Gildan Activewear Bundle

How Does Gildan Activewear Dominate the Apparel Market?

Ever wondered how a simple t-shirt can become a global phenomenon? Gildan Activewear, a powerhouse in the apparel industry, has mastered the art of activewear production and distribution. From blank apparel for wholesale to branded lines, Gildan's influence is undeniable. Discover the secrets behind Gildan's success and its impact on the clothing brand landscape.

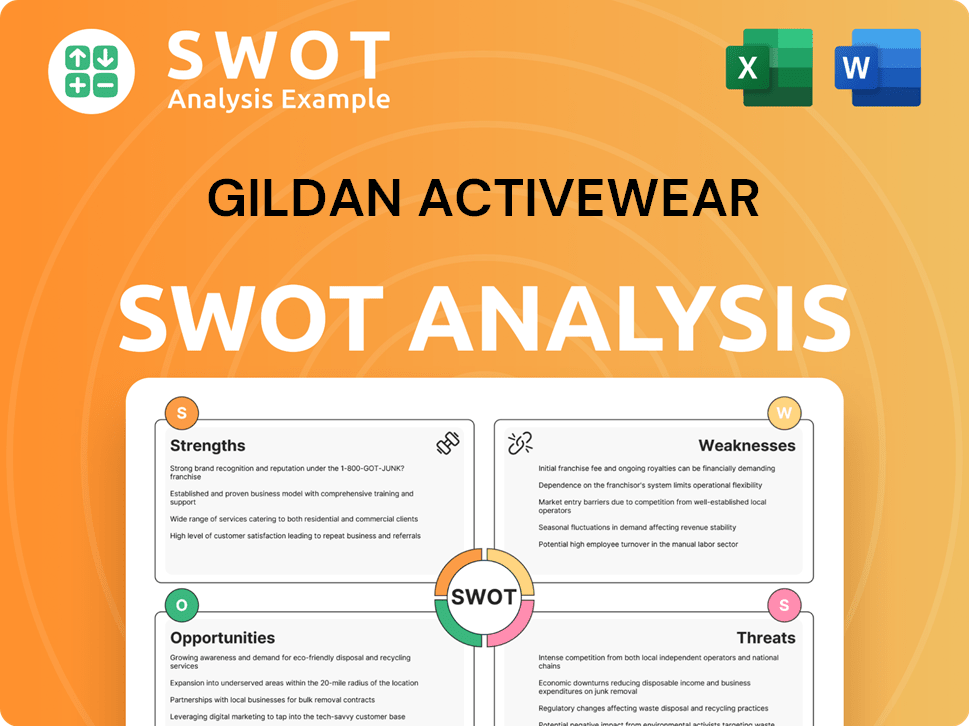

Gildan Activewear's vertically integrated model, a key aspect of its strategy, allows for unparalleled control over its activewear supply chain. This approach, combined with its focus on cost-effectiveness, has positioned the Gildan company as a leader in the manufacturing of everyday apparel. To further understand Gildan's strategic advantages, consider exploring the Gildan Activewear SWOT Analysis, which offers valuable insights into its strengths, weaknesses, opportunities, and threats within the competitive apparel industry.

What Are the Key Operations Driving Gildan Activewear’s Success?

The operational model of Gildan Activewear is centered around a highly efficient, vertically integrated manufacturing approach. This strategy is a core component of how the Gildan company creates and delivers value. Their primary products include blank activewear items like t-shirts and fleece, which are mostly sold to wholesale distributors and screen printers.

Gildan manufacturing processes span the complete production cycle. This includes spinning cotton yarns, knitting, dyeing, finishing, and cutting fabric, and ultimately, sewing garments. This extensive vertical integration, which includes owned manufacturing facilities in Central America, the Caribbean, and Bangladesh, gives the company significant control over product quality, cost, and lead times. The company's supply chain is meticulously managed, emphasizing efficiency and sustainability.

Gildan also serves the retail market with its branded apparel, catering to a broad customer base that values comfort, durability, and affordability. Their distribution networks are robust, using strategically located distribution centers to serve its global customer base effectively. This operational effectiveness translates into customer benefits such as consistent product availability, competitive pricing, and reliable quality, solidifying Gildan's market differentiation. Learn more about how the company approaches its Marketing Strategy of Gildan Activewear.

Gildan focuses on blank activewear like t-shirts, sport shirts, and fleece. These products are primarily sold to wholesale distributors, screen printers, and embellishers. The company also offers branded apparel for the retail market.

The manufacturing process is fully integrated, starting with cotton yarn spinning. This is followed by knitting, dyeing, finishing, and cutting fabric, and finally, sewing garments. This vertical integration allows for control over quality and cost.

Gildan has a meticulously managed supply chain that emphasizes efficiency and sustainability. Their distribution networks are robust, utilizing strategically located distribution centers to serve a global customer base. This ensures consistent product availability.

Gildan's operational effectiveness results in competitive pricing and reliable quality. This solidifies its market differentiation, distinguishing it from competitors who may rely more on outsourced production. This allows for a rapid response to market demands.

Gildan's unique operational model provides several advantages, including economies of scale and rapid response to market demands. This vertical integration allows for greater control over the entire production process, from raw materials to finished products.

- Vertical Integration: Owning and operating manufacturing facilities.

- Cost Control: Efficient processes lead to competitive pricing.

- Quality Assurance: Control over every stage of production.

- Supply Chain Management: Optimized for efficiency and sustainability.

Gildan Activewear SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gildan Activewear Make Money?

The primary revenue streams for Gildan Activewear stem from the sale of activewear and hosiery products. The Gildan company focuses on wholesale sales of blank activewear to a wide network of distributors and screen printers. Direct-to-consumer sales through various retail channels also contribute to its revenue.

Gildan manufacturing relies heavily on volume sales and cost efficiency, leveraging its vertically integrated model. Product diversification within its activewear lines and expanding retail presence are key strategies. The company's focus is on high-volume sales of core apparel products through both wholesale and retail channels.

In fiscal year 2023, Gildan reported net sales of approximately $3.20 billion. The activewear segment accounted for roughly 85% of net sales, with the hosiery and underwear segment contributing the remaining 15%. This demonstrates the importance of the activewear segment to the company's overall financial performance.

Gildan Activewear generates revenue mainly through wholesale sales of blank activewear, including t-shirts, sport shirts, and fleece, to a vast network of distributors and screen printers. This segment is a significant portion of its overall revenue. The company also utilizes direct-to-consumer sales of its branded apparel via various retail channels.

- Wholesale Sales: The majority of revenue comes from wholesale channels, supplying blank apparel to distributors and screen printers. This is a core aspect of Gildan's business model.

- Direct-to-Consumer Sales: Gildan also monetizes its products through direct sales via retail channels, expanding its market reach.

- Volume and Cost Efficiency: The company's monetization strategies are largely based on volume sales and cost efficiency, leveraging its vertically integrated model.

- Product Diversification: Strategies include product diversification within its activewear lines.

- Retail Expansion: Expanding its retail presence to capture additional market share is another key strategy.

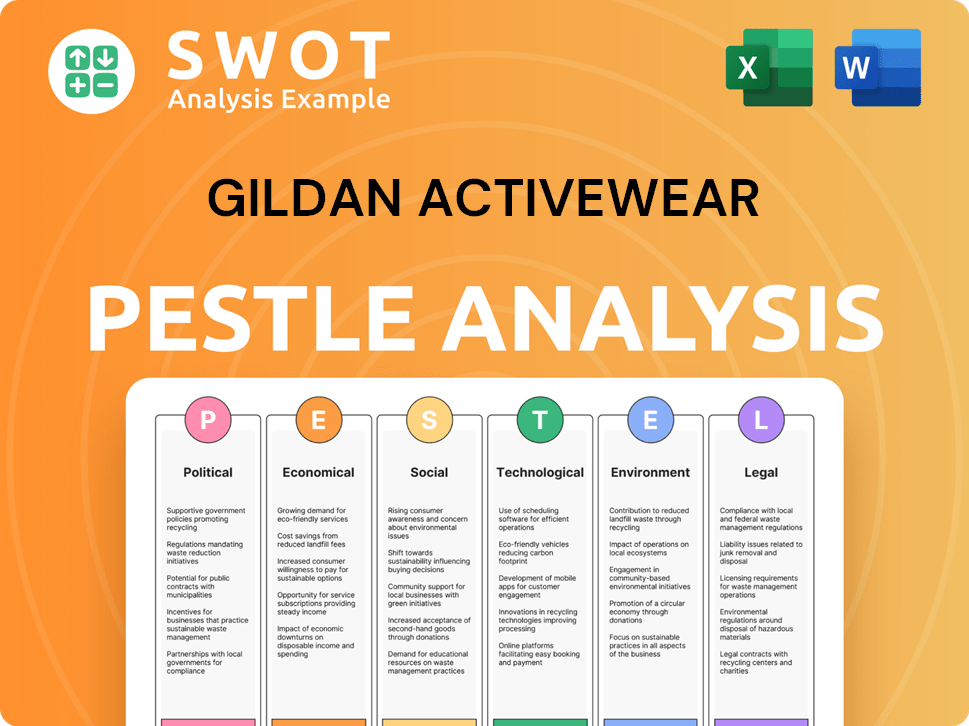

Gildan Activewear PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Gildan Activewear’s Business Model?

The journey of Gildan Activewear has been marked by strategic moves and significant milestones that have shaped its current operational and financial standing. A key strategic move has been the continuous expansion and optimization of its vertically integrated Gildan manufacturing facilities, especially in Central America and the Caribbean. This strategy has allowed for unparalleled cost control and efficiency. This integration has been a key differentiator, enabling Gildan to navigate challenges such as fluctuating raw material costs and supply chain disruptions more effectively than competitors.

The company's competitive advantages are rooted in several key areas. Its economies of scale, stemming from massive production volumes, allow for highly competitive pricing. The strong brand recognition within the blank apparel market, particularly for its Gildan brand, provides a significant moat. Furthermore, its extensive distribution network and long-standing relationships with wholesale distributors solidify its market position. Gildan consistently adapts to new trends by investing in sustainable practices and product innovation, such as developing more eco-friendly fabrics and processes, to meet evolving consumer preferences and regulatory demands.

The company also continues to explore strategic acquisitions to enhance its product portfolio and market reach, demonstrating its commitment to sustained growth and adaptability in a dynamic apparel industry. For instance, during recent global supply chain upheavals, Gildan's owned manufacturing provided a significant advantage in maintaining production and delivery schedules. For more information on the company's ownership structure and financial performance, you can refer to Owners & Shareholders of Gildan Activewear.

Significant milestones include the expansion of manufacturing facilities and strategic acquisitions to enhance market presence. These moves have helped the company to increase its production capacity and diversify its product offerings. The company has also focused on sustainable practices and product innovation to meet evolving consumer preferences and regulatory demands.

A key strategic move has been the continuous expansion and optimization of its vertically integrated manufacturing facilities. This has allowed for unparalleled cost control and efficiency, providing a significant advantage in maintaining production and delivery schedules. The company continues to explore strategic acquisitions to enhance its product portfolio and market reach.

The company's competitive advantages are rooted in economies of scale and strong brand recognition. Its extensive distribution network and long-standing relationships with wholesale distributors solidify its market position. The company's focus on sustainable practices and product innovation also contributes to its competitive edge.

In recent financial reports, the company has demonstrated consistent revenue growth. For example, in 2024, Gildan reported revenues of approximately $3.2 billion. The company's strategic moves have allowed it to maintain profitability despite challenges in the apparel industry. The company's strong financial performance is supported by its efficient activewear production processes and effective cost management.

Gildan's competitive advantages include economies of scale, strong brand recognition, and a vertically integrated supply chain. This integration allows for greater control over the Gildan activewear supply chain and cost management, especially when compared to competitors. The company's focus on sustainability and product innovation also enhances its competitive position in the apparel industry.

- Economies of Scale: Massive production volumes allow for competitive pricing.

- Strong Brand Recognition: Particularly within the blank apparel market.

- Vertically Integrated Manufacturing: Provides cost control and supply chain resilience.

- Extensive Distribution Network: Solidifies market position.

Gildan Activewear Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Gildan Activewear Positioning Itself for Continued Success?

The Gildan Activewear company holds a leading position in the global activewear and hosiery market, particularly within the blank apparel segment. Its integrated operations, extensive scale, and established distribution networks contribute to a significant market share and strong customer loyalty. With a global presence, it operates and sells across North America, Europe, Asia, and Latin America, making it a key player in the apparel industry.

Despite its strong market position, Gildan faces several challenges. These include fluctuating raw material costs, intense competition, and evolving consumer preferences. Furthermore, regulatory changes and the need for sustainable practices require ongoing adaptation and investment, impacting the Gildan manufacturing process.

Gildan is a leading supplier of activewear and hosiery. It excels in the blank apparel sector, supplying wholesale distributors and screen printers. The company's global reach and integrated operations contribute to its strong market share.

Key risks include fluctuating raw material costs, especially cotton. Intense competition from established and emerging apparel manufacturers poses a challenge. Changes in labor practices and environmental standards also impact operations.

Gildan is focused on optimizing its supply chain and expanding its product offerings. The company is also enhancing its direct-to-consumer presence. Sustainability efforts are crucial for brand reputation and appealing to eco-conscious consumers.

In 2024, Gildan reported net sales of approximately $3.2 billion. They are focused on operational excellence and disciplined capital allocation. The company aims to sustain and expand its profitability in the coming years.

Gildan's strategic focus includes supply chain optimization and product expansion. Sustainability is a core element of its operations, which is important to appeal to consumers. The company actively works to improve its ethical practices and environmental impact.

- Emphasis on sustainable materials and manufacturing processes.

- Expanding direct-to-consumer channels to reach a broader audience.

- Continuous improvement in labor practices and ethical sourcing.

- Investment in technology and innovation to enhance efficiency.

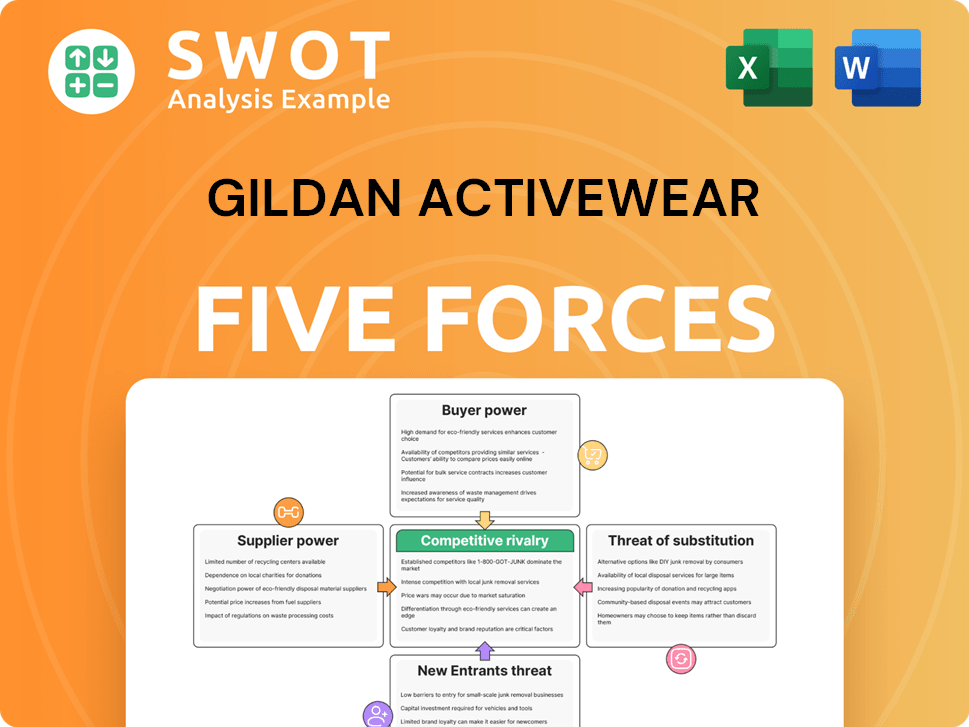

Gildan Activewear Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gildan Activewear Company?

- What is Competitive Landscape of Gildan Activewear Company?

- What is Growth Strategy and Future Prospects of Gildan Activewear Company?

- What is Sales and Marketing Strategy of Gildan Activewear Company?

- What is Brief History of Gildan Activewear Company?

- Who Owns Gildan Activewear Company?

- What is Customer Demographics and Target Market of Gildan Activewear Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.