Coles Group Bundle

Who Really Owns Coles Group?

Ever wondered about the forces shaping the future of your local Coles supermarket? The ownership structure of a company is a critical determinant of its strategic direction and overall success. Uncover the fascinating journey of Coles Group, from its humble beginnings to its current standing as a retail giant in Australia.

This exploration into Coles Group SWOT Analysis will reveal the key players behind Coles ownership, tracing its evolution since its 2018 spin-off from Wesfarmers and its subsequent listing on the ASX. Understanding who owns Coles provides critical insights into the company's governance, financial performance, and its competitive positioning within the Australian retail landscape. Discover the answers to questions like: Who are the major shareholders of Coles? Who controls Coles Group? Is Coles Group a publicly traded company? And, who is the CEO of Coles Group?

Who Founded Coles Group?

The story of Coles Group begins with George James Coles, who laid the foundation for what would become a retail giant. He learned the retail trade from his family's general store in Tasmania. This early exposure shaped his understanding of the business and set the stage for his future ventures.

On April 9, 1914, George Coles opened the first 'Coles Variety Store' in Collingwood, Melbourne. The initial ownership primarily involved the Coles family, with George Coles at the helm, driving the early expansion. While specific details on the initial shareholding aren't readily available in public records, the focus was on building a strong retail presence.

The business quickly evolved from a single variety store into a chain. This growth was fueled by a commitment to providing value to Australian shoppers. This early strategy set the stage for the future of the company, focusing on expansion and market dominance.

The early expansion of Coles included strategic acquisitions to solidify its position in the grocery market. These moves were crucial in establishing a broad presence across Australia.

- In 1958, Coles entered food retailing by acquiring 54 John Connell Dickins grocery stores.

- The acquisition of the Beilby's chain in South Australia followed in 1959.

- In 1960, Coles acquired 265 Matthews Thompson grocery stores in New South Wales.

- The first Coles supermarket, operating under the Dickins name, opened in Balwyn North, Melbourne, in 1960.

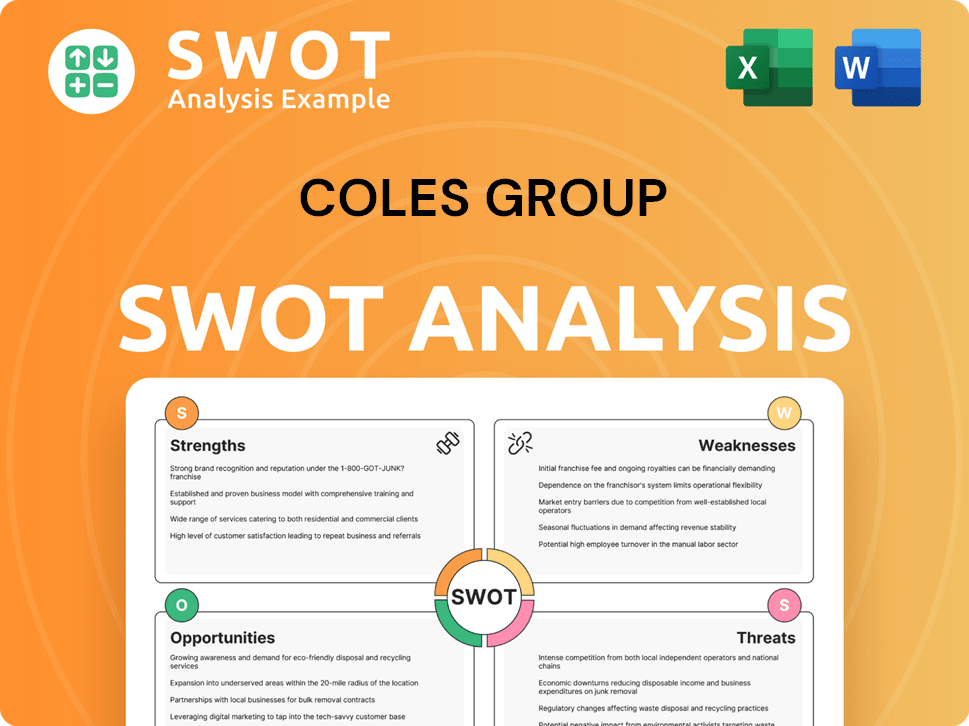

Coles Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Coles Group’s Ownership Changed Over Time?

The ownership of Coles Group, a major player in the Australian retail market, has seen significant changes over time. Initially known as Coles Myer Ltd, the company's structure underwent a major transformation in 2008 when Wesfarmers acquired it for A$22 billion. This marked a pivotal moment, making Coles Group a subsidiary of the conglomerate and leading to investments and rebranding efforts.

A key shift occurred in November 2018, when Wesfarmers spun off Coles Group as an independent entity. This move, which re-listed Coles on the Australian Securities Exchange (ASX) under the ticker COL, allowed Coles to operate independently. Wesfarmers distributed a portion of its shares to its shareholders, while retaining a minority stake to maintain strategic alignment.

| Milestone | Date | Details |

|---|---|---|

| Formation as Coles Myer Ltd | 1986 | The company was known as Coles Myer Ltd. |

| Wesfarmers Acquisition | Early 2008 | Wesfarmers acquired Coles Group for A$22 billion. |

| Demerger and IPO | November 2018 | Coles Group was spun off and re-listed on the ASX. |

Currently, Coles Group's ownership is diverse, comprising both institutional and retail investors. As of May 23, 2025, there were 263 institutional owners holding a substantial number of shares. Major shareholders include State Street Global Advisors, Inc., BlackRock, Inc., and The Vanguard Group, Inc. The public holds a significant portion of the shares, while individual insiders have a smaller stake. These ownership dynamics have enabled Coles to pursue strategic initiatives, particularly in automation and online retail, as highlighted in the Competitors Landscape of Coles Group.

Coles Group's ownership has evolved significantly, from being a subsidiary of Wesfarmers to becoming an independent, publicly traded company. This shift has brought in a diverse group of institutional and retail investors.

- Wesfarmers acquired Coles Group in early 2008.

- Coles Group was demerged and re-listed on the ASX in November 2018.

- Major shareholders include State Street Global Advisors, BlackRock, and The Vanguard Group.

- The public holds a substantial portion of the shares.

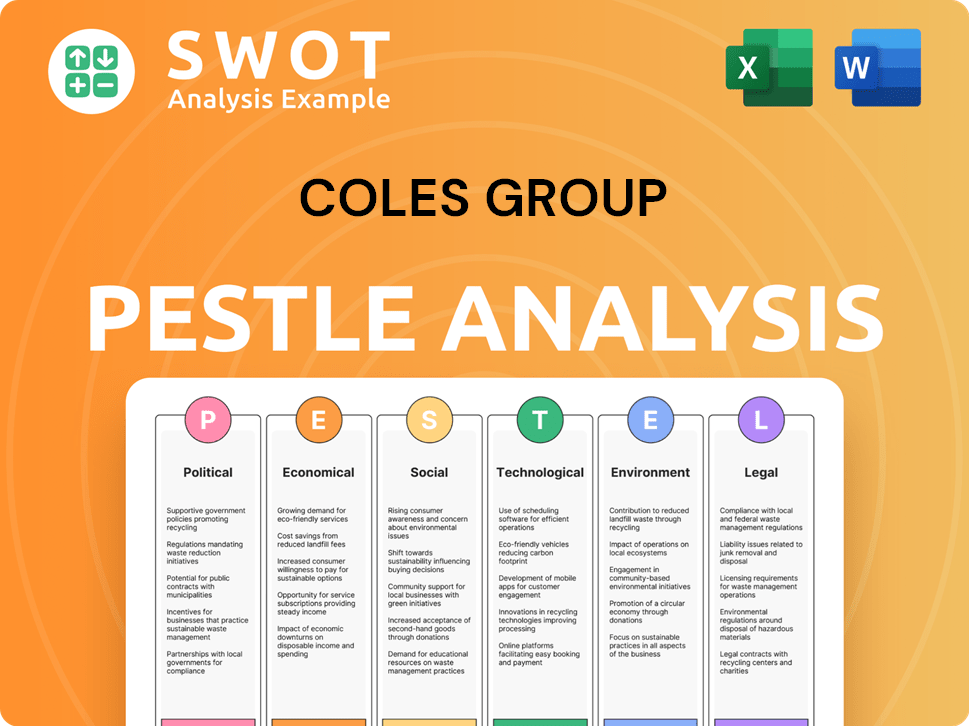

Coles Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Coles Group’s Board?

As of early 2025, the Board of Directors of Coles Group Limited is responsible for the company's governance and strategic direction. The board comprises both executive and non-executive directors. James Graham, who was appointed Chairman in 2018 when Coles listed on the ASX, retired from the Board effective April 30, 2025. Peter Allen, an independent Non-executive Director since September 1, 2024, succeeded Mr. Graham as Chairman on May 1, 2025. Leah Weckert serves as the CEO and Managing Director. The composition of the board reflects Coles Group's commitment to strong corporate governance.

Other board members and their committee roles as of late 2024 and early 2025 include: Richard Freudenstein (Audit Committee, HR Committee, Nominating Committee, and HR Committee Chair), Jacqueline Chow (Audit Committee, Nominating Committee, Compensation Committee Chair, and HR Committee Chair), Terence Bowen (Audit Committee Chair, Audit Committee, Nominating Committee), Abi Cleland (HR Committee, Nominating Committee, HR Committee Chair), Scott Price (HR Committee, Nominating Committee), Wendy Stops (Audit Committee, Nominating Committee), and Andrew Penn (Nominating Committee, Audit Committee Chair). The board's diverse expertise supports Coles Group's operations across its growth strategy.

| Director | Role | Committee Memberships |

|---|---|---|

| Peter Allen | Chairman | N/A |

| Leah Weckert | CEO and Managing Director | N/A |

| Richard Freudenstein | Non-Executive Director | Audit, HR, Nominating, HR Committee Chair |

| Jacqueline Chow | Non-Executive Director | Audit, Nominating, Compensation Committee Chair, HR Committee Chair |

| Terence Bowen | Non-Executive Director | Audit Committee Chair, Audit, Nominating |

| Abi Cleland | Non-Executive Director | HR, Nominating, HR Committee Chair |

| Scott Price | Non-Executive Director | HR, Nominating |

| Wendy Stops | Non-Executive Director | Audit, Nominating |

| Andrew Penn | Non-Executive Director | Nominating, Audit Committee Chair |

Coles Group operates under a one-share-one-vote structure, common for ASX-listed companies. Voting power is directly proportional to the number of shares held. There is no public information suggesting dual-class shares or special voting rights that would grant outsized control to specific entities beyond their shareholding. This structure ensures that all shareholders have voting rights aligned with their ownership stake. This structure is a key aspect of understanding Coles ownership and who controls Coles Group.

The Board of Directors at Coles Group is structured to ensure effective governance and strategic oversight. Key figures include the Chairman, CEO, and various non-executive directors. The company uses a one-share-one-vote system.

- Peter Allen is the current Chairman.

- Leah Weckert is the CEO and Managing Director.

- The board includes members with diverse expertise.

- Voting power is based on share ownership.

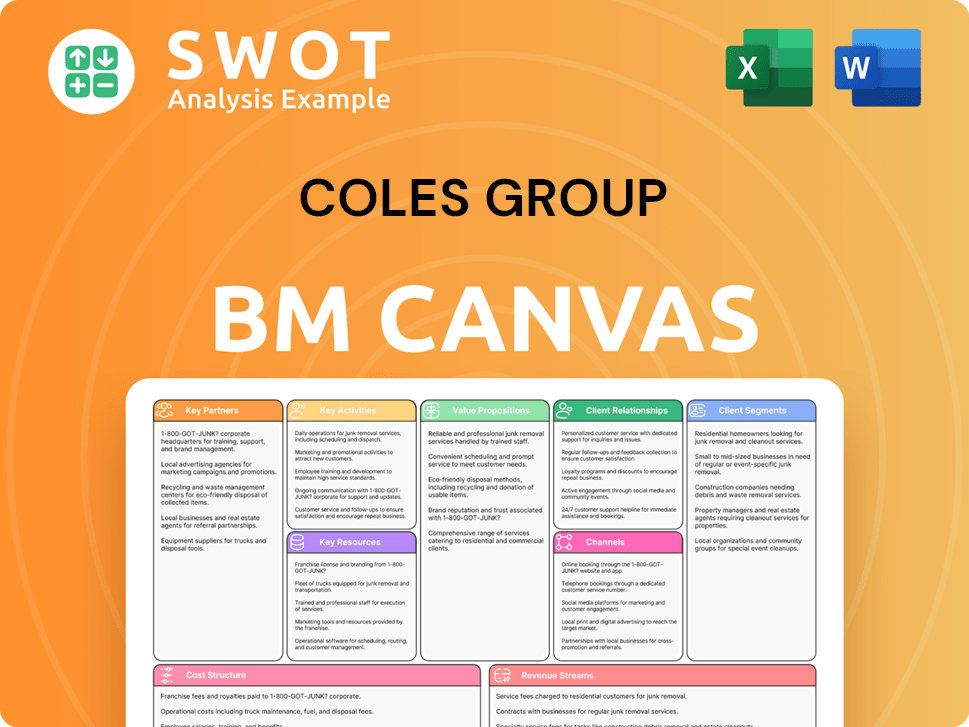

Coles Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Coles Group’s Ownership Landscape?

Over the past few years, the ownership profile of Coles Group has remained relatively stable, with a focus on delivering shareholder value. A significant change in leadership occurred on May 1, 2025, with Peter Allen succeeding James Graham as Chairman. This transition is expected to maintain the company's strategic direction. The company's commitment to its shareholders is reflected in its financial performance and strategic decisions.

Coles has actively reshaped its business through strategic acquisitions and divestments. In May 2023, the company sold its Coles Express stations to Viva Energy for A$300 million, enabling a stronger focus on its core supermarket and liquor operations. In April 2023, Coles announced plans to purchase two milk processing plants from Saputo Inc. for A$105 million. Furthermore, in February 2024, Coles Liquor agreed to acquire 20 liquor stores in Tasmania from Federal Group. These moves highlight Coles' adaptability to market dynamics and its strategic approach to growth.

| Metric | Value | Year |

|---|---|---|

| Group Sales Revenue | A$23.035 billion | First Half 2025 |

| Underlying Net Profit After Tax | A$666 million | First Half 2025 |

| eCommerce Sales Growth (Supermarkets) | 22.6% | First Half 2025 |

| eCommerce Sales Growth (Liquor) | 9.2% | First Half 2025 |

| Flybuys Active Members | 9.7 million | First Half 2025 |

Industry trends point to increased institutional ownership and investments in technology and automation. Coles is investing in automated distribution centers (ADCs) and online grocery retailing. The company's focus on eCommerce, with significant growth in both Supermarkets and Liquor, and its Flybuys loyalty program, indicate its commitment to evolving consumer behaviors. For more details on the company's strategic initiatives, consider reading about the Growth Strategy of Coles Group.

Coles Group is a publicly traded company, with its shares listed on the Australian Securities Exchange. The ownership structure includes a mix of institutional investors and individual shareholders.

The company's financial performance in the first half of 2025 showed a 3.7% increase in group sales revenue, reaching A$23.035 billion, with an underlying net profit after tax of A$666 million.

Key executives at Coles Group include the CEO and other senior leaders who drive the company's strategic direction and operational performance.

Coles holds a significant market share in the Australian supermarket industry, competing with other major players to maintain its position.

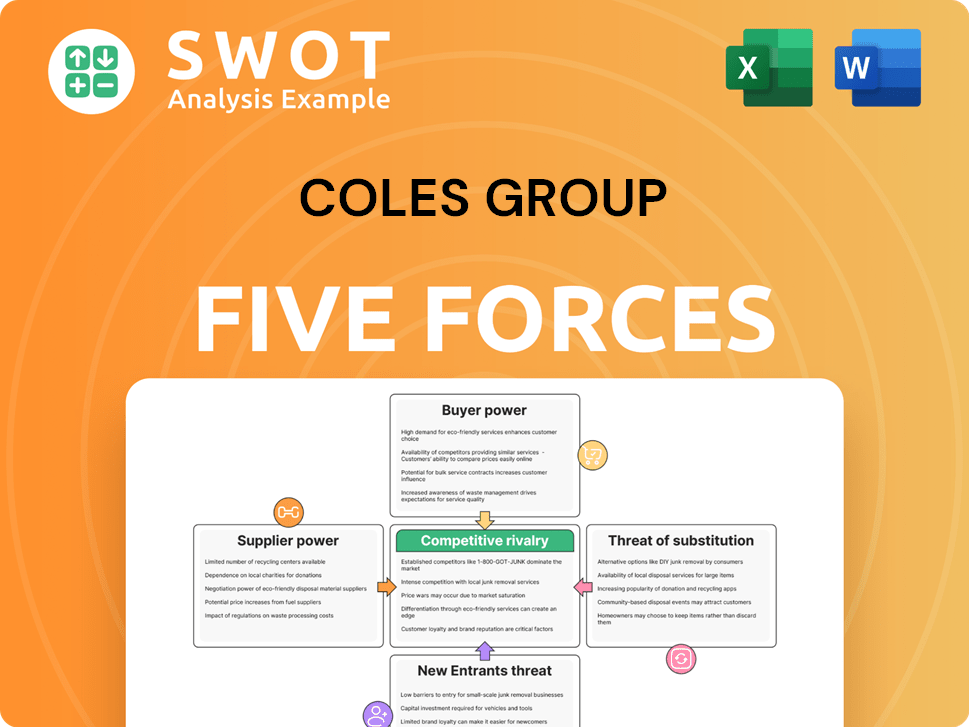

Coles Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coles Group Company?

- What is Competitive Landscape of Coles Group Company?

- What is Growth Strategy and Future Prospects of Coles Group Company?

- How Does Coles Group Company Work?

- What is Sales and Marketing Strategy of Coles Group Company?

- What is Brief History of Coles Group Company?

- What is Customer Demographics and Target Market of Coles Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.