Deckers Outdoor Bundle

How Well Does Deckers Outdoor Company Know Its Customers?

The success of brands like Hoka, under the Deckers Outdoor Company umbrella, highlights the critical importance of understanding customer demographics and target market analysis. Hoka's rise in the athletic footwear market is a testament to the power of identifying and catering to specific consumer needs, a strategy that has significantly boosted Deckers' market share. This approach is a cornerstone of effective business strategy.

From its humble beginnings as a sandal maker, Deckers Outdoor Company has evolved into a global powerhouse, demonstrating the importance of adapting to changing consumer behavior. Deckers Outdoor SWOT Analysis reveals how the company strategically positions its brands to resonate with diverse customer segments. Understanding the customer demographics, including the age range of Teva sandal consumers and income levels of UGG boot purchasers, is key to Deckers' ongoing success in a competitive market. This exploration delves into the Deckers Outdoor Company customer profile and its sophisticated customer segmentation strategy.

Who Are Deckers Outdoor’s Main Customers?

Understanding the primary customer segments is crucial for analyzing the business of the Deckers Outdoor Company. Their diverse brand portfolio caters to a wide range of consumers, each with distinct characteristics and preferences. This approach allows for targeted marketing strategies and product development, ensuring relevance and appeal across different demographics.

The company's success hinges on its ability to identify and serve these varied customer segments effectively. Each brand within the Deckers portfolio, such as UGG, Hoka, Teva, and Sanuk, targets a specific group, allowing for focused product offerings and marketing campaigns. This segmentation strategy is key to maintaining a strong market presence and driving growth.

The primary customer segments for Deckers Outdoor Company are diverse, reflecting the varied brands within its portfolio. For example, UGG targets a female-dominated demographic, while Hoka focuses on performance-oriented athletes. Teva appeals to outdoor enthusiasts, and Sanuk resonates with a younger, casual audience.

UGG primarily targets a female demographic, spanning late teens to middle-aged adults. This segment is often associated with a comfortable and fashion-conscious lifestyle. Income levels range from moderate to affluent, with varied education levels. The brand's appeal lies in its blend of comfort and style, making it a popular choice for everyday wear.

Hoka targets performance-oriented athletes and active individuals, typically aged 25-55. This segment is focused on running, hiking, and outdoor activities. They often have higher disposable incomes and prioritize specialized, high-performance gear. The brand's emphasis on innovation and performance attracts serious athletes and fitness enthusiasts.

Teva appeals to outdoor enthusiasts and adventure seekers, with a customer base that values durability and versatility. The age range is broad, from young adults to older active individuals. These customers seek footwear suitable for various outdoor activities. Teva's focus on functionality and sustainability resonates with this segment.

Sanuk resonates with a younger, more laid-back demographic seeking comfortable and casual footwear, often associated with beach and surf culture. This segment values comfort and style for everyday wear. The brand's focus on relaxed designs and sustainable materials appeals to this demographic.

Deckers' success is driven by its ability to understand and cater to diverse customer needs. The Hoka brand has shown significant growth, with net sales increasing by 34.3% to $1.81 billion in fiscal year 2024. This growth highlights the effectiveness of targeting the performance athletic market. The company's strategic diversification beyond the UGG brand has allowed it to capture new market opportunities.

- Customer Demographics: UGG targets a female-dominated demographic, while Hoka focuses on athletes.

- Brand Positioning: Each brand has a distinct positioning, from comfort (UGG) to performance (Hoka).

- Market Segmentation: Deckers uses market segmentation to target specific consumer groups.

- Consumer Behavior: Understanding consumer behavior is crucial for product development and marketing.

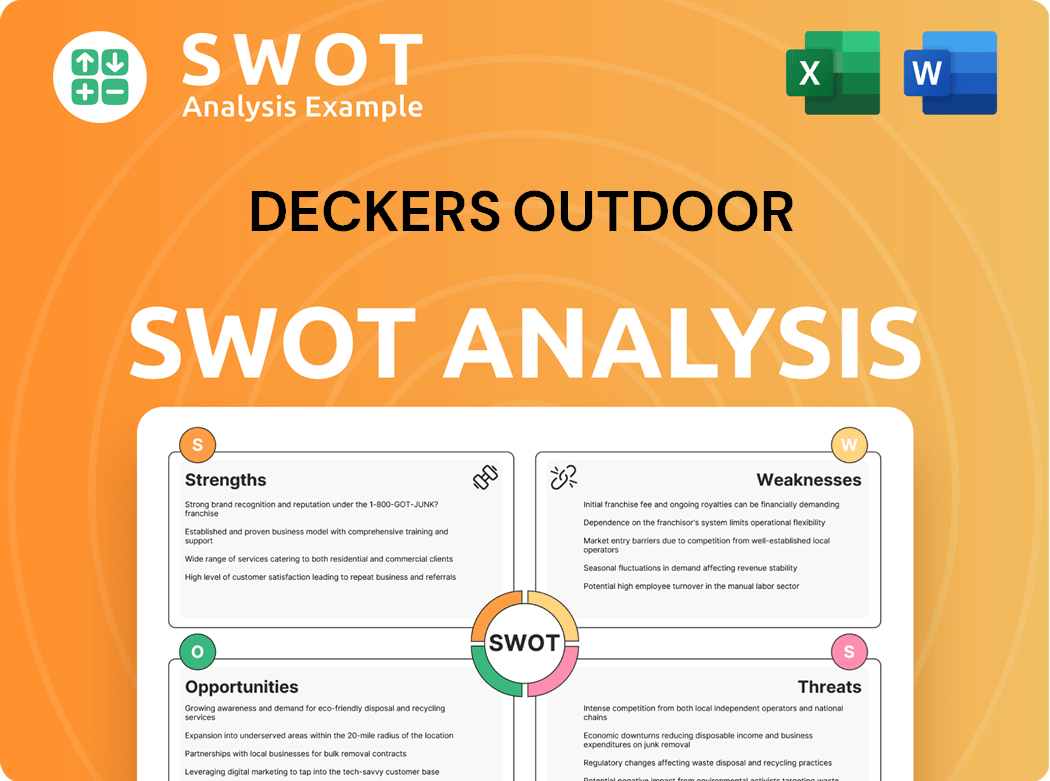

Deckers Outdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Deckers Outdoor’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any brand, and for Deckers Outdoor Company, this understanding is especially complex due to its diverse brand portfolio. Each brand within the company caters to a distinct segment of consumers with unique motivations, purchasing behaviors, and loyalty drivers. This approach allows Deckers to effectively target its marketing efforts and product development to meet the specific needs of each customer group.

The key to Deckers' success lies in its ability to identify and cater to the varied needs of its customers. This involves a deep understanding of the psychological and functional drivers behind each customer's purchasing decisions. By tailoring its products, marketing strategies, and customer experiences to these specific segments, Deckers ensures that each brand resonates with its target audience, fostering brand loyalty and driving sales.

The company's strategy of segmenting its market allows it to create a diverse portfolio of brands that each have a unique value proposition. For instance, UGG focuses on comfort and luxury, while Hoka emphasizes performance and support. This approach allows Deckers to capture a wide range of consumer preferences and maintain a strong market presence across different segments.

UGG customers prioritize comfort, warmth, and casual style. Their purchasing decisions are often influenced by seasonal trends and the desire for high-quality loungewear and footwear. The brand's reputation for comfort and durability fosters loyalty.

Hoka customers are driven by performance, cushioning, and support. Their decisions are often based on technical features like stack height and pronation control. They seek injury prevention and enhanced comfort for running and other high-impact activities.

Teva customers value durability, versatility, and functionality for outdoor adventures. They prefer footwear that can withstand various terrains and conditions. Their preferences lean towards practical and reliable products.

Sanuk customers seek comfort, casual style, and a relaxed aesthetic. They often value the brand's unique 'sidewalk surfer' design. This segment is attracted to the brand's laid-back and comfortable footwear options.

Koolaburra by UGG customers are motivated by affordability and a desire for similar comfort and style to UGG but at a lower price point. This brand caters to customers seeking value without compromising on style.

Deckers tailors its marketing, product features, and customer experiences to these specific segments through targeted advertising campaigns and product lines designed to meet specific functional and aesthetic needs. The company focuses on understanding the unique needs of each segment to drive sales and brand loyalty.

Deckers' customer segmentation strategy is a key driver of its success, allowing it to target specific consumer needs effectively. This approach enables the company to tailor its marketing efforts, product development, and overall customer experience to resonate with each brand's target audience. By focusing on the distinct needs and preferences of each segment, Deckers can foster brand loyalty and drive sales growth.

- UGG: Focuses on comfort, style, and luxury, targeting consumers seeking cozy and fashionable footwear.

- Hoka: Emphasizes performance and support, catering to athletes and fitness enthusiasts who prioritize technical features and injury prevention.

- Teva: Values durability and versatility, appealing to outdoor adventurers who need reliable footwear for various terrains.

- Sanuk: Centers on comfort and casual style, attracting consumers looking for relaxed and comfortable footwear options.

- Koolaburra by UGG: Provides affordability and style, targeting customers seeking similar comfort and aesthetics to UGG at a lower price point.

Deckers Outdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Deckers Outdoor operate?

The geographical market presence of the [Company Name] is extensive, with a strategic focus on North America, Europe, and the Asia-Pacific region. The United States serves as a primary market, benefiting from strong brand recognition and substantial market share across its various product lines. However, international markets are increasingly vital for revenue growth, especially within Europe and Asia.

In fiscal year 2024, the company reported a significant increase in international net sales, rising by 20.3% to reach $1.29 billion. This growth underscores the importance of global markets in the company's overall financial performance. The company's strategic approach involves adapting its offerings and marketing strategies to suit the diverse preferences and climates of different regions.

The company's success in diverse markets is supported by localized strategies. These include adjusting product assortments to match regional climate and fashion trends, using local influencers and marketing campaigns, and forming partnerships with regional retailers. For example, UGG may offer different styles or materials in warmer climates compared to colder regions. Hoka's marketing in Asia might emphasize specific performance benefits relevant to local running cultures or urban environments.

Within Europe, the United Kingdom, Germany, and France are significant markets, particularly for UGG and Hoka. The Asia-Pacific region, including Japan and China, presents varying consumer preferences and buying power.

Recent expansions have focused on growing the Hoka brand globally, with strategic investments in marketing and distribution in key international markets. This is to capitalize on the global surge in athletic footwear demand.

The geographic distribution of sales indicates a healthy balance between established domestic markets and rapidly expanding international territories. This balance contributes to the company's overall revenue growth, supported by effective Owners & Shareholders of Deckers Outdoor strategies.

- The United States remains a primary market.

- Europe and Asia-Pacific are key for growth.

- Localization of products and marketing is crucial.

- Hoka brand is expanding globally.

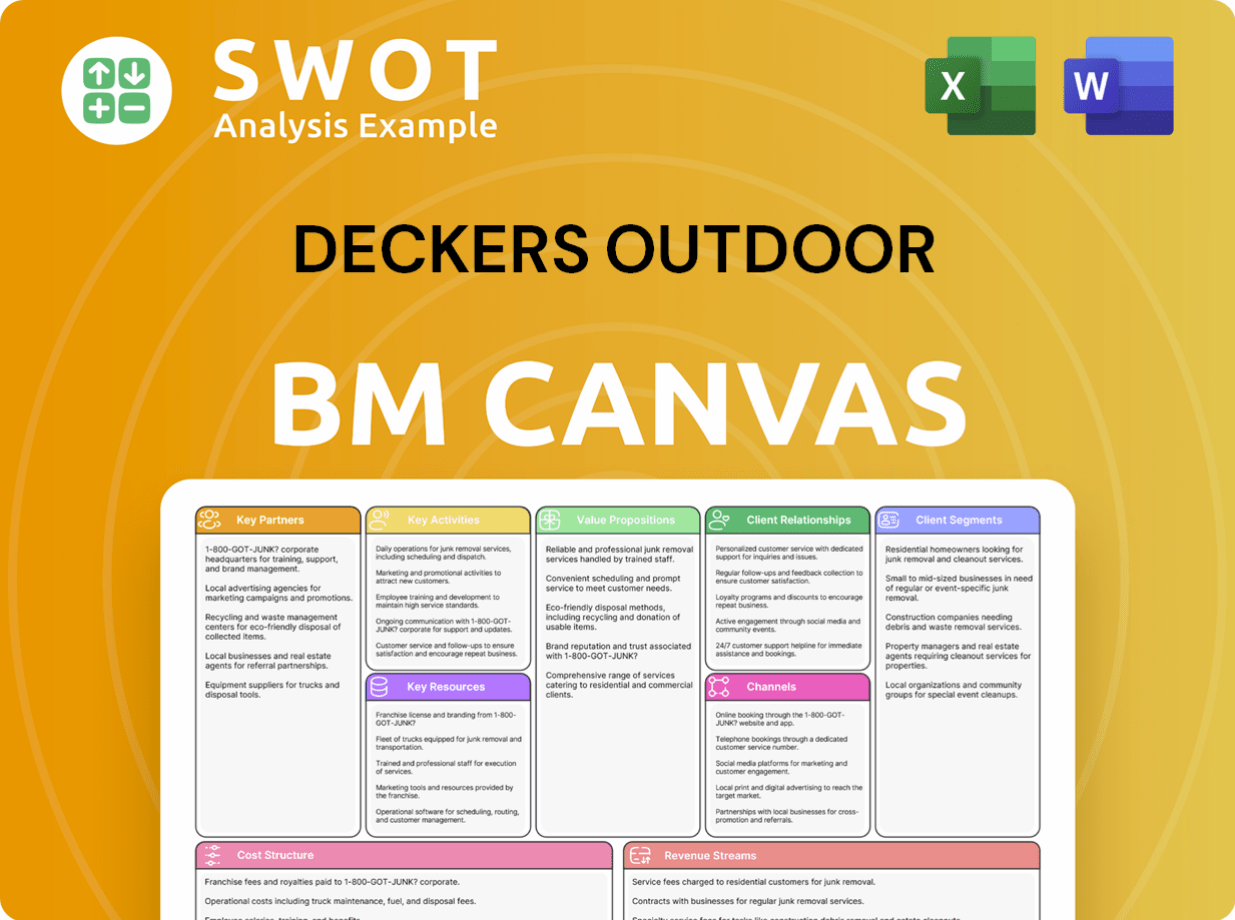

Deckers Outdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Deckers Outdoor Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any company. For the Deckers Outdoor Company, a multi-faceted approach is employed, combining digital and traditional marketing with strategic sales tactics and loyalty-building initiatives. This comprehensive strategy targets various customer segments, ensuring sustained growth and brand loyalty. The company's ability to adapt and innovate in its customer engagement strategies is key to its market performance.

Digital marketing plays a significant role in acquiring new customers. This includes targeted online advertising, search engine marketing (SEM), and active social media campaigns across platforms like Instagram, Facebook, and TikTok. Influencer marketing is particularly effective for brands like Hoka and UGG, where partnerships with athletes, fitness enthusiasts, and fashion influencers authentically showcase products. Traditional methods, such as print advertisements and out-of-home advertising, also contribute to brand building and reaching specific demographics.

Sales tactics include strategic wholesale partnerships with major retailers, which provide broad market reach. The direct-to-consumer (DTC) channel is also growing through brand-specific e-commerce websites and retail stores. This DTC channel allows greater control over the customer experience and access to valuable customer data. In fiscal year 2024, the company reported a 10.9% increase in direct-to-consumer net sales, reaching $2.03 billion, highlighting the success of this channel in acquiring and serving customers.

The company uses targeted online advertising and search engine marketing (SEM) to reach potential customers. Social media campaigns on platforms like Instagram, Facebook, and TikTok are also key. Influencer marketing is effectively used for brands like Hoka and UGG.

Strategic wholesale partnerships with major retailers help expand market reach. The direct-to-consumer (DTC) channel, through e-commerce and retail stores, is a growing focus. The DTC channel provides greater control over customer experience and data.

Customer retention focuses on personalized experiences, loyalty programs, and strong after-sales service. Customer data and CRM systems are used to personalize marketing and offers. Product innovation and quality are also key to fostering loyalty.

Continuous introduction of new styles, technologies, and collaborations keeps customers engaged. The company invests in product quality to ensure customer satisfaction. This approach encourages repeat purchases and builds long-term loyalty.

The company is shifting towards a more digitally-centric acquisition strategy. Hoka's rapid growth, driven by online engagement and performance marketing, is a prime example. This shift enhances personalization and fosters direct customer relationships.

Customer retention is enhanced through personalized experiences. The use of customer data and CRM systems allows for tailored marketing communications. This approach helps in delivering relevant product recommendations and exclusive offers.

Loyalty programs and excellent after-sales service are integral to customer retention. While specific programs aren't always detailed, the focus is on building customer satisfaction. This includes easy returns and responsive customer support.

The company invests in product innovation and quality to ensure customer satisfaction. Continuous introduction of new styles and technologies keeps customers engaged. This encourages repeat purchases and fosters brand loyalty.

The company likely utilizes customer data and CRM systems to segment its customer base effectively. This segmentation allows for the delivery of personalized marketing communications. Targeted approaches enhance the customer experience.

The DTC channel provides greater control over customer experience and access to valuable data. Direct sales through e-commerce and retail stores are a key strategy. This approach allows for more personalized customer interactions.

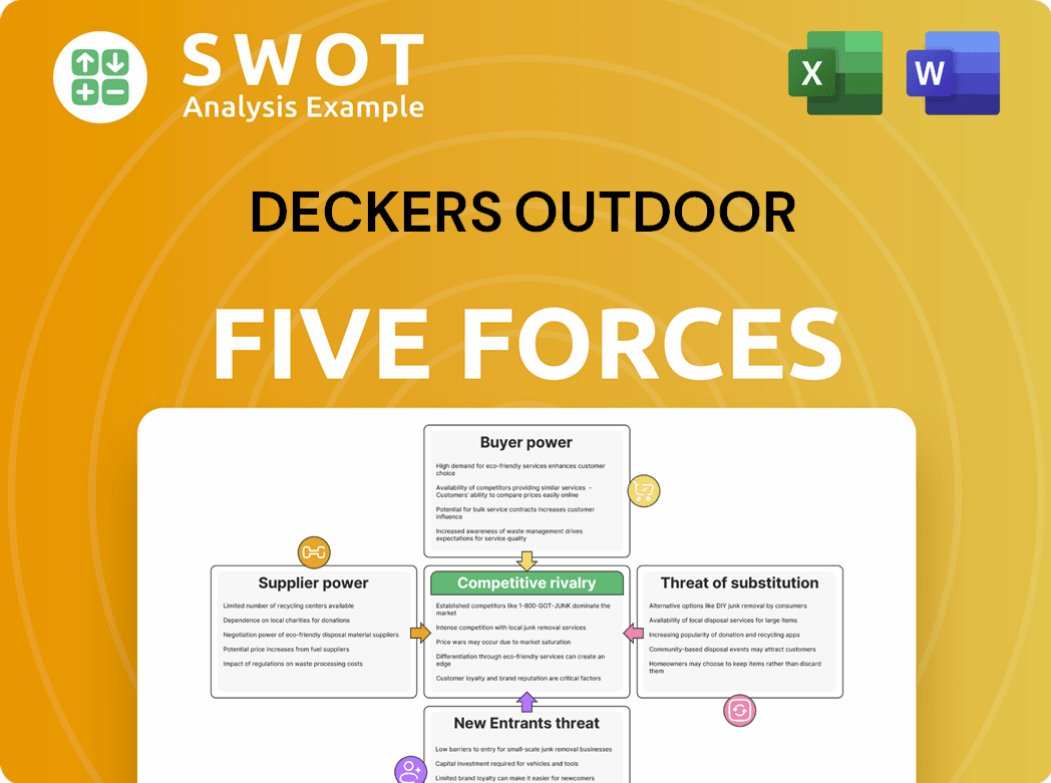

Deckers Outdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Deckers Outdoor Company?

- What is Competitive Landscape of Deckers Outdoor Company?

- What is Growth Strategy and Future Prospects of Deckers Outdoor Company?

- How Does Deckers Outdoor Company Work?

- What is Sales and Marketing Strategy of Deckers Outdoor Company?

- What is Brief History of Deckers Outdoor Company?

- Who Owns Deckers Outdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.