Feihe Bundle

How Does Feihe Company Navigate China's Competitive Infant Formula Market?

Feihe Company, a prominent player in China's infant nutrition sector, has evolved significantly since its inception in 1962. From its roots as Zhaoguang Dairy, Feihe has transformed into a national leader, consistently adapting to consumer demands and regulatory changes. Its focus on products tailored for Chinese infants has solidified its dominance, making it a fascinating case study in market strategy.

This report offers a deep dive into the Feihe SWOT Analysis, exploring the Feihe competitive landscape, its key rivals, and the advantages that set it apart. We'll conduct a thorough Feihe market analysis, examining its Feihe competitors and the broader Feihe industry trends shaping its trajectory in the Feihe dairy market. Understanding Feihe's Feihe strategy is crucial for grasping its success and predicting its future outlook, considering factors like Feihe market share in China and the impact of Feihe vs. international baby formula brands.

Where Does Feihe’ Stand in the Current Market?

Feihe Company holds a strong market position in China's infant formula sector. This is a result of its consistent growth and focus on the domestic market. The company's main offerings include infant formula, milk powder, and other dairy products, with a focus on products designed for Chinese infants and young children. Feihe's presence is primarily in mainland China, where it has built a strong distribution network.

The company has strategically emphasized premiumization and quality. This move is in response to growing consumer demand for safer and more nutritious options. Feihe's vertically integrated supply chain supports this, providing 'farm-to-table' control and quality assurance. Financially, Feihe has shown strong performance, often exceeding industry averages in revenue growth.

Feihe's scale provides advantages in research and development, marketing, and distribution. While strong in China, its international presence is limited. This indicates a concentration of strength within its home market. For a deeper dive into the ownership structure, you can check out the details on Owners & Shareholders of Feihe.

Feihe is consistently among the top infant formula brands in China. While precise market share fluctuates, it often competes for the top spot. This strong position is a key aspect of the Feihe competitive landscape. The company's focus on the Chinese market has been a significant factor in its success.

Feihe's product lines are centered around infant formula, milk powder, and related dairy products. These products are specifically formulated for Chinese infants and children. This targeted approach is a key element of Feihe's strategy within the Feihe dairy market.

Feihe's primary market is mainland China, where it has built a robust distribution network. This network reaches both urban and rural areas, ensuring broad market coverage. This extensive distribution is crucial for the company's success and a key aspect of the Feihe market analysis.

Feihe has shifted its focus to premiumization and quality, responding to consumer demand. This strategy has been supported by its vertically integrated supply chain. This 'farm-to-table' approach highlights quality assurance and is a key part of Feihe's brand positioning strategy.

Feihe's key strengths include its strong domestic market position and vertically integrated supply chain. The company benefits from its scale, which supports R&D, marketing, and distribution. These factors contribute to Feihe's competitive advantages in the market.

- Strong domestic market share in China.

- Vertically integrated supply chain for quality control.

- Focus on premiumization and high-quality products.

- Extensive distribution network across China.

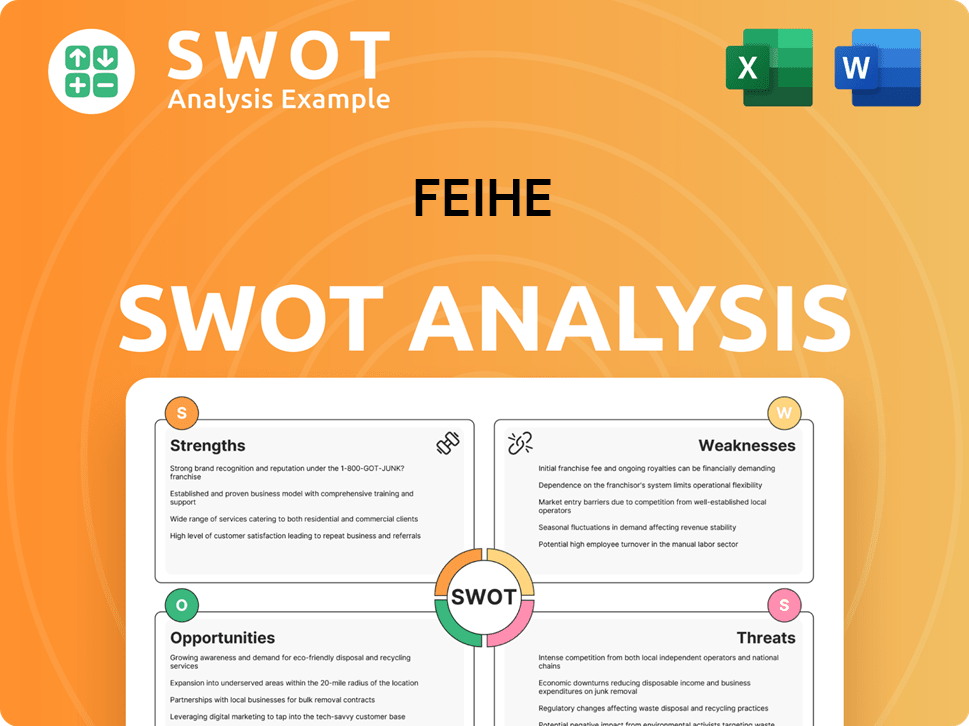

Feihe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Feihe?

The infant formula market in China is intensely competitive, with Feihe facing significant challenges. This competitive landscape includes both international and domestic players, each vying for market share. Understanding the key competitors is crucial for analyzing Feihe's position and future prospects within the Feihe industry.

Feihe's competitive environment is shaped by the strategies and performance of its rivals. Market dynamics are also influenced by consumer preferences, regulatory changes, and distribution channel evolution. A detailed Feihe market analysis reveals the complexities of this sector.

The competitive landscape in the Feihe dairy market is dynamic, influenced by various factors. These factors include product innovation, pricing strategies, and the effectiveness of marketing campaigns. The following sections provide an overview of Feihe's key competitors and the competitive forces at play.

International brands pose a significant challenge to Feihe's market share. These competitors often have strong brand recognition and extensive R&D capabilities. Nestlé, Danone, and Mead Johnson are among the most prominent.

Nestlé, through its Wyeth Nutrition brand, is a major player in the Chinese infant formula market. They compete on innovation and premium offerings. Nestlé's global resources and extensive product portfolio are key competitive advantages.

Danone also competes in the premium segment with specialized formulas. Danone's brand recognition and product diversification strategies challenge Feihe's market position. They focus on high-end segments.

Mead Johnson, now part of Reckitt Benckiser, is another major international competitor. They compete on brand recognition and product offerings. Mead Johnson's established presence in the market is a key factor.

Domestic competitors also pose significant challenges to Feihe. These companies often compete on price and localized strategies. China Mengniu Dairy and Inner Mongolia Yili Industrial Group are key players.

Mengniu has a broad dairy product portfolio and is a major competitor in the infant formula market. Their market strategies and distribution networks are key. Mengniu's acquisitions, such as Bellamy's Australia, have intensified competition.

Yili also has a significant presence in the dairy industry, including infant formula. Yili's brand recognition and distribution capabilities are key factors. Their broad product range allows them to compete effectively.

Other domestic players, such as Junlebao Dairy and Ausnutria Dairy, are also significant. These companies often focus on price and localized marketing. They are expanding rapidly in lower-tier cities.

Junlebao has been expanding rapidly, posing a direct challenge to Feihe's reach. They compete on price and accessibility. Their growth strategy focuses on lower-tier cities.

Ausnutria, with its Hyproca brand, focuses on niche segments like goat milk formula. They are disrupting traditional distribution models. Their product specialization is a key differentiator.

Emerging players focusing on e-commerce and niche segments also pose indirect competition. These companies disrupt traditional distribution models. They cater to evolving consumer preferences.

The Feihe competitive landscape is influenced by mergers, acquisitions, and evolving consumer preferences. Factors such as product innovation, pricing strategies, and marketing campaigns significantly impact market share. Understanding these dynamics is crucial for strategic planning.

- Mergers and Acquisitions: Acquisitions like Bellamy's by Mengniu intensify competition in the premium and organic segments.

- E-commerce: The rise of e-commerce channels has reshaped distribution and consumer behavior.

- Product Innovation: Specialized formulas and organic options are gaining popularity, driving innovation.

- Regulatory Changes: Regulations impact product formulations and market access.

- Consumer Preferences: Changing preferences influence demand for different types of formula.

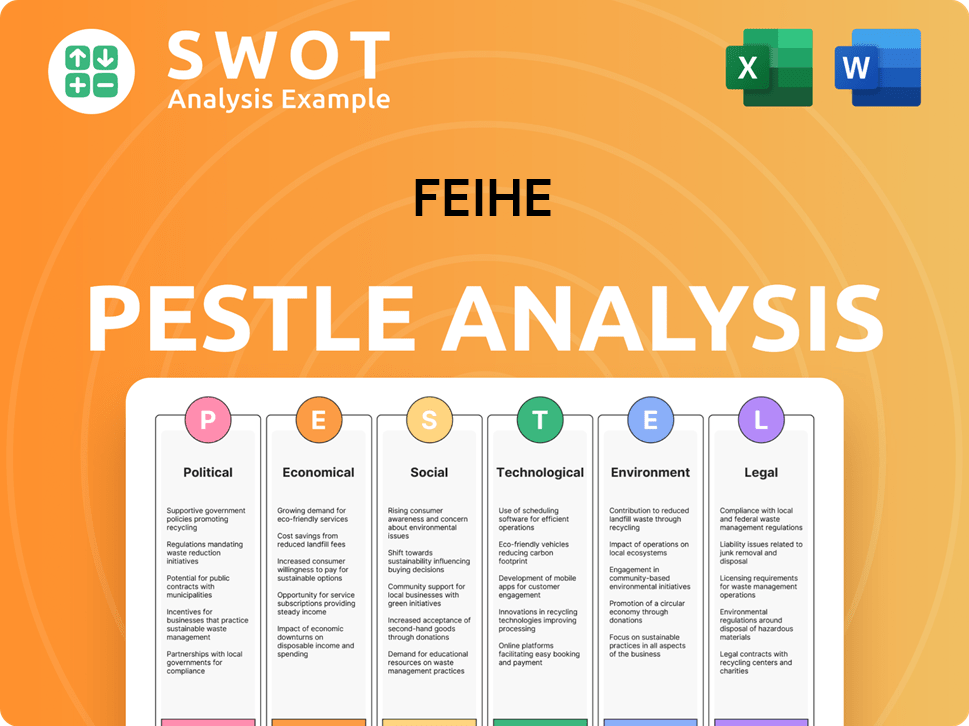

Feihe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Feihe a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of a company like Feihe is crucial for a comprehensive Feihe market analysis. Feihe, a major player in the Feihe dairy market, has carved a significant niche in China's infant formula sector. Examining its strengths provides valuable insights for investors, competitors, and industry analysts alike, offering a clearer view of its position within the Feihe competitive landscape.

Feihe's success is deeply intertwined with its strategic focus on the Chinese market. Its ability to understand and cater to local preferences is a key differentiator. This approach, coupled with a robust supply chain and strong brand reputation, has allowed it to gain a substantial Feihe market share in China. This analysis will explore the core elements that underpin Feihe's competitive edge, providing a detailed look at its operational and strategic strengths.

The company's competitive advantages are multi-faceted, encompassing its market positioning, operational efficiency, and brand equity. These advantages are not static; they are continuously refined and adapted to maintain a strong position in a dynamic market. For a deeper dive into their marketing approach, check out the Marketing Strategy of Feihe.

Feihe's deep understanding of the Chinese market is a cornerstone of its strategy. They tailor their products to meet the specific nutritional needs and cultural preferences of Chinese consumers, which is a key Feihe competitive advantage. This localization strategy has helped them build strong brand loyalty and trust among parents who prioritize products suited for their babies.

Feihe controls its supply chain from dairy farms to distribution, ensuring product quality and safety. This 'farm-to-can' approach allows for greater control and responsiveness to market demands. This integration also enhances cost efficiencies, contributing to their overall competitive position within the Feihe industry.

Feihe has invested heavily in building a strong brand image, emphasizing its heritage, scientific backing, and commitment to quality. Extensive marketing campaigns and endorsements have helped establish a trusted brand. This brand equity helps them to compete effectively against both domestic and international brands in the Feihe competitive landscape.

Feihe's widespread distribution network across China ensures product availability in both urban and rural areas. This extensive reach is a significant barrier to entry for new players. This robust distribution system supports their ability to maintain and grow their market share within the Feihe dairy market.

Feihe's competitive advantages are a blend of strategic market positioning, operational efficiency, and strong brand presence. These elements work together to create a sustainable edge in a competitive market. In 2024, Feihe reported strong financial results, reflecting the effectiveness of their strategies.

- Localization Strategy: Tailoring products to meet the specific needs of Chinese consumers, focusing on local dietary habits and infant development.

- Vertically Integrated Supply Chain: Ensuring quality control and cost efficiency from farm to consumer, a key factor in the Feihe industry.

- Strong Brand Image: Building trust through heritage, scientific backing, and quality assurance.

- Extensive Distribution Network: Ensuring widespread product availability across China.

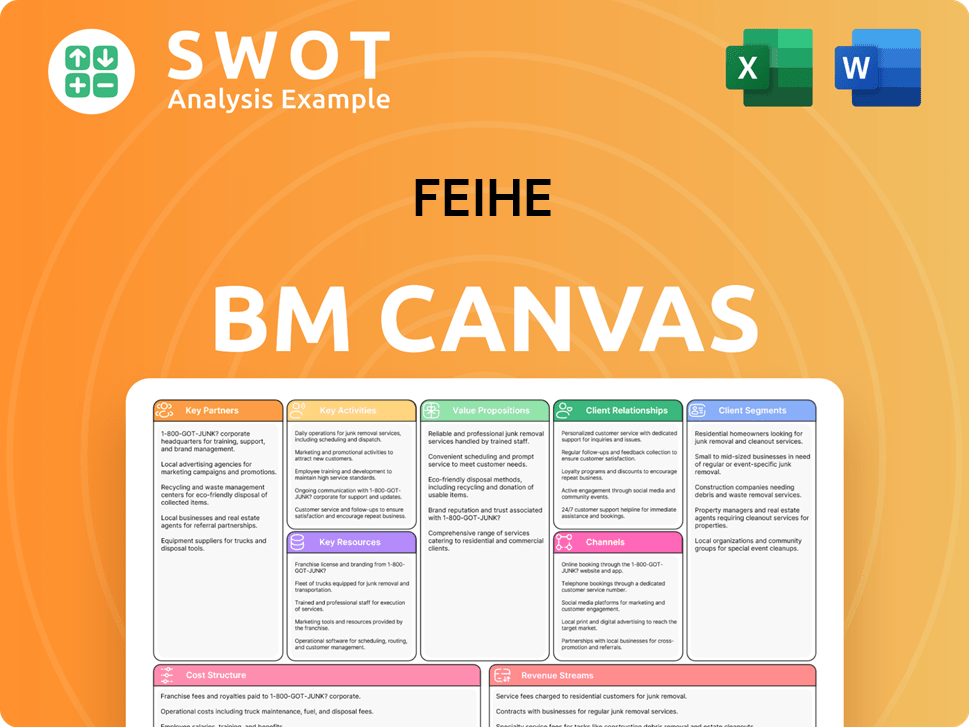

Feihe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Feihe’s Competitive Landscape?

The infant formula industry in China is experiencing dynamic shifts, impacting the competitive landscape of companies like Feihe. Technological advancements, consumer preferences for specialized products, and evolving regulatory environments are key drivers. Analyzing the Feihe competitive landscape requires understanding these trends and their influence on market dynamics.

Feihe's position is also affected by challenges such as declining birth rates and increased competition. The company's future outlook hinges on its ability to adapt to these changes and capitalize on emerging opportunities. An in-depth Feihe market analysis is crucial for understanding its strategic responses and potential for future growth.

The Chinese infant formula market is seeing increased demand for products with specific health benefits, such as those supporting gut health. There's a growing emphasis on transparency in sourcing and production, with consumers seeking detailed information about product origins. Regulatory changes continue to shape the market, favoring companies with strong quality control and R&D capabilities.

A primary challenge is the declining birth rate in China, which is reducing the overall market size for infant formula. Increased competition from both domestic and international brands, particularly in premium segments, poses a continuous threat. Evolving consumer preferences towards alternative feeding methods or product categories could also impact demand.

The premiumization trend in the Chinese market, driven by rising disposable incomes, offers opportunities for higher-value products. Expanding into adjacent product categories, such as children's milk or adult nutrition, could diversify revenue streams. Strategic partnerships and entry into emerging markets could also provide new growth avenues.

Feihe is likely to continue investing in R&D for product innovation and reinforce its vertically integrated supply chain. Targeted marketing strategies and exploring emerging markets are key to addressing evolving consumer needs. For more insight, consider reading about the Growth Strategy of Feihe.

China's infant formula market was valued at approximately $27.8 billion in 2023. The declining birth rate in China, with approximately 9.02 million births in 2023, poses a significant challenge. The premium segment of the market is growing, with consumers increasingly willing to pay more for quality products. Feihe needs to adapt its strategies to maintain its market share and ensure future growth, considering these dynamic market conditions.

- The premium segment of the infant formula market is experiencing growth.

- Competition from both domestic and international brands is intensifying.

- Regulatory changes continue to influence market dynamics.

- Feihe's strategy focuses on innovation, supply chain, and targeted marketing.

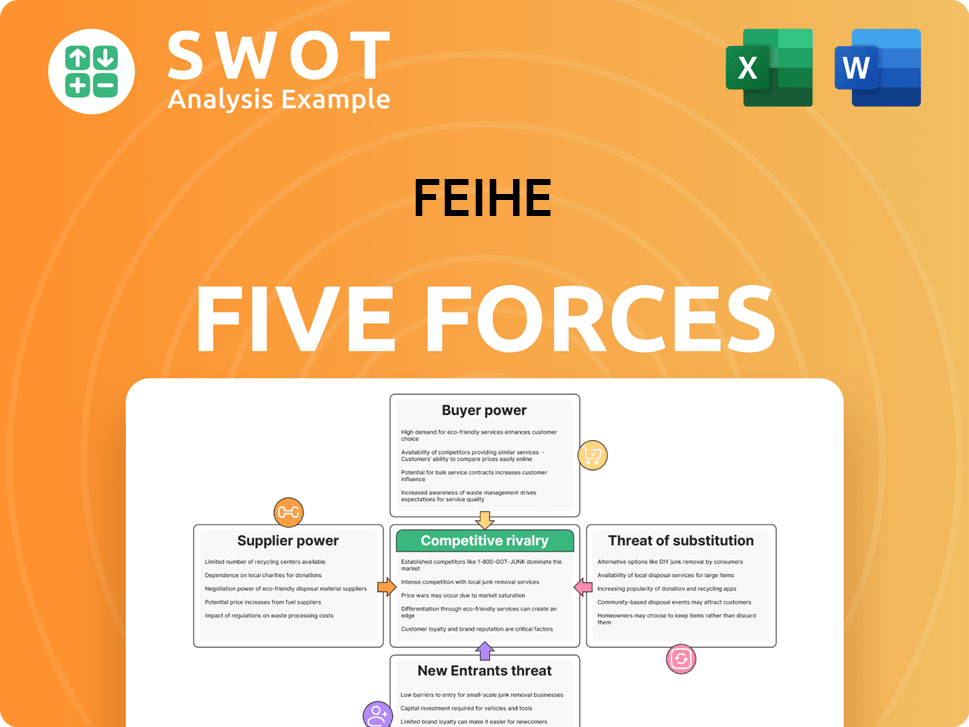

Feihe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Feihe Company?

- What is Growth Strategy and Future Prospects of Feihe Company?

- How Does Feihe Company Work?

- What is Sales and Marketing Strategy of Feihe Company?

- What is Brief History of Feihe Company?

- Who Owns Feihe Company?

- What is Customer Demographics and Target Market of Feihe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.