability objectives.

Cemex is focused on several key initiatives to drive growth. These include expanding its market presence, enhancing sustainable product offerings, and optimizing its operational efficiency through strategic investments and partnerships. The company's commitment to sustainability is a core driver of its expansion plans.

- Geographical expansion in strategic urban markets.

- Enhancement of sustainable product and service offerings.

- 'Operation Resilience' strategy to optimize the supply chain.

- 'Future in Action' program targeting carbon neutrality by 2050.

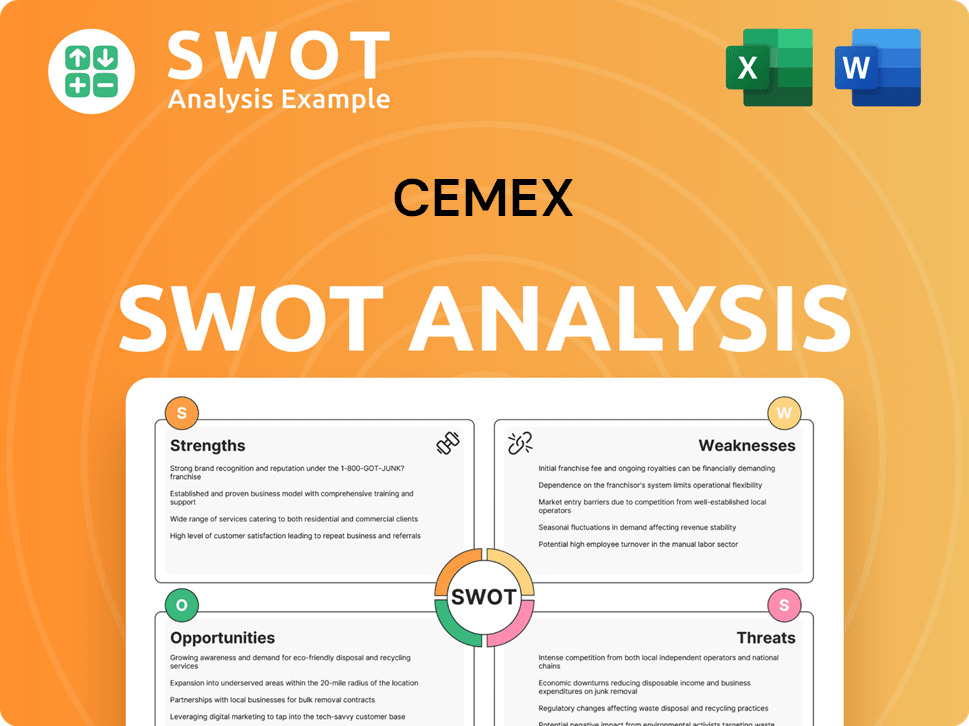

Cemex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cemex Invest in Innovation?

The Cemex Company is actively investing in innovation and technology as a core component of its growth strategy. This approach is designed to maintain its competitive edge and drive sustainable growth in the construction materials sector. The company's 'Future in Action' program underscores its commitment to achieving carbon neutrality, integrating sustainability into its core operations and product offerings.

A significant portion of Cemex's research and development (R&D) efforts is focused on creating sustainable building materials and advanced construction solutions. This strategic focus is essential for adapting to evolving market demands and regulatory pressures related to environmental sustainability. Cemex's emphasis on innovation is evident in its product development and operational strategies.

Cemex's innovation strategy encompasses both product development and operational improvements, with a strong emphasis on digital transformation and sustainable practices. This dual approach allows the company to address current market needs while preparing for future challenges and opportunities in the construction industry. The company's strategic initiatives are designed to enhance its market position and ensure long-term growth.

Cemex has made significant strides with its Vertua product line, which offers lower-carbon concrete and cement options. This initiative directly addresses the growing demand for environmentally friendly construction materials. The company's focus on sustainable products is a key element of its long-term growth strategy.

Sales of Vertua products reached 60% of total cement and concrete sales in 2023. This demonstrates a substantial shift towards sustainable products within Cemex's portfolio. The company aims to increase this to 70% by 2025, showcasing a clear commitment to sustainability goals.

Cemex is actively embracing digital transformation across its operations, including manufacturing and customer interaction. This includes leveraging artificial intelligence (AI) and the Internet of Things (IoT) to optimize production processes. The company's digital initiatives are designed to enhance efficiency and customer experience.

Cemex Go, the digital platform for order management and customer service, continues to be a key tool for improving operational efficiency. This platform processes over 60% of global sales by 2024. The platform's success underscores the importance of digital solutions in the construction industry.

Cemex is exploring cutting-edge technologies for carbon capture, utilization, and storage (CCUS) as part of its long-term decarbonization roadmap. This involves collaborations with external innovators and research institutions. The company's commitment to CCUS highlights its proactive approach to reducing its environmental impact.

The company's commitment to innovation is further evidenced by its recognition in various industry awards for its sustainable solutions and digital advancements. These accolades reflect Cemex's dedication to excellence and its leadership in the construction materials sector. Recognition validates the effectiveness of Cemex's innovation efforts.

Cemex's innovation strategy is multifaceted, encompassing sustainable materials, digital transformation, and advanced technologies. These initiatives are crucial for maintaining a competitive advantage and achieving long-term growth potential. The company's focus on these areas is a key aspect of its Cemex Growth Strategy.

- Sustainable Materials: Development and expansion of the Vertua product line, focusing on lower-carbon concrete and cement to meet environmental standards and customer demand.

- Digital Transformation: Implementation of AI and IoT to optimize production, improve supply chain efficiency, and enhance customer experience through platforms like Cemex Go.

- Carbon Capture, Utilization, and Storage (CCUS): Exploration and implementation of CCUS technologies to reduce carbon emissions and support decarbonization goals.

- Strategic Partnerships: Collaboration with external innovators and research institutions to accelerate the development and deployment of new technologies.

- Operational Efficiency: Continuous improvement of production processes and supply chain management to reduce costs and increase efficiency.

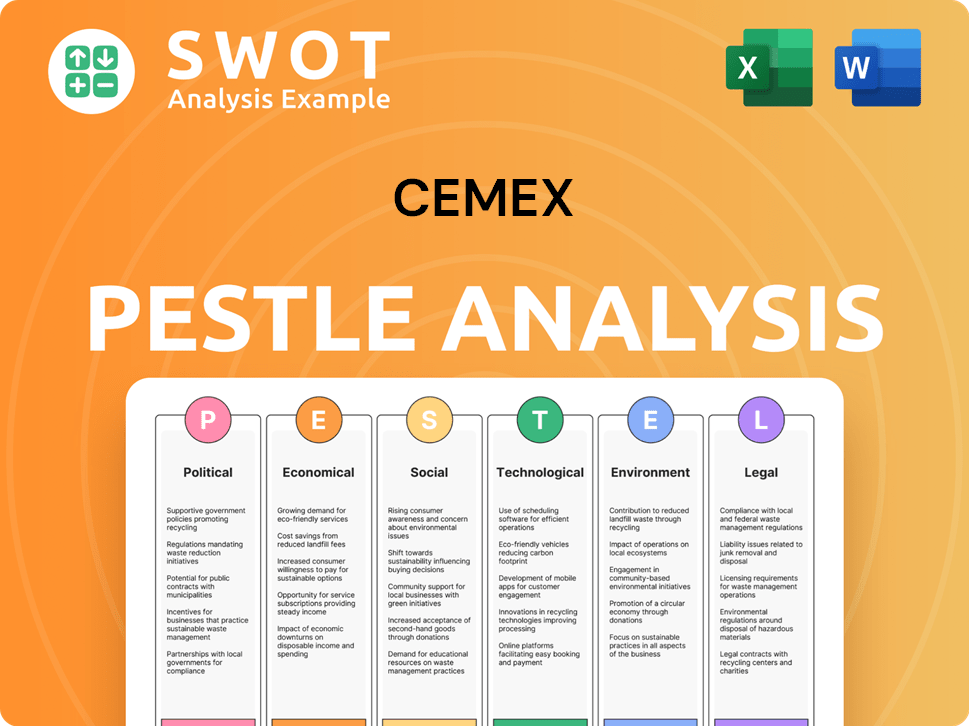

Cemex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cemex’s Growth Forecast?

The financial outlook for the company reflects a strategic focus on profitable growth, driven by its 'Future in Action' program. This program is central to the company's strategy, guiding its investments and operational improvements. The company's approach emphasizes disciplined capital allocation, ensuring resources are directed towards the most promising opportunities.

For 2024, the company anticipates robust performance, projecting consolidated net sales to increase by a mid-single-digit percentage. This growth builds on the strong momentum from 2023, where the company reported net sales of $17.4 billion. This positive outlook is supported by strategic investments in key areas and a focus on operational efficiency.

The company expects a Free Cash Flow after Maintenance Capital Expenditures of approximately $600 million in 2024. This is a significant indicator of its financial health and ability to fund future growth initiatives. This financial strength allows the company to pursue its strategic goals, including decarbonization projects and capacity expansions.

The company's revenue growth strategies include expanding its sustainable product portfolio and optimizing operational efficiency. The company focuses on high-growth markets and strategic partnerships to drive sales. These strategies are designed to enhance the company’s market share and overall financial performance.

The company conducts thorough market analysis to identify opportunities and adapt to changes. This includes assessing regional demand, understanding competitive dynamics, and evaluating the impact of economic trends. This proactive approach helps the company make informed decisions and maintain a competitive edge. You can learn more about this in Target Market of Cemex.

The company's expansion plans for 2024 include strategic investments in high-growth markets and capacity expansions. These investments are targeted to increase production capacity and meet rising demand. The company's expansion strategy is aligned with its long-term growth objectives and commitment to sustainable practices.

The company is committed to sustainability through decarbonization projects and the use of sustainable products. These initiatives are designed to reduce the company's environmental impact and contribute to a more sustainable future. This commitment is a key part of the company's 'Future in Action' program.

The company is committed to maintaining healthy profit margins by optimizing operational efficiency and leveraging its sustainable product portfolio. Investment levels are strategically directed towards decarbonization projects, digital transformation, and capacity expansions in high-growth markets. The company's long-term financial goals are aligned with its 'Future in Action' program, aiming for sustainable profitability and increased shareholder value through a disciplined approach to debt reduction and reinvestment in its core businesses. The company's deleveraging efforts have been significant, with a reported net debt to EBITDA ratio of 2.07x as of Q1 2024, indicating improved financial flexibility. This financial narrative underpins the company's strategic plans, demonstrating a clear path towards sustainable growth and enhanced financial performance.

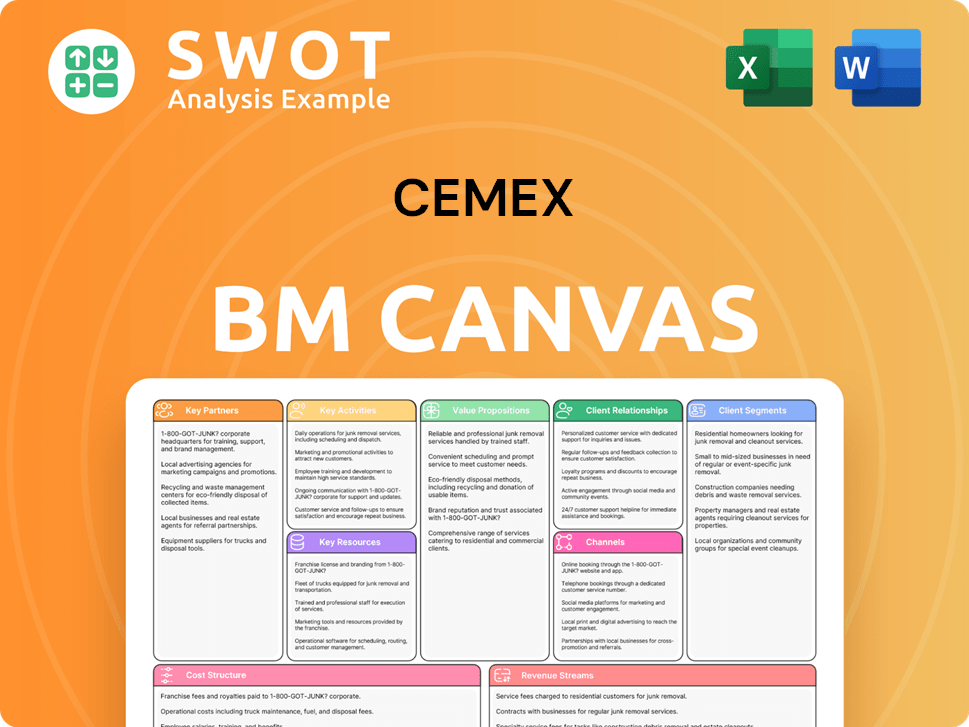

Cemex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cemex’s Growth?

The growth strategy and future prospects of the Cemex Company are subject to various risks and obstacles. These challenges span market competition, regulatory changes, supply chain vulnerabilities, and technological disruptions. Addressing these issues is crucial for Cemex's sustained success and expansion in the construction materials industry.

Market competition, particularly from regional players, presents a continuous challenge, impacting pricing and market share. Regulatory changes, especially concerning environmental policies, require significant investments and operational adjustments. Furthermore, supply chain disruptions and technological advancements pose ongoing risks that Cemex must actively manage.

Internal constraints, such as skilled labor shortages and capital allocation limitations, can also hinder expansion. Despite these challenges, Cemex employs a comprehensive risk management framework, including geographical diversification and scenario planning, to mitigate potential impacts and ensure long-term growth. Understanding these risks is crucial for investors and stakeholders assessing Cemex's future trajectory.

Competition from regional players and new entrants impacts pricing power and market share. The construction materials market is highly competitive, with numerous companies vying for market share. Cemex's ability to maintain its competitive edge is critical for its Cemex Growth Strategy.

Environmental policies and carbon emissions regulations require substantial investments. Stricter regulations in Europe and other regions can increase operational costs. Compliance with evolving standards is a continuous challenge for Cemex.

Disruptions in raw material availability or transportation logistics pose a risk. Global supply chain issues can impact Cemex's operations. The company mitigates this through supplier diversification.

Failure to adapt to new construction methods or material innovations can be a risk. Technological advancements require continuous adaptation and investment in research and development. Cemex must stay ahead of the curve to maintain its Cemex Competitive Advantage Analysis.

Skilled labor shortages and capital allocation limitations can hinder expansion. Efficient resource management is crucial for Cemex's growth. Strategic planning is essential to overcome these internal challenges.

Increasing geopolitical instability and the accelerating pace of climate change pose emerging risks. These factors can significantly shape Cemex's future trajectory. Continuous adaptation and strategic foresight are essential.

Cemex addresses these risks through a comprehensive risk management framework. This includes diversifying its geographical footprint and product portfolio. Scenario planning helps prepare for various market conditions and regulatory shifts. For example, Cemex has actively diversified its energy sources to reduce exposure to fossil fuel price volatility. The company's proactive approach is crucial for its long-term success and sustainability initiatives.

Cemex has successfully navigated economic downturns and market fluctuations through resilient business models and strategic initiatives. These initiatives include focusing on operational efficiency, technological innovation, and sustainable practices. The company’s ability to adapt to market changes and leverage strategic partnerships is vital for its Cemex Future Prospects. Understanding the Mission, Vision & Core Values of Cemex provides further insights into the company's strategic direction.

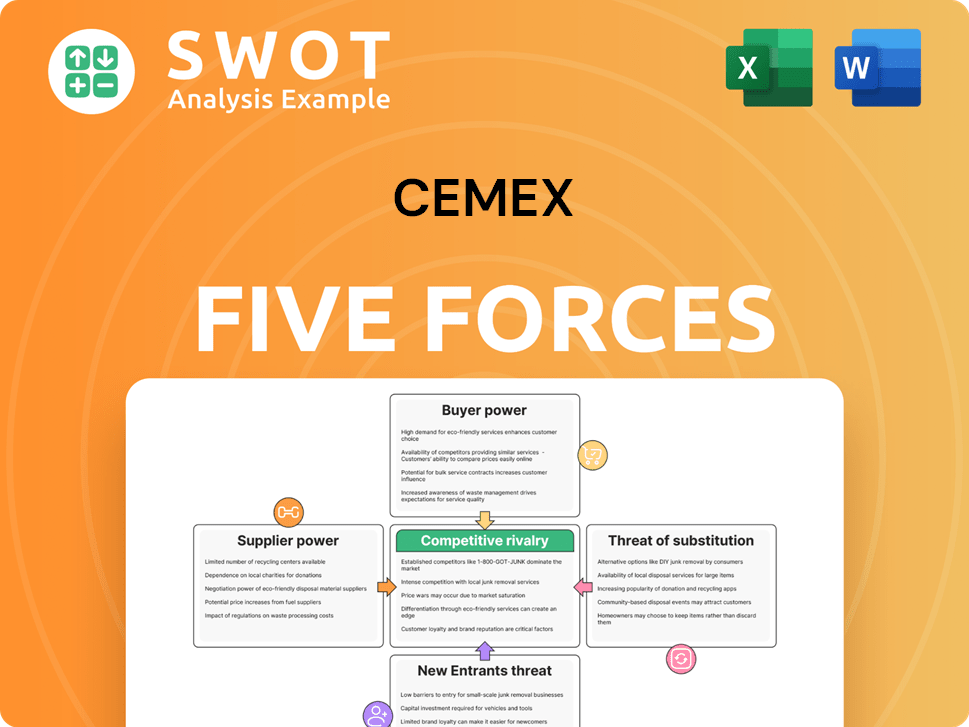

Cemex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cemex Company?

- What is Competitive Landscape of Cemex Company?

- How Does Cemex Company Work?

- What is Sales and Marketing Strategy of Cemex Company?

- What is Brief History of Cemex Company?

- Who Owns Cemex Company?

- What is Customer Demographics and Target Market of Cemex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.