ACS Actividades de Construccion y Servicios Bundle

Can ACS Actividades de Construccion y Servicios Maintain Its Global Dominance?

The global construction and infrastructure sector is a battlefield of innovation and strategic maneuvering, where industry giants constantly vie for supremacy. ACS Actividades de Construccion y Servicios (ACS Group), a titan in this arena, has evolved from a Spanish construction firm into a multinational powerhouse. This ACS Actividades de Construccion y Servicios SWOT Analysis will provide a comprehensive understanding of its position.

Understanding the ACS competitive landscape is crucial for investors, analysts, and strategists alike. This ACS company analysis will uncover ACS Actividades de Construccion y Servicios's key strengths, weaknesses, opportunities, and threats, providing insights into its ACS market share and ACS financial performance. We'll explore ACS's competitive advantages and how it navigates the complexities of the Construction industry Spain and beyond, answering questions like: What are ACS's main competitors? How does ACS compare to its rivals? and what is the ACS Actividades de Construccion y Servicios future outlook?

Where Does ACS Actividades de Construccion y Servicios’ Stand in the Current Market?

ACS Actividades de Construccion y Servicios (ACS Group) is a leading player in the global construction and infrastructure sector. The company's core operations span civil and building construction, industrial services, and services for infrastructure and buildings. ACS Group leverages its diversified portfolio to maintain a strong market presence worldwide, consistently ranking among the top international contractors.

The company's value proposition lies in its ability to undertake large-scale, complex projects across various sectors. This includes transportation infrastructure, building projects, and energy infrastructure. ACS Group's broad offering allows it to serve a diverse customer base, including governmental entities, public-private partnerships, and private corporations, demonstrating its adaptability and market reach.

ACS Group has a substantial global reach, with a particularly strong foothold in North America, primarily through its subsidiary Hochtief. It also has significant operations in Europe and Australia. The company's strategic focus includes a balance between large-scale infrastructure concessions and traditional construction, with a growing emphasis on industrial services and smart infrastructure solutions. This diversification helps mitigate risks and capitalize on emerging opportunities, such as renewable energy infrastructure.

ACS Group consistently ranks among the top international contractors. Hochtief, a major part of ACS, has been consistently ranked among the top international contractors by Engineering News-Record (ENR). The company's strong market position is supported by its diverse project portfolio and global presence.

ACS offers a wide array of services, including major transportation infrastructure, large-scale building projects, and energy infrastructure. The company also provides comprehensive facility management services. This diverse offering allows ACS to serve a wide range of clients, from governmental entities to private corporations.

ACS Group has a strong global presence, with a particularly strong foothold in North America. It also has significant operations in Europe and Australia. This broad geographical reach allows ACS to diversify its projects and reduce its reliance on any single market.

ACS Group has demonstrated robust financial health, with strong revenue figures in recent fiscal years. The company's financial stability is a key factor in its ability to secure and execute large-scale projects. For example, ACS Group reported significant revenue for the fiscal year 2023.

ACS Group's strategic positioning emphasizes a balance between large-scale infrastructure concessions and traditional construction. It focuses on industrial services and smart infrastructure solutions. This diversification allows ACS to mitigate risks and capitalize on emerging opportunities.

- ACS Group's focus on renewable energy infrastructure is increasing.

- The company's financial health and project execution capabilities are strong.

- ACS holds a particularly strong position in the North American market.

- The Brief History of ACS Actividades de Construccion y Servicios provides further context on the company's evolution.

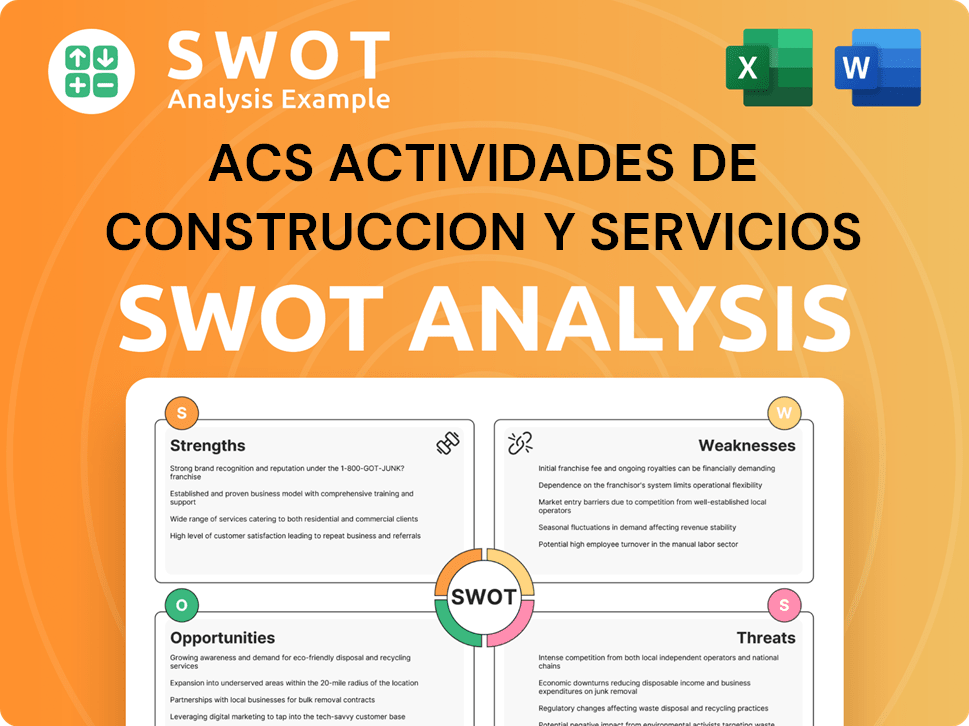

ACS Actividades de Construccion y Servicios SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ACS Actividades de Construccion y Servicios?

The ACS Actividades de Construccion y Servicios (ACS) group operates within a fiercely contested global market. The ACS competitive landscape is shaped by a diverse array of direct and indirect competitors across its various business segments. Understanding these rivals is critical for assessing ACS company analysis and its strategic positioning.

ACS's primary rivals include large, multinational construction and infrastructure conglomerates. These competitors challenge ACS through various means, often vying for similar large-scale public and private projects. The competitive environment is dynamic, with mergers, acquisitions, and technological advancements constantly reshaping the industry.

ACS faces competition from several key players in the construction and infrastructure sectors. These competitors challenge ACS across various projects, including infrastructure concessions, construction, and energy services.

VINCI, a French concessions and construction company, directly competes with ACS. VINCI often competes for similar large-scale public and private projects globally. In 2023, VINCI reported revenues of approximately €68.8 billion.

Bouygues, another French industrial group, challenges ACS, particularly in Europe. Bouygues emphasizes its strong market presence in specific European regions and its diversification into media and telecom. Bouygues Construction had revenues of €14.3 billion in 2023.

Strabag, a leading European construction company, competes with ACS in various civil engineering and building construction projects. Strabag often competes on price and efficiency in its core markets. Strabag's construction output in 2023 was approximately €17.7 billion.

Ferrovial, a Spanish multinational, is a significant rival in infrastructure development. Ferrovial focuses on its expertise in toll roads and airports. Ferrovial's revenues in 2023 were approximately €8.6 billion.

ACS also faces competition from specialized firms in its industrial services and facility management segments. These firms focus on specific niches, such as sustainable construction and smart infrastructure. The revenue of specialized firms varies greatly depending on their focus and market.

Emerging players focusing on sustainable construction and digital construction technologies also pose an indirect challenge. These companies are pushing the industry towards new methods. The market share of these players is growing, but data varies.

The competitive landscape is further intensified by mergers and alliances. For example, the consolidation trends in the engineering and construction sector create larger entities with broader capabilities. For more insights on the ownership structure, you can read about Owners & Shareholders of ACS Actividades de Construccion y Servicios.

Several factors drive competition in the construction industry. These include project size, geographical location, and technological advancements. ACS's ability to adapt to these dynamics is crucial for maintaining its market position.

- Project Bidding: Intense competition during bids for large-scale PPP projects and major infrastructure concessions.

- Technological Innovation: Adoption of digital construction technologies and sustainable practices.

- Geographical Expansion: Competition in emerging markets and established regions.

- Financial Performance: Competitors' financial health and investment capacity.

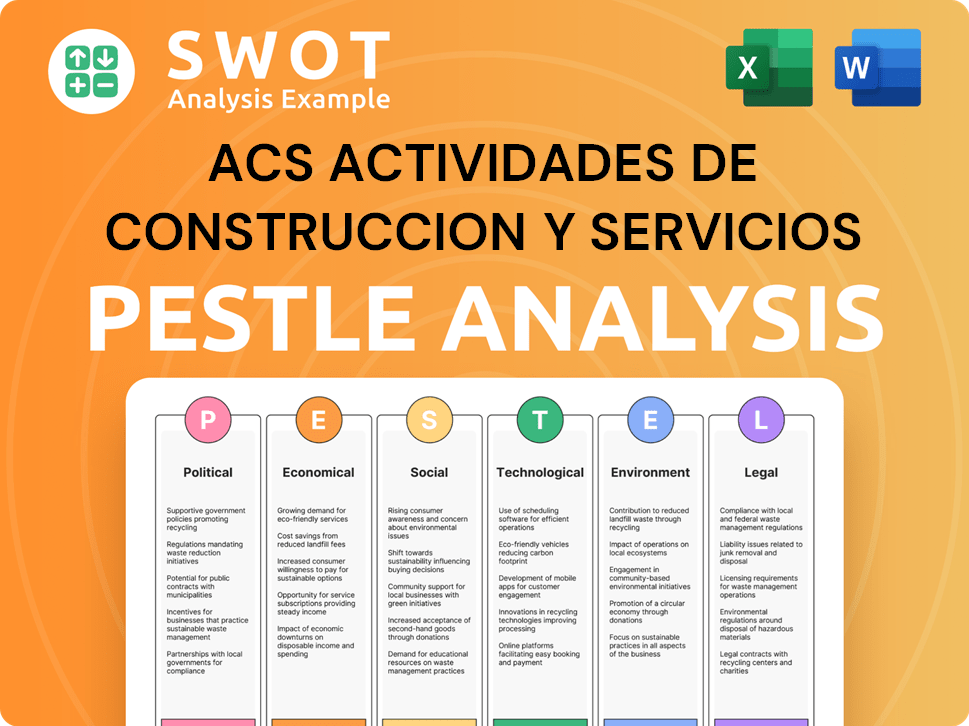

ACS Actividades de Construccion y Servicios PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ACS Actividades de Construccion y Servicios a Competitive Edge Over Its Rivals?

The competitive landscape for ACS Actividades de Construccion y Servicios (ACS) is shaped by its significant global presence and diverse business model. ACS, through its subsidiaries like Hochtief, has established a strong foothold in key markets such as North America, Europe, and Australia. This geographic diversification is a crucial element of its strategy, allowing it to mitigate risks associated with regional economic fluctuations and capitalize on a wide range of project opportunities. The company's ability to leverage local expertise while maintaining a global project pipeline is a key differentiator in the construction industry.

ACS's focus on complex, large-scale infrastructure projects and concessions is another critical competitive advantage. The company has a proven track record of delivering challenging projects, from high-speed rail lines and airport expansions to intricate industrial plants. This specialization in high-value, technically demanding projects often results in higher profit margins and fewer direct competitors capable of undertaking such ventures. ACS's strong financial health and access to capital markets further support its ability to bid on and finance these multi-billion dollar projects.

Furthermore, ACS benefits from its strategic emphasis on public-private partnerships (PPPs) and concessions, providing stable, long-term revenue streams and reducing exposure to direct construction risks. By developing, financing, and operating infrastructure assets, ACS secures recurring income, which provides a degree of resilience against market volatility. The company also leverages its strong relationships with governments and public entities, built over decades of successful project delivery. To understand more about the financial aspects, you can explore Revenue Streams & Business Model of ACS Actividades de Construccion y Servicios.

ACS operates globally, with significant presence in North America, Europe, and Australia. This broad geographical reach helps in diversifying revenue streams and reducing reliance on any single market. The company's international operations are a key factor in its overall financial performance and resilience.

ACS excels in complex infrastructure projects, including high-speed rail, airports, and industrial plants. This expertise allows the company to secure high-value contracts and operate with fewer direct competitors. Their specialization in technically demanding projects is a significant advantage.

ACS's strong financial position enables it to bid on and finance large-scale projects. This financial stability is crucial in the construction industry, allowing the company to manage risks and ensure project completion. Access to capital markets supports its growth strategy.

The company strategically focuses on public-private partnerships (PPPs), which provide stable, long-term revenue streams. This approach reduces exposure to direct construction risks and ensures recurring income. Strong government relationships are vital for PPP success.

ACS's competitive advantages include its global presence, expertise in complex projects, and strategic focus on PPPs. These factors contribute to its strong market position and financial performance. The company's ability to integrate advanced construction techniques and digital tools also provides a competitive edge.

- Global Diversification: Mitigates regional economic risks.

- Project Specialization: Higher margins and fewer competitors.

- Financial Strength: Supports large-scale project financing.

- PPP Strategy: Stable, long-term revenue streams.

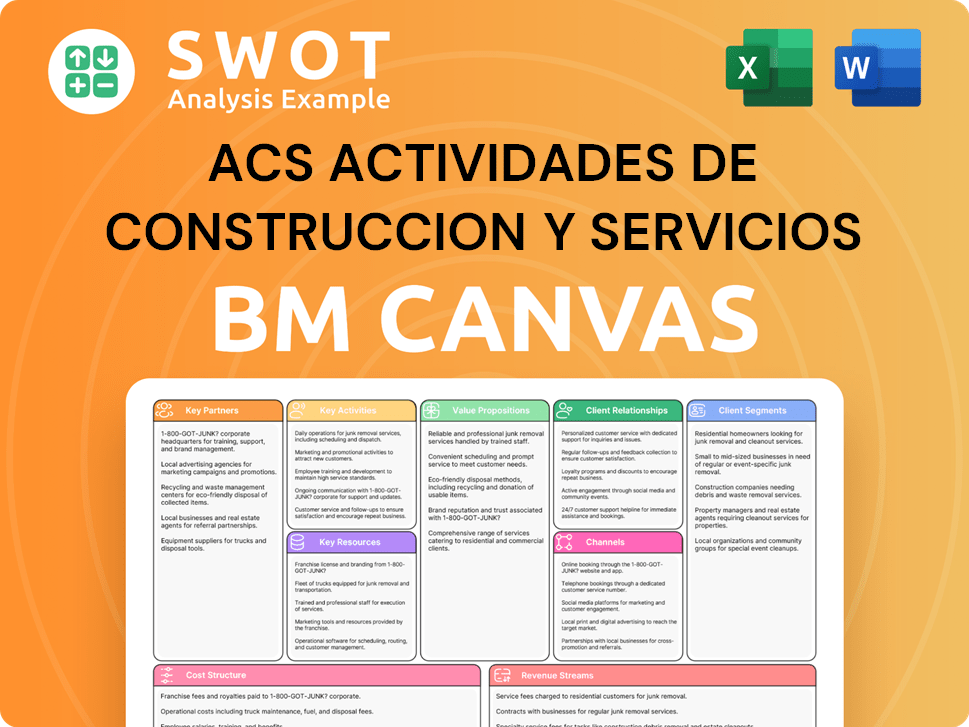

ACS Actividades de Construccion y Servicios Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ACS Actividades de Construccion y Servicios’s Competitive Landscape?

The global construction and infrastructure industry is undergoing significant transformations, impacting companies like ACS Actividades de Construccion y Servicios. These changes present both challenges and opportunities, necessitating strategic adaptation to maintain and enhance market position. Understanding the current trends and future outlook is crucial for investors and stakeholders.

The competitive landscape for ACS is dynamic, shaped by factors such as technological advancements, sustainability demands, and geopolitical influences. ACS must navigate these elements to maintain its financial performance and market share. A detailed ACS company analysis reveals the strategies needed to capitalize on emerging opportunities while mitigating risks.

Sustainability and green construction are increasingly important. Technological advancements, including BIM and AI, are reshaping project delivery. Urbanization and population growth continue to drive infrastructure demand, especially in emerging markets. Government stimulus packages support infrastructure development.

Geopolitical instability can disrupt supply chains and project timelines. Volatility in raw material prices poses a risk. Intense competition, particularly from Chinese contractors, threatens market share. Attracting and retaining skilled labor remains a persistent challenge. This affects ACS's ability to maintain profitability.

Specialized sectors like renewable energy infrastructure and smart city development offer growth. Digital infrastructure projects, such as data centers and fiber optic networks, are expanding. ACS Group's established expertise positions it well for these segments. Strategic partnerships and acquisitions can boost growth.

Diversification into high-margin concessions is a key strategy. Investing in sustainable practices is crucial. Embracing digital transformation enhances efficiency and competitiveness. These measures are vital for long-term resilience and success.

ACS must proactively address industry trends and challenges to maintain a competitive edge. The company's ability to adapt to these factors will influence its financial performance and market share. Understanding the dynamics of the ACS competitive landscape is crucial for investors.

- Sustainability: Integrate sustainable practices and materials into all projects.

- Technology: Invest in digital transformation, including BIM and AI.

- Diversification: Expand into high-growth sectors like renewable energy.

- Geopolitical Risk: Develop strategies to mitigate supply chain disruptions.

For a deeper dive into the strategic initiatives of the company, further insights can be found in the Growth Strategy of ACS Actividades de Construccion y Servicios article. The construction industry in Spain, where ACS has a significant presence, is influenced by these global trends. ACS’s market share and financial performance are closely tied to its ability to adapt and innovate. As of 2024, the European construction market is expected to grow, offering opportunities for companies that are well-positioned to capitalize on them. Recent data indicates that infrastructure spending in the EU is increasing, driven by both public and private investments, which benefits major players like ACS.

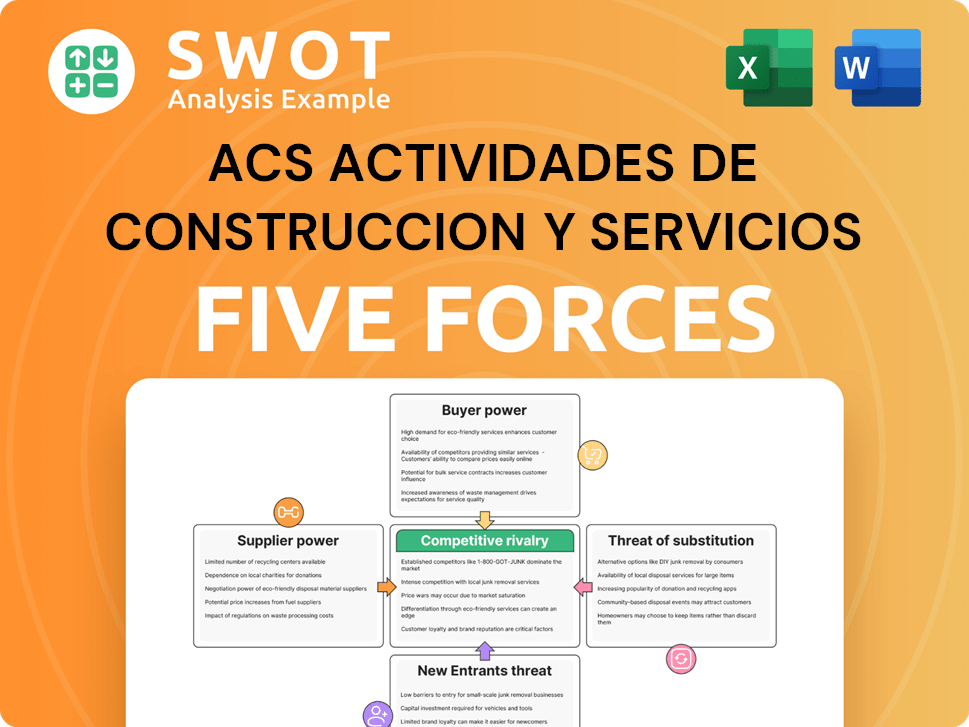

ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACS Actividades de Construccion y Servicios Company?

- What is Growth Strategy and Future Prospects of ACS Actividades de Construccion y Servicios Company?

- How Does ACS Actividades de Construccion y Servicios Company Work?

- What is Sales and Marketing Strategy of ACS Actividades de Construccion y Servicios Company?

- What is Brief History of ACS Actividades de Construccion y Servicios Company?

- Who Owns ACS Actividades de Construccion y Servicios Company?

- What is Customer Demographics and Target Market of ACS Actividades de Construccion y Servicios Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.