Groupon Bundle

Can Groupon Conquer the Competitive E-commerce Jungle?

Groupon, the pioneer of daily deals, once dominated the online marketplace by connecting consumers with local businesses through discounted offers. From its humble beginnings in Chicago, the company experienced meteoric growth, becoming a household name synonymous with value-driven shopping. But in today's fast-paced digital world, can Groupon maintain its edge?

To understand Groupon's current position, this analysis dives deep into the Groupon SWOT Analysis, exploring its competitive landscape and identifying its primary rivals. We'll conduct a thorough Groupon market analysis, examining its Groupon competition and the strategies it employs to stay relevant. Understanding the Groupon business model and its challenges is essential in evaluating its future prospects, especially when compared to other Groupon competitors within the daily deals platforms and local commerce sectors.

Where Does Groupon’ Stand in the Current Market?

Groupon's current market position reflects a company navigating a competitive e-commerce landscape. The company focuses on connecting consumers with local merchants, offering deals across various categories like health, beauty, and things to do. Its geographic presence is primarily in North America, with a reduced international footprint.

Groupon has shifted from a daily-deal site to a broader marketplace to build more sustainable relationships with merchants and consumers. This strategic pivot aims to move beyond transient discounts. The company strives for sustained profitability, targeting positive adjusted EBITDA.

In 2023, Groupon reported revenues of $583.5 million, indicating ongoing challenges in revenue generation. Its market capitalization is lower than its peak, reflecting investor concerns. Despite strong brand recognition in local deals, it faces competition from diversified e-commerce giants and niche platforms. For a deeper understanding of the company's structure, consider exploring the details about Owners & Shareholders of Groupon.

Groupon primarily targets local experiences and services, connecting consumers with local merchants. This includes deals in health, beauty, things to do, food & drink, and home & garden. The company's focus is on the local commerce sector.

Groupon operates mainly in North America, with a reduced presence in international markets. The company has strategically scaled back its global operations. The focus is now on core, profitable regions.

Groupon's revenue for the full year 2023 was $583.5 million, showing challenges in revenue generation. The company aims for sustained profitability and positive adjusted EBITDA. Its market capitalization is lower than its peak.

Groupon has evolved from a daily-deal site to a broader marketplace. This shift aims to offer a more curated selection of experiences and goods. The goal is to build sustainable relationships with merchants and consumers.

Groupon faces challenges from larger e-commerce companies and niche platforms. The company's ability to achieve sustained profitability is a key focus. Its strong brand recall in local deals provides an opportunity to maintain its market position.

- Competition: Increased competition from diversified e-commerce giants.

- Financial Performance: The need to improve revenue generation and achieve profitability.

- Market Adaptation: Adapting to the evolving e-commerce environment.

- Brand Recognition: Leveraging brand recall in the local deals space.

Groupon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Groupon?

Understanding the competitive landscape is crucial for analyzing the business strategies and market position of any company, including Groupon. The Groupon competition is multifaceted, involving both direct and indirect rivals. A thorough Groupon market analysis reveals a dynamic environment where various players vie for consumer spending in the local deals and experiences sector.

The Groupon business model, centered on offering discounted deals from local businesses, faces challenges from a wide array of competitors. These competitors range from specialized marketplaces to large e-commerce platforms, each employing different strategies to capture market share. Analyzing these competitors helps in understanding Groupon's strategies to stay competitive and its overall financial performance.

The Groupon competitive landscape analysis 2024 shows a continued evolution of the market. Several factors, including changing consumer preferences and technological advancements, influence the competitive dynamics. To gain a deeper understanding of the company's strategic positioning, it's essential to examine its key competitors.

Direct competitors offer similar services, focusing on local deals and experiences. These companies directly compete with Groupon for the same customer base. They often employ similar marketing strategies and pricing models.

Historically, LivingSocial was a major direct competitor. Although it is now part of Groupon's parent company, its past presence significantly shaped the market. The Groupon vs LivingSocial comparison highlights the evolution of the daily deals platforms.

Various smaller, regional deal sites target specific geographic areas or niche interests. These sites offer localized deals, often focusing on partnerships with local businesses. They present a challenge to Groupon by catering to specific markets.

Indirect competitors offer products or services that compete for the same consumer spending, even if they don't directly offer daily deals. These competitors often have broader market reach and deeper pockets. They can significantly impact Groupon's market share.

Amazon, a large e-commerce platform, offers local services and product discounts. How Groupon competes with Amazon Local is a key aspect of its strategy. Amazon's vast resources pose a significant challenge.

OTAs like Expedia and Booking.com compete for experiential spending by offering tours, activities, and hotel deals. These offerings overlap with Groupon's travel segment. This competition impacts Groupon's revenue streams.

Specialized marketplaces target specific segments of Groupon's customer base. These platforms often have stronger brand recognition in their niches. They compete directly with Groupon for specific types of deals.

- ClassPass (fitness and wellness)

- OpenTable (restaurant reservations)

- Ticketing Platforms (events and attractions)

- These platforms offer alternatives to Groupon for specific needs.

The rise of social media and influencer marketing also presents a challenge, as businesses increasingly promote deals directly. This bypasses traditional deal aggregators. New entrants focusing on subscription models or personalized recommendations constantly push Groupon to innovate its value proposition. Understanding these dynamics is crucial for assessing Groupon's challenges in the market and its ability to maintain a competitive edge. For more insights, consider reading the Growth Strategy of Groupon.

Groupon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Groupon a Competitive Edge Over Its Rivals?

The competitive landscape for companies like Groupon, necessitates a deep dive into its core advantages. Groupon's standing in the market is shaped by its brand recognition, extensive merchant network, and specialized knowledge in the local deals sector. Despite the evolving dynamics of the market, Groupon's brand maintains a solid presence, particularly among consumers looking for discounts on local experiences. This brand equity is a result of years of operation and substantial marketing efforts, fostering a degree of trust and familiarity that new entrants often struggle to achieve. Understanding the Groupon competition is crucial for any market analysis.

Groupon's business model hinges on its ability to connect consumers with local businesses, offering deals across various categories and locations. This is supported by a vast network of local merchants, built over years of sales and partnership development. Groupon's expertise in structuring and managing deal campaigns, understanding merchant needs, and optimizing consumer engagement provides an operational advantage. This is a key aspect of the Groupon market analysis.

Groupon has invested in technology to streamline the deal redemption process for both consumers and merchants, aiming to create a seamless experience. While proprietary technologies may not be as dominant as in some tech sectors, its platform infrastructure and data analytics capabilities, refined over time, contribute to its operational efficiency. The company's ability to continuously refresh its value proposition for both sides of its marketplace is critical in maintaining these advantages against an evolving competitive backdrop. If you want to know more about their target audience, you can read about the Target Market of Groupon.

Groupon's brand has become synonymous with local deals, giving it an edge in attracting both consumers and merchants. This recognition is a significant asset, as it reduces the cost of customer acquisition compared to newer entrants. The established brand also fosters trust, encouraging consumers to try new businesses and services through Groupon's platform.

Groupon's vast network of local merchants offers a wide variety of deals across different categories. This network is a key competitive advantage, as it provides consumers with a diverse range of options. The ability to offer a broad selection of deals is crucial for attracting and retaining a large customer base, which is essential for the Groupon business model.

Groupon's experience in structuring and managing deal campaigns, understanding merchant needs, and optimizing consumer engagement provides a significant operational advantage. The company has refined its processes over the years, allowing it to efficiently manage deals and provide a seamless experience for both consumers and merchants. This operational efficiency is vital in the daily deals platforms market.

Groupon has invested in technology to streamline the deal redemption process for both consumers and merchants. Its platform infrastructure and data analytics capabilities, refined over time, contribute to its operational efficiency. While proprietary technologies may not be as dominant as in some tech sectors, this infrastructure supports its ability to manage a large volume of deals.

Groupon's competitive advantages are multifaceted, including brand recognition, an extensive merchant network, operational expertise, and technological infrastructure. These advantages enable Groupon to offer a wide range of deals, attract a large customer base, and efficiently manage its operations. However, the company faces challenges from competitors and the evolving market landscape.

- Brand Recognition: Groupon's brand is well-known, fostering trust among consumers.

- Merchant Network: A broad network provides diverse deal options.

- Operational Efficiency: Expertise in managing deals and optimizing engagement.

- Technological Infrastructure: Streamlined processes for both consumers and merchants.

Groupon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Groupon’s Competitive Landscape?

The e-commerce and local services industry is experiencing significant shifts, impacting companies like Groupon. Technological advancements, especially in mobile commerce and personalized recommendations, are reshaping consumer expectations. Regulatory changes and evolving consumer preferences also play a crucial role. These trends present both challenges and opportunities for Groupon, requiring strategic adaptation and innovation to maintain its market position.

For a comprehensive Groupon market analysis, understanding these industry dynamics is crucial. The company faces pressure from diversified e-commerce platforms and niche service providers. Furthermore, shifts in consumer behavior towards experiences and convenience require Groupon to adapt its offerings and strategies to stay competitive.

Mobile commerce and personalized recommendations are becoming increasingly important, with consumers expecting seamless and relevant offers. Regulatory changes regarding data privacy and consumer protection necessitate continuous adaptation. The demand for experiences over physical goods and a focus on convenience are also shaping the market.

Combating deal fatigue and maintaining profitability in a discount-driven market is a key challenge. Increased competition from diversified e-commerce platforms and niche service providers will continue to pressure market share. Declining demand for traditional deal models could also impact Groupon if consumers shift towards full-price convenience or subscription services.

The growth of the experience economy presents a significant opportunity for expansion into travel, events, and local activities. Product innovations such as enhanced personalization and subscription-based models could revitalize the platform. Strategic partnerships with complementary businesses could unlock new customer segments and revenue streams.

Groupon's competitive position is likely to evolve towards a more curated marketplace for local experiences. The company will need to leverage its brand and merchant network while embracing technological advancements and diversified revenue strategies. Staying resilient in a rapidly changing market requires continuous adaptation and innovation.

To navigate the challenges and capitalize on opportunities, Groupon needs to focus on several key areas. Enhancing personalization and expanding into the experience economy are crucial. Strategic partnerships and product innovation can also drive growth. For more details, explore the Revenue Streams & Business Model of Groupon.

- Investing in advanced analytics and AI to tailor deals and improve user experience.

- Developing loyalty programs and marketing solutions to provide sustainable value to merchants.

- Exploring subscription-based models for curated deals to diversify revenue streams.

- Forming partnerships with local tourism boards and event organizers to expand reach.

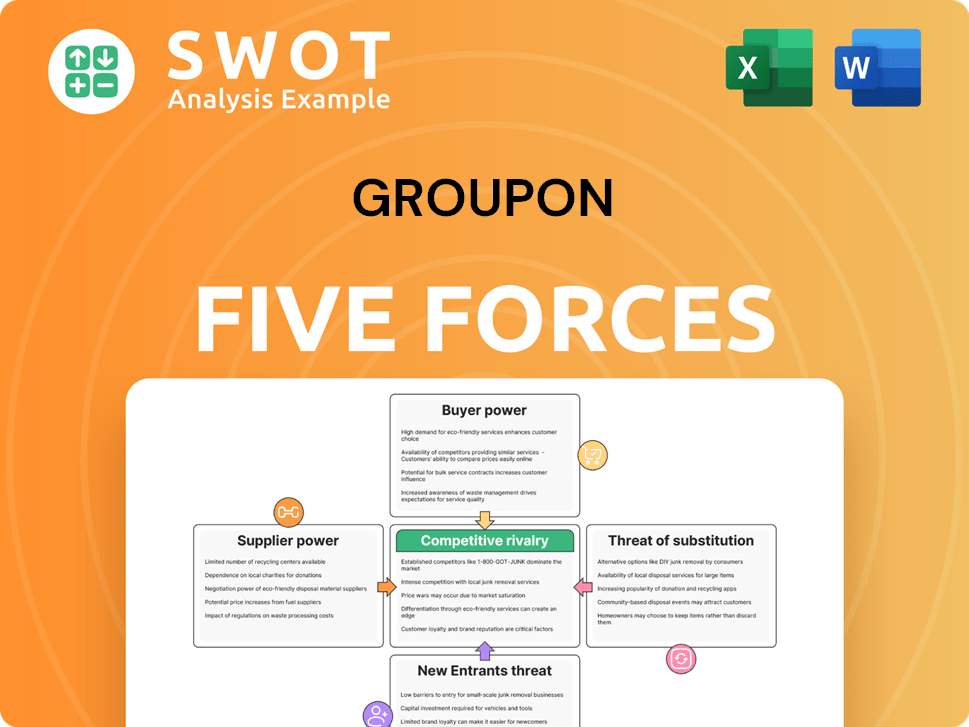

Groupon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Groupon Company?

- What is Growth Strategy and Future Prospects of Groupon Company?

- How Does Groupon Company Work?

- What is Sales and Marketing Strategy of Groupon Company?

- What is Brief History of Groupon Company?

- Who Owns Groupon Company?

- What is Customer Demographics and Target Market of Groupon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.