Feihe Bundle

Who Buys Feihe? Unveiling the Customer Behind China's Dairy Giant

In the cutthroat world of the baby formula market, understanding customer demographics is the key to unlocking success. For Feihe Company, a leader in Chinese infant formula, knowing their target market is not just important—it's fundamental. This deep dive explores the intricacies of Feihe's customer base, revealing the demographics, preferences, and behaviors that drive its market dominance.

The 2008 melamine scandal reshaped the Chinese infant formula landscape, making trust and quality paramount. Feihe SWOT Analysis showcases how Feihe has strategically positioned itself to meet the needs of its target audience. By examining Feihe's customer age range, income levels, and geographic location, we gain valuable insights into the company's brand positioning strategy and its ability to capture a significant Feihe market share in China.

Who Are Feihe’s Main Customers?

Understanding the primary customer segments is crucial for analyzing the success of the infant formula market, particularly for companies like Feihe. The core focus of Feihe, a leading player in the Growth Strategy of Feihe, revolves around the B2C (business-to-consumer) market, specifically targeting parents and caregivers of infants and young children in China. This strategic focus has allowed Feihe to capture a significant share of the market, demonstrating a deep understanding of its customer demographics.

The typical customer profile for Feihe includes mothers aged between 25 and 40 years old. These mothers are often well-educated and possess a higher disposable income. This demographic seeks premium nutrition for their children, making them less price-sensitive and more value-driven. This customer segment is primarily located in urban areas and increasingly in affluent rural areas across China. The emphasis on quality and safety, along with locally sourced ingredients, resonates strongly with this demographic.

Family status is a key criterion, with new parents and those planning families representing the primary purchasers. While gender is not a direct segment, mothers are often the primary decision-makers regarding infant nutrition. Feihe's ability to cater to these needs has allowed it to regain significant market share, especially after past industry challenges. The company's product lines are strategically positioned to meet the demands of this discerning consumer base.

Feihe's primary customer segment includes mothers aged 25-40. These consumers are generally well-educated and possess a higher disposable income. They reside in urban and affluent rural areas across China.

Safety, quality, and locally-sourced ingredients are crucial. The target market is less price-sensitive and more value-driven regarding infant nutrition. Family status, with new parents, is a key criterion.

Feihe targets urban and affluent rural areas. The focus is on consumers with higher disposable incomes. This enables a focus on premium product lines.

Growth in segments seeking specialized formulas is observed. This includes formulas for infants with allergies or digestive sensitivities. This reflects evolving nutritional science and consumer awareness.

Feihe has successfully positioned itself to cater to the discerning needs of Chinese parents. This has allowed the company to regain significant market share from international brands. As of 2024, Feihe held a significant share in the Chinese infant formula market.

- Market Share: As of 2024, Feihe held a significant share in the Chinese infant formula market, indicating its success in capturing a broad segment of this demographic.

- Brand Positioning: Feihe focuses on safety, quality, and locally-sourced ingredients to appeal to Chinese parents.

- Product Innovation: The company has expanded into specialized formulas to meet evolving consumer needs.

- Target Audience: The primary target audience includes mothers aged 25-40 with higher disposable incomes.

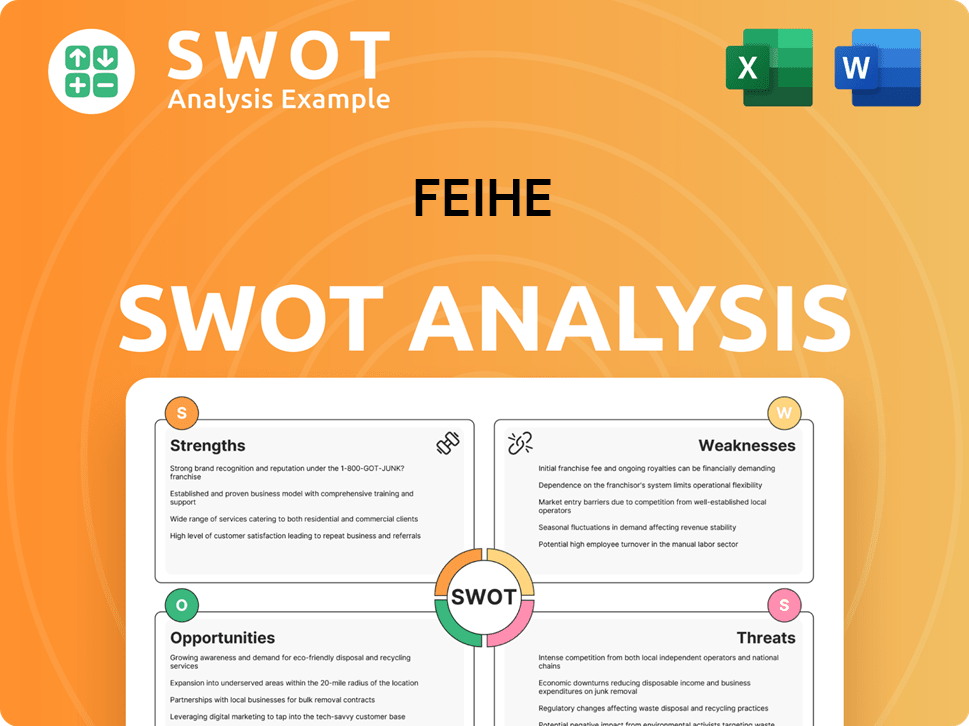

Feihe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Feihe’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any company, and for the infant formula market, this is especially true. The key drivers for customers of the company are trust, safety, and nutritional efficacy. These factors significantly shape purchasing decisions and brand loyalty within the demanding baby formula market.

In the context of the Chinese infant formula market, parents prioritize product safety and quality due to past issues in the industry. This preference translates into a strong demand for brands with transparent supply chains and stringent quality control measures. The company addresses these needs through vertically integrated operations and sourcing of ingredients.

Purchasing behavior is characterized by extensive research, often involving online platforms and social media. Parents actively seek reviews and recommendations from other parents to inform their decisions. Brand reputation, the scientific backing of ingredients, and positive word-of-mouth are key decision-making criteria.

Customers of the company are primarily motivated by the desire to provide the best possible start for their children. This includes ensuring the formula supports healthy growth and development. Practical drivers include ease of access and clear nutritional information.

Parents prefer formulas that are perceived as safe, reliable, and beneficial for their children's health. The company's marketing emphasizes its 'more suitable for Chinese babies' slogan. This directly addresses the cultural and physiological needs of the target audience.

Product usage patterns align with the nutritional needs of infants and young children. Parents seek formulas that support healthy growth and development. Loyalty is built on consistent product quality, perceived health benefits, and reliability.

The company addresses common concerns about food safety and the complexities of choosing the right formula. They provide clear product information and invest in research and development for specialized formulas.

- The company has launched products with specific formulations addressing common infant issues.

- Marketing campaigns emphasize the brand's commitment to quality and suitability for Chinese babies.

- The company's focus on transparency and quality control helps build trust with consumers.

- The company's strong brand image of reliability is a key factor in customer loyalty.

The company's success in the baby formula market is significantly influenced by its ability to meet the specific needs and preferences of its target market. By emphasizing trust, safety, and nutritional efficacy, the company has positioned itself as a reliable choice for parents. The company's commitment to quality and its focus on the Chinese market are key elements of its strategy. For more insights into the company's overall strategic approach, consider reading about the Growth Strategy of Feihe.

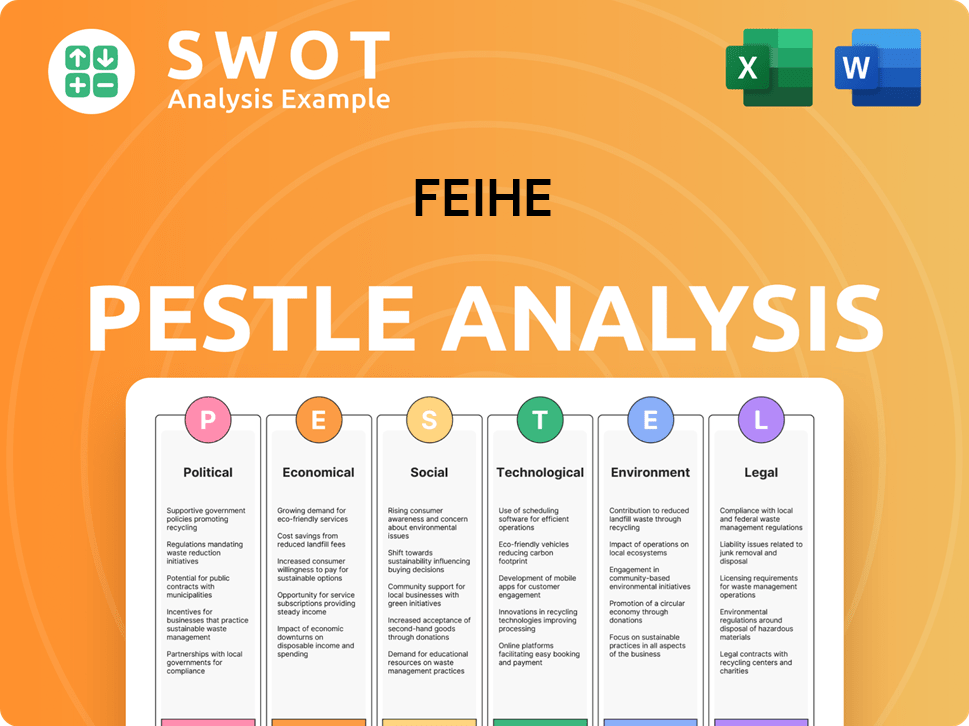

Feihe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Feihe operate?

The primary geographical market for the infant formula company is mainland China. The company holds a significant position within the Chinese baby formula market, with its sales and distribution heavily concentrated in this region. Its strategic focus is on serving Chinese infants, reflecting its strong specialization in the domestic market.

The company's major markets span across various provinces and key cities, particularly in economically developed areas. These regions typically have higher disposable incomes, which fuels robust consumer demand for premium infant nutrition. The company's market leadership indicates strong brand recognition and sales penetration across tier-one and tier-two cities, and increasingly, in tier-three and lower-tier cities as well.

While specific market share percentages per region are not publicly detailed, the company's overall performance indicates a strong presence. The company tailors its product portfolio to address specific regional dietary habits or common infant health concerns observed in different parts of China. This includes marketing campaigns that resonate with local cultural nuances and partnerships with regional distributors and retailers. For more information, you can check out Owners & Shareholders of Feihe.

The company's strong brand recognition and sales penetration are evident across tier-one and tier-two cities. There's a growing presence in tier-three and lower-tier cities, indicating an expanding reach within the Chinese market. This expansion strategy is crucial for capturing a broader segment of the Chinese infant formula market.

Consumers in larger, cosmopolitan cities might be more exposed to international brands. Consumers in more traditional or rural areas might place a higher value on domestic brands. The company adapts its marketing to resonate with local cultural nuances and regional consumer preferences.

The company localizes its offerings by tailoring its product portfolio to address specific regional dietary habits. It also focuses on common infant health concerns observed in different parts of China. These efforts include marketing campaigns that resonate with local cultural nuances.

The company partners with regional distributors and retailers to ensure effective product distribution. The focus is on optimizing its distribution network and market penetration within China. This strategic approach supports its strong specialization in the Chinese market.

The company has a significant market share in the Chinese infant formula market. Exact percentages vary, but the company is a leading player. The company's strong presence reflects its strategic emphasis on serving Chinese infants.

The company conducts consumer behavior analysis to understand regional preferences. This helps tailor marketing campaigns and product offerings. Understanding consumer behavior drives effective market segmentation.

The company utilizes various distribution channels to reach consumers. These include partnerships with regional distributors and retailers. The distribution strategy is key to market penetration.

The company employs marketing campaigns tailored to local cultural nuances. These campaigns help build brand awareness. Effective marketing is crucial for reaching the target audience.

The company's product pricing strategy is designed to be competitive within the market. Pricing is adjusted based on regional economic conditions. The strategy aims to maximize sales and market share.

Customer satisfaction surveys help the company gather feedback. This feedback is used to improve products and services. The company aims to maintain high customer satisfaction levels.

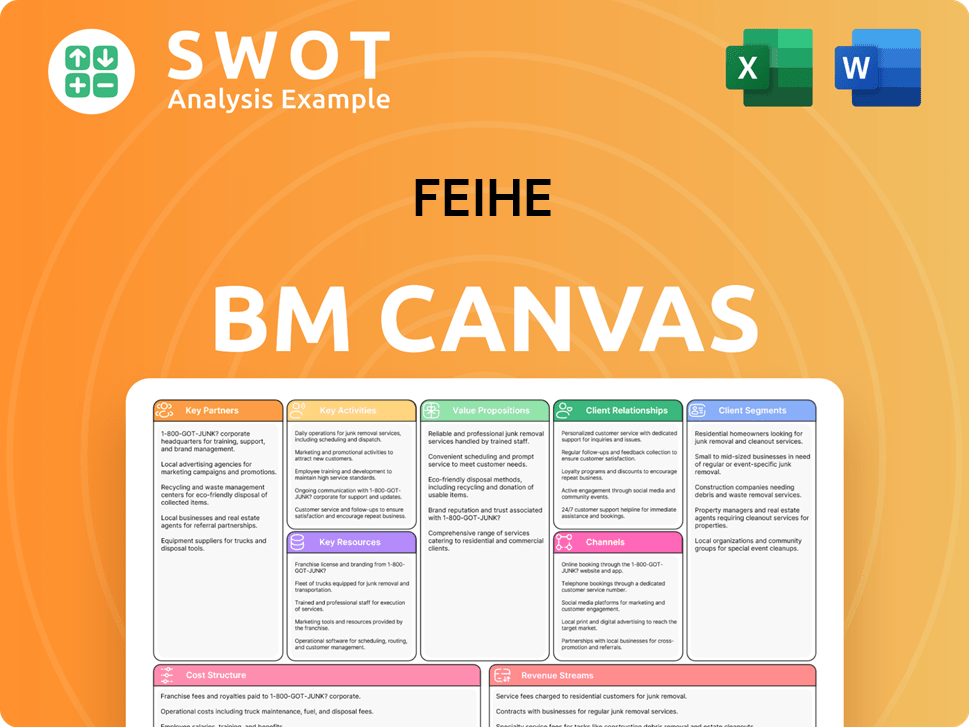

Feihe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Feihe Win & Keep Customers?

The success of infant formula companies like Feihe hinges on effective customer acquisition and retention strategies, particularly in the competitive Chinese baby formula market. These strategies must be finely tuned to the specific needs and preferences of the Feihe target market, which primarily consists of parents of infants and young children. Understanding customer demographics, including factors like age range, income levels, and geographic location, is crucial for crafting targeted marketing campaigns and ensuring product relevance.

Feihe's approach involves a blend of digital and traditional marketing channels to reach its target audience. Digital platforms like WeChat and Douyin (TikTok) are central to engaging with parents, offering educational content and leveraging influencer collaborations. Traditional methods, such as television commercials and print media, also contribute to building brand awareness. These efforts are supported by strategic partnerships with various distribution channels, including maternity and baby stores, pharmacies, and e-commerce platforms, ensuring widespread product availability.

Customer retention is equally important in the infant formula market, and Feihe invests in loyalty programs and personalized experiences. Data from customer relationship management (CRM) systems can be used to tailor communications and product recommendations based on a child's age or specific nutritional needs. After-sales service, including responsive customer support, also contributes to customer loyalty. The company's focus on quality and its 'more suitable for Chinese babies' messaging directly addresses consumer concerns and preferences, building trust and encouraging repeat purchases. To understand Feihe's position in the market, it's helpful to analyze the Competitors Landscape of Feihe.

Feihe leverages digital channels such as WeChat and Douyin (TikTok) for direct engagement with parents. These platforms are used for educational content, influencer collaborations, and live-streaming events. This approach helps to build brand awareness and foster a strong relationship with the target audience.

Traditional advertising methods, including television commercials and print media in parenting magazines, are still used to reach a wider audience. These channels help to reinforce brand messaging and build trust among potential customers. This approach complements the digital marketing efforts.

Feihe partners with various distribution channels, including maternity and baby stores, pharmacies, and e-commerce platforms. This ensures widespread product availability and accessibility for consumers. Partnerships with major e-commerce sites like Tmall and JD.com are crucial.

Loyalty programs are a key part of retaining customers, offering discounts, exclusive content, or access to parenting resources. Feihe focuses on building long-term relationships with parents. These programs encourage repeat purchases and build brand loyalty within the Feihe target market.

Feihe uses customer data and CRM systems to tailor communications and product recommendations. This approach ensures that parents receive relevant information based on their child's age or specific needs. This personalization enhances customer satisfaction and builds stronger relationships.

- Targeted Advertising: Tailoring ads based on customer data.

- Product Recommendations: Suggesting products based on a child's age and needs.

- Personalized Content: Providing relevant parenting advice and information.

- Exclusive Offers: Offering special promotions to loyal customers.

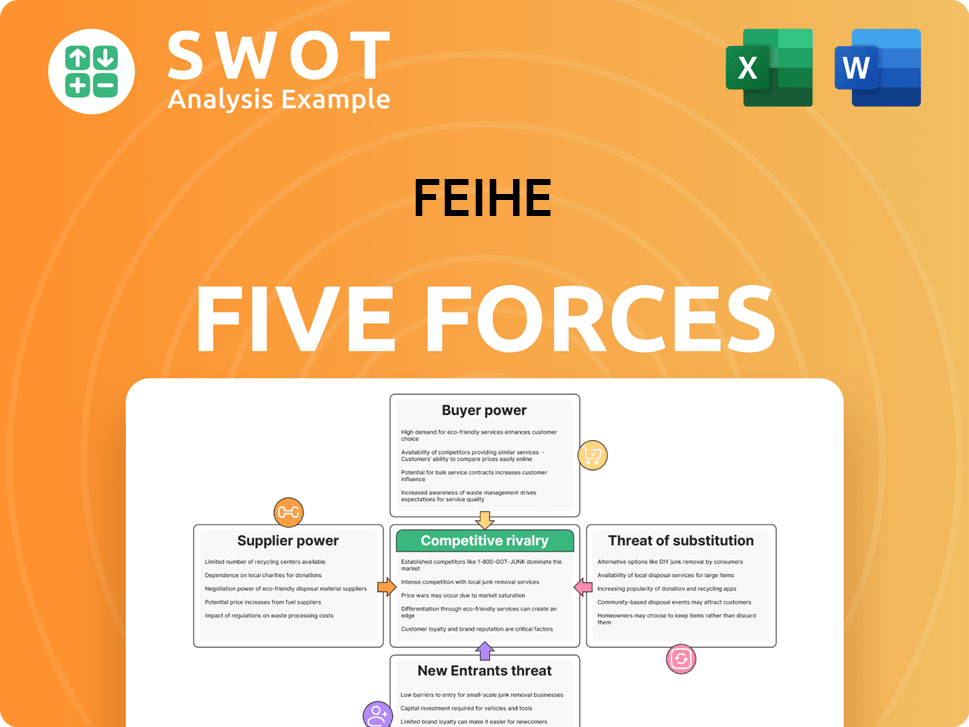

Feihe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Feihe Company?

- What is Competitive Landscape of Feihe Company?

- What is Growth Strategy and Future Prospects of Feihe Company?

- How Does Feihe Company Work?

- What is Sales and Marketing Strategy of Feihe Company?

- What is Brief History of Feihe Company?

- Who Owns Feihe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.