Groupon Bundle

Can Groupon Reclaim Its Former Glory?

Groupon, the pioneer of daily deals, has faced significant shifts since its inception. This Groupon SWOT Analysis will provide a deep dive into the company's current standing and future trajectory. We'll explore how Groupon's business model has evolved and what strategic moves it's making to stay competitive in the e-commerce landscape.

Understanding the Groupon growth strategy is crucial for investors and business strategists alike. This analysis will examine Groupon's future prospects, considering factors such as its market share, financial performance, and how it plans to navigate challenges and capitalize on opportunities. We'll also look at Groupon's expansion plans in 2024 and beyond, providing a comprehensive Groupon company analysis.

How Is Groupon Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strengthening its core marketplace while exploring new avenues to boost customer engagement and merchant value. The company is streamlining its product offerings and improving the customer experience to encourage repeat purchases and increase the average order value. This involves simplifying the deal redemption process and personalizing recommendations based on user preferences. While specific details on new geographical market entries in 2024-2025 are not widely publicized, the emphasis seems to be on increasing penetration within existing markets by optimizing the merchant-partner ecosystem and increasing the variety and quality of deals available. This approach is a key part of the overall Groupon growth strategy.

A key aspect of the company's expansion strategy involves solidifying its relationships with local merchants, aiming to be a more valuable partner for customer acquisition and retention. This includes offering enhanced tools and insights to merchants to help them better manage their campaigns and understand their return on investment. The company is also exploring ways to diversify its revenue streams beyond traditional deal commissions, potentially through advertising services for merchants or subscription models for consumers. This is a critical element of understanding the company's Groupon business model.

For instance, in its Q4 2023 earnings call, the company highlighted efforts to drive growth through improved product offerings and a focus on higher-margin inventory, indicating a strategic shift towards more profitable deals rather than just volume. The company's financial performance is closely tied to its ability to execute these expansion initiatives effectively. The focus on higher-margin deals and improved customer experience is crucial for long-term sustainability.

The company's expansion plans in 2024 and beyond center on several key areas. These include optimizing the merchant-partner ecosystem, enhancing the customer experience, and diversifying revenue streams. These initiatives are designed to improve the company's competitive advantages and address its challenges and opportunities.

- Merchant Partnerships: Strengthening relationships with local merchants by providing enhanced tools and insights to improve their campaign management and ROI.

- Customer Experience: Simplifying deal redemption and personalizing recommendations to drive repeat purchases and increase average order value.

- Revenue Diversification: Exploring new revenue streams beyond traditional deal commissions, such as advertising services and subscription models.

- Market Penetration: Deepening market presence within existing regions by optimizing the merchant-partner ecosystem and increasing deal variety.

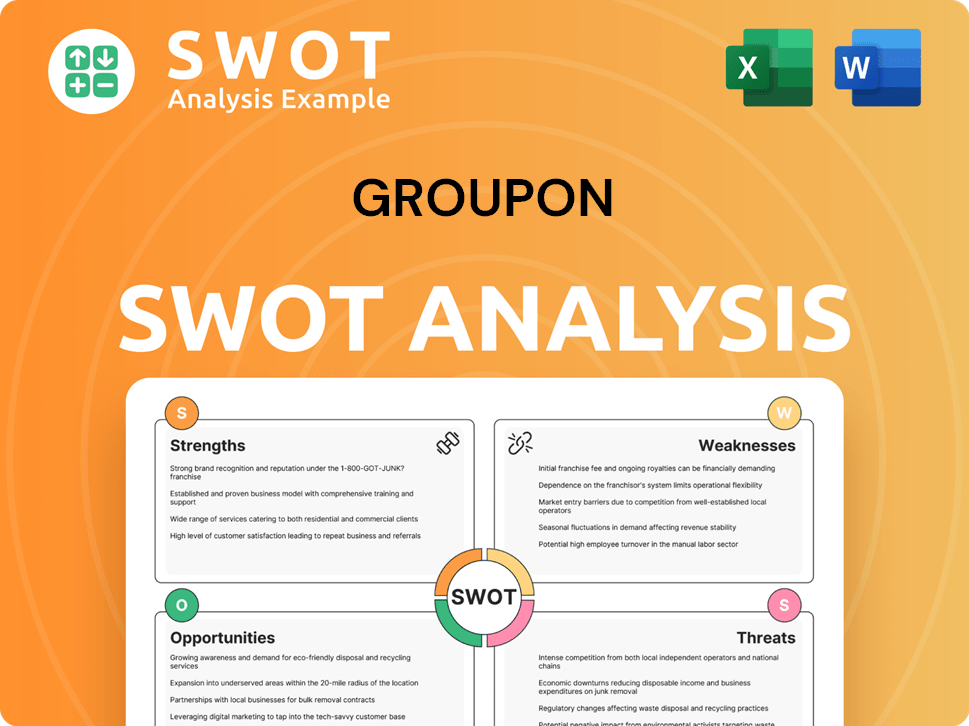

Groupon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Groupon Invest in Innovation?

The innovation and technology strategy of the company focuses on using data, artificial intelligence (AI), and enhanced platform capabilities to drive growth. This approach includes investing in personalization algorithms to offer users more relevant deals, which aims to boost conversion rates and customer satisfaction. The strategy involves analyzing user behavior, purchase history, and demographic data to tailor recommendations effectively. This is a key part of the overall Groupon growth strategy.

Digital transformation efforts are central to streamlining operations and improving the user experience across web and mobile platforms. The goal is to make the process of discovering and redeeming deals seamless and intuitive for customers. Continuous improvement of technological infrastructure and data analytics is a testament to its commitment to innovation. These advancements support growth objectives by increasing customer engagement, driving repeat purchases, and attracting new merchants.

The integration of AI is crucial for optimizing merchant targeting and deal pricing, aiming to create a more efficient marketplace. This technological focus directly impacts the Groupon future prospects by improving operational efficiency and enhancing the customer experience. The company's commitment to technological advancement is designed to contribute to its long-term sustainability.

The company uses advanced personalization algorithms. These algorithms analyze user behavior, purchase patterns, and demographic data to tailor deal recommendations. This targeted approach aims to increase conversion rates and boost customer satisfaction, which is a key component of the Groupon business model.

AI plays a crucial role in optimizing merchant targeting and deal pricing. This helps create a more efficient marketplace, improving both the merchant and customer experience. The use of AI is a significant part of Groupon's technological advancements.

The company is continuously working on improving its web and mobile platforms. These improvements focus on streamlining operations and enhancing the user interface. The goal is to make deal discovery and redemption seamless and intuitive, which enhances Groupon's user experience and engagement.

Data analytics are essential for understanding user behavior and market trends. The company uses data analytics to refine its strategies and improve decision-making. This data-driven approach supports the overall Groupon company analysis.

Continuous improvement of the technological infrastructure is a priority. This includes upgrading servers, databases, and other essential systems. A robust infrastructure supports the scalability and reliability of the platform, impacting Groupon's long-term sustainability.

The company focuses on enhancing its mobile app features to improve user experience. These features may include improved search functionalities, personalized recommendations, and easier deal redemption. The mobile app is a key channel for Groupon's customer acquisition strategies.

The company's commitment to technological advancements is designed to contribute to growth objectives, increasing customer engagement, driving repeat purchases, and attracting new merchants. These advancements are a critical part of Groupon's competitive advantages.

- Enhanced Personalization: Tailoring deals to individual user preferences increases the likelihood of purchases.

- Improved Efficiency: AI-driven optimization of merchant targeting and deal pricing streamlines operations.

- Seamless User Experience: Intuitive web and mobile platforms enhance user engagement and satisfaction.

- Data-Driven Decision Making: Using data analytics to refine strategies and improve the platform.

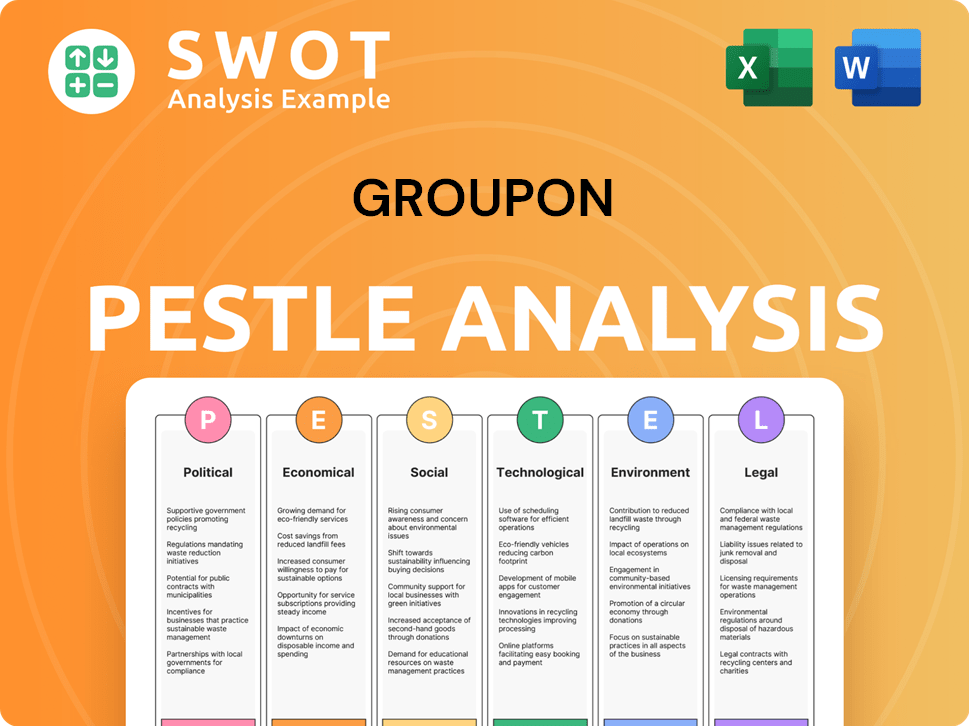

Groupon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Groupon’s Growth Forecast?

The financial outlook for Groupon centers on achieving sustainable growth through improved profitability. The company's strategic shift focuses on higher-margin deals, even if this means a reduction in overall revenue. This approach aims to strengthen the company's financial health and create a more stable foundation for future expansion.

Groupon's 2023 financial results demonstrate progress toward its goals. The company has shown a significant improvement in adjusted EBITDA, indicating a positive trend in financial performance. While revenue decreased, the focus on profitability suggests a strategic pivot towards more sustainable business practices. This shift is crucial for long-term success.

Groupon's management is optimistic about continued adjusted EBITDA growth in 2024. The emphasis on profitability and cash flow highlights the company's strategic plans for sustainable growth. Understanding the Marketing Strategy of Groupon can provide additional insights into how the company plans to achieve its financial goals.

In Q4 2023, adjusted EBITDA reached $50.7 million, a significant increase from a loss of $10.1 million in Q4 2022. For the full year 2023, adjusted EBITDA was $85.6 million, a substantial improvement from a loss of $75.6 million in 2022. This indicates a positive trajectory.

Q4 2023 revenue was $124.3 million, down from $169.3 million in Q4 2022, primarily due to a strategic shift away from lower-margin inventory. Full-year 2023 revenue was $520.6 million, a decrease from $599.1 million in 2022. This reflects a focus on higher-quality deals.

Groupon's strategy prioritizes profitability and sustainable revenue generation. The company is moving away from lower-margin deals to focus on higher-quality, more profitable offerings. This shift is expected to improve financial health.

Management anticipates continued adjusted EBITDA growth in 2024. The focus is on improving profitability and cash flow, which will support sustainable growth. The company's long-term sustainability depends on these strategies.

The financial performance of Groupon in 2023 and its strategic shifts point toward a focus on sustainable growth. The company's ability to improve adjusted EBITDA while managing revenue demonstrates a commitment to profitability.

- Adjusted EBITDA: Reached $50.7 million in Q4 2023.

- Full-Year 2023 Adjusted EBITDA: $85.6 million.

- Q4 2023 Revenue: $124.3 million.

- Full-Year 2023 Revenue: $520.6 million.

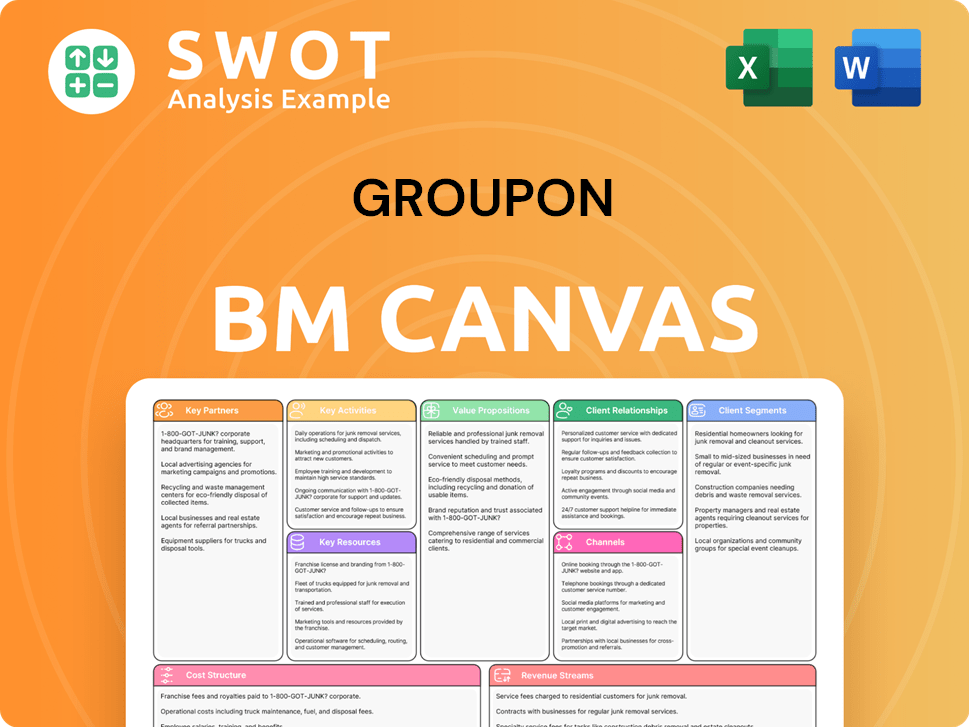

Groupon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Groupon’s Growth?

The path forward for the company, like any business, is fraught with potential risks and obstacles. Understanding these challenges is crucial for assessing its long-term viability and potential for growth. The company's ability to navigate these issues will significantly influence its future prospects and market position.

A key area of concern revolves around market competition and the need to continually innovate to stay ahead. The rise of specialized services and direct-to-consumer models presents a constant challenge. Furthermore, internal factors, such as the ability to attract and retain talent, also play a critical role in its success. These factors could impact the company's ability to execute its strategic plans effectively.

Regulatory changes and compliance requirements can also pose significant hurdles. These might include consumer data privacy rules and online advertising regulations. Successfully adapting to these changes is crucial for maintaining operational flexibility and avoiding penalties.

The company faces intense competition from various e-commerce platforms and local service providers. Direct-to-consumer models and specialized apps further intensify this competition. Maintaining a competitive edge requires continuous innovation and adaptation.

Changes in regulations, especially concerning consumer data privacy and online advertising, could increase compliance costs. These changes may also affect operational flexibility. Staying compliant is essential to avoid legal issues.

Maintaining a compelling inventory of deals that attract consumers and provide value to merchants is an ongoing struggle. The company must constantly refresh its offerings. This is crucial for sustained customer engagement.

Supply chain disruptions for merchant partners can indirectly affect the goods category. The company's goods category performance depends on the reliability of its merchants. This can affect the overall financial performance.

Emerging platforms and business models could pose a threat if the company fails to innovate. Continuous investment in technology is vital. Staying ahead of technological advancements is key to long-term success.

Resource constraints, particularly in talent acquisition and retention, can hinder growth initiatives. Competition for skilled professionals is intense. This can limit the company’s ability to execute its plans.

To mitigate these risks, the company has focused on diversifying its deal categories and investing in its technology platform. Building stronger merchant relationships is also a key strategy. The company's recent strategic shift towards higher-margin inventory and improved profitability indicates a proactive approach to financial risk management. For a deeper understanding of the company's business model, consider reading about the Revenue Streams & Business Model of Groupon.

Analyzing the company's market share reveals its position relative to competitors. The company's market share can fluctuate based on competitive pressures and strategic initiatives. Understanding market share trends is essential for evaluating its growth strategy.

The company's financial performance, including revenue and profitability, is a key indicator of its health. Monitoring financial metrics provides insights into its ability to generate sustainable returns. Reviewing the company's financial statements is crucial for investors.

Identifying the company's competitive advantages helps to assess its long-term viability. These advantages can include brand recognition, customer loyalty, and exclusive partnerships. Understanding these advantages is important for evaluating the company's competitive strategy.

The company's expansion plans, including geographic and product diversification, are crucial for future growth. Analyzing expansion strategies provides insights into its ability to capture new markets. Understanding these plans helps to assess the company's growth potential.

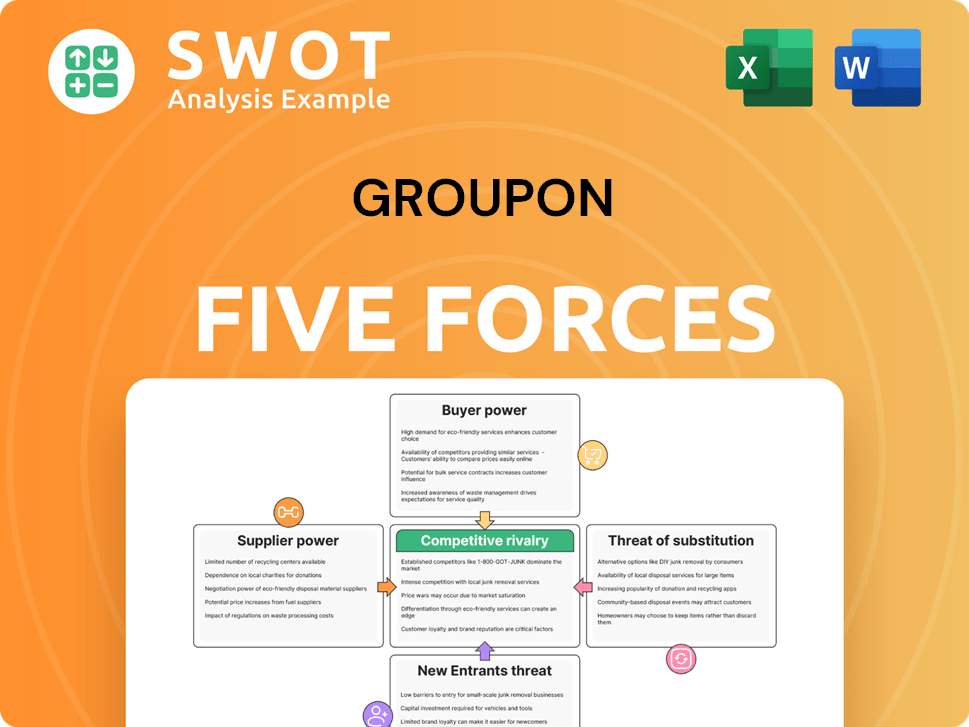

Groupon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Groupon Company?

- What is Competitive Landscape of Groupon Company?

- How Does Groupon Company Work?

- What is Sales and Marketing Strategy of Groupon Company?

- What is Brief History of Groupon Company?

- Who Owns Groupon Company?

- What is Customer Demographics and Target Market of Groupon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.