Fortescue Metals Group Bundle

How Does Fortescue Metals Group Thrive in the Iron Ore Industry?

Fortescue Metals Group (FMG) has revolutionized the iron ore market, becoming a global powerhouse through strategic infrastructure development and massive-scale iron ore production. This Australian mining company's journey is a compelling case study in how to build a business from the ground up. Its impact extends beyond production, as it pioneers decarbonization and green energy initiatives, setting a new standard for the industry.

As the world's fourth-largest iron ore producer, understanding Fortescue's operations is vital. This analysis delves into its core mining activities, Fortescue Metals Group SWOT Analysis, and innovative green energy ventures. Investors, customers, and industry observers will gain valuable insights into the company's financial performance, iron ore production, and its future plans within the dynamic landscape of global resources.

What Are the Key Operations Driving Fortescue Metals Group’s Success?

The core operations of Fortescue Metals Group (FMG) center on the exploration, development, production, and sale of iron ore. This Australian mining company primarily serves the global steel industry. Its value proposition is built on delivering large volumes of high-quality iron ore efficiently and reliably to its customers.

FMG's operations are designed to provide a consistent supply of raw materials to steel mills, particularly in China and other Asian markets. The company's integrated approach, from mine to port, ensures control over the supply chain and optimizes delivery times. This streamlined process allows FMG to maintain its competitive edge in the global iron ore market.

The company focuses on high-volume, low-cost iron ore production. This is achieved through significant investments in infrastructure and a relentless pursuit of operational efficiencies. As of the first half of the 2024 financial year, FMG shipped a substantial 94.6 million tonnes of iron ore, demonstrating its capacity and commitment to meeting global demand.

FMG begins its operational process with extensive exploration activities to identify viable iron ore deposits within its vast tenements in the Pilbara region. Once deposits are confirmed, the company undertakes capital-intensive development, including constructing mines, processing facilities, and essential infrastructure such as railways and port facilities.

The company employs large-scale open-pit mining techniques. This is followed by crushing, screening, and blending processes to produce various grades of iron ore. FMG's commitment to innovation, particularly in automation and digital technologies, further contributes to its operational effectiveness.

A key element of FMG's operational efficiency is its integrated supply chain. Iron ore is transported from its mines via the company's own railway network to its port facilities at Port Hedland. From there, it is shipped globally. This integrated approach enhances control and optimizes delivery.

FMG's core capabilities translate into customer benefits through reliable supply, competitive pricing, and consistent product quality. This differentiates FMG in a highly competitive global commodity market. For more insights, consider reading about the Marketing Strategy of Fortescue Metals Group.

FMG's operations are unique due to their focus on high-volume, low-cost production. This is achieved through strategic investments in infrastructure and a continuous drive for operational efficiencies. This approach allows FMG to maintain its competitive position in the market.

- Large-Scale Mining: Utilizing open-pit mining methods to extract vast quantities of iron ore.

- Integrated Logistics: Operating its own railway and port facilities for efficient transportation.

- Technological Innovation: Implementing automation and digital technologies to improve efficiency.

- Customer-Focused Approach: Prioritizing reliable supply, competitive pricing, and consistent product quality.

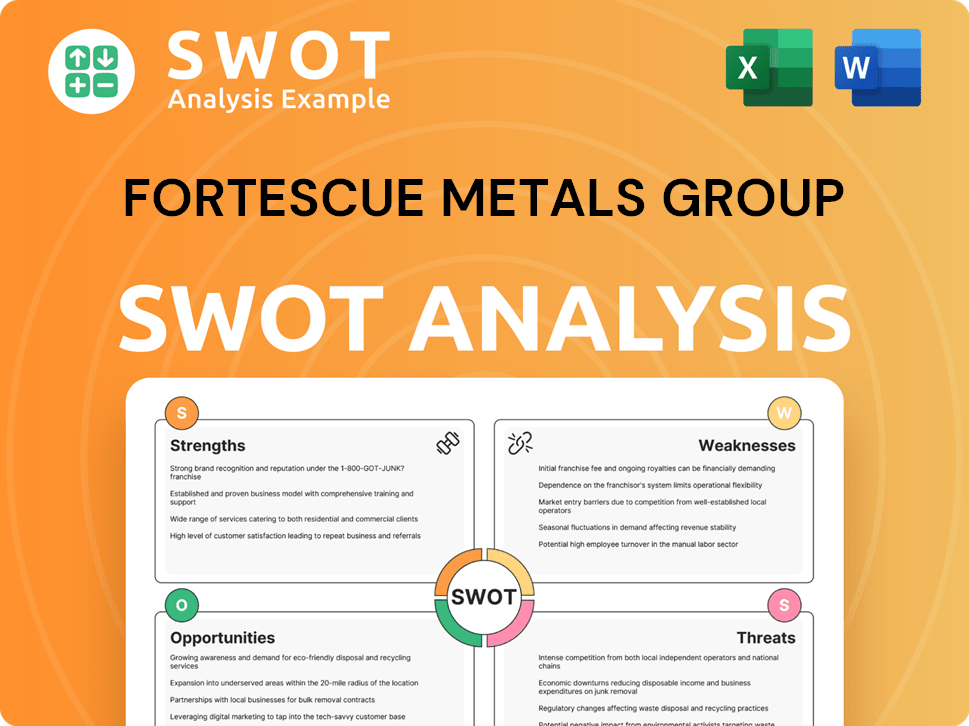

Fortescue Metals Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fortescue Metals Group Make Money?

The primary revenue stream for Fortescue Metals Group (FMG), a leading iron ore mining company, is the sale of iron ore. FMG generates revenue by extracting, processing, and shipping iron ore to global customers, with sales volumes directly influencing its financial results. The company's monetization strategy centers on leveraging its extensive mining operations and integrated logistics to deliver substantial volumes of iron ore to meet global demand, particularly from the steel industry.

In the first half of the 2024 financial year, FMG reported a revenue of approximately US$8.7 billion. This revenue is largely driven by the prevailing iron ore price on international markets and the volume of ore shipped. This demonstrates the critical role of iron ore production and exports in FMG's financial performance. The company's focus on efficient iron ore production and sales is key to its profitability.

FMG is also diversifying its monetization strategies through its Fortescue Energy segment. This segment focuses on developing green energy projects, including green hydrogen and green ammonia. While still in its early stages, Fortescue Energy aims to generate revenue through the sale of these green energy commodities and potentially through technology licensing or partnerships related to its decarbonization efforts. This expansion aligns with global decarbonization trends and opens new avenues for future growth. For more insights, explore the Competitors Landscape of Fortescue Metals Group.

FMG's revenue is primarily driven by its iron ore mining operations. The company’s financial performance is significantly influenced by the volume of iron ore sold and the prevailing market prices. Here's a breakdown:

- Iron Ore Sales: The core revenue source, dependent on production volume and global iron ore prices.

- Fortescue Energy: A growing segment focused on green energy projects, aiming to generate revenue from green hydrogen, green ammonia, and related technologies.

- Market Dynamics: Global demand for iron ore, especially from the steel industry, heavily influences revenue.

- Operational Efficiency: Efficient mining, processing, and shipping of iron ore are crucial for maximizing revenue.

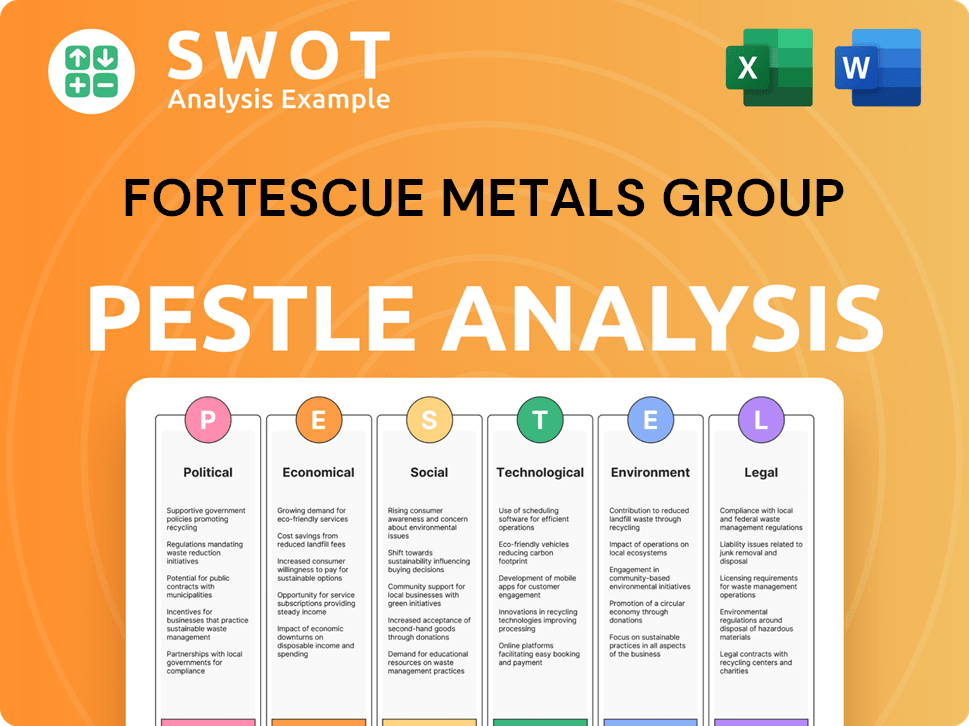

Fortescue Metals Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Fortescue Metals Group’s Business Model?

The journey of Fortescue Metals Group (FMG) has been marked by significant milestones and strategic shifts. A pivotal moment was the rapid development of major mining and infrastructure assets in the Pilbara region. This transformation propelled FMG from a junior explorer to a global iron ore powerhouse in a relatively short time. This involved overcoming substantial financial and logistical hurdles to establish its integrated mine-to-port operations.

FMG has consistently focused on expanding its production capacity, demonstrated by projects like Iron Bridge, which began its first production in 2023. The aim is to deliver 22 million tonnes per annum of high-grade magnetite concentrate. Operational challenges have included navigating fluctuating iron ore prices, managing complex logistics in remote regions, and ensuring regulatory compliance. FMG has responded by emphasizing cost efficiency, technological innovation, and disciplined capital allocation.

FMG's competitive advantages stem from several factors. Its significant economies of scale, enabled by its large-scale mining operations and owned infrastructure, allow for low-cost production. Its strong brand reputation as a reliable supplier of iron ore in the global market further solidifies its position. Furthermore, FMG's strategic pivot towards green energy through Fortescue Energy provides a significant competitive edge, positioning it as a leader in sustainable resource development. This proactive adaptation to new trends and technological shifts, particularly in decarbonization, demonstrates its commitment to long-term sustainability and future growth in a rapidly evolving global economy.

FMG's rapid development of mining and infrastructure in the Pilbara was a key milestone. This transformed the company into a global iron ore producer. The Iron Bridge project, commencing production in 2023, is a significant step in expanding capacity.

FMG's strategic moves include a focus on cost efficiency and technological innovation. The company has also made a significant pivot towards green energy. These moves position the company for long-term sustainability and growth.

FMG's competitive edge comes from its economies of scale and low-cost production. Its strong brand reputation as a reliable iron ore supplier is also a key factor. The company's move into green energy further enhances its competitive position.

FMG achieved a C1 cost of US$17.62 per wet metric tonne in the first half of the 2024 financial year. This demonstrates the company's commitment to cost management. FMG's focus on operational efficiency is a key part of its strategy.

FMG's large-scale mining operations and infrastructure provide significant economies of scale. The company's reputation as a reliable iron ore supplier is crucial. FMG's expansion into green energy positions it well for the future.

- FMG's focus on cost efficiency helps it navigate price fluctuations.

- Technological innovation supports operational improvements.

- The company's move into renewable energy is a strategic advantage.

- Understanding the target market of Fortescue Metals Group is crucial for investors.

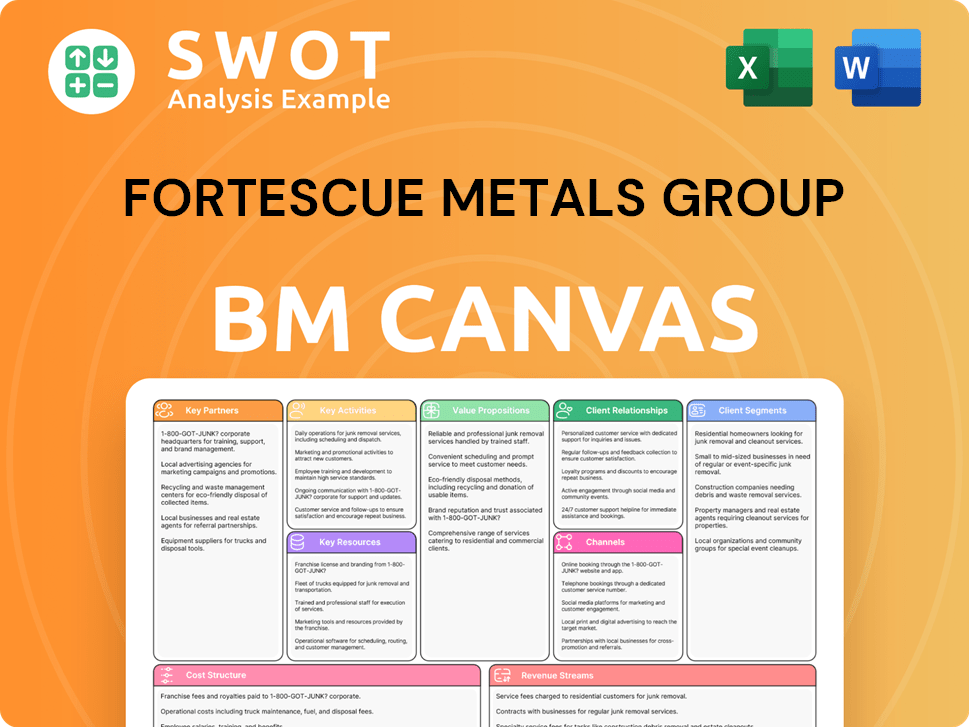

Fortescue Metals Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Fortescue Metals Group Positioning Itself for Continued Success?

As a leading iron ore mining company, Fortescue Metals Group (FMG) holds a significant position in the global market. It is the world's fourth-largest iron ore producer. It competes with major players like Rio Tinto and BHP. FMG distinguishes itself through high-volume, low-cost production methods and its aggressive push into green energy initiatives.

FMG has a substantial market share in the seaborne iron ore market, particularly in Asia. Its iron ore shipments reach numerous countries globally. The company's focus on both iron ore production and renewable energy projects highlights its dual strategy for future growth and sustainability. FMG is an Australian mining company.

Fortescue is a major player in the iron ore production market. It is one of the largest iron ore producers globally. Its extensive operations and global reach solidify its role in the industry. Its focus on cost-effective production and customer relationships supports its strong market standing.

Fluctuations in iron ore prices, influenced by the steel industry and economic conditions, pose a risk. Regulatory changes, especially regarding environmental standards, are also potential challenges. The emergence of new competitors or technological shifts in steelmaking could affect demand.

FMG is focused on optimizing iron ore operations for efficiency and cost reduction. Its strategic initiatives include significant investments in green hydrogen and green ammonia projects. The company aims to become a leading producer of green energy. FMG plans to solidify its position as a key iron ore supplier and a major player in the green energy transition.

FMG is committed to achieving real zero emissions across its iron ore operations by 2030. Leadership emphasizes a dual strategy of maximizing returns from iron ore and aggressively pursuing green energy opportunities. The company is leveraging its financial strength and engineering expertise to capitalize on emerging markets for sustainable commodities.

FMG's sustainability initiatives are a core part of its strategy. It focuses on decarbonizing its operations and investing in renewable energy projects. The company's commitment to green hydrogen and ammonia is a key part of its future plans.

- Real zero emissions target for iron ore operations by 2030.

- Significant investments in green hydrogen and green ammonia.

- Focus on leveraging financial strength and expertise.

- Expansion in sustainable commodities markets.

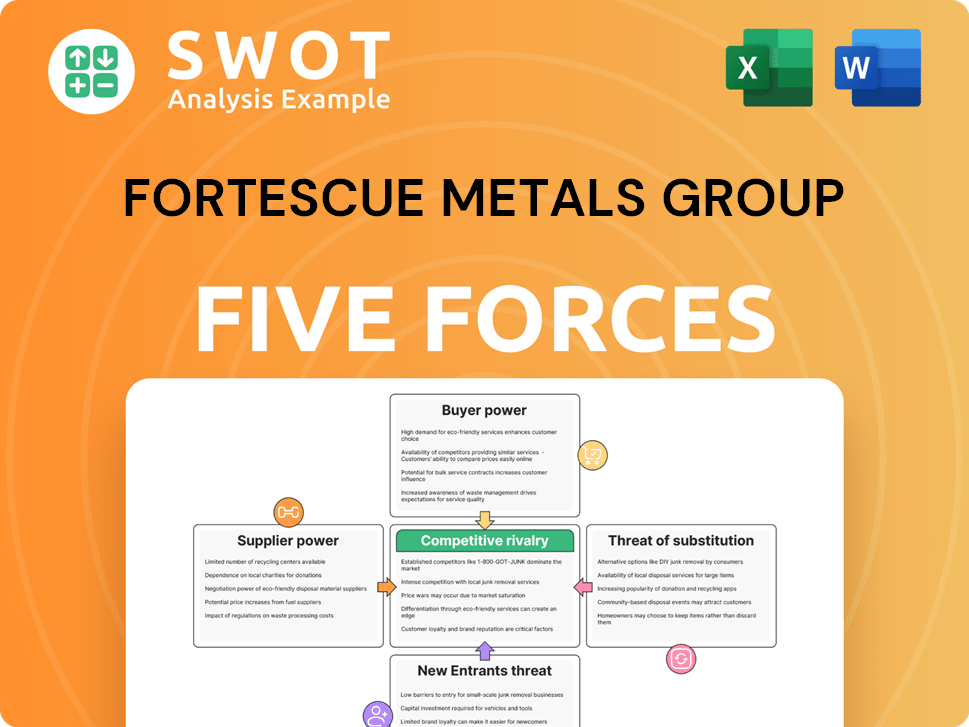

Fortescue Metals Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fortescue Metals Group Company?

- What is Competitive Landscape of Fortescue Metals Group Company?

- What is Growth Strategy and Future Prospects of Fortescue Metals Group Company?

- What is Sales and Marketing Strategy of Fortescue Metals Group Company?

- What is Brief History of Fortescue Metals Group Company?

- Who Owns Fortescue Metals Group Company?

- What is Customer Demographics and Target Market of Fortescue Metals Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.