Energizer Bundle

How Does Energizer Compete in Today's Power Market?

Energizer, a household name since 1896, faces a constantly evolving Energizer SWOT Analysis within the primary battery and portable lighting sectors. The company's iconic Energizer Bunny symbolizes its enduring brand recognition, but the competitive landscape demands continuous innovation. Understanding Energizer's position requires a deep dive into its rivals, market share dynamics, and strategic adaptations.

This exploration of the Energizer competitive landscape will dissect its market position, scrutinize its key competitors, and highlight its unique advantages. We'll analyze the battery industry and Energizer's business strategy, examining how it navigates challenges and capitalizes on opportunities within its product portfolio. The analysis will cover Energizer's market share, its strategies for innovation and growth, and its response to changing consumer preferences, providing a comprehensive understanding of its future outlook.

Where Does Energizer’ Stand in the Current Market?

Energizer Holdings, Inc. maintains a significant position in the global market, particularly within the primary battery and portable lighting sectors. The company is consistently ranked among the top manufacturers of primary batteries, often competing for market leadership. Its product lines include a wide array of battery chemistries and sizes under the Energizer and Eveready brands, catering to diverse consumer and industrial needs. Energizer's extensive geographic presence spans North America, Europe, Asia, and Latin America, ensuring broad market coverage.

A key aspect of the Energizer competitive landscape is its strong brand recognition and established distribution networks, particularly in retail channels. This allows the company to maintain a strong market position, where brand trust and product availability are crucial. The acquisition of Spectrum Brands' auto care business in 2018 further diversified its offerings, expanding its market reach beyond traditional battery segments. This strategic move enhanced its market reach and provided new avenues for growth.

For the fiscal year ended September 30, 2023, Energizer reported net sales of $2.7 billion. This financial performance highlights the company's substantial scale within the industry. While facing ongoing competitive pressures, its established market presence and strategic initiatives support its continued relevance and growth.

Energizer is a leading player in the global primary battery market. It competes directly with Duracell and other brands. The company's market share fluctuates but remains substantial, reflecting its strong brand and wide distribution.

The company's product portfolio includes a comprehensive range of batteries under the Energizer and Eveready brands. It also offers portable lighting solutions. Energizer's diverse product range caters to various consumer and industrial needs, supporting its market position.

Energizer has a global presence, serving markets across North America, Europe, Asia, and Latin America. This widespread geographic reach helps the company maintain a strong competitive position. The company's international operations are a key component of its strategy.

The acquisition of Spectrum Brands' auto care business in 2018 diversified Energizer's offerings. This move expanded its market reach and provided new avenues for growth. The company's diversification strategy supports its long-term competitive advantages.

In the fiscal year 2023, Energizer reported net sales of $2.7 billion, demonstrating its significant scale in the industry. The company's financial health is supported by its strong brand recognition and established distribution networks. The company's financial performance is a key factor in its competitive position.

- Energizer's market share is consistently strong in the primary battery market.

- The company's product portfolio includes a wide range of battery types and sizes.

- Geographic diversification is a key part of the company's strategy.

- Strategic acquisitions, like the one from Spectrum Brands, have been a part of Energizer's business strategy.

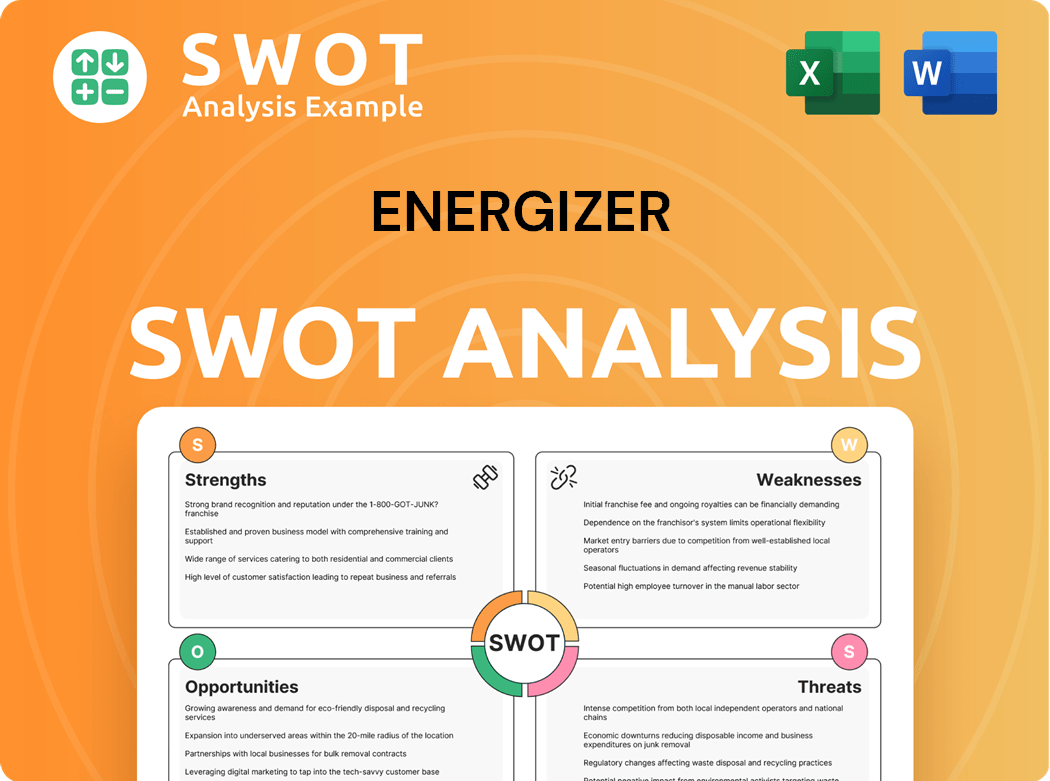

Energizer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Energizer?

The Growth Strategy of Energizer involves navigating a complex competitive landscape. The company, Energizer Holdings, Inc., faces significant competition across its diverse product lines, particularly in the battery and portable lighting markets. Understanding its key rivals is crucial for assessing its market position and future prospects.

Energizer's competitive environment is shaped by established players, emerging brands, and evolving consumer preferences. The company's ability to innovate, adapt, and maintain a strong brand presence is essential for sustaining its market share and achieving growth. This analysis explores the major competitors and competitive dynamics within the industries Energizer operates.

In the primary battery market, Energizer's most significant competitor is Duracell, owned by Berkshire Hathaway. The competition between Energizer and Duracell is intense, focusing on brand recognition, product innovation, and retail presence. Other notable competitors include Panasonic, which has a strong presence in Asia and in rechargeable battery technologies, and private label brands offered by major retailers. These private label brands compete primarily on price, which can put pressure on Energizer's margins.

Duracell is a direct competitor in the primary battery market, consistently vying for market leadership. They compete on brand recognition, product innovation, and extensive retail presence.

Panasonic is a global competitor, particularly strong in Asia and in rechargeable battery technologies. They offer a wide range of battery products, challenging Energizer's market share.

Private label brands from major retailers compete primarily on price. These brands can erode Energizer's market share by offering lower-cost alternatives.

Turtle Wax is a key competitor in the automotive care market. They challenge with specialized product formulations, brand loyalty, and extensive distribution networks.

Armor All, now part of Spectrum Brands, is another significant player in the automotive care market. They compete with specialized product formulations and brand recognition.

STP competes in the automotive care market, offering specialized products. They challenge Energizer through established distribution networks.

In the portable lighting segment, Energizer faces a diverse group of competitors. These range from specialized tactical lighting companies to broader consumer electronics brands. Competition in this area often centers on product features, durability, and technological advancements, such as LED efficiency and battery life. Within the automotive care market, Energizer competes with established players like Turtle Wax, Armor All, and STP. These competitors rely on specialized product formulations, brand loyalty, and extensive distribution networks. Emerging players in both the battery and auto care sectors, particularly those focused on sustainable or smart technologies, also pose a disruptive threat. This necessitates continuous innovation and adaptation in Energizer's product strategies.

Energizer's competitive landscape is shaped by several key factors, including brand recognition, product innovation, pricing strategies, distribution networks, and the ability to adapt to changing consumer preferences. Understanding these factors is crucial for assessing Energizer's market position and future growth potential.

- Brand Recognition: Strong brand names like Energizer and Duracell are critical in the battery market.

- Product Innovation: Developing new battery technologies and features, such as longer-lasting batteries and rechargeable options, is essential.

- Pricing Strategies: Competitive pricing is important, especially against private label brands.

- Distribution Networks: Access to retail channels and online platforms is vital for reaching consumers.

- Consumer Preferences: Adapting to consumer demand for sustainable and smart technologies is crucial.

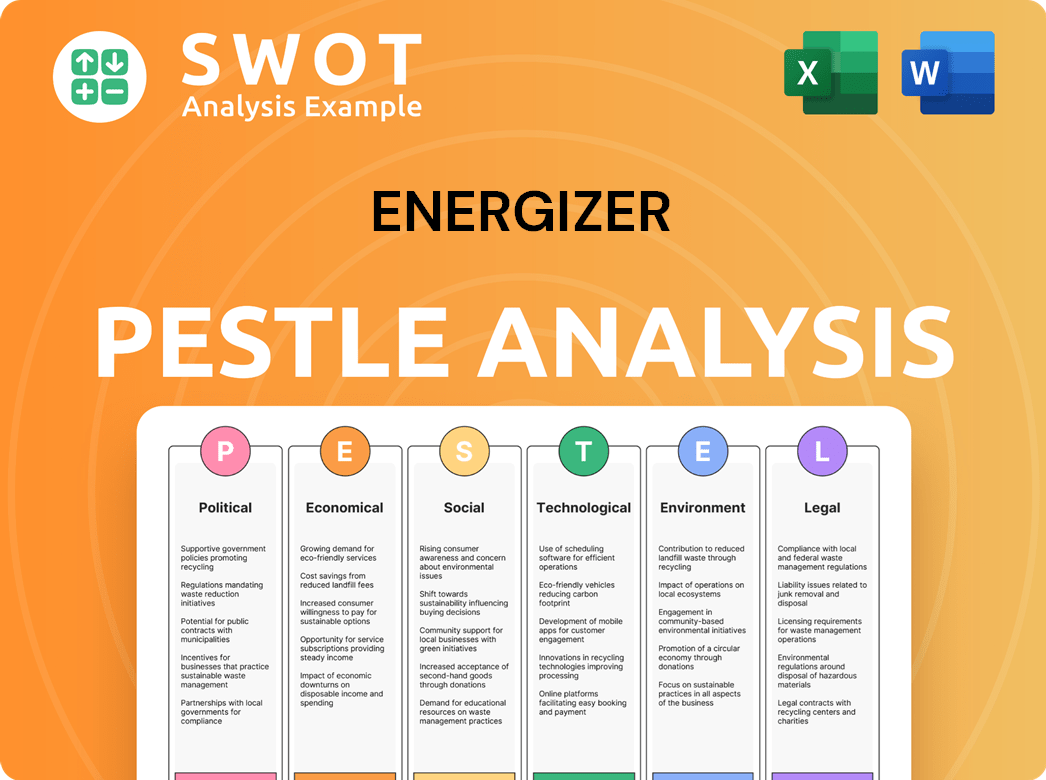

Energizer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Energizer a Competitive Edge Over Its Rivals?

Understanding the Energizer competitive landscape involves recognizing its core strengths that set it apart in the battery and portable power market. The company has cultivated a strong brand reputation, particularly with its Energizer and Eveready brands. This brand recognition is a crucial advantage, fostering customer loyalty and creating a significant barrier to entry for new rivals. Furthermore, Energizer's extensive global distribution network ensures its products are widely available, enhancing its market penetration.

Energizer's competitive edge is also bolstered by its economies of scale in manufacturing and procurement, enabling efficient production of high volumes of batteries and auto care products. Continuous investments in research and development are also key, leading to innovations like longer-lasting alkaline batteries and advanced LED lighting solutions. These innovations help Energizer maintain its competitive position in a dynamic market. For an in-depth look at who Energizer targets with its products, check out this article about the Target Market of Energizer.

The company's focus on operational efficiency and supply chain optimization further strengthens its competitive position. While these advantages are generally sustainable due to the investment needed to build comparable brand recognition and distribution, Energizer faces ongoing threats from rapid technological shifts and aggressive pricing strategies by competitors. Analyzing Energizer's market share and Energizer's main competitors in the battery market is essential for a comprehensive understanding of its competitive position.

Energizer's strong brand equity, especially with the Energizer and Eveready brands, is a significant competitive advantage. This recognition, built over decades, fosters consumer trust and loyalty. Brand loyalty contributes to repeat purchases and provides a strong barrier to entry for new competitors in the battery industry analysis.

Energizer's extensive global distribution network ensures its products are widely accessible across various retail channels. This broad reach, from supermarkets to e-commerce platforms, enhances market penetration. Broad availability is crucial for maintaining a competitive edge in the portable power market.

Economies of scale in manufacturing and procurement allow Energizer to produce high volumes of batteries and auto care products cost-effectively. This cost advantage helps in maintaining competitive pricing. Efficient production is a key element of Energizer business strategy.

Continuous investment in research and development enables Energizer to introduce innovative products. Innovations such as longer-lasting alkaline batteries and advanced LED lighting solutions help maintain a competitive edge. Innovation is a core component of Energizer product portfolio.

Energizer's competitive advantages include strong brand recognition, a global distribution network, economies of scale, and continuous innovation. These factors help the company maintain its market position. The company has shown resilience in the face of challenges.

- Strong Brand Equity: Globally recognized brands like Energizer and Eveready.

- Extensive Distribution: Reaching consumers through various retail channels.

- Economies of Scale: Efficient high-volume production.

- Continuous Innovation: Developing new and improved products.

Energizer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Energizer’s Competitive Landscape?

The Energizer competitive landscape is significantly influenced by industry trends, technological advancements, and consumer preferences. The company faces both opportunities and challenges as it navigates the dynamic battery market. Understanding these factors is crucial for assessing its future prospects. For a deeper dive into the company's operational structure, you can explore the Revenue Streams & Business Model of Energizer.

Battery industry analysis reveals a shift towards sustainability and energy efficiency. The rise of rechargeable batteries and alternative power sources necessitates that Energizer adapts its Energizer business strategy to remain competitive. This requires continuous innovation and a focus on evolving consumer demands.

Technological advancements in rechargeable batteries and energy-efficient devices are key. Consumer preferences are shifting towards eco-friendlier products and smart home integration. Regulatory changes regarding battery disposal and chemical content also play a role.

The rise of new battery chemistries and energy storage solutions could displace traditional primary batteries. Increased regulatory scrutiny on manufacturing processes poses a challenge. Aggressive pricing strategies from competitors and private label brands are a factor.

Emerging markets offer growing demand for portable power. Product innovations in high-performance batteries for specialized applications are promising. Strategic partnerships to expand into new segments like electric vehicle charging infrastructure offer growth.

Energizer's market share is impacted by its Energizer competitors, including Duracell and various private label brands. The company’s ability to innovate and adapt is crucial for maintaining and growing its market position. The portable power market is expected to reach $18.3 billion by 2030.

Energizer's strategies for innovation and growth involve a focus on sustainability and advanced material science. The company may diversify into related power solutions. This includes strategic partnerships and product development.

- Focus on sustainability initiatives and eco-friendly product development.

- Invest in research and development for advanced battery technologies.

- Expand into emerging markets with increasing demand for portable power solutions.

- Enhance marketing and advertising strategies to maintain brand visibility.

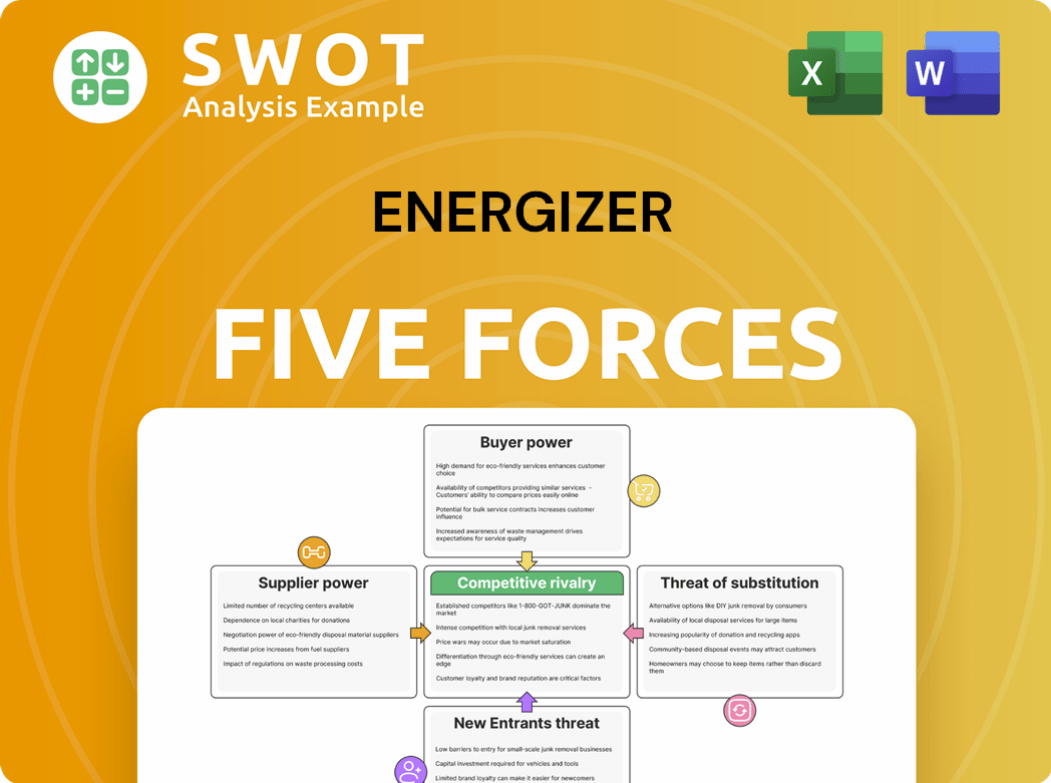

Energizer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Energizer Company?

- What is Growth Strategy and Future Prospects of Energizer Company?

- How Does Energizer Company Work?

- What is Sales and Marketing Strategy of Energizer Company?

- What is Brief History of Energizer Company?

- Who Owns Energizer Company?

- What is Customer Demographics and Target Market of Energizer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.