Energizer Bundle

Who Really Owns Energizer?

Understanding the ownership structure of Energizer Holdings, Inc. is key to understanding its strategic moves and market position. From its origins as the Eveready Battery Company in 1896 to its current status as a global consumer goods giant, Energizer's ownership has evolved significantly. This article explores the key players and historical shifts that have shaped the Energizer SWOT Analysis and its place in the market.

Energizer's journey from a division of Ralston Purina to a publicly traded company on the New York Stock Exchange highlights the importance of understanding its ownership. Knowing who owns Energizer, its parent company, and the influence of major shareholders provides crucial insights. With a market cap of approximately $1.61 billion as of June 9, 2025, and annual revenue of around $2.89 billion in 2024, this analysis delves into the core of this battery manufacturer's ownership and its impact on its future.

Who Founded Energizer?

Understanding the ownership of the company involves tracing its complex history. The story begins with the American Electrical Novelty and Manufacturing Company in 1896, which later evolved into the Eveready Battery Company, the precursor to the modern company. The ownership structure wasn't defined by a single founder or a simple equity split.

Over the years, the company underwent several ownership changes. The company's evolution to its current form is a story of corporate restructuring and strategic decisions. The most significant shift occurred in 1986 when Union Carbide, the then-parent company, sold Eveready Battery to Ralston Purina.

The current structure of the company as a publicly traded entity began in 2000. Ralston Purina spun off Eveready, which was then listed on the New York Stock Exchange. This event marked the beginning of its modern corporate form. Therefore, the initial ownership largely refers to the public shareholders and institutional investors who acquired stakes during and after this spin-off.

The company's roots trace back to 1896 with the American Electrical Novelty and Manufacturing Company. This marks the beginning of its long and complex corporate journey.

The company has seen several ownership changes over the decades. These shifts reflect strategic decisions and corporate restructuring.

In 1986, Union Carbide sold Eveready Battery to Ralston Purina. This was a significant ownership transition in the company's history.

The modern company as a publicly traded entity began in 2000. Ralston Purina spun off Eveready, listing it on the New York Stock Exchange.

The initial ownership of the company in its current form primarily refers to the public shareholders and institutional investors. They acquired stakes during and after the 2000 spin-off.

Details about early angel investors or family members are not readily available. This is due to the long history and corporate transformations the company has undergone.

The company's ownership structure is largely defined by its history of corporate transitions. For a more detailed overview, you can explore the Brief History of Energizer. The company's stock is traded on the New York Stock Exchange under the ticker symbol ENR. As of the fiscal year 2024, the company reported net sales of approximately $3.2 billion. The company's market capitalization is a key metric for understanding its current valuation and ownership structure. The company's headquarters are located in St. Louis, Missouri. The company is a significant player in the battery manufacturer industry.

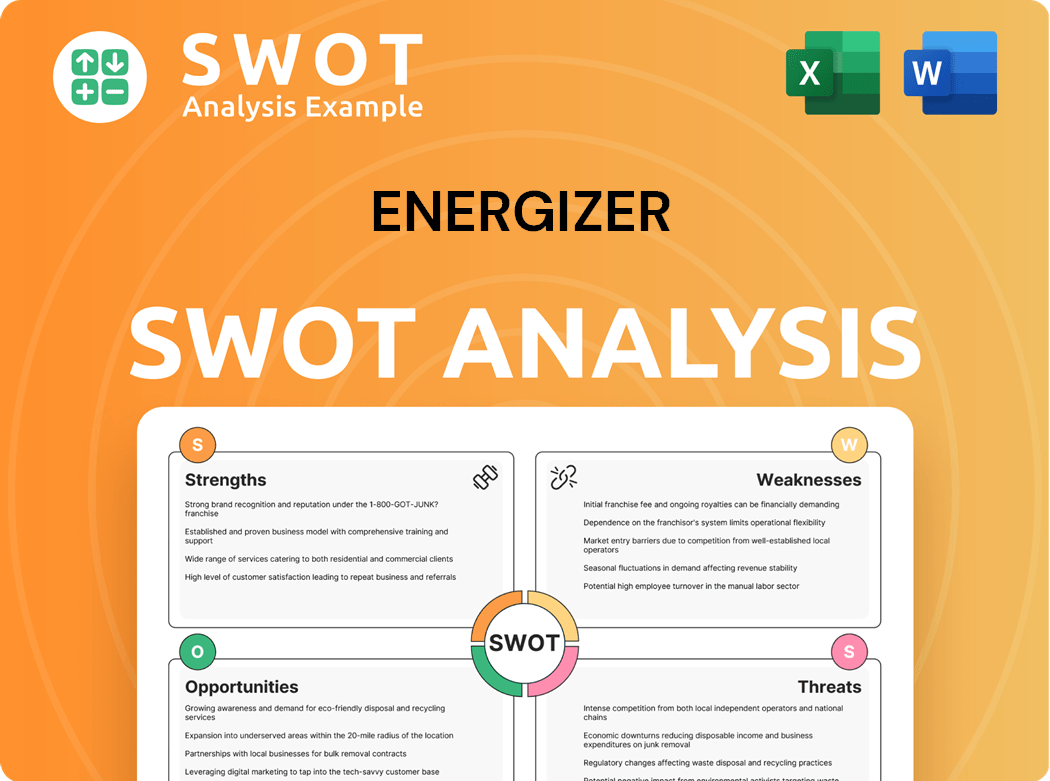

Energizer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Energizer’s Ownership Changed Over Time?

The ownership structure of Energizer Holdings, Inc. has evolved significantly since its inception. Initially, the company was part of Ralston Purina. In 2000, Energizer became a publicly traded entity, listed on the New York Stock Exchange (NYSE: ENR), marking a pivotal moment in its corporate journey. The company further refined its focus on batteries and auto care when it separated its Household Products and Personal Care businesses on July 1, 2015, creating two independent public companies.

This separation allowed Energizer to concentrate on its core business segments, particularly its battery and auto care divisions. This strategic move reshaped the company's structure and influenced its market positioning. Understanding Energizer's Revenue Streams & Business Model provides additional insight into its operational focus.

| Ownership Structure | As of December 31, 2024 | As of April 2025 |

|---|---|---|

| Institutional Ownership | 85.84% | 90.71% |

| Mutual Funds | N/A | 86.44% |

| Insider Ownership | N/A | 0.63% |

Institutional investors play a crucial role in Energizer's ownership. As of December 31, 2024, institutional investors held a significant 85.84% stake in Energizer Holdings, Inc. This substantial ownership by institutional investors highlights their confidence in the company's strategic direction and financial performance. Key institutional investors as of March 31, 2024, included Vanguard Group Inc. with approximately 8.46% and BlackRock Inc. with about 8.17%. By April 2025, mutual funds increased their holdings to 86.44%, while insider ownership remained at 0.63%.

Energizer is primarily owned by institutional investors, indicating strong market confidence.

- Institutional ownership is a key factor influencing the company's strategic decisions.

- The separation in 2015 streamlined Energizer's focus on batteries and auto care.

- Understanding the ownership structure is vital for investors and stakeholders.

- The company's stock performance and strategic decisions are influenced by significant institutional investments.

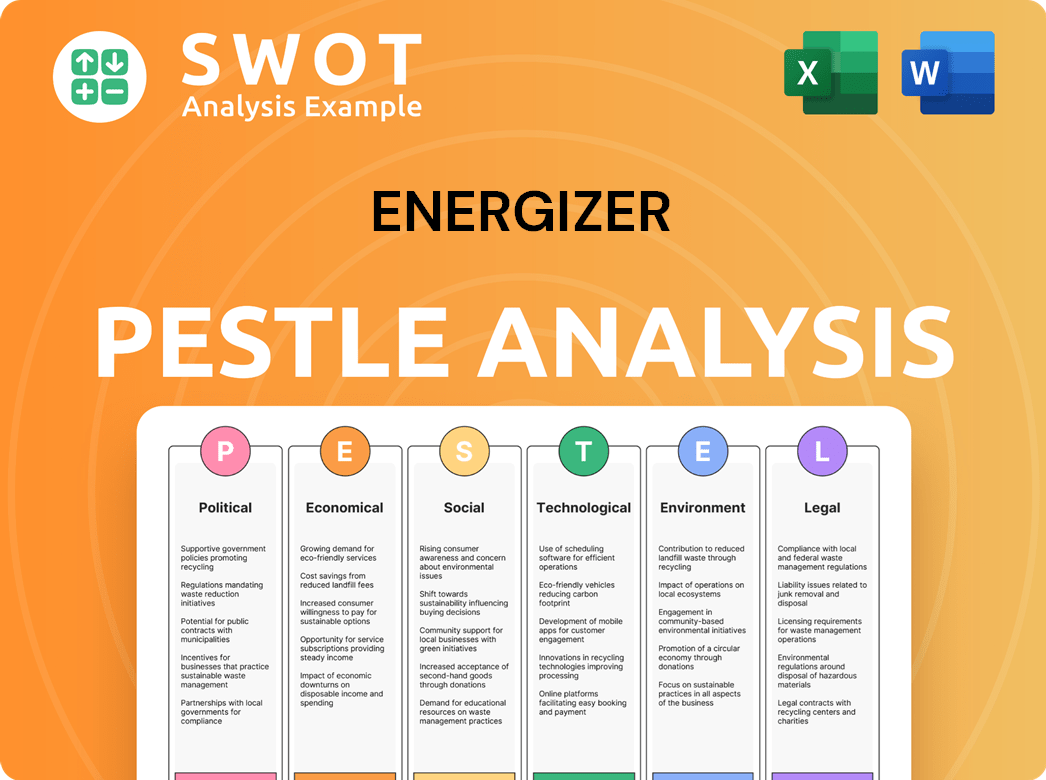

Energizer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Energizer’s Board?

As of June 2025, the governance of Energizer Holdings, Inc. is overseen by a Board of Directors. Key figures include Mark S. LaVigne, who holds the positions of President, Chief Executive Officer, and Director, and Patrick J. Moore, serving as the Independent Chairman of the Board. The board also comprises independent directors such as Cynthia J. Brinkley, Rebecca D. Frankiewicz, Kevin J. Hunt, and James C. Johnson.

The presence of independent directors on the board is a standard practice aimed at ensuring balanced oversight and accountability. While specific details on which board members directly represent major shareholders are not explicitly stated in the available data, the structure is designed to provide robust governance. This structure is crucial for overseeing the company's strategic direction and financial performance, especially within the competitive landscape of the battery manufacturer industry.

| Board Member | Title | Role |

|---|---|---|

| Mark S. LaVigne | President, CEO, and Director | Leads the company's operations and strategic direction. |

| Patrick J. Moore | Independent Chairman of the Board | Provides independent oversight and leadership to the board. |

| Cynthia J. Brinkley, Rebecca D. Frankiewicz, Kevin J. Hunt, James C. Johnson | Independent Directors | Offer unbiased perspectives and ensure balanced decision-making. |

Energizer's voting structure is based on a one-share-one-vote principle, ensuring each shareholder has voting rights proportional to their share ownership. The company's authorized capital includes 300 million shares of common stock and 10 million shares of preferred stock, both with a par value of $.01 per share. Shareholders do not have preemptive or cumulative voting rights. For actions by written consent, unanimous consent from all shareholders is required under Missouri law. Special shareholder meetings can be called by a majority of Energizer's voting stock, in addition to the board of directors. Directors can only be removed 'for cause' with a majority vote. The company's Corporate Governance Principles outline clear criteria for directors, including integrity and share ownership requirements. For more insights into Energizer's strategic direction, consider reading about the Growth Strategy of Energizer.

The Board of Directors at Energizer Holdings, Inc. plays a crucial role in the company's governance, with a structure that includes both executive and independent directors. The voting structure is straightforward, with each share of common stock carrying one vote, ensuring shareholder rights are proportional to their investment. This structure supports the company's operations and strategic direction.

- The board includes key figures like Mark S. LaVigne and Patrick J. Moore.

- Independent directors ensure balanced oversight.

- Voting is based on a one-share-one-vote principle.

- Shareholders do not have preemptive rights.

Energizer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Energizer’s Ownership Landscape?

Over the past few years, the ownership structure of Energizer Holdings, Inc. has seen significant shifts. As of December 31, 2024, institutional investors held a considerable stake, accounting for 85.84% of the company's ownership. Key institutional holders included BlackRock, Inc. at 14.80% and Vanguard Group Inc. at 12.82%. This trend continued into April 2025, with institutional ownership increasing to 90.71%. Mutual fund holdings also rose from 84.83% to 86.44% during the same period. Insider holdings remained relatively stable at 0.63% in April 2025.

These ownership dynamics reflect a strong institutional confidence in Energizer's strategic direction and market position. The consistent high percentage of institutional ownership indicates a stable investor base, which is crucial for the company's long-term growth and stability. Understanding the ownership structure provides valuable insight into the company's financial health and strategic focus, which can be important for investors and stakeholders alike. To learn more about the marketing strategies of Energizer, you can check out this article: Marketing Strategy of Energizer.

Energizer has also been active with share buybacks, with a new authorization approved on November 19, 2024, for up to 7.5 million shares. The company paid dividends of $0.30 per common share in December 2024, totaling $1.20 per share for fiscal year 2024. In terms of mergers and acquisitions, Energizer acquired Advanced Power Solutions NV (APS) in May 2025 and Centralsul in May 2024. A notable divestiture occurred on January 24, 2024, when Energizer announced the sale of its Varta consumer battery business for $307.5 million. The current President and CEO is Mark S. LaVigne. For fiscal year 2025, the company anticipates organic revenue growth of 1% to 2% and Adjusted EBITDA in the range of $625 million to $645 million.

Energizer's ownership is largely dominated by institutional investors, showing a strong confidence in the company. The high percentage of institutional holdings suggests stability and a focus on long-term value. The company's share buyback programs and dividend payments also reflect a commitment to returning value to shareholders.

BlackRock, Inc. and Vanguard Group Inc. are among the top institutional holders of Energizer shares. Their significant stakes highlight their belief in the company's potential. These key investors play a crucial role in shaping the company's strategic direction.

Energizer has engaged in share buybacks and dividend payments, indicating a focus on shareholder value. The company's recent acquisitions and divestitures are aimed at streamlining its portfolio. These activities are designed to improve financial performance and strategic focus.

Energizer anticipates organic revenue growth and a specific range for Adjusted EBITDA in fiscal year 2025. The company's strategic moves and financial performance are key indicators of its future success. These projections offer insights into the company's growth trajectory.

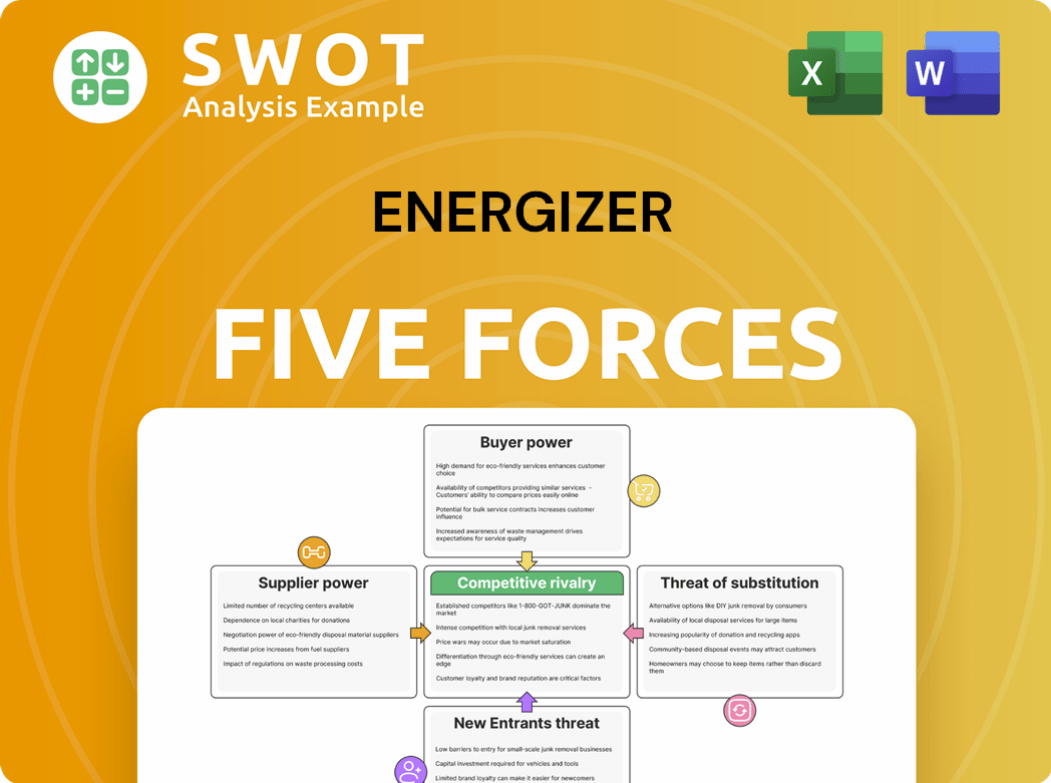

Energizer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Energizer Company?

- What is Competitive Landscape of Energizer Company?

- What is Growth Strategy and Future Prospects of Energizer Company?

- How Does Energizer Company Work?

- What is Sales and Marketing Strategy of Energizer Company?

- What is Brief History of Energizer Company?

- What is Customer Demographics and Target Market of Energizer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.