Gildan Activewear Bundle

How Does Gildan Activewear Navigate the Cutthroat Apparel Industry?

The apparel industry is a battlefield, especially in the activewear and blank apparel segments, where competition is fierce and consumer tastes constantly shift. Gildan Activewear SWOT Analysis reveals how this company has not only survived but thrived. Understanding the competitive landscape is crucial for investors, analysts, and anyone interested in the future of this apparel giant.

This deep dive into Gildan Activewear's competitive landscape explores its market position and the strategies that have allowed it to gain market share. We'll examine Gildan's key competitors, its unique advantages, and the broader industry trends shaping its future, providing valuable insights for anyone looking to understand the dynamics of the apparel industry and Gildan's financial performance. This Gildan market analysis will help you understand who are Gildan's main competitors.

Where Does Gildan Activewear’ Stand in the Current Market?

Gildan Activewear holds a strong market position, particularly in the wholesale blank apparel sector. The company is a major global manufacturer of activewear and socks. Its primary offerings include t-shirts, sport shirts, and fleece, primarily sold in bulk to distributors and screen printers.

Gildan's value proposition centers on providing high-quality, cost-effective apparel through a vertically integrated supply chain. This allows for significant control over production costs and quality, which is a key element of its competitive pricing strategy. The company also has a presence in the retail market with brands like American Apparel and Comfort Colors.

The Brief History of Gildan Activewear highlights its evolution and market strategies. Gildan's financial health reflects its scale and operational efficiencies, with strong cash flow generation and consistent profitability. Its extensive distribution network is a significant advantage in the North American wholesale market.

While specific market share figures for 2024-2025 are subject to market dynamics, Gildan has historically maintained a dominant share in the North American blank apparel market. The company's strong position is evident in its extensive distribution network and product availability.

Gildan has a widespread global presence, with strongholds in North America, Europe, and Asia. Its vertically integrated supply chain supports its global reach. This allows for efficient manufacturing and distribution across various regions.

Gildan has strategically diversified its product offerings beyond basic t-shirts to include a broader range of activewear and lifestyle apparel, as well as socks. This diversification helps capture a wider customer base. This includes promotional product distributors, mass merchandisers, and individual consumers.

Gildan's financial performance is generally strong, reflecting its scale and operational efficiencies. Analysts often note its strong cash flow generation and consistent profitability within its niche. The company's financial health underscores its ability to maintain a competitive edge.

Gildan's competitive advantages include its vertically integrated supply chain, which allows for cost control and quality management. Its strong distribution network and product availability provide a significant advantage in the North American wholesale market. The company's brand recognition and diversified product offerings also contribute to its market position.

- Vertically Integrated Supply Chain

- Extensive Distribution Network

- Strong Brand Recognition

- Diversified Product Portfolio

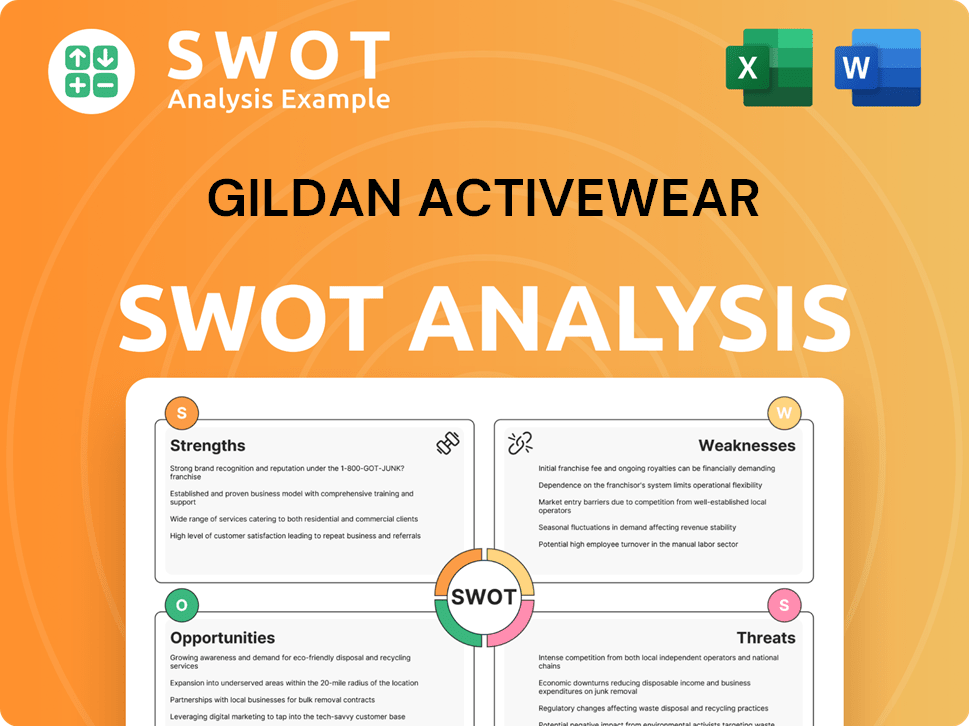

Gildan Activewear SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Gildan Activewear?

The Gildan Activewear operates within a highly competitive environment, facing both direct and indirect challenges. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This analysis examines Gildan's market analysis, focusing on key competitors and industry dynamics.

Gildan Activewear competes in the apparel industry, primarily in the wholesale blank apparel segment. This segment is characterized by intense competition, with companies vying for market share based on price, product quality, and distribution capabilities. The company also faces competition in the retail segment, where it sells branded apparel.

In the wholesale blank apparel segment, HanesBrands Inc. is a significant direct competitor. HanesBrands, through its Hanes and Champion brands, offers a similar range of products, including activewear, underwear, and socks. HanesBrands also operates a vertically integrated supply chain, which allows it to compete effectively on cost and efficiency. HanesBrands' total revenue for 2023 was approximately $6.0 billion, demonstrating its significant market presence.

Fruit of the Loom, a Berkshire Hathaway company, is another key direct competitor. It has a long-standing presence in the blank apparel and underwear markets. Fruit of the Loom is known for its extensive product lines and strong brand recognition, appealing to a broad consumer base. In 2023, Fruit of the Loom generated approximately $2.3 billion in revenue.

Gildan also faces competition from numerous smaller, regional manufacturers and private label brands. These competitors often cater to specific market niches or offer more specialized products. These entities can be more agile and responsive to changing consumer preferences, posing a competitive challenge.

In the retail segment, Gildan competes with a broader array of apparel companies, including athletic wear giants like Nike and Adidas. These companies have substantial brand recognition and marketing budgets, allowing them to capture significant market share. Nike's revenue in fiscal year 2024 was $51.2 billion, while Adidas reported €21.4 billion in sales for the same year.

Fast fashion retailers and other lifestyle apparel brands also pose a competitive threat. These companies often offer trendy products at competitive prices, appealing to a broad consumer base. The fast fashion market is highly dynamic, with trends changing rapidly.

The rise of e-commerce and DTC brands introduces new indirect competitors. These brands can bypass traditional wholesale channels and reach consumers directly. This allows them to offer custom or niche apparel offerings. The DTC model has disrupted traditional retail, increasing competition.

The ongoing emergence of sustainable and ethically produced apparel brands presents a competitive challenge. Consumers increasingly prioritize these attributes. This trend is driving companies to adopt more sustainable practices. The sustainable apparel market is experiencing rapid growth.

Mergers and acquisitions have reshaped the competitive landscape. For example, Gildan's acquisition of American Apparel expanded its product portfolio. Understanding Gildan's competitive advantages and how it compares to its rivals is crucial. For more insights, explore the Marketing Strategy of Gildan Activewear.

Several factors influence the competitive dynamics in the apparel industry. These include pricing strategy, product quality, distribution network, brand recognition, and sustainability initiatives. Gildan's market position analysis indicates a strong focus on cost efficiency and large-scale production.

- Pricing Strategy: Competitive pricing is essential in the wholesale market.

- Product Quality: Maintaining consistent product quality is crucial for customer satisfaction.

- Distribution Network: An efficient distribution network ensures products reach customers.

- Brand Recognition: Strong brand recognition helps in attracting and retaining customers.

- Sustainability Initiatives: Consumers increasingly value sustainable practices.

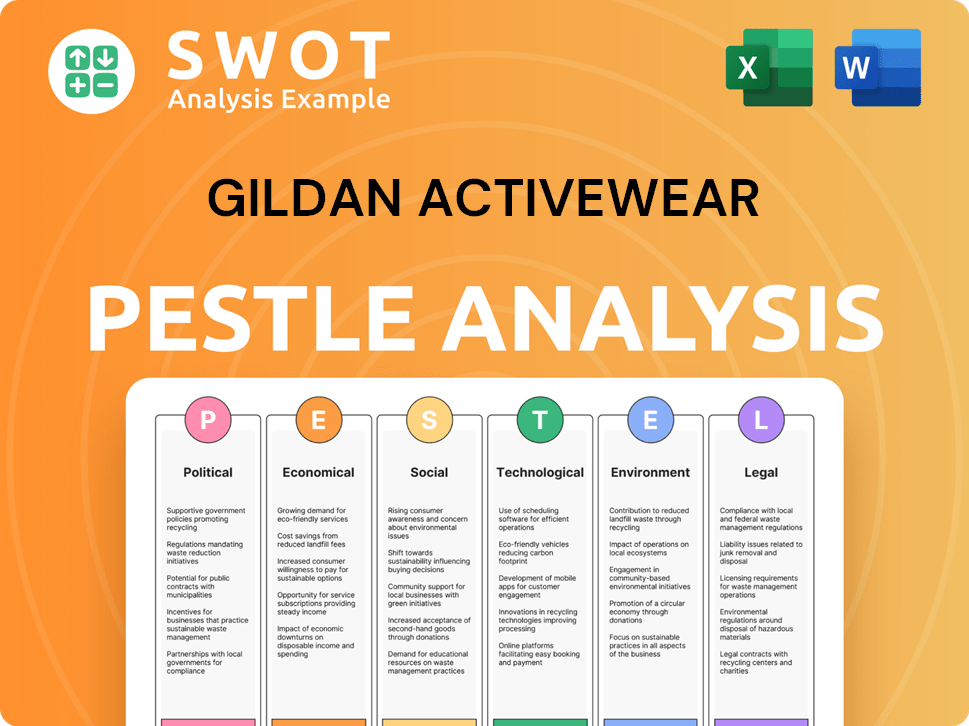

Gildan Activewear PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Gildan Activewear a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Gildan Activewear is crucial for investors and industry analysts alike. The company, a major player in the apparel industry, has carved out a significant market share through strategic advantages. This analysis delves into Gildan's core strengths, market position, and how it stacks up against its rivals.

Gildan's success is underpinned by its vertically integrated manufacturing model, which provides a significant competitive edge. This integrated approach, from yarn spinning to distribution, allows for stringent cost control and operational efficiency. This is a key factor in the company's ability to offer competitive pricing in the wholesale apparel market, a critical element in its Gildan market analysis.

Gildan benefits from substantial economies of scale, enabling it to optimize production and reduce per-unit costs. This scale supports a robust distribution network, ensuring widespread availability of its products. This operational efficiency, combined with a strong brand reputation, positions Gildan favorably within the competitive landscape.

Gildan has consistently expanded its production capacity and product offerings. Key acquisitions and strategic investments have broadened its market reach. The company's focus on sustainability initiatives has also become a significant part of its strategy.

Gildan has invested in automation and supply chain optimization. Expansion into new product categories and geographic markets has been a priority. The company continues to adapt to changing consumer demands, particularly in the areas of sustainable practices.

Gildan's vertically integrated model provides cost advantages and supply chain control. Its brand equity and wide product range foster customer loyalty. The company's ability to scale production efficiently is a key differentiator in the apparel industry.

Gildan holds a significant portion of the blank apparel market. Its strong distribution network ensures broad product availability. The company's focus on value and quality has solidified its position among screen printers and distributors.

Gildan's competitive advantages are multifaceted, stemming from its operational efficiency and strategic market positioning. The company's vertical integration and economies of scale allow it to maintain cost leadership. Its brand equity, particularly in the blank apparel market, promotes strong customer loyalty.

- Vertical Integration: Enables cost control and efficient production processes.

- Economies of Scale: Allows for lower per-unit costs and optimized production.

- Brand Equity: Fosters strong customer loyalty among distributors.

- Product Range: Offers a wide variety of styles, colors, and sizes.

Gildan Activewear Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Gildan Activewear’s Competitive Landscape?

The Gildan Activewear competitive landscape is significantly shaped by industry trends, including technological advancements, shifting consumer preferences, and regulatory changes. The apparel industry faces challenges from intense price competition and the need to manage complex global supply chains. Gildan market analysis reveals that the company's ability to adapt to these trends will be crucial for its future success.

Gildan Activewear's financial performance is influenced by global economic shifts, including inflation and currency fluctuations, which can impact consumer spending and raw material costs. Opportunities for growth include expansion in emerging markets, product innovation, and leveraging digital channels. Strategic partnerships and acquisitions are also potential avenues for market expansion or diversification. Understanding the Gildan Activewear competitive advantages is key to navigating this dynamic environment.

Technological advancements in automation and digital printing are transforming manufacturing processes. Shifting consumer preferences towards sustainable and ethically produced apparel are driving changes in the industry. Regulatory changes regarding labor practices and environmental standards also play a role.

Intense price competition in the blank apparel market remains a significant challenge. The potential for new entrants with disruptive business models poses a threat. Managing a complex global supply chain amidst geopolitical uncertainties is also a key challenge. Understanding Gildan's competitors is crucial.

Expanding presence in emerging markets presents a significant growth opportunity. Investing in product innovation to meet evolving consumer tastes is essential. Leveraging digital channels for both wholesale and direct-to-consumer sales can drive growth. Strategic partnerships and acquisitions may provide avenues for market expansion.

Adapting to industry trends, balancing cost efficiency with sustainability demands, and innovating products and operational strategies are key. Gildan Activewear's ability to navigate these factors will determine its competitive position. Analyzing the Gildan Activewear market position analysis is important.

Gildan's success hinges on several key factors. These include its ability to respond to changing consumer demands, manage its supply chain effectively, and maintain a strong focus on sustainability. The company's market share Gildan is influenced by these factors.

- Prioritizing sustainable materials and responsible manufacturing.

- Investing in digital channels for enhanced sales.

- Exploring strategic partnerships and acquisitions.

- Maintaining a competitive pricing strategy.

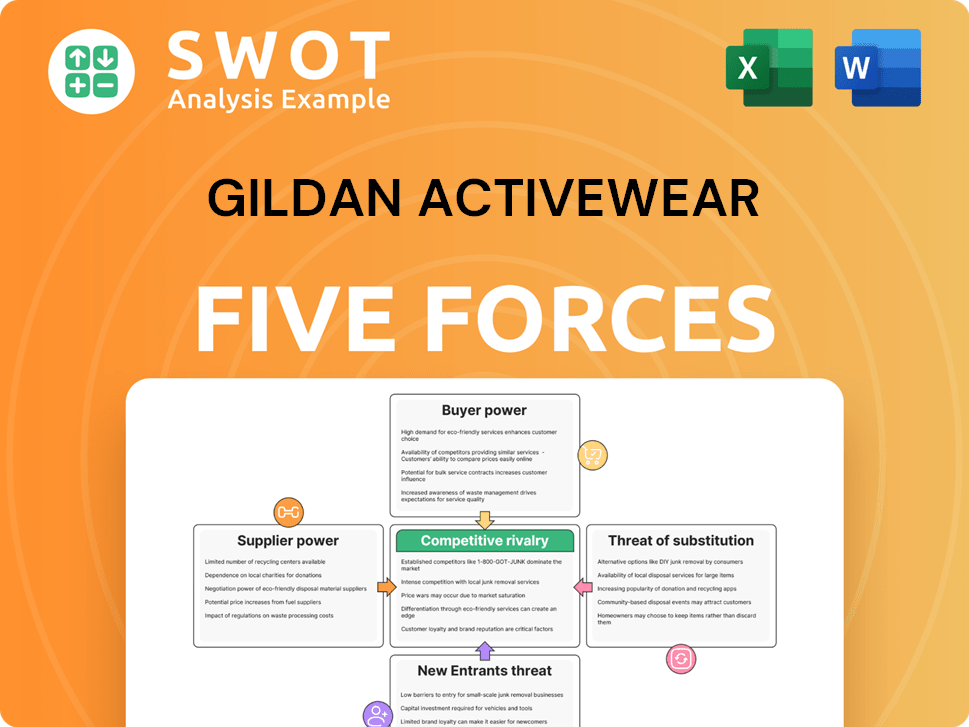

Gildan Activewear Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gildan Activewear Company?

- What is Growth Strategy and Future Prospects of Gildan Activewear Company?

- How Does Gildan Activewear Company Work?

- What is Sales and Marketing Strategy of Gildan Activewear Company?

- What is Brief History of Gildan Activewear Company?

- Who Owns Gildan Activewear Company?

- What is Customer Demographics and Target Market of Gildan Activewear Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.