Deckers Outdoor Bundle

Can Deckers Outdoor Company Outpace Its Rivals?

Deckers Outdoor Company, home to powerhouse brands like UGG and Hoka, operates in a fiercely contested footwear industry. Its strategic prowess, especially with the high-growth Hoka brand, is critical for navigating the competitive landscape. This report delves into Deckers' market position, analyzing its key rivals and the strategies that fuel its success.

From its origins crafting custom sandals, Deckers Outdoor Company has transformed into a global force, challenging competitors in the footwear industry. Understanding the Deckers Outdoor SWOT Analysis is crucial for investors and strategists alike. This analysis will examine Deckers' competitive advantages, market share, and financial performance, offering insights into its long-term growth potential and brand positioning within the dynamic footwear market, including UGG and Hoka. We will also look at Deckers competitors.

Where Does Deckers Outdoor’ Stand in the Current Market?

Deckers Outdoor Company holds a strong market position within the footwear industry. The company's success is largely driven by the growth of its Hoka brand and the consistent performance of UGG. This diversified portfolio allows Deckers to cater to various customer segments, from performance athletes with Hoka to casual lifestyle consumers with UGG and outdoor enthusiasts with Teva and Sanuk.

Deckers operates globally, selling products through wholesale channels, direct-to-consumer (DTC) channels, and international distributors. Over time, Deckers has strategically invested in its direct-to-consumer capabilities and focused on premiumization, particularly with Hoka's strong performance in the athletic footwear segment. This digital transformation has allowed the company to gain greater control over its brand narratives and customer relationships.

Deckers' financial health is robust, with analysts noting its strong balance sheet and consistent profitability. The company's gross margin increased to 55.9% in Q3 FY24, up from 53.0% in the prior year period, indicating efficient operations and strong brand pricing power. To learn more about the company's target consumer, check out the Target Market of Deckers Outdoor.

Hoka has been a significant growth driver for Deckers. Net sales for Hoka increased by 21.9% to $429.3 million in Q3 FY24. This growth contributed significantly to the company's overall revenue.

UGG also demonstrated strong performance. Net sales for UGG increased by 15.2% to $1.07 billion in Q3 FY24. UGG continues to be a key contributor to Deckers' revenue.

Deckers' overall revenue growth was 16% to $1.47 billion in Q3 FY24. This growth reflects the strength of both the Hoka and UGG brands. The company's diversified brand portfolio contributes to its market share.

Deckers operates globally, with a significant presence in North America, Europe, and Asia. The company's international distribution networks and direct-to-consumer channels contribute to its market reach. This global presence helps Deckers to maintain its market share.

Deckers' market position is shaped by several key dynamics. The company's focus on premiumization and direct-to-consumer channels has enhanced its brand positioning. The strong performance of Hoka and UGG has driven revenue growth.

- Strong brand positioning in the footwear industry.

- Effective DTC strategy and digital transformation.

- Consistent profitability and strong financial health.

- Diversified brand portfolio mitigating risks.

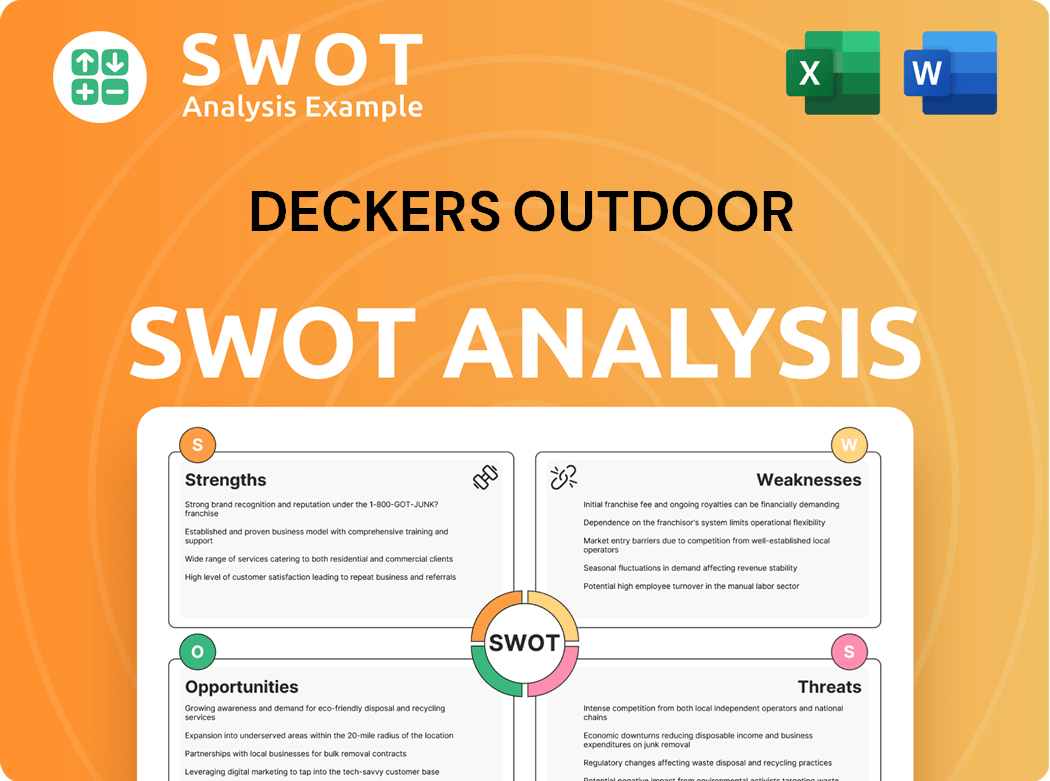

Deckers Outdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Deckers Outdoor?

The competitive landscape for Deckers Outdoor Company is multifaceted, encompassing various brands and product categories. The company faces a diverse range of rivals, from global giants to niche players, each vying for market share in the footwear industry. Understanding the competitive dynamics is crucial for assessing Deckers' market position and future growth prospects. A comprehensive Deckers Outdoor Company competitive analysis reveals the key players and strategies shaping the industry.

Deckers' success depends on its ability to navigate this complex environment, differentiating its brands and effectively competing on innovation, brand image, and distribution. The company's performance is closely tied to its ability to adapt to changing consumer preferences and market trends. Analyzing the competitive landscape provides insights into the challenges and opportunities Deckers faces.

The company's financial performance, including revenue and market share, is directly impacted by its ability to compete effectively. The footwear industry is dynamic, with constant innovation and evolving consumer demands. Deckers' strategic decisions, such as product development, marketing, and distribution, are influenced by the competitive environment.

In the athletic footwear segment, particularly for its Hoka brand, Deckers competes with major players. These competitors challenge Hoka through research and development, marketing, and distribution.

Nike and Adidas are dominant forces in the broader athletic market. Brooks Running and ASICS are also significant competitors, particularly in the specialized running shoe market.

UGG and Koolaburra face competition from brands offering similar comfort and style. These rivals compete on brand image, fashion trends, and price point.

VF Corporation, Crocs, and Birkenstock are significant competitors in the lifestyle and casual footwear segment. Direct-to-consumer brands also pose a challenge.

Teva and Sanuk compete with brands like Chaco, Keen, and Reef. These brands offer sandals and casual footwear for outdoor activities.

The competitive landscape is shaped by direct-to-consumer brands, online retailers, and fast-fashion players. Mergers and acquisitions also reshape the competitive dynamics.

Deckers' brands, including UGG and Hoka, face distinct competitive pressures. Analyzing the strengths and weaknesses of each brand is crucial for understanding the overall competitive landscape. This analysis considers market share, brand positioning, and financial performance.

- UGG: Faces competition from brands offering similar products at lower price points. Market share analysis is essential.

- Hoka: Competes in the high-growth athletic footwear segment. Market trends and innovation are key factors.

- Teva and Sanuk: Compete in the outdoor and casual lifestyle segment. Brand positioning and consumer preferences are important.

- Overall: The company's growth strategies and financial performance are influenced by these competitive dynamics.

Deckers Outdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Deckers Outdoor a Competitive Edge Over Its Rivals?

The competitive advantages of Deckers Outdoor Company are largely centered on its powerful brand portfolio, especially UGG and Hoka, its dedication to innovation, and its effective direct-to-consumer (DTC) strategy. These elements collectively enable the company to maintain a strong market position within the footwear industry. A deeper dive into these aspects provides a clearer picture of Deckers' strengths within the competitive landscape.

Deckers' ability to command premium pricing and maintain strong margins is a direct result of its brand strength. The company's investment in research and development for brands like Hoka ensures a steady stream of technologically advanced products. Furthermore, Deckers has strategically expanded its direct-to-consumer channels, which accounted for approximately 53% of its total net sales in Q3 FY24. This strategic approach provides higher margins, greater control over brand messaging, and direct access to customer data.

Deckers’ competitive edge is also enhanced by its robust supply chain and efficient operational management, which enable it to deliver products effectively to a global market. These advantages, evolved from a focus on quality and comfort in its early days, now represent a sophisticated blend of brand management, technological innovation, and direct customer engagement, making them sustainable against imitation and industry shifts. For a look at the company's origins, check out Brief History of Deckers Outdoor.

UGG's brand recognition and customer loyalty are significant. UGG's net sales increased by 15.2% to $1.07 billion in Q3 FY24, showing consistent performance. Hoka's reputation for innovative performance technology has resonated with runners and lifestyle consumers, driving a 21.9% increase in net sales to $429.3 million in Q3 FY24.

Deckers invests heavily in research and development for performance brands like Hoka. This focus ensures a pipeline of technically advanced products that meet evolving consumer demands. The company's proprietary technology and design expertise are difficult for competitors to replicate, contributing to its competitive advantage.

Deckers has strategically expanded its direct-to-consumer channels. DTC accounted for approximately 53% of total net sales in Q3 FY24. This strategy provides higher margins and greater control over brand messaging. It also gives direct access to customer data, which fosters stronger customer relationships and enables agile responses to market trends.

Deckers has a robust supply chain and efficient operational management. These factors contribute to the effective delivery of products to a global market. These efficiencies support the company's ability to maintain competitiveness and meet consumer demand efficiently.

Deckers Outdoor Company's competitive advantages are multifaceted, including strong brand recognition, innovative product development, and a robust direct-to-consumer strategy. These strengths are evident in the financial performance of its key brands and its ability to adapt to market trends. The company's focus on innovation and customer engagement further solidifies its position in the footwear market.

- Strong Brand Portfolio: UGG and Hoka command significant market share and customer loyalty.

- Innovative Product Development: Continuous investment in R&D for technologically advanced products.

- Direct-to-Consumer Strategy: High DTC sales provide higher margins and direct customer access.

- Operational Efficiency: Robust supply chain and efficient management support global distribution.

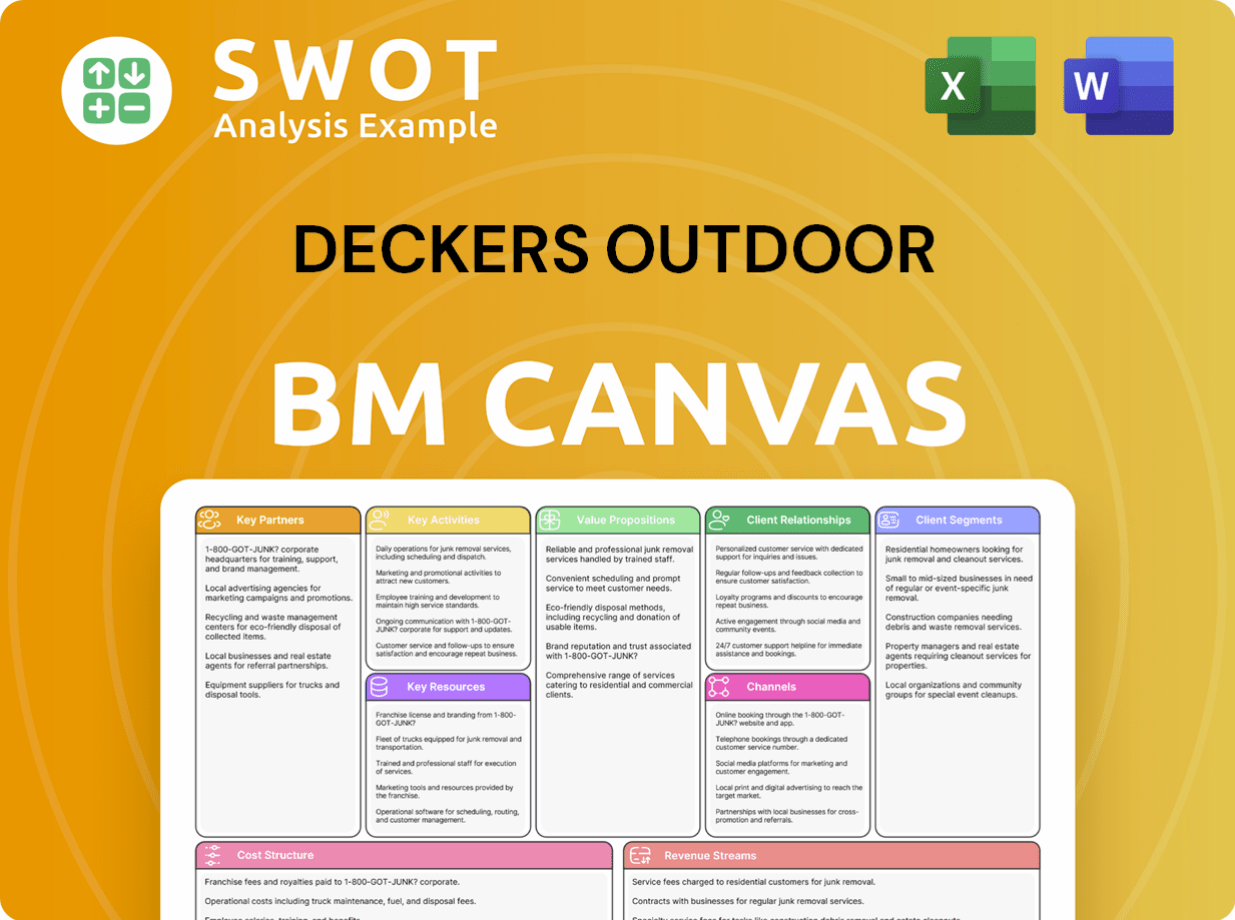

Deckers Outdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Deckers Outdoor’s Competitive Landscape?

The footwear and apparel industry is experiencing significant shifts, influencing companies like Deckers Outdoor Company. Technological advancements, consumer demand for sustainability, and the growth of e-commerce are reshaping the competitive landscape. Understanding these trends is crucial for assessing Deckers' market position, potential risks, and future prospects.

Deckers faces both opportunities and challenges. The success of brands like Hoka and UGG provides growth avenues, while intense competition and economic uncertainties pose risks. The company’s ability to adapt to evolving consumer preferences and navigate supply chain complexities will determine its long-term success. A deep dive into the Marketing Strategy of Deckers Outdoor helps to understand the company's approach in this dynamic environment.

The footwear industry is currently shaped by digital transformation and changing consumer preferences. E-commerce continues to grow, with online sales representing a significant portion of total revenue. Sustainability is a major factor, influencing material choices and supply chain practices. Furthermore, the rise of athleisure and outdoor lifestyles drives demand for specialized footwear and apparel.

Intense competition from established and emerging brands presents a constant challenge. Supply chain disruptions, raw material cost fluctuations, and geopolitical uncertainties can impact profitability. Economic downturns and shifts in consumer spending habits pose additional risks. Regulatory scrutiny regarding labor practices and environmental impact adds complexity.

Deckers can capitalize on the strong performance of Hoka and UGG. Expanding Hoka's product lines and leveraging UGG's brand recognition for new collaborations can drive growth. Strengthening direct-to-consumer channels through personalized marketing and enhanced digital experiences will boost customer loyalty. International expansion, particularly in emerging markets, offers further potential.

Deckers is likely to focus on brand diversification and strategic marketing investments. This includes leveraging its direct-to-consumer strength and exploring international expansion. Potential strategic acquisitions could also be part of the growth strategy. Continuous innovation in product design and materials remains critical for maintaining a competitive edge.

In fiscal year 2024, Deckers reported net sales of approximately $4.29 billion, a significant increase from the previous year. Hoka's net sales grew by over 30%, demonstrating its strong market performance. UGG also showed growth, highlighting the brand's continued appeal. E-commerce sales represented a considerable portion of total revenue, reflecting the importance of digital channels.

- Hoka's rapid growth reflects its strong market share in the running shoe market.

- UGG's brand positioning and strategic collaborations support its continued relevance.

- Deckers' financial performance indicates its resilience in a competitive market.

- The company's strategic initiatives are designed to sustain growth and profitability.

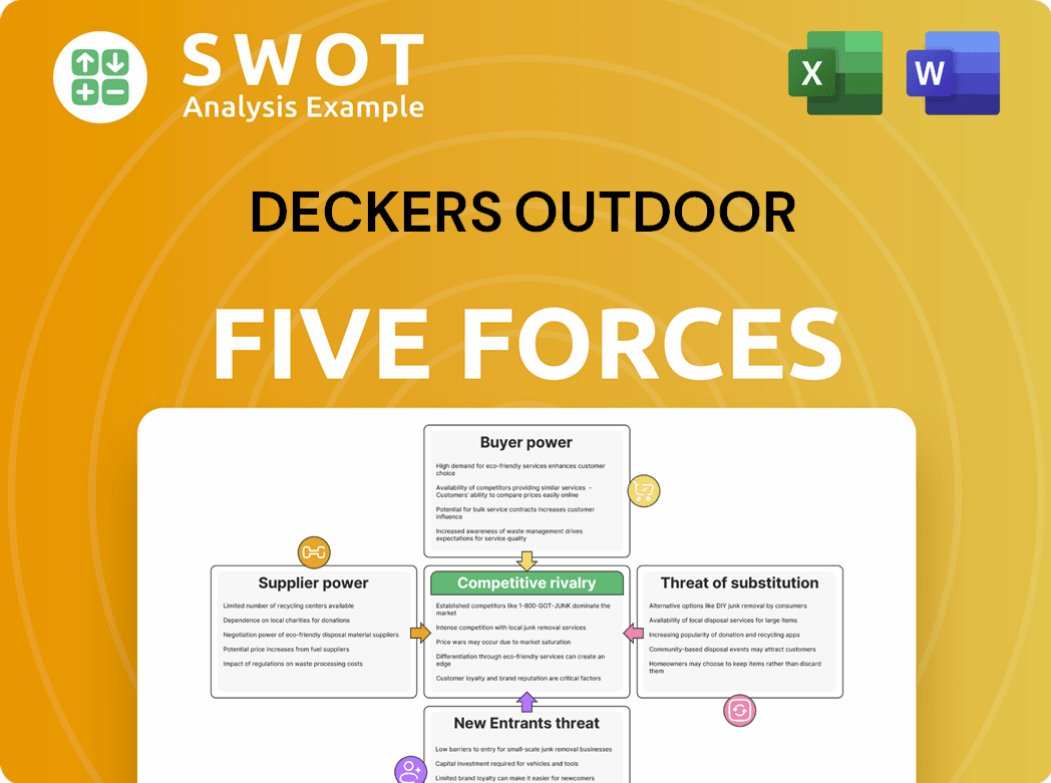

Deckers Outdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Deckers Outdoor Company?

- What is Growth Strategy and Future Prospects of Deckers Outdoor Company?

- How Does Deckers Outdoor Company Work?

- What is Sales and Marketing Strategy of Deckers Outdoor Company?

- What is Brief History of Deckers Outdoor Company?

- Who Owns Deckers Outdoor Company?

- What is Customer Demographics and Target Market of Deckers Outdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.