Coles Group Bundle

Can Coles Group Maintain Its Retail Dominance?

Coles Group, a cornerstone of the Australian retail industry, is constantly evolving its Coles Group SWOT Analysis to stay ahead. With significant investments in supply chain automation, like the new A$880 million distribution center, Coles is signaling its commitment to future growth. This strategic focus is crucial in a competitive landscape where agility and efficiency are paramount.

This analysis dives deep into Coles Group's growth strategy, exploring its expansion initiatives, and innovative technologies. We'll examine the company's financial outlook, assessing its potential for long-term growth within the dynamic retail industry. Furthermore, we'll evaluate the risks and opportunities facing Coles Group, providing valuable insights for investors and business strategists interested in the future of this leading Australian retailer. Understanding the Coles Group SWOT Analysis is critical for grasping its competitive position.

How Is Coles Group Expanding Its Reach?

The Coles Group's growth strategy involves several key expansion initiatives to enhance its market position within the retail industry. These initiatives are designed to attract new customers, diversify revenue streams, and adapt to the evolving demands of the market. The company's focus includes modernizing its supply chain, expanding its store network, and bolstering its e-commerce capabilities to ensure sustained growth.

A significant aspect of the Coles Group's strategic approach is its investment in supply chain modernization, particularly through the development of automated distribution centers (ADCs). This investment aims to increase efficiency and capacity, supporting the company's broader expansion plans. Furthermore, the company is actively growing its physical store presence and enhancing its digital platforms to meet the changing consumer preferences.

This multi-faceted strategy underscores the Coles Group's commitment to adapting and growing within the competitive retail landscape. For a deeper understanding of the company's foundational principles, consider exploring the Mission, Vision & Core Values of Coles Group.

A major component of the Coles Group's expansion strategy is the modernization of its supply chain. This involves substantial investments in automated distribution centers (ADCs) to enhance efficiency and capacity. The goal is to streamline operations and support the company's growth objectives.

The company is actively expanding its store network to reach new customers and increase its market share. This includes opening new stores and renovating existing ones to improve the overall shopping experience. The expansion of the store network is a key part of Coles Group's overall growth strategy.

Coles Group is focusing on growing its e-commerce presence to meet the increasing demand for online shopping. This involves optimizing customer fulfillment centers (CFCs) and e-commerce platforms. The company aims to enhance its digital capabilities to drive further growth in online sales.

The company is consolidating its Liquorland brand across a significant number of stores. This strategic move aims to streamline operations and enhance brand visibility. The consolidation efforts are part of Coles Group's broader strategy to optimize its retail portfolio.

In October 2024, Coles Group announced an A$880 million agreement with Witron to develop a new ambient ADC in Truganina, Victoria. This facility, expected to start in FY25 and take up to five years to complete, will have approximately 15% more capacity than its existing NSW and Queensland ADCs, processing up to 4.6 million cartons per week. In the first half of FY25, Coles opened 9 new stores and completed 25 supermarket and 67 liquor store renewals, bringing its total to 1,853 stores. Supermarket e-commerce sales surged by 25.7% in Q3 FY25.

- Automated Distribution Centers (ADCs): Investment in ADCs to modernize the supply chain and increase efficiency.

- Store Network Expansion: Opening new stores and renovating existing ones to expand market reach.

- E-commerce Enhancement: Optimizing customer fulfillment centers (CFCs) and e-commerce platforms to drive online sales growth.

- Liquor Brand Consolidation: Consolidating the Liquorland brand to streamline operations and enhance brand visibility.

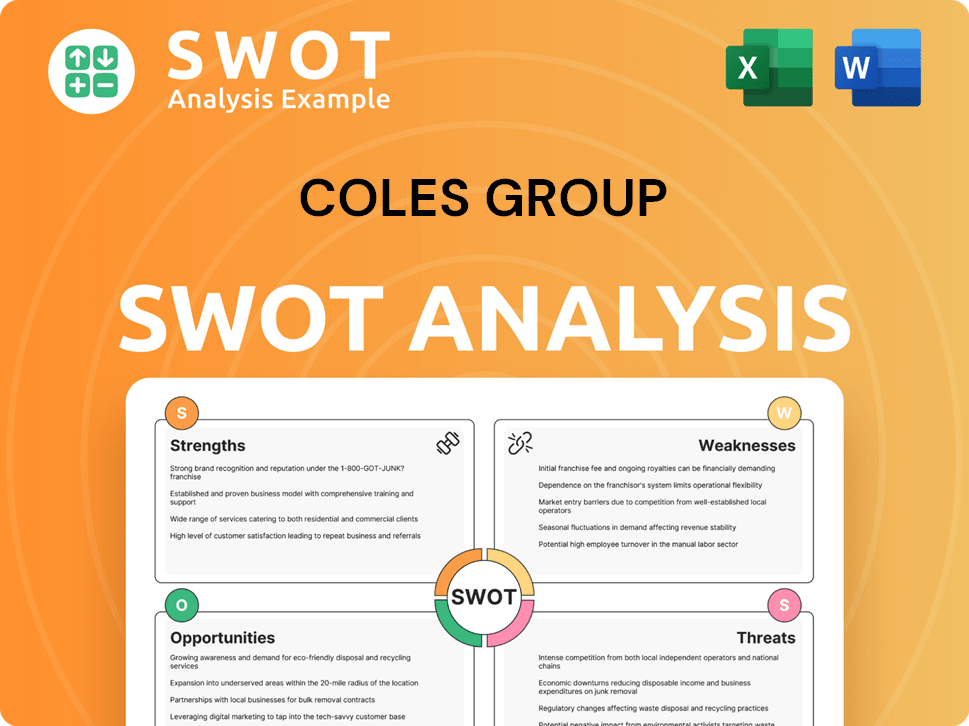

Coles Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Coles Group Invest in Innovation?

The innovation and technology strategy of Coles Group is central to its growth strategy, focusing on digital transformation, automation, and the application of cutting-edge technologies. This approach aims to enhance customer experience, improve operational efficiency, and drive sustainable practices within the retail industry. This strategy is critical for maintaining and expanding Coles' market share in a competitive landscape.

Coles is leveraging strategic partnerships and investments in technology to adapt to evolving consumer preferences and market dynamics. These initiatives are designed to improve customer engagement, streamline operations, and foster a more sustainable business model. The company's focus on digital solutions and automation is a key component of its long-term growth projections.

The company's commitment to technological advancement is evident in its recent collaborations and investments, positioning it to meet future challenges and opportunities in the retail sector. By embracing innovation, Coles aims to strengthen its competitive position and deliver value to both customers and shareholders. For more on the company's origins, you can read a Brief History of Coles Group.

In November 2024, Coles announced a five-year strategic partnership with Microsoft. This collaboration focuses on enhancing Coles' digital presence, customer engagement, and operational efficiency.

The partnership includes building an AI-as-a-Service platform to securely deploy Azure OpenAI use cases across Coles. This initiative aims to leverage AI for various applications.

Coles is developing a 'digital chef' that will provide personalized meal ideas and recipes based on customer preferences. This innovation enhances customer experience.

In January 2025, Coles began trialing an all-in-one AI-powered Smart Trolley in partnership with Instacart at Coles Richmond Traders in Melbourne. This trolley allows customers to track spending in real-time and skip checkout lines.

Coles is modernizing its data and analytics platform to provide faster insights through data democratization. This improves decision-making processes.

A third Automated Distribution Centre (ADC) is planned for Victoria, which will boost capacity by 15% and fully automate eastern Australia's room-temperature distribution network. This enhances efficiency.

Coles is committed to sustainability, with a goal to achieve 100% renewable electricity by June 2025. This commitment aligns with broader environmental goals and consumer expectations.

- As of FY24, electricity generated by renewables accounted for 45% of its total grid electricity consumption.

- Solar panels have been installed on 100 supermarkets, liquor stores, and distribution centers nationally.

- Coles has removed 500 million pieces of plastic from its Own Brand packaging since 2021.

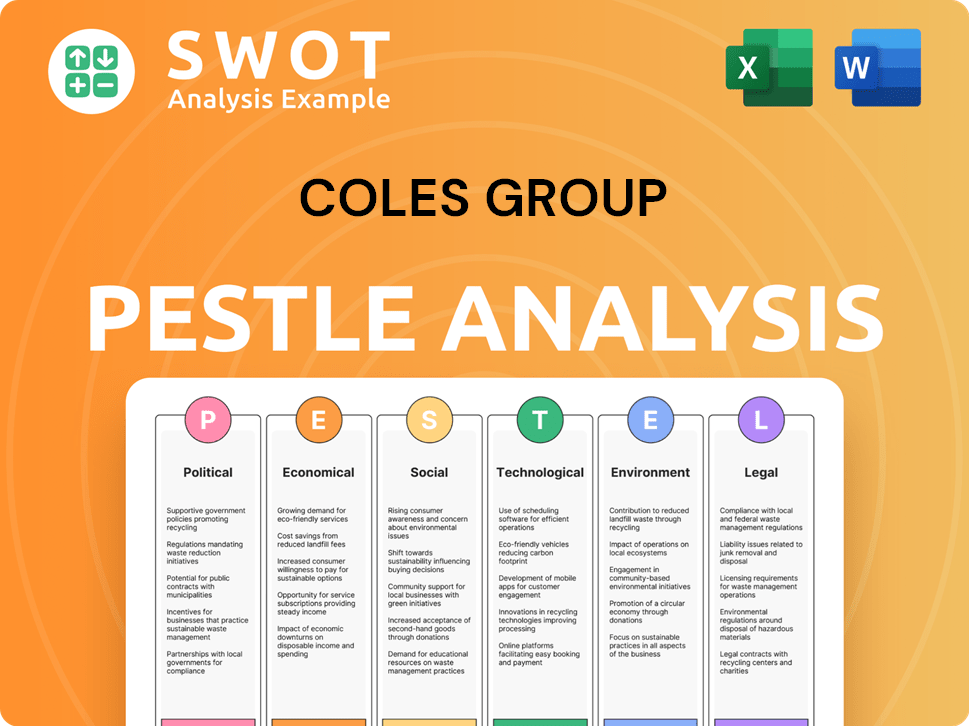

Coles Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Coles Group’s Growth Forecast?

The financial outlook for Coles Group is shaped by strategic investments and a focus on delivering value to its customers. In the first half of FY25, the company demonstrated solid financial performance, with growth in key revenue streams. This performance is a reflection of the company's robust business model and its ability to adapt to changing market conditions within the retail industry.

Coles Group's focus on operational efficiency and strategic initiatives is expected to drive future growth. The company's investments in digital capabilities, supply chain optimization, and customer loyalty programs are designed to enhance its competitive position. These initiatives are crucial for sustaining long-term value creation and navigating the competitive landscape within the Australian market. For a deeper understanding, explore the Competitors Landscape of Coles Group.

The company's financial strategy is geared towards maintaining a strong balance sheet and delivering shareholder value. The declaration of a fully franked interim dividend and the company's strong cash generation capabilities highlight its commitment to financial discipline. These factors contribute to a positive outlook for Coles Group's future prospects.

In the first half of FY25 (ending January 5, 2025), Coles Group reported a 3.7% increase in group sales revenue, reaching A$23.035 billion. Supermarket sales revenue grew by 4.3% to A$20.629 billion, indicating strong performance in its core business. Liquor sales also saw an increase, rising by 0.8% to A$2.004 billion.

Underlying EBITDA (excluding significant items) grew by 12.5% to A$2.137 billion, and underlying EBIT increased by 8.9% to A$1.209 billion. Underlying NPAT increased by 6.4% to A$666 million, although reported net profit after tax (NPAT) saw a slight decline of 2.2% to A$576 million. These figures reflect the company's ability to manage costs and improve profitability.

Coles Group declared a fully franked interim dividend of 37 cents per share, a 2.8% increase. The company maintains a strong balance sheet with net debt of A$1.7 billion as of January 2025. The dividend payout ratio is estimated at around 85%, demonstrating the company's commitment to returning value to shareholders.

Analysts forecast Coles' operating margins to average 5% (post AASB 16) over the next five years. UBS predicts Coles' revenue to grow by approximately 1% to A$44 billion in FY25, with operating profit (EBIT) growth of 2% to A$2.1 billion, and flat net profit after tax (NPAT) of A$1.11 billion. For FY26, UBS projects revenue growth of 1.8% to A$44.8 billion, potentially leading to a 13.7% increase in net profit.

Coles Group's financial performance and future outlook are supported by several key factors:

- Revenue Growth: Solid revenue growth across supermarkets and liquor, indicating market strength.

- Profitability: Strong growth in underlying EBITDA and EBIT, despite a slight decline in reported NPAT.

- Dividend: Increased interim dividend, reflecting a commitment to shareholder returns.

- Balance Sheet: A strong balance sheet with manageable net debt.

- Cash Generation: Consistent strong cash generation, averaging 100% over the past five years to June 2024, and forecast to continue.

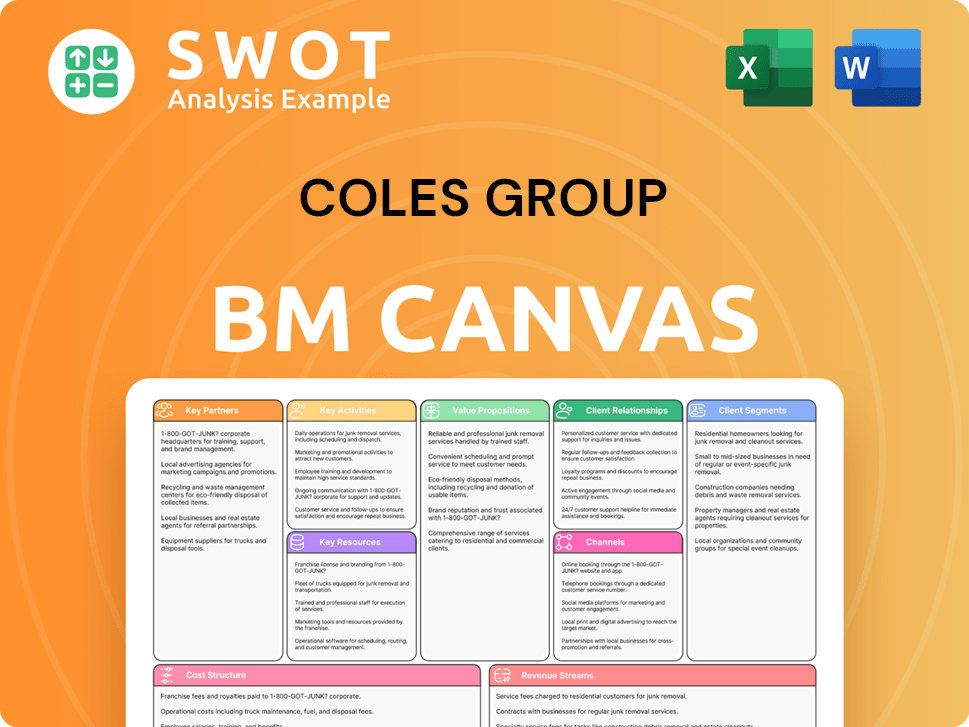

Coles Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Coles Group’s Growth?

Several risks and obstacles could hinder the Coles Group's growth strategy and Coles future. These challenges span competitive pressures, regulatory scrutiny, supply chain vulnerabilities, technological disruptions, and economic factors. Addressing these issues will be crucial for the company's sustained success in the retail industry.

The competitive landscape, primarily the rivalry with Woolworths and the impact of discount chains like Aldi, poses a significant threat. Regulatory changes and investigations, particularly from the Australian Competition and Consumer Commission (ACCC), add to the operational risks. Furthermore, the company must navigate the complexities of supply chain management and technological advancements.

Economic pressures and sustainability commitments also present challenges. Consumer spending habits and the need to meet environmental targets will influence Coles Group's performance. The company's ability to adapt and innovate will determine its ability to overcome these obstacles and achieve its strategic goals.

Coles Group faces intense competition from Woolworths and discount retailers like Aldi. The market is highly competitive, with both Coles and Woolworths often mirroring each other's strategies. Aldi's focus on low prices continues to attract customers, impacting Coles Group market share analysis.

Regulatory scrutiny, including investigations by the ACCC, poses a risk to Coles Group. These investigations often focus on pricing practices and supplier relationships within the retail industry. Compliance with regulations is essential, but changes can impact Coles Group financial performance.

Despite investments in automation, supply chain disruptions remain a risk for Coles Group. The 2024 Woolworths warehouse strike highlighted potential vulnerabilities. The A$880 million Automated Distribution Centre in Victoria carries upfront costs and the risk of delays, which could impact liquidity.

Coles Group must continuously adapt to the rapid pace of technological advancements. The recent departures of key technology executives could impact the execution of the Coles Group digital transformation strategy. Adapting to new technologies is crucial for Coles Group online grocery sales and overall business strategy.

Economic pressures, such as households prioritizing essential spending, can affect Coles Group's sales. Non-food categories and liquor sales may be particularly impacted. Monitoring and adapting to changing consumer behavior is crucial for maintaining Coles Group financial performance.

Coles Group faces emerging risks related to its sustainability commitments. The company's environmental initiatives, such as eliminating deforestation from its supply chains, are under scrutiny. Meeting these commitments is essential for maintaining a positive brand image and addressing Coles Group sustainability initiatives.

Coles Group must navigate challenges related to competition, regulation, and supply chain management. The Coles Group competitive landscape requires continuous adaptation and innovation. The company's ability to maintain and grow its market share will depend on how effectively it addresses these strategic issues.

Operational risks include supply chain disruptions, technological challenges, and economic pressures. Delays or cost overruns in major projects, like the new distribution center, can strain resources. The company must also invest in technology and adapt to changing consumer spending patterns to maintain Coles Group financial performance.

External factors, such as regulatory changes and economic conditions, significantly impact Coles Group. Compliance with regulations and adapting to changing consumer spending habits are crucial. Coles Group's ability to manage these external factors will influence its long-term growth projections.

To mitigate risks, Coles Group can focus on supply chain resilience, technological innovation, and customer loyalty. Investing in Coles Group supply chain management and enhancing digital capabilities are key. Building strong Coles Group customer loyalty programs will help the company to maintain its market position. For more insights, consider reading about the Coles Group SWOT analysis.

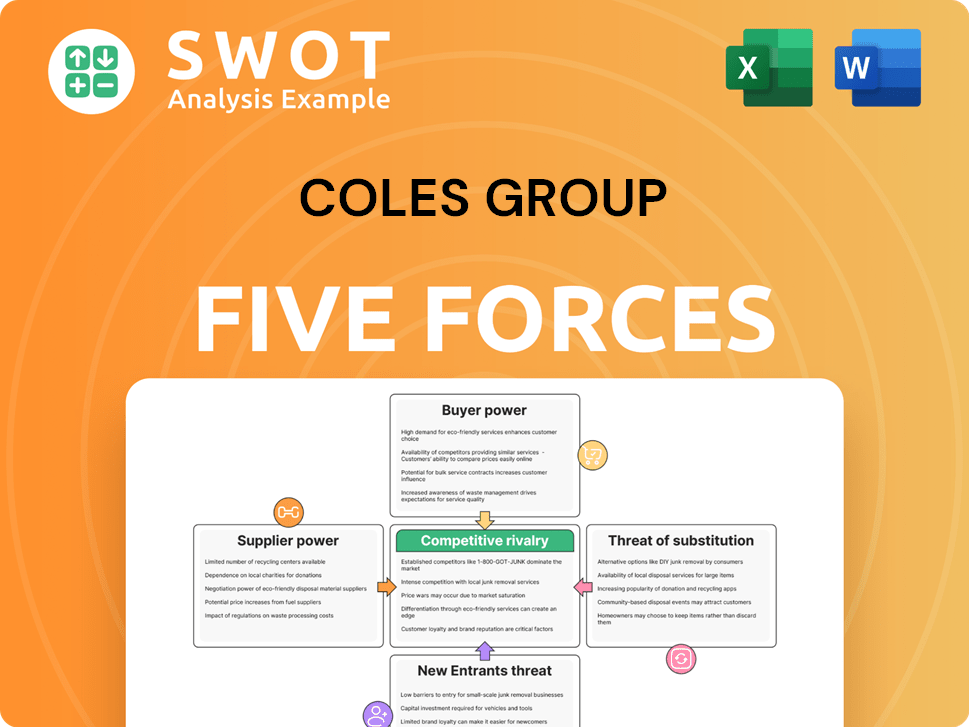

Coles Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coles Group Company?

- What is Competitive Landscape of Coles Group Company?

- How Does Coles Group Company Work?

- What is Sales and Marketing Strategy of Coles Group Company?

- What is Brief History of Coles Group Company?

- Who Owns Coles Group Company?

- What is Customer Demographics and Target Market of Coles Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.