Cumulus Media Bundle

Can Cumulus Media Thrive in Today's Audio Arena?

In an era dominated by digital giants, how does a traditional media company like Cumulus Media navigate the competitive landscape? This analysis dives deep into Cumulus Media's position within the dynamic audio sector, examining its core strengths and the evolving challenges it faces. From its roots in terrestrial radio to its expansion into podcasts, we'll explore Cumulus Media's journey and its strategic maneuvers to stay ahead.

The Cumulus Media SWOT Analysis provides a comprehensive look at the company's internal and external factors. Understanding the Cumulus Media competitive landscape is crucial for investors and strategists alike. This media company analysis will dissect the Radio industry and Market share dynamics, providing insights into Cumulus Media's market position and potential. We'll also examine Cumulus Media's business strategy and revenue streams to understand its future prospects.

Where Does Cumulus Media’ Stand in the Current Market?

Cumulus Media's core operations revolve around terrestrial radio broadcasting and digital audio content, particularly through its Westwood One Podcast Network. The company's value proposition lies in providing a broad reach for advertisers across various demographics and offering diverse audio content to listeners. With a robust portfolio of radio stations and a growing digital presence, Cumulus Media aims to capture a significant share of the audio media market.

The company's strategic focus includes a shift towards digital platforms, recognizing the evolving consumption habits of audio content consumers. This involves substantial investments in podcast production and distribution, allowing Cumulus Media to diversify its offerings and tap into the expanding digital audio advertising market. Cumulus Media's strategy is designed to maintain its competitive standing in an industry facing digital alternatives, with a strong emphasis on local market presence and listener engagement.

As of early 2024, Cumulus Media ranks as the third-largest radio broadcaster in the U.S. based on revenue. Its geographic footprint spans across 80 markets, with a notable concentration in mid-sized and smaller markets. Cumulus Media reported net revenue of $953.5 million for the full year 2023, demonstrating its substantial scale within the radio industry. For more insights, explore the Growth Strategy of Cumulus Media.

Cumulus Media holds a prominent position in the U.S. audio media market, focusing on terrestrial radio broadcasting and digital audio content. Its competitive landscape includes major players like iHeartMedia and Audacy. The company's strategy involves leveraging its extensive radio station portfolio and podcast network to maintain and grow its market share.

Cumulus Media generates revenue primarily through advertising sales on its radio stations and digital platforms. Additional revenue streams include content licensing and distribution. The company's ability to attract both national and local advertisers is crucial to its financial performance and overall market position.

Cumulus Media's competitive advantages include its extensive radio station portfolio, strong local market presence, and growing digital audio offerings. The company's ability to reach diverse audiences through varied programming and its focus on digital transformation are key strengths. Its Westwood One Podcast Network further enhances its competitive edge.

Challenges for Cumulus Media include the ongoing shift to digital audio consumption and competition from streaming services. Opportunities lie in expanding its digital audio content, growing its podcast network, and leveraging its local market presence. Adapting to evolving consumer preferences and technological advancements is crucial.

Cumulus Media's financial performance is influenced by advertising revenue and its ability to maintain a strong market share in the radio industry. The company's revenue for 2023 was $953.5 million, reflecting its scale within the broadcast media sector. The company's market share is impacted by its ability to compete with major rivals like iHeartMedia and Audacy.

- Cumulus Media's revenue streams are primarily from advertising.

- The company faces competition from digital audio platforms.

- Strategic investments in digital content are crucial for growth.

- Local market presence and listener engagement are key.

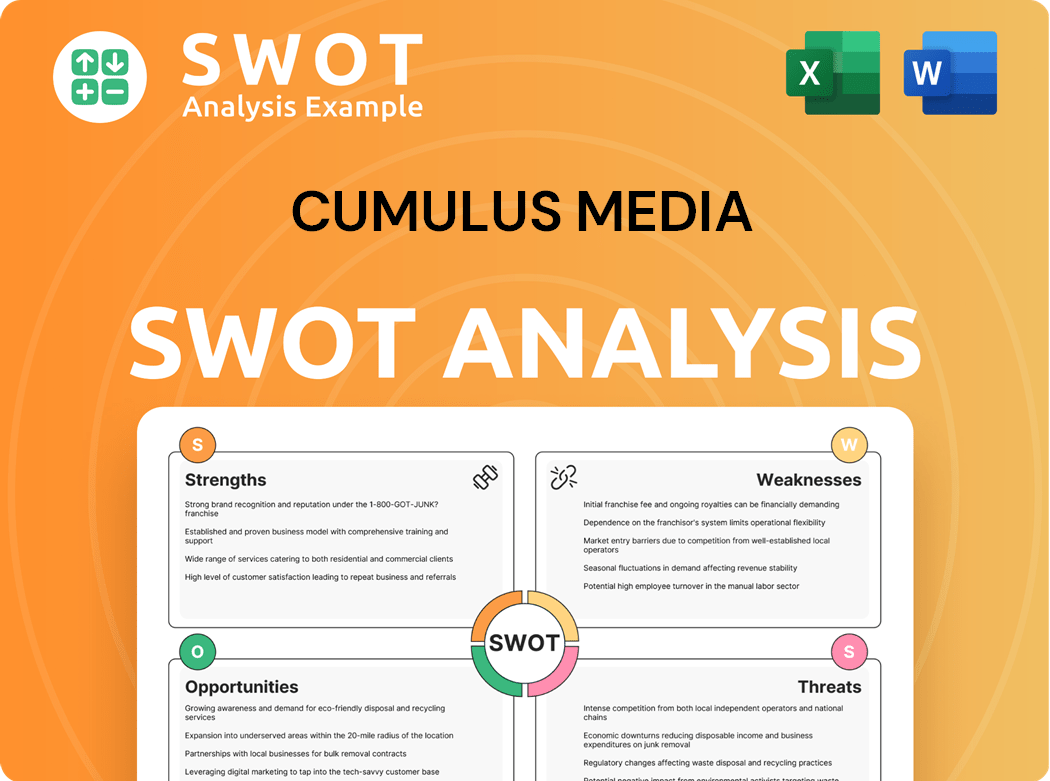

Cumulus Media SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Cumulus Media?

The competitive landscape for Cumulus Media is multifaceted, encompassing both traditional and digital audio platforms. The company faces significant challenges from established radio broadcasters and emerging digital audio services. A comprehensive understanding of its key competitors is crucial for assessing Cumulus Media's market position and future prospects. This analysis delves into the primary and secondary competitors influencing Cumulus Media's performance, offering insights into the dynamics of the radio industry and the broader broadcast media sector.

Understanding the competitive landscape is vital for investors and stakeholders interested in a detailed media company analysis. This analysis provides a clear picture of Cumulus Media's rivals, including their market share, strategies, and impact on Cumulus Media's financial performance. The focus is on identifying the main rivals and assessing their strengths and weaknesses relative to Cumulus Media. This helps in evaluating Cumulus Media's competitive advantages and challenges in the evolving audio market.

Cumulus Media's success hinges on its ability to navigate this complex environment. The following sections detail the key competitors, their strategies, and their impact on Cumulus Media's business. This competitive analysis is essential for anyone seeking to understand the forces shaping the audio media industry and the strategic decisions Cumulus Media must make to remain competitive. For a deeper dive into the company's financial aspects, consider reading about Revenue Streams & Business Model of Cumulus Media.

iHeartMedia is the largest radio broadcaster in the U.S., posing a significant challenge to Cumulus Media. iHeartMedia's extensive reach and diverse station formats enable it to compete aggressively for advertising dollars.

Audacy is another major competitor, holding a substantial portfolio of radio stations. It competes with Cumulus Media on a national and regional level, particularly in major markets.

SiriusXM's Stitcher represents a significant competitor in the podcasting space. Stitcher's investments in exclusive content attract listeners and challenge Cumulus Media's digital audio strategies.

Spotify's investment in podcasting positions it as a direct competitor, particularly for advertising revenue and listener attention. Spotify's growth in the audio market poses a challenge for Cumulus Media.

Streaming services indirectly compete for listener attention and advertising budgets. These services offer ad-supported tiers and increasingly integrate spoken-word content, impacting Cumulus Media's audience share.

Amazon and Google are expanding their audio offerings, representing a long-term competitive threat. Their resources and market presence could significantly impact Cumulus Media's market position.

The competitive landscape is dynamic, with companies vying for listener engagement and advertising revenue. The rise of independent podcasters and content creators further fragments the audio landscape.

- Advertising Revenue: Cumulus Media's advertising revenue is directly impacted by the performance of its competitors. In 2024, iHeartMedia's revenue was approximately $3.5 billion, while Cumulus Media's revenue was around $850 million, indicating a significant difference in market share.

- Digital Strategy: Cumulus Media's digital strategy must compete with the digital audio platforms. iHeartMedia's iHeartRadio platform and Audacy's app are examples of platforms that compete for listeners.

- Podcast Acquisitions: The acquisition of popular podcast talent and exclusive content deals is a key strategy. Spotify's exclusive deals and SiriusXM's investments in podcasting demonstrate this trend.

- Market Share: The radio industry is highly competitive, with market share fluctuating based on audience engagement and advertising performance. Cumulus Media's market position is continually challenged by its competitors.

- Financial Performance: Cumulus Media's financial performance is directly influenced by its ability to compete effectively. The company's ability to generate revenue and manage costs is critical in this environment.

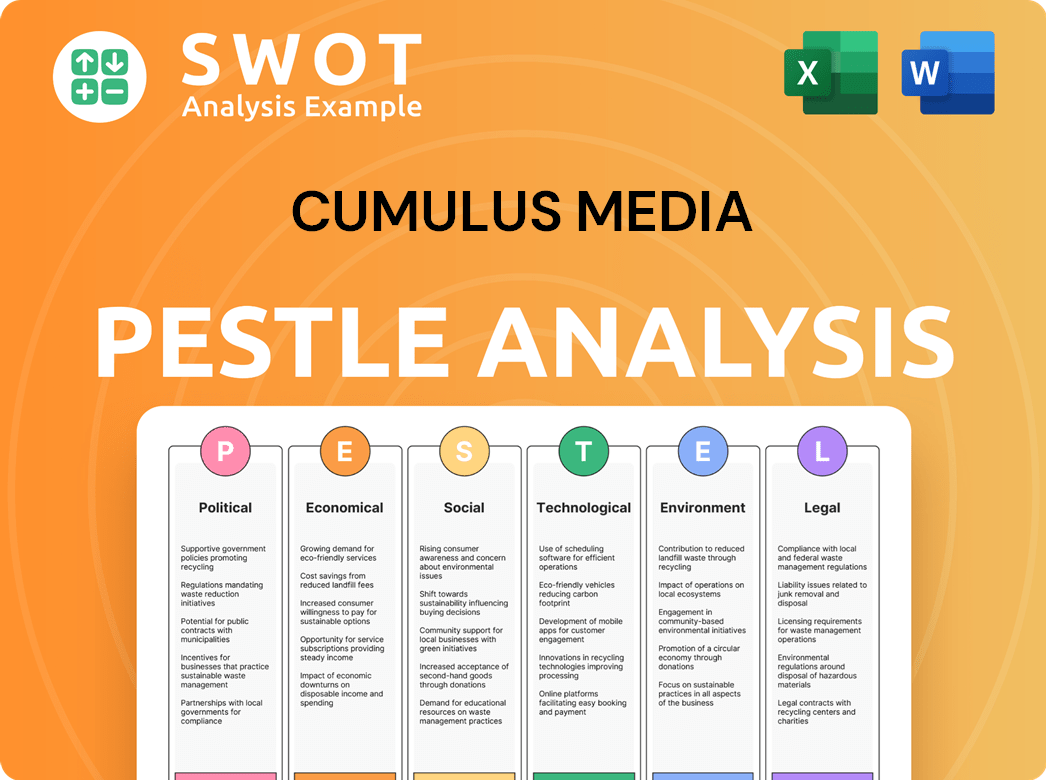

Cumulus Media PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Cumulus Media a Competitive Edge Over Its Rivals?

Understanding the Cumulus Media competitive landscape requires a deep dive into its strengths and how it positions itself within the dynamic media industry. The company has carved out a significant presence in the broadcast media sector. This analysis explores the key elements that define its competitive advantages, offering insights into its market position and strategic direction.

Cumulus Media's strategic moves and competitive edge are crucial for understanding its long-term viability. The company's ability to adapt and innovate in the face of technological advancements and evolving consumer habits is fundamental. This analysis will highlight the key factors contributing to its success and the challenges it faces in maintaining its market share.

The media company analysis of Cumulus Media reveals a complex interplay of traditional and digital strategies. Its approach to revenue streams, advertising revenue, and overall financial performance is a critical focus. This examination will shed light on how Cumulus Media navigates the competitive landscape, focusing on its core strengths and areas for potential growth.

Cumulus Media boasts a robust network of approximately 400 owned-and-operated radio stations across 80 U.S. markets. This extensive reach allows for unparalleled access to diverse local audiences, a key advantage in attracting advertisers. The strong community connections foster listener loyalty, which translates into effective local advertising solutions.

The Westwood One audio network aggregates and distributes premium content to over 8,200 broadcast radio stations and digital outlets. This network reaches a massive audience of over 250 million monthly listeners, providing a powerful platform for national advertisers. It allows Cumulus Media to monetize its content across various channels.

Cumulus Media has strategically invested in its podcasting capabilities through the Westwood One Podcast Network. This diversification into digital audio content allows the company to capture new audiences and advertising revenue streams. The podcasting industry is experiencing substantial growth, presenting significant opportunities for Cumulus Media.

Cumulus Media has long-standing relationships with advertisers, built on years of delivering results through its radio stations. These relationships represent a significant competitive barrier to entry for newer players in the radio industry. The company's established reputation helps secure advertising revenue.

Cumulus Media's competitive advantages are rooted in its extensive reach, strong content offerings, and established relationships. These elements provide a solid foundation for navigating the evolving media landscape. The company's focus on both traditional and digital platforms allows it to maximize its revenue streams.

- Extensive Radio Station Network: Approximately 400 owned-and-operated radio stations across 80 markets.

- Westwood One: Reaches over 250 million monthly listeners through its audio network.

- Podcasting: Significant player in the growing podcast market.

- Advertiser Relationships: Long-standing relationships built on delivering results.

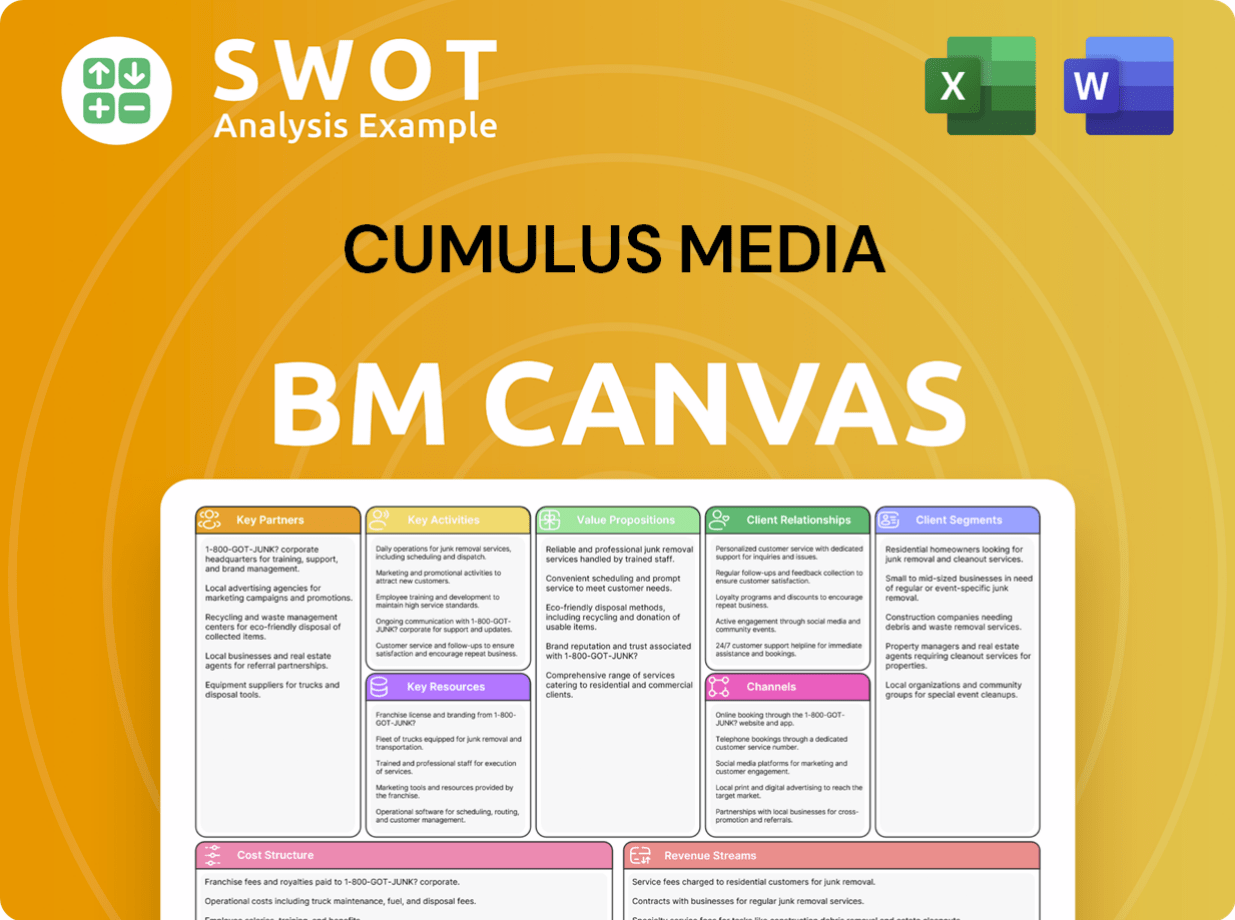

Cumulus Media Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Cumulus Media’s Competitive Landscape?

The competitive landscape for Cumulus Media is dynamic, shaped by shifting consumer habits and technological advancements. The company navigates a media environment where traditional radio competes with digital audio platforms. A thorough media company analysis reveals the need for strategic adaptation to maintain and grow market share.

Cumulus Media's financial performance hinges on its ability to diversify revenue streams and effectively manage its broadcast media assets. Understanding its competitive position requires a deep dive into its business strategy, including its digital initiatives and radio station portfolio.

The radio industry is evolving, with increased consumption of audio content via podcasts and streaming services. Digital innovation is crucial for Cumulus Media, as evidenced by its investments in platforms like the Westwood One Podcast Network. The trend shows the need to adapt to changing listener preferences and advertising models.

Cumulus faces challenges from digital platforms like Google and Meta, which compete for advertising revenue. The shift of younger demographics away from traditional radio poses a long-term threat. Regulatory changes and economic fluctuations add to the complexity of the landscape.

The podcast industry offers significant growth potential, with increasing listenership and advertiser interest. Smart speakers and in-car entertainment systems provide avenues to deliver audio content to new environments. Strategic partnerships and content development can further enhance Cumulus's reach.

Cumulus Media is focused on diversifying its revenue streams beyond traditional advertising. Investment in digital audio platforms and leveraging its content library are key strategies. The company aims to become a more integrated audio-first media company, balancing its radio heritage with digital expansion.

To thrive in the competitive landscape, Cumulus Media must focus on several key areas. These include expanding its digital footprint, enhancing its content offerings, and optimizing its advertising strategies. Strategic decisions are critical for long-term sustainability.

- Digital Expansion: Increasing investment in digital audio platforms and podcasting.

- Content Development: Creating exclusive content to attract listeners and advertisers.

- Advertising Innovation: Developing data-driven advertising solutions.

- Partnerships: Forming strategic alliances with technology companies and content creators.

As of 2024, the radio advertising market faces challenges, with digital platforms capturing a larger share of ad spend. The company’s ability to adapt and innovate will determine its future success. For more information about the company's ownership structure, you can read Owners & Shareholders of Cumulus Media.

Cumulus Media Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cumulus Media Company?

- What is Growth Strategy and Future Prospects of Cumulus Media Company?

- How Does Cumulus Media Company Work?

- What is Sales and Marketing Strategy of Cumulus Media Company?

- What is Brief History of Cumulus Media Company?

- Who Owns Cumulus Media Company?

- What is Customer Demographics and Target Market of Cumulus Media Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.