Groupon Bundle

How Does Groupon Thrive in Today's Market?

Groupon, the e-commerce giant, connects consumers with local businesses through enticing discounts, but how does the Groupon SWOT Analysis reveal its inner workings? This unique platform offers a win-win scenario, providing users with access to a wide array of goods and services at reduced prices while simultaneously offering businesses a powerful tool for customer acquisition. Dive in to understand the core of Groupon's business model and its impact on the local commerce landscape.

With reported global revenue figures and growth in specific markets, understanding How Groupon works is critical for anyone interested in the dynamics of online marketplaces. Uncover the secrets behind Groupon deals, its impact on small businesses, and the strategies that drive its success. Explore the Groupon platform, from the deal redemption process to its advertising strategies, and gain insights into its financial performance and evolution.

What Are the Key Operations Driving Groupon’s Success?

The core operations of Groupon are centered around its online platform, which serves as a marketplace connecting consumers with local merchants. This Groupon business model focuses on offering Groupon deals and Groupon discounts on a variety of products and services. These offerings include local activities, travel, goods, and experiences, catering to a broad customer base.

The value proposition for consumers is clear: savings on purchases. For merchants, the platform offers a way to acquire new customers, increase brand exposure, and generate predictable sales. Groupon acts as a marketing and promotional channel, driving traffic and sales for businesses. The Groupon platform facilitates this exchange, making it easy for both parties to connect and transact.

The operational processes involve geo-targeted marketing, presenting users with relevant deals based on their location and preferences. Groupon leverages collective buying power to negotiate discounts. The company partners with a wide range of businesses, from local restaurants to national retailers, to provide exclusive deals. Its distribution network mainly relies on its mobile app and website, allowing customers to browse and purchase deals easily.

Groupon uses geo-targeting to show users deals relevant to their location. This ensures users see offers from businesses nearby, increasing the likelihood of a purchase. This personalized approach enhances the user experience.

Groupon negotiates discounts based on the collective buying power of its users. The more people who commit to a deal, the better the discount. This model benefits both consumers and merchants.

Groupon partners with a wide variety of businesses to offer deals. These partnerships are key to providing a diverse selection of offers. This allows Groupon to cater to different customer preferences.

The mobile app and website are the primary distribution channels for Groupon. These platforms make it easy for customers to browse and purchase deals. This accessibility drives sales and user engagement.

Groupon's performance-based model, where merchants only pay upon customer delivery, is a significant advantage. This direct connection and the ability to offer diverse, curated deals translate into tangible benefits for both consumers and merchants. As of 2024, Groupon continues to adapt its strategies to maintain relevance in the competitive online marketplace.

- Consumer Savings: Offers significant discounts on various products and services.

- Merchant Benefits: Provides customer acquisition and brand exposure.

- Performance-Based Payment: Merchants only pay when customers redeem deals.

- Diverse Deal Selection: Offers a wide range of deals, from local experiences to goods.

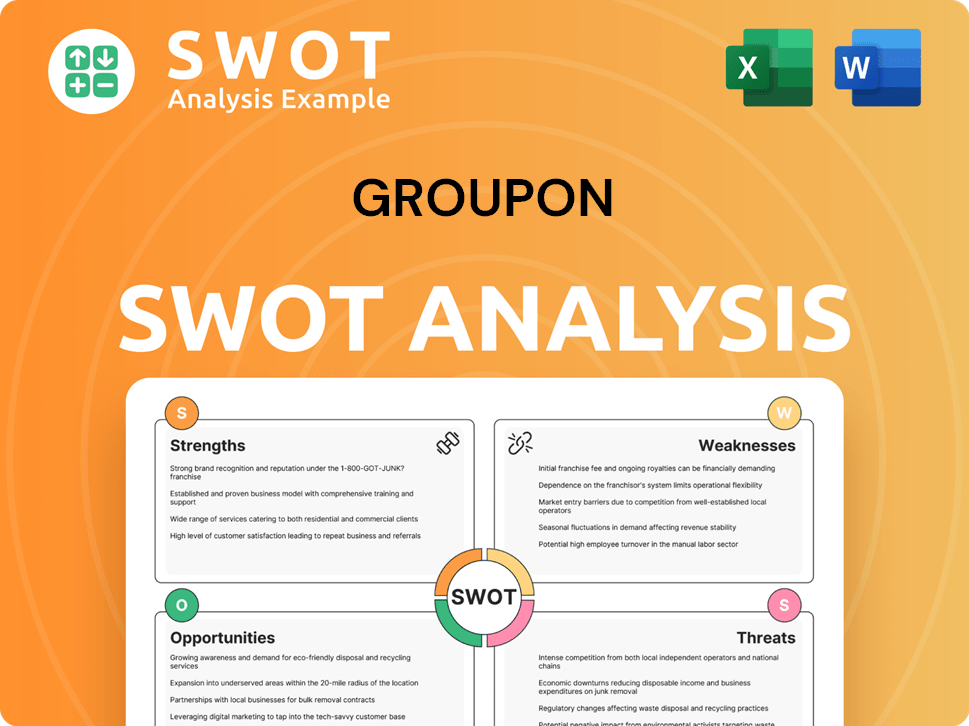

Groupon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Groupon Make Money?

The Growth Strategy of Groupon centers on a multifaceted revenue model, primarily driven by commissions from the deals sold through its platform. This strategy involves sharing profits with participating merchants, with an average commission rate of approximately 50%. This commission-based approach forms the backbone of how Groupon operates and generates revenue.

In the first quarter of 2025, Groupon reported a global revenue of $117.19 million. This represents a 4.8% decrease compared to the same period in 2024. The revenue breakdown for Q1 2025 shows that North America contributed $91.11 million, while international markets generated $26.07 million.

Groupon's monetization strategies extend beyond simple transaction fees. The company employs various methods, including premium placement services and targeted advertising. Businesses can pay for enhanced visibility and custom marketing campaigns on the Groupon platform. Additionally, Groupon offers a subscription service, Groupon Select, providing members with exclusive discounts and perks for a monthly fee. Groupon's pricing strategies, such as discounts of 50% to 90%, value-based pricing, and bundled offers, aim to maximize market penetration and customer acquisition.

Groupon's business model relies on several key revenue streams and strategies to generate income and maintain its market position. These elements are crucial to understanding how Groupon works and its approach to the market.

- Commission-Based Revenue: The primary revenue source is commissions from each deal sold. The average commission rate is approximately 50%, which is a significant portion of each transaction.

- Advertising and Premium Placement: Businesses can pay for enhanced visibility through premium placement and targeted advertising solutions, increasing their reach to potential customers.

- Subscription Services: Groupon Select offers exclusive discounts and perks for a monthly fee, providing a recurring revenue stream and encouraging customer loyalty.

- Pricing Strategies: Groupon uses dynamic pricing models, including discounts ranging from 50% to 90%, value-based pricing, and bundled offers, to attract customers and maximize sales.

- Strategic Shifts: The company has shifted its focus, such as exiting the Goods business to concentrate on services and experiences, reflecting an evolving business strategy.

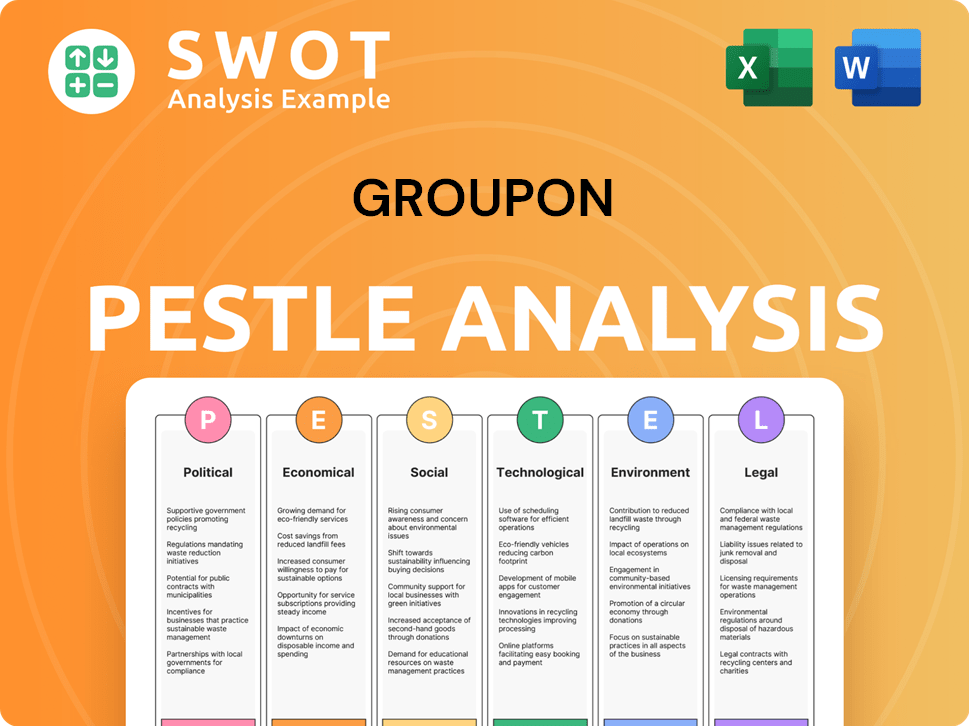

Groupon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Groupon’s Business Model?

Groupon's journey has been marked by significant milestones and strategic shifts. Originally launched in 2008 as a daily deal site, it quickly expanded its global footprint. A key strategic move was the 2016 transition away from the 'tipping point' model, enabling immediate deal redemptions. In 2024, Groupon achieved a notable financial milestone by returning to positive free cash flow, reporting $40.6 million for the full year 2024, marking the first time since the post-pandemic period.

The company has navigated operational challenges, including platform disruptions in 2024, which have since been addressed in Q1 2025. Strategic partnerships also play a crucial role, as demonstrated by the April 2024 collaboration with SiteMinder to enhance travel offerings. These moves highlight Groupon's adaptability and commitment to growth.

Groupon's competitive advantages include a substantial customer base and strong brand recognition. Its wide array of offerings, spanning various products and services, appeals to a broad audience. The company leverages data analytics and machine learning for personalized recommendations, enhancing user engagement. Furthermore, its performance-based model, where merchants only pay when customers are delivered, provides a significant advantage over traditional advertising. To understand its position, it's helpful to look at the Competitors Landscape of Groupon.

Groupon's evolution includes significant financial achievements. The company reported a return to positive free cash flow in 2024, reaching $40.6 million. In Q1 2025, Groupon saw a 165.7% positive swing in net income, reaching $7.56 million, reversing a net loss from Q1 2024.

Groupon has strategically adapted its business model. The shift away from the 'tipping point' model in 2016 allowed for more immediate deal redemptions. Partnerships, such as the April 2024 collaboration with SiteMinder, have enhanced offerings.

Groupon's competitive advantages include a large customer base and strong brand recognition. The platform's wide range of offers appeals to a broad audience. The company leverages data analytics and machine learning for personalized recommendations.

Groupon is focused on platform modernization and AI integration for sales and search optimization. The company plans further development over the next 12-24 months. These initiatives aim to enhance user experience and merchant performance.

Groupon's business model is centered around offering deals and discounts to a large customer base. It generates revenue through commissions on the deals sold. The platform's success is tied to its ability to attract both customers and merchants.

- Groupon deals: Offers discounts on various products and services.

- Groupon discounts: Attracts customers with reduced prices.

- Groupon platform: Facilitates transactions between customers and merchants.

- Groupon business model: Commission-based revenue generation.

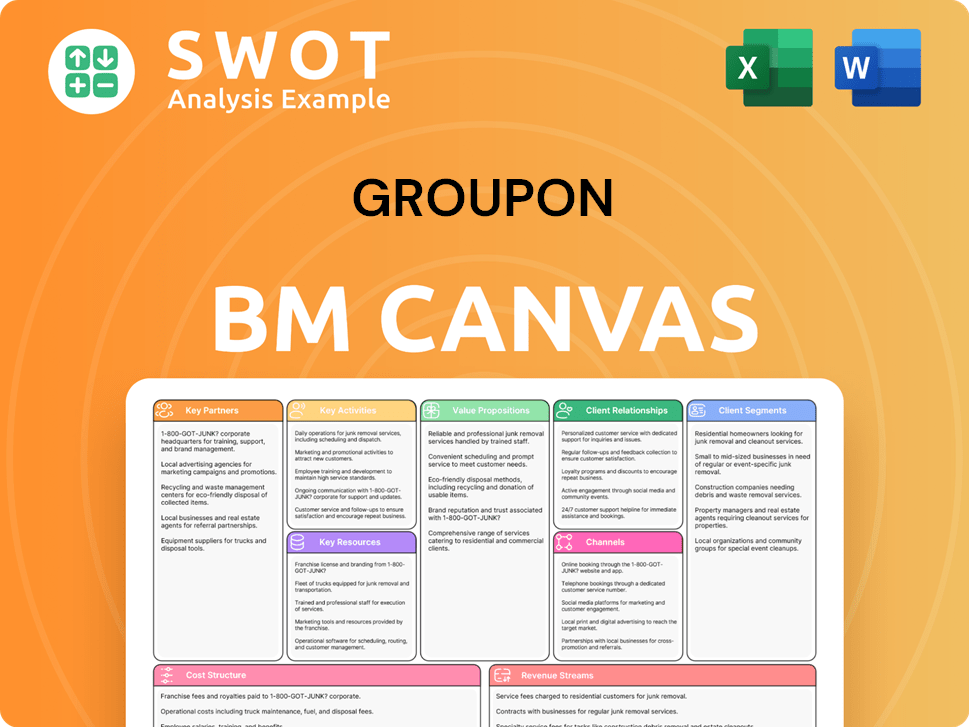

Groupon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Groupon Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook for Groupon. The company operates within the competitive online deals and e-commerce marketplace. It faces rivals like LivingSocial, RetailMeNot, Amazon Local, and Travelzoo. Despite its global presence in over 28 countries, its market share was reported as 0.03% in Q1 2025, highlighting the dominance of larger players.

Groupon's success hinges on its brand recognition and the variety of offerings that foster customer loyalty. However, the company navigates several challenges. Competition, shifting consumer preferences, and economic downturns pose risks. Regulatory changes and technological advancements also present ongoing challenges for the company.

Groupon competes in the online deals and e-commerce market. It faces strong competition from companies like Amazon and RetailMeNot. Despite a global presence, its market share is relatively small, indicating a tough competitive landscape. Understanding the Target Market of Groupon can provide insights into its strategic positioning.

Key risks include increasing competition and evolving consumer preferences. Economic downturns and regulatory changes also pose threats. Groupon's revenue declined by approximately 5.33% in the three months ending December 31, 2024, signaling financial challenges. Its high debt-to-equity ratio of 6.2 also increases financial risk.

Groupon's management is optimistic about growth in 2025, particularly in North America. The company aims to become a trusted destination for local experiences. Strategic initiatives include platform modernization and AI integration. Analysts forecast earnings and revenue growth of 104.6% and 7.1% per annum, respectively.

Groupon's net margin and return on assets are below industry averages. This indicates difficulties in achieving profitability and efficiently using assets. The company's financial performance is a key factor in its future growth and sustainability. The local marketplace strategy has shown positive momentum.

Groupon focuses on platform modernization and AI integration to enhance user and merchant value. It aims to move away from being a 'daily deals platform selling everything to everyone'. These initiatives are crucial for adapting to changing market dynamics and maintaining a competitive edge. The company is working on improving the Groupon business model.

- Platform Modernization: Improving the user experience and technology infrastructure.

- AI Integration: Using artificial intelligence to personalize offers and improve efficiency.

- Local Marketplace Focus: Emphasizing local experiences and deals.

- Merchant Partnerships: Building stronger relationships with merchants.

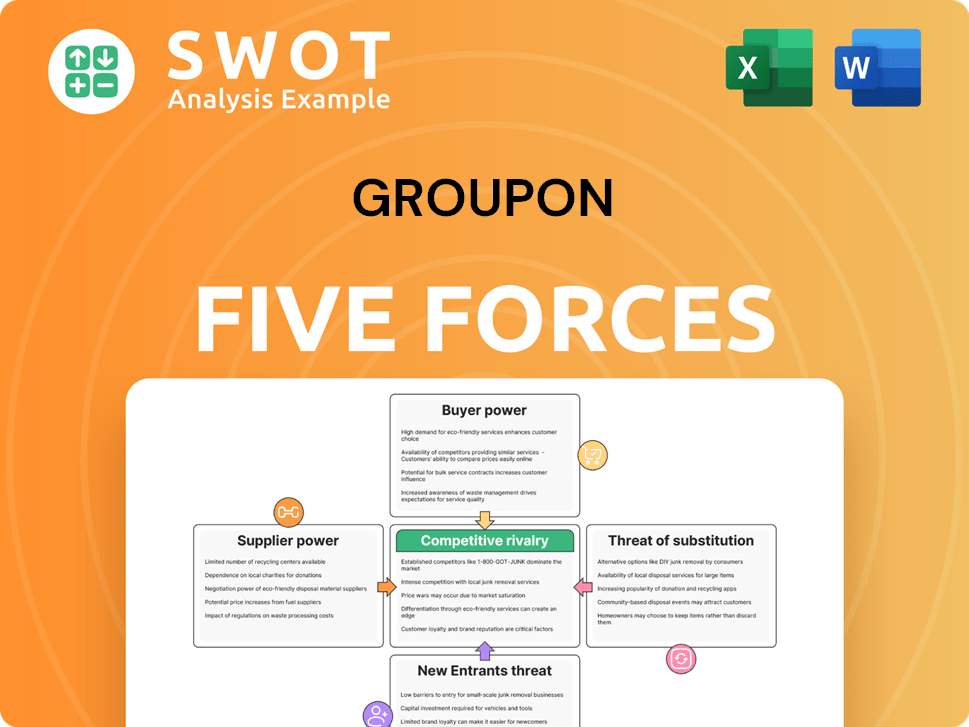

Groupon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Groupon Company?

- What is Competitive Landscape of Groupon Company?

- What is Growth Strategy and Future Prospects of Groupon Company?

- What is Sales and Marketing Strategy of Groupon Company?

- What is Brief History of Groupon Company?

- Who Owns Groupon Company?

- What is Customer Demographics and Target Market of Groupon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.