Gildan Activewear Bundle

Can Gildan Activewear Maintain Its Momentum?

Gildan Activewear, a powerhouse in the Gildan Activewear SWOT Analysis, has consistently demonstrated a knack for navigating the complexities of the apparel industry. Founded in 1984, the company has evolved from a blank apparel innovator into a global leader, achieving remarkable financial performance. Its success is a testament to its strategic prowess and commitment to efficient, large-scale manufacturing.

This deep dive explores Gildan's growth strategy and future prospects, examining its impressive revenue growth and market share. We will dissect its vertically integrated supply chain and manufacturing locations to understand its competitive advantage in the apparel industry. Furthermore, we'll analyze Gildan's expansion plans, sustainability initiatives, and long term outlook to assess its investment potential and forecast its future performance.

How Is Gildan Activewear Expanding Its Reach?

The Gildan Activewear is actively pursuing several expansion initiatives to drive future growth. These initiatives focus on capacity expansion, market share gains, and new product launches. This approach is designed to strengthen its position within the apparel industry.

A key element of their growth strategy involves increasing textile capacity and expanding vertical integration within yarn spinning. This is expected to significantly contribute to attractive earnings growth in 2025. The company's strategic moves are aimed at enhancing its overall financial performance.

Furthermore, the company is undertaking a $265 million manufacturing expansion in Bangladesh. This expansion aims to diversify production, reduce costs, and lessen reliance on Latin America. This diversification strategy is crucial for mitigating supply chain risks and ensuring a stable operational framework for Gildan Future.

The activewear division continues to be a key growth engine. Sales jumped 9% in Q1 2025, driven by strong North American demand and new product introductions. This performance highlights the effectiveness of their market strategies.

The company anticipates continued growth in key product categories, driven by recent innovations and new program launches. Approximately three-quarters of Gildan's expected sales growth for 2025 is projected to come from these new programs. This strategic focus is vital for long-term success.

Gildan aims for a 25% increase in direct-to-consumer channels by 2025. This expansion into online sales channels is a key component of their growth strategy. This will help them to increase their market share.

While the company phased out its Under Armour offerings in the underwear/hosiery division, which saw a 38% decline in sales in Q1 2025, the strong performance in activewear is expected to compensate for this. This demonstrates the company's ability to adapt to market changes.

Gildan Activewear is focusing on capacity expansion, market share gains, and new product launches to drive future growth. The company's strategic initiatives include increasing textile capacity, expanding vertical integration, and diversifying manufacturing locations. These plans are supported by strong performance in the activewear division and a focus on direct-to-consumer channels. For more details on how the company approaches the market, explore the Marketing Strategy of Gildan Activewear.

- Capacity expansion and vertical integration to boost earnings.

- Manufacturing expansion in Bangladesh to diversify production.

- Focus on activewear with new product introductions.

- Increase in direct-to-consumer channels.

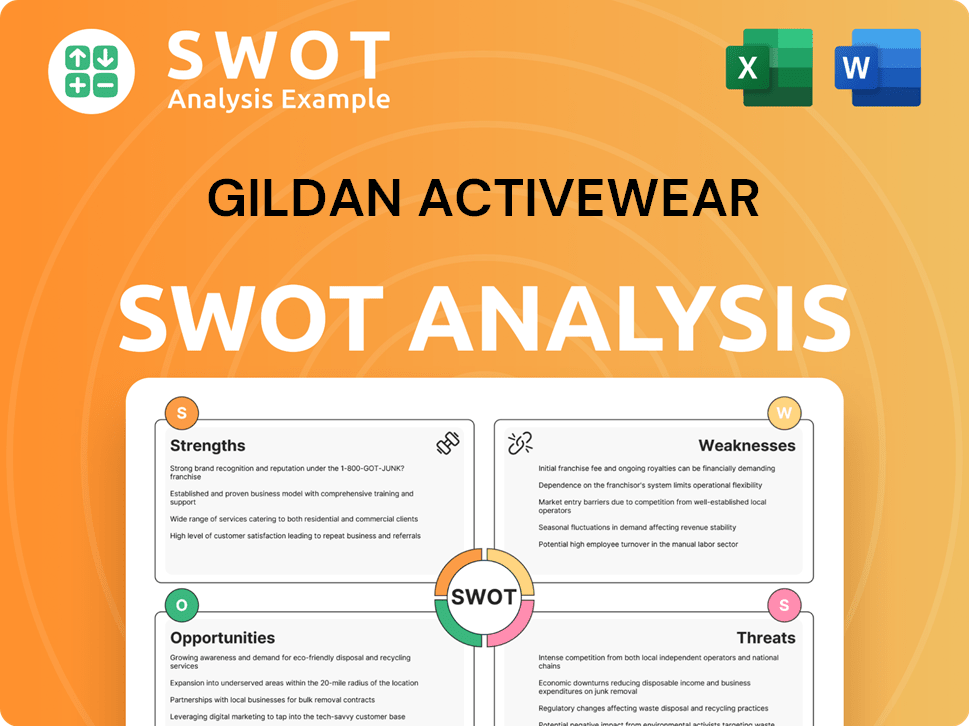

Gildan Activewear SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gildan Activewear Invest in Innovation?

The foundation of the Gildan Activewear growth strategy lies in its commitment to innovation and technological advancements. This approach is central to enhancing product quality, optimizing manufacturing processes, and promoting environmental responsibility within the apparel industry. By continuously investing in research and development, the company aims to meet and exceed customer expectations with high-quality products.

Gildan Activewear's focus on innovation is evident in its recent technological advancements. These innovations are designed to improve product offerings and manufacturing efficiency, thereby supporting the company's long-term growth objectives. The company's commitment to sustainability is also a key driver, influencing its technology and product development strategies.

Gildan Activewear's dedication to innovation includes the introduction of Plasma Print Technology, which is designed to improve direct-to-garment printing. This technology reduces the need for pre-treatment, leading to softer fabrics, brighter colors, and improved print consistency. In addition, Soft Cotton Technology is being integrated into the new Light Cotton™ collection, enhancing softness, printability, and durability.

Plasma Print Technology enhances direct-to-garment printing. It reduces pre-treatment needs, leading to softer fabrics and brighter colors.

Soft Cotton Technology redefines softness and comfort. It is integrated into the Light Cotton™ collection.

Gildan Activewear is committed to sustainable practices. The company focuses on reducing environmental impact through innovative technologies and processes.

Gildan Activewear achieved a 25.2% reduction in water intensity per kilogram produced at its manufacturing facilities in 2024 compared to 2018.

The company increased its sourcing of sustainable cotton from 35.7% in 2023 to 77.3% in 2024.

Gildan Activewear doubled the percentage of recycled polyester or alternative fibers sourced during the same period.

Gildan Activewear integrates sustainability into its innovation strategy, reflected in its 'Next Generation ESG' strategy. The company's efforts have been recognized by external organizations.

- Achieved ISO 45001 certification in two additional facilities in 2024, bringing the total to five.

- Included in S&P Global's 2025 Sustainability Yearbook for the 13th consecutive year.

- Received CDP's Leadership Band for its 2024 climate change disclosures for the fifth time.

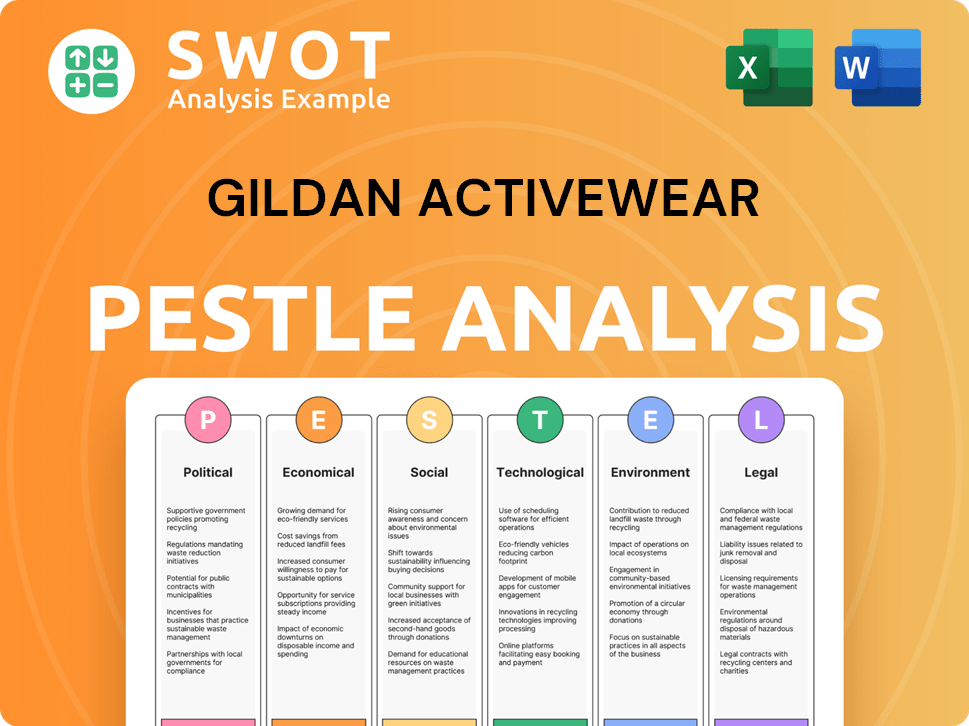

Gildan Activewear PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Gildan Activewear’s Growth Forecast?

The financial outlook for Gildan Activewear in 2025 reflects a positive trajectory within the apparel industry. The company anticipates mid-single-digit revenue growth for the full year. This forecast indicates continued expansion and market share gains for Gildan Activewear.

Gildan projects an approximate 50 basis-point increase in its adjusted operating margin for 2025. This improvement suggests enhanced operational efficiency and profitability. Furthermore, the adjusted diluted earnings per share (EPS) are forecasted to range between $3.38 and $3.58, representing a 13% to 19% increase year-over-year.

The company’s financial health is also supported by its strong free cash flow, expected to exceed $450 million. Gildan's financial flexibility is supported by a leverage ratio of 2.2x net debt to EBITDA, within its target range of 1.5x–2.5x. This financial stability allows for strategic investments and future growth initiatives.

In Q1 2025, Gildan reported a 2.3% year-over-year increase in total revenue, reaching $712 million. This growth was primarily driven by a 9% increase in the activewear division, which saw sales of $647 million.

Gross profit for Q1 2025 rose to $222 million, and net earnings increased by 7.6% to $84.7 million compared to Q1 2024. The adjusted operating margin also saw a 100 basis point increase to 19.0% in Q1 2025.

For the full fiscal year 2024, Gildan reported record sales of $3.271 billion, a 2% increase from the previous year. Despite a leadership struggle that impacted the first half of 2024, the company achieved record Q4 sales of $822 million, up 5% over the prior year.

Net earnings for the full year 2024 declined about 25% from $533.6 million in 2023 to $400.9 million, primarily due to higher taxes and expenses related to a proxy contest and leadership changes.

Gildan announced a 10% dividend increase for 2025, reflecting confidence in its financial stability and future prospects. This increase demonstrates Gildan's commitment to returning value to its shareholders.

Gildan Activewear Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Gildan Activewear’s Growth?

The path for Gildan Activewear's growth strategy faces several potential risks and obstacles. These challenges range from intense competition and market fluctuations to regulatory changes and internal transitions. Understanding these hurdles is crucial for assessing the company's future prospects within the apparel industry.

The company must navigate a complex environment, including the impact of macroeconomic factors on consumer spending and potential product shortages. Moreover, the company's financial performance is subject to global economic conditions and changes in trade policies. The competitive landscape and supply chain dynamics are critical factors influencing Gildan's ability to achieve its Gildan Future goals.

The global apparel and activewear market, valued at $483.7 billion in 2022, presents a highly competitive environment for Gildan Activewear. Market trends indicate flat to low single-digit declines in the activewear market, which adds to the headwinds the company faces. The company is also exposed to regulatory changes, such as the implementation of the Global Minimum Tax (GMT). This has already impacted the company's adjusted effective income tax rate, which increased to 15% in Q1 2025 from 3.6% in Q1 2024.

The apparel industry is fiercely competitive, requiring constant innovation and efficiency. Gildan Activewear competes with numerous global and regional players. This competitive intensity can affect Gildan Activewear's market share and revenue growth.

Supply chain disruptions, particularly those related to trade policy uncertainty and import tariffs, pose a risk. Gildan Activewear relies on a complex network of suppliers and manufacturers. Disruptions can lead to product shortages and increased costs.

Economic downturns and changes in consumer spending habits can significantly affect Gildan Activewear's financial performance. Consumer confidence and disposable income directly influence demand for apparel. Economic instability can lead to decreased sales and profitability.

Changes in tax laws, such as the Global Minimum Tax (GMT), can affect Gildan Activewear's effective tax rate and profitability. Compliance with evolving regulations requires ongoing monitoring and adjustments. These changes can impact the company’s financial statements.

Internal challenges, including leadership changes and resource allocation, can affect Gildan Activewear's operations. The proxy battle and executive leadership transitions can create instability. Efficient resource allocation is critical for sustainable growth.

Shifting market trends, such as changes in consumer preferences and demand for activewear, can influence Gildan Activewear's product lines. Adapting to these trends is essential for maintaining market relevance. The flat to low single-digit declines in the activewear market pose a challenge.

Gildan Activewear's financial performance is directly tied to its ability to manage these risks. For example, the increase in the adjusted effective income tax rate to 15% in Q1 2025 from 3.6% in Q1 2024, due to regulatory changes, impacts profitability. The company's ability to maintain a stable effective tax rate, despite the GMT, is crucial. The company's net debt of $1.849 billion also demands disciplined capital allocation.

Gildan Activewear is implementing strategic adjustments to mitigate these risks. The company's vertically integrated business model provides operational flexibility and cost advantages. The focus on its Gildan Sustainable Growth (GSG) strategy is also critical. Further insights into Gildan Activewear's business model can be found in Revenue Streams & Business Model of Gildan Activewear.

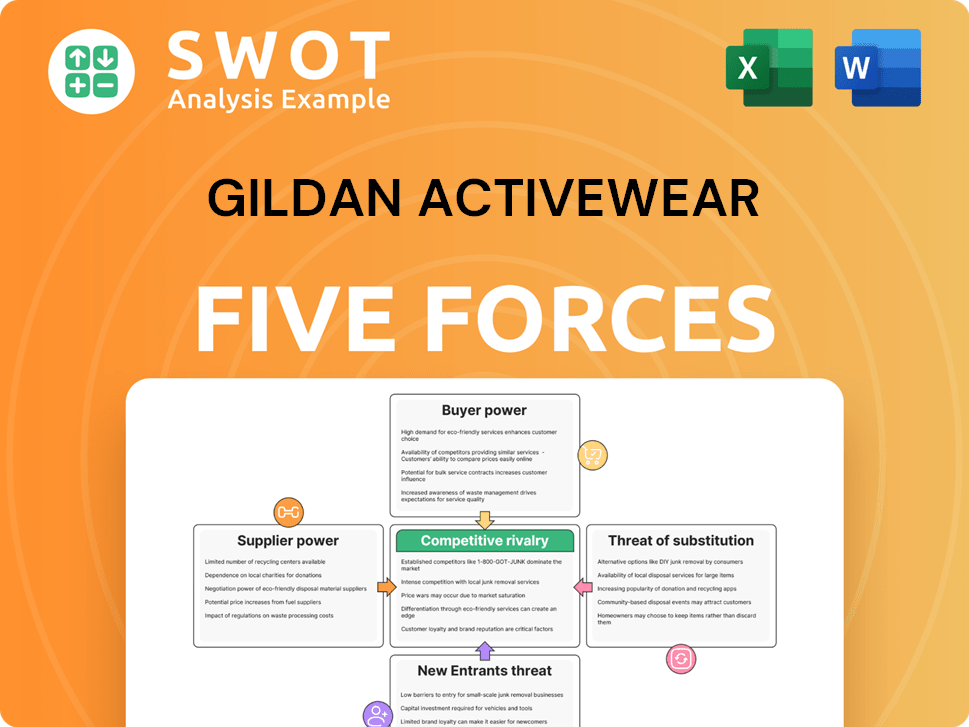

Gildan Activewear Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gildan Activewear Company?

- What is Competitive Landscape of Gildan Activewear Company?

- How Does Gildan Activewear Company Work?

- What is Sales and Marketing Strategy of Gildan Activewear Company?

- What is Brief History of Gildan Activewear Company?

- Who Owns Gildan Activewear Company?

- What is Customer Demographics and Target Market of Gildan Activewear Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.