Fortescue Metals Group Bundle

How Does Fortescue Metals Group Stack Up in the Iron Ore Arena?

The iron ore market is a global powerhouse, constantly reshaped by economic tides and sustainability demands. Fortescue Metals Group (FMG), an Australian giant, has rapidly ascended the ranks since its inception in 2003. Understanding the Fortescue Metals Group SWOT Analysis is crucial for any investor or strategist navigating this complex landscape.

This exploration of the FMG competitive landscape delves into its market position, dissecting its key rivals within the iron ore market analysis, and uncovering the competitive advantages that fuel its success. We'll examine how FMG's iron ore production and strategic initiatives position it against industry giants, considering the impact of iron ore price fluctuations and China's demand. Furthermore, we'll explore FMG's future outlook within the Australian mining companies and the broader global mining industry.

Where Does Fortescue Metals Group’ Stand in the Current Market?

Fortescue Metals Group (FMG) holds a significant position in the global iron ore market. It's the world's fourth-largest iron ore producer, primarily operating in the Pilbara region of Western Australia. FMG focuses on the exploration, development, production, and sale of iron ore, with a strong emphasis on serving markets in China and other Asian economies.

The company's core value proposition revolves around providing high-quality iron ore to meet the increasing global demand, particularly from steel manufacturers. FMG's strategic location in the Pilbara region offers access to substantial iron ore reserves, which are crucial for its production capacity. Furthermore, FMG is expanding its operations and diversifying into green energy, which is a key aspect of its long-term strategy.

In the first half of fiscal year 2024, FMG reported iron ore shipments of 94.6 million tonnes. This substantial volume directly contributed to the company's revenue stream. FMG's focus remains on expanding its iron ore production capacity to meet global demand.

FMG's financial health is robust, with an EBITDA of US$5.9 billion in the first half of FY24. The company's net profit after tax reached US$3.2 billion during the same period. These figures demonstrate FMG's strong profitability and financial stability within the iron ore market.

FMG is actively diversifying its business through its Fortescue Energy segment. In the first half of FY24, the company invested US$0.4 billion in this segment. This strategic shift is essential for long-term sustainability and growth.

FMG has a strong global presence, with a significant focus on the Chinese and Asian markets. The company's ability to meet the demand from these markets is a key factor in its success. FMG's market share analysis shows its competitive standing.

FMG's competitive landscape is shaped by its ability to efficiently extract and sell iron ore while also investing in sustainable energy solutions. For a deeper dive into the company's competitive positioning, consider reading this in-depth analysis of Fortescue Metals Group.

FMG's market position is influenced by several key factors, including iron ore prices, demand from China, and the company's cost structure. The mining industry rivals, such as Rio Tinto and BHP, also play a crucial role in shaping the competitive landscape.

- Iron ore price fluctuations significantly impact FMG's revenue and profitability.

- Demand from China remains a primary driver of FMG's sales volume.

- FMG's cost structure and operational efficiency are critical for maintaining competitiveness.

- The company's sustainability initiatives and ESG performance are increasingly important to investors.

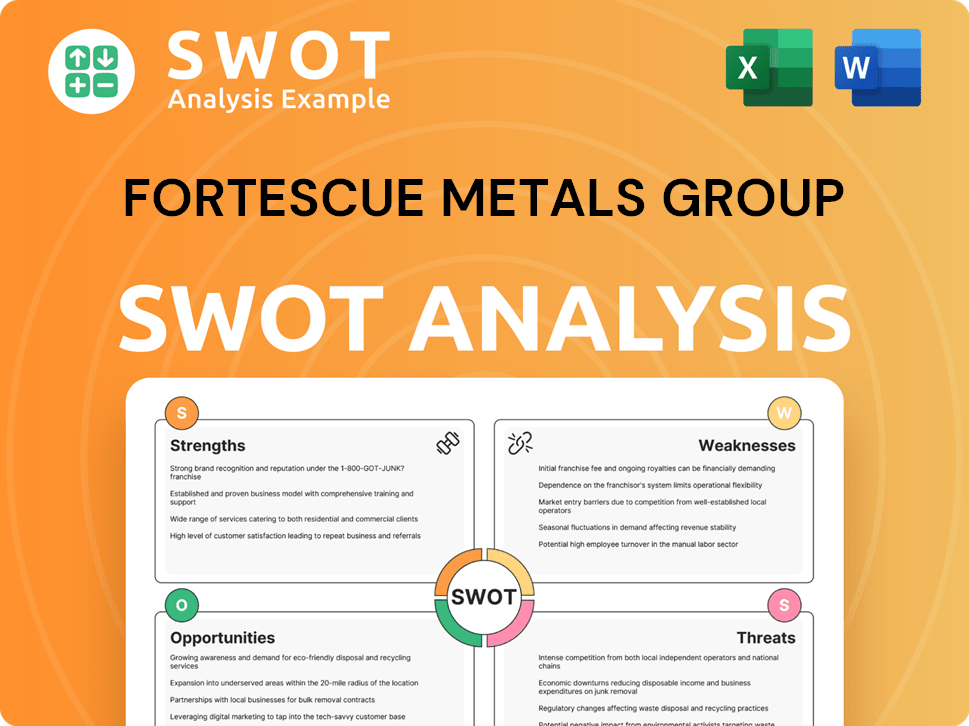

Fortescue Metals Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Fortescue Metals Group?

The competitive landscape for Fortescue Metals Group (FMG) is primarily defined by the iron ore market, where it faces significant challenges and opportunities. FMG's success hinges on its ability to compete effectively against larger, established players. Understanding the Marketing Strategy of Fortescue Metals Group is crucial for analyzing its competitive positioning.

The iron ore market is dynamic, with prices and demand heavily influenced by global economic conditions, particularly in China, the largest consumer. FMG's ability to navigate these fluctuations and maintain profitability is a key aspect of its competitive strategy. The company's focus on cost efficiency and innovation are critical for sustaining its market share.

FMG operates within a highly competitive environment. The company's performance is directly impacted by the strategies and capabilities of its main rivals. These competitors possess substantial resources, global reach, and established relationships with key customers.

The primary competitors of FMG include Rio Tinto, BHP, and Vale. These companies are major iron ore producers with significant market share and influence. They compete with FMG on production volume, cost efficiency, and strategic partnerships.

Rio Tinto is one of the largest mining companies globally, with substantial iron ore operations in the Pilbara region of Western Australia. It directly competes with FMG in terms of production and market share. In 2023, Rio Tinto produced approximately 331.8 million tonnes of iron ore.

BHP is another major player in the iron ore market, also with significant operations in Western Australia. BHP is a key rival to FMG in terms of production volume and operational efficiency. BHP's iron ore production in the financial year 2023 was around 257 million tonnes.

Vale S.A. is the world's largest producer of iron ore. It poses a significant challenge, particularly in the seaborne iron ore markets due to its vast production capacity and global reach. Vale's iron ore production in 2023 reached approximately 306.1 million metric tons.

These competitors engage in price competition and vie for strategic supply agreements with major steel producers. They constantly optimize their logistics and production to gain a competitive edge. The ongoing consolidation within the mining sector impacts competitive dynamics, potentially creating even larger and more formidable rivals.

Emerging players and smaller regional miners can also exert competitive pressure, especially in niche markets or during periods of fluctuating demand. These companies may focus on specific geographic regions or product types, adding complexity to the FMG competitive landscape.

FMG's competitive position is influenced by several factors, including production costs, ore quality, logistics efficiency, and relationships with customers. The company's ability to manage these factors effectively determines its success in the iron ore market. Key considerations include:

- Production Costs: Lower production costs allow for higher profit margins and the ability to compete during periods of low iron ore prices.

- Ore Quality: The quality of the iron ore produced impacts its marketability and pricing.

- Logistics: Efficient transportation of iron ore to customers is crucial for cost-effectiveness.

- Customer Relationships: Strong relationships with major steel producers are essential for securing long-term supply agreements.

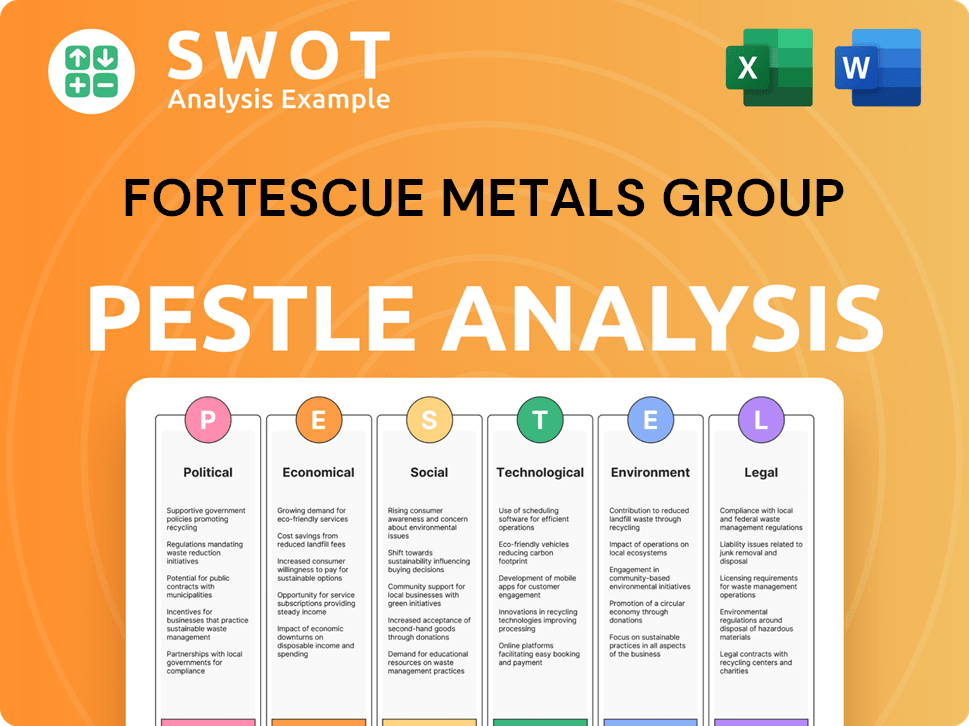

Fortescue Metals Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Fortescue Metals Group a Competitive Edge Over Its Rivals?

Understanding the FMG competitive landscape requires a deep dive into its core strengths. Fortescue Metals Group (FMG) has carved a significant niche in the iron ore market analysis, primarily through its strategic advantages. These advantages are crucial for its success in the mining industry rivals arena, particularly when assessing iron ore production capabilities and overall market positioning.

FMG's competitive edge is built on several pillars, including operational efficiency, customer relationships, and a forward-thinking approach to sustainability. The company's focus on innovation and expansion further strengthens its position, making it a key player among Australian mining companies. As the iron ore price impact on Fortescue Metals Group fluctuates, these advantages become even more critical for maintaining profitability and market share.

The company's commitment to sustainability and technological advancements are also key differentiators. FMG's investments in green energy and its focus on developing new iron ore products reflect its adaptability and commitment to meeting evolving customer demands. For more insights into FMG's target audience, you can read about the Target Market of Fortescue Metals Group.

FMG benefits from significant economies of scale due to its large-scale, low-cost iron ore operations in the Pilbara region. This allows for competitive production costs. The company's integrated infrastructure, including rail networks and port facilities, streamlines the transportation of iron ore, enhancing efficiency.

FMG has established strong relationships with key customers, particularly in China, fostering customer loyalty. The company is focused on developing new iron ore products, such as the West Pilbara Iron Ore Project (WPIOP) products, to cater to evolving customer demands and attract higher margins.

FMG's proactive approach to decarbonization and investment in green energy projects through Fortescue Energy is a significant differentiator. This commitment to sustainability positions FMG favorably with environmentally conscious investors and customers. This is a key factor in its ESG performance.

FMG leverages proprietary technology and innovation in mining and processing, contributing to operational efficiencies. A strong talent pool enables the company to adapt to changing market conditions. These technological advancements are crucial for its expansion projects and competitive positioning.

FMG's competitive advantages include low-cost production, strong customer relationships, and a focus on sustainability. These factors contribute to its ability to maintain a strong position in the iron ore market. The company's financial performance, when compared to mining industry rivals, is a key indicator of its success.

- Low-Cost Production: FMG's Pilbara operations and integrated infrastructure result in competitive production costs.

- Customer Relationships: Strong ties with key customers, particularly in China, ensure consistent demand.

- Sustainability Initiatives: Investment in green energy projects enhances its appeal to environmentally conscious investors.

- Technological Innovation: Proprietary technology and a strong talent pool drive operational efficiencies.

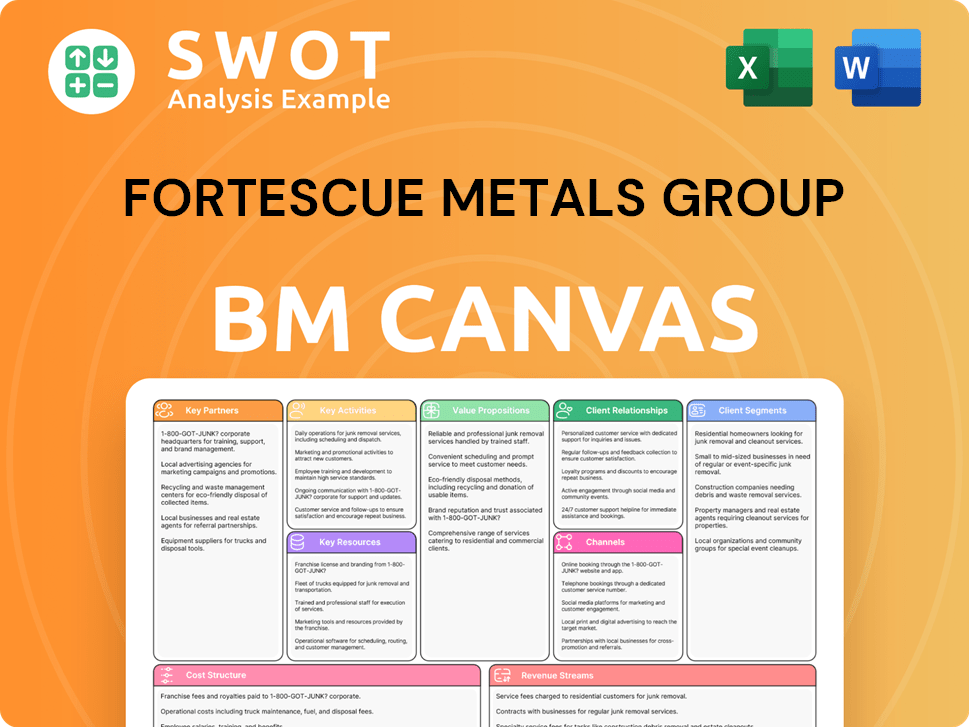

Fortescue Metals Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Fortescue Metals Group’s Competitive Landscape?

The iron ore industry is currently undergoing significant shifts, presenting both challenges and opportunities for companies like Fortescue Metals Group (FMG). The global drive towards decarbonization, volatile commodity prices, and the increasing demand for higher-grade iron ore are key factors shaping the FMG competitive landscape. Understanding these trends is crucial for assessing FMG's future outlook and strategic positioning within the iron ore market analysis.

FMG faces risks from intensified competition and geopolitical tensions, but also benefits from emerging markets and technological innovations. The company's investments in green energy and product diversification are vital for maintaining its competitive edge. This analysis explores the industry trends, future challenges, and opportunities impacting FMG, providing insights into its strategic direction and potential for growth.

The primary trends shaping the FMG competitive landscape include the global push for decarbonization, commodity price volatility, and the rising demand for higher-grade iron ore. Decarbonization impacts steel production, thus affecting iron ore demand, and requires significant investments in green technologies. Volatile prices, influenced by global events, pose challenges but also opportunities for companies with robust cost structures. The demand for higher-grade iron ore is driven by steelmakers aiming to reduce their carbon footprint.

FMG faces challenges such as intensified competition from existing players, potential new entrants, and disruptive technologies in steelmaking. Geopolitical tensions and trade policies could also affect global iron ore demand and supply chains. Maintaining cost competitiveness and adapting to evolving market dynamics are crucial for FMG. The company must navigate these challenges to sustain its market position and financial performance compared to rivals.

Growth opportunities for FMG lie in emerging markets with increasing infrastructure development, continued innovation in mining and processing technologies, and strategic partnerships. FMG's investments in green energy, through Fortescue Energy, and diversification of its product portfolio can create new revenue streams. The West Pilbara Iron Ore Project (WPIOP) is expected to deliver higher-grade products, capitalizing on the demand for premium iron ore.

FMG's strategic responses include investing in green energy initiatives, diversifying its product portfolio, and enhancing operational efficiencies. These strategies aim to mitigate risks and capitalize on opportunities in the iron ore market. The company's focus on sustainability and technological advancements is crucial for long-term success. For further insights, consider reading about the Growth Strategy of Fortescue Metals Group.

FMG's future outlook hinges on its ability to navigate industry trends, address challenges, and seize opportunities. Key factors include managing commodity price volatility, adapting to decarbonization pressures, and maintaining a competitive cost structure. Strategic decisions related to sustainability, technological innovation, and market diversification will be critical.

- Decarbonization: FMG's investments in green hydrogen and ammonia production (Fortescue Energy) are crucial to reduce emissions.

- Market Dynamics: FMG must respond to fluctuations in iron ore prices and demand from China and other key markets.

- Operational Efficiency: Continuous improvement in mining and processing technologies is essential to maintain cost competitiveness.

- Strategic Partnerships: Collaborations can enhance market access and technological capabilities.

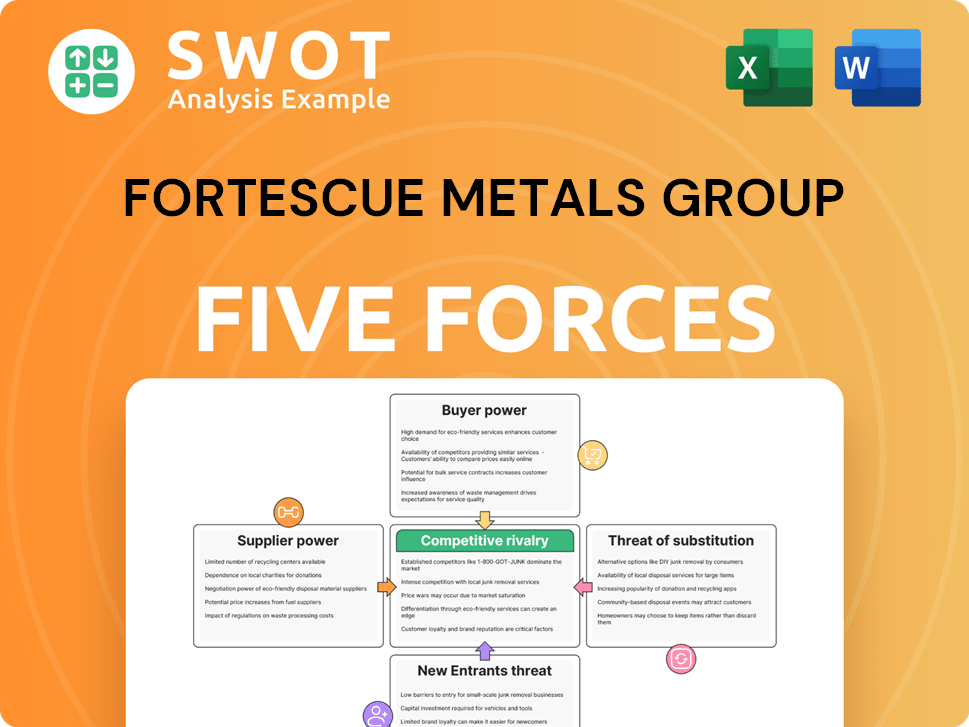

Fortescue Metals Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fortescue Metals Group Company?

- What is Growth Strategy and Future Prospects of Fortescue Metals Group Company?

- How Does Fortescue Metals Group Company Work?

- What is Sales and Marketing Strategy of Fortescue Metals Group Company?

- What is Brief History of Fortescue Metals Group Company?

- Who Owns Fortescue Metals Group Company?

- What is Customer Demographics and Target Market of Fortescue Metals Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.