Coupang Bundle

Can Coupang Maintain Its Dominance in the South Korean E-commerce Arena?

Coupang, the 'Amazon of South Korea,' has revolutionized online retail with its lightning-fast delivery and customer-centric approach. But in the cutthroat world of e-commerce, staying ahead requires constant vigilance. This analysis dives deep into the Coupang SWOT Analysis, exploring its rivals and the strategies shaping the future of online shopping in South Korea.

Understanding the Coupang competitive landscape is vital for investors and businesses alike. This exploration of Coupang's market analysis will uncover its main competitors and how it stacks up against online retail rivals like Naver Shopping and Gmarket. We'll examine Coupang's business model analysis, including its strengths and weaknesses, to understand its growth strategy and financial performance compared to its rivals in the South Korean e-commerce market.

Where Does Coupang’ Stand in the Current Market?

The company has established itself as a leading player in South Korea's e-commerce sector. Its core operations revolve around a comprehensive e-commerce platform that offers a wide array of products, coupled with a robust logistics network designed for rapid delivery. This integrated approach allows the company to provide a superior customer experience, making it a preferred choice for online shoppers.

The company's value proposition centers on speed, convenience, and a broad selection of goods. Its "Rocket Delivery" service is a key differentiator, offering same-day or next-day delivery for many items. This focus on efficiency, combined with an extensive product catalog and user-friendly interface, has helped the company build a strong brand loyalty and attract a large customer base. The company's business model analysis highlights a commitment to customer satisfaction through innovation and operational excellence.

The company holds a significant market position in South Korea's e-commerce industry. Based on visitor traffic as of May 2025, it captures an estimated 20-25% of the market. In 2023, it was the largest player with a 39.7% market share, demonstrating its dominance in the online retail space.

The company's active customer base reached a record 22.5 million in Q3 2024, marking an 11% year-over-year increase. Furthermore, revenue per customer increased by 4% year-over-year to $307, reflecting strong customer engagement and spending within the platform.

The company primarily operates in South Korea, where 90% of its 2024 revenue originated. However, it is actively expanding into new markets, such as Taiwan, where product selection increased nearly 500% year-over-year in Q1 2025, and Japan for food delivery services. This expansion strategy is a key part of their growth strategy.

The company has diversified its offerings beyond core e-commerce, including restaurant delivery (Coupang Eats), OTT media services (Coupang Play), and fintech services (Coupang Pay). Coupang Eats has shown significant growth, doubling its market share by credit card transaction value to 35.3% in 2024, solidifying its position in the online food delivery market.

The company's financial performance indicates strong growth and profitability. In Q1 2025, the company's consolidated net revenues were $7.9 billion, an 11% year-over-year increase. The company's gross profit increased 20% year-over-year to $2.3 billion, with a gross profit margin of 29.3%, an improvement of 217 basis points year-over-year. The company reported an operating income of $154 million in Q1 2025, a 300% year-over-year increase. The company's financial performance compared to rivals is a key indicator of its success. For more information on the company's ownership, you can read about the Owners & Shareholders of Coupang.

The company's competitive landscape is shaped by its strong market position, diversified services, and robust financial performance. The company's strengths and weaknesses are evident in its market share and expansion strategies.

- The company's e-commerce market share was 29% in 2023, compared to Naver's 17%, highlighting its dominance.

- In Q1 2025, the company's operating income increased by 300% year-over-year, demonstrating improved profitability.

- The company's revenue is projected to rise to an estimated $40,074 million by 2026, indicating continued growth.

- The company's focus on fast delivery and a wide product selection continues to drive customer acquisition strategies.

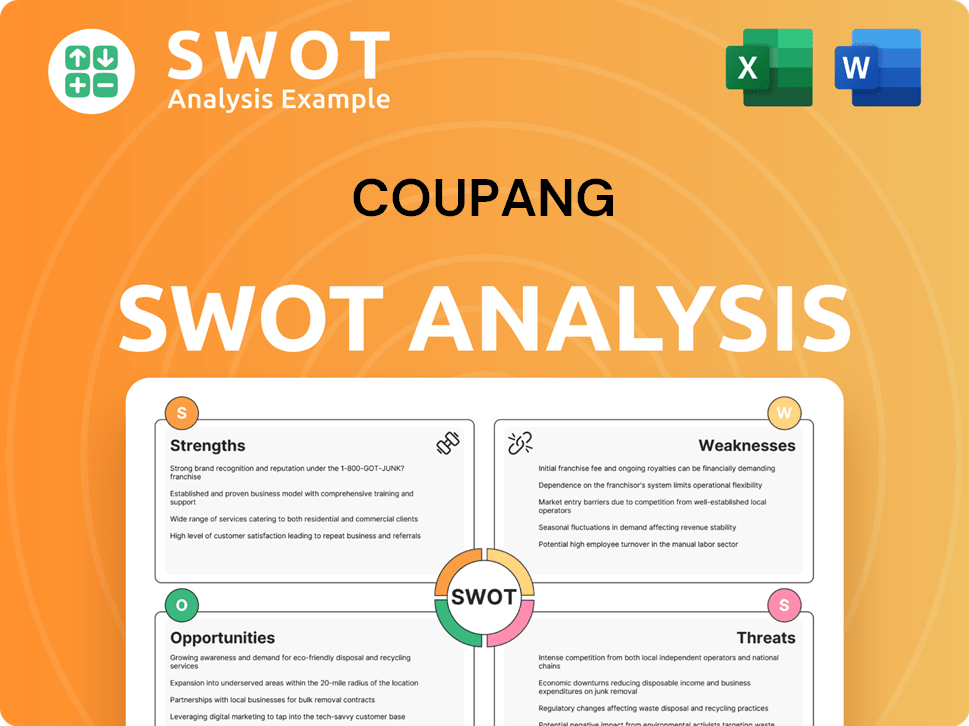

Coupang SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Coupang?

The Coupang competitive landscape is characterized by intense rivalry across various sectors, particularly in e-commerce and food delivery. Understanding Coupang's competitors is crucial for a thorough Coupang market analysis, as these rivals influence its strategic decisions and financial performance.

Coupang faces both direct and indirect competition, with the nature of the competition varying by geographic market. In South Korea, its home market, Coupang's main competitors include established players like Naver, Gmarket, and SSG.com. In international markets, such as Taiwan, Coupang contends with dominant platforms like Shopee and local competitors.

The competitive dynamics are constantly evolving, with new entrants and strategic moves by existing players shaping the landscape. For instance, the rise of Chinese e-commerce giants and Coupang's acquisition of Farfetch have broadened the scope of its competitive set.

In South Korea, Coupang's primary rivals include Naver, Gmarket, 11st, and SSG.com. Naver's integrated marketplace and search engine dominance pose a significant challenge. Gmarket and 11st often target price-sensitive consumers.

Naver, a major player in South Korean e-commerce, is a formidable competitor. Naver has been enhancing its delivery services. Naver has partnered with Kurly, a fresh food delivery app.

Coupang Eats competes with Baedal Minjok (Baemin) in the online food delivery sector. Coupang Eats has rapidly gained market share, challenging Baemin's historical dominance. By early 2025, Coupang Eats secured the second position.

In 2024, Coupang Eats' market share by credit card transaction value doubled to 35.3%. Baemin's market share fell from over 70% to 57.6%.

In Taiwan, Shopee is a dominant platform, and PChome and Momo also have loyal user bases. Chinese retailers like AliExpress and Temu are intensifying competition. JD.com has also launched its Korean business.

The acquisition of Farfetch in January 2024 for $500 million positions Coupang in the global luxury fashion market. This acquisition expands Coupang's competitive scope.

Coupang's success hinges on its ability to differentiate itself from rivals. Key factors include:

- Logistics and Delivery: Coupang's Rocket Delivery service is a key differentiator.

- Pricing and Promotions: Competitive pricing strategies are crucial for attracting customers.

- Product Assortment: A wide range of products is essential to meet consumer demand.

- Technology and Innovation: Continuous innovation in e-commerce and delivery technologies.

- Customer Experience: Providing a seamless and user-friendly shopping experience.

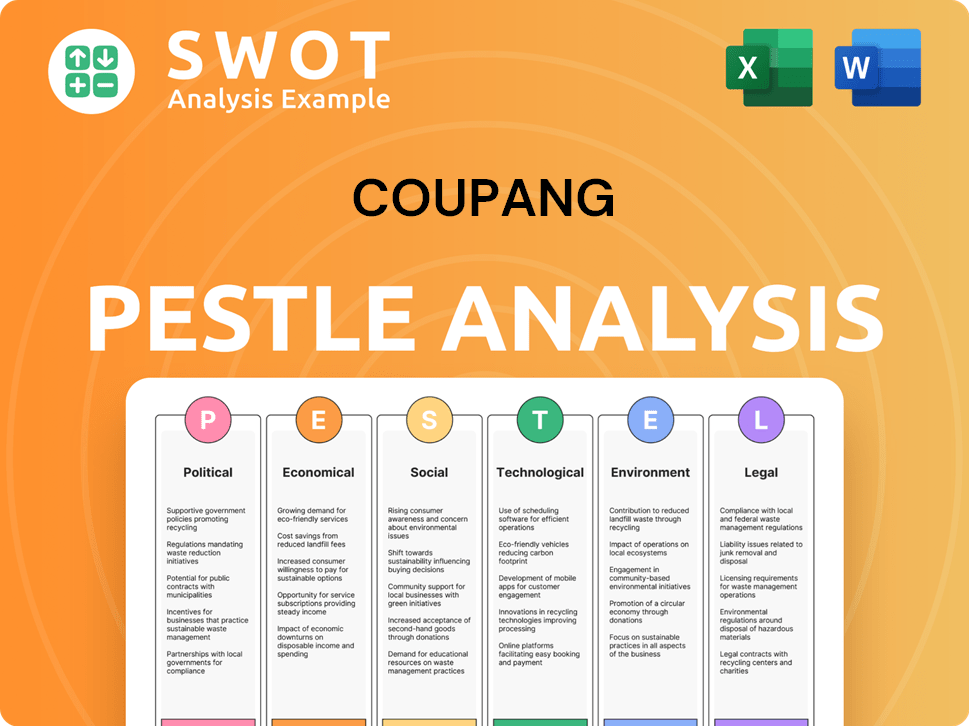

Coupang PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Coupang a Competitive Edge Over Its Rivals?

The competitive landscape for Coupang is shaped by its unique strengths in the South Korean e-commerce market. Analyzing Coupang's target market reveals how the company has built its competitive edge through strategic investments and a customer-centric approach. This has allowed it to gain significant market share and set itself apart from its rivals.

Coupang's success is deeply rooted in its ability to provide fast and reliable delivery services, which is a key differentiator in the e-commerce competition. This has allowed the company to quickly become a dominant force in the South Korean online retail market. Its commitment to customer satisfaction and continuous innovation further strengthens its position.

The company's integrated logistics network, customer-centric approach, and embrace of technology are central to its competitive advantages. These elements work together to create a strong and sustainable business model, making it a formidable player in the e-commerce sector.

Coupang's extensive logistics network is a major competitive advantage. Nearly 70% of the South Korean population lives within a 7-mile radius of a Coupang fulfillment center. This network supports its Rocket Delivery service, with 99.3% of orders delivered within 24 hours.

Coupang focuses on customer satisfaction through a user-friendly app, personalized recommendations, and 24/7 customer service. The Rocket WOW membership program offers benefits like free delivery and streaming content. This approach fosters customer loyalty and platform engagement.

Coupang uses data analytics and AI to optimize operations and enhance the shopping experience. The company's technology helps forecast demand and improve efficiency. A diverse merchant base, including small businesses and large brands, ensures a wide product selection.

The acquisition of Farfetch in early 2024 allows Coupang to enter the global luxury goods market. This move leverages its logistics capabilities for high-end customers. The goal is to achieve profitability for Farfetch in the near future.

Coupang's competitive advantages are built on its logistics network, customer focus, and technological innovation. These elements combine to create a strong position in the South Korean e-commerce market. Continuous investment in logistics and technology is crucial for maintaining its lead.

- Extensive Fulfillment Network: Over 100 fulfillment centers across South Korea.

- Rapid Delivery: Rocket Delivery with 99.3% of orders delivered within 24 hours.

- Customer-Focused Services: User-friendly app, personalized recommendations, and 24/7 customer service.

- Strategic Acquisitions: Farfetch acquisition to expand into the global luxury market.

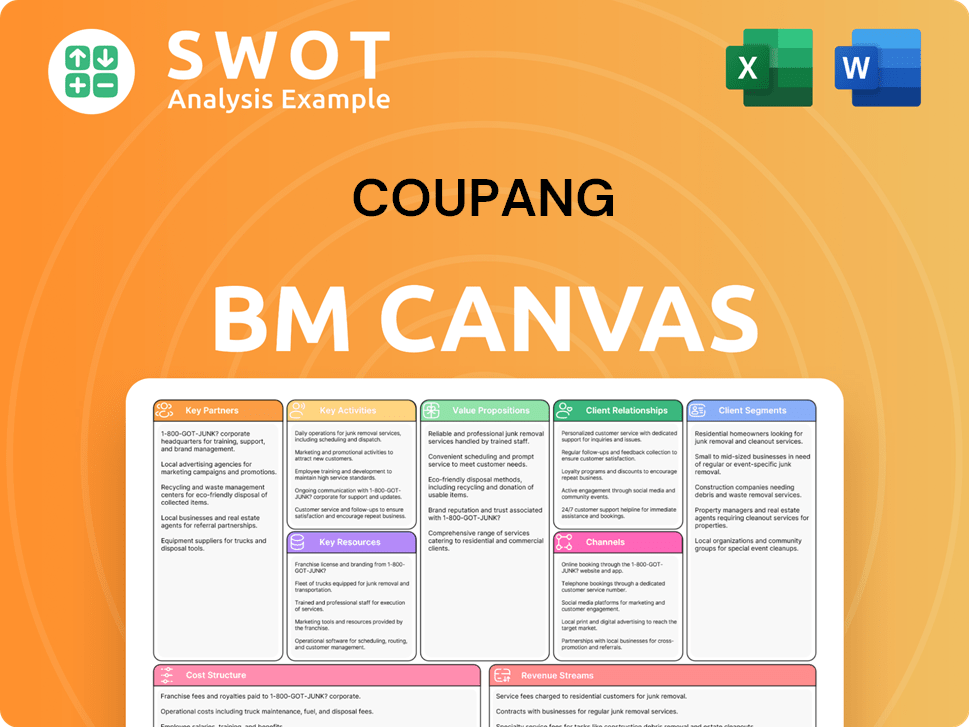

Coupang Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Coupang’s Competitive Landscape?

The e-commerce sector in South Korea is experiencing robust growth, presenting both opportunities and challenges for companies like Coupang. With the market reaching $230 billion in 2024, the competitive landscape is intensifying, especially with the entry of global players. Understanding the current industry dynamics, future challenges, and potential opportunities is crucial for assessing Coupang's position and future prospects. This includes examining the company's strengths and weaknesses in the context of its rivals and the evolving market.

The South Korean e-commerce market is projected to grow at a rate of 13% annually, reaching $336 billion by 2027. This growth is driven by increasing mobile shopping, accounting for nearly 73% of online sales, and the demand for fast delivery services. However, Coupang faces challenges from increased e-commerce competition, macroeconomic factors, and the need to adapt to changing consumer preferences in new markets. A detailed Coupang market analysis is essential to navigate these complexities.

The Coupang competitive landscape is shaped by the increasing dominance of mobile shopping and the demand for quick delivery. Industry consolidation is expected, potentially benefiting established players. The South Korean e-commerce market is growing, offering opportunities for companies that can adapt to changing consumer behaviors. The sector is also influenced by trends in technology and logistics.

Intensifying competition from Chinese online retailers like AliExpress and Temu is a major concern. The slowing e-commerce market growth rate, from 20% in 2021 to 8% in Q3 2023, presents a challenge. International expansion brings risks related to adapting to local preferences and navigating regulatory environments. Macroeconomic headwinds and supply chain disruptions could impact profitability.

Expanding into new markets such as Taiwan and Japan offers substantial growth avenues. Diversifying product offerings and enhancing the logistics network can improve delivery times. Investment in technology, including data analytics and AI, can optimize operations. Building a comprehensive ecosystem of services can enhance customer loyalty and create multiple revenue streams. The acquisition of Farfetch opens opportunities in the global luxury goods market.

Increased competition from both domestic and international players is affecting Coupang's sales growth and user base expansion. Key rivals include established e-commerce platforms and new entrants. The ability to compete effectively in terms of pricing, delivery speed, and customer service will be crucial. Understanding the strategies of Coupang competitors is essential for maintaining market share.

Coupang's success depends on replicating its business model in new markets and continuous innovation. The company's ability to maintain its growth trajectory hinges on these factors. Analysts project Coupang's revenue to climb 13% in 2025, accelerating to 15% in 2026, with adjusted earnings per share projected to reach $0.49 in 2025. For a deep dive into the company's strategic moves, check out the Growth Strategy of Coupang.

- Expanding into new markets provides significant growth avenues for the company.

- Diversifying product offerings and improving the logistics network are key opportunities.

- Investment in technology and innovation can optimize operations and customer experience.

- Building a comprehensive ecosystem of services enhances customer loyalty and revenue streams.

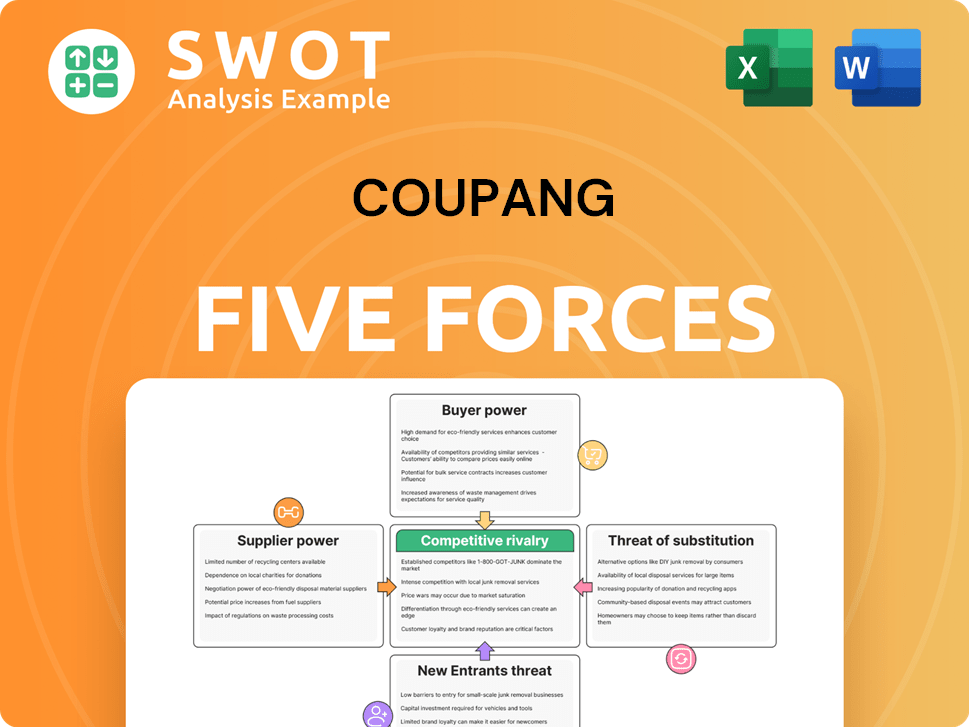

Coupang Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coupang Company?

- What is Growth Strategy and Future Prospects of Coupang Company?

- How Does Coupang Company Work?

- What is Sales and Marketing Strategy of Coupang Company?

- What is Brief History of Coupang Company?

- Who Owns Coupang Company?

- What is Customer Demographics and Target Market of Coupang Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.