Feihe Bundle

Who Really Owns Feihe Company?

Understanding the ownership structure of a company is crucial for investors and strategists alike. Feihe Company, a leading player in the Chinese dairy industry, has a fascinating ownership journey. From its roots as a state-owned enterprise to its current status as a publicly traded entity, Feihe's ownership has significantly influenced its strategic decisions.

This analysis will uncover the key players behind Feihe, exploring the evolution of its ownership from its inception in 1962 as Hongguang Dairy Plant. We'll examine the stakes held by major shareholders, including the influence of figures like Ying Ruimin, and the impact of its relisting on the Hong Kong Stock Exchange. Furthermore, we will provide a Feihe SWOT Analysis to better understand the company's position in the baby formula market, its financial performance, and its future prospects within the competitive dairy industry.

Who Founded Feihe?

The story of Feihe Company, a major player in the Chinese dairy industry, began in 1962. It started as Hongguang Dairy Plant, a state-owned enterprise located in Qiqihar city, China. This early phase focused on dairy farming and processing, laying the groundwork for the company's future.

Understanding the Feihe ownership structure is key to grasping its evolution. While the initial state-owned structure doesn't provide detailed founder equity splits, the company's journey through various ownership phases reveals the influence of key figures and strategic investors. This includes its transition to a public company and subsequent privatization.

Youbin Leng, the current Chairman and CEO, has been a central figure in Feihe's development. His leadership and the involvement of other key stakeholders, particularly during the transition from state-owned to private enterprise, have significantly shaped the company's direction and growth within the Chinese dairy market.

Feihe's origins trace back to 1962 as Hongguang Dairy Plant, a state-owned enterprise in Qiqihar, China. The primary focus was on dairy farming and processing, setting the stage for future expansion. The ownership structure during this period was typical of state-owned enterprises, with the government holding control.

Youbin Leng, the current Chairman and CEO, has played a pivotal role in Feihe's history. His leadership has been instrumental in guiding the company through various stages of development. Leng's influence is evident in the strategic decisions that have shaped Feihe's market position.

Feihe, under the name American Dairy, went public on the New York Stock Exchange in 2008. This marked a significant step in the company's evolution, providing access to capital and increasing its visibility in the global market. The IPO allowed the company to expand its operations and enhance its brand.

In 2013, Feihe underwent privatization through a merger with its parent company. Youbin Leng and other 'Rollover Holders' held approximately 41.3% of the outstanding shares before the privatization. Private equity firms, such as an affiliate of Morgan Stanley Private Equity Asia, also gained beneficial ownership.

The ownership structure of Feihe has evolved over time, involving various stakeholders. Key figures like Youbin Leng, along with private equity firms, have played crucial roles in shaping the company's ownership. Understanding these stakeholders is vital for comprehending Feihe's strategic direction and financial performance.

Feihe continues to be a significant player in the Chinese dairy market. The company's ownership structure reflects a mix of management control and private equity involvement. Its focus remains on producing high-quality baby formula and other dairy products, catering to the needs of the Chinese consumer market.

The evolution of Feihe's ownership, from its state-owned beginnings to its current structure, highlights the strategic shifts and key players that have shaped the company. The involvement of individuals like Youbin Leng and the influence of private equity firms have been critical in Feihe's growth and market positioning, establishing it as a prominent brand in the Chinese dairy industry. For more details, consider exploring a comprehensive analysis of the company's history and ownership structure.

Feihe's journey began as a state-owned enterprise in 1962, evolving through various ownership structures.

- Youbin Leng, the current CEO, has been a key figure in the company's development.

- The company went public on the NYSE in 2008 and was later privatized in 2013.

- Prior to privatization, Youbin Leng and other 'Rollover Holders' held approximately 41.3% of the shares.

- Private equity firms, such as Morgan Stanley, also gained ownership.

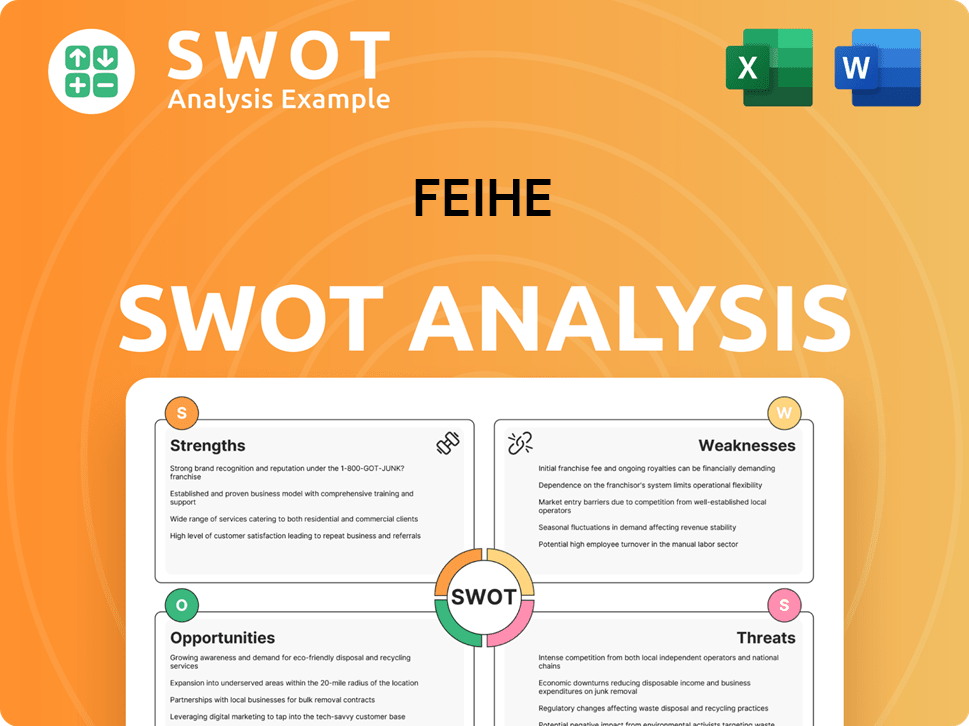

Feihe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Feihe’s Ownership Changed Over Time?

The ownership structure of Feihe International Limited has seen significant changes over time. A major shift occurred on November 13, 2019, when the company was relisted on the Main Board of The Stock Exchange of Hong Kong Limited (SEHK: 6186). This relisting included an initial public offering (IPO), which was the largest in the formula milk industry at that time. This event marked a pivotal moment in the company's history, influencing its ownership dynamics and future growth trajectory.

As of June 13, 2025, the market capitalization of Feihe International stands at USD 6.41 billion, with approximately 9.1 billion shares outstanding. The current ownership structure reflects a mix of insider and institutional investors. Understanding these key stakeholders is crucial for assessing the company's strategic direction and financial performance. The company's history, including the influence of individuals like Ying Ruimin, has shaped its current standing in the Chinese dairy and baby formula market.

| Ownership Category | Stake | Details |

|---|---|---|

| Insiders | Majority | Control company decisions. CEO Youbin Leng holds the largest stake. |

| Youbin Leng | 43% | Largest individual shareholder and CEO. |

| Hua Liu | 3.8% | Vice Chairman and significant shareholder. |

| Institutional Investors | Substantial | Includes Vanguard, iShares, and DFA. |

Insiders currently hold a considerable stake in Feihe, which allows them to collectively make key decisions. CEO Youbin Leng is the largest shareholder, holding a significant 43% stake. Hua Liu, who also serves as Vice Chairman, owns approximately 3.8% of the stock. Institutional investors also play a crucial role, with 138 institutional owners and shareholders filing 13D/G or 13F forms with the SEC. These investors collectively hold a total of 356,667,945 shares. Major institutional shareholders include Vanguard Total International Stock Index Fund Investor Shares (VGTSX), Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX), and iShares Core MSCI Emerging Markets ETF (IEMG). Further details about the Growth Strategy of Feihe can provide additional context.

Feihe's ownership structure is a blend of insider and institutional investors, influencing the company's strategic direction.

- CEO Youbin Leng is the largest shareholder with a 43% stake.

- Institutional investors hold a substantial portion of the stock.

- The company's total equity as of December 31, 2024, was RMB 27,407,385,000.

- The IPO in 2019 was a significant event, reshaping ownership.

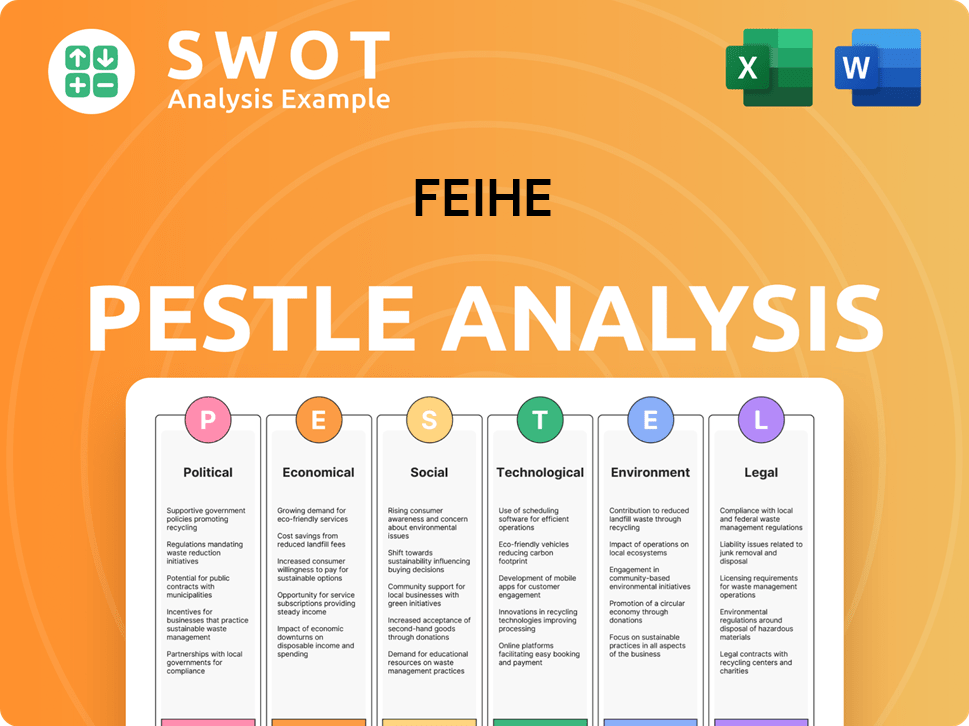

Feihe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Feihe’s Board?

As of May 20, 2025, the Board of Directors of Feihe Company comprises executive, non-executive, and independent non-executive directors. The executive directors are Mr. LENG Youbin (Chairman), Mr. LIU Hua, Mr. CAI Fangliang, and Ms. Judy Fong-Yee TU. Non-executive directors include Mr. GAO Yu, Mr. Kingsley Kwok King CHAN, Mr. CHEUNG Kwok Wah, and Mr. Maher EL-OMARI. The independent non-executive directors are Ms. LIU Jinping, Mr. SONG Jianwu, Mr. FAN Yonghong, and Mr. Jacques Maurice LAFORGE.

This structure ensures a balance of perspectives in the company's governance. The board oversees the company's strategic direction and ensures that the interests of all stakeholders, including shareholders, are considered in decision-making processes. The composition of the board reflects a commitment to both expertise and independence, which is crucial for effective corporate governance in the competitive Chinese dairy market. The board's role is pivotal in guiding the company's performance and maintaining its position in the baby formula and broader dairy industry.

| Director Type | Director Name | Title |

|---|---|---|

| Executive Director | LENG Youbin | Chairman |

| Executive Director | LIU Hua | Vice Chairman |

| Non-Executive Director | GAO Yu | Director |

Mr. LENG Youbin, the Chairman and CEO, holds a significant stake in Feihe Company, with approximately 43% ownership as of the latest reports. This substantial holding makes him the largest individual shareholder, providing him with considerable influence over the company's strategic direction and voting power. The significant insider ownership, coupled with the roles of other key shareholders like Hua Liu, who holds 3.8% of the stock, indicates a strong alignment between management and ownership interests. This alignment is crucial for the company's long-term success, as it ensures that the leadership's decisions are closely tied to the financial performance and shareholder value. This structure supports the company's goals within the Chinese dairy industry.

Understanding the Feihe ownership structure is key to grasping how the company operates and makes decisions. The board, led by major shareholder Youbin Leng, is central to this, ensuring that the company's strategy aligns with the interests of its stakeholders.

- The Chairman and CEO, Youbin Leng, has significant voting power.

- The board's decisions are influenced by the substantial insider ownership.

- The company's governance aims to balance the interests of shareholders.

- For more insights, check out the Marketing Strategy of Feihe.

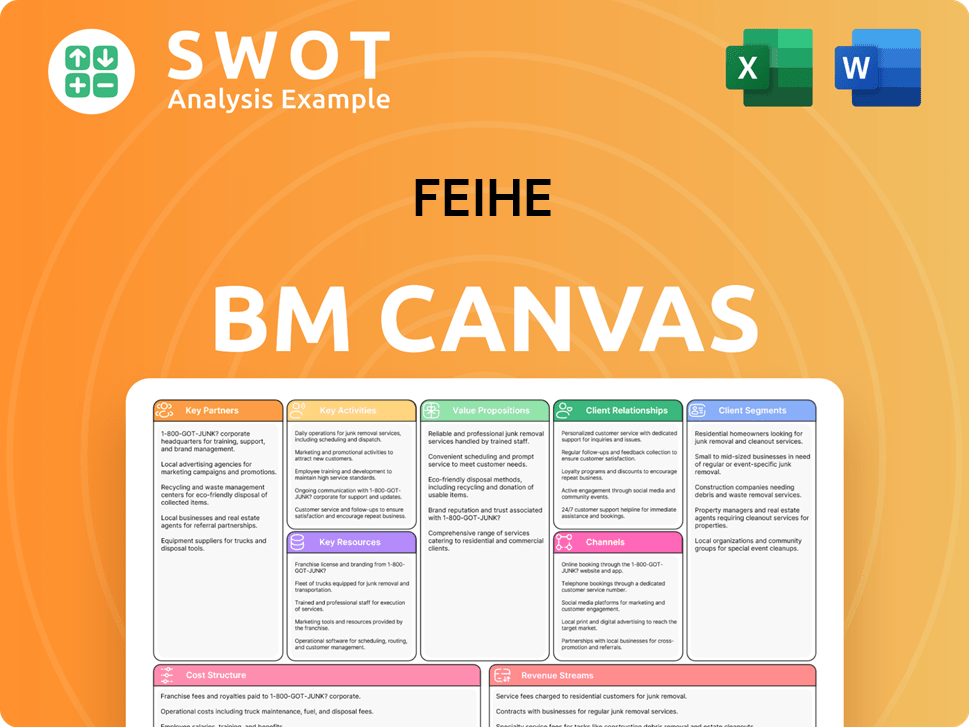

Feihe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Feihe’s Ownership Landscape?

In the past few years, the Feihe Company has shown robust growth. The company's revenue reached RMB 20.75 billion in 2024, marking a 6% increase year-on-year. Net profit also rose significantly, up 11% to RMB 3.65 billion. Infant formula milk powder products were a major contributor, accounting for RMB 19.06 billion of the revenue in 2024, a 6.6% increase from the previous year. This performance highlights Feihe's strong position in the Chinese dairy market and its focus on baby formula.

Feihe's global expansion has been notable, with its Canadian subsidiary, Royal Mook, entering a strategic cooperation with American baby products company Munchkin in April 2024. The Canadian infant formula milk powder production factory officially commenced operations in September 2024. In 2024, revenue in the Chinese mainland was RMB 20.55 billion, with contributions from the United States at RMB 160 million, and Canada at RMB 38.51 million, all demonstrating growth. The company continues to invest in research and development, adding 153 domestic and international patents in 2024, bringing the total to 659.

| Metric | 2024 Revenue (RMB Billion) | Year-on-Year Growth |

|---|---|---|

| Total Revenue | 20.75 | 6% |

| Infant Formula Revenue | 19.06 | 6.6% |

| Net Profit | 3.65 | 11% |

Regarding ownership, CEO Youbin Leng holds a significant stake, around 43% as of May 13, 2025. There is substantial institutional ownership, with 138 institutional shareholders holding over 356 million shares. The company has also engaged in share buybacks, with an equity buyback plan announced on August 29, 2023. Furthermore, Feihe has invested in financial products, including wealth management and structured deposit products from SPD Bank, with an aggregated outstanding principal amount of RMB 2.5 billion as of May 20, 2025. Despite some concerns about dividend sustainability due to a high payout ratio, analysts forecast rising earnings for the company.

CEO Youbin Leng holds a 43% stake, indicating strong insider confidence. Institutional investors hold a substantial number of shares. These two groups significantly influence the company's strategic direction.

The company has engaged in share buybacks, reflecting a positive outlook. Investments in financial products show active financial management. These actions aim to enhance shareholder value.

Feihe's revenue grew in 2024, showing resilience and market strength. Infant formula sales drive revenue growth. These results indicate strong market demand.

Analysts predict increasing earnings despite high payout ratios. New product lines, like the Zhuorui series, are set to expand. The company's future looks promising.

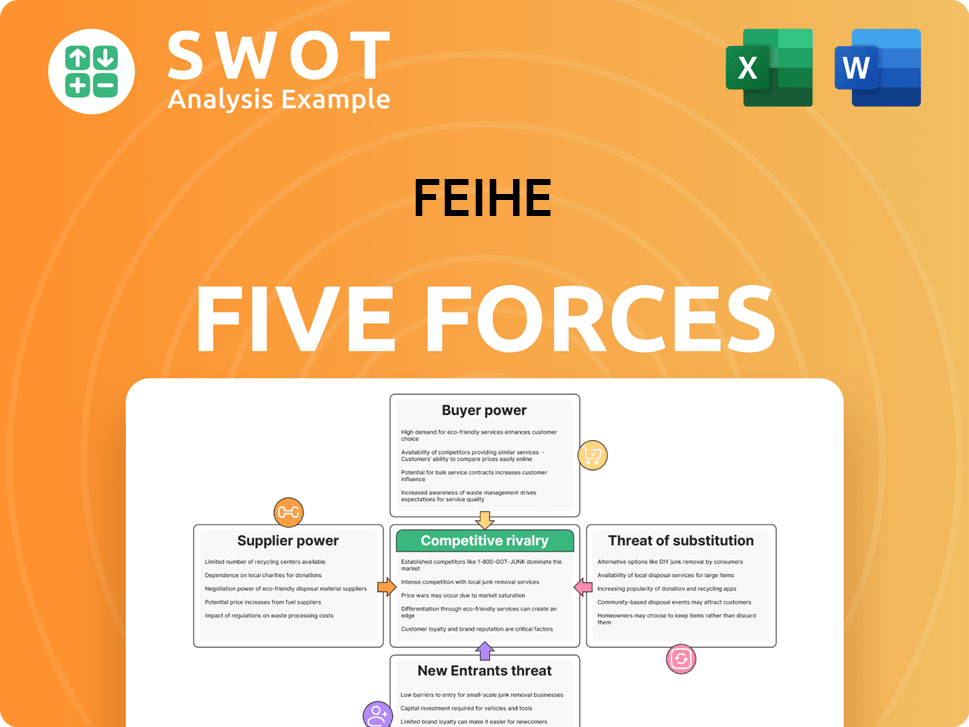

Feihe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Feihe Company?

- What is Competitive Landscape of Feihe Company?

- What is Growth Strategy and Future Prospects of Feihe Company?

- How Does Feihe Company Work?

- What is Sales and Marketing Strategy of Feihe Company?

- What is Brief History of Feihe Company?

- What is Customer Demographics and Target Market of Feihe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.