Fortescue Metals Group Bundle

Can Fortescue Metals Group Maintain Its Ascent?

Fortescue Metals Group (FMG), a powerhouse in the iron ore sector, has consistently redefined growth within the mining industry. Its rapid rise, fueled by strategic market entries and large-scale operations in the Pilbara region, has challenged industry norms and reshaped the global landscape. Founded in 2003, FMG has become the world's fourth-largest iron ore producer, a testament to its effective strategic planning and execution.

Beyond its iron ore core, Fortescue's future hinges on strategic expansion and innovation. This analysis will delve into FMG's Fortescue Metals Group SWOT Analysis, exploring its ambitious plans for future growth, including renewable energy projects and expansion projects, and examining its competitive advantages in the evolving iron ore market. Understanding FMG's growth strategy is crucial for anyone seeking insights into the future prospects of this leading mining company, including its sustainability initiatives and overall financial performance.

How Is Fortescue Metals Group Expanding Its Reach?

Fortescue's growth strategy is expanding beyond its core iron ore business. The company is actively diversifying into green energy through Fortescue Future Industries (FFI). This strategic shift aims to capitalize on the growing demand for sustainable energy solutions and reduce reliance on fossil fuels.

A key component of this expansion involves geographical diversification. FFI is exploring opportunities across North and South America, Europe, Africa, and Australia. This includes potential partnerships and acquisitions to accelerate green hydrogen production and infrastructure development. The company is also investing in new technologies and research to improve the efficiency and cost-effectiveness of green energy production.

This strategic pivot is a significant move for the mining company, positioning it for long-term growth. This approach is detailed in the Marketing Strategy of Fortescue Metals Group.

FFI is developing large-scale green hydrogen and green ammonia projects globally. A proposed facility in Queensland, Australia, is planned to have a capacity of 5.4 GW. Another project in Norway aims for a 300 MW capacity. These initiatives are central to FMG's growth strategy, aiming to establish a leading position in the green energy sector.

FMG is expanding its footprint across multiple continents. This includes exploring projects in North America, South America, Europe, Africa, and Australia. The company is actively seeking partnerships and acquisitions to accelerate its green energy development. This expansion is designed to diversify revenue streams and reduce its dependence on the iron ore market.

The company is investing in new technologies to improve the efficiency and cost-effectiveness of green energy production. Fortescue is targeting final investment decisions (FIDs) on several green energy projects in 2024 and 2025. These investments are crucial for achieving its sustainability goals and driving future growth.

While specific financial details for 2025 are not yet available, the company's focus on green energy initiatives is expected to influence its future financial performance. FMG's market share in the iron ore sector and its ability to secure funding for green energy projects will be critical factors in its growth.

Fortescue's expansion strategy includes significant investments in green hydrogen and ammonia production, alongside geographical diversification. The company is actively pursuing projects globally to reduce its reliance on fossil fuels and capitalize on the growing demand for sustainable energy solutions. This strategy aims to position FMG as a leader in the green energy market.

- Focus on green hydrogen and green ammonia projects.

- Geographical expansion across multiple continents.

- Investment in new technologies and research.

- Targeting final investment decisions on green energy projects in 2024 and 2025.

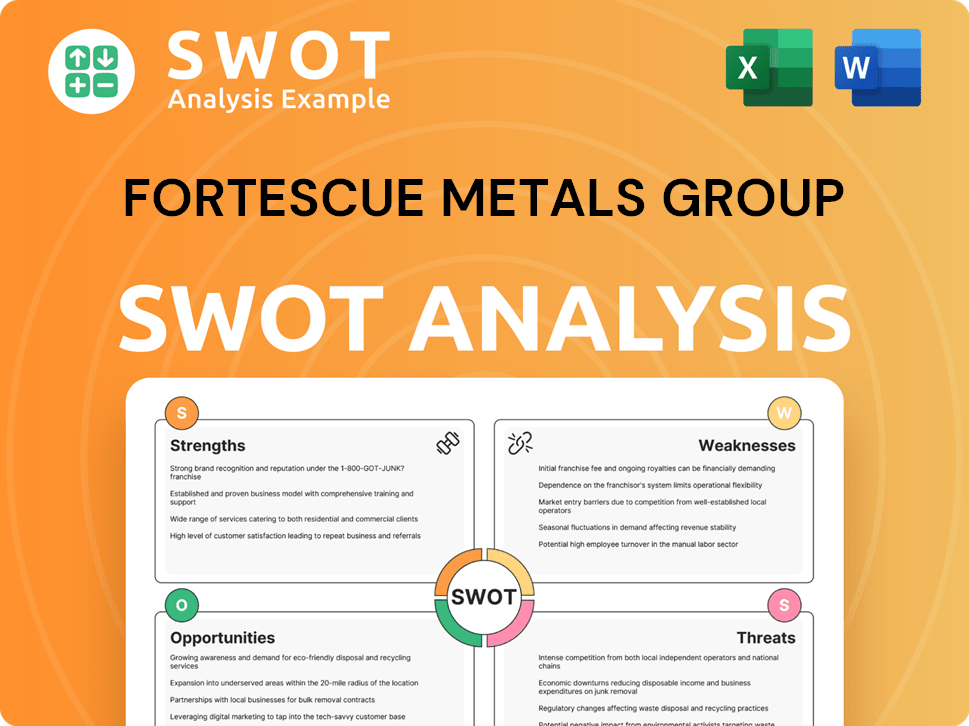

Fortescue Metals Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fortescue Metals Group Invest in Innovation?

Fortescue Metals Group (FMG) actively employs innovation and technology to drive its growth strategy. This approach is particularly evident through its Fortescue Future Industries (FFI) arm, which focuses on decarbonization and green energy initiatives. FMG's commitment to technological advancement is central to its future prospects, enabling new product offerings and capabilities in the green energy sector.

The company's strategy involves significant investments in research and development. These investments are aimed at advancing green hydrogen and green ammonia production technologies. FMG is also developing zero-emission solutions for its mining operations. This includes exploring battery electric and green hydrogen-powered haul trucks and trains to reduce Scope 1 and 2 emissions.

FMG's digital transformation strategy integrates advanced analytics, artificial intelligence, and automation across its operations. This integration enhances efficiency, safety, and productivity. The company is also focused on developing innovative solutions for renewable energy generation and storage to power its green energy projects. These efforts are crucial for maintaining and enhancing its competitive position in the iron ore market and beyond.

FMG invests heavily in the development of green hydrogen and green ammonia production technologies. This includes exploring various production methods and scaling up pilot projects to commercial levels. The goal is to become a major player in the green energy market, offering sustainable alternatives to fossil fuels.

FMG is actively working on transitioning its mining operations to zero-emission solutions. This involves the development and deployment of battery electric and green hydrogen-powered haul trucks and trains. These initiatives aim to significantly reduce the company's carbon footprint and operating costs.

The company is implementing advanced analytics, artificial intelligence, and automation across its operations. This includes using data-driven insights to optimize processes and improve decision-making. Automation is being used to enhance safety, efficiency, and productivity.

FMG is developing renewable energy generation and storage solutions to power its green energy projects. This includes investing in solar, wind, and battery storage technologies. These projects are essential for ensuring the sustainability of its operations.

FMG is investing in projects aimed at producing green iron, which could revolutionize the steelmaking industry by significantly reducing carbon emissions. This innovation is a key part of its strategy to diversify and expand its product offerings.

Through FFI, FMG collaborates with external innovators and research institutions to accelerate the development and deployment of cutting-edge technologies. These partnerships are crucial for accessing expertise and accelerating innovation.

FMG's technological advancements are central to its growth objectives, enabling new product offerings and capabilities in the green energy sector. These advancements are not only improving operational efficiency but also creating new revenue streams.

- Green Hydrogen Production: FMG aims to produce 15 million tonnes of green hydrogen per year by 2030.

- Green Ammonia: The company is developing green ammonia production facilities to support its decarbonization efforts.

- Zero-Emission Mining Fleet: FMG is investing in electric and hydrogen-powered haul trucks and trains.

- Digital Integration: Advanced analytics and AI are being used to optimize operations and improve decision-making.

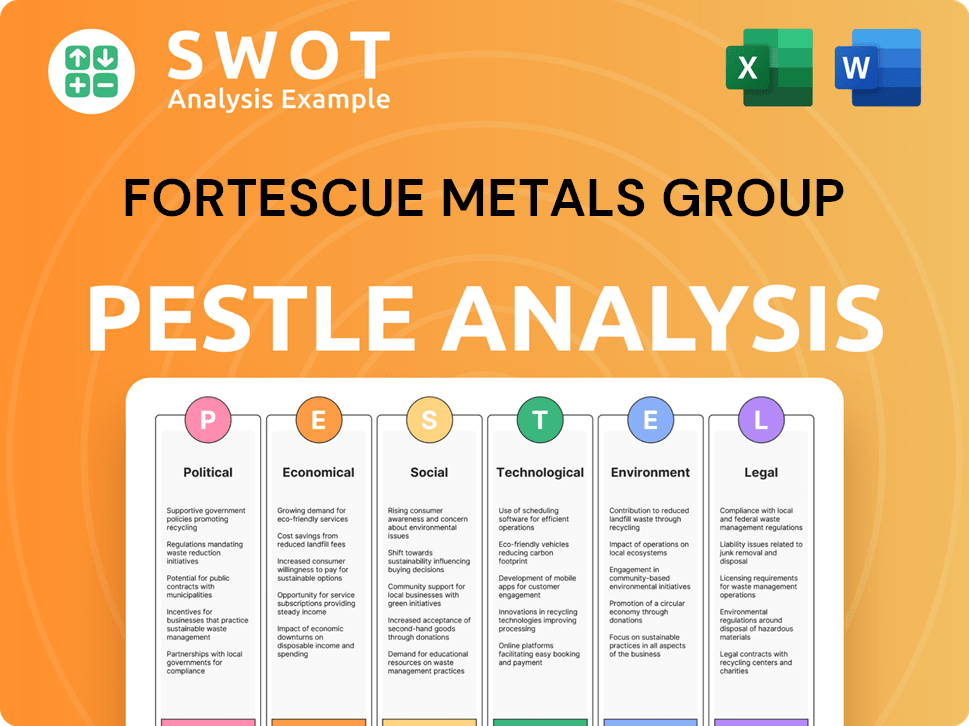

Fortescue Metals Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fortescue Metals Group’s Growth Forecast?

The financial outlook for Fortescue Metals Group (FMG) is shaped by its dual strategy of maintaining a strong iron ore business while investing heavily in green energy through Fortescue Future Industries (FFI). For the first half of the 2024 financial year, the company demonstrated robust financial performance.

FMG reported a net profit after tax of US$2.6 billion, which is a 41% increase compared to the prior corresponding period. This growth was primarily driven by higher iron ore prices and increased shipments. The company's commitment to its iron ore operations is evident through its maintained guidance for iron ore shipments for the full financial year 2024, projected to be between 192 to 197 million tonnes.

The company's financial strategy balances the profitability of its iron ore operations with the substantial capital requirements of its green energy initiatives. This approach is crucial for sustainable growth and diversification. This strategy is designed to ensure long-term value creation for shareholders while contributing to the global transition towards green energy. For a deeper understanding of the company's ownership structure, you can explore Owners & Shareholders of Fortescue Metals Group.

FMG's iron ore business continues to be a significant revenue driver. The company's consistent production and sales volumes contribute substantially to its financial stability. The company's ability to maintain its production guidance reflects its operational efficiency and market position.

FMG's financial outlook includes substantial investments in FFI, with capital expenditure for FFI projected to be between US$400 million and US$500 million in FY24. These investments are crucial for advancing green energy projects and achieving long-term sustainability goals.

FMG aims to maintain a strong balance sheet and continue returning capital to shareholders through dividends. This approach demonstrates the company's commitment to creating shareholder value and financial prudence. The dividend policy is a key component of its financial strategy.

The company has long-term goals to produce millions of tonnes of green hydrogen annually. This transition is central to FMG's growth strategy, aiming to become a leading global green energy company. This diversification is key to future prospects.

FMG's financial performance is closely tied to iron ore prices and production volumes. The company's ability to manage costs and maintain production levels is crucial for its financial outlook. Key financial metrics include revenue, net profit, capital expenditure, and dividend payments.

- Iron ore shipments guidance for FY24: 192 to 197 million tonnes.

- FFI capital expenditure for FY24: US$400 million to US$500 million.

- Net profit after tax (1H FY24): US$2.6 billion.

- Focus on sustainable growth and diversification.

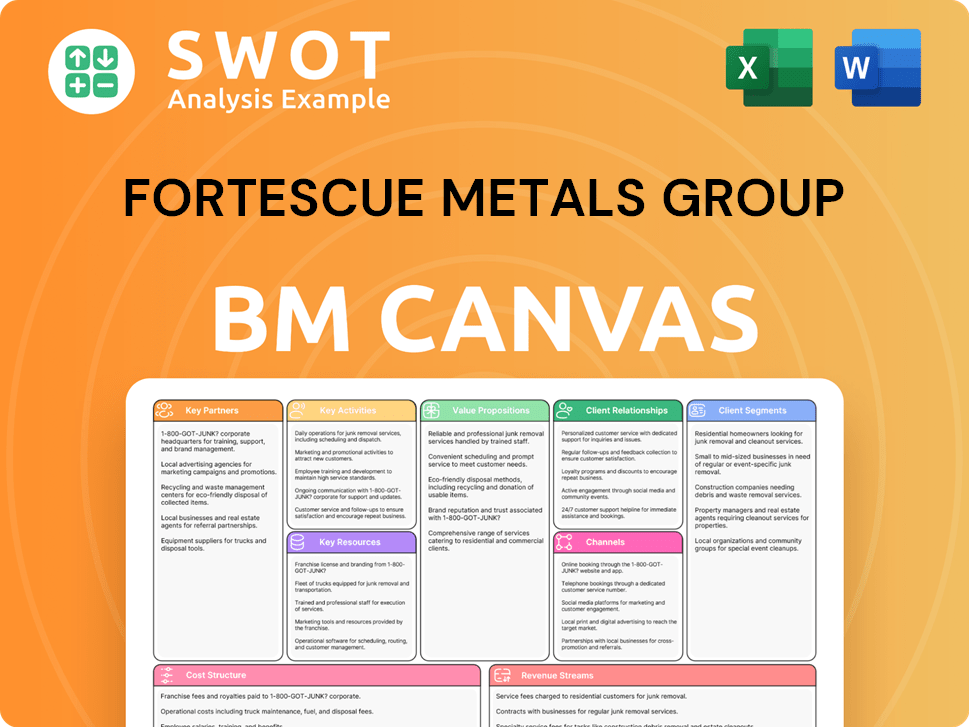

Fortescue Metals Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fortescue Metals Group’s Growth?

The growth strategy of Fortescue Metals Group (FMG), especially its pivot towards green energy, faces several potential risks and obstacles. The company's ambitious plans require careful navigation of market dynamics, technological advancements, and regulatory landscapes. Understanding these challenges is crucial for assessing FMG's future prospects and investment potential.

Market competition in the green hydrogen and ammonia sectors is intensifying, which could impact project profitability. Changes in regulations related to renewable energy and carbon emissions also pose potential risks. Supply chain vulnerabilities, especially for critical minerals and specialized equipment, could lead to delays and increased costs for FMG.

Technological disruption and the volatility of commodity prices, particularly iron ore, are additional factors that could affect FMG's financial capacity. The company's transition from a mining company to a diversified green energy producer also presents internal challenges, such as managing cultural shifts and skill development.

The green hydrogen and green ammonia markets are becoming increasingly competitive. Many companies are vying for market share and technological leadership, which could squeeze profit margins. This competition requires FMG to innovate and maintain a competitive edge.

Changes in regulations and policy frameworks for renewable energy and carbon emissions could significantly impact FMG's projects. These changes might affect project feasibility and profitability. The company needs to stay adaptable and compliant with evolving environmental standards.

Supply chain disruptions, especially for critical minerals and specialized equipment, can cause project delays and cost escalations. Securing reliable sources and managing supply chain risks are crucial for FMG's green energy initiatives. The company must diversify its supply chain to mitigate these risks.

The green energy landscape is evolving rapidly, with new technological breakthroughs potentially rendering existing technologies obsolete. FMG must stay at the forefront of innovation to remain competitive. Investing in research and development is essential to mitigate this risk.

The volatility of commodity prices, especially iron ore, can impact FMG's financial capacity to fund green energy investments. The company needs to manage its financial health and potentially hedge against price fluctuations. FMG's reliance on iron ore makes it vulnerable to market cycles.

Managing the cultural shift and skill development required for the transition from a mining company to a diversified green energy producer poses a challenge. FMG needs to invest in training and development to ensure its workforce is equipped with the necessary skills. Adapting to new business models is also crucial.

FMG addresses these risks through diversification of its project portfolio, robust risk management frameworks, and strategic partnerships. The company has a history of navigating challenges, such as fluctuations in iron ore demand and price, by optimizing operations and maintaining cost discipline. The company's proactive approach is vital for sustainable growth. FMG's ability to adapt and innovate will be key to its success.

In recent financial reports, FMG has demonstrated strong performance, but its future is tied to the successful execution of its green energy projects. The company's investment in green hydrogen and ammonia is significant. The company's stock performance and future investment plans are closely watched by investors. For more details, you can read about the Brief History of Fortescue Metals Group.

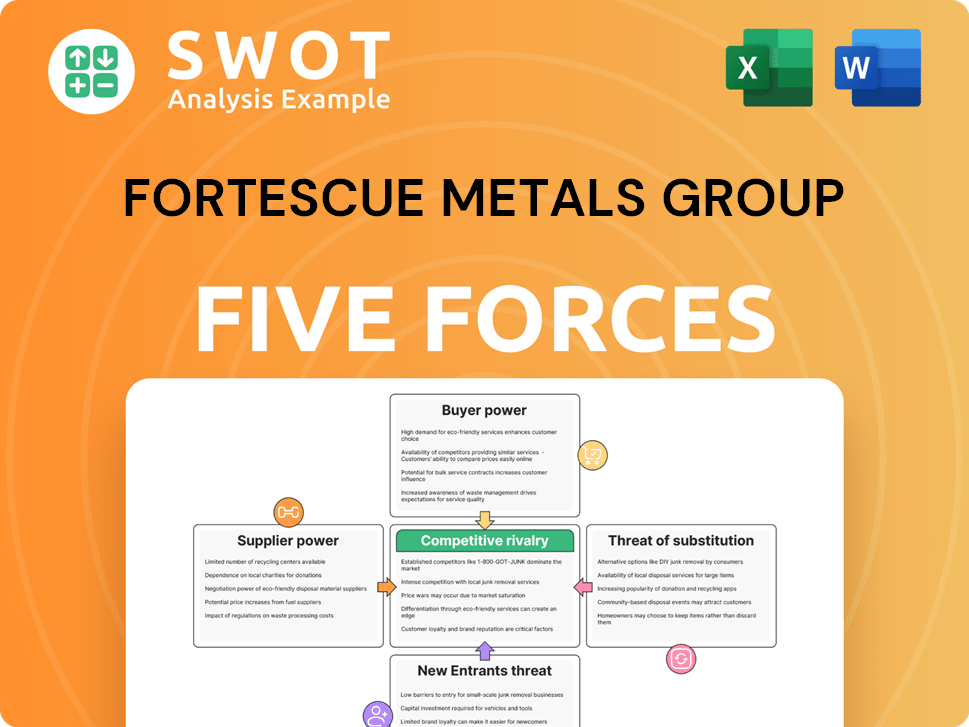

Fortescue Metals Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fortescue Metals Group Company?

- What is Competitive Landscape of Fortescue Metals Group Company?

- How Does Fortescue Metals Group Company Work?

- What is Sales and Marketing Strategy of Fortescue Metals Group Company?

- What is Brief History of Fortescue Metals Group Company?

- Who Owns Fortescue Metals Group Company?

- What is Customer Demographics and Target Market of Fortescue Metals Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.