Energizer Bundle

Can Energizer Power Up Its Future?

Energizer, a name synonymous with enduring power, has evolved from a battery pioneer to a global consumer products leader. This transformation, marked by strategic acquisitions and a commitment to innovation, sets the stage for an exploration of its future trajectory. We delve into Energizer's Energizer SWOT Analysis to understand its current position and future potential.

This deep dive into the Energizer company analysis will uncover the Energizer growth strategy and examine its Energizer future prospects within the dynamic battery market trends and consumer electronics industry. We'll assess how Energizer's established Energizer business model is adapting to emerging challenges and opportunities, ensuring investors and stakeholders are well-informed about its long-term viability and growth potential.

How Is Energizer Expanding Its Reach?

The Mission, Vision & Core Values of Energizer is focused on expanding its market reach and product offerings. This strategy includes geographical expansion, new product introductions, and potential mergers and acquisitions. The company aims to strengthen its global footprint, especially in growing markets where demand for portable power and auto care products is increasing.

In fiscal year 2023, the company reported net sales of approximately $2.96 billion, which provides a solid base for further expansion, even though there was a slight decrease compared to the previous year. The company seeks to reach new customer bases and diversify revenue streams by adjusting its product portfolio to suit regional preferences and economic conditions.

A crucial part of the company's expansion plan involves continuous product innovation within its existing categories. This includes launching new products and exploring opportunities within the automotive aftermarket, such as with brands like Armor All and STP. The company's focus is on growing its presence in areas like appearance, performance, and functional fluids, using its established distribution networks.

The company is actively pursuing growth in emerging markets. These markets offer significant opportunities for increased sales of batteries and auto care products. The strategy involves adapting products to meet local consumer needs and preferences, thereby driving market share gains.

The company is dedicated to continuous product innovation. This includes the launch of new products like the Energizer Accu Recharge line in 2024, which uses sustainable materials. This approach not only meets changing consumer demands but also opens doors in the eco-conscious market.

The company considers mergers and acquisitions to strengthen its market position. The goal is to integrate complementary businesses that enhance its core offerings. While specific details beyond 2024 have not been released, the company has shown a proactive approach to identifying and integrating such businesses.

The company is focusing on sustainability to meet consumer demand. The launch of the Energizer Accu Recharge line, made with recycled materials, is a key example. These efforts not only boost the brand's image but also tap into the growing eco-conscious market segment.

The company's future prospects look promising, supported by its strategic initiatives and market position. The company's focus on geographical expansion and product innovation, combined with its financial stability, positions it well for sustained growth. The company's ability to adapt to market trends, such as the increasing demand for sustainable products, will be key to its long-term success.

- The company aims to increase its market share in both the battery and auto care segments.

- The company is exploring opportunities in the electric vehicle market, including related products and services.

- The company is continually evaluating its marketing and advertising strategies to boost brand awareness.

- The company's financial performance in recent quarters indicates a solid foundation for future investments.

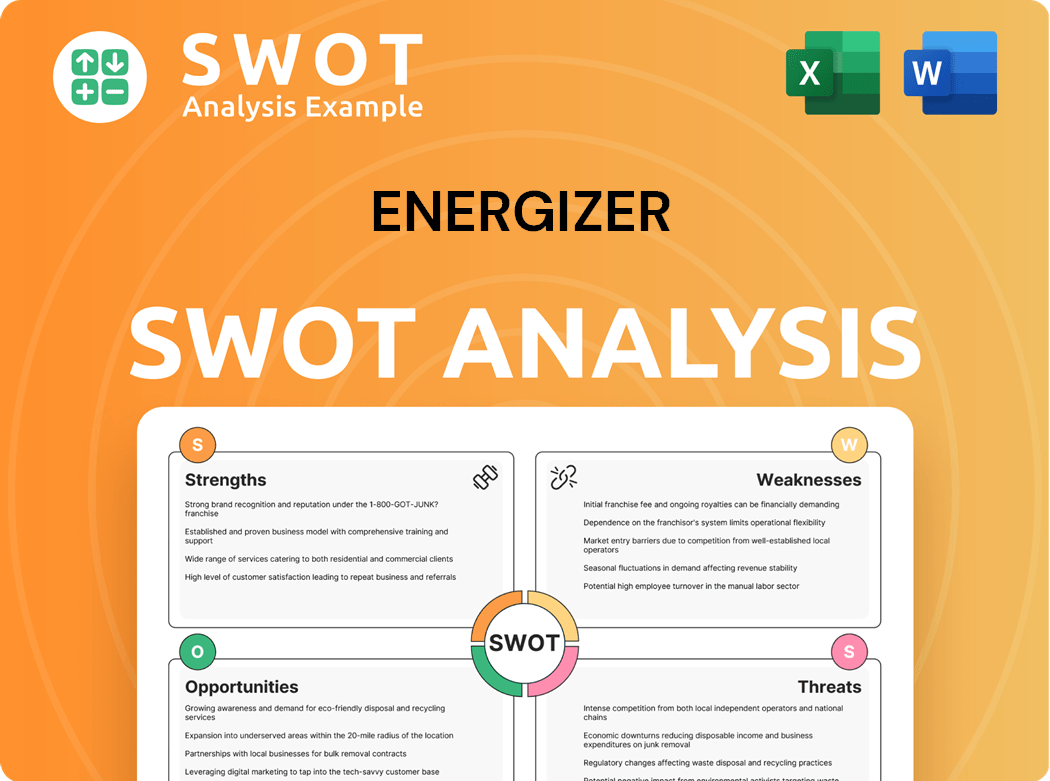

Energizer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Energizer Invest in Innovation?

The Energizer growth strategy is significantly fueled by its dedication to innovation and technological advancements. The company consistently invests in research and development to enhance product performance, introduce new solutions, and improve manufacturing processes. This strategic approach is crucial for maintaining a competitive edge in the dynamic consumer electronics industry.

A key aspect of Energizer’s future prospects involves adapting to evolving market demands, including the growing emphasis on sustainability. The company’s initiatives in product innovation and operational efficiency are vital for navigating the complexities of the battery market trends. This strategic alignment with consumer preferences and technological advancements positions Energizer for continued success.

Energizer company analysis reveals a strong emphasis on technological integration to optimize its supply chain and manufacturing capabilities. The company is exploring new battery chemistries and portable lighting solutions to offer greater energy density, longer life, and improved safety features. These efforts are designed to maintain a competitive edge within the rapidly evolving technological landscape.

The development of the 'Energizer Accu Recharge' line in 2024, featuring rechargeable batteries made with 15% recycled materials, showcases a commitment to product innovation and sustainability. This initiative is a response to consumer demand for environmentally friendly products. This aligns with the company's broader sustainability goals.

While specific details on R&D investments in AI, IoT, or extensive automation are not widely publicized, the focus on optimizing the supply chain and manufacturing capabilities suggests underlying technological adoption. Advanced analytics could enhance demand forecasting and inventory management. This will contribute to overall growth objectives.

Energizer's sustainability initiatives are a key part of its strategy to meet consumer expectations. The use of recycled materials in products like the 'Energizer Accu Recharge' line demonstrates a commitment to reducing environmental impact. This is essential for long-term brand relevance and market competitiveness.

Energizer is exploring new battery chemistries to improve energy density, lifespan, and safety features. These advancements are critical for maintaining a competitive edge in the battery market. This is particularly important as technology evolves.

Energizer's focus on portable lighting solutions, which offer improved energy efficiency and extended life, is another area of innovation. These solutions are designed to meet the needs of consumers. This is a strategy to capture market share.

Energizer uses technology to improve operational efficiency, including supply chain optimization and manufacturing processes. This helps in cost reduction and improving the overall efficiency of the business. This is crucial for profitability.

Energizer employs a multi-faceted approach to innovation and technology. This includes product development, operational improvements, and sustainability initiatives. These strategies are designed to drive growth and maintain a competitive advantage.

- Product Development: Focus on rechargeable batteries and improved lighting solutions.

- Operational Efficiency: Integration of advanced analytics for demand forecasting and inventory management.

- Sustainability: Use of recycled materials and eco-friendly manufacturing processes.

- Technological Advancements: Exploration of new battery chemistries to enhance performance.

- Market Adaptation: Adapting to the changing needs of consumers.

For more insights into how Energizer approaches its marketing, consider reading the Marketing Strategy of Energizer.

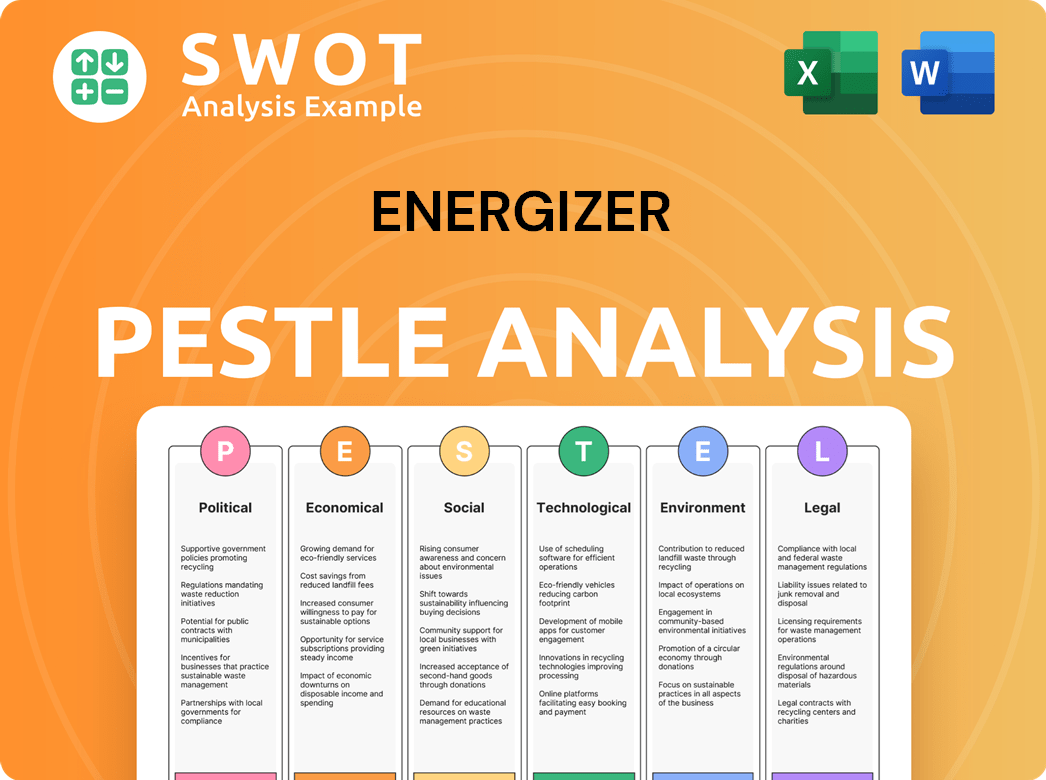

Energizer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Energizer’s Growth Forecast?

The financial outlook for Energizer reflects a strategic approach to stabilize revenue and enhance profitability. For fiscal year 2023, the company reported net sales of $2.96 billion, showing a slight decrease from the previous year. This performance is viewed within the context of broader consumer electronics industry trends and the dynamic global economic environment, which influences the battery market trends.

Despite a minor dip in sales, Energizer's financial strategies have shown positive results in cost management. The gross margin improved to 40.5% in the fourth quarter of fiscal year 2023, up from 37.7% in the prior year. This improvement, primarily due to lower raw material and freight costs, indicates effective operational efficiency. This is a key factor in the Energizer growth strategy.

Energizer's financial strategy also involves managing its debt and optimizing its capital structure. As of September 30, 2023, the company reported total debt of $3.3 billion, with a net debt to adjusted EBITDA ratio of 4.4x. While this leverage is notable, the company's focus on generating strong free cash flow, which was $261.2 million in fiscal year 2023, provides flexibility for debt reduction and strategic investments.

Energizer's net sales for fiscal year 2023 were $2.96 billion, showing a slight decrease. The company's performance is influenced by the consumer electronics industry and battery market trends. The slight decrease in sales is a key aspect of the Energizer company analysis.

The gross margin improved to 40.5% in Q4 FY2023, up from 37.7% the prior year. This improvement is mainly due to lower raw material and freight costs. This reflects effective cost management strategies within the Energizer business model.

Total debt was $3.3 billion as of September 30, 2023, with a net debt to adjusted EBITDA ratio of 4.4x. This leverage is a key financial consideration. The company's debt management is crucial for its long-term growth opportunities.

Free cash flow for fiscal year 2023 was $261.2 million. This strong cash flow provides flexibility for debt reduction and strategic investments. It supports Energizer's investor relations information.

Energizer projects its fiscal year 2024 adjusted earnings per share to be in the range of $3.10 to $3.30. This outlook reflects a cautious yet optimistic approach to the consumer electronics industry. The company's financial performance in the last quarter is a key factor.

- The company aims to balance shareholder returns with growth initiatives.

- Strategic acquisitions and product development are key to supporting long-term financial goals.

- Maintaining market position is a priority, influenced by how Energizer competes with Duracell.

- The company's expansion plans in renewable energy are also being considered.

Energizer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Energizer’s Growth?

The path to growth for the company is not without its hurdles. The company faces several risks and obstacles that could impact its strategic goals and operational efficiency. Understanding these challenges is crucial for assessing the long-term viability of its business model and its ability to capitalize on future prospects.

Market competition, regulatory changes, and supply chain vulnerabilities are among the primary risks. The company's success hinges on its capacity to navigate these challenges effectively. The company must proactively address these risks to ensure sustainable growth and maintain its competitive edge in the consumer electronics industry.

The company's growth ambitions are significantly influenced by the competitive landscape. The company operates within a market characterized by numerous established players and emerging brands. This intense competition can lead to pricing pressures and necessitate continuous innovation to maintain and expand market share. Effective strategies for product differentiation and brand loyalty are therefore essential for sustained success. Additionally, the company must stay ahead of battery market trends to remain competitive.

The battery and portable lighting sectors are highly competitive, with established players and emerging brands. This competition can lead to price wars and reduced profit margins. Continuous innovation and strong branding are essential to maintain market share and differentiate products.

Evolving environmental standards and product safety regulations pose potential risks. Changes in battery disposal rules and chemical compositions could increase manufacturing costs. The company must adapt to these changes to avoid penalties and maintain compliance.

Geopolitical events, raw material price fluctuations, and logistical disruptions can impact production. Reliance on a complex global supply chain makes the company susceptible to external shocks. Diversification and robust risk management are crucial.

Rapid advancements in battery technology and energy storage solutions can pose a risk. Failure to adapt to new chemistries and market trends could lead to obsolescence. The company must invest in R&D to stay ahead of the curve.

Attracting and retaining skilled talent can hinder R&D and operational efficiency. Competition for qualified personnel in the tech and manufacturing sectors is intense. Effective talent management is essential for innovation.

Inflation and fluctuations in currency exchange rates can impact profitability. Rising costs of raw materials and manufacturing can squeeze margins. The company needs to manage costs effectively to maintain financial health.

The company's strategic approach involves diversification of its product portfolio and geographical markets. Implementing robust risk management frameworks and engaging in scenario planning are also key strategies. The company's recent emphasis on sustainable product lines, such as the Energizer Accu Recharge with recycled materials, demonstrates an effort to mitigate environmental regulatory risks and align with evolving consumer preferences. For more information on the company's market position, see Target Market of Energizer.

The battery market is highly competitive, with the company facing rivals like Duracell and numerous private-label brands. In 2024, the global battery market was valued at over $100 billion, with significant growth projected. The company must continually innovate to maintain its market share.

Environmental regulations, particularly those concerning battery disposal and chemical composition, pose risks. Compliance costs and potential penalties can impact profitability. The company's sustainability initiatives, such as using recycled materials, are crucial for mitigating these risks.

Geopolitical events and raw material price fluctuations can disrupt the supply chain. Inflation and currency exchange rate volatility also impact profitability. The company's risk management strategies must address these external factors effectively.

Rapid advancements in battery technology require continuous innovation. Attracting and retaining skilled talent in R&D and operations is also crucial. The company's ability to adapt to these challenges will determine its long-term success.

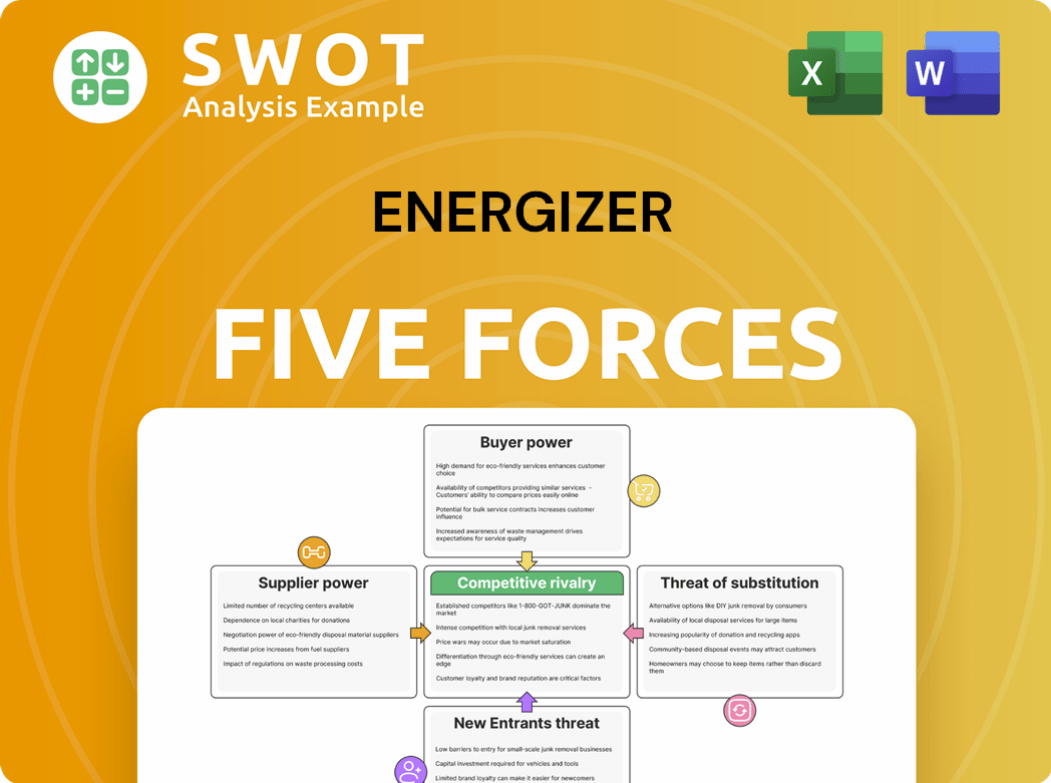

Energizer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Energizer Company?

- What is Competitive Landscape of Energizer Company?

- How Does Energizer Company Work?

- What is Sales and Marketing Strategy of Energizer Company?

- What is Brief History of Energizer Company?

- Who Owns Energizer Company?

- What is Customer Demographics and Target Market of Energizer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.