Coles Group Bundle

How Does Coles Group Thrive in Australia's Retail Battleground?

In the fiercely contested Australian retail sector, Coles Group stands as a giant, but what forces shape its success? Founded over a century ago, Coles has evolved from a single store into a vast network of supermarkets and liquor outlets. To truly understand Coles's position, we must delve into its competitive environment.

This Coles Group SWOT Analysis provides a detailed examination of the company's strengths, weaknesses, opportunities, and threats within the grocery market Australia. Understanding the Coles Group competitive landscape involves a close look at its Coles Group competitors, their strategies, and the dynamics of the retail sector competition. Analyzing Coles Group market share Australia and its financial performance compared to competitors offers crucial insights into its strategic positioning and future prospects.

Where Does Coles Group’ Stand in the Current Market?

The core operations of Coles Group revolve around its extensive supermarket network, offering a wide array of products including groceries, fresh produce, and household essentials. It also has a significant presence in the liquor retail sector and provides financial services. The company's value proposition centers on providing customers with quality products, competitive prices, and convenient shopping experiences through its physical stores and online platforms.

Coles Group's market position is primarily defined by its strong presence in the Australian retail industry. It operates as the second-largest supermarket chain in Australia, trailing only Woolworths. This position is supported by a vast network of stores, a well-established supply chain, and a focus on customer service and value.

Coles Group's competitive landscape is shaped by its key rivals and strategic initiatives. The company has been investing in digital transformation and diversifying its offerings to maintain its market position and adapt to changing consumer behaviors. For a deeper understanding of the company's growth strategies, consider reading about the Growth Strategy of Coles Group.

Coles holds a significant market share in the Australian grocery market. As of February 2025, it accounts for approximately 29% of national supermarket grocery sales. This positions Coles as the second-largest player, behind Woolworths, which holds 38% of the market. ALDI has 9%, and Metcash (IGA) has 7%.

Coles' financial performance reflects its robust market standing. For the first half of 2025, group sales revenue increased by 3.7% to $23.035 billion. The company's underlying net profit after tax (NPAT), excluding significant items, increased by 6.4% to $666 million for the same period. This demonstrates the company's ability to drive revenue growth and maintain profitability.

Coles has invested heavily in its online shopping platform, Coles Online. This has led to significant growth in eCommerce sales. For the first half of 2025, Supermarket eCommerce sales grew by 22.6%, and Liquor eCommerce sales increased by 9.2%. This expansion into digital channels is crucial for maintaining competitiveness in the evolving retail landscape.

Coles offers a diverse range of products and services. Besides groceries, it has a significant presence in the liquor retail sector through brands like Liquorland, Vintage Cellars, and First Choice Liquor. Coles also provides financial services such as credit cards and insurance products, enhancing its customer value proposition.

Coles Group's competitive advantages stem from its extensive store network and strong supplier relationships. These factors enable the company to reach a large customer base and offer a diverse range of products. The company is also focused on customer loyalty programs and sustainability initiatives.

- Extensive store network providing broad market reach.

- Strong supplier relationships ensuring product availability and competitive pricing.

- Investment in digital platforms for enhanced customer experience.

- Focus on customer loyalty programs to retain and grow customer base.

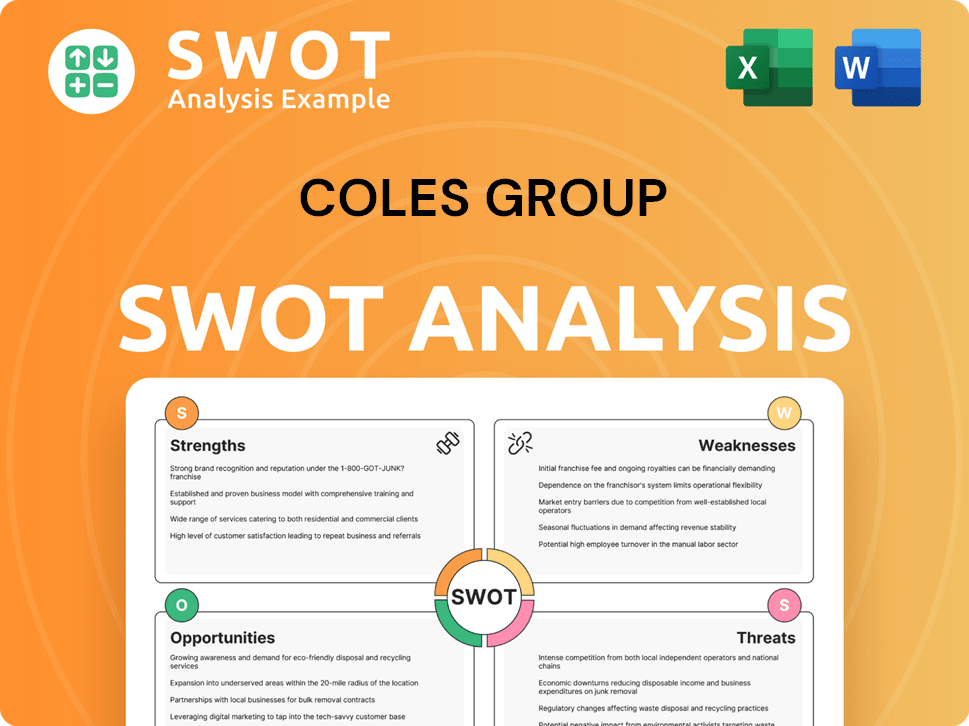

Coles Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Coles Group?

The Coles Group competitive landscape is shaped by a dynamic retail environment. Understanding the key players and their strategies is crucial for a thorough Coles Group market analysis. The grocery market in Australia is highly competitive, with several major players vying for market share.

The Coles Group competitors are constantly evolving, with new entrants and changing consumer preferences influencing the competitive dynamics. Assessing the strengths and weaknesses of these rivals is essential for evaluating Coles Group's position in the market. This analysis includes both direct competitors like Woolworths and indirect competitors like Aldi, along with other significant players in the retail sector.

Coles Group faces a significant challenge from its primary competitor, Woolworths Group. Woolworths currently holds a larger market share in the Australian supermarket grocery sales, at 38% compared to Coles' 29%. Woolworths operates over 1,000 stores across Australia and processes approximately 30 million customer transactions per week, making it a formidable rival. Both companies offer similar supermarket offerings and often mirror each other's initiatives.

Woolworths is Coles' most direct and significant competitor, operating a vast network of stores across Australia.

They compete head-to-head in various areas, including product offerings, pricing strategies, and customer loyalty programs.

Aldi is a 'hard discounter' known for its low prices, which puts downward pressure on the market.

Aldi's value proposition resonates with budget-conscious consumers, impacting the pricing strategies of Coles and Woolworths.

Metcash supplies independent supermarkets such as IGA.

IGA stores provide personalized service and support local communities.

Costco offers a different model with bulk buying and membership fees.

Costco's business model attracts a specific segment of consumers who value bulk purchases.

Independent grocers, such as Drake Supermarkets and Harris Farm Markets, offer personalized services.

They often focus on local products and community engagement.

Online retailers like Amazon Fresh are emerging players in the e-commerce space.

E-commerce penetration in Australian food retailing remains relatively low, around 3%.

The supermarket industry analysis reveals a complex competitive landscape. Coles Group competes with a variety of players, each with unique strengths and strategies.

- Woolworths Group is the primary direct competitor, with a larger market share.

- Aldi, a 'hard discounter,' offers lower prices and impacts the pricing strategies of Coles and Woolworths.

- Metcash, Costco, and independent grocers provide alternative shopping options, with a focus on personalized service and local products.

- Online retailers like Amazon Fresh pose a growing threat, although e-commerce penetration is still relatively low.

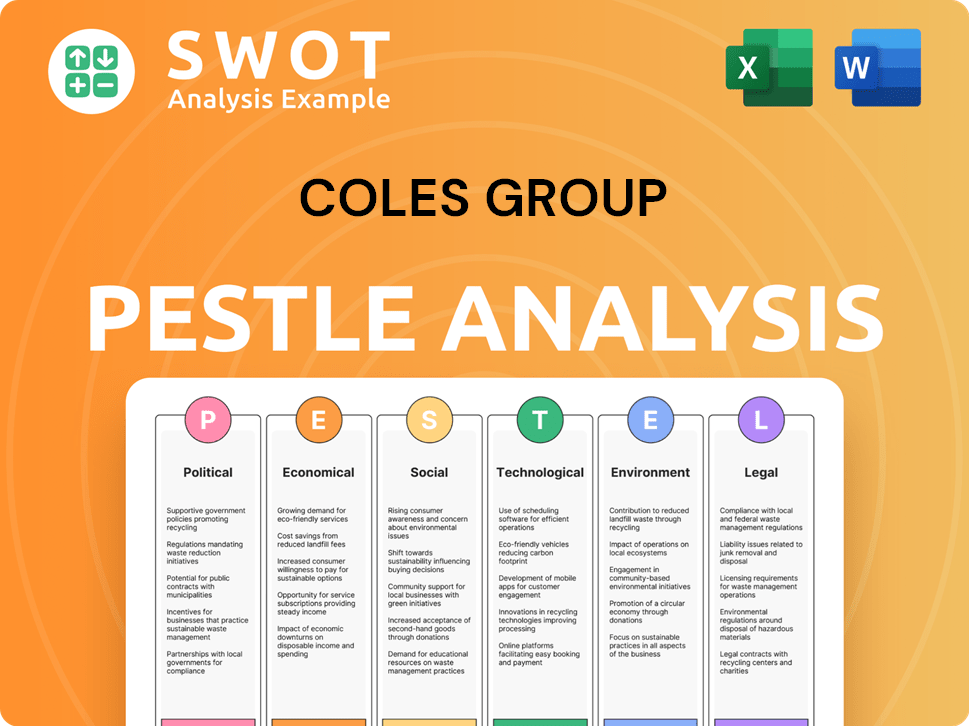

Coles Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Coles Group a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Coles Group involves examining its competitive advantages within the Australian retail sector. The company, a major player in the grocery market Australia, has cultivated a strong brand presence and an extensive store network, which are key elements in its competitive strategy. This widespread reach allows it to serve a vast customer base, a significant advantage over smaller competitors and new entrants in the supermarket industry analysis.

Coles Group's success also hinges on its customer loyalty programs and strategic supplier relationships. Initiatives like Flybuys, which had 9.7 million active members in the first half of 2025, provide valuable customer data and enhance loyalty. The company's commitment to Australian suppliers, particularly for its Own Brand products, ensures competitive pricing and a diverse product range. These factors are crucial in the retail sector competition.

Moreover, Coles invests heavily in technological advancements to improve customer experience and operational efficiency. This includes its online shopping platform, self-checkout systems, and the use of AI and data analytics. Investments in automated distribution centers (ADCs) also strengthen its supply chain management. These technological integrations and supply chain advantages contribute significantly to Coles Group's position in the Australian retail market.

Coles operates over 1,850 stores across Australia, providing a widespread presence that is difficult to replicate. This extensive network is a key competitive advantage, enabling the company to reach a large customer base effectively. The broad reach supports efficient distribution and enhances brand visibility across various regions.

Flybuys, with 9.7 million active members in the first half of 2025, is a significant advantage. These programs gather valuable customer data, enabling personalized offers and enhancing customer loyalty. This targeted approach helps Coles maintain customer engagement and improve sales performance.

Strong supplier relationships, both domestic and international, allow Coles to secure competitive pricing and offer a diverse range of products. Direct contracting with Australian producers for Own Brand products ensures quality and supports local businesses. These relationships are vital for maintaining a competitive edge.

Coles invests in technology to enhance customer experience and operational efficiency. This includes online shopping platforms, self-checkout systems, and the use of AI and data analytics. Investments in automated distribution centers (ADCs) also strengthen its supply chain management.

Coles Group's competitive landscape is shaped by its strong brand, extensive network, and strategic initiatives. These elements contribute to its market position and ability to compete effectively. Understanding these advantages is crucial for any Coles Group market analysis.

- Extensive Store Network: Over 1,850 stores provide broad market coverage.

- Customer Loyalty: Flybuys program with 9.7 million active members.

- Supplier Relationships: Direct contracts with Australian producers.

- Technological Advancements: Investment in online platforms and AI.

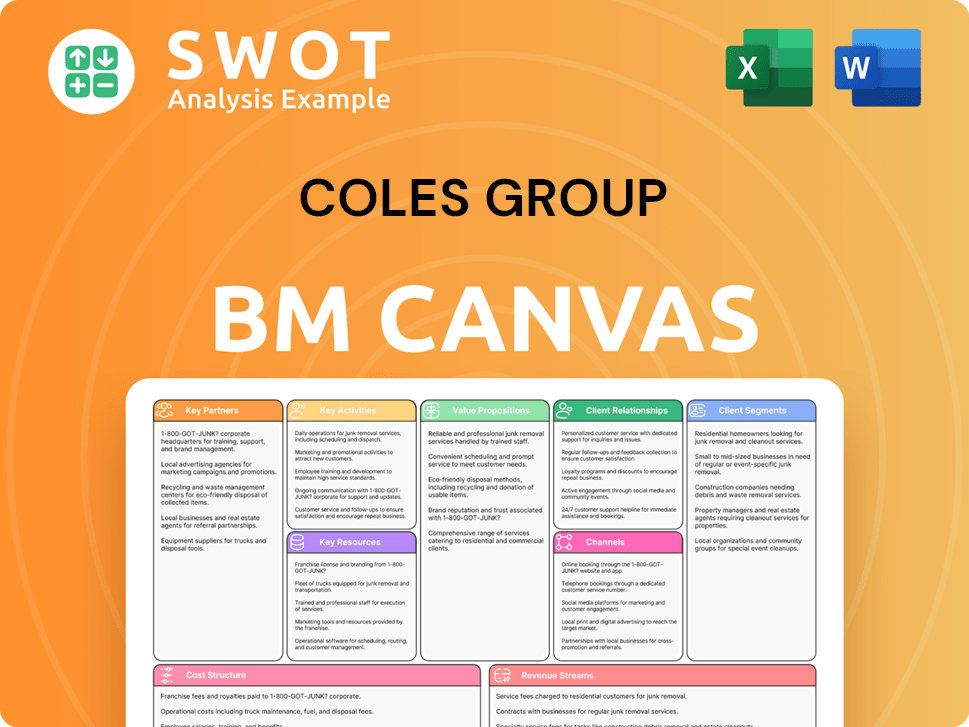

Coles Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Coles Group’s Competitive Landscape?

The Australian retail sector, and within it the Grocery market Australia, is experiencing significant shifts. Technological advancements and evolving consumer preferences are reshaping the Coles Group competitive landscape. This dynamic environment presents both challenges and opportunities for retailers like Coles, demanding strategic adaptations to maintain market share and profitability.

Supermarket industry analysis reveals that economic volatility, changing consumer spending habits, and supply chain disruptions are key factors influencing the market. The company's financial performance is closely tied to its ability to navigate these challenges and capitalize on emerging trends. Understanding the competitive dynamics is crucial for assessing Coles Group's future prospects.

Technological advancements, especially in e-commerce and data analytics, are transforming the Retail sector competition. Sustainability and ethical sourcing are becoming increasingly important to consumers. Economic volatility and changing spending patterns, including a focus on value and private label products, also play a role.

Intense competition from both local and international players is a major challenge. The company's reliance on the Australian market exposes it to domestic economic downturns and regulatory changes. Supply chain disruptions and inflationary pressures pose ongoing threats, impacting profitability and operations.

Expanding e-commerce capabilities offers significant growth potential. Diversification into new product categories, such as health foods and organic products, can attract new customers. Strategic partnerships and sustainability initiatives are also key to driving innovation and enhancing brand image.

Coles is investing in AI and automation to improve supply chain efficiency and customer experience. The company is also focusing on sustainability efforts and expanding its online presence. Strategic partnerships and diversification are key to its growth strategy.

To maintain its competitive position, Coles is focused on several key strategies. These include leveraging technology, expanding its e-commerce platform, and strengthening its sustainability initiatives. The recent five-year agreement with Microsoft, announced in 2024, highlights the company's commitment to using cloud and AI capabilities for operational efficiency and growth.

- E-commerce Expansion: Coles is actively enhancing its online grocery platform to meet growing demand, as reflected in increased online sales.

- Sustainability Initiatives: The company is investing in sustainable practices to appeal to environmentally conscious consumers.

- Strategic Partnerships: Collaborations, such as the one with Microsoft, are crucial for innovation and efficiency.

- Diversification: Expanding into new product categories and services, like insurance, to boost revenue streams.

For a deeper dive into how Coles is approaching its market strategy, consider reading the Marketing Strategy of Coles Group. The company's ability to adapt to these trends and challenges will be crucial in the ongoing Coles Group market analysis and its overall success in the competitive Australian retail landscape. The company's Coles Group competitors, including Woolworths and Aldi, are also adapting to these changes, making the competitive environment dynamic and ever-evolving.

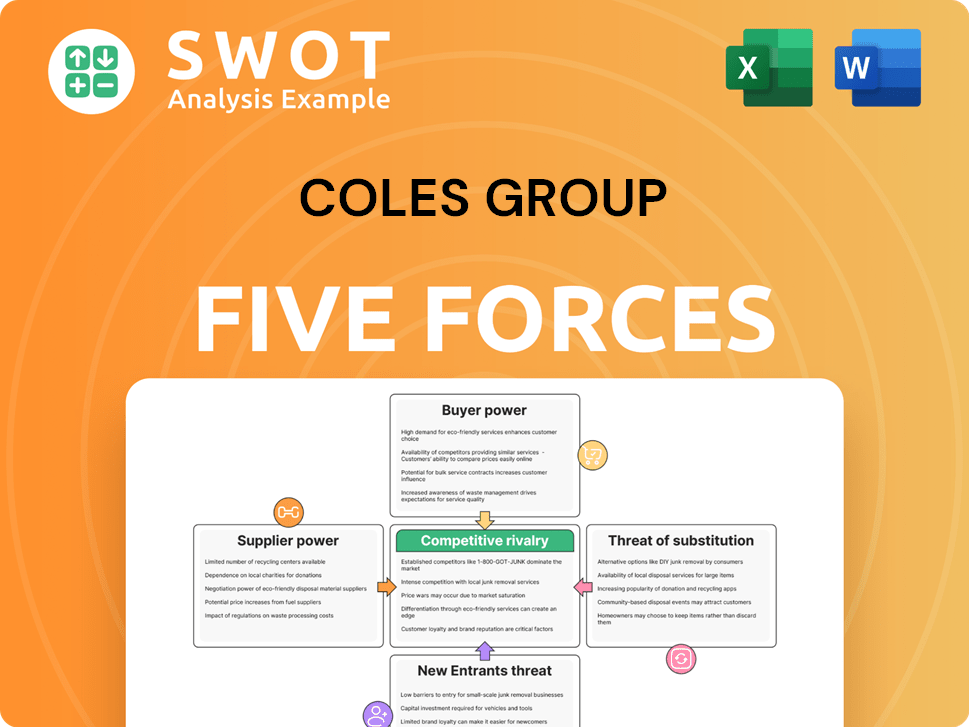

Coles Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coles Group Company?

- What is Growth Strategy and Future Prospects of Coles Group Company?

- How Does Coles Group Company Work?

- What is Sales and Marketing Strategy of Coles Group Company?

- What is Brief History of Coles Group Company?

- Who Owns Coles Group Company?

- What is Customer Demographics and Target Market of Coles Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.